Bone And Joint Health Supplements Market By Product (Vitamins, minerals, Collagen, Glucosamine, Omega-3, Other), By Form (Capsules, tablets, Powders, Liquids, Other), By Consumer (Adults, Pregnant women, Elderly people, Children, Infants), By Distribution Channel (Supermarkets/hypermarkets, Pharmacies, E-commerce, Health & beauty stores, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46762

-

May 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

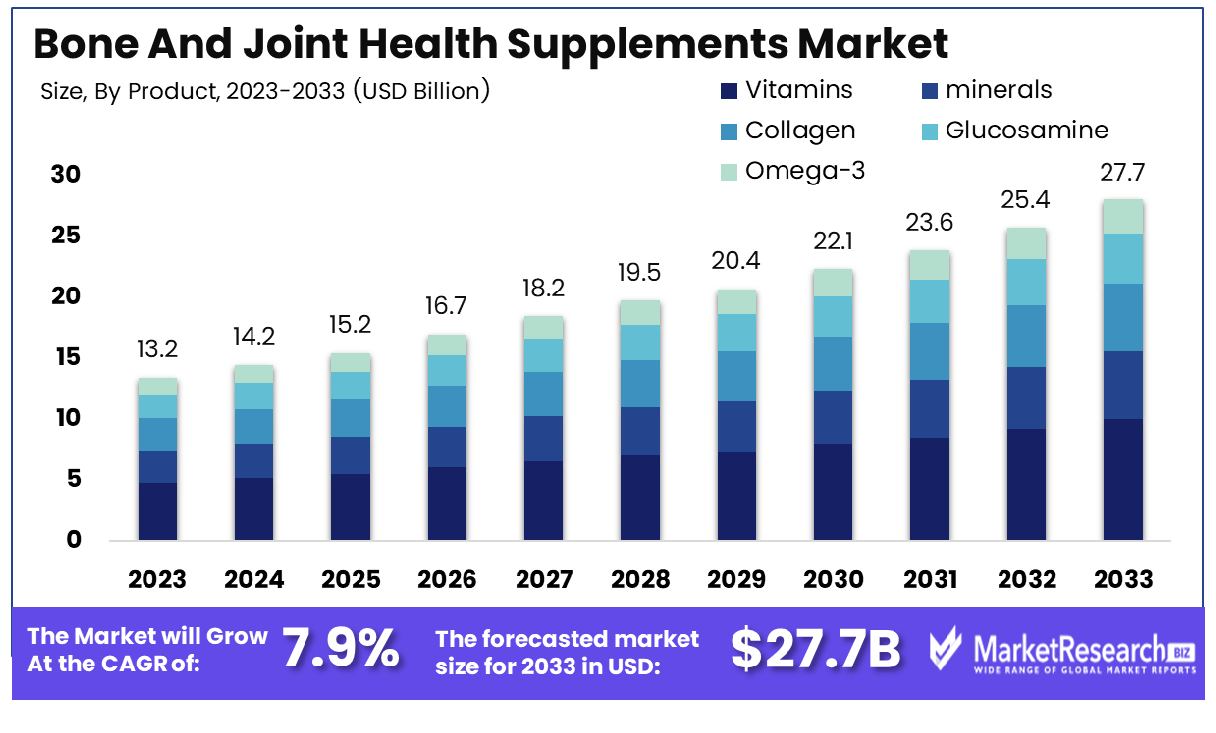

The Global Bone And Joint Health Supplements Market was valued at USD 13.2 Bn in 2023. It is expected to reach USD 27.7 Bn by 2033, with a CAGR of 7.9% during the forecast period from 2024 to 2033.

The Bone and Joint Health Supplements Market encompasses a dynamic sector within the health and wellness industry, focusing on products designed to support and optimize bone and joint function. This market segment includes a diverse range of offerings such as dietary supplements, vitamins, minerals, and herbal formulations, tailored to address issues ranging from osteoporosis to arthritis. With an aging population and increasing health consciousness, demand for these supplements continues to surge. Understanding consumer trends and scientific advancements is pivotal for stakeholders navigating this thriving market landscape.

The Bone and Joint Health Supplements Market presents a compelling landscape marked by robust growth and evolving consumer dynamics. As per recent data, the market is witnessing a surge in demand, propelled by an aging population increasingly prioritizing proactive healthcare solutions. Notably, a 2001 survey revealed that 85% of respondents had utilized one or more dietary supplements in the preceding year, with over 44 million consumers opting for botanical remedies and 24 million for specialty supplements. This data underscores the substantial consumer base seeking alternative health solutions, including those targeting bone and joint health.

Shifting consumer preferences towards preventive healthcare measures and the rising prevalence of musculoskeletal disorders continue to fuel market expansion. Key factors driving this trend include growing awareness regarding the importance of maintaining bone and joint health across age demographics, particularly among the elderly and fitness-conscious individuals.

Market players are responding to these trends with a flurry of innovation, introducing new formulations enriched with scientifically-backed ingredients and tailored to address specific consumer needs. Strategic collaborations and mergers within the industry are facilitating enhanced product development capabilities and market penetration.

Amidst this growth trajectory, regulatory scrutiny and quality assurance remain paramount concerns for stakeholders. Ensuring compliance with stringent regulations and maintaining product efficacy and safety standards are imperative to sustain consumer trust and foster long-term market growth.

Key Takeaways

- Market Value: The Global Bone And Joint Health Supplements Market was valued at USD 13.2 Bn in 2023. It is expected to reach USD 27.7 Bn by 2033, with a CAGR of 7.9% during the forecast period from 2024 to 2033.

- By Product: In the Bone and Joint Health Supplements Market, Collagen emerges as a significant player, commanding 35% of the market share, attributed to its vital role in supporting bone and joint health.

- By Form: Tablets lead the market with 40% share, offering convenience and ease of consumption, thus making them the preferred choice among consumers seeking bone and joint health supplements.

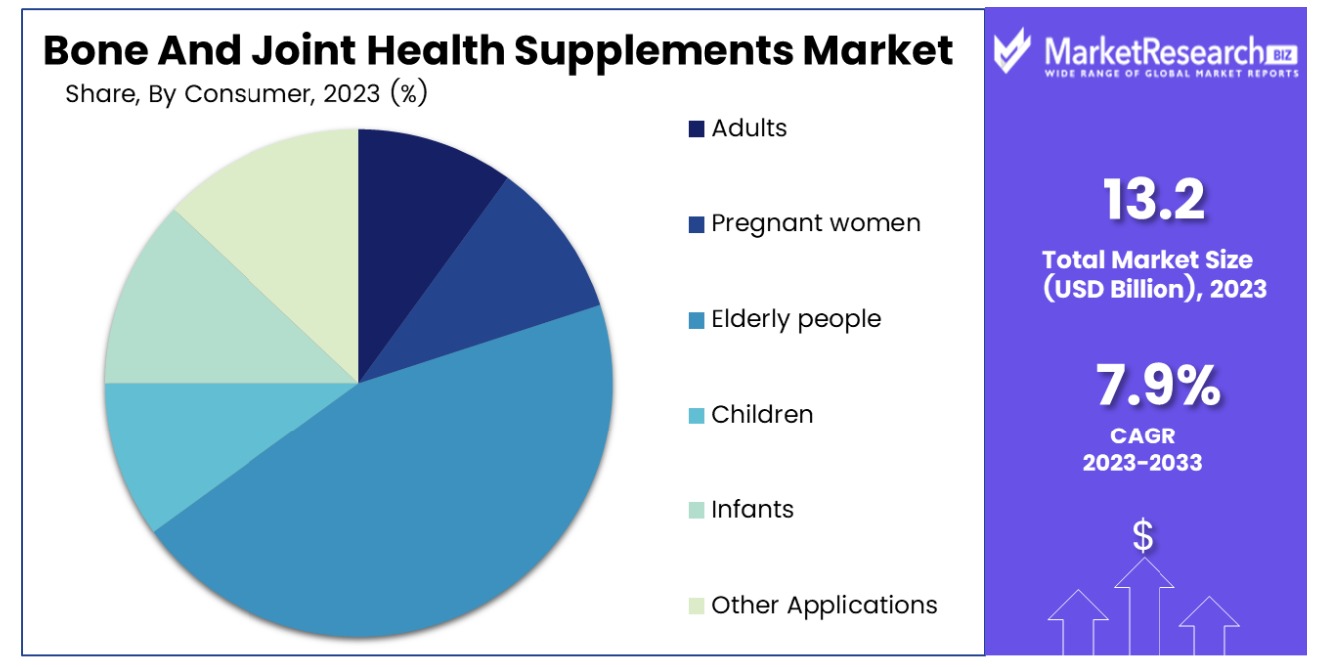

- By Consumer: Among consumers, Elderly people constitute the largest segment, accounting for 45% of the market, reflecting the growing awareness and concern for bone and joint health in aging populations.

- By Distribution Channel: E-commerce emerges as the dominant distribution channel, capturing a substantial 50% share, highlighting the shift towards online purchasing trends and the convenience it offers in accessing bone and joint health supplements.

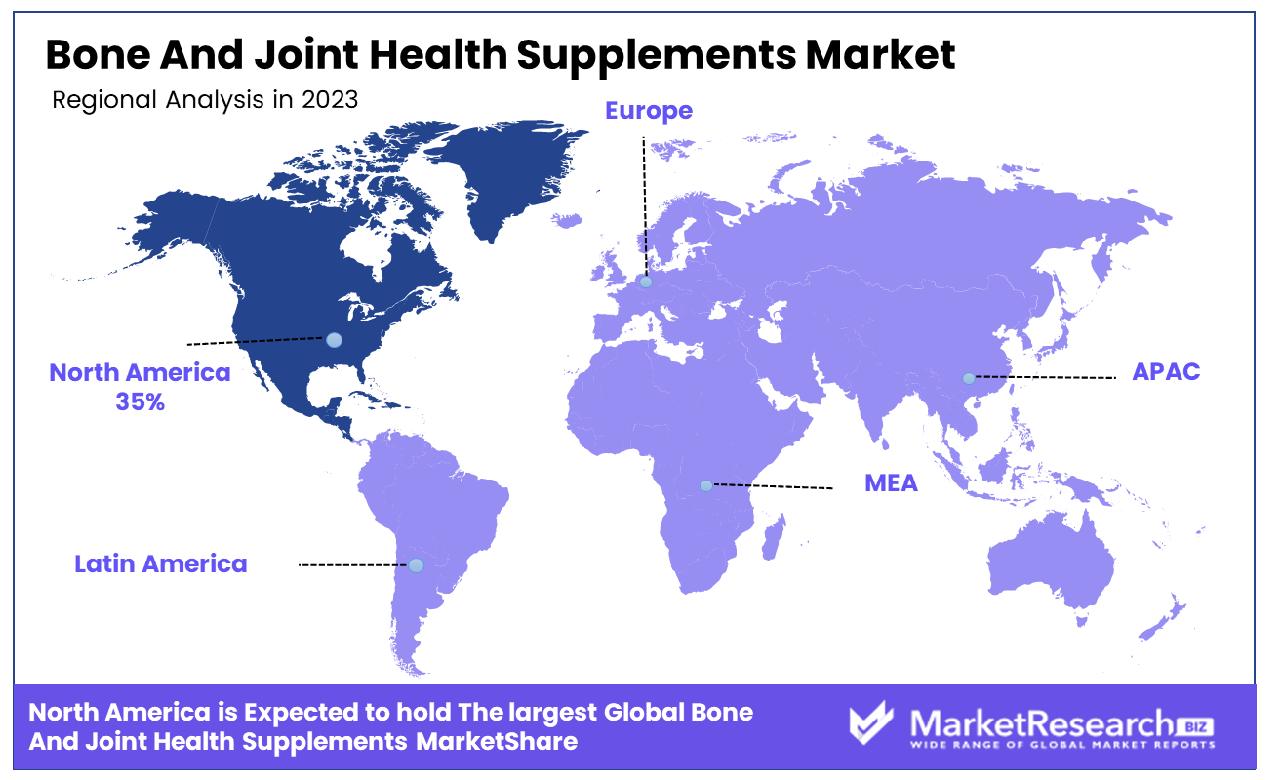

- Regional Dominance: North America emerges as the dominant region in the Bone and Joint Health Supplements Market, commanding a significant 35% market share, driven by a growing aging population and increasing awareness of bone health.

- Growth Opportunity: Rising health consciousness and a surge in sports-related injuries, the Bone and Joint Health Supplements Market presents lucrative growth opportunities globally, particularly in emerging economies where preventive healthcare measures are gaining traction.

Driving factors

Rising Bone Disorders

As bone disorders like osteoporosis, osteoarthritis, and rheumatoid arthritis become more prevalent globally, the demand for bone and joint health supplements experiences a significant surge. Statistics from reputable health organizations reveal a steady increase in the incidence of these disorders, attributing them to factors such as aging populations, sedentary lifestyles, and poor dietary habits. For instance, osteoporosis affects millions worldwide, with the International Osteoporosis Foundation estimating that around 200 million women suffer from this condition.

Osteoarthritis, characterized by the degeneration of joint cartilage and underlying bone, is a leading cause of disability among the elderly, with its prevalence expected to rise as populations age. These alarming statistics underscore the urgent need for effective preventive measures and therapeutic interventions, thus driving consumers towards bone and joint health supplements.

Increased Awareness Propels Market Growth

Growing awareness regarding the importance of bone and joint health further amplifies the demand for supplements tailored to address these concerns. Health campaigns, educational initiatives, and information dissemination through various media channels have succeeded in highlighting the significance of maintaining optimal bone density and joint function throughout life. Consumers are increasingly proactive in seeking preventive healthcare solutions, spurred by a desire to enhance their quality of life and reduce the risk of debilitating musculoskeletal conditions.

Healthcare professionals play a pivotal role in advocating for the incorporation of dietary supplements rich in calcium, vitamin D, glucosamine, and other essential nutrients to support bone and joint health. As awareness continues to spread, more individuals are proactively incorporating these supplements into their daily routines, thus driving market growth.

Preventive Healthcare Focus

The paradigm shift towards preventive healthcare practices has reshaped consumer behavior, leading to a growing preference for proactive measures to maintain overall well-being, including bone and joint health. With escalating healthcare costs and an increasing emphasis on disease prevention, individuals are adopting healthier lifestyles and dietary habits to mitigate the risk of chronic conditions. This proactive approach extends to the consumption of bone and joint health supplements, perceived as convenient and cost-effective strategies to safeguard musculoskeletal health.

The rising popularity of holistic wellness trends, coupled with a preference for natural and alternative therapies, further bolsters the demand for supplements formulated with herbal extracts, antioxidants, and other bioactive compounds known for their beneficial effects on bone density and joint function. Consequently, the bone and joint health supplements market continues to expand as consumers embrace preventive healthcare as a cornerstone of their wellness routines.

Restraining Factors

Navigating Regulatory Hurdles

Regulatory hurdles pose a significant challenge to the bone and joint health supplements market, yet they also present opportunities for industry players to demonstrate compliance and build trust with consumers. Regulations governing dietary supplements vary across jurisdictions, encompassing requirements related to safety, efficacy, labeling, and ingredient standards. Navigating this complex regulatory landscape demands substantial investments in research, quality control, and regulatory compliance to ensure product safety and efficacy.

However, regulatory compliance also serves as a cornerstone of consumer trust, reinforcing the credibility and reliability of brands within the marketplace. Companies that proactively adhere to regulatory standards and invest in transparency and quality assurance mechanisms can differentiate themselves as trustworthy and reputable suppliers.

Balancing Affordability and Quality

Cost barriers represent another significant consideration shaping consumer behavior and market dynamics within the bone and joint health supplements sector. As healthcare costs escalate and economic uncertainties persist, consumers are increasingly price-sensitive and cautious about discretionary spending on non-essential healthcare products. The perceived value proposition of supplements must align with consumer expectations regarding efficacy, affordability, and accessibility to drive adoption and market growth.

Manufacturers face the dual challenge of balancing product quality with affordability to cater to diverse consumer segments while ensuring sustainable profitability. While premium formulations may command higher price points, affordability remains a critical factor influencing purchasing decisions, particularly among price-conscious demographics.

By Product Analysis

Collagen holds a significant 35% share in bone and joint health supplements.

In 2023, Collagen held a dominant market position in the By Product segment of the Bone And Joint Health Supplements Market, capturing more than a 35% share. Collagen supplements have surged in popularity due to their widely recognized benefits for joint health and overall wellness. Consumers are increasingly turning to collagen supplements as a natural way to support joint flexibility, mobility, and strength.

Collagen's leading position in the market can be attributed to its versatility and effectiveness. Not only does collagen support joint health, but it also promotes healthy skin, hair, and nails, appealing to a broad consumer base seeking holistic wellness solutions. Additionally, collagen supplements come in various forms, including powders, pills, and liquid formulations, catering to diverse consumer preferences.

The market for collagen supplements has witnessed significant innovation and product development. Manufacturers are incorporating advanced formulations, such as collagen peptides with enhanced bioavailability, to improve efficacy and ensure optimal absorption by the body. This commitment to innovation has further solidified collagen's position as a frontrunner in the Bone And Joint Health Supplements Market.

By Form Analysis

Tablets are the preferred form, commanding 40% of the market.

In 2023, Tablets held a dominant market position in the By Form segment of the Bone And Joint Health Supplements Market, capturing more than a 40% share. Tablets have emerged as the preferred form of supplementation for consumers seeking convenience, portability, and ease of dosage management.

The dominance of Tablets can be attributed to several key factors. Firstly, tablets offer a convenient and familiar format for consumers accustomed to taking vitamins and supplements in pill form. This familiarity breeds trust and confidence in the product, driving higher adoption rates among consumers concerned with bone and joint health.

Tablets are prized for their ease of consumption and portability. Unlike powders or liquids that may require mixing or measuring, tablets offer a hassle-free solution for busy consumers on the go. This convenience factor resonates particularly well with the target demographic for bone and joint health supplements, which often includes aging populations and individuals with active lifestyles.

By Consumer Analysis

Elderly consumers constitute the largest segment, capturing 45% of the market.

In 2023, Elderly people held a dominant market position in the By Consumer segment of the Bone And Joint Health Supplements Market, capturing more than a 45% share. This segment's prominence reflects the growing awareness and prioritization of bone and joint health among aging populations globally.

Several factors contribute to the dominance of Elderly people in this segment. Firstly, as individuals age, they often experience a decline in bone density and joint flexibility, leading to an increased need for nutritional support to maintain optimal musculoskeletal health. Consequently, elderly individuals are more inclined to seek out supplements specifically formulated to support bone and joint function.

Elderly consumers are typically more health-conscious and proactive about managing age-related health concerns, including joint pain and osteoporosis. This heightened awareness drives demand for bone and joint health supplements tailored to their unique nutritional needs and preferences.

By Distribution Channel Analysis

E-commerce dominates distribution channels, with a substantial 50% share.

In 2023, E-commerce held a dominant market position in the By Distribution Channel segment of the Bone And Joint Health Supplements Market, capturing more than a 50% share. This significant share highlights the increasing shift towards online purchasing behaviors among consumers seeking bone and joint health supplements.

The dominance of E-commerce in this segment can be attributed to several key factors. Firstly, the convenience and accessibility offered by online shopping platforms have made them increasingly popular among consumers seeking health and wellness products. With just a few clicks, consumers can browse a wide range of bone and joint health supplements, compare prices, read reviews, and make purchases from the comfort of their homes.

E-commerce platforms provide a diverse selection of products from various brands, allowing consumers to explore different formulations and price points to find the best fit for their needs. This extensive product availability and choice contribute to E-commerce's appeal as a preferred distribution channel for bone and joint health supplements.

Key Market Segments

By Product

- Vitamins

- minerals

- Collagen

- Glucosamine

- Omega-3

- Other

By Form

- Capsules

- tablets

- Powders

- Liquids

- Other

By Consumer

- Adults

- Pregnant women

- Elderly people

- Children

- Infants

By Distribution Channel

- Supermarkets/hypermarkets

- Pharmacies

- E-commerce

- Health & beauty stores

- Other

Growth Opportunity

Awareness of Benefits

The year 2024 presents an opportune moment for the global bone and joint health supplements market to capitalize on the heightened awareness of the benefits of preventive healthcare. With increasing education and information dissemination regarding musculoskeletal health, consumers are more proactive in seeking solutions to maintain optimal bone density and joint function.

This growing awareness is fueling demand for supplements rich in essential nutrients such as calcium, vitamin D, and glucosamine, as individuals recognize their role in supporting bone health and preventing debilitating conditions like osteoporosis and osteoarthritis. Manufacturers can leverage this trend by emphasizing the scientifically proven benefits of their products through targeted marketing campaigns and educational initiatives, thereby expanding market penetration and driving sales growth.

Reimbursement Support

In 2024, the bone and joint health supplements market stands to benefit from increasing reimbursement support, facilitating broader access to these products for consumers. Collaborations with healthcare providers, insurance companies, and government agencies are paving the way for reimbursement programs and cost-sharing arrangements, making supplements more affordable and accessible to a wider demographic.

This development not only addresses cost barriers but also enhances consumer confidence in the efficacy and value of bone and joint health supplements, driving adoption rates and market expansion. Manufacturers can capitalize on this opportunity by actively engaging with stakeholders to advocate for reimbursement policies and position their products as integral components of preventive healthcare strategies.

Latest Trends

Advanced Formulations

In 2024, the global bone and joint health supplements market is witnessing a notable trend towards advanced formulations designed to deliver enhanced efficacy and targeted benefits. Manufacturers are investing in research and development to create innovative formulations that leverage cutting-edge ingredients, novel delivery systems, and synergistic combinations to address specific musculoskeletal concerns.

These advanced formulations aim to optimize nutrient absorption, promote tissue repair and regeneration, and provide comprehensive support for bone and joint health. From encapsulated microencapsulation technologies to bioavailable nutrient complexes, the market is witnessing a proliferation of innovative products catering to diverse consumer needs and preferences. This trend reflects a strategic response to evolving consumer demands for science-backed solutions that offer tangible health benefits, driving market growth and differentiation in an increasingly competitive landscape.

Minimally Invasive Surgery Support

Another prominent trend shaping the bone and joint health supplements market in 2024 is the increasing focus on supporting minimally invasive surgical interventions for musculoskeletal conditions. As advancements in medical technology and surgical techniques enable less invasive approaches to orthopedic procedures, there is growing recognition of the complementary role that supplements can play in optimizing surgical outcomes and facilitating post-operative recovery.

Manufacturers are developing specialized supplement formulations tailored to support pre-operative conditioning, intraoperative nutrition, and post-operative rehabilitation, thereby bridging the treatment continuum and enhancing patient outcomes. These supplements may contain ingredients known for their anti-inflammatory properties, tissue healing properties, and bone-strengthening effects, offering a holistic approach to musculoskeletal care.

Regional Analysis

North America leads the bone and joint health supplements market with 35% share

North America emerges as a dominant force in the global bone and joint health supplements market, capturing a significant 35% share. This supremacy can be attributed to factors such as a large aging population, high prevalence of bone and joint disorders, and a robust healthcare infrastructure facilitating easy access to supplements. Increasing awareness about preventive healthcare measures and the adoption of dietary supplements further contribute to market growth in this region.

In Europe, the market for bone and joint health supplements showcases steady growth, driven by an aging population and rising consumer awareness regarding the importance of maintaining bone and joint health.

Asia Pacific presents lucrative opportunities for market players, fueled by factors such as a rapidly growing geriatric population, increasing disposable income, and changing dietary patterns. Countries like China and India are witnessing significant demand for bone and joint health supplements due to the rising prevalence of lifestyle-related disorders and a shift towards proactive healthcare management.

The Middle East & Africa region witnesses moderate growth in the bone and joint health supplements market, attributed to improving healthcare infrastructure and rising consumer awareness about preventive healthcare measures.

Latin America demonstrates potential for market expansion, driven by factors such as improving healthcare access, a growing middle-class population, and increasing consumer awareness about the benefits of bone and joint health supplements.

Overall, North America maintains its dominance in the global bone and joint health supplements market with a substantial 35% share, while Asia Pacific emerges as a key growth region, fueled by demographic and lifestyle changes driving demand for such supplements.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global bone and joint health supplements market is significantly influenced by key players who play pivotal roles in shaping its dynamics and growth trajectory. Among these, GNC Holdings, LLC emerges as a prominent force driving market expansion. With its extensive network of retail outlets and online presence, GNC Holdings, LLC leverages its strong brand recognition to offer a diverse range of bone and joint health supplements catering to varied consumer needs. Its focus on quality assurance and customer trust solidifies its position as a leader in the market.

Arazo Nutrition is another key player making notable contributions to the global bone and joint health supplements market. Through its commitment to scientific research and product innovation, Arazo Nutrition delivers high-quality supplements formulated to support bone and joint health. Its emphasis on transparency and consumer education fosters trust and loyalty among its customer base, driving sustained growth and market relevance.

Nature's Bounty, Inc. and BYHEALTH Co., Ltd. also play significant roles in shaping market dynamics through their comprehensive portfolios of bone and joint health supplements. These companies leverage their extensive experience and industry expertise to develop and distribute products that address the growing demand for natural and effective solutions to support bone and joint health.

Reckitt Benckiser Group plc, Amway, BASF SE, Bayer AG, Vita Life Sciences Ltd, Glanbia plc, NOW Foods, and Herbalife International of America, Inc. further diversify the market landscape with their innovative product offerings and global reach. Their strategic investments in research and development, coupled with a focus on marketing and distribution, contribute to the overall growth and competitiveness of the global bone and joint health supplements market in 2024.

Market Key Players

- GNC Holdings, LLC

- Arazo Nutrition

- Nature's Bounty, Inc.

- BYHEALTH Co., Ltd.

- Reckitt Benckiser Group plc

- Amway

- BASF SE

- Bayer AG

- Vita Life Sciences Ltd

- Glanbia plc

- NOW Foods

- Herbalife International of America, Inc.

Recent Development

- In February 2024, Amway launched a novel range of bone and joint health supplements enriched with bioavailable nutrients, addressing nutritional deficiencies and promoting musculoskeletal wellness.

- In April 2024, GNC introduced advanced joint support supplements containing innovative ingredients like turmeric and collagen, promoting joint flexibility and mobility for aging populations.

Report Scope

Report Features Description Market Value (2023) USD 13.2 Bn Forecast Revenue (2033) USD 27.7 Bn CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vitamins, minerals, Collagen, Glucosamine, Omega-3, Other), By Form (Capsules, tablets, Powders, Liquids, Other), By Consumer (Adults, Pregnant women, Elderly people, Children, Infants), By Distribution Channel (Supermarkets/hypermarkets, Pharmacies, E-commerce, Health & beauty stores, Other) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GNC Holdings, LLC, Arazo Nutrition, Nature's Bounty, Inc., BYHEALTH Co., Ltd., Reckitt Benckiser Group plc, Amway, BASF SE, Bayer AG, Vita Life Sciences Ltd, Glanbia plc, NOW Foods, Herbalife International of America, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-