5G Infrastructure Market By Communication Infrastructure (Small Cell, Macro Cell), By Network Architecture (5G Standalone (NR + Core), 5G NR Non-Standalone (LTE Combined), And Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

10091

-

June 2023

-

155

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

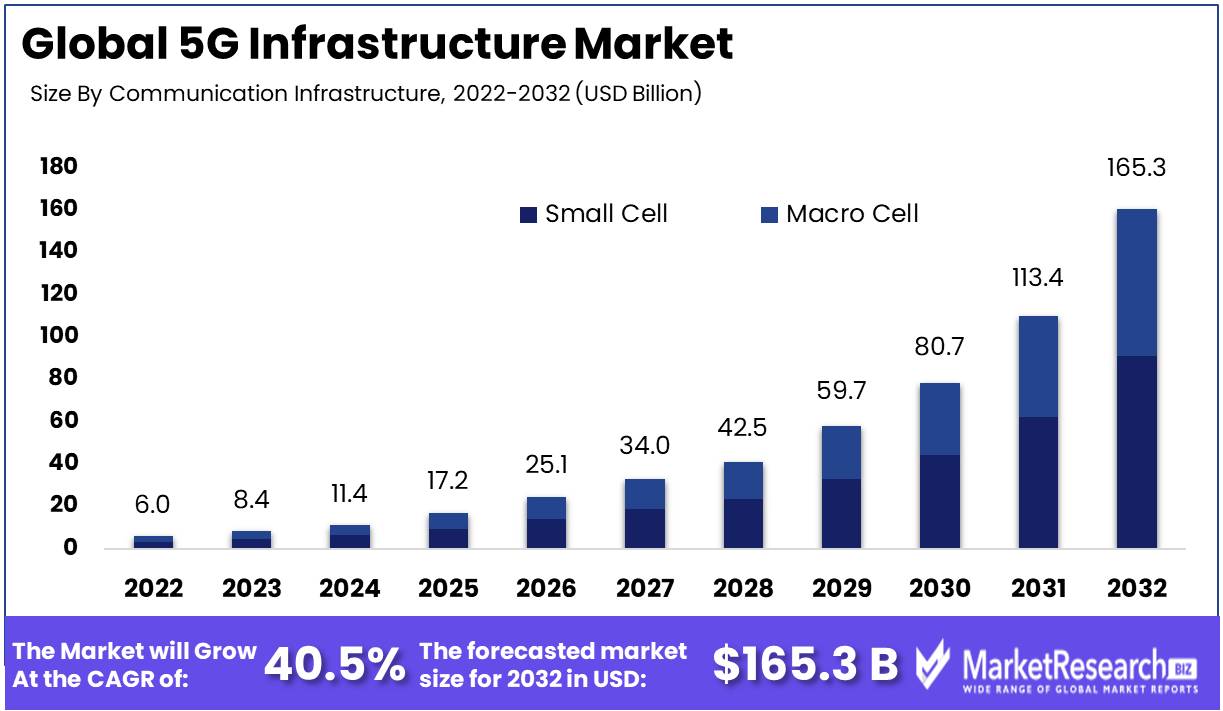

The 5G Infrastructure Market size is expected to be worth around USD 165.3 Bn by 2032 from USD 6 Bn in 2022, growing at a CAGR of 40.5% during the forecast period from 2023 to 2032.

The enigmatic realm of the 5G infrastructure market is beyond the comprehension of mundane mortals, as it delves deeply into the intricate fabric of network infrastructure, paving the way for the majestic fifth-generation wireless technology to demonstrate its formidable prowess. Imagine a world where connectivity is faster than the wind and as reliable as a thousand sunsets, all while basking in the ethereal radiance of lower-latency transmissions. It is a realm where smartphones, tablets, laptops, and even the enigmatic Internet of Things (IoT) devices coexist, enjoying the bountiful benefits conferred by this technological marvel.

Behold, beloved traveler, as the 5G infrastructure market unfolds before your very eyes in all its splendor. Its offerings surpass those of its predecessors, with faster speeds that ignite the flames of speed in your digital existence, greater bandwidth that weaves a tapestry of limitless possibilities, and lower latency that eliminates the agonizing delay in your human interactions. In addition, it embraces the symphony of simultaneous connections, allowing a multitude of devices to perform a grand digital ballet together.

Prepare to witness the transformation, as the 5G infrastructure market will be the catalyst for the profound transformation of numerous industries. The influence of 5G will be felt everywhere, from the sacred halls of healthcare to the bustling corridors of transportation, from the innovative sanctuaries of manufacturing to the realms of entertainment that captivate our spirits. Faster speeds will reawaken dormant capabilities, while lower latency will break down time barriers, bestowing seamless connectivity to a multitude of devices. The siren song of increased bandwidth will entice businesses into its embrace, enabling them to compose innovative symphonies.

On the canvas of the 5G infrastructure market, innovative brushstrokes create a tapestry of marvels. Within this work of art, small cells emerge as protectors of connectivity, disseminating their low-power, short-range base stations across densely populated regions to strengthen coverage and capacity. Observe the majesty of massive MIMO systems, which feature multiple antennas that multiply the streams of spatial enchantment and grant us enhanced signal quality.

The 5G infrastructure market is flooded with celestial investments from a variety of industrial sectors. Telecom companies emerge as harbingers of investment, spurred by an insatiable desire to provide their customers with faster and more reliable connectivity. As hospitals and clinics align their resources to improve patient care and herald in a new era of remote monitoring, the healthcare industry responds. 5G entwines with the symphony of transportation, as automotive entities invest in this wondrous technology to shape the essence of autonomous vehicles.

Driving Factors

High Speed and Low Latency Demand

The demand for high-speed internet and low-latency connections has never been greater. Due to the growing number of connected devices and the popularity of augmented reality (AR) and virtual reality (VR) applications, seamless connectivity requires low latency. 5G technology can provide lightning-fast speeds, reduced latency, and stable connections, making it an ideal solution for both businesses and consumers.

Data Consumption

As more people rely on their devices for streaming video content, communicating with friends and family, purchasing online, and working remotely, data consumption continues to skyrocket. The inability of traditional networks to meet this demand results in sluggish connections and network congestion. 5G technology can alleviate these problems by providing faster download and upload speeds, superior network capacity, and decreased data transit times.

5G Advancements

The development of 5G technology is a significant factor in its sustained expansion. Millimeter-wave technology has enabled ultra-fast internet speeds, while other enhancements have made 5G networks more reliable, faster, and more widespread. In addition, the current migration from 4G to 5G networks and the development of 5G-capable devices will only serve to accelerate the transformation.

Government Initiatives

The deployment of 5G networks has been largely facilitated by government initiatives. Numerous governments offer grants, subsidies, and tax breaks to telecommunications companies as inducements for countries to invest significantly in 5G infrastructure. The government's efforts to promote the adoption of 5G infrastructure for critical applications, such as smart homes, smart cities, and autonomous vehicles, will play a significant role in propelling the market growth.

Restraining Factors

Deployment Costs

Costs of deployment continue to pose the greatest obstacle for companies developing 5G infrastructure. The construction of new infrastructure necessitates substantial investments, which many service providers struggle to finance. Costs associated with developing enhanced networks for 5G technology are also included in deployment expenses. These costs cause businesses to delay the launch of 5G services, thereby retarding the rate of innovation in this field.

Regulations

Regulations are an additional significant factor restraining the 5G Infrastructure market. The current regulatory environment governing 5G technology is complex due to the involvement of numerous stakeholders, such as telecom regulators, governments, and industry organizations. This complexity increases the difficulty faced by businesses attempting to incorporate and implement 5G infrastructure.

Device Availability

The availability of devices is another factor that inhibits the growth of the 5G infrastructure market. This technology necessitates the use of sophisticated devices that are compatible with the 5G network. Additionally, businesses require devices capable of transferring data at a faster rate and enabling advanced services and applications. This requirement presents a challenge for companies seeking to rapidly develop and launch 5G services.

Insurance Coverage Limitations

Coverage limitations are also among the most significant market restraints for 5G infrastructure. Companies developing 5G infrastructures must ensure that all consumers are adequately covered. This requirement presents a significant obstacle, as there are still many areas without 5G coverage. The development of additional infrastructure to accommodate these areas is prohibitively expensive.

Overcoming Restraining Factors

The aforementioned obstacles can be overcome by adopting certain actions. Companies can leverage existing infrastructure and co-locate 5G infrastructure on existing assets to reduce deployment costs. This strategy would aid in reducing the need for independent infrastructure. In addition, constructing more open networks can encourage the development of new systems and democratize the infrastructure requirement.

Communication Infrastructure Analysis

The world is marching relentlessly toward the adoption of 5G technology, and the market for communication infrastructure is moving at an extraordinary rate to keep up with demand. The small cell segment currently dominates the 5G infrastructure market. This segment consists of low-powered radio access nodes that transmit and receive data over a larger network of radio access nodes. It is anticipated that the small cell segment will continue to dominate the market in the future years.

In recent years, emerging economies such as China, India, and Brazil, among others, have experienced tremendous economic expansion. These nations are embracing technology to enhance their economic conditions, and as a result, the small cell segment of communication infrastructure has been rapidly adopted. Governments in emerging economies are collaborating with telecommunications firms to construct the infrastructure required to improve connectivity and, consequently, increase access to information that is vital to their economic development.

With 5G technology, the global trend is toward increased data consumption. To meet the growing demand for quicker internet speeds among consumers, telecommunications companies are transitioning to small cell segments. These segments are deployed in densely populated urban regions with high data demand. Consumers now congregate in public areas such as retail malls and stadiums and expect seamless connectivity; small cell segments provide the necessary solutions to meet their requirements.

Core Network Technology Analysis

The network function virtualization (NFV) market segment dominates the 5G infrastructure market. NFV is a concept involving the execution of network functions via virtualized networks rather than hardware. Numerous telecommunications firms are adopting NFV because it eliminates the need for distinct, physical hardware, resulting in substantial cost savings. It is anticipated that network function virtualization will continue to gain popularity in the future years.

Emerging economies possess substantial technical expertise and are eager to implement technology to stimulate economic growth. They realize that the adoption of cutting-edge technology leads to infrastructure expansion, which drives the economy as a whole. Consequently, emerging economies are rapidly adopting network function virtualization to enhance connectivity throughout their respective nations. Collaboration between telecommunications companies from emerging economies and wireless carriers from developed nations leads to the implementation of virtualized networks in emerging economies.

It is anticipated that network function virtualization will continue to gain popularity in the future years. In addition to driving economic growth, NFV provides cost savings, which is why telecommunications companies are investing extensively in this technology. In the future years, the NFV segment of the 5G infrastructure market is anticipated to record the highest growth rate. Developed and emerging economies equally recognize the benefits of this technology, and telecommunications companies are investing in NFV to provide their customers with dependable, cost-effective, and quick network connectivity.

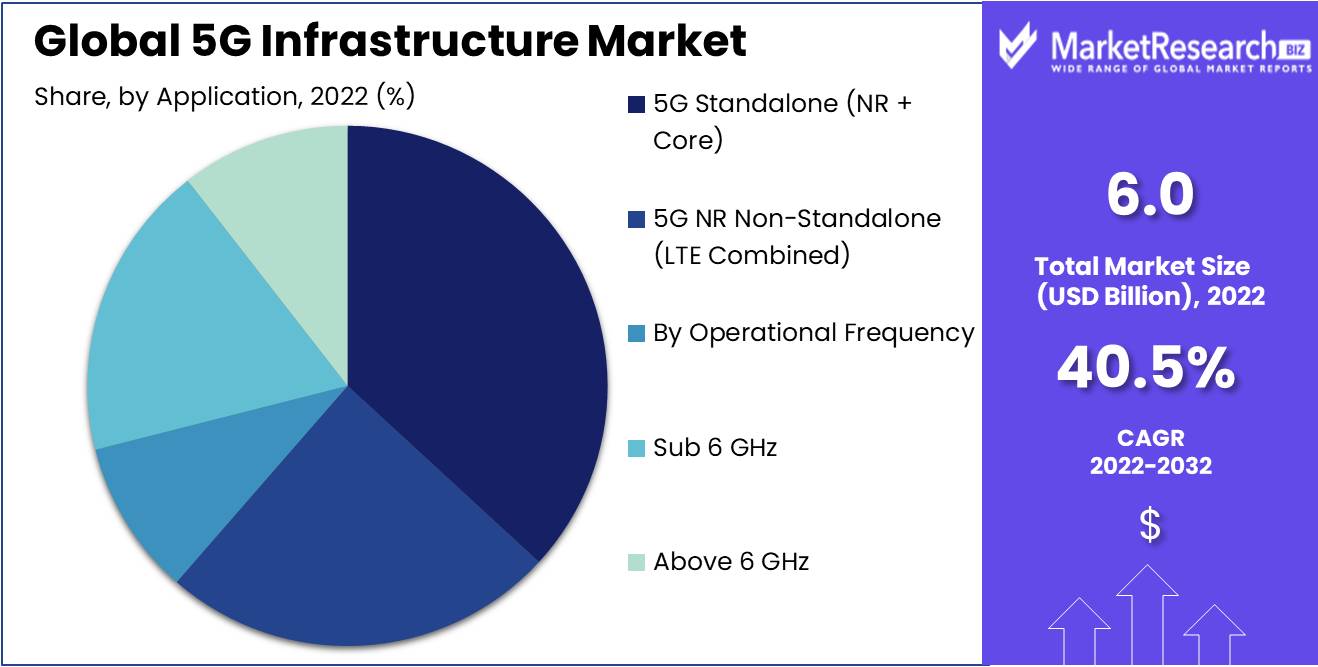

Network Architecture Analysis

The 5G infrastructure market is dominated by the segment of standalone (NR + Core) devices. This segment is independent and distinct from the extant network infrastructure, as its name suggests. The segment of standalone architecture offers several benefits, including minimal latency, increased privacy, and enhanced security.

Emerging economies recognize that adopting cutting-edge technology fosters economic growth, which explains why standalone architecture technology is gaining popularity in these regions. Governments in emerging economies are collaborating with telecommunications firms to build the infrastructure necessary for the deployment of standalone architecture technology, which in turn stimulates economic growth.

The increase in data utilization is one of the most significant growth drivers for 5G infrastructure. Consumers demand faster and more dependable internet connectivity and data access for their routine needs. Those telecommunications companies that choose the segment of standalone architecture can provide customers with seamless connectivity.

Key Market Segments

By Communication Infrastructure

- Small Cell

- Macro Cell

Based on Component

- Services

- Hardware

By Core Network Technology

- Network Function Virtualization (NFV)

- Software-Defined Networking (SDN)

By Network Architecture

- 5G Standalone (NR + Core)

- 5G NR Non-Standalone (LTE Combined)

- By Operational Frequency

- Sub 6 GHz

- Above 6 GHz

Based on Vertical

- Residential

- Enterprise/Corporate

- Energy & Utility

- Transportation & Logistics

- Other Verticals

Growth Opportunity

Mobile Broadband

The mobile broadband market is a crucial growth driver for the 5G infrastructure market. Significantly increased demand for mobile broadband is primarily attributable to the pervasive adoption of smartphones and other mobile devices. 5G technology represents a substantial advance over earlier generations of mobile networks. It can provide faster speeds, reduced latency, and a larger network capacity, making it ideal for supporting data-intensive applications such as video streaming and online gaming.

Collaboration

Collaboration between various organizations is also a crucial aspect of the growth of the 5G infrastructure market. Numerous businesses are collaborating on the development of new technologies and solutions that can assist in enhancing the capabilities of 5G networks. Collaboration between network infrastructure providers, device manufacturers, and other technology firms can result in innovative solutions that considerably enhance the performance of 5G networks. This can result in increased adoption by enterprises and consumers.

Technology Integration

Integration of multiple technologies is an additional essential growth driver for the 5G infrastructure market. Integrating technologies like artificial intelligence (AI), the Internet of things (IoT), and edge computing can substantially improve the capabilities of 5G networks. Combining 5G networks and AI technology can enable cutting-edge applications such as autonomous vehicles and smart cities. The incorporation of the Internet of Things with 5G networks can improve the connectivity of various devices, thereby enabling new use cases and business models.

Industry-Specific Use Cases

Additionally, industry-specific use cases can play a significant role in propelling the growth of the 5G infrastructure market. Different industries have unique requirements, and 5G technology can provide solutions that can meet these requirements. 5G technology can facilitate telemedicine applications in the healthcare industry, allowing doctors to remotely monitor patients' vital signs and provide care from a distance. 5G can enable the use of robotics and other automation technologies in the manufacturing sector, increasing efficiency and output.

Latest Trends

Increasing Demand for High Speed and Low Latency Connectivity

Increasing demand for high-speed and low-latency connectivity is one of the main factors driving the 5G infrastructure market. 5G promises to provide consumers with wireless connections that are rapid, dependable, and secure, and that can support the most recent technologies and applications. Users can experience quicker download and upload speeds, decreased latency, and more reliable connectivity with 5G.

As the number of connected devices increases and more data is produced, quicker and more efficient data transmission is required. 5G offers speeds up to 100 times quicker than 4G, with minimal latency between devices. This makes it excellent for applications requiring real-time communication, including autonomous vehicles, augmented reality, and remote surgery.

Adoption of Massive MIMO Technology in 5G Infrastructure

The adoption of massive MIMO (multiple input, multiple output) technology is an additional key factor propelling the 5G infrastructure market. Massive MIMO takes MIMO technology to the next level by employing hundreds or thousands of antennas, resulting in quicker and more reliable wireless connections.

With massive MIMO technology, 5G networks can provide higher data rates, increased capacity, and enhanced coverage, making them ideal for densely populated areas like stadiums, urban centers, and transportation nodes. Multiple users can connect to the network simultaneously without sacrificing speed or quality thanks to this technology.

Expansion of 5G Infrastructure in Industrial IoT Applications

Industrial Internet of Things (IIoT) refers to the use of IoT technologies in industries such as manufacturing, transportation, and energy to increase efficiency, reduce costs, and boost productivity. The adoption of 5G in the IIoT is anticipated to drive the growth of the 5G infrastructure market, as it will enable real-time data processing and analysis, resulting in more effective and efficient operations.

5G networks can support a large number of devices and sensors, making it possible for autonomous and connected machinery to operate in unison. This will result in the creation of smart factories, connected communities, and intelligent transportation systems, which will fundamentally alter the way we live and work.

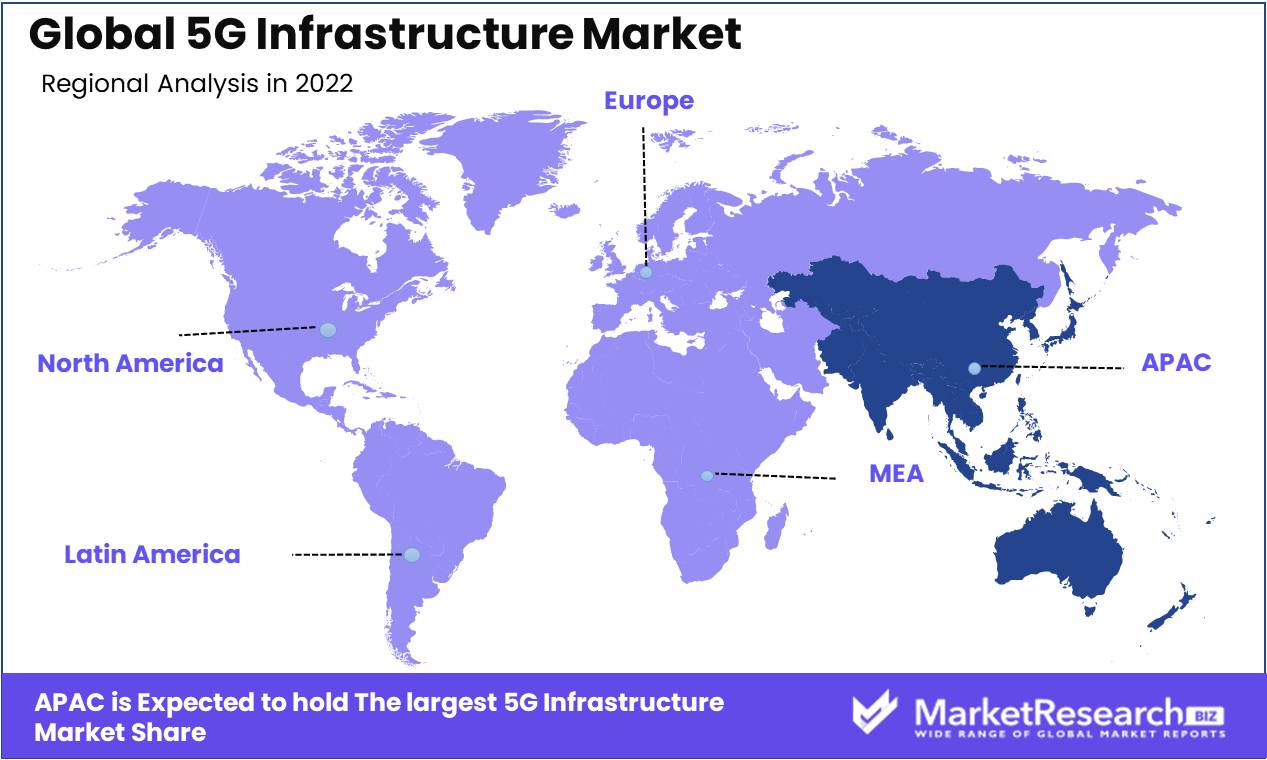

Regional Analysis

Several important factors position the APAC (Asia-Pacific) region to dominate the 5G infrastructure market. APAC nations, including China, South Korea, and Japan, have made substantial investments in the development of 5G infrastructure. These nations are actively deploying 5G networks and have reached significant coverage and adoption rates milestones.

Particular China has become a global leader in 5G infrastructure. The Chinese government has provided substantial support and funding for 5G development, resulting in the rapid deployment of 5G networks throughout the country. In addition to being at the forefront of 5G equipment manufacturing, Chinese companies also contribute to the region's dominance.

Additionally, South Korea has established itself as a leader in 5G infrastructure. The country has one of the highest 5G penetration rates in the world, with ubiquitous 5G adoption and coverage. South Korean telecommunications companies have been at the forefront of the deployment of 5G networks and have provided a vast array of 5G services.

As part of its national strategy, the technologically advanced nation of Japan has been actively promoting 5G infrastructure. The government of Japan has supported 5G trials, research, and development. Japanese enterprises also contribute significantly to the global 5G ecosystem.

In addition, the large population and rising demand for high-speed connectivity in the APAC region make it an attractive market for 5G infrastructure. In APAC nations, industries such as manufacturing, healthcare, transportation, and entertainment are increasingly adopting 5G technology to increase productivity and provide innovative services.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Huawei is presently one of the leading players in the 5G infrastructure market and has made significant investments in R&D to enhance its products and services. They have recently introduced a number of 5G products, including base stations, antennas, and routers that are all compliant with 3GPP standards.

Ericsson, on the other hand, has been at the forefront of innovation and has participated in numerous 5G trials and testing initiatives worldwide. In addition, they have been actively collaborating with other industry leaders to develop and implement new standards and technologies.

Nokia has also been a major player in the 5G infrastructure market, focusing on the development of new 5G products and services to satisfy the needs of both consumers and business customers. The high reliability, low latency, and high capacity of their 5G base stations make them ideal for the high-speed, low-latency applications that are prevalent in the 5G market.

ZTE is a significant participant in the 5G infrastructure market and has been actively developing new 5G products and technologies. They have made substantial investments in research and development and are actively testing and evaluating their 5G products with consumers worldwide.

Top Key Players in 5G Infrastructure Market

- Intel Corporation

- Telefonaktiebolaget LM Ericsson

- ABB Ltd.

- Samsung Electronics Co. Ltd.

- com Inc. (Amazon Robotics LLC.)

- Honda Motor Co. Inc.

- Yaskawa Electric Corporation

- OMRON Corporation (Adept Technology Inc.)

- Lely Holding S.à r.l.

- NORTHROP GRUMMAN CORPORATION

- Asustek Computer Inc.

- Nokia Corporation

- Google Inc.

Recent Development

- In 2022, Ericsson announced the release of its most recent 5G base station, the Ericsson Radio 6600. This cutting-edge technology, designed to be more efficient and dependable than previous models, promises to revolutionize the industry. Nokia introduced its own 5G base station, the Nokia AirScale AA6000, immediately after Ericsson's announcement. Designed to support the next generation of 5G networks and beyond, this cutting-edge technology is poised to disrupt the market.

- In 2023, Huawei, not to be surpassed, announced its own 5G base station. This latest device, which offers scalability and cost-effectiveness, is likely to be a hit with businesses vying for 5G infrastructure market dominance. Samsung unveiled its brand-new 5G base station, the Samsung 5G Base Station, as the icing on the cake. This cutting-edge technology boasts enhanced energy efficiency and is the latest entry in what is shaping up to be fierce competition between the industry's major players.

Report Scope

Report Features Description Market Value (2022) USD 6 Bn Forecast Revenue (2032) USD 165.3 Bn CAGR (2023-2032) 40.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Communication Infrastructure (Small Cell, Macro Cell)

By Core Network Technology (Network Function Virtualization (NFV), Software-Defined Networking (SDN))

By Network Architecture (5G Standalone (NR + Core), 5G NR Non-Standalone (LTE Combined), By Operational Frequency, Sub 6 GHz, Above 6 GHz)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Intel Corporation, Telefonaktiebolaget LM Ericsson, ABB Ltd., Samsung Electronics Co. Ltd., com Inc. (Amazon Robotics LLC.), Honda Motor Co. Inc., Yaskawa Electric Corporation, OMRON Corporation (Adept Technology Inc.), Lely Holding S.à r.l., NORTHROP GRUMMAN CORPORATION, Asustek Computer Inc., Nokia Corporation, Google Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Intel Corporation

- Telefonaktiebolaget LM Ericsson

- ABB Ltd.

- Samsung Electronics Co. Ltd.

- com Inc. (Amazon Robotics LLC.)

- Honda Motor Co., Inc.

- Yaskawa Electric Corporation

- OMRON Corporation (Adept Technology, Inc.)

- Lely Holding S.à r.l.

- NORTHROP GRUMMAN CORPORATION

- Asustek Computer Inc.

- Nokia Corporation

- Google Inc.