AdTech Market By Solution (Demand-side Platforms (DSPs), Supply-side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), Others), By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Others), By Organization Size (Large Enterprises, SMEs), By Platform (Mobile devices, Web, Others), By Industry Verticals (BFSI, Retail & Consumer Goods, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51237

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Solution Analysis

- By Advertising Type Analysis

- By Organization Size Analysis

- By Platform Analysis

- By Industry Verticals Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

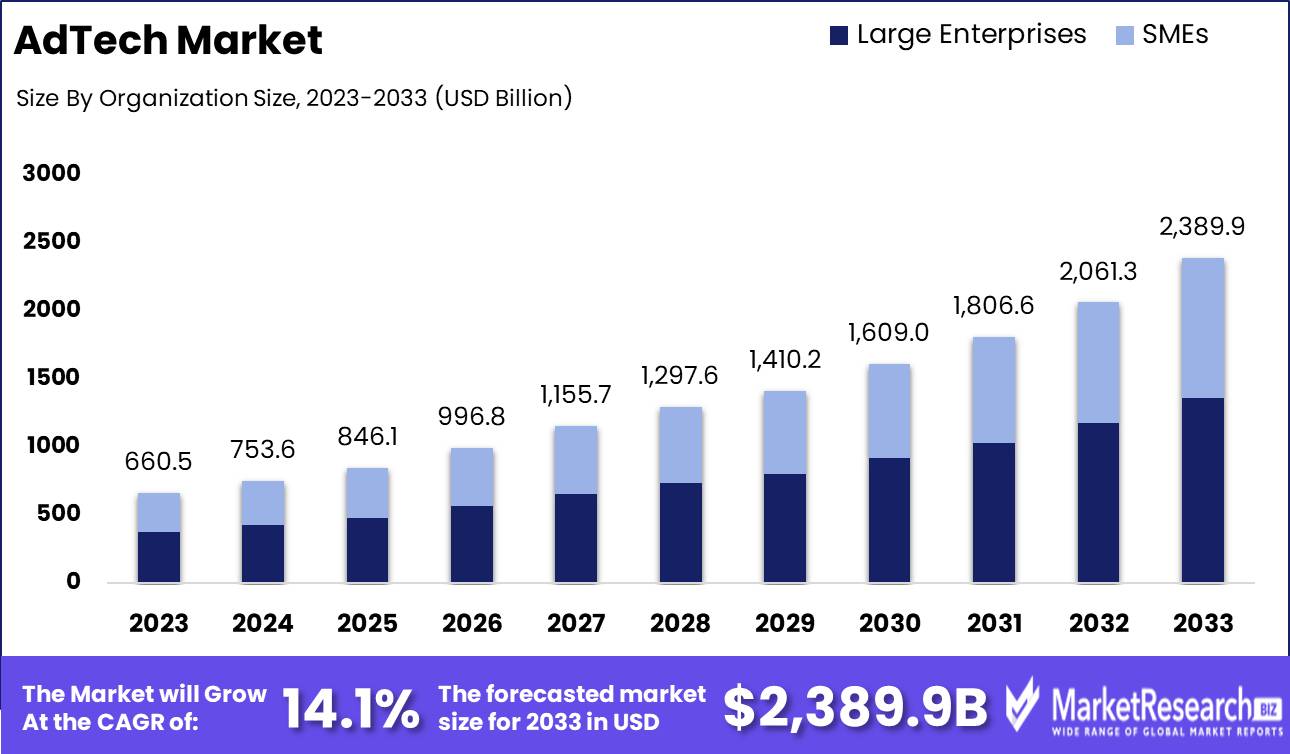

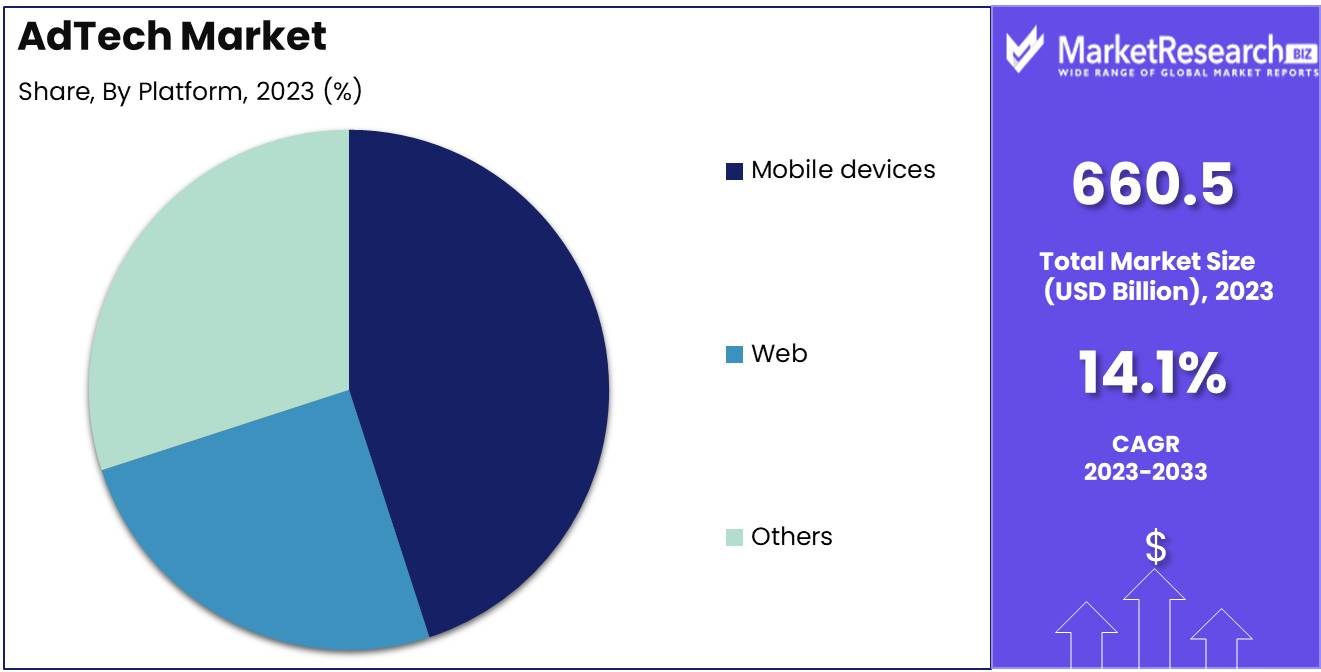

The AdTech Market was valued at USD 660.5 billion in 2023. It is expected to reach USD 2,389.9 billion by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

The AdTech market refers to the ecosystem of technology platforms, tools, and software solutions designed to manage and optimize digital advertising campaigns across various channels, including display, mobile, video, social media, and search. This market encompasses a wide range of technologies such as demand-side platforms (DSPs), supply-side platforms (SSPs), ad exchanges, data management platforms (DMPs), and programmatic advertising solutions. AdTech enables brands and advertisers to deliver highly targeted, data-driven ads, enhancing campaign performance and return on investment (ROI).

The AdTech market is experiencing significant growth, driven by an accelerated shift to digital advertising as brands seek to engage with increasingly digital-savvy consumers. A key trend within this transformation is the rise of data-driven personalization, which allows advertisers to deliver more targeted and relevant ads to specific audience segments. With the integration of artificial intelligence (AI) and automation, advertisers are now able to optimize campaigns in real time, improving performance and reducing inefficiencies.

Furthermore, connected TV (CTV) and audio ads are emerging as powerful channels, expanding the landscape beyond traditional display and search ads. This growth is underpinned by increased investment in these innovative technologies, making them integral to future strategies in AdTech.

However, alongside these advancements, the market faces mounting challenges related to privacy and data security. As regulations such as the GDPR and CCPA become more stringent, companies must adopt more transparent and compliant methods of data collection and usage. Despite these concerns, investment in AI and automation remains robust, offering solutions that allow for greater compliance while maintaining the precision of targeted advertising. The market is thus poised for continued expansion, as the combination of digital migration, enhanced personalization, and technological innovation drives the AdTech ecosystem into a new era of growth and complexity. Brands that effectively navigate the balance between personalization and privacy are expected to lead the market in the coming years.

Key Takeaways

- Market Growth: The AdTech Market was valued at USD 660.5 billion in 2023. It is expected to reach USD 2,389.9 billion by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

- By Solution: Demand-side Platforms (DSPs) dominated the AdTech market's By Solution segment.

- By Advertising Type: Programmatic Advertising dominated the expanding AdTech market segments.

- By Organization Size: Large Enterprises dominated the AdTech market by organization size.

- By Platform: Mobile Devices dominated the AdTech market by platform.

- By Industry Verticals: BFSI dominated AdTech across diverse industry verticals globally.

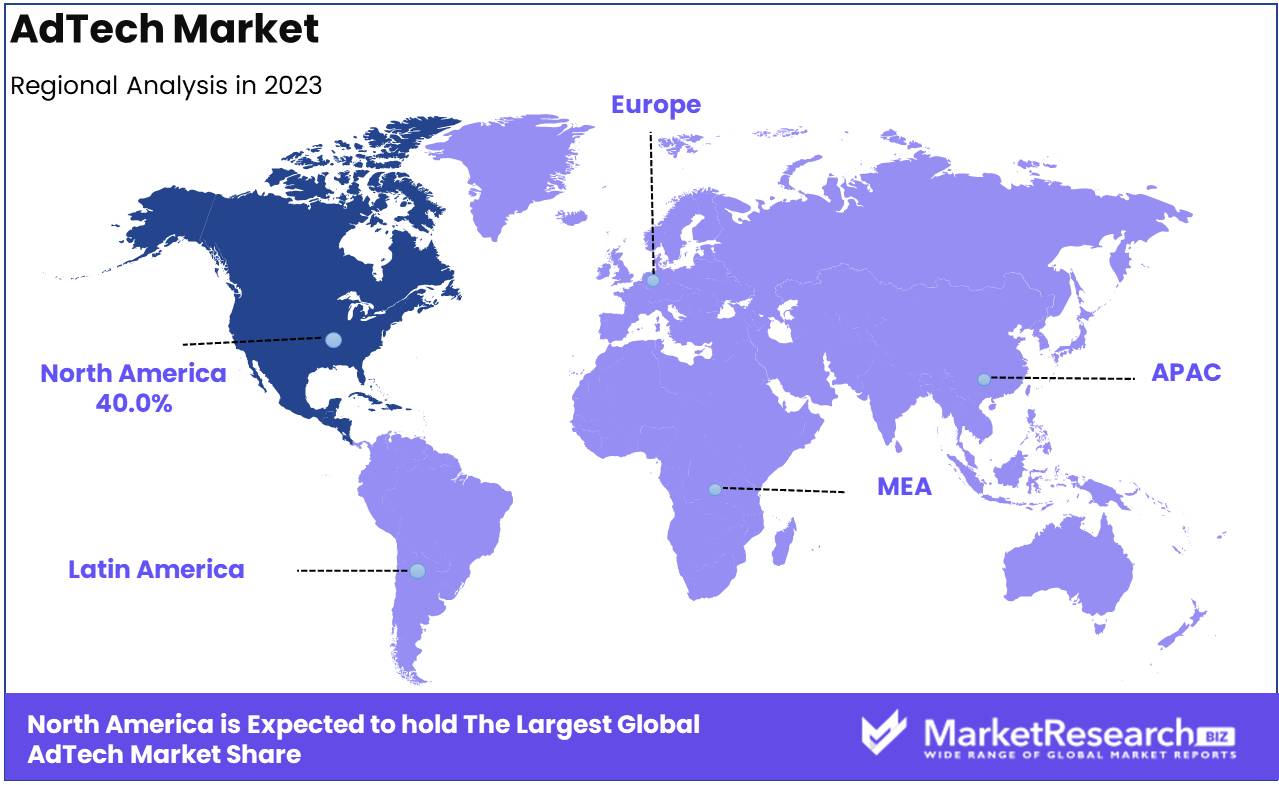

- Regional Dominance: North America dominates the AdTech market with over a 40% largest share.

- Growth Opportunity: AI/ML and Connected TV (CTV) advertising will drive personalization, engagement, and targeted reach, fueling significant growth and innovation in the global AdTech market.

Driving factors

Exponential Increase in Digital Advertising Spending: A Catalyst for Market Expansion

The growth of the AdTech market is heavily driven by the exponential rise in global digital advertising spending. As brands increasingly shift from traditional advertising methods to digital platforms, spending on digital advertisements has surged. According to industry data, global digital ad spending reached approximately $616 billion in 2022, with projections indicating continued upward momentum. This growth can be attributed to the increasing ubiquity of internet access, mobile device usage, and social media engagement, which have expanded the reach and effectiveness of digital marketing campaigns.

This increased spending has created a need for more sophisticated advertising technologies to optimize campaigns, measure effectiveness, and target audiences more efficiently. As a result, the AdTech market has experienced a rapid rise in demand for solutions that can automate, personalize, and analyze digital ads in real time. The scaling of digital ad budgets across industries and geographies directly fuels the adoption of AdTech platforms, making it a foundational driver of market growth.

Growing Demand for Data-Driven Marketing: Enhancing Precision and Personalization

The demand for data-driven marketing is transforming the AdTech landscape by pushing brands and marketers to leverage advanced analytics, artificial intelligence, and big data to optimize their campaigns. As businesses recognize the importance of tailoring advertising to individual consumer behaviors and preferences, the use of data to inform marketing decisions has become a key trend. According to recent studies, nearly 65% of marketing leaders reported increased reliance on data to drive their campaigns in 2023.

Data-driven marketing allows advertisers to better target consumers, improve customer experiences, and increase return on investment (ROI). This shift has spurred demand for AdTech tools that can collect, process, and analyze vast amounts of user data in real time, enabling marketers to implement more effective strategies. By providing insights into consumer behavior, purchase patterns, and media consumption habits, data-driven marketing directly supports the growth of AdTech by enhancing the precision and personalization of digital advertising efforts.

Advancements in Programmatic Advertising: Automating and Optimizing Ad Campaigns

Programmatic advertising, which automates the buying and selling of digital ads through real-time bidding (RTB) and machine learning algorithms, has become one of the most significant advancements in the AdTech market. The global programmatic ad spend is projected to exceed $150 billion by 2024, demonstrating its crucial role in the industry's evolution.

This method allows advertisers to target audiences more efficiently, reduce costs, and optimize ad performance by adjusting campaigns in real time. The automation of ad buying through programmatic platforms has increased the accessibility of digital advertising for businesses of all sizes, enabling small and medium-sized enterprises (SMEs) to compete with larger companies. As programmatic technologies continue to evolve, offering more sophisticated targeting capabilities and integration with data-driven strategies, the demand for AdTech solutions is expected to increase substantially.

Furthermore, the combination of programmatic advertising with advancements in artificial intelligence and machine learning has created an environment where ads can be more accurately placed, reducing waste in ad spend and improving engagement. This not only enhances the ROI for advertisers but also drives the growth of the AdTech market by providing scalable, efficient solutions for businesses across all sectors.

Restraining Factors

The Complexity of Measurement Hindering the Optimal Utilization of AdTech Solutions

The complexity of measuring the effectiveness and return on investment (ROI) of advertising technologies has emerged as a significant restraining factor for the AdTech market's growth. AdTech encompasses a wide array of tools and platforms that track, analyze, and optimize advertising campaigns, yet accurately assessing their impact remains a challenge for advertisers.

With multiple data sources such as clicks, impressions, conversion rates, and audience metrics, advertisers often struggle to aggregate and interpret these data points effectively. Moreover, the increasing fragmentation of media channels ranging from traditional television to social media and connected devices further complicates the measurement process. This leads to inconsistencies in data quality and reliability, affecting decision-making and budget allocation.

According to recent industry insights, more than 40% of advertisers report that they are not fully confident in their ability to measure the effectiveness of their AdTech investments. Such challenges in attributing specific outcomes to particular AdTech solutions reduce the likelihood of companies increasing their spending on advanced advertising platforms, thereby limiting the market's growth potential. Advertisers demand transparent, real-time measurement tools, and the inability to provide these hampers widespread adoption of AdTech solutions, slowing down the overall growth of the sector.

Rapid Technological Changes Increasing Barriers to Entry and Adoption

The rapid pace of technological advancements in the AdTech industry represents another critical restraining factor that impacts the market’s growth. While innovation is essential for keeping AdTech solutions competitive, frequent technological changes pose challenges for both existing and potential new entrants into the market.

Businesses need to continuously update their infrastructure and retrain their workforce to keep up with emerging technologies such as artificial intelligence (AI), machine learning (ML), programmatic advertising, and privacy-compliant data solutions. This constant evolution increases operational costs and often creates resistance among companies that may prefer to avoid frequent technology overhauls. Additionally, smaller advertisers or those with limited technical resources are particularly disadvantaged, as they may find it difficult to adopt new technologies quickly or may even be excluded from accessing the latest advancements due to cost or complexity barriers.

A report suggests that nearly 30% of businesses cite the rapid pace of technological change as a key barrier to adopting new advertising solutions. This hesitancy not only limits the number of companies integrating advanced AdTech tools into their marketing strategies but also affects overall market growth by preventing uniform adoption across the industry.

By Solution Analysis

In 2023, Demand-side Platforms (DSPs) dominated the AdTech market's By Solution segment.

In 2023, Demand-side Platforms (DSPs) held a dominant market position in the By Solution segment of the AdTech market, driven by the increasing demand for automated and real-time bidding solutions. DSPs enable advertisers to purchase digital ad space efficiently across multiple networks, enhancing campaign targeting and cost-effectiveness. This growth is further fueled by the shift towards programmatic advertising and the rising need for data-driven decision-making in marketing strategies.

Supply-side Platforms (SSPs) also contributed significantly, serving as a critical solution for publishers by optimizing inventory monetization and offering transparency in ad exchanges. Ad Networks, though facing competition from more advanced platforms, continue to provide value by aggregating media inventory and serving as intermediaries between advertisers and publishers.

Data Management Platforms (DMPs) played a key role in gathering, analyzing, and segmenting audience data, facilitating more precise targeting for advertisers. Lastly, the "Others" category, which includes innovative solutions like Customer Data Platforms (CDPs) and creative ad technologies, contributed to the market's expansion by addressing specific needs in personalization and dynamic ad creation. Each solution is integral to the evolving ecosystem of the AdTech market.

By Advertising Type Analysis

In 2023, Programmatic Advertising dominated the expanding AdTech market segments.

In 2023, Programmatic Advertising held a dominant market position in the By Advertising Type segment of the AdTech market. Programmatic advertising's automated, data-driven approach facilitated efficient ad placement and targeting, accounting for a significant share of overall advertising spend. Its ability to deliver real-time bidding and optimize campaigns across multiple channels has made it a preferred choice for advertisers.

Search Advertising continued to thrive due to its strong return on investment (ROI), particularly for performance-driven marketers leveraging search engines to capture intent-driven consumer traffic. Display Advertising maintained relevance by offering highly visual and engaging content, often enhanced by dynamic creative optimization and retargeting strategies.

Mobile Advertising experienced robust growth, fueled by the increasing use of smartphones and apps, making it a key channel for reaching consumers on the go. Email Marketing remained a cost-effective tool for customer retention and direct engagement, especially through personalized and automated campaigns.

Native Advertising grew as advertisers sought less intrusive, more contextual placements that blended seamlessly with content, leading to higher engagement rates. Lastly, the Others category, comprising emerging formats like connected TV (CTV) and audio ads, gained traction as brands looked to diversify their advertising portfolios across new and innovative channels. Collectively, these segments drove the expansion of the AdTech market.

By Organization Size Analysis

In 2023, Large Enterprises dominated the AdTech market by organization size.

In 2023, Large Enterprises held a dominant market position in the "By Organization Size" segment of the AdTech market. This can be attributed to their extensive financial resources, enabling them to adopt advanced technologies, optimize advertising strategies, and leverage data-driven insights at scale. Large enterprises also have well-established relationships with technology providers, which further accelerates the adoption of innovative AdTech solutions. These organizations typically operate across multiple markets, requiring sophisticated, multi-channel advertising platforms to enhance their global reach and brand visibility. Additionally, the rising demand for programmatic advertising, AI-based customer analytics, and personalized marketing campaigns has further solidified the position of large enterprises within the AdTech ecosystem.

On the other hand, small and medium-sized enterprises (SMEs) are also increasingly investing in AdTech solutions but at a slower pace due to budget constraints and the need for more specialized resources. However, with the rise of cloud-based solutions and affordable software-as-a-service (SaaS) models, SMEs are expected to contribute to market growth in the coming years, as these technologies provide more accessible and scalable options for targeted advertising and customer engagement.

By Platform Analysis

In 2023, Mobile Devices dominated the AdTech market by platform.

In 2023, Mobile Devices held a dominant market position in the By Platform segment of the AdTech market, driven by the rapid growth of mobile internet penetration and increased smartphone usage. This dominance is largely attributed to the rise in mobile-based content consumption, including social media, mobile apps, and video streaming services. The convenience of mobile devices for on-the-go internet access has led to a surge in mobile advertising, which accounted for a significant portion of total digital ad spending.

Meanwhile, the web platform remained a critical player, with its continued relevance in desktop browsing and e-commerce activities. While growth in this segment is comparatively slower, desktop ad campaigns still offer targeted reach and are particularly effective for detailed and complex user interactions, such as B2B advertising.

Other platforms, including smart TVs, gaming consoles, and wearables, also contributed to the AdTech ecosystem. Although this category represented a smaller market share, it is poised for future growth as these platforms become more integrated into consumers' daily lives, offering new touchpoints for advertisers to engage with users in diverse ways.

By Industry Verticals Analysis

In 2023, BFSI dominated AdTech across diverse industry verticals globally.

In 2023, The Banking, Financial Services, and Insurance (BFSI) sector held a dominant market position in the "By Industry Verticals" segment of the AdTech market. The BFSI sector's significant investment in digital advertising solutions is attributed to increasing consumer demand for personalized financial services, enhanced customer engagement, and the need for targeted marketing to reach specific demographics. This trend is expected to continue, driven by the growing adoption of programmatic advertising and AI-powered customer analytics.

The Retail & Consumer Goods sector also demonstrated substantial growth, capitalizing on AdTech for personalized shopping experiences and omnichannel strategies. Media & Entertainment followed closely, leveraging advanced advertising technologies to maximize user engagement across digital platforms.

The Education sector is gradually adopting AdTech to enhance outreach and student recruitment processes, while IT & Telecom companies are utilizing advertising technologies to bolster customer acquisition and retention in a highly competitive landscape.

In Healthcare, the cautious but increasing use of digital advertising is primarily focused on improving patient engagement and promoting healthcare services. Meanwhile, other sectors, including automotive, travel, and logistics, are also exploring the potential of AdTech to optimize marketing strategies.

Each industry vertical leverages AdTech to meet unique needs, contributing to the overall expansion of the market across diverse sectors.

Key Market Segments

By Solution

- Demand-side Platforms (DSPs)

- Supply-side Platforms (SSPs)

- Ad Networks

- Data Management Platforms (DMPs)

- Others

By Advertising Type

- Programmatic Advertising

- Search Advertising

- Display Advertising

- Mobile Advertising

- Email Marketing

- Native Advertising

- Others

By Organization Size

- Large Enterprises

- SMEs

By Platform

- Mobile devices

- Web

- Others

By Industry Verticals

- BFSI

- Retail & Consumer Goods

- Media & Entertainment

- Education

- IT & Telecom

- Healthcare

- Others

Growth Opportunity

Artificial Intelligence (AI) and Machine Learning (ML) Driving Personalization

Artificial Intelligence (AI) and Machine Learning (ML) are poised to significantly impact the global AdTech market. AI-driven solutions are transforming how advertisers interact with consumers by enabling personalized ad experiences at scale. This evolution is critical, as personalization is becoming a key driver of consumer engagement and conversion rates. According to industry forecasts, AI-powered advertising can increase ROI by up to 30%, largely due to its ability to analyze vast datasets and optimize real-time bidding (RTB) systems. Furthermore, AI and ML facilitate predictive analytics, which helps advertisers anticipate consumer behavior and preferences, allowing for more effective targeting. This shift will enable brands to optimize campaign performance and improve user experiences, leading to sustained market growth.

Connected TV (CTV) Advertising: Expanding Reach and Engagement

The rapid growth of Connected TV (CTV) advertising presents another key opportunity for the global AdTech market. As consumers increasingly shift from traditional TV to streaming services, CTV has emerged as a critical platform for advertisers. Global CTV ad spending is expected to exceed $27 billion, driven by high consumer engagement and the ability to deliver targeted, non-intrusive ads. CTV’s advanced targeting capabilities, combined with programmatic ad delivery, allow brands to reach highly segmented audiences across devices, enhancing the overall effectiveness of digital advertising campaigns. This growth is expected to drive innovation in AdTech, leading to the development of more sophisticated tools for measuring ad effectiveness and optimizing CTV ad strategies.

Latest Trends

Growth of Digital Out-of-Home (DOOH) Advertising

Digital Out-of-Home (DOOH) advertising is anticipated to experience significant growth, driven by technological advancements and increased consumer engagement with dynamic outdoor content. The proliferation of digital displays across urban landscapes, coupled with the integration of data-driven targeting, is enabling advertisers to deliver personalized, location-specific content. As consumer mobility rebounds post-pandemic, DOOH is becoming an essential component of omnichannel marketing strategies. The use of programmatic buying in DOOH further enhances flexibility and scalability, allowing advertisers to optimize campaigns in real-time. This trend is poised to grow as advertisers seek innovative ways to engage audiences in public spaces.

AI-Powered Functionality in AdTech

Artificial Intelligence (AI) is reshaping the AdTech landscape by enhancing campaign performance through automation, personalization, and predictive analytics. AI-powered functionality will increasingly be leveraged for tasks such as dynamic creative optimization, automated bidding, and audience segmentation. Machine learning algorithms are refining targeting capabilities by analyzing vast amounts of consumer data to identify patterns and predict user behavior.

Additionally, AI-driven chatbots and virtual assistants are expected to enhance user engagement, further blurring the lines between advertising and customer service. As the demand for data-driven decision-making intensifies, AI’s role in the AdTech ecosystem is expected to expand, offering advertisers a competitive edge through precision and efficiency.

Regional Analysis

North America dominates the AdTech market with over a 40% largest share.

The AdTech market demonstrates significant regional variation, with North America dominating the landscape. In 2023, North America accounted for over 40% of the global AdTech market, driven by high internet penetration rates, advanced technological infrastructure, and early adoption of programmatic advertising. The U.S. leads in the adoption of data-driven marketing, supported by major players such as Google, Facebook, and Amazon, contributing to a market size expected to exceed USD 200 billion by 2027.

Europe follows as a key market, accounting for approximately 25% of the global share. The region's growth is propelled by GDPR compliance fostering transparency, alongside increasing investments in digital advertising. The United Kingdom, Germany, and France are among the largest contributors, with the UK leading in digital ad spend.

The Asia Pacific region exhibits the fastest growth, projected to grow at a CAGR of over 12% through 2027. This expansion is driven by rapid digitization, increasing smartphone usage, and rising internet penetration, particularly in China and India. China, with its flourishing e-commerce sector, is the largest contributor in this region, followed closely by India’s burgeoning digital advertising market.

In Latin America, the AdTech market is growing steadily, driven by increasing digitalization, particularly in Brazil and Mexico. The Middle East & Africa, while currently smaller in scale, is experiencing notable growth due to increasing mobile and internet penetration, especially in the UAE and South Africa, with regional investments expected to drive expansion over the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global AdTech market is dominated by several key players, each of which brings distinct strengths that influence the market landscape. Google LLC remains a pivotal player, leveraging its comprehensive suite of digital advertising tools, including Google Ads and AdSense, alongside its dominance in search and mobile ecosystems. Meta Platforms Inc. (including Facebook) similarly plays a central role, benefiting from its unparalleled reach across social media and highly targeted ad offerings, underpinned by its advanced machine learning algorithms.

Amazon.com Inc. continues to grow in influence within the AdTech space, particularly with its highly effective retail media network, offering unique capabilities in integrating e-commerce data with advertising. Oracle Corporation and Adobe Inc. are both significant contributors, focusing on marketing cloud solutions that cater to enterprise-level clients seeking sophisticated ad management and analytics.

Microsoft Corporation, through its acquisition of Xandr and its own Bing network, also strengthens its footprint in the digital advertising space, particularly in programmatic advertising. Additionally, Verizon Communications Inc. and Criteo offer competitive programmatic and performance marketing solutions that cater to both advertisers and publishers.

Alibaba Group Holding Limited continues to shape the AdTech market, particularly within the Chinese and broader Asia-Pacific markets, benefiting from its dominance in e-commerce and comprehensive advertising solutions. InMobi Technology Services Private Limited and SpotX have also established themselves as strong players in the mobile and video advertising segments, respectively, contributing to the growth and innovation within the overall AdTech ecosystem. The competitive landscape is characterized by innovation, integration, and a growing emphasis on privacy and data protection.

Market Key Players

- InMobi Technology Services Private Limited

- Twitter Inc.

- Meta Platforms Inc.

- Oracle Corporation

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

- Adobe Inc.

- Google LLC

- Verizon Communications Inc.

- Criteo

- Facebook Incorporation

- SpotX

- Other key players

Recent Development

- In March 2024, Magnite, a leading independent sell-side advertising platform, announced an exclusive partnership with Mediaocean. This collaboration is aimed at streamlining omnichannel advertising by integrating Magnite's sell-side capabilities with Mediaocean's omnichannel ad platform. This move enhances efficiency for advertisers, particularly in programmatic advertising, by optimizing ad placements across multiple channels.

- In December 2023, TripleLift partnered with LiveRamp to integrate TripleLift Audiences with RampID. This collaboration enables marketers to leverage scalable first-party audience solutions, ensuring privacy-centric addressability across the open web. This development addresses the growing need for privacy-compliant solutions as the industry moves away from third-party cookies.

- In November 2023, Amazon introduced advanced features aimed at improving campaign planning, activation, and measurement. These features provide advertisers with more granular control over their audiences, delivering faster insights into campaign performance. This upgrade highlights Amazon’s focus on optimizing ad performance and transparency.

Report Scope

Report Features Description Market Value (2023) USD 660.5 Billion Forecast Revenue (2033) USD 2,389.9 Billion CAGR (2024-2032) 14.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Demand-side Platforms (DSPs), Supply-side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), Others), By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, Others), By Organization Size (Large Enterprises, SMEs), By Platform (Mobile devices, Web, Others), By Industry Verticals (BFSI, Retail & Consumer Goods, Media & Entertainment, Education, IT & Telecom, Healthcare, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Google, InMobi Technology Services Private Limited, Twitter Inc., Meta Platforms Inc., Oracle Corporation, Amazon.com Inc., Alibaba Group Holding Limited, Microsoft Corporation, Adobe Inc., Google LLC, Verizon Communications Inc., Criteo, Facebook Incorporation, SpotX, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- InMobi Technology Services Private Limited

- Twitter Inc.

- Meta Platforms Inc.

- Oracle Corporation

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

- Adobe Inc.

- Google LLC

- Verizon Communications Inc.

- Criteo

- Facebook Incorporation

- SpotX

- Other key players