Whiskey Market By Material (Rye, Corn, Crude, Malt, Wheat, Blended Whiskey), By Quality (Premium, Super Premium, High-End Premium), By Product Type (Rye, Irish, Scotch, Bourbon, Tennessee, Japanese, Others (Danish, Finnish, Indian, Welsh, American whiskey and Canadian whiskey), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

8534

-

February 2025

-

184

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

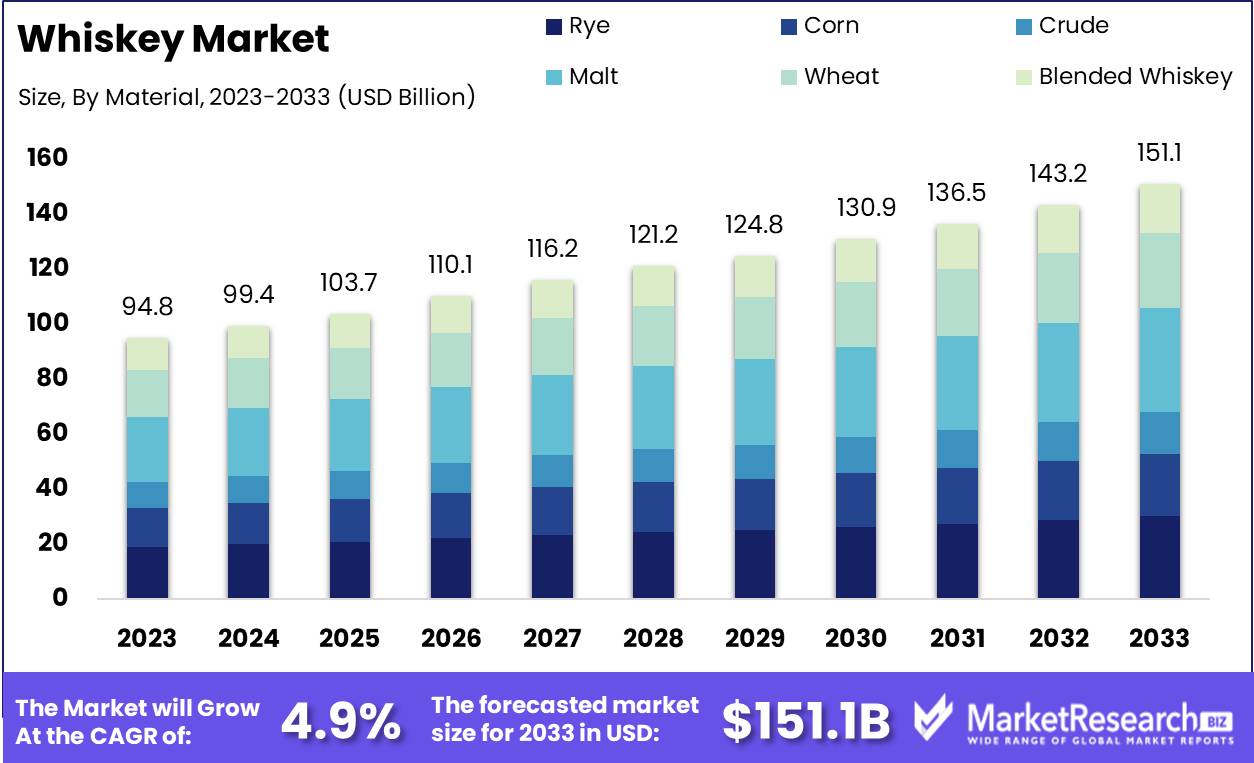

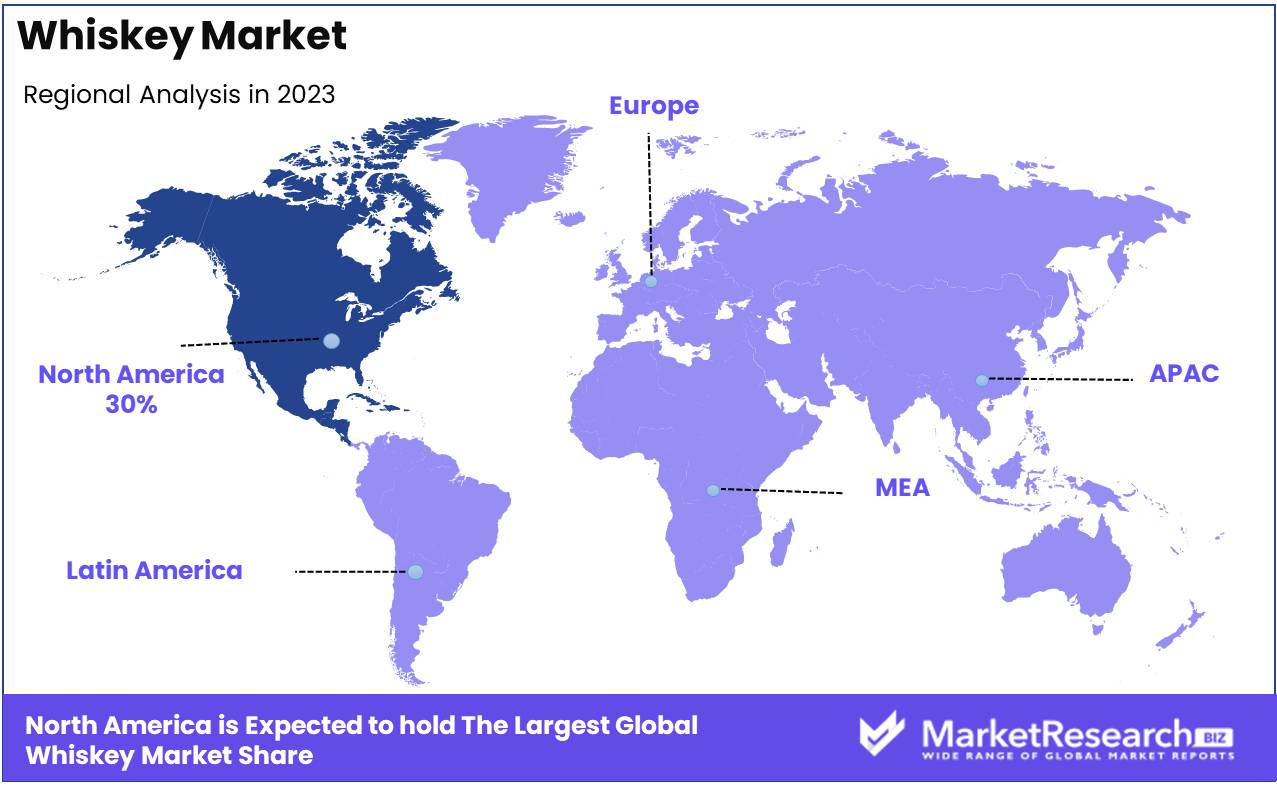

The Global Whiskey Market was valued at USD 94.8 Bn in 2023. It is expected to reach USD 151.1 Bn by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033. North America holds a 30% market share, driven by a robust spirits market and high consumer demand.

Whiskey is a distilled alcoholic beverage made from fermented grain mash, which typically includes barley, corn, rye, and wheat. The grains are aged in wooden casks, often oak, which imparts a distinct flavor profile and color. Whiskey is produced in various styles, such as Scotch whisky, Bourbon, Irish whiskey, and rye whiskey, each with its own production process and regional characteristics. The aging process and the grain mixture are crucial elements in shaping the final taste, making whiskey a complex and highly prized drink across the globe.

Whiskey Market refers to the global trade and consumption of whiskey. This market includes various types of whiskey, such as single malts, blended whiskeys, and grain whiskeys, sold in different formats, from standard bottles to premium and limited-edition releases. The whiskey market has experienced steady growth due to an expanding global appetite for premium spirits and increasing consumer interest in diverse whiskey styles.

Several factors are driving the growth of the whiskey market. The increasing global demand for premium and super-premium whiskey, fueled by rising disposable incomes and changing drinking preferences, is a significant driver. Consumers are seeking high-quality, unique, and craft spirits, and whiskey brands are capitalizing on this by offering rare and aged editions. Additionally, the rise of whiskey tourism, with distillery visits and whisky tasting experiences, is increasing consumer engagement. Furthermore, the growing popularity of whiskey-based cocktails and the expansion of whiskey brands into new markets are contributing to market expansion.

The demand for whiskey is steadily increasing, particularly in markets like the United States, the United Kingdom, and Japan, where whiskey has long been a staple of the alcohol industry. Emerging markets, particularly in Asia, are showing significant growth potential, as changing social norms and a growing middle class are expanding the consumption of alcoholic beverages. Additionally, the demand for craft, artisanal, and small-batch whiskeys is rising, driven by millennials and Gen Z consumers who are more focused on quality, sustainability, and unique experiences.

The whiskey market presents various opportunities for both new entrants and established brands. With the growing demand for premium and craft whiskey, there is potential for distilleries to differentiate their offerings by focusing on unique production methods or regional characteristics. E-commerce and online retailing also offer opportunities for whiskey brands to reach a broader audience, especially in regions where traditional retail infrastructure may be limited.

Key Takeaways

- Market Value: The Global Whiskey Market was valued at USD 94.8 Bn in 2023. It is expected to reach USD 151.1 Bn by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

- By Material: Malt accounts for 25% of the market, essential for traditional whiskey production.

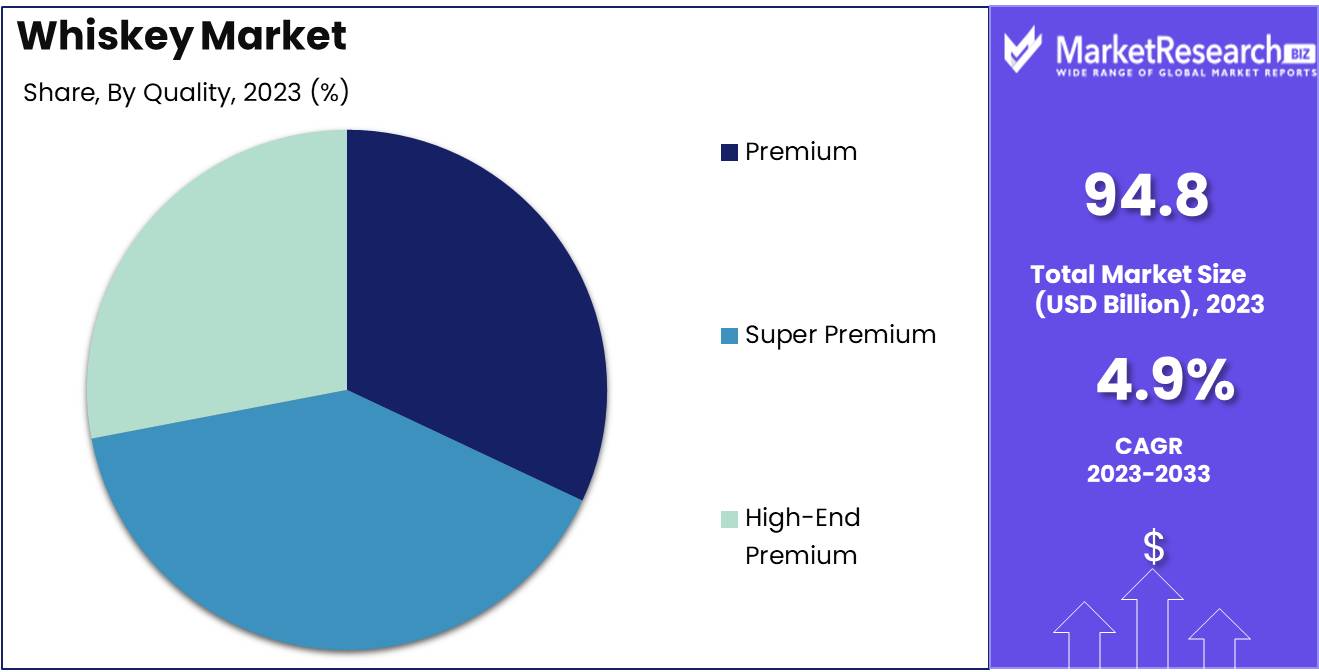

- By Quality: Super Premium whiskey represents 40%, indicating a strong demand for high-quality, luxury spirits.

- By Product Type: Scotch whiskey makes up 35%, renowned for its heritage and distinctive flavor profile.

- Regional Dominance: North America holds a 30% market share, driven by a robust spirits market and high consumer demand.

- Growth Opportunity: Expanding into emerging markets with rising disposable incomes and developing limited-edition and craft whiskey products can drive market growth.

Driving factors

Rising Global Demand for Premium and Craft Spirits

The rising global demand for premium and craft spirits has been a significant factor propelling the growth of the Whiskey Market. Consumers are increasingly gravitating toward high-quality, artisanal products that offer unique flavors and craftsmanship. This trend is particularly evident in the whiskey segment, where the allure of aged, small-batch, and single-malt varieties has captivated discerning consumers.

The premiumization trend is driven by a growing appreciation for the artistry involved in whiskey production, as well as a willingness among consumers to pay a premium for superior products. This shift toward premium and craft spirits is not only boosting sales but also encouraging innovation within the market, as distillers experiment with new aging techniques, ingredients, and blends to meet evolving consumer tastes.

Increasing Consumer Interest in Whiskey Tasting and Experiences

The increasing consumer interest in whiskey tasting and experiences is another key driver of the Whiskey Market's growth. As consumers seek more immersive and educational experiences, whiskey tasting events, distillery tours, and masterclasses have gained popularity. These experiences allow consumers to deepen their knowledge of whiskey, explore different flavor profiles, and engage with the heritage and craftsmanship behind their favorite brands.

This trend is also supported by the rise of whiskey bars and clubs, where enthusiasts can socialize and share their passion for the spirit. The focus on experiential consumption not only enhances brand loyalty but also creates opportunities for whiskey producers to market their products in a more personalized and engaging way, further driving market growth.

Growth in Disposable Income and Lifestyle Changes

The growth in disposable income, coupled with lifestyle changes, has significantly contributed to the expansion of the Whiskey Market. As economies improve and disposable incomes rise, consumers are more inclined to indulge in premium products, including whiskey. The evolving lifestyle preferences of a younger, more affluent demographic are also shaping market dynamics. This group tends to prioritize quality, authenticity, and unique experiences, all of which are well-aligned with the offerings of the premium whiskey segment.

The growing trend of social drinking and the increasing acceptance of whiskey as a sophisticated beverage choice have further fueled its demand. These lifestyle shifts, combined with greater purchasing power, are driving the global consumption of whiskey, particularly in emerging markets where economic growth is robust.

Restraining Factors

High Taxation and Regulatory Restrictions

High taxation and stringent regulatory restrictions present significant retraining factors for the Whiskey Market. Governments in many countries impose heavy taxes on alcoholic beverages, including whiskey, which can significantly increase the final retail price. These high costs can deter consumers, particularly in price-sensitive markets, and limit the accessibility of whiskey, especially in emerging economies.

Regulatory restrictions on advertising, distribution, and consumption further constrain market growth. For instance, strict licensing laws, advertising bans, and restrictions on sales in certain regions or times can hinder market expansion efforts and limit the reach of whiskey brands. These regulatory and taxation challenges create a complex operating environment for whiskey producers, potentially slowing market growth and reducing profitability.

Competition from Other Alcoholic Beverages

The Whiskey Market faces intense competition from other alcoholic beverages, which acts as a significant retraining factor. Consumers have a wide array of choices, including wine, beer, vodka, rum, and gin, each with its own appeal and cultural significance. The rise of craft beer, artisanal spirits, and ready-to-drink (RTD) cocktails has intensified this competition, offering consumers alternative options that are often perceived as more affordable, accessible, or trendy.

Shifts in consumer preferences towards low-alcohol or non-alcoholic beverages, driven by health and wellness trends, further challenge the growth of the whiskey market. This competitive landscape can erode whiskey's market share, making it imperative for whiskey brands to continually innovate and differentiate their offerings to maintain relevance and attract consumers in a crowded market.

By Material Analysis

In 2023, Malt held a dominant market position in the By Material segment of the Whiskey Market, capturing more than a 25% share.

In 2023, Malt held a dominant position in the By Material segment of the Whiskey Market, capturing more than a 25% share. Malt whiskey, renowned for its rich flavor and complexity, is highly preferred by whiskey connoisseurs and is a key component in many premium and super-premium whiskey brands.

Rye whiskey, known for its spicy and fruity notes, continues to be a popular choice, particularly in the North American market. Corn whiskey, primarily used in the production of bourbon, holds significant market share due to its smooth and sweet profile. Wheat and Blended Whiskey also contribute to the diversity of the whiskey market, each offering unique taste profiles that appeal to different consumer preferences.

By Quality Analysis

In 2023, Super Premium held a dominant market position in the By Quality segment of the Whiskey Market, capturing more than a 40% share.

In 2023, Super Premium whiskey captured more than a 40% share in the By Quality segment of the Whiskey Market. The increasing consumer demand for high-quality, luxury spirits has driven the growth of the super premium segment, characterized by superior craftsmanship, aged varieties, and exclusive blends.

Premium whiskey remains a strong market segment, offering a balance between quality and affordability. High-End Premium whiskey, while niche, attracts discerning consumers willing to invest in exceptional and rare whiskey experiences.

By Product Type Analysis

In 2023, Scotch held a dominant market position in the By Product Type segment of the Whiskey Market, capturing more than a 35% share.

In 2023, Scotch whiskey held a dominant market position in the By Product Type segment of the Whiskey Market, capturing more than a 35% share. Renowned globally for its distinctive flavor and heritage, Scotch whiskey enjoys widespread popularity and commands a significant market share.

Bourbon and Tennessee whiskeys are highly favored in the United States, known for their unique production processes and flavor profiles. Irish whiskey, with its smooth and light characteristics, continues to grow in popularity. Japanese whiskey, recognized for its craftsmanship and subtle flavors, has gained international acclaim. Other types, including Rye, Danish, Finnish, Indian, Welsh, American, and Canadian whiskeys, contribute to the rich diversity of the global whiskey market.

Key Market Segments

By Material

- Rye

- Corn

- Crude

- Malt

- Wheat

- Blended Whiskey

By Quality

- Premium

- Super Premium

- High-End Premium

By Product Type

- Rye

- Irish

- Scotch

- Bourbon

- Tennessee

- Japanese

- Others (Danish, Finnish, Indian, Welsh, American whiskey and Canadian whiskey)

Growth Opportunity

Innovation in Aged and Specialty Whiskey

The development of innovative and aged whiskey products presents a significant opportunity for the Whiskey Market in 2024. As consumers continue to seek premium and unique offerings, the demand for aged whiskey and specialty blends is expected to grow. Distillers are increasingly focusing on creating limited edition releases, experimenting with different aging processes, cask finishes, and ingredient combinations to cater to the sophisticated palates of whiskey enthusiasts.

These innovative products not only command higher price points but also enhance brand prestige and attract connoisseurs willing to pay a premium for exclusivity. This trend towards innovation and premiumization will likely continue to drive market growth, especially in regions where consumers are becoming more discerning and willing to invest in high-quality spirits.

Emerging Markets and Non-Traditional Regions

Expansion into emerging markets and non-traditional whiskey regions offers another substantial growth opportunity for the Whiskey Market in 2024. Regions such as Asia-Pacific, Latin America, and Africa are experiencing economic growth, increasing disposable incomes, and a rising middle class, all of which contribute to a growing appetite for whiskey.

Non-traditional whiskey regions, including parts of Eastern Europe and the Middle East, are showing increased interest in whiskey as a symbol of status and sophistication. By targeting these high-potential markets, whiskey producers can diversify their revenue streams, tap into new consumer segments, and mitigate the risks associated with saturation in traditional markets. This strategic expansion is poised to contribute significantly to the global growth of the whiskey industry.

Latest Trends

Sustainability in Whiskey Production

The adoption of sustainable and eco-friendly production practices is emerging as a significant trend in the Whiskey Market for 2024. As environmental consciousness grows among consumers, whiskey brands are increasingly focusing on reducing their carbon footprint, conserving water, and utilizing sustainable sourcing for ingredients. Distilleries are investing in renewable energy, eco-friendly packaging, and waste reduction initiatives to align with the global shift towards sustainability.

These efforts not only appeal to environmentally conscious consumers but also enhance brand reputation and loyalty. As sustainability becomes a key differentiator in the marketplace, brands that prioritize eco-friendly practices are likely to gain a competitive edge and attract a broader audience, particularly among younger, socially aware consumers.

Rise of Whiskey-Based Cocktails

The increasing popularity of whiskey-based cocktails is another notable trend shaping the Whiskey Market in 2024. As mixology continues to thrive, bartenders and consumers alike are experimenting with whiskey as a versatile base for a wide range of cocktails. This trend is broadening the appeal of whiskey beyond traditional neat or on-the-rocks consumption, making it more accessible to a wider audience, including younger drinkers and those new to the spirit.

Whiskey-based cocktails, such as the classic Old Fashioned or innovative new creations, are becoming staples in bars and restaurants worldwide, driving demand for both premium and standard whiskey brands. This cocktail culture not only boosts whiskey sales but also encourages exploration of different whiskey varieties, further fueling market growth.

Regional Analysis

In 2023, North America led the Whiskey Market, capturing 30% of the market share.

In 2023, North America led the Whiskey Market, capturing 30% of the market share. The region's dominance is driven by the strong tradition of whiskey production and consumption, particularly in the United States and Canada. The popularity of bourbon and Tennessee whiskey, along with the craft distillery movement, has contributed to the market's growth. Additionally, innovations in flavor profiles and premium offerings cater to a diverse consumer base, from connoisseurs to casual drinkers.

Europe remains a significant market for whiskey, with Scotland and Ireland being key producers and exporters. The Asia Pacific region is witnessing rapid growth in whiskey consumption, driven by rising disposable incomes and a growing appreciation for premium spirits. Latin America and the Middle East & Africa are emerging markets, with increasing demand for both imported and locally produced whiskeys.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Whiskey Market is expected to experience robust growth in 2024, driven by increasing consumer demand for premium and craft whiskey products. Leading companies such as Bacardi Limited and La Martiniquaise are focusing on expanding their premium whiskey portfolios and enhancing their brand presence through strategic marketing initiatives.

Pernod Ricard SA and Beam Suntory, Inc. are leveraging their extensive distribution networks and strong brand equity to capture a significant share of the market. Chivas Brothers Ltd and United Spirits Limited are emphasizing product innovation and the development of unique flavor profiles to attract discerning consumers.

Allied Blenders & Distillers and William Grant & Sons Ltd. are investing in the expansion of their production capacities and exploring new market opportunities through regional expansions. Whyte & Mackay Limited and Diageo North America, Inc. are focusing on sustainability and ethical sourcing practices to appeal to environmentally conscious consumers.

Suntory Holdings Ltd and Asahi Group Holdings, Ltd. are leveraging their expertise in the alcoholic beverages market to offer a diverse range of whiskey products that cater to different consumer preferences. Distillers Pvt Ltd and Loch Lomond Distillers Ltd. are emphasizing artisanal production methods and heritage to appeal to niche segments that value authenticity and tradition.

The competitive landscape of the Whiskey Market in 2024 will be characterized by a blend of traditional craftsmanship and modern innovation, catering to the evolving tastes and preferences of consumers. Companies that can effectively leverage their brand heritage and offer high-quality, premium products are likely to gain a competitive edge in this dynamic market.

Market Key Players

- Bacardi Limited

- La Martiniquaise

- Pernod Ricard SA

- Beam Suntory, Inc.

- Chivas Brothers Ltd

- United Spirits Limited

- Allied Blenders & Distillers

- William Grant & Sons Ltd.

- Whyte & Mackay Limited

- Diageo North America, Inc.

- Suntory Holdings Ltd

- Asahi Group Holdings, Ltd

- Distillers Pvt Ltd

- Loch Lomond Distillers Ltd.

- Kirin Holdings Company Limited

Recent Development

- In May 2024, William Grant & Sons Ltd. invested $30 million in upgrading their distillation facilities to enhance production efficiency and product quality. This investment aims to improve production capacity by 25%.

- In March 2024, Beam Suntory, Inc. acquired a regional distillery to expand their product portfolio. This acquisition is expected to boost their production capacity by 15%.

Report Scope

Report Features Description Market Value (2023) USD 94.8 Bn Forecast Revenue (2033) USD 151.1 Bn CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Rye, Corn, Crude, Malt, Wheat, Blended Whiskey), By Quality (Premium, Super Premium, High-End Premium), By Product Type (Rye, Irish, Scotch, Bourbon, Tennessee, Japanese, Others (Danish, Finnish, Indian, Welsh, American whiskey and Canadian whiskey) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bacardi Limited, La Martiniquaise, Pernod Ricard SA, Beam Suntory, Inc., Chivas Brothers Ltd, United Spirits Limited, Allied Blenders & Distillers, William Grant & Sons Ltd., Whyte & Mackay Limited, Diageo North America, Inc., Suntory Holdings Ltd, Asahi Group Holdings, Ltd, Distillers Pvt Ltd, Loch Lomond Distillers Ltd., Kirin Holdings Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bacardi Limited

- La Martiniquaise

- Pernod Ricard SA

- Beam Suntory, Inc.

- Chivas Brothers Ltd

- United Spirits Limited

- Allied Blenders & Distillers

- William Grant & Sons Ltd.

- Whyte & Mackay Limited

- Diageo North America, Inc.

- Suntory Holdings Ltd

- Asahi Group Holdings, Ltd

- Distillers Pvt Ltd

- Loch Lomond Distillers Ltd.

- Kirin Holdings Company Limited