Global Wedding Rings Market By Product(Gold, Diamond, Platinum, Others), By End User(Men, Women), By Distribution Channel(Online, Offline) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

22584

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

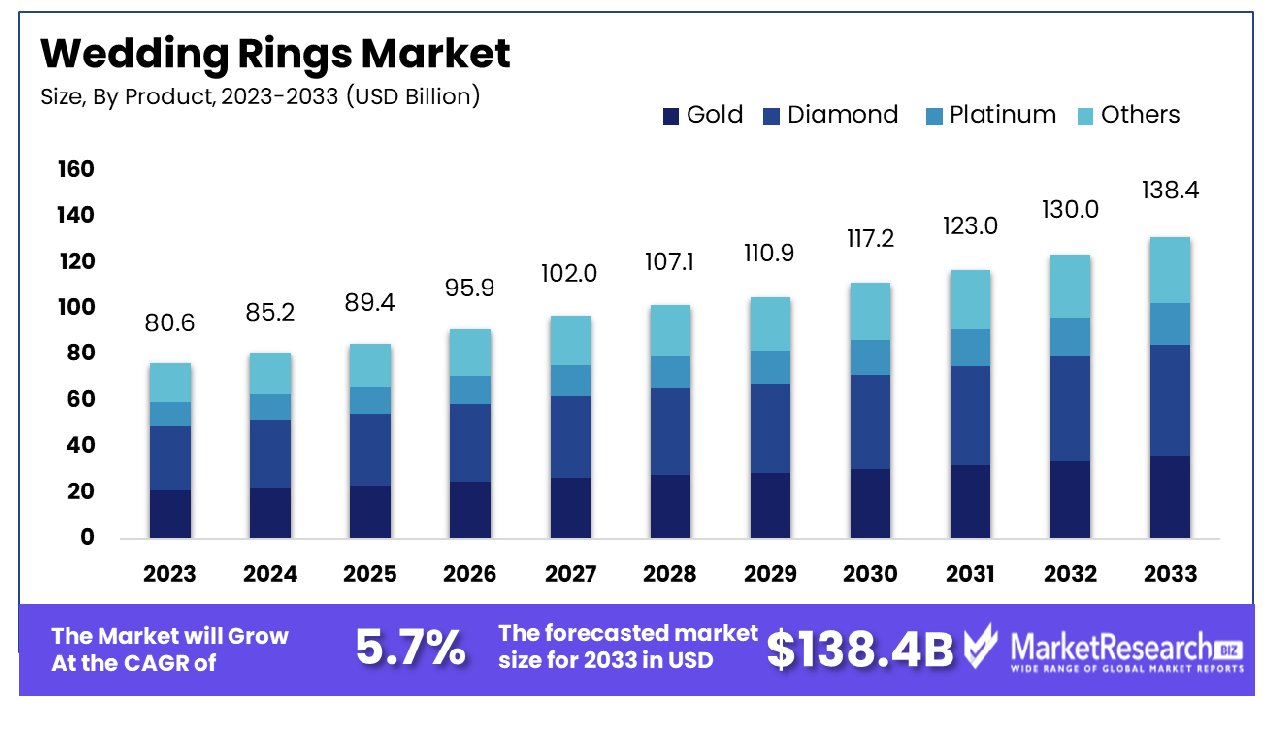

The Global Wedding Rings Market was valued at USD 80.6 billion in 2023. It is expected to reach USD 138.4 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

The wedding ring market encompasses the global and regional commerce of rings traditionally exchanged in matrimonial ceremonies. This market serves a broad demographic, offering a range of products from mass-produced to high-end custom designs. Key drivers include cultural significance, personalization trends, and economic conditions influencing discretionary spending.

The market is highly sensitive to fluctuations in raw material prices, particularly gold and diamonds, and is influenced by evolving fashion trends and societal attitudes towards marriage. Strategic considerations for stakeholders include innovation in product design, enhancement of distribution channels, and engagement with emerging e-commerce platforms to capitalize on consumer preferences and expand market reach.

The wedding rings market continues to exhibit robust growth, reflecting broader socio-economic trends and evolving consumer preferences within the luxury goods sector. As we analyze the market dynamics, it becomes evident that economic recovery and increasing disposable incomes are pivotal factors driving up market valuations. In the United States, consumer spending on engagement rings has shown a notable increase, with the average budget for engagement rings rising to $9,500 in 2022 from $7,400 in 2019, according to Estate Diamond Jewelry. This uptick suggests a renewed confidence in premium expenditure amidst a post-pandemic resurgence.

Additionally, preferences in terms of ring composition and aesthetics are also shifting. Data from The Knot indicates that the average size of engagement rings is now around 1.7 carats, with a significant proportion of purchases clustering between 1.0 and 2.0 carats. This points to a sustained consumer interest in larger stones, which aligns with a broader trend toward more conspicuous consumption in the luxury sector. Moreover, the preference for 18K gold rings—known for their 75% pure gold content—over the less pure 14K alternatives, underscores a growing market inclination towards higher quality and greater aesthetic value.

These insights not only underscore the resilience and upward trajectory of the wedding ring market but also highlight the importance of premium quality and authenticity as key drivers of consumer choice. As the market evolves, these trends are likely to further shape consumer behavior and purchasing patterns, presenting unique opportunities and challenges for market stakeholders.

Key Takeaways

- Market Growth: The Global Wedding Rings Market was valued at USD 80.6 billion in 2023. It is expected to reach USD 138.4 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- Regional Dominance: North America holds 42.3% of the global wedding rings market.

- By Product: Diamonds hold a 50% share in the wedding rings market.

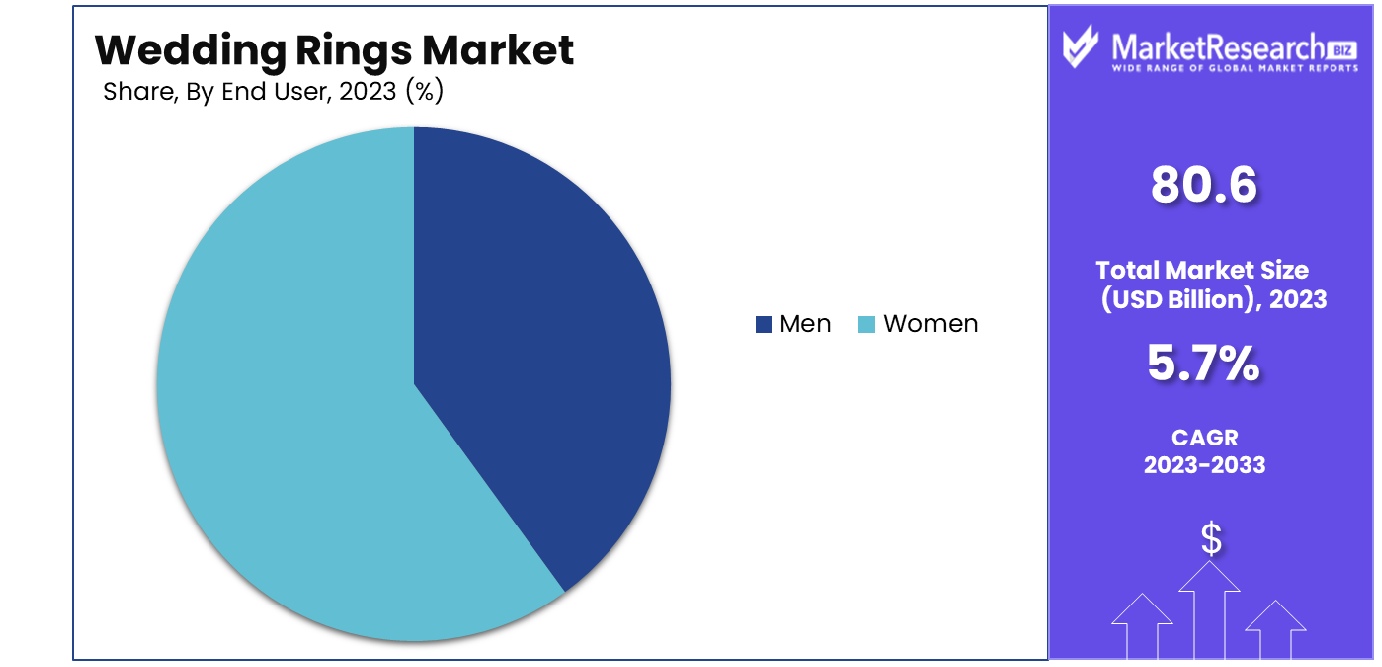

- By End User: Women are the primary consumers, dominating 70% of the market.

- By Distribution Channel: Offline sales channels dominate, accounting for 80% of sales.

Driving factors

Rising Global Wedding Rates: A Catalyst for Market Expansion

The resurgence in global wedding rates serves as a primary catalyst for the expansion of the wedding rings market. As more couples commit to marriage, the demand for wedding rings naturally increases. This surge not only boosts sales volumes but also stimulates diversity in product offerings to cater to various cultural preferences and traditions.

The correlation between the number of weddings and ring sales underscores a direct impact on market growth, as each wedding represents the potential for new purchases in this category.

Increasing Disposable Incomes in Emerging Economies: Enhancing Purchasing Power

In emerging economies, rising disposable incomes are significantly enhancing consumers' purchasing power, which in turn affects the wedding rings market. As individuals in these regions experience improved financial stability, their ability to spend on non-essential luxury items such as wedding rings increases.

This trend is particularly noticeable in markets like Asia and Latin America, where economic growth has led to larger budgets for weddings and related expenditures. The increase in disposable income not only broadens the customer base but also shifts consumer preferences towards more expensive, high-quality options.

Growth of Online Retail Platforms: Customization at the Core

The expansion of online retail platforms has revolutionized the wedding rings market by making customization and personalization more accessible to consumers. Platforms that offer customized ring designs cater to a growing demand for unique and personalized wedding rings, allowing couples to express their individual styles and preferences.

This shift towards customized products is not only a response to consumer demand but also an opportunity for retailers to differentiate their offerings and enhance customer engagement and satisfaction, further driving market growth.

Restraining Factors

Volatility in Precious Metal Prices: Introducing Market Uncertainty

The volatility in precious metal prices, such as gold and platinum, is a significant restraining factor for the wedding rings market. Fluctuating prices can lead to higher costs of production for manufacturers, which are often passed on to the consumer in the form of increased retail prices.

This unpredictability can deter budget-conscious buyers, potentially reducing the overall demand for traditional wedding rings. Additionally, the instability in metal prices can challenge retailers' ability to maintain consistent profit margins, complicating inventory and pricing strategies, and potentially stifling market growth.

Cultural Shifts Towards Non-Traditional Relationship Commitments: Redefining Market Dynamics

A profound cultural shift is taking place in many societies, where there is a growing acceptance and prevalence of non-traditional relationship commitments. This trend includes an increase in long-term partnerships without formal marriage, civil unions, and other forms of commitment that may not necessarily involve the exchange of traditional wedding rings.

This shift is reshaping the demand dynamics within the market, as fewer couples may choose to purchase traditional wedding rings. While this presents a challenge to the conventional market, it also opens opportunities for innovation in product offerings, such as rings that symbolize commitment without being explicitly tied to marriage, thereby adapting to evolving consumer preferences and relationships.

By Product Analysis

Diamond rings dominated the product segment, holding a 50% share of the global wedding rings market.

In 2023, Diamond held a dominant market position in the Product type segment of the Wedding Rings Market, capturing more than a 50% share. This significant dominance underscores the enduring appeal of diamonds as a symbol of love and commitment, favored for their beauty and durability. Despite the high cost, diamonds continue to be the preferred choice for wedding rings, driven by both traditional values and modern marketing that emphasizes diamonds as a cornerstone of romantic gestures.

Following diamonds, gold remains a traditional favorite, prized for its classic appeal and the variety of styles and finishes it offers, from white to yellow and rose gold. Gold's versatility and the cultural heritage associated with gold wedding bands keep it a strong contender in the market, appealing to a wide demographic looking for both traditional and contemporary designs.

Platinum also commands a significant portion of the market, particularly among consumers seeking premium, durable, and hypoallergenic options. Its dense, weighty feel and resistance to wear make it a popular choice for both men’s and women’s wedding bands, aligning well with market segments that prioritize longevity and luxury in their ring choices.

The 'Others' category, which includes newer and alternative materials such as tungsten, titanium, and silicone, caters to niche markets looking for unique, practical, and often more affordable wedding ring options. This segment is growing, particularly among younger consumers and those with active lifestyles who seek durability and comfort, alongside a modern aesthetic that breaks away from traditional materials. Each of these segments contributes uniquely to the diverse and evolving landscape of the wedding rings market, reflecting broader consumer trends and shifts in preferences.

By End User Analysis

Women are the primary end users in the wedding ring market, dominating with a 70% share.

In 2023, Women held a dominant market position in the By End User segment of the Wedding Rings Market, capturing more than a 70% share. This substantial majority reflects the traditional and continued focus of wedding ring marketing and design predominantly towards women. The designs, marketing campaigns, and retail strategies are often centered around female preferences, which emphasize style diversity, gemstone variety, and intricate detailing. This segment benefits significantly from the ongoing trend of personalization and customization, as women increasingly seek rings that reflect their individual styles and values.

Conversely, the Men's segment, while smaller, is also showing signs of growth, accounting for the remainder of the market share. This growth is driven by a rising interest in unique and modern wedding bands among men, including those made from non-traditional materials such as tungsten, titanium, and even silicone. These materials cater to preferences for durability and comfort, appealing to men who might prioritize practicality and subtlety in their choice of wedding ring.

The distinct market dynamics between these segments illustrate broader cultural trends and consumer behaviors. While women's preferences continue to dominate the product development strategies of many companies, there is an increasing acknowledgment of the diverse needs and preferences of men in the wedding ring market. This evolving understanding is leading to broader product offerings and marketing strategies that aim to cater more comprehensively to both segments, reflecting a more inclusive approach to the market.

By Distribution Channel Analysis

Offline sales channels continue to dominate, accounting for 80% of all wedding ring distributions globally.

In 2023, Offline held a dominant market position in the By Distribution Channel segment of the Wedding Rings Market, capturing more than an 80% share. This overwhelming preference for offline channels is primarily driven by the high-touch nature of purchasing wedding rings, where consumers often seek a tactile and personalized buying experience. Customers prefer to physically inspect, try on, and feel the rings before making such a significant emotional and financial commitment. Jewelry stores and boutiques further enhance customer satisfaction by offering bespoke services, such as custom fittings and on-the-spot adjustments, which are crucial in the decision-making process.

In contrast, the Online segment, while smaller, is progressively expanding as technology improves and consumer behaviors shift towards digital platforms. Online channels offer the convenience of browsing a vast selection of styles from home and have been gradually incorporating more interactive and immersive technologies like virtual try-ons and 3D modeling to mimic the in-store experience. This segment is particularly appealing to a younger demographic who are accustomed to online shopping and value the ability to easily compare prices and designs.

The distribution landscape in the wedding rings market shows a significant tilt towards traditional shopping experiences but also indicates growing potential for online sales channels to increase their market share by leveraging technology and enhancing consumer trust. As online platforms continue to evolve and address the barriers to online jewelry shopping, they are likely to capture a greater portion of the market, driven by convenience and a broader array of choices.

Key Market Segments

By Product

- Gold

- Diamond

- Platinum

- Others

By End User

- Men

- Women

By Distribution Channel

- Online

- Offline

Growth Opportunity

Expansion of Eco-Friendly and Ethically Sourced Materials: Embracing Sustainability

In 2023, the global wedding rings market is witnessing a significant shift towards sustainability, with eco-friendly and ethically sourced materials becoming a key growth opportunity. Consumers are increasingly aware of the environmental and ethical implications of their purchases. This consciousness is driving demand for wedding rings made from materials that are not only environmentally sustainable but also ethically obtained.

Jewelers who incorporate recycled metals and conflict-free diamonds into their offerings are tapping into a market segment that values transparency and sustainability. This trend not only caters to consumer preferences but also aligns with global initiatives for sustainable business practices, enhancing brand reputation and customer loyalty. As more companies adopt these practices, they are likely to see a competitive advantage in a market that is becoming progressively more conscientious.

Increasing Popularity of Personalized and Custom-Designed Rings: Personalization as a Priority

Another prominent opportunity in the 2023 wedding rings market lies in the increasing popularity of personalized and custom-designed rings. Today's consumers seek unique products that reflect their personal style and the distinctiveness of their relationships. Customization allows for individual expression through bespoke designs, engravings, and the choice of specific stones or metals.

This trend is driving growth in the market as it not only enhances customer satisfaction but also encourages higher spending on premium, tailor-made options. Jewelers offering these personalized services are capturing a larger share of the market by meeting the rising consumer demand for one-of-a-kind, meaningful pieces that commemorate special occasions like weddings.

Latest Trends

Rise in Demand for Vintage and Antique Style Rings: Nostalgia Meets Modernity

In 2023, the global wedding rings market is experiencing a significant trend toward vintage and antique style rings, marking a blend of nostalgia and modern fashion sensibilities. This demand is fueled by consumers' desire for unique, timeless pieces that convey a sense of history and enduring beauty. Vintage rings often feature intricate designs, traditional craftsmanship, and a charm that new, modern rings might lack. They appeal to couples looking for something unique that tells a story or carries a heritage.

This trend not only revitalizes interest in historical designs but also supports a sustainable approach by repurposing existing jewelry, thus appealing to environmentally conscious buyers. Jewelers who specialize in or expand their collections to include vintage and antique styles are likely to capture a growing segment of the market that values both aesthetic and historical significance.

Adoption of Alternative Materials: Innovation in Durability and Style

Parallel to the resurgence of classic designs, there is a growing trend in the wedding rings market toward the use of alternative materials like silicone and tungsten. These materials offer practical benefits such as durability, hypoallergenic properties, and affordability, making them especially appealing to active individuals or those in professions that demand rugged jewelry. Silicone rings, in particular, are gaining popularity for their comfort and versatility, offering a modern solution for couples seeking non-traditional, functional wedding bands.

Tungsten's appeal lies in its tough, scratch-resistant nature, coupled with a sleek, contemporary look that attracts style-conscious consumers. The adoption of these materials reflects a broader market shift toward diverse, customizable options that cater to varied lifestyles and preferences, expanding the potential customer base and driving growth in new market segments.

Regional Analysis

The North American wedding rings market commands a significant 42.3% share of the global industry.

The global wedding rings market showcases distinct trends and growth dynamics across various regions. In North America, the market holds a dominant share, accounting for 42.3% of the global landscape. This dominance is driven by high consumer spending power and a strong preference for personalized and premium wedding rings. The trend towards customization and unique, ethically sourced materials is particularly pronounced in this region.

In Europe, the market is characterized by a preference for antique and vintage styles, aligning with the region's rich history in jewelry craftsmanship. European consumers place a high value on heritage and artisanal quality, which supports a thriving market for traditional and bespoke wedding rings.

The Asia Pacific region presents a rapidly growing segment, fueled by increasing disposable incomes and expanding consumer bases in countries like China and India. The cultural significance of marriages and the increasing influence of Western trends have led to a surge in demand for both modern and traditional designs.

In the Middle East & Africa, luxury and opulence define the market, with a strong inclination towards gold and precious stones. The wedding rings market in this region benefits from the luxurious tastes of its consumers, who prefer intricate designs and high-value materials.

Latin America shows a growing preference for alternative materials and innovative designs, reflecting a shift towards more cost-effective and durable options. This trend is driven by the region's young demographics and growing urbanization, which influence consumer choices toward practical yet stylish wedding ring options.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global wedding rings market is markedly shaped by the strategic activities of key players, each contributing uniquely to the industry’s evolution. Companies like Cartier International SNC and Tiffany & Co. continue to dominate with their timeless designs and strong brand prestige, appealing to both traditional and luxury segments. The influence of Louis Vuitton and LVMH, with their broad luxury portfolios, extends into the wedding rings sector, emphasizing high-end craftsmanship and exclusive materials, thus catering to affluent demographics.

Innovative players such as Charles & Colvard, Ltd. are revolutionizing the market with their focus on lab-created gemstones, particularly moissanite, which offers a cost-effective, ethical alternative to traditional diamonds. This appeals significantly to environmentally conscious and price-sensitive consumers.

Companies like Pandora A/S and Swarovski AG have successfully captured the mid-market segment, offering affordable luxury with a strong emphasis on customization and personalization. Their ability to balance quality with accessible pricing broadens their appeal and drives their market presence.

On the other hand, Asian companies like Chow Tai Fook, Lukfook, and Chow Sang Sang leverage their deep understanding of local consumer preferences and extensive retail networks across Asia, particularly in China, which is experiencing rapid market growth due to increasing wedding rates and disposable incomes.

Robbins Bros. Jewelry, Inc. and CrownRing specialize in personalized wedding bands, emphasizing unique customer experiences and bespoke services, which are critical for differentiation in a competitive market.

Market Key Players

- Cartier International SNC

- Charles & Colvard, Ltd.

- CrownRing

- David Yurman Enterprises LLC

- H. Samuel

- Harry Winston, Inc.

- Louis Vuitton

- Pandora A/S

- Robbins Bros. Jewelery, Inc.

- Swarovski AG

- Tiffany & Co.

- Laofengxiang

- Chow Tai Fook

- Chow Sang Sang

- Lukfook

- Mingr

- LVMH

- Harry Winston

- CHJD

- Yuyuan

- TSL

- Van Cleef&Arpels

Recent Development

- In March 2024, Cartier International SNC launched a new collection of wedding rings incorporating ethically sourced diamonds and recycled precious metals. This launch reflects their commitment to sustainability in luxury jewelry.

- In January 2024, CrownRing partnered with a well-known designer to create a limited edition series of wedding rings. This collaboration aims to blend traditional craftsmanship with modern design, targeting younger consumers.

Report Scope

Report Features Description Market Value (2023) USD 80.6 Billion Forecast Revenue (2033) USD 138.4 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Gold, Diamond, Platinum, Others), By End User(Men, Women), By Distribution Channel(Online, Offline) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cartier International SNC, Charles & Colvard, Ltd., CrownRing, David Yurman Enterprises LLC, H. Samuel, Harry Winston, Inc., Louis Vuitton, Pandora A/S, Robbins Bros. Jewelery, Inc., Swarovski AG, Tiffany & Co., Laofengxiang, Chow Tai Fook, Chow Sang Sang, Lukfook, Mingr, LVMH, Harry Winston, CHJD, Yuyuan, TSL, Van Cleef&Arpels Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cartier International SNC

- Charles & Colvard, Ltd.

- CrownRing

- David Yurman Enterprises LLC

- H. Samuel

- Harry Winston, Inc.

- Louis Vuitton

- Pandora A/S

- Robbins Bros. Jewelery, Inc.

- Swarovski AG

- Tiffany & Co.

- Laofengxiang

- Chow Tai Fook

- Chow Sang Sang

- Lukfook

- Mingr

- LVMH

- Harry Winston

- CHJD

- Yuyuan

- TSL

- Van Cleef&Arpels