Wellness Supplement Market Report By Product Type (Vitamins & Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acid Supplements, Probiotics, Other Supplements), By Form (Tablets, Capsules, Soft Gels, Powders, Liquids, Gummies), By End-User (Adults, Children, Elderly), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Pharmacies/Drug Stores, Health & Wellness Stores), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024

-

50202

-

August 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

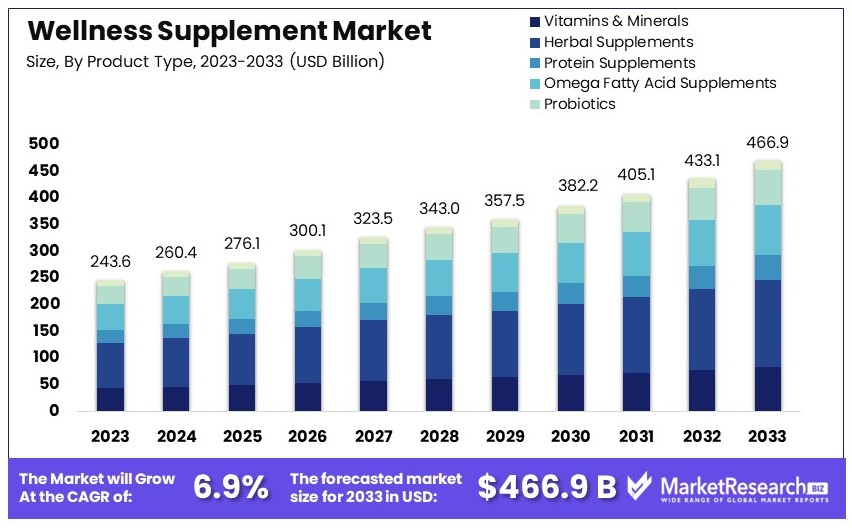

The Global Wellness Supplement Market size is expected to be worth around USD 466.9 Billion by 2033, from USD 243.6 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

The Wellness Supplement Market encompasses a broad range of products designed to enhance health and well-being. This market includes vitamins, minerals, herbal supplements, and functional foods. Consumers are increasingly focusing on preventative health measures and holistic wellness, driving demand for these products.

The trend towards natural and organic ingredients is prominent, with clean label and non-GMO supplements gaining traction. Key players are innovating with formulations that address specific health needs such as immune support, mental clarity, and energy enhancement. The market is highly competitive, with numerous brands offering tailored solutions to meet diverse consumer preferences. Strategic partnerships, technological advancements, and robust distribution channels are critical for success in this dynamic sector.

The wellness supplement market is experiencing significant growth, driven by increasing health awareness among consumers and demographic trends. Health-conscious individuals, particularly millennials and Gen Z, are major contributors to this market expansion. Approximately 80% of millennials consider health benefits when choosing food products, reflecting a strong inclination towards wellness. Gen Z, too, emphasizes healthy eating, regular exercise, and mental health management, showcasing a generational shift towards holistic health practices. This trend is supported by a 2018 study revealing that 80% of millennials focus on health benefits when making food choices, compared to 64% of baby boomers.

The aging population also plays a crucial role in the demand for wellness supplements. Supplement usage is notably higher among elderly individuals, especially women aged 60 and over, with an 80.2% usage rate. This demographic primarily consumes vitamins D and B12, calcium, and omega-3 fatty acids, which are essential for maintaining bone health, cognitive function, and overall well-being.

These trends indicate a robust market potential for wellness supplements. The growing awareness of health and wellness among younger generations and the increasing supplement usage among the elderly suggest sustained demand. Market players should focus on product innovation and targeted marketing strategies to cater to these diverse consumer groups. Leveraging data on consumer preferences and demographic shifts can enhance market positioning and drive growth. The wellness supplement market, thus, presents a promising landscape for stakeholders, driven by health-conscious behavior and aging population dynamics.

Key Takeaways

- Market Value: The Wellness Supplement Market was valued at USD 243.6 billion in 2023 and is expected to reach USD 466.9 billion by 2033, with a CAGR of 6.9%.

- Product Analysis: Herbal Supplements dominated with 35%; their natural composition significantly drives consumer preference.

- Form Analysis: Capsules lead with 40%; their convenience and effectiveness enhance their adoption.

- End User Analysis: Adults are the largest segment at 60%; driven by increased health awareness and spending capacity.

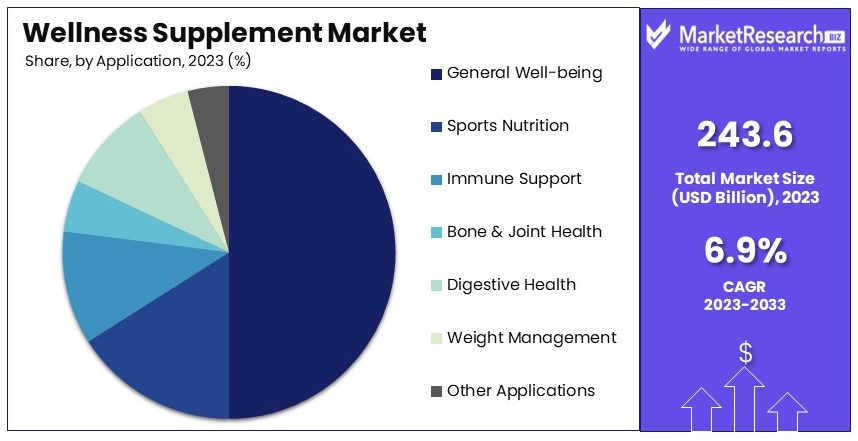

- Application Analysis: General Well-Being accounts for 50%; reflecting a broad consumer focus on maintaining overall health.

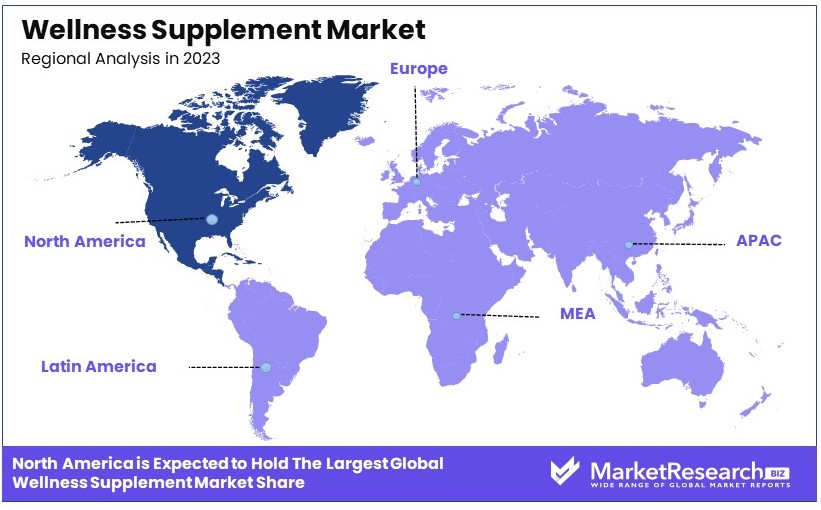

- Dominant Region: North America dominates with 42.5%; established wellness culture and high disposable income underscore its leadership.

- High Growth Region: (Region and percent not provided); growing health consciousness and economic development are likely fueling expansion.

- Analyst Viewpoint: The market shows moderate saturation with robust competition; ongoing innovation and demographic aging will likely drive future growth.

Driving Factors

Rising Health Consciousness Drives Market Growth

The growing awareness of health and wellness among consumers has significantly driven the wellness supplement market. With an increasing focus on preventive healthcare, individuals are more inclined to adopt supplements to maintain and improve their health. This shift is evident in the surge of products such as vitamins, minerals, and herbal supplements that cater to diverse health needs.

For instance, Vitamin D supplements have seen increased demand due to their role in immune support, particularly highlighted during the COVID-19 pandemic. As consumers become more knowledgeable about the benefits of wellness supplements, the market sees a corresponding increase in product innovation and variety. This trend is further supported by healthcare professionals who advocate for preventive measures, thus bolstering the market's credibility and expansion.

Aging Population Drives Market Growth

The global aging population is another crucial factor propelling the wellness supplement market. As the number of elderly individuals rises, there is a greater demand for supplements that support age-related health issues, such as bone health, cognitive function, and cardiovascular health. Companies are responding with targeted products like glucosamine for joint health and omega-3 fatty acids for heart health.

An example is the increased sales of calcium supplements aimed at preventing osteoporosis in older adults. This demographic shift not only increases the customer base but also drives the development of specialized products tailored to the unique needs of older adults, ensuring sustained market growth.

E-commerce and Digital Marketing Drive Market Growth

The expansion of e-commerce and the effectiveness of digital marketing have significantly contributed to the market's growth. Consumers now have easier access to a wide range of wellness supplements through online platforms, which also offer detailed product information and customer reviews. This convenience and transparency enhance consumer trust and purchasing behavior.

For instance, Amazon's health and wellness section has seen a notable increase in sales, driven by targeted advertising and user-friendly interfaces that simplify the buying process. Additionally, the rise of social media influencers and online health communities has amplified product visibility and consumer engagement, creating a robust digital ecosystem that drives continuous market growth.

Restraining Factors

Regulatory Challenges Restrain Market Growth

The wellness supplement market faces significant regulatory challenges that can hinder its growth. Different countries have varying regulations regarding the approval, labeling, and marketing of supplements, which can create barriers for companies operating on a global scale.

For example, the stringent approval process by the U.S. Food and Drug Administration (FDA) can delay the introduction of new products, as companies must provide extensive safety and efficacy data before gaining market entry. These regulatory hurdles increase the cost and time required to bring new supplements to market, limiting the ability of companies to innovate and expand quickly. Additionally, inconsistent regulations across regions can complicate international trade, affecting market expansion efforts.

Market Saturation and Competition Restrain Market Growth

The high level of competition and market saturation can restrain growth in the wellness supplement market. With a large number of companies offering similar products, differentiation becomes challenging, leading to price wars and reduced profit margins.

For instance, the proliferation of vitamin C supplements has led to intense competition, making it difficult for new entrants to establish a foothold without significant marketing investment. This competitive environment forces companies to spend heavily on branding and advertising to stand out, which can strain resources and limit profitability. Market saturation also means that consumers have many options, reducing brand loyalty and making it harder for companies to maintain steady growth.

Product Type Analysis

Herbal supplements dominate with 35% due to increasing consumer preference for natural products.

The wellness supplement market is segmented into various product types, including vitamins & minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and other supplements. Among these, herbal supplements have emerged as the dominant sub-segment. This dominance can be attributed to the growing consumer awareness of health and wellness, coupled with a preference for natural and organic products. Research indicates that herbal supplements hold approximately 35% of the market share within this segment.

Vitamins and minerals also play a crucial role, often complementing the herbal supplement offerings, as they are essential for overall health and cater to a broad demographic. Protein supplements, particularly favored by the athletic and bodybuilding communities, contribute significantly to the segment's growth by addressing specific nutritional needs. Omega fatty acids and probiotics are gaining traction due to their health benefits concerning heart health and digestive health, respectively. The "other supplements" category, which includes niche but rising products like amino acids and specialty fibers, continues to expand as consumers seek personalized health solutions.

In-depth research shows that the herbal supplement market's growth is fueled by factors such as the rise in preventive healthcare, the prevalence of chronic diseases, and the increasing validation of traditional medicine. Companies in this space are increasingly investing in research and development to back up health claims, which enhances consumer trust and further drives the market. This segment’s growth is supported by stringent regulations that ensure product quality and safety, attracting more health-conscious consumers.

Form Analysis

Capsules dominate with 40% due to their convenience and effectiveness.

The form of wellness supplements significantly influences consumer preferences and market dynamics. Capsules, tablets, soft gels, powders, liquids, and gummies constitute this segment. Capsules lead the segment, accounting for around 40% of the market share. They are favored for their convenience, dosage accuracy, and faster absorption rates compared to other forms. Furthermore, capsules can mask the taste of unpleasant ingredients, enhancing consumer compliance.

Tablets and soft gels also hold substantial shares. Tablets are cost-effective and offer a longer shelf life, which appeals to both manufacturers and consumers. Soft gels are preferred for oil-based supplements like vitamin D therapy and omega fatty acids due to better bioavailability. Powders and liquids are popular in the protein supplement sub-segment, catering especially to athletes and fitness enthusiasts for their ease of mixing with liquids. Gummies have seen a rise in popularity due to their appeal to children and adults alike, offering a palatable alternative to traditional supplement forms.

The dominance of capsules is supported by technological advancements in encapsulation techniques, which improve nutrient stability and absorption. As consumer preferences evolve towards convenience and efficacy, capsules are expected to maintain their lead, supported by innovations in capsule materials, such as vegetarian and clean-label options, which cater to a wider audience, including those with dietary restrictions.

End-User Analysis

Adults dominate with 60% due to a high focus on health maintenance and disease prevention.

The end-user segment of the wellness supplement market is categorized into adults, children, and the elderly. Adults constitute the largest market share, approximately 60%, driven by a heightened focus on health maintenance, lifestyle diseases, and proactive wellness practices. This group actively seeks supplements for energy, stress management, and chronic disease management, reflecting a broad range of needs that span preventive health and therapeutic care.

Children and the elderly are also significant contributors to market growth. Children's supplements focus on development needs, including vitamins for growth and immune system support. The elderly segment is rapidly expanding due to the aging global population and the increased need for supplements to support cognitive health, bone and joint health, and overall well-being in older age.

The dominance of the adult segment is further reinforced by their spending power and health awareness, making them more likely to invest in premium health products. This trend is complemented by targeted marketing campaigns and product formulations designed to meet the specific health concerns of adults, such as heart health, digestive health, and weight management. As adults continue to lead busy, stress-induced lifestyles, the demand for health supplements that offer quick, effective solutions to health concerns is expected to grow, further cementing the dominance of this segment in the market.

Distribution Channel Analysis

Online retailers dominate with 45% due to the convenience of shopping and wide range of available products.

The distribution channel for wellness supplements includes supermarkets/hypermarkets, specialty stores, online retailers, pharmacies/drug stores, and health & wellness stores. Online retailers have taken the lead, capturing around 45% of the market, attributed to the growing consumer preference for shopping online due to its convenience, the ability to easily compare products and prices, and the direct-to-consumer marketing strategies employed by many supplement brands.

Supermarkets and hypermarkets provide accessibility and convenience but face competition from specialty stores that offer expert advice and higher-quality, niche products. Pharmacies and drug stores remain critical, especially for clinically recommended supplements, while health and wellness stores attract a dedicated clientele looking for specialized products and personal service.

The rise of e-commerce in the supplements market is powered by increasing internet penetration, the proliferation of smart devices, and the enhancement of online payment security. Online retailers continue to evolve, offering subscription services, personalized consultations, and augmented reality tools to enhance the buying experience. The significant growth of this channel is expected to continue as consumers seek more convenient, informed, and personalized shopping experiences.

Application Analysis

General well-being dominates with 50% due to broad consumer appeal and encompassing health benefits.

The application segment of the wellness supplement market is diverse, including sports nutrition, general well-being, immune support, bone and joint health, digestive health, weight management, and other specific health needs. General well-being applications dominate, holding about 50% of the market share. This dominance is due to the universal appeal of these products, which are designed to support overall health and are suitable for a wide demographic.

Sports nutrition is tailored for athletes and fitness enthusiasts, focusing on performance enhancement and recovery. Immune support has seen a significant increase in demand, particularly in light of global health events. Supplements for bone and joint health are increasingly sought after by the elderly population, while products aimed at digestive health cater to those with specific dietary needs or digestive disorders. Weight management remains a substantial segment, driven by the growing global prevalence of obesity and associated health issues.

The general well-being segment's strength lies in its broad appeal, encompassing a range of demographic groups and health concerns, making it a foundational aspect of daily health routines for many consumers. This segment's growth is bolstered by an increasing focus on preventive healthcare, a shift towards holistic health approaches, and the extensive range of products available that address multiple health concerns simultaneously. As consumers continue to prioritize holistic approaches to health, the demand for general well-being supplements is expected to maintain its leading position in the market.

Key Market Segments

By Product Type

- Vitamins & Minerals

- Herbal Supplements

- Protein Supplements

- Omega Fatty Acid Supplements

- Probiotics

- Other Supplements

By Form

- Tablets

- Capsules

- Soft Gels

- Powders

- Liquids

- Gummies

By End-User

- Adults

- Children

- Elderly

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retailers

- Pharmacies/Drug Stores

- Health & Wellness Stores

By Application

- Sports Nutrition

- General Well-being

- Immune Support

- Bone & Joint Health

- Digestive Health

- Weight Management

- Other Applications

Growth Opportunities

Expansion into Emerging Markets Offers Growth Opportunity

The wellness supplement market exhibits notable growth potential in emerging markets such as India, China, and Brazil. Factors such as rising disposable incomes, increasing health awareness, and a burgeoning middle class are pivotal in driving this expansion. In India, for instance, Herbalife has been strategically enhancing its market presence. This expansion capitalizes on the growing urban demand for health and wellness products.

Additionally, China and Brazil are witnessing similar trends where economic growth and improved living standards bolster the market for wellness supplements. These countries present a fertile ground for market growth, given their large populations and increasing consumer spending on health-related products. Companies entering these markets can benefit from tailoring their products to local preferences and leveraging local distribution channels. The positive economic outlook and health trends in these regions underscore the significant potential for wellness supplement companies to expand and thrive.

Personalized Nutrition Offers Growth Opportunity

The shift towards personalized nutrition represents a substantial growth opportunity in the wellness supplement market. This trend leverages advancements in genetic testing and biomarker analysis to provide individualized supplement recommendations. Companies such as DNAfit exemplify this approach by offering personalized supplement plans based on genetic testing. Such tailored solutions enable consumers to optimize their health and wellness regimes, addressing specific nutritional needs and health goals.

The increasing consumer preference for customized health solutions drives demand for personalized nutrition. This trend is supported by growing awareness of the benefits of tailored nutrition and advancements in technology that make genetic testing more accessible and affordable. As consumers seek more precise and effective health interventions, personalized nutrition is poised to become a significant growth driver in the wellness supplement market.

Integration with Digital Health Platforms Offers Growth Opportunity

The integration of wellness supplements with digital health platforms presents a promising avenue for market growth. By collaborating with mobile medical apps and health platforms such as Noom and MyFitnessPal, supplement companies can provide consumers with personalized health insights and supplement recommendations. This synergy enhances user engagement and drives supplement sales.

Digital health platforms collect extensive user data, offering valuable insights into individual health profiles and behaviors. By leveraging this data, supplement brands can offer tailored suggestions that meet specific health needs. This integration not only improves consumer experience but also fosters brand loyalty and repeat purchases. The increasing adoption of digital health tools and mobile apps underscores the potential for this integrated approach to significantly boost the wellness supplement market, offering personalized and data-driven solutions to health-conscious consumers.

Trending Factors

Clean Label and Natural Ingredients Are Trending Factors

The preference for clean label supplements is driven by consumers’ growing health consciousness and concerns about synthetic additives. The demand for supplements containing natural, non-GMO, and organic ingredients is rising. Brands like Garden of Life, which emphasize the use of organic and non-GMO components, are becoming more popular among health-conscious consumers.

This trend is fueled by the increasing awareness of the potential health risks associated with synthetic ingredients and the perceived benefits of natural alternatives. The clean label movement aligns with broader wellness trends, as consumers seek transparency and simplicity in the products they consume. This shift towards natural ingredients is expected to drive further growth in the wellness supplement market, as more brands adopt clean label practices to meet consumer demand. The focus on natural ingredients also opens opportunities for product innovation, allowing companies to differentiate themselves in a competitive market.

Focus on Immune Health Are Trending Factors

The COVID-19 pandemic has significantly heightened consumer focus on immune health, driving increased demand for immune-supporting supplements. Products containing essential vitamins like vitamin C, vitamin D, and zinc have seen notable sales surges. For instance, the brand Emergen-C, known for its vitamin C supplements, experienced a substantial increase in demand during the pandemic.

This heightened interest in immune health is expected to persist as consumers continue to prioritize their well-being and seek preventive health measures. The trend towards immune health supplements is supported by a growing body of scientific research highlighting the importance of these nutrients in supporting the immune system. This focus on immune health not only drives current market demand but also encourages ongoing product development and innovation within the wellness supplement industry, creating potential for sustained market expansion.

Sustainability and Eco-Friendly Packaging Are Trending Factors

The increasing consumer demand for sustainable and eco-friendly packaging is driving significant changes in the wellness supplement market. Brands that utilize recyclable, biodegradable, or reusable packaging are gaining favor among environmentally conscious consumers. For example, Ritual, a vitamin company, has adopted eco-friendly packaging made from recycled materials, aligning with the values of sustainability-minded shoppers.

This shift towards sustainable packaging is not only driven by consumer preferences but also by regulatory pressures and corporate responsibility initiatives. The adoption of eco-friendly packaging solutions is expected to enhance brand loyalty and attract new customers who prioritize environmental impact. As the trend towards sustainability continues to grow, it presents opportunities for brands to innovate and differentiate themselves by offering environmentally responsible packaging options. This trend is likely to contribute to the overall expansion of the wellness supplement market as it aligns with broader consumer and industry shifts towards sustainability.

Regional Analysis

North America Dominates with 42.5% Market Share in the Wellness Supplement Industry

North America's commanding 42.5% share of the global wellness supplement market is underpinned by several critical factors. High consumer awareness regarding health and wellness, coupled with substantial disposable income, propels spending on supplements. The region's robust regulatory framework ensures product quality and safety, enhancing consumer trust. Furthermore, the presence of leading industry players who invest heavily in research and marketing amplifies the region's market reach.

The wellness supplement market in North America is influenced by diverse regional characteristics, including advanced healthcare infrastructure and a growing trend toward preventive healthcare. The market is also driven by an aging population seeking health maintenance and lifestyle support through supplements. These dynamics are supported by a well-established retail network that ensures wide product availability, from urban centers to remote areas, facilitating consistent growth.

North America is poised to maintain its dominance in the wellness supplement market. Continued innovation in product offerings and marketing strategies are expected to attract a broader consumer base. The increasing prevalence of chronic diseases and a heightened focus on health among millennials and baby boomers alike will likely sustain demand. Anticipated growth in e-commerce will further bolster the market's expansion, with North America potentially enhancing its market share even further.

Regional Market Share and Growth Projections:

- Europe: Europe holds a significant share of the market at 28%. The region's growth is supported by an increasing preference for natural and organic supplements and strong health and wellness trends, particularly in Western European countries.

- Asia Pacific: Accounting for 21% of the market, Asia Pacific is witnessing rapid growth due to rising health consciousness and improving economic conditions. This region is expected to see the highest growth rate, potentially reaching a 30% share by 2030 due to expanding middle-class populations and increased urbanization.

- Middle East & Africa: With a smaller base at 5% of the global market, MEA is projected to experience a steady rise in market share, driven by economic development and a growing awareness of dietary supplements among the population.

- Latin America: Holding around 4% of the market, Latin America shows potential for growth influenced by increasing health awareness and government initiatives to improve healthcare accessibility. The region could see an increase to 6% by 2030.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Wellness Supplement market is led by major players like Nestle and GNC Holdings, who dominate through extensive product ranges and strong global presence. Their market influence is enhanced by their commitment to quality and innovation.

Amway and Abbott Laboratories contribute significantly with their comprehensive wellness products and robust distribution networks. Their strategic positioning caters to a broad consumer base, strengthening their market impact.

Reckitt Benckiser Group PLC and Hexagonnutrition Ltd. offer specialized supplements, focusing on health and wellness. Their targeted approach enhances their market presence.

Danone and Baxter provide nutrition-focused supplements, leveraging their expertise in health products to influence the market. Their global reach and innovative solutions bolster their strategic positioning.

Fresenius Kabi AG and B. Braun SE are key players in clinical nutrition, driving market growth with their advanced supplement formulations.

Perrigo Company plc and Sun Pharmaceutical Industries Ltd. offer affordable and effective supplements, catering to diverse consumer needs and enhancing their market influence.

Centrum (GSK plc) is renowned for its multivitamin products, maintaining a strong market presence with its trusted brand.

BASF SE and DSM contribute with their extensive research and high-quality ingredients, impacting the market through innovation and sustainability. Collectively, these companies drive the Wellness Supplement market through quality, innovation, and strategic positioning.

Market Key Players

- Nestle

- GNC Holdings

- Amway

- Abbott Laboratories

- Reckitt Benckiser Group PLC

- Hexagonnutrition Ltd.

- Danone

- Baxter

- Fresenius Kabi AG

- B. Braun SE

- Perrigo Company plc

- Sun Pharmaceutical Industries Ltd.

- Centrum (GSK plc)

- BASF SE

- DSM

Recent Developments

- August 2024: Ascend Wellness Holdings announced its Q2 financial results, reporting a 15% year-over-year increase in net revenue to $141.5 million. The company also achieved a 33% increase in adjusted EBITDA, highlighting significant growth in its operations across multiple states.

- August 2024: iHerb, a major online retailer of wellness products, announced the addition of three new supplement products from Martha Stewart's line. The new products include Marine Wellness Collagen, Wellness Greens, and Wellness Red, which will be available globally.

Report Scope

Report Features Description Market Value (2023) USD 243.6 Billion Forecast Revenue (2033) USD 466.9 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamins & Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acid Supplements, Probiotics, Other Supplements), By Form (Tablets, Capsules, Soft Gels, Powders, Liquids, Gummies), By End-User (Adults, Children, Elderly), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Pharmacies/Drug Stores, Health & Wellness Stores), By Application (Sports Nutrition, General Well-being, Immune Support, Bone & Joint Health, Digestive Health, Weight Management, Other Applications)" Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle, GNC Holdings, Amway, Abbott Laboratories, Reckitt Benckiser Group PLC, Hexagonnutrition Ltd., Danone, Baxter, Fresenius Kabi AG, B. Braun SE, Perrigo Company plc, Sun Pharmaceutical Industries Ltd., Centrum (GSK plc), BASF SE, DSM" Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nestle

- GNC Holdings

- Amway

- Abbott Laboratories

- Reckitt Benckiser Group PLC

- Hexagonnutrition Ltd.

- Danone

- Baxter

- Fresenius Kabi AG

- B. Braun SE

- Perrigo Company plc

- Sun Pharmaceutical Industries Ltd.

- Centrum (GSK plc)

- BASF SE

- DSM