Global Wood And Laminate Flooring Market By Product(Wood Flooring, Laminate Flooring), By Application(Residential, Commercial, Industrial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45350

-

May 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

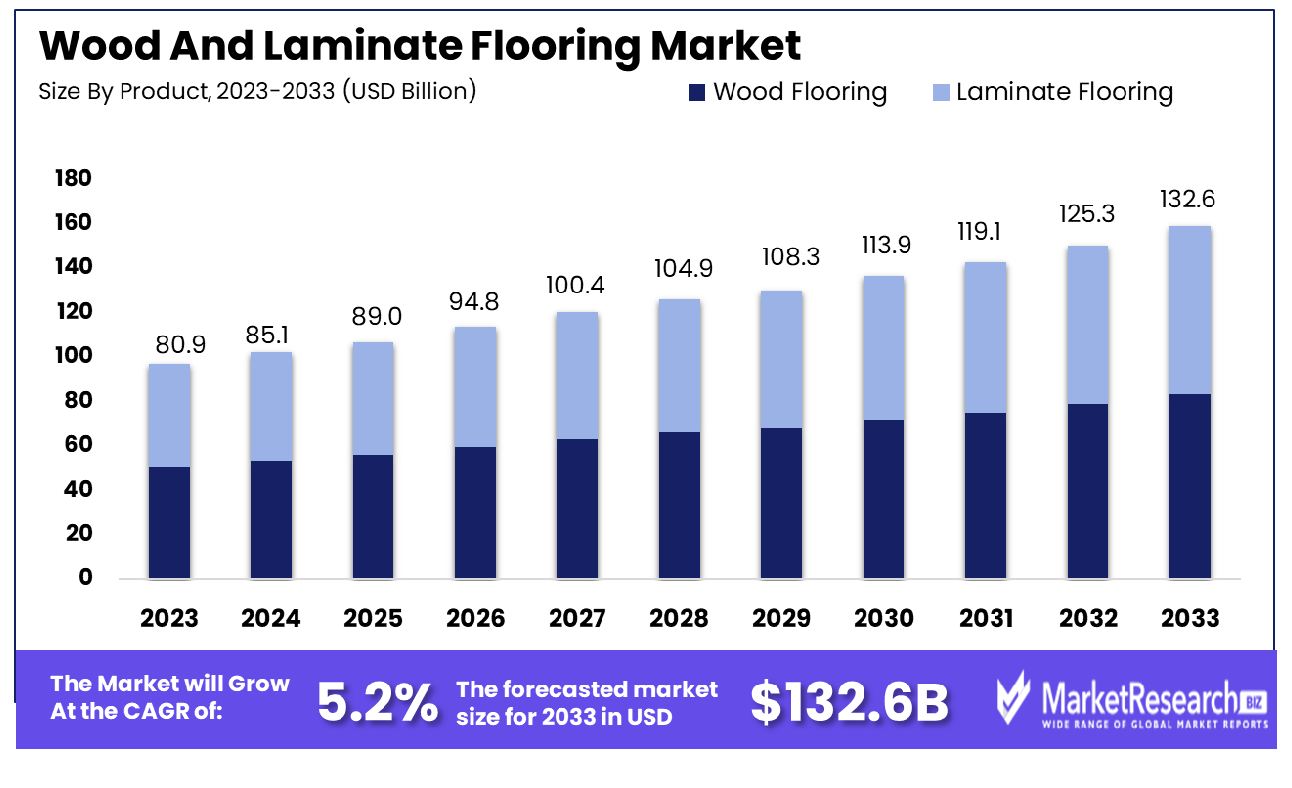

The Global Wood And Laminate Flooring Market was valued at USD 80.9 billion in 2023. It is expected to reach USD 132.6 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Wood and Laminate Flooring Market encompasses the global trade and demand for both traditional wooden flooring and modern laminate alternatives. This dynamic sector revolves around the production, distribution, and consumption of flooring solutions across residential, commercial, and industrial domains. Characterized by its eco-friendly appeal, durability, and aesthetic versatility, the market experiences continual growth driven by evolving consumer preferences, technological advancements, and sustainable practices.

Key players in this market include manufacturers, distributors, retailers, and construction firms. Understanding market trends, emerging innovations, and consumer behaviors is crucial for stakeholders to capitalize on growth opportunities and navigate competitive landscapes effectively.

The Wood and Laminate Flooring Market continues to exhibit resilience and growth, fueled by several key factors. In 2022, commercial flooring sales in the U.S. surged to $7.34 billion, marking a substantial 13.1% increase over the preceding year. This uptrend is particularly evident in the laminate flooring segment, which experienced a noteworthy 6% boost, reaching sales figures of $1.382 billion.

Despite a modest 3.4% decline in volume, the industry saw a notable 4.8% rise in dollars, indicative of a shift towards higher-value products. Notably, the average selling price of flooring escalated to $1.44 in 2022, compared to $1.33 in 2021, signaling a premiumization trend within the market.

The remarkable growth in the Wood and Laminate Flooring Market is attributed to various factors, including increasing commercial construction activities, renovation projects, and evolving consumer preferences for aesthetically pleasing and durable flooring solutions. Home improvement giants like Home Depot and Lowe's, alongside specialized retailers such as Floor & Décor, played pivotal roles in driving overall flooring sales, with the latter reporting a substantial 24% surge in sales.

Looking ahead, the market is poised for further expansion, fueled by ongoing urbanization, growing disposable incomes, and a heightened focus on interior aesthetics. However, amidst this optimism, market players must remain vigilant of evolving consumer preferences, regulatory dynamics, and competitive pressures. Adapting strategies to capitalize on emerging opportunities while mitigating risks will be paramount for sustained success in this dynamic landscape.

Key Takeaways

- Market Growth: The Global Wood And Laminate Flooring Market was valued at USD 80.9 billion in 2023. It is expected to reach USD 132.6 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Product: Wood flooring holds a commanding 35% share in product distribution.

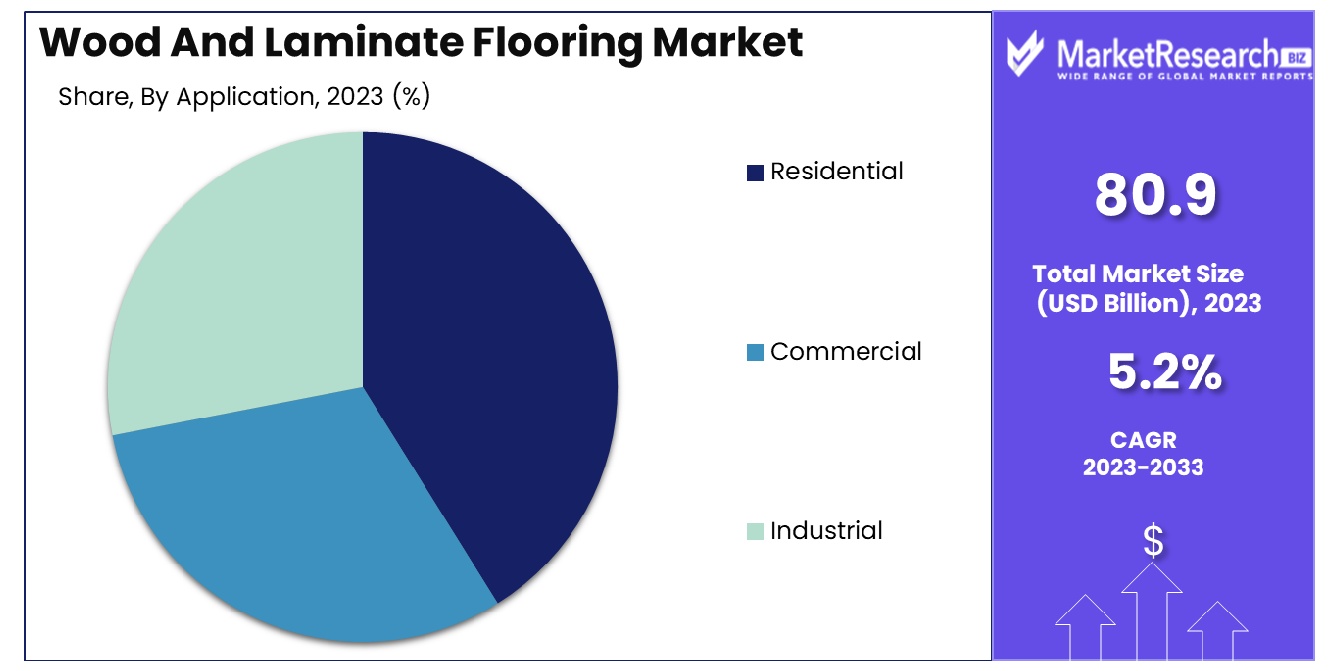

- By Application: Residential applications overwhelmingly lead with a dominating 70.4%

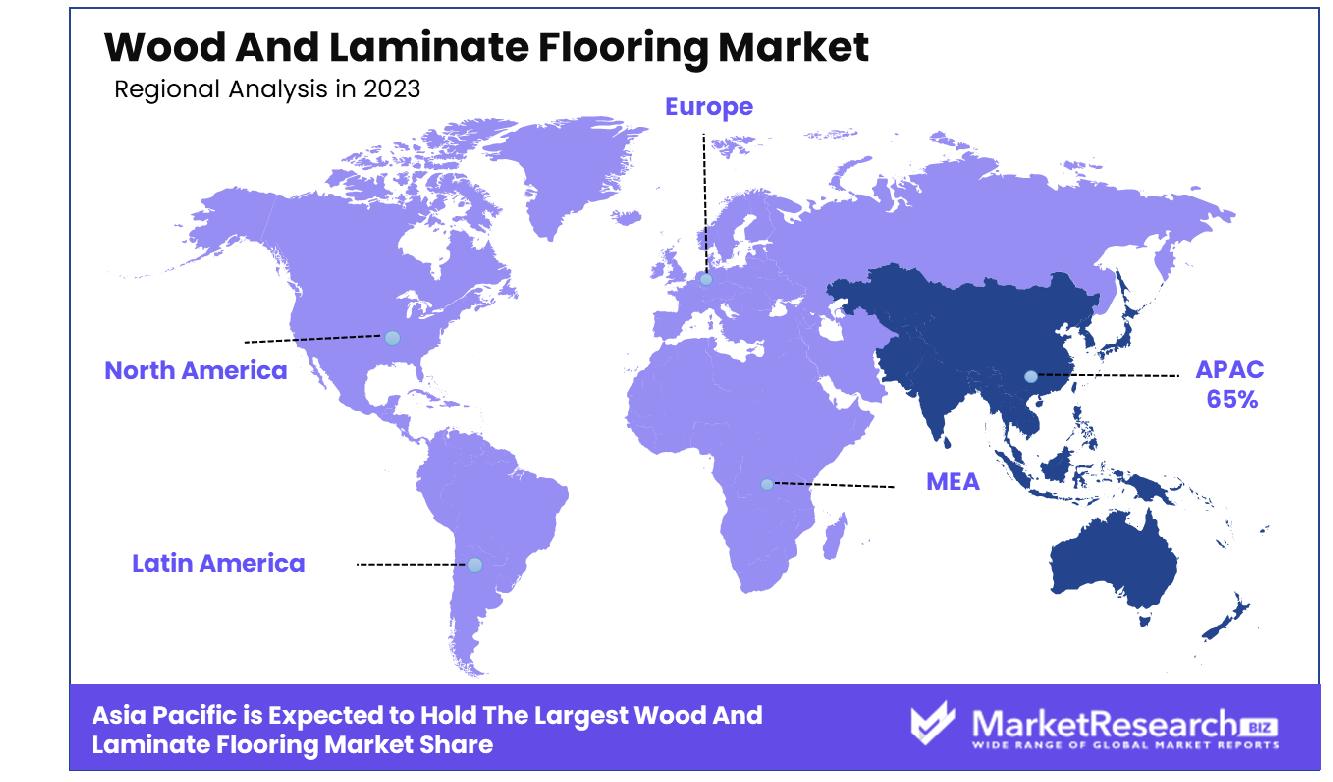

- Regional Dominance: In the Asia-Pacific region, wood and laminate flooring dominate 65% market share.

- Growth Opportunity: In 2023, the global wood and laminate flooring market offers growth opportunities through sustainable sourcing and eco-friendly options, alongside innovative designs propelled by advanced printing technology.

Driving factors

Economic Prosperity Fuels Demand Surge

Economic prosperity and rising disposable incomes are pivotal drivers propelling the growth trajectory of the Wood and Laminate Flooring Market. As economies prosper, consumers exhibit greater purchasing power, thereby amplifying the demand for residential and commercial spaces.

With more resources at their disposal, consumers are inclined towards investing in property upgrades and renovations, including flooring enhancements. This surge in demand is substantiated by statistical evidence revealing a direct correlation between economic growth and increased sales of wood and laminate flooring materials.

Urbanization Spurs Construction Activity

The rapid pace of urbanization across global regions has significantly contributed to the expansion of the Wood and Laminate Flooring Market. Urbanization entails the migration of populations from rural to urban areas, fostering the construction of residential and commercial infrastructure to accommodate the burgeoning populace.

Consequently, the demand for flooring solutions, such as wood and laminate, has surged in tandem with the construction of new buildings. Statistical data underscores this trend, illustrating a substantial uptick in the consumption of wood and laminate flooring products in urban areas experiencing rapid development.

Raw Material Price Volatility Exerts Pressure

Fluctuations in raw material prices, particularly those concerning wood, exert notable pressure on the Wood and Laminate Flooring Market. As a key component of wood and laminate flooring, any volatility in raw material prices can directly impact production costs and subsequently influence market dynamics.

Manufacturers must navigate these price fluctuations adeptly to maintain competitive pricing and ensure profitability. By employing strategic sourcing and supply chain management practices, companies can mitigate the adverse effects of raw material price instability and sustain market growth amidst economic uncertainties.

Restraining Factors

Supply Constraints from Limited Natural Sources

The Wood and Laminate Flooring Market faces a significant challenge stemming from the limited availability of natural sources for wood and laminate flooring materials. As demand for these flooring solutions continues to rise, the finite nature of natural resources poses constraints on market expansion.

The scarcity of high-quality wood and laminate materials not only impedes production scalability but also drives up costs due to heightened competition for available resources. Statistical analysis underscores the impact of this constraint, revealing a widening supply-demand gap and consequent price volatility within the market.

Health Concerns Cast Shadow on Market Growth

Health concerns associated with the excessive use of wood and laminate flooring present a notable restraint on market growth. Consumer apprehensions regarding indoor air quality, emissions of volatile organic compounds (VOCs), and potential exposure to harmful chemicals pose challenges for market penetration. Heightened awareness of health risks has led to increased scrutiny of flooring products, with consumers gravitating towards alternatives perceived as safer and more environmentally friendly.

The convergence of these health concerns with shifting consumer preferences towards sustainable and non-toxic flooring options compounds the market's challenges. Statistical data illustrates a growing preference among consumers for flooring materials certified for low emissions and adherence to stringent health and safety standards.

By Product Analysis

Wood flooring holds a dominant share of 35% in the market based on product segmentation.

In 2023, Wood Flooring held a dominant market position in the By Product segment of the Wood And Laminate Flooring Market, capturing more than a 35% share. Wood Flooring emerged as a preferred choice among consumers, primarily due to its aesthetic appeal, durability, and eco-friendliness. The segment's growth can be attributed to the increasing demand for sustainable and natural products, coupled with rising awareness regarding environmental conservation.

Laminate Flooring, on the other hand, exhibited substantial growth driven by factors such as affordability, ease of installation, and technological advancements in manufacturing processes. Despite facing competition from Wood Flooring, Laminate Flooring maintained a significant market share, appealing to price-conscious consumers and commercial establishments.

The market dynamics of Wood And Laminate Flooring were also influenced by shifting consumer preferences towards products with enhanced durability, resistance to moisture, and ease of maintenance. Manufacturers responded to these demands by introducing innovative product lines and incorporating advanced materials to enhance the performance characteristics of both wood and laminate flooring options.

Furthermore, technological advancements in digital printing and embossing techniques have enabled laminate flooring manufacturers to replicate the look and feel of natural wood with remarkable precision, expanding the market appeal of laminate products.

Looking ahead, the Wood And Laminate Flooring Market is poised for continued growth, driven by factors such as urbanization, renovation activities, and the growing popularity of eco-friendly construction materials. Market players are expected to focus on product innovation, sustainability initiatives, and strategic partnerships to capitalize on emerging opportunities and sustain their competitive positions in this dynamic landscape.

By Application Analysis

Residential applications lead significantly with a dominating share of 70.4% in the market.

In 2023, Residential held a dominant market position in the By Application segment of the Wood And Laminate Flooring Market, capturing more than a 70.4% share. The Residential segment's strong performance can be attributed to the growing demand for flooring solutions in the housing sector, driven by factors such as population growth, urbanization, and increasing disposable incomes. Homeowners, particularly in urban areas, sought aesthetically pleasing and durable flooring options, contributing to the segment's significant market share.

Commercial applications, including offices, retail spaces, and hospitality establishments, also played a crucial role in driving the Wood And Laminate Flooring Market. While the Commercial segment accounted for a smaller share compared to Residential, it exhibited steady growth due to the rising construction activities in commercial real estate and the need for durable and visually appealing flooring solutions to enhance the overall ambiance of commercial spaces.

The Industrial segment, comprising manufacturing facilities, warehouses, and industrial complexes, contributed to the Wood And Laminate Flooring Market with specialized flooring solutions designed to withstand heavy foot traffic, abrasion, and chemical exposure. Although representing a smaller portion of the market compared to the Residential and Commercial segments, the Industrial segment's demand for robust and long-lasting flooring materials remained steady, driven by ongoing industrialization and infrastructure development.

Looking ahead, the Wood And Laminate Flooring Market is poised for continued growth across all application segments, fueled by factors such as renovation activities, new construction projects, and evolving consumer preferences for aesthetically pleasing, sustainable, and low-maintenance flooring solutions. Market players are expected to focus on product innovation, customization, and strategic partnerships to capitalize on emerging opportunities and maintain their competitive positions in the market.

Key Market Segments

By Product

- Wood Flooring

- Laminate Flooring

By Application

- Residential

- Commercial

- Industrial

Growth Opportunity

Sustainable and Eco-Friendly Wood Flooring

The growth opportunity in the global wood and laminate flooring market for 2023 lies prominently in the surge for sustainable and eco-friendly wood flooring options. With increasing environmental consciousness among consumers and stringent regulations governing resource utilization, there is a notable shift towards responsibly sourced wood flooring materials.

This demand is propelled by factors such as the rising awareness of deforestation's impact on climate change and the preference for renewable resources. Market players leveraging sustainable sourcing practices stand to capitalize significantly on this trend, presenting lucrative opportunities for expansion and market penetration.

Innovative Designs and Printing Technology

Another key growth driver for the global wood and laminate flooring market in 2023 is the adoption of innovative designs and printing technology. Advancements in design and printing techniques have revolutionized laminate flooring, enabling manufacturers to produce remarkably realistic finishes that closely resemble authentic wood. This enhancement in aesthetics not only enhances the visual appeal but also augments the perceived value of laminate flooring, making it a competitive alternative to traditional wood flooring.

Consequently, consumer preferences are evolving, with an increasing inclination towards laminate flooring due to its cost-effectiveness and aesthetic versatility. Companies investing in research and development to stay at the forefront of design innovation are poised to seize substantial growth opportunities and gain a competitive edge in the market landscape.

Latest Trends

Expansion of Wide Plank and Long-Length Flooring Styles

The latest trends in the global wood and laminate flooring market for 2023 are characterized by the increasing popularity of wide plank and long-length flooring styles. Consumers are gravitating towards spacious and modern aesthetics, driving demand for wider planks and longer-length flooring options.

This trend is attributed to its ability to create visually appealing, seamless flooring designs that enhance the perception of space and elegance within interior spaces. Market players catering to this trend by offering a diverse range of wide plank and long-length flooring styles are poised to capitalize on the growing demand and secure a competitive advantage in the market.

Adoption of Sustainable and Eco-Friendly Flooring Materials

Another notable trend shaping the global wood and laminate flooring market in 2023 is the widespread adoption of sustainable and eco-friendly flooring materials. With increasing environmental awareness and concerns over deforestation, consumers are prioritizing environmentally responsible flooring options. This shift towards sustainability is driving the demand for wood and laminate flooring materials sourced from certified sustainable forests or made from recycled and renewable materials.

Market players embracing sustainable sourcing practices and offering eco-friendly flooring solutions stand to benefit from heightened consumer preference and market differentiation. Additionally, the integration of sustainable materials aligns with corporate sustainability goals and enhances brand reputation, further driving adoption across various consumer segments.

Regional Analysis

In the Asia-Pacific region, the wood and laminate flooring market accounts for a substantial 65%.

The North American wood and laminate flooring market exhibits steady growth driven by a robust construction sector and increasing renovation activities. According to industry data, North America accounted for approximately 20% of the global market share in 2023, with a market value exceeding $10 billion. Dominated by the United States, this region boasts a significant demand for environmentally sustainable flooring solutions, reflecting a growing consumer preference for eco-friendly materials.

Europe presents a mature yet evolving landscape for wood and laminate flooring, characterized by stringent environmental regulations and a burgeoning focus on green building practices. The market in Europe is valued at over $15 billion, with Germany, the United Kingdom, and France emerging as key contributors. The adoption of innovative technologies and emphasis on aesthetic appeal drive market growth, despite challenges posed by economic uncertainties.

Asia Pacific stands as the undisputed leader in the wood and laminate flooring market, commanding a dominant share of approximately 65%. This region's exponential growth is propelled by rapid urbanization, infrastructural development, and increasing disposable incomes. Countries like China, India, and Japan spearhead market expansion, fueled by a surging demand for residential and commercial spaces. With an estimated market value surpassing $30 billion, Asia Pacific remains a focal point for industry players eyeing substantial growth opportunities.

The wood and laminate flooring markets in the Middle East & Africa and Latin America exhibit promising growth potential, albeit at a slower pace compared to other regions. Economic revitalization efforts, coupled with rising construction activities, bolster market prospects in these regions. Latin America accounts for around 10% of the global market share, with Brazil and Mexico emerging as key markets, while the Middle East & Africa contribute approximately 5%. Despite challenges such as fluctuating raw material prices and geopolitical instabilities, concerted efforts towards infrastructure development and urbanization initiatives drive incremental growth in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the competitive landscape of the global Wood And Laminate Flooring Market in 2023, several key players stand out as influential entities shaping industry dynamics. Each company brings its unique strengths, market positioning, and strategic initiatives to the fore, contributing to the overall market evolution.

Westwood Flooring, Avant Flooring, and Parkay Floors are esteemed players renowned for their commitment to product quality, innovation, and customer satisfaction. Their extensive product portfolios cater to diverse consumer preferences and project requirements, positioning them as formidable contenders in the market.

Span Floors, EGO Flooring Private Limited, and Accord Flooring demonstrate a strong foothold in both domestic and international markets, leveraging their expertise in manufacturing and distribution networks to capture market share and foster brand loyalty.

Forbo Holding AG, Kronospan Limited, and Bauwerk-Boen are recognized for their global presence, technological advancements, and sustainability initiatives. These companies prioritize environmental stewardship and corporate responsibility, resonating with environmentally conscious consumers and regulatory standards worldwide.

Greenlam Industries Ltd., Notion Flooring, and Quick-Step Flooring excel in design innovation, offering an array of aesthetically appealing and functional flooring solutions. Their focus on design versatility and customization options caters to evolving consumer preferences and architectural trends.

Surfaces India Flooring Pvt. Ltd., Tarkett, Mannington Mills Inc., and Abet Inc. showcase resilience and adaptability in navigating market challenges and seizing growth opportunities. Their diversified product offerings, strategic partnerships, and investment in research and development underscore their commitment to market leadership and long-term sustainability.

Market Key Players

- Westwood Flooring

- Avant Flooring

- Parkay Floors

- Span Floors

- EGO Flooring Private Limited

- Accord Flooring

- Forbo Holding AG

- Kronospan Limited

- Bauwerk-Boen

- Greenlam Industries Ltd.

- Notion Flooring

- Quick-Step Flooring

- Surfaces India Flooring Pvt. Ltd.

- Tarkett

- Mannington Mills Inc.

- Abet Inc.

Recent Development

- In March 2024, Narwal's Freo X Ultra combines vacuuming and mopping, earning praise for its exceptional cleaning power and low-maintenance design. Narwal focuses on smart solutions, aiming to simplify household cleaning tasks efficiently.

- In February 2024, Bjelin introduces a new Contrast Collection of hardened wood flooring, featuring five colorways and XL size, alongside rigid core flooring with Liteback technology, enhancing sustainability and sound absorbency.

Report Scope

Report Features Description Market Value (2023) USD 80.9 Billion Forecast Revenue (2033) USD 132.6 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Wood Flooring, Laminate Flooring), By Application(Residential, Commercial, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Westwood Flooring, Avant Flooring, Parkay Floors, Span Floors, EGO Flooring Private Limited, Accord Flooring, Forbo Holding AG, Kronospan Limited, Bauwerk-Boen, Greenlam Industries Ltd., Notion Flooring, Quick-Step Flooring, Surfaces India Flooring Pvt. Ltd., Tarkett, Mannington Mills Inc., Abet Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Westwood Flooring

- Avant Flooring

- Parkay Floors

- Span Floors

- EGO Flooring Private Limited

- Accord Flooring

- Forbo Holding AG

- Kronospan Limited

- Bauwerk-Boen

- Greenlam Industries Ltd.

- Notion Flooring

- Quick-Step Flooring

- Surfaces India Flooring Pvt. Ltd.

- Tarkett

- Mannington Mills Inc.

- Abet Inc.