Wood Preservatives Market By Formulation (Water-Based Wood Preservatives, Solvent-Based Wood Preservatives, Oil-Based Wood Preservatives), By Application (Wood Flooring, Railroad Ties, Cabinets and Decks, Doors & Windows, Others), By End-use (Commercial, Residential, Industrial), By Sales Channel (Direct Sales, Indirect Sales), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46742

-

May 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

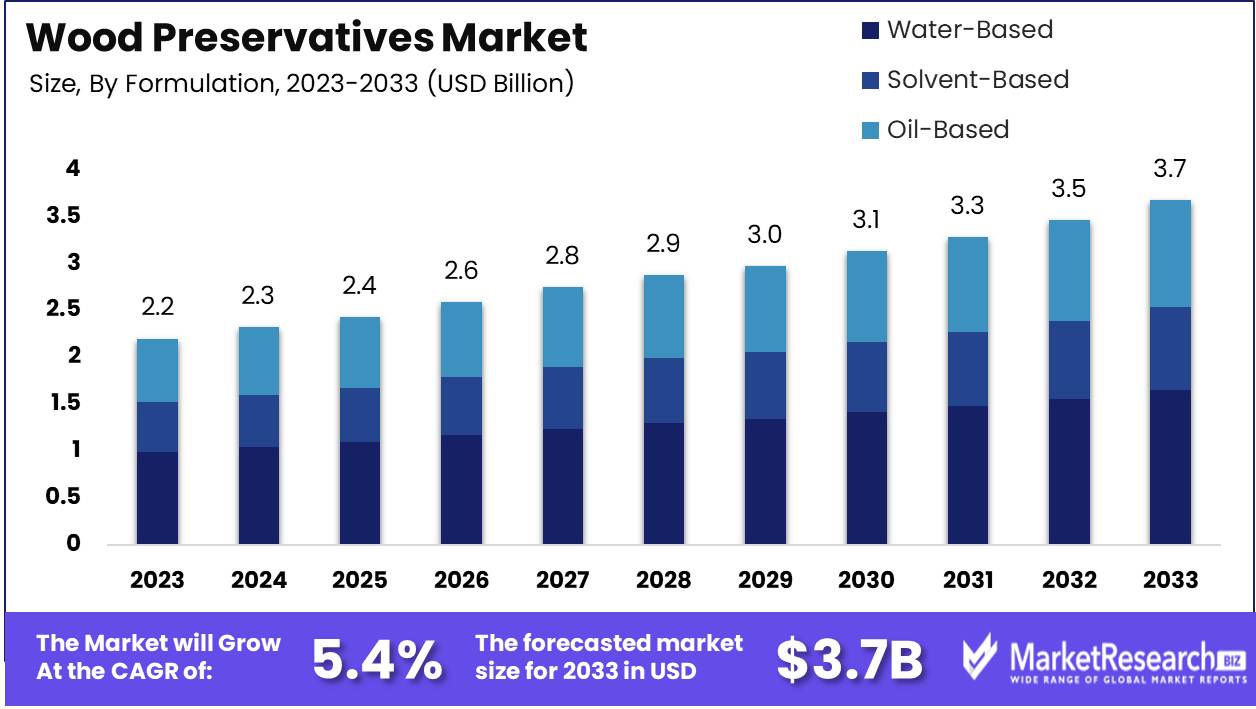

The Wood Preservatives Market was valued at USD 2.2 billion in 2023. It is expected to reach USD 3.7 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Wood Preservatives Market encompasses the array of chemicals and treatments used to protect wood from decay, insect infestation, and environmental damage. These preservatives enhance the durability and longevity of wood products, making them essential for construction, furniture, and outdoor applications. The market is driven by the increasing demand for sustainable building materials, innovations in preservation technology, and regulatory standards promoting the use of eco-friendly products.

The wood preservatives market is poised for significant growth, driven by increasing demand for wood in interior decorative applications and wooden flooring within residential and commercial buildings. This trend is bolstered by consumer preferences for sustainable and aesthetically pleasing materials, which positions wood as a preferred choice. In parallel, the market landscape is characterized by a complex value chain involving multiple intermediaries, including raw material suppliers, manufacturers, distributors, and end-users. The interplay of these stakeholders influences pricing, product availability, and innovation, thereby shaping market dynamics. Competitor behavior analysis indicates a competitive market with major players focusing on product innovation and strategic partnerships to gain a competitive edge.

To ensure robust market estimations, the data triangulation technique has been employed, facilitating the integration of primary and secondary research inputs along with expert validation. This methodology enhances the precision of statistical numbers for each segment and sub-segment within the global wood preservatives market, ensuring reliable and actionable insights.

Furthermore, a thorough analysis of customer behaviors underscores a growing inclination towards high-performance and eco-friendly wood preservatives, reflecting broader environmental sustainability trends. As such, companies operating in this space are increasingly investing in R&D to develop advanced preservatives that meet stringent environmental standards while providing long-lasting protection to wood products. This strategic focus is expected to drive market expansion and offer substantial opportunities for growth in the coming years.

Key Takeaways

- Market Growth: The Wood Preservatives Market was valued at USD 2.2 billion in 2023. It is expected to reach USD 3.7 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

- By Formulation: In 2023, water-based wood preservatives dominated the market with a 54.4% share.

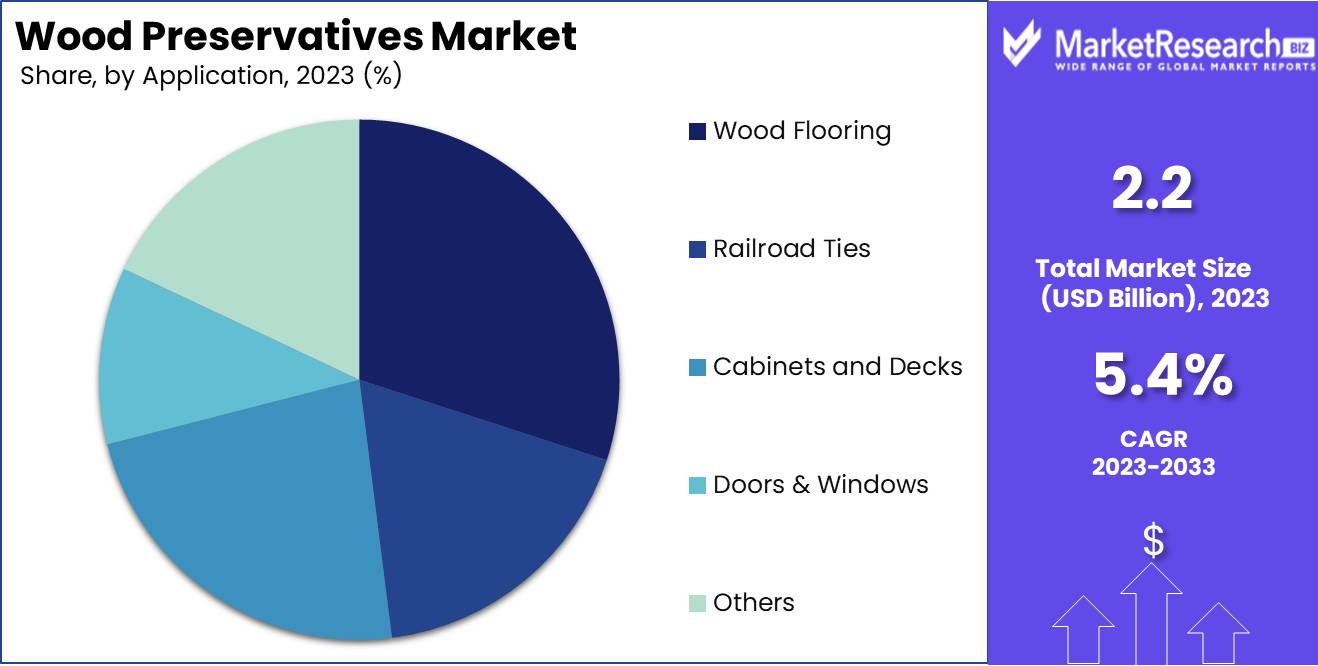

- By Application: Wood Flooring dominated the Wood Preservatives Market with a 38.2% market share.

- By End-use: The commercial segment dominated the Wood Preservatives Market with a 46.3% market share.

- By Sales Channel: Direct Sales dominated the Wood Preservatives Market with a 64.2% market share.

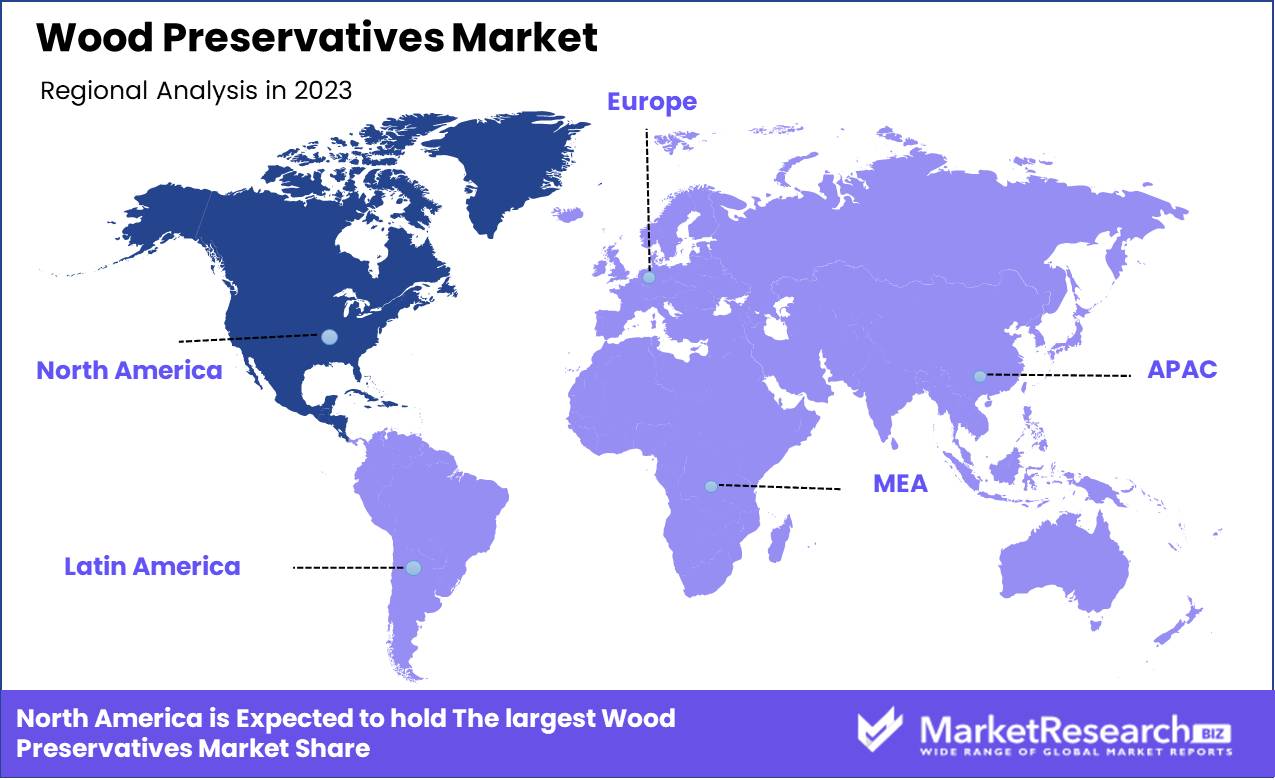

- Regional Dominance: North America dominates the wood preservatives market with a 50% share.

- Growth Opportunity: The global wood preservatives market in 2024 will thrive due to expanded applications across diverse industries.

Driving factors

Increasing Demand for Eco-Friendly Wood Preservatives

The shift towards sustainable practices is driving the demand for eco-friendly wood preservatives. With increasing environmental regulations and consumer awareness, there is a significant move away from traditional chemical preservatives to more sustainable, biodegradable options. This trend is expected to bolster market growth as companies innovate and introduce products that meet eco-friendly criteria. Adopting these preservatives minimizes environmental impact and aligns with global sustainability goals, appealing to both consumers and regulatory bodies.

Rapid Urbanization

Urbanization is a critical factor influencing the wood preservatives market. As urban populations grow, the need for housing and infrastructure development increases. This surge in construction activities drives the demand for wood and, consequently, wood preservatives to ensure durability and longevity. The rapid urbanization seen in emerging economies, particularly in Asia-Pacific and Latin America, presents a substantial opportunity for market expansion. The rise in disposable income and improved living standards in these regions further fuel this growth, creating a robust market for wood preservatives.

Growing Demand for Wood in Construction and Infrastructure

The construction and infrastructure sectors are pivotal to the wood preservatives market's growth. Wood is preferred due to its versatility, aesthetics, and structural benefits. The demand for treated wood in residential, commercial, and industrial construction is rising, driven by the need for durable, long-lasting materials. This demand is amplified by the increased focus on renovating and maintaining existing infrastructure, where wood preservatives play a crucial role in extending the life of wood products. The interplay between these sectors not only boosts market demand but also encourages continuous innovation in wood preservation technologies.

Restraining Factors

Technological Advancements: Balancing Innovation with Regulatory Compliance

Technological advancements in the wood preservatives market are a double-edged sword. On one hand, they drive innovation, enhancing the efficiency and effectiveness of wood preservation techniques. For instance, the development of new chemical formulations and application methods can significantly extend the lifespan of treated wood, making it more attractive to consumers and industries alike. Advanced technologies also facilitate the creation of preservatives that are less harmful to the environment and human health, which aligns with growing regulatory pressures.

However, the rapid pace of technological innovation also poses challenges. Companies must continuously invest in research and development to stay competitive, which can be a significant financial burden, especially for smaller firms. Additionally, new technologies often require substantial changes in production processes, including the need for new equipment and training for employees, which can disrupt operations and increase costs. Moreover, the stringent regulatory landscape governing chemical use in wood preservatives necessitates that new technologies undergo rigorous testing and approval processes, further slowing down market entry and adoption.

Consumer Demand for Eco-Friendly Products: Driving Change Amidst Cost and Availability Challenges

The increasing consumer demand for eco-friendly wood preservatives is reshaping the market landscape. Environmental concerns and health awareness are pushing consumers and businesses toward products that minimize ecological impact and reduce exposure to harmful chemicals. This shift is particularly pronounced in regions with stringent environmental regulations, such as North America and Europe, where consumers are more environmentally conscious and willing to pay a premium for green products.

Despite the clear demand, the transition to eco-friendly wood preservatives faces significant challenges. Eco-friendly alternatives often come with higher production costs, which can lead to higher prices for end consumers. This price sensitivity can be a barrier, particularly in cost-competitive markets. Additionally, the availability of raw materials for eco-friendly preservatives is sometimes limited, which can constrain supply and drive up prices further.

By Formulation Analysis

In 2023, water-based wood preservatives dominated the market with a 54.4% share.

In 2023, Water-Based Wood Preservatives held a dominant market position in the By Formulation segment of the Wood Preservatives Market, capturing more than a 54.4% share. This substantial market penetration can be attributed to several key factors. Firstly, water-based preservatives are favored for their eco-friendly properties, aligning with the increasing global emphasis on sustainability. These preservatives emit fewer volatile organic compounds (VOCs), reducing environmental and health risks. Furthermore, advancements in formulation technologies have enhanced the efficacy and durability of water-based solutions, making them highly effective in protecting wood from decay, insects, and microbial attacks. The ease of application and compatibility with various wood types further bolster their appeal across diverse end-use industries.

Solvent-based wood Preservatives hold the second-largest share, driven by their deep penetration capabilities and robust protection against harsh weather conditions. Despite environmental concerns, their effectiveness in industrial applications ensures steady demand.

Oil-based wood Preservatives, while capturing a smaller market segment, remain crucial due to their superior moisture resistance and extended lifespan. These attributes make them indispensable for specific applications, such as utility poles and railway ties, where long-term durability is paramount.

By Application Analysis

In 2023, Wood Flooring dominated the Wood Preservatives Market with a 38.2% market share.

In 2023, Wood Flooring held a dominant market position in the By Application segment of the Wood Preservatives Market, capturing more than a 38.2% share. This dominance is attributed to several key factors. First, the increasing consumer preference for aesthetic and durable flooring options has driven the demand for wood flooring, which inherently requires robust preservation techniques to enhance its longevity and resistance to environmental factors. Moreover, advancements in wood preservation technologies have made treated wood flooring more cost-effective and environmentally friendly, further bolstering its market appeal. The construction boom, particularly in residential and commercial spaces, has also significantly contributed to the rise in demand for wood flooring.

In the same segment, Railroad Ties represent another significant application, benefiting from infrastructure development projects globally, which require durable and long-lasting materials. Cabinets and Decks have also seen a steady demand due to rising home renovation trends and outdoor living space enhancements. Doors & Windows follow closely, driven by the need for aesthetically pleasing and weather-resistant wood products. Lastly, Others encompass a range of applications including furniture and agricultural structures, where wood preservatives play a crucial role in extending product life and maintaining quality. This diverse application spectrum underscores the critical importance of wood preservatives across various industries.

By End-use Analysis

In 2023, the Commercial segment dominated the Wood Preservatives Market with a 46.3% market share.

In 2023, the Commercial segment held a dominant market position in the By End-use segment of the Wood Preservatives Market, capturing more than a 46.3% share. This substantial market share is attributable to several key factors. Firstly, the expansion of commercial infrastructure projects globally has driven a significant demand for wood preservatives to enhance the durability and longevity of wooden structures. Commercial establishments, such as office buildings, retail spaces, and hospitality venues, increasingly rely on high-quality wood preservatives to ensure compliance with safety regulations and maintain aesthetic appeal.

Additionally, the rising trend of sustainable and eco-friendly construction practices in the commercial sector has further fueled the demand for advanced wood preservative solutions. The emphasis on extending the life cycle of wooden materials in commercial projects aligns with broader environmental sustainability goals, encouraging the adoption of innovative, less toxic preservative products.

In contrast, the Residential segment, although substantial, holds a smaller market share, primarily driven by homeowner demand for maintenance and protection of wooden fixtures. The Industrial segment, characterized by applications in utility poles, railway ties, and marine structures, follows closely, necessitating specialized, high-performance preservatives to withstand harsh environments.

By Sales Channel Analysis

In 2023, Direct Sales dominated the Wood Preservatives Market with a 64.2% market share.

In 2023, Direct Sales held a dominant market position in the By Sales Channel segment of the Wood Preservatives Market, capturing more than a 64.2% share. This substantial share can be attributed to the direct engagement with end-users, enabling manufacturers to establish stronger relationships and better understand customer needs. Direct Sales channels facilitate customized solutions, timely delivery, and consistent quality assurance, which are crucial in sectors demanding high-performance wood preservatives. The direct interaction reduces the intermediary costs, enhancing profitability for producers and offering competitive pricing for customers. Additionally, manufacturers benefit from immediate feedback, enabling quicker innovation and adaptation to market trends.

Indirect Sales, while comprising the remaining market share, play a significant role by leveraging established distribution networks and reaching a broader audience. This channel includes wholesalers, retailers, and online platforms that provide extensive market coverage and convenience to customers who prefer purchasing through familiar and accessible outlets. Indirect Sales channels often benefit from the credibility and reach of well-known distributors, aiding in brand visibility and trust. Despite its smaller share, the indirect approach is vital for market penetration in regions where direct sales infrastructure is limited, ensuring the widespread availability of wood preservatives across diverse geographic and demographic segments.

Key Market Segments

By Formulation

- Water-Based Wood Preservatives

- Solvent-Based Wood Preservatives

- Oil-Based Wood Preservatives

By Application

- Wood Flooring

- Railroad Ties

- Cabinets and Decks

- Doors & Windows

- Others

By End-use

- Commercial

- Residential

- Industrial

By Sales Channel

- Direct Sales

- Indirect Sales

Growth Opportunity

Rising Demand in Personal Care and Hygiene Products

The global wood preservatives market is poised for significant growth in 2024, driven by increasing demand for personal care and hygiene products. Wood preservatives, traditionally used for their antimicrobial properties in timber protection, are finding novel applications in the formulation of personal care items. The preservatives' efficacy in preventing microbial growth is critical in extending the shelf life of hygiene products. This shift is not only diversifying the market but also ensuring a stable demand trajectory as consumer awareness of hygiene and health continues to rise globally. The intersection of wood preservatives with the booming personal care industry represents a strategic growth avenue, likely to be a key revenue driver in the coming years.

Expansion in Animal Husbandry and Tanning Applications

Another pivotal opportunity lies within the animal husbandry and leather tanning sectors. Wood preservatives play an essential role in safeguarding wooden structures and equipment used in animal housing and feed storage. As the global animal husbandry industry expands to meet the increasing demand for meat and dairy products, the need for durable, treated wood products is set to rise. Additionally, in the leather tanning industry, wood preservatives are crucial in the maintenance of tanning equipment and storage facilities, ensuring long-term operational efficiency. The growing scale of these industries in emerging markets underscores a significant demand potential for wood preservatives, thereby opening up robust growth prospects.

Latest Trends

Growing Demand for Water-Based Preservatives

The wood preservatives market is witnessing a marked shift towards water-based preservatives, driven by increasing environmental and health concerns. Traditional solvent-based preservatives, while effective, are associated with volatile organic compounds (VOCs) and other harmful emissions. Water-based alternatives offer a safer and more sustainable solution, aligning with stricter regulatory frameworks globally. This trend is particularly prominent in regions like North America and Europe, where environmental regulations are more stringent. Furthermore, the construction industry's growing preference for eco-friendly materials is accelerating the adoption of water-based wood preservatives, which are perceived as less toxic and more user-friendly.

Advances in Technology and Environmentally Friendly Preservatives

Technological advancements are playing a crucial role in the development of next-generation wood preservatives that are both effective and environmentally benign. Innovations in nanotechnology and biotechnology are leading to the creation of preservatives that not only protect wood from decay and pests but also minimize environmental impact. For instance, nano-copper-based preservatives offer enhanced durability and performance with a reduced environmental footprint compared to traditional methods. Additionally, the development of bio-based preservatives, derived from natural sources, is gaining traction. These preservatives are biodegradable and non-toxic, making them highly attractive in a market increasingly driven by sustainability considerations.

Regional Analysis

North America dominates the wood preservatives market with a 50% share.

The wood preservatives market exhibits significant regional variation driven by differing levels of industrialization, construction activities, and climatic conditions. North America, holding a dominant position with a market share of approximately 50%, is driven by substantial demand in the U.S. and Canada. This region benefits from advanced construction technologies and a strong emphasis on wood preservation for both residential and commercial applications. The U.S. construction sector's recovery and stringent regulations regarding wood treatment bolster market growth.

In Europe, the market is propelled by the widespread use of wood in building and furniture industries, particularly in countries like Germany, France, and the UK. The European market is also influenced by stringent environmental regulations and the rising trend towards sustainable construction materials. This region witnesses substantial demand for eco-friendly preservatives, aligning with the EU's Green Deal objectives.

The Asia Pacific region shows robust growth potential due to rapid urbanization and infrastructure development, especially in China and India. Increased investments in construction and the rising popularity of wooden furniture contribute to market expansion. The region's market dynamics are shaped by growing awareness about the benefits of wood preservation in extending the lifespan of wood products.

Latin America and the Middle East & Africa regions are emerging markets with moderate growth, driven by increasing construction activities and expanding awareness about wood preservation techniques. In Latin America, Brazil and Mexico are key contributors, while in the Middle East & Africa, the market is gaining traction in the UAE and South Africa due to infrastructural developments and a rising preference for wood-based materials.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global wood preservatives market in 2024 will be shaped by key players who demonstrate diverse strategies and robust innovations to address evolving market demands. Companies such as Advance Agrisearch Limited and Jubilant Agric & Consumer Products are leveraging their extensive experience in agricultural chemicals to enhance the efficacy and environmental sustainability of their wood preservatives.

BERKEM and Groupe Berkem emphasize green chemistry, aligning their product portfolios with increasing regulatory pressures and consumer preferences for eco-friendly solutions. Similarly, Lonza Specialty Ingredients (under Bain Capital and Cinven) continues to lead with its strong commitment to sustainability and innovation, capitalizing on its extensive R&D capabilities. Koppers Performance Chemicals and Copper Care Wood Preservatives Inc. maintains a significant market presence through their advanced copper-based preservatives, which offer high durability and protection against microbial decay. LANXESS and Impra Wood Protection Ltd focus on biocidal products, ensuring high performance against a broad spectrum of wood-destroying organisms.

Asian manufacturers like Changchun Wood Preservative Manufacturing Co. Ltd and Sanyu Chemical (Shenzhen) Co. Ltd are increasingly competitive, driven by cost-effective production and expanding regional markets. Dolphin Bay and Rio Tinto contribute to the market with innovative solutions tailored to specific regional needs, particularly in tropical climates. Nisus Corporation and Remmers Gruppe AG are noted for their specialty products that address niche markets, including residential and historic building preservation. Troy Corporation and Wykamol Group Ltd differentiate themselves through unique formulations that enhance wood aesthetics while providing superior protection.

Viance and Wolman Wood and Fire Protection GmbH focus on comprehensive solutions combining fire retardancy and biocidal protection, essential for construction safety standards. Kurt Obermeier GmbH & Co. KG and TIMBERLINE (PTY) LTD are recognized for their innovations in extending wood lifespan and reducing environmental impact.

Market Key Players

- Advance Agrisearch Limited

- BERKEM

- Changchun Wood Preservative Manufacturing Co. Ltd

- Copper Care Wood Preservatives Inc.

- Dolphin Bay

- Groupe Berkem

- Impra Wood Protection Ltd

- Jubilant Agric & Consumer Products

- Koppers Performance Chemicals

- Kurt Obermeier GmbH & Co. KG

- LANXESS

- Lonza Specialty Ingredients (Bain Capital and Cinven)

- Nisus Corporation

- Remmers Gruppe AG

- Rio Tinto

- Sanyu Chemical (Shenzhen) Co. Ltd

- TIMBERLINE (PTY) LTD

- Troy Corporation

- Viance

- Wolman Wood and Fire Protection GmbH

- Wykamol Group Ltd

Recent Development

- In April 2024, Koppers Holdings Inc. announced a significant partnership with a major North American timber company to supply a newly developed copper-based wood preservative. This partnership aims to meet the growing demand for high-performance wood preservatives that offer enhanced durability and protection. The new preservative is noted for its lower environmental impact compared to traditional treatments.

- In March 2024, BASF SE launched a new range of environmentally friendly wood preservatives under the brand name "GreenGuard." This new product line is designed to offer superior protection against wood decay, insects, and mold, while minimizing the environmental impact. The development reflects BASF’s ongoing efforts to innovate and lead in sustainable chemical solutions for the wood preservation industry.

- In January 2024, Lonza Group announced the expansion of its wood protection business through the acquisition of a state-of-the-art production facility in the United States. This strategic move is aimed at enhancing the company’s production capacity and reinforcing its position in the North American market. The facility is equipped with advanced technologies that align with Lonza’s commitment to sustainable and environmentally friendly wood preservation solutions.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 3.7 Billion CAGR (2024-2032) 5.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Formulation (Water-Based Wood Preservatives, Solvent-Based Wood Preservatives, Oil-Based Wood Preservatives), By Application (Wood Flooring, Railroad Ties, Cabinets and Decks, Doors & Windows, Others), By End-use (Commercial, Residential, Industrial), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Advance Agrisearch Limited , BERKEM, Changchun Wood Preservative Manufacturing Co. Ltd, Copper Care Wood Preservatives Inc., Dolphin Bay, Groupe Berkem, Impra Wood Protection Ltd , Jubilant Agric & Consumer Products , Koppers Performance Chemicals, Kurt Obermeier GmbH & Co. KG, LANXESS, Lonza Specialty Ingredients (Bain Capital and Cinven), Nisus Corporation, Remmers Gruppe AG, Rio Tinto, Sanyu Chemical (Shenzhen) Co. Ltd, TIMBERLIFE (PTY) LTD, Troy Corporation, Viance, Wolman Wood and Fire Protection GmbH, Wykamol Group Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Advance Agrisearch Limited

- BERKEM

- Changchun Wood Preservative Manufacturing Co. Ltd

- Copper Care Wood Preservatives Inc.

- Dolphin Bay

- Groupe Berkem

- Impra Wood Protection Ltd

- Jubilant Agric & Consumer Products

- Koppers Performance Chemicals

- Kurt Obermeier GmbH & Co. KG

- LANXESS

- Lonza Specialty Ingredients (Bain Capital and Cinven)

- Nisus Corporation

- Remmers Gruppe AG

- Rio Tinto

- Sanyu Chemical (Shenzhen) Co. Ltd

- TIMBERLINE (PTY) LTD

- Troy Corporation

- Viance

- Wolman Wood and Fire Protection GmbH

- Wykamol Group Ltd