Gemstones Market By Product Type (Diamond, Emerald, Ruby, Sapphire, Alexandrite, Topaz, And Others), By Product Format (Natural, Synthetic), By End User (Jewellery & Omaments, Bangles, Necklaces, Pendants, Earrings, Rings, Anklets, Brooches, Luxury Art), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39778

-

July 2023

-

176

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

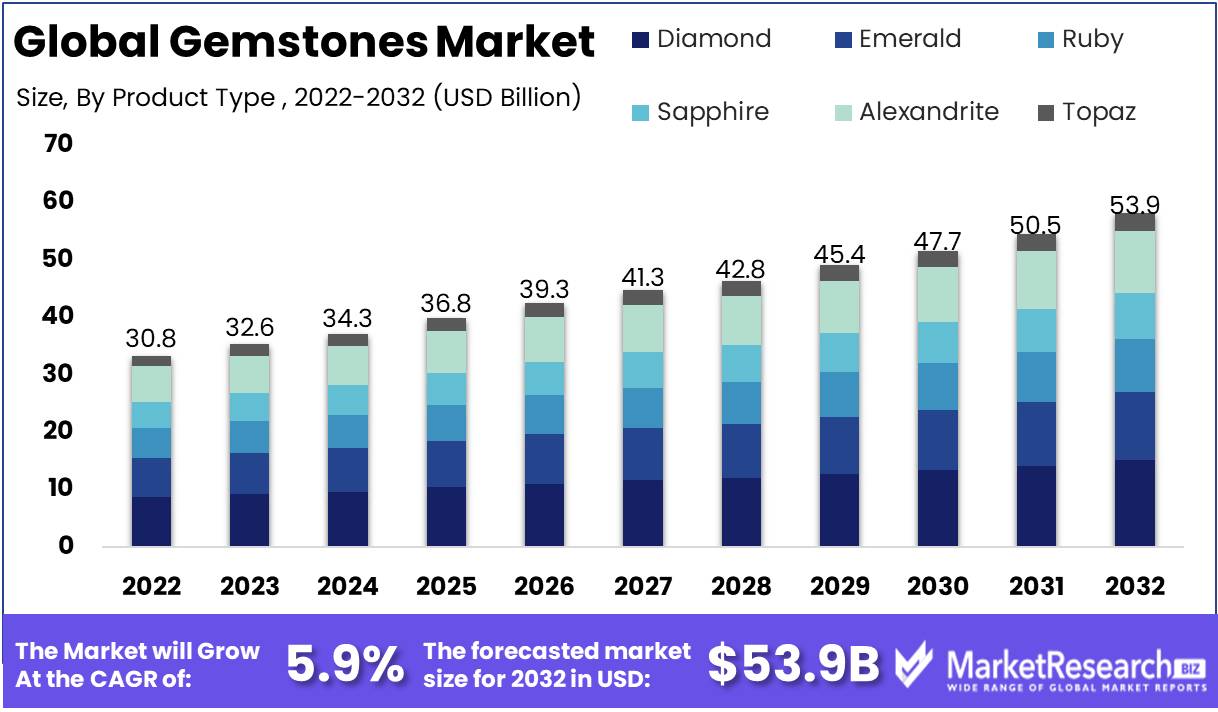

Gemstones Market size is expected to be worth around USD 53.9 Bn by 2032 from USD 30.8 Bn in 2022, growing at a CAGR of 5.9% during the forecast period from 2023 to 2032.

The global gemstones market is a dynamic sector characterized by the trade and consumption of precious and semi-precious stones, encompassing a wide variety of minerals renowned for their aesthetic, symbolic, and sometimes intrinsic value. Latest developments within the gemstone market have demonstrated significant advancements in production processes, ethical sourcing, and innovative marketing strategies, collectively influencing the industry landscape.

In 2023, researchers at the University of California, Berkeley, introduced a noteworthy breakthrough by devising a more efficient and cost-effective method for producing synthetic diamonds employing laser technology. This achievement signifies a notable shift in the market, as it not only offers the potential for increased supply but also lowers the cost barriers, potentially democratizing access to synthetic diamonds.

Furthermore, De Beers, a prominent player in the diamond industry, has embarked on a transformative journey with its Tracr Blockchain initiative. This initiative aspires to provide comprehensive origin and impact data for all its diamonds by 2030. Utilizing blockchain technology to trace each diamond's journey from mine to market, this project fosters transparency and sustainability, addressing growing consumer concerns regarding ethical sourcing and the environmental impact of the industry.

In a recent revelation at the September 2023 Jewellery & Gem World Hong Kong show, Fuli Gemstones introduced a groundbreaking innovation in gem cutting, unveiling the "Fuli Cut." This new gem cut has the potential to revolutionize the aesthetic aspects of gemstone jewelry, capturing the attention of both industry professionals and consumers alike. Such innovations in gemstone design contribute to market differentiation and may drive demand for unique and exquisite gemstone products.

The impact of these innovations and trends in the gemstones market is multifaceted. It includes increased competition from synthetic diamonds, heightened transparency and ethical standards, and a growing demand for unique and innovative gemstone designs. These changes are reshaping the industry, presenting both challenges and opportunities for stakeholders. As the market continues to evolve in response to these developments, adaptability and innovation will be key drivers of success for businesses operating in the gemstone sector.

Driving Factors

Increasing Consumer Demand for Luxury Goods

Consumers increasingly pursue luxury and fashion accessories to enhance their personal style and make a fashion statement in today's society. In recent years, the desirability of high-end accessories, such as jewelry, has increased substantially due to a variety of factors that cater to the changing demands and preferences of consumers. As the gemstones market expands, the demand for prestige and fashion accessories increases significantly. Individuals are more inclined to invest in high-quality items that reflect their individuality and sense of style. These accessories are in high demand, particularly in the prestige market, as a result of the desire for rare and exceptional gemstones.

Growth of the Jewelry Industry

Rapid development in the jewelry industry is one of the driving forces behind the increasing consumer demand for luxury and fashion accessories. With technological advancements and access to a global market, jewelry designers and manufacturers are able to offer a vast selection of products that appeal to a variety of tastes and budgets. Brands are continually launching innovative jewelry products and introducing new designs and jewelry collections, ensuring that consumers have access to a variety of options that cater to their specific preferences. The elevated demand for jewelry and the incorporation of gemstones into gems in jewelry products are anticipated to be significant factors propelling the growth of the gemstones market during the forecasted period mentioned above. Online platforms have emerged as a significant sales channel, making it simpler for consumers to browse and buy jewelry from the comfort of their own homes.

Expansion of Online Commerce and Sales Channels

The expansion of e-commerce and online sales channels has transformed the way consumers purchase and had a significant impact on the precious stones market. With just a few clicks, consumers can now explore an extensive selection of luxury and fashion accessories from brands and retailers around the globe. This increased accessibility and convenience have been instrumental in propelling consumer demand. Online platforms offer a one-of-a-kind purchasing experience by enabling consumers to compare prices, read reviews, and investigate personalized options, such as gemstone customization and personalization.

The Rise of Gemstone Customization and Personalization

Customization and personalization of gemstones have become increasingly popular in the gemstones market. Consumers can now create one-of-a-kind items that reflect their individuality and distinctive style. This personal touch not only adds sentimental value but also ensures that the jewelry has a deeper resonance with the wearer. Options for customization include choosing the stone type, such as diamonds, sapphires, rubies, or emeralds, as well as the setting, metal, and design elements. This level of customization enables customers to create exquisite pieces that exemplify their desired aesthetic and communicate their individual story. Furthermore, the rapid rise in consumer belief in astrology is anticipated to create multiple opportunities that will contribute to the expansion of the gemstones market.

A Growing Awareness and Appreciation for Unique and Rare Gemstones

The steady growth of the market share for gemstones in recent years has led to a rise in the number of people interested in purchasing them. Consumers are valuing the rarity and beauty of these precious stones more and more, searching for pieces that separate out from the crowd. Due to their scarcity and captivating hues, tanzanite, alexandrite, paraiba tourmaline, and padparadscha sapphire have acquired popularity. The allure of possessing a gemstone that is both aesthetically appealing and rare motivates consumers to purchase luxury accessories that feature these exceptional stones. Thus, these are some of the features that tend to incline the customers towards gemstones.

Restraining Factors

Price Volatility and Potential Investment Risks

Price volatility is one of the primary restraining factors in the dynamic stones market, which can pose potential investment risks. Gemstones, as natural resources, are subject to supply and demand fluctuations, as well as political instability, economic conditions, and market speculation. The volatility of gemstone prices can have a negative impact on the profitability of investments. Such risks emphasize the need for in-depth market research and detailed analysis, as well as a diversified investment strategy, in order to mitigate potential losses.

Potential Ethical Concerns and Responsible Sourcing Requirements

As the market for gemstones grows, so do concerns regarding ethical sourcing and responsible business practices. Consumers and industry stakeholders are increasingly aware of the negative effects of unethical procurement, such as mining practices that harm the environment or exploit workers. Responsible sourcing requirements have acquired importance in the industry to address these issues.

Potential Challenges in Gemstone Authentication and Certification

On the gemstones market, authenticity is paramount, and guaranteeing the credibility of gemstones is essential for both buyers and sellers. However, it can be difficult to determine the authenticity of stones due to the existence of sophisticated imitations and treatments. Gemstone treatments and identification fraud can mislead consumers and sow seeds of mistrust in the market. The authentication and certification of gemstones play a crucial role in mitigating these issues. Certified gemstones aid in establishing credibility and increase market value.

Competition from Synthetic and Lab Grown Gemstones

Increasing competition from synthetic and laboratory-grown stones is another factor restraining the gemstones market. Technological advances have enabled the production of gemstone substitutes that closely resemble natural stones. Despite the fact that these synthetic gemstones are inexpensive and of consistent quality, they pose a threat to the natural gemstone industry. Industry participants must adapt by accentuating the distinctive characteristics and inherent value of natural gemstones, such as their scarcity, durability, and aesthetic appeal.

Product Type Analysis

The gemstones market is a complex and diverse industry, comprised of numerous product types of gemstones that cater to a variety of consumer preferences and requirements. The Diamond Segment is one of the dominant market segments. The human race has been captivated by the majesty of diamonds since the dawn of time. With their unparalleled brilliance and sturdiness, diamonds have become a sought-after gem, coveted by consumers worldwide.

The ability to retain its value over time is a key component of the gemstone market, and this one is no exception. In contrast to other gemstones, which may diminish or lose their brilliance, diamonds retain their brilliance for generations. Due to their durability, diamonds are a popular option for engagement rings and other jewelry.

The adoption of the Diamond Segment in this market has been led primarily by the economic growth of emerging economies. As developing nations experience economic expansion and an increase in disposable income, consumers are increasingly drawn to luxury items, such as diamonds. Growing middle-class populations in these emerging economies are anxious to embrace the allure of diamond jewelry, constituting a vast consumer base.

Product Format Analysis

The Synthetic Segment is another dominant segment of the gemstones market. Synthetic gemstones are laboratory-grown alternatives to natural gemstones, providing consumers with a cheaper alternative that is visually identical. The rising demand for synthetic stones can be attributed to a number of factors, including the economic growth of emergent nations.

As emerging economies experience rapid development, consumers are attracted to reasonably priced luxury items. Synthetic gemstones offer consumers who desire the appearance and feel of natural gemstones without the high cost of an affordable alternative. Moreover, technological advancements have made the production of synthetic stones more efficient and cost-effective, thereby accelerating their market penetration.

Trends and behaviors of consumers also influence the demand for the Synthetic Segment. In recent years, the trend of sustainable and ethical consumption has gained prominence. Synthetic gemstones are produced in a lab, providing an environmentally friendly alternative to mining natural stones. This is appealing to consumers who prioritize ethical sourcing and environmental footprint reduction.

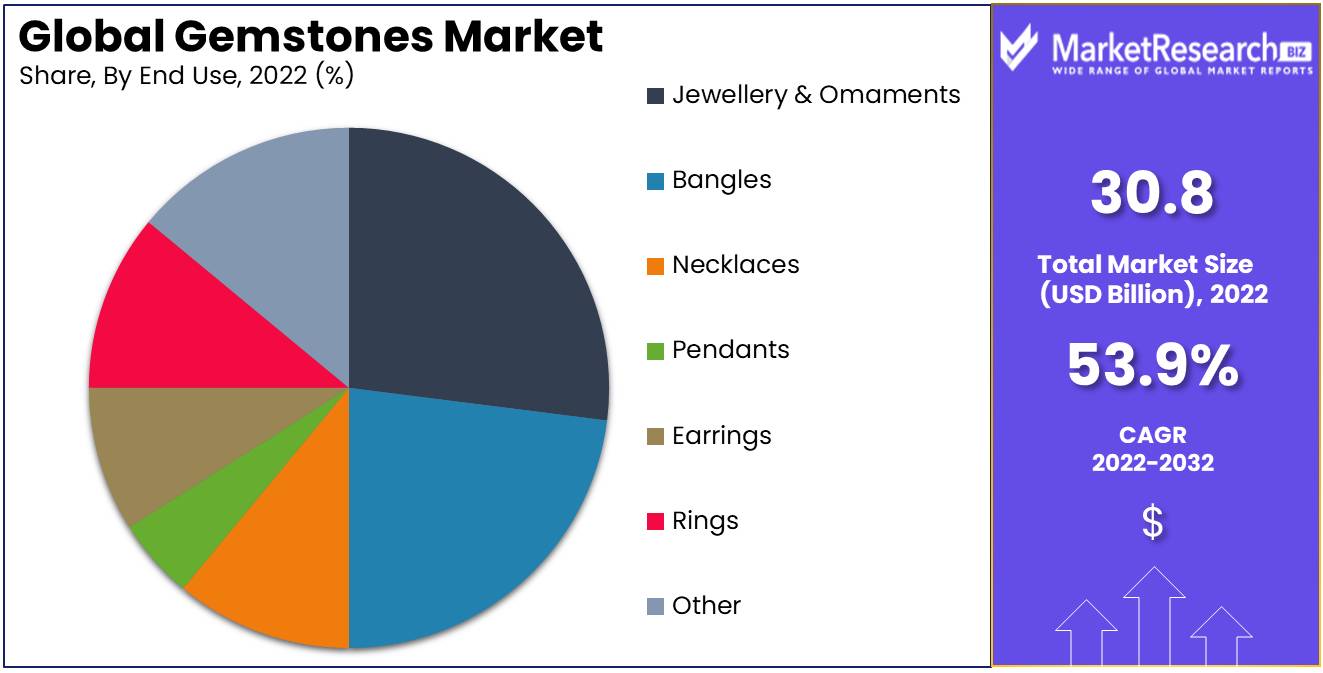

End User Analysis

The Jewellery & Ornaments Segment is one of the dominant segments within the gemstones market. Jewelry has always played an important role in human culture as a representation of affluence, status, and personal adornment. Consequently, the demand for gemstones has skyrocketed, particularly in the market for jewelry.

Similar to the Diamond Segment, economic growth in emerging economies drives the adoption of the Jewellery & Ornaments Segment. As the income levels of these nations rise, so does the demand for high-quality jewelry. In addition, the cultural significance of jewelry in a number of emerging economies drives the adoption of gemstones within this market segment.

Demand for the Jewellery & Ornaments Segment is also strongly impacted by consumer trends and behavior. People view jewelry as an expression of their personal style, and they are increasingly drawn to unique and customized items. This has resulted in an increase in demand for stones with a variety of coloured gemstones, designs, and settings. By providing a variety of stones, the Jewellery & Ornaments Segment accommodates to this trend and satisfies the desires of its discriminating customers.

Key Market Segments

By Product Type

- Diamond

- Emerald

- Ruby

- Sapphire

- Alexandrite

- Topaz

- Other Product Types

By Product Format

- Natural

- Synthetic

By End User

- Jewellery & Ornaments

- Bangles

- Necklaces

- Pendants

- Earrings

- Rings

- Anklets

- Brooches

- Luxury Art

Growth Opportunity

Increasing Demand for Gemstones and Jewelry

The gemstones market and market for jewelry are experiencing an increase in demand, attracting the interest of consumers and investors. As economies grow and disposable incomes increase, people are more likely to indulge in luxury items, especially gemstone jewelry. This escalating demand presents substantial opportunities for businesses functioning in the gemstone market.

E-commerce Fuels Global Gemstone Trade

By enabling global trade, e-commerce platforms have revolutionized the gemstone industry. Online marketplaces have created a convenient and accessible channel for consumers to investigate and purchase a diverse array of gemstones from around the globe. This digital revolution has expanded gemstone merchants' customer base and created new market growth opportunities. Also, the Gemstones market is currently growing due to the strong consumer purchasing power.

Embracing Ethical and Sustainable Sourcing

In response to rising consumer consciousness, the ethical and sustainable procurement of stones has become a top priority. Currently, consumers are more aware of the provenance of the products they purchase, including gemstones. As a result, the demand for ethically sourced and sustainably mined gemstones is on the rise, creating opportunities for businesses that adhere to responsible business practices.

Customization and Personalization Drive Gemstone Sales

Customers have a growing predilection for personalized products in the gemstone industry. Businesses can capitalize on the increasing demand for unique pieces by offering customized jewelry and stone cuts. By providing customized options, businesses can cater to individual preferences, increase consumer satisfaction, and ultimately increase sales.

The Rise of Lab-Created Gemstones

Due to technological advancements, lab-grown gemstones that closely resemble native stones have emerged. These lab-grown diamonds offer an affordable and ethical alternative to their mined counterparts, appealing to consumers who are concerned about the environment. Embracing and promoting these eco-friendly options can be a strategic move for gemstone companies seeking to attract environmentally conscious customers.

Latest Trends

Growth of Colored Gemstones in Jewelry

Colored gemstones, such as emeralds, rubies, and sapphires, have experienced significant industry growth in jewelry. These vibrant and unique gemstones are increasingly sought after for their beauty, rarity, and ability to make a statement. Their allure transcends traditional white diamonds, bringing a sense of individuality and personality to jewelry pieces. Gemstones like emeralds capture the essence of nature's beauty, with their deep green hues symbolizing renewal and prosperity. Rubies, with their captivating red color, evoke passion and vitality. Sapphires, available in a spectrum of colors, mesmerize with their elegance and versatility.

Demand for Sustainably Sourced and Fair-Trade Gemstones

As consumers become more conscious of ethical practices and sustainability, there is a growing demand for sustainably sourced and fair-trade gemstones. This trend aligns with the broader movement towards responsible consumerism, where individuals seek transparency and accountability in the products they purchase. Sustainably sourced gemstones ensure that their extraction and production processes adhere to strict environmental standards. Fair-trade practices ensure that miners and workers receive fair wages and safe working conditions.

Utilization of Gemstones in Personalized and Customized Jewelry Pieces

In an era where individuality is celebrated, personalized and customized jewelry pieces are on the rise. Gemstones play a pivotal role in the creation of these unique and meaningful works of art, providing endless possibilities for self-expression and storytelling. From birthstones representing one's birth month to gemstones that hold emotional significance, customization empowers individuals to create jewelry that reflects their personality, memories, and values. By incorporating these precious gemstones into personalized pieces, jewelers can cater to the growing demand for bespoke designs and offer a truly one-of-a-kind experience.

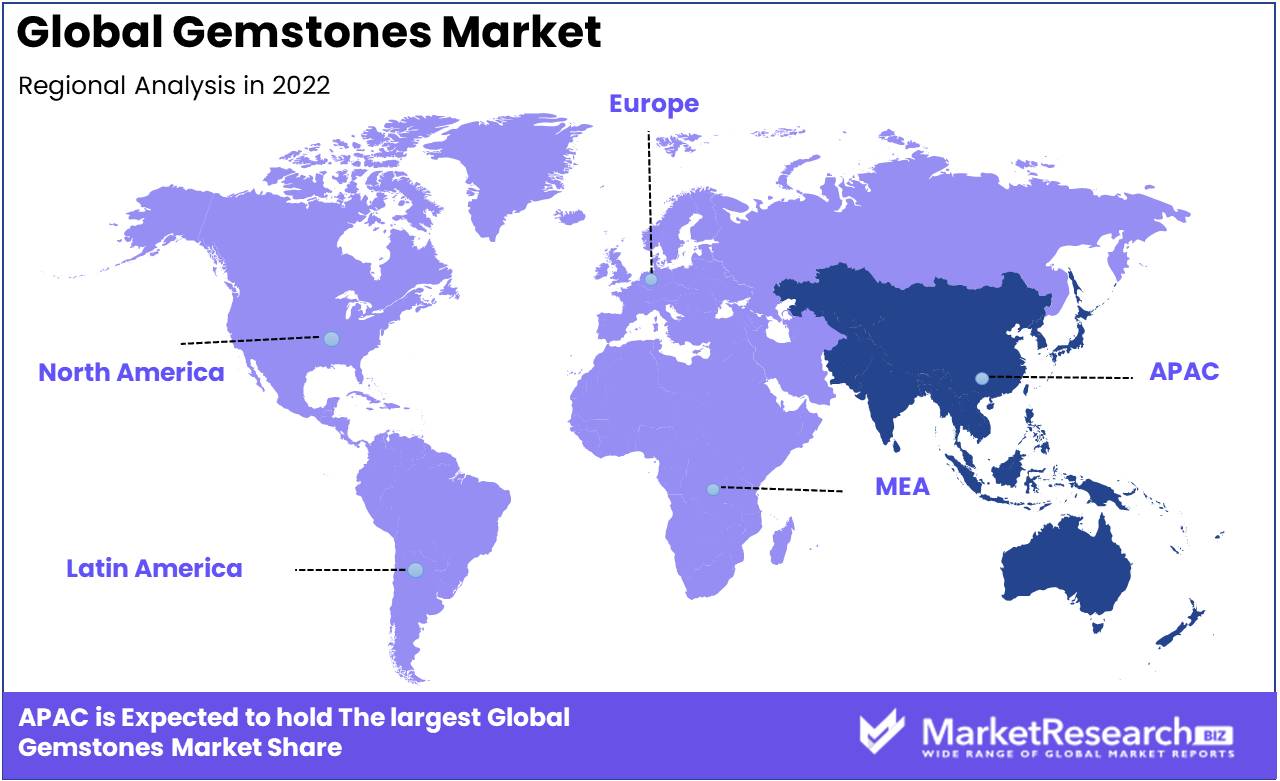

Regional Analysis

Asia-Pacific has emerged as the dominant force in the ever-changing world of gemstones. With its abundant mineral deposits, expert artisans, and booming economy, this region has solidified its position as the global gemstone market's dominant player. Asia-Pacific nations are at the forefront of satisfying this growing demand for these mesmerizing stones.

The significance of the Asia-Pacific region in gemstone commerce cannot be understated. It encompasses an extensive region that includes, among others, China, India, Australia, and Thailand. Not only do these nations have an abundance of precious minerals and gemstone resources, but they also have the know-how to extract, process, and transform raw materials into magnificent gemstones that attract the attention of connoisseurs worldwide.

In addition, accomplished artisans and craftsmen who have mastered the art of cutting, polishing, and shaping these stones have a long history in the Asia-Pacific region. The exquisite craftsmanship exhibited by these artisans enhances the attractiveness and exclusivity of the gemstones, making them highly desirable among collectors and enthusiasts worldwide. The precision and attention to detail that these artisans bring to their craft are unrivaled, resulting in an exquisite gemstone market that attracts purchasers from around the world.

The economic expansion and development of Asia-Pacific nations have also contributed significantly to this market's dominance. These nations have experienced accelerated industrialization and urbanization, which has resulted in an expanding middle class with increased purchasing power. As a consequence, the demand for luxury items, such as gemstones, has increased dramatically. The increasing number of affluent individuals in countries such as China and India drives the gemstones market, generating a lucrative business opportunity in the region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The gemstones market is significantly influenced by industry leaders who have made substantial strides. Companies such as Gem Diamonds, SWAROVSKI, Bric Jewels Co. Ltd., JINDAL GEMS JAIPUR, Anglo American PLC, and Gemfields Group Limited dominate the market due to their dedication to quality, ethical business practices, innovation, and customer service. As this market continues to evolve, these key players are at the forefront, shaping the future of the industry and ensuring its continued development.

Gem Diamonds is recognized internationally as a prominent diamond mining and exploration firm. Gem Diamonds' enterprises in Lesotho and Botswana have made substantial contributions to the diamond market. The company focuses on producing exceptionally valuable, massive, high-quality diamonds. Their dedication to ethical mining practices and sustainable development distinguishes them from the competition.

A family-owned company with more than 125 years of history, SWAROVSKI is synonymous with crystal elegance and opulence. SWAROVSKI, renowned for its precision-cut crystals, has become a world champion in the gemstones market. The brand's prestige has been elevated by its innovative designs and collaborations with renowned fashion labels. With its superior crystals and crystal jewelry, SWAROVSKI continues to influence the industry.

Bric Jewels Co., Ltd. specializes in the creation of breathtaking jewelry made with colored gemstones. Bric Jewels has amassed a devoted clientele by emphasizing the importance of providing customers with exceptional craftsmanship and original designs. Their extensive selection of precious stones, which includes sapphires, emeralds, rubies, and more, accommodates a variety of market preferences. Bric Jewels has earned a reputation for designing exquisite, one-of-a-kind pieces that captivate audiences around the globe.

JINDAL GEMS JAIPUR has established itself as an industry champion in the production and export of gemstones. The company sources, trims, and polishes stones to perfection in the gemstone trading center of Jaipur, India. JINDAL GEMS JAIPUR offers an extensive selection of stones to meet the diverse demands of global markets. Their dedication to quality, innovation, and customer satisfaction has made them an industry leader in gemstones.

Top Key Players in Market

- Gem Diamonds

- SWAROVSKI

- Bric Jewels Co. Ltd.

- JINDAL GEMS JAIPUR

- Anglo American plc

- Gemfields Group Limited

- Petra Diamonds Limited

- PJSC ALROSA

- Rio Tinto

- Debswana

- Lucara Diamond

- Botswana Diamonds PLC

- Fura Gems INC.

- Pala International

- KGK Group

- Trans Hex Group

- Arctic Star Exploration Corp.

- Blue Nile Inc.

- Tiffany & Co.

- STORNOWAY DIAMOND and MOUNTAIN DIAMONDS

Recent Development

- In October 2023, LVMH, the owner of Tiffany & Co., made a significant move into the world of lab-created diamonds. In private appointments with clients at its flagship store in Paris, LVMH's Fred label unveiled a new high-end jewelry collection featuring lab-created diamonds.

- In 2023, De Beers is in the lead as it strengthens its commitment to procuring exceptional gemstones. The renowned diamond company has declared its intention to open a brand-new gemstone mine in Botswana.

- In 2023, researchers at the University of California, Berkeley developed a new process for creating synthetic diamonds. The process uses a laser to heat and compress carbon atoms into diamond crystals.

- In 2022, Concurrently, the mining behemoth Rio Tinto has set its sights on Australia's copious gemstone reserves. Rio Tinto declared a monumental expansion of its gemstone mining operations within the country.

Report Scope

Report Features Description Market Value (2022) USD 30.8 Bn Forecast Revenue (2032) USD 53.9 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diamond, Emerald, Ruby, Sapphire, Alexandrite, Topaz, Other Product Types)

By Product Format (Natural, Synthetic)

By End User (Jewellery & Ornaments, Bangles, Necklaces, Pendants, Earrings, Rings, Anklets, Brooches, Luxury Art)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gem Diamonds, SWAROVSKI, Bric Jewels Co. Ltd., JINDAL GEMS JAIPUR, Anglo American plc, Gemfields Group Limited, Petra Diamonds Limited, PJSC ALROSA, Rio Tinto, Debswana, Lucara Diamond, Botswana Diamonds PLC, Fura Gems INC., Pala International, KGK Group, Trans Hex Group, Arctic Star Exploration Corp., Blue Nile Inc., Tiffany & Co., STORNOWAY DIAMOND and MOUNTAIN DIAMONDS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Gem Diamonds

- SWAROVSKI

- Bric Jewels Co. Ltd.

- JINDAL GEMS JAIPUR

- Anglo American plc

- Gemfields Group Limited

- Petra Diamonds Limited

- PJSC ALROSA

- Rio Tinto

- Debswana

- Lucara Diamond

- Botswana Diamonds PLC

- Fura Gems INC.

- Pala International

- KGK Group

- Trans Hex Group

- Arctic Star Exploration Corp.

- Blue Nile Inc.

- Tiffany & Co.

- STORNOWAY DIAMOND and MOUNTAIN DIAMONDS