Water As Fuel Market Size, Share, Growth, And Industry Analysis – By Application (Industrial Hydrogen Production, and Others), By Technology (PEM Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis, and Others), By End-Use Industry (Refineries, Manufacturing, Petrochemicals, Others), By Product Type, By Distribution Mode, And By Region Forecast - 2023-2032

-

40880

-

Aug 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

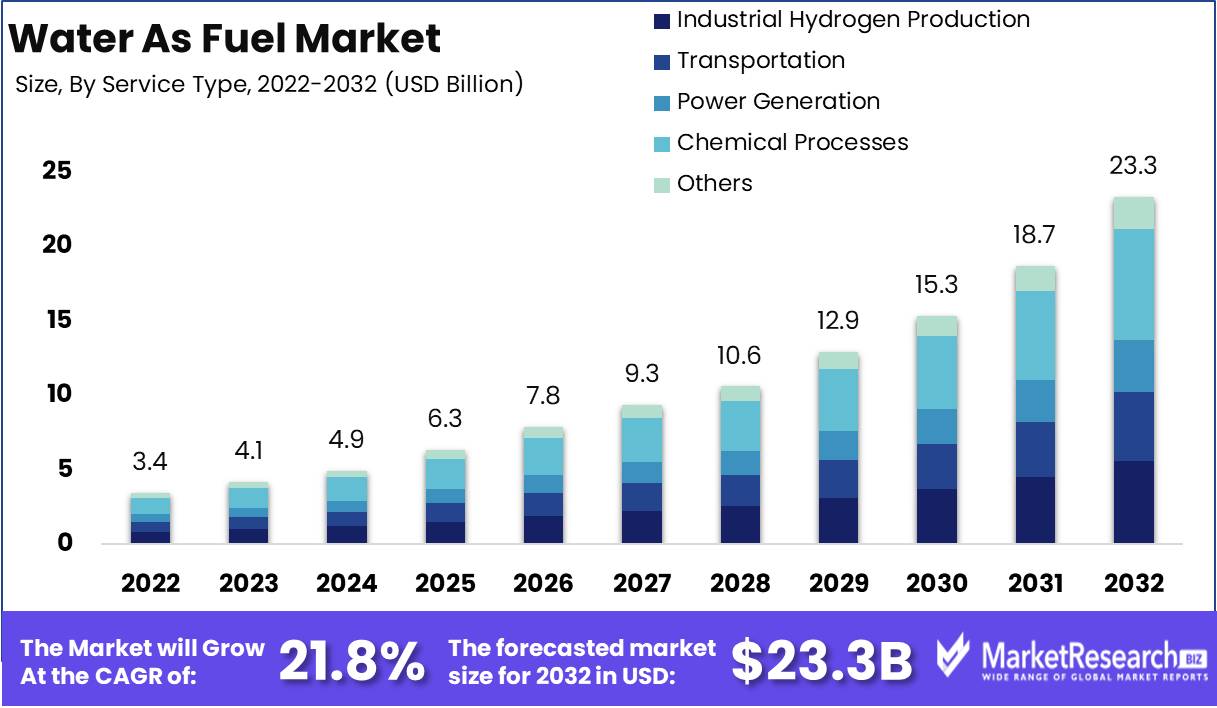

The Global Water As Fuel Market revenue is expected to increase to USD 23.3 Bn in 2032 from USD 3.4 Bn in 2022, and register a revenue CAGR of 21.8% during the forecast period (2023 to 2032).

Water as a fuel holds promise as a clean and renewable energy source, primarily through hydrogen production via water electrolysis. This involves splitting water molecules into hydrogen and oxygen using electricity. Such programs focus on developing efficient electrolysis techniques, often leveraging renewable energy sources such as solar and wind to power the process sustainably.

These initiatives offer a pathway to decarbonize various sectors, from transportation to industry. Cutting-edge technologies like Proton Exchange Membrane (PEM) and alkaline electrolyzers enhance efficiency and scalability. Also, advancements in photoelectrochemical and biological processes are being explored.

Market solutions span on-site hydrogen generation, fuel cells for power production, and hydrogen-based transportation, and these offer promise of a greener energy landscape.

The global water as fuel market has been rapidly registering inclining revenue growth, driven by increasing focus on clean and green energy sources and technologies. Water electrolysis for hydrogen production is at the forefront in this arena, and the technology is expected to continue to drive innovation and revenues ahead.

Rising consumption of hydrogen in industries such as transportation and power generation is also supporting market growth. Services in the market include advanced electrolyzer installations, on-site hydrogen production, and fuel cell deployment. Technological advancements in PEM and alkaline electrolyzers enhance efficiency. Government initiatives for green hydrogen production is expected to further support market growth, as adoption offers advantages of reduced carbon emissions and energy independence.

Driving factors

Government Support and Incentives & Rising Demand for Clean Energy

Growing environmental concerns and climate targets prompt governments worldwide to offer subsidies, tax incentives, and grants for water-as-fuel research and implementation, and this is expected to boost market revenue.

The global shift towards sustainable energy sources is driving demand for green hydrogen production through water electrolysis, and this holds major potential as an increasing number of industries seek low-carbon alternatives. Hydrogen stations play a pivotal role in the utilization of water as fuel, as they facilitate the electrolysis process to extract hydrogen from water molecules.

Advancements in Electrolyzer Technology & Integration with Renewable Energy Sources

Ongoing R&D in Proton Exchange Membrane (PEM) and alkaline electrolyzers enhances efficiency, reduces costs, and increases scalability. As water-as-fuel systems become more economically viable and more innovative solutions are introduced, revenue from this market is expected to increase substantially over the forecast period.

Coupling water electrolysis with surplus renewable energy such as solar and wind power not only promotes clean hydrogen production, but also generates additional revenue streams from excess energy utilization. Such innovations only promise to continue and development of more cutting-solutions are expected to enter the market in the near future.

Expanding Industrial Applications & Global Partnerships and Collaborations

Water-derived hydrogen finds application in various sectors including transportation, distributed power generation, and chemical industries, thereby providing streams for expanding revenue avenues as diverse industries adopt the technology.

Collaborative efforts between research institutions, industries, and governments worldwide facilitate knowledge sharing, technology transfer, and funding, thereby accelerating market growth through collective expertise and resources.

Restraining Factors

High Initial Investment & Limited Hydrogen Infrastructure

The substantial upfront costs associated with setting up water-as-fuel infrastructure, including advanced electrolyzers and renewable energy integration, can deter potential investors and restrain market growth.

The lack of a robust hydrogen distribution network also restrains adoption of water-as-fuel solutions, as the transportation and storage of hydrogen pose challenges that limit market expansion.

Technological Challenges & Competition from Alternatives

Despite advancements, electrolyzer technology still faces efficiency and durability issues, impacting market growth by limiting scalability and reliability.

Competition from other clean energy sources like batteries and carbon capture technologies diverts attention and investment away from water-as-fuel solutions, affecting market share and revenue potential.

Regulatory Uncertainty & Lack of Public Awareness

Evolving regulations and standards related to hydrogen production, transportation, and safety can create uncertainty, and hamper market growth due to concerns over compliance and legal hurdles.

Limited public awareness about the benefits and potential of water-as-fuel technologies can slow down adoption rates, and restrain revenue growth as potential customers remain unfamiliar with the technology's advantages.

Opportunity

Electrolyzer Manufacturing & Renewable Energy Integration

Companies can capitalize on the growing demand for water electrolyzers by developing and manufacturing advanced electrolyzer technologies, catering to both large-scale industrial applications and smaller, decentralized systems.

Offering solutions that enable seamless integration of water electrolysis with renewable energy sources like solar and wind, companies can tap into the demand for efficient green hydrogen production.

Hydrogen Storage and Distribution & Fuel Cell Deployment

Developing innovative hydrogen storage and distribution solutions, such as advanced tanks and pipelines, presents an opportunity to address a critical infrastructure gap in the market.

Companies can provide fuel cell technologies for applications ranging from transportation to power generation, offering end-to-end solutions that utilize hydrogen produced through water electrolysis.

Research and Development Services & Consulting and Advisory Services

Organizations can offer R&D services to collaborate with industries and governments, driving innovation and helping address technical challenges related to water-as-fuel technologies.

Companies knowledgeable in water-as-fuel solutions can provide consulting services to guide clients through the adoption process, offering expertise on system design, implementation, and regulatory compliance.

By Application

Among the application segments, the transportation segment accounts for a significantly larger revenue share in the global water as fuel market. A key factor such as increased focus on reducing carbon emissions across various transportation modes, including vehicles, maritime vessels, and aviation, is driving demand for clean energy alternatives like hydrogen. Hydrogen fuel cells offer a promising solution for achieving emission reduction targets and fuel efficiency improvements. Surge in demand is supported by stringent environmental regulations, incentives for sustainable transportation, and technological advancements enhancing the feasibility of hydrogen-powered vehicles and transportation systems.

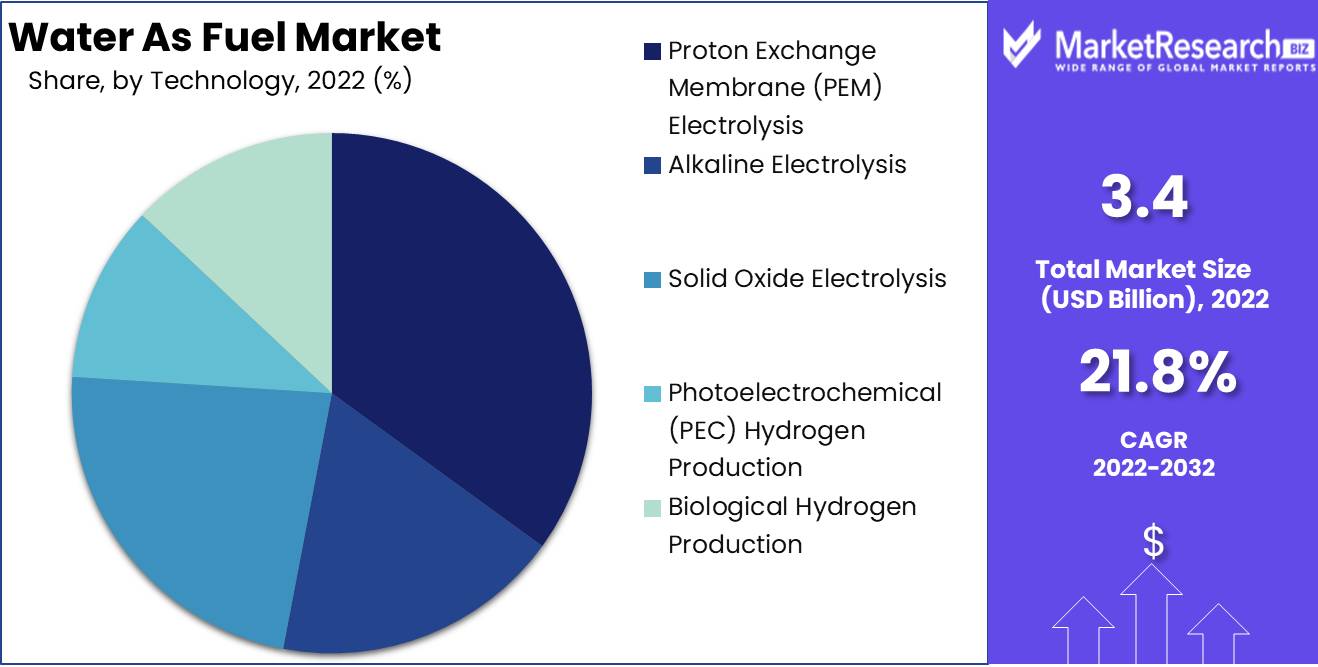

By Technology

The Proton Exchange Membrane (PEM) electrolysis segment among the technology segments accounts for relatively larger revenue share owing to higher adoption and preference. PEM electrolysis offers higher efficiency, scalability, and flexibility compared to other technologies. Steady revenue growth in this segment is supported by increasing investments in R&D, with focus on driving down costs and enhancing electrolyzer performance. The advent of innovative catalyst materials, improved membrane technology, and better system design are among other major factors contributing to revenue dominance of the PEM electrolysis segment.

By End-Use Industry

The industrial hydrogen production segment accounts for comparatively larger share than other end-use industry segments owing increasing traction as in increasing number of industries such as refineries, petrochemicals, and manufacturing seek to reduce carbon footprint and transition to cleaner energy sources. Hydrogen serves as a versatile feedstock and fuel, aligning with sustainability goals. Steady demand is supported by regulatory pressures, corporate sustainability commitments, and the need to optimize industrial processes. Also, the integration of hydrogen in existing infrastructure and chemical processes further supports dominance of this segment in terms of revenue contribution.

Key Market Segments

By Application

- Industrial Hydrogen Production

- Transportation

- Power Generation

- Chemical Processes

- Others

By Technology

- Proton Exchange Membrane (PEM) Electrolysis

- Alkaline Electrolysis

- Solid Oxide Electrolysis

- Photoelectrochemical (PEC) Hydrogen Production

- Biological Hydrogen Production

By End-Use Industry

- Refineries

- Manufacturing

- Petrochemicals

- Utilities

- Automotive

- Aerospace

- Electronics

- Others

By Product Type

- Electrolyzers (PEM, Alkaline, Solid Oxide)

- Fuel Cells

- Hydrogen Storage Systems

- Hydrogen Infrastructure

- Others

By Distribution Mode

- On-Site Hydrogen Production

- Centralized Hydrogen Production

- Pipeline Distribution

- Transport Distribution (Cylinders, Tankers)

- Others

Regional Analysis

North America

In North America, the water as fuel market exhibits significant growth, capturing a substantial market share driven by the United States and Canada. The region's commitment to reducing carbon emissions fuels demand for hydrogen-based solutions. Robust investments in research and development foster technological advancements, enhancing electrolyzer efficiency. Initiatives like tax incentives and partnerships between government agencies and private sectors bolster revenue growth. The transportation and power generation sectors present lucrative opportunities, with potential revenue growth driven by the expanding adoption of hydrogen fuel cells and green energy strategies.

Europe

Europe has emerged as a prominent player in the global water as fuel market, led by rising traction of the solutions in countries such as Germany, France, and the Netherlands. High emphasis on achieving carbon neutrality underpins a robust demand for hydrogen technologies in the region. Stringent regulations and subsidies for renewable energy promote electrolyzer installations, and supporting market revenue growth. Hydrogen is pivotal in sectors such as industrial processes and transportation, positioning Europe for substantial industry growth. Collaborative projects and cross-border initiatives enhance hydrogen infrastructure, thereby supporting regional revenue expansion through advancements in hydrogen production, storage, and distribution technologies.

Asia Pacific

Asia Pacific market revenue growth is supported by developments in countries such as Japan, South Korea, and China, which subsequently account for significant revenue share respectively. Rapid industrialization and urbanization are key factors driving the need for cleaner energy solutions, and this is boosting hydrogen demand. Technological developments in PEM electrolysis and fuel cells supports the region's commitment to innovation. Robust government initiatives, such as China's push for hydrogen economy development, further accelerate market expansion. Strong emphasis on green transportation, fuel cell adoption, and hydrogen infrastructure investments position Asia-Pacific as a key player in driving global revenue growth.

Latin America

Latin America exhibits a burgeoning water as fuel market, with Brazil and Chile leading the charge. The region's vast renewable energy resources align well with hydrogen production through electrolysis. Increasing interest in sustainable transportation and power generation drives market share growth. Technological developments in electrolyzer efficiency and integration with renewable sources fuel industry growth. Government-backed initiatives promoting clean energy adoption provide momentum for revenue expansion. Collaborative efforts between countries encourage regional hydrogen infrastructure development, elevating Latin America's position in the global water as fuel market.

Middle East & Africa

Middle East & Africa market revenue growth is expected to incline moderately initially, spearheaded by the United Arab Emirates and South Africa showing interest in water-as-fuel as a potential energy alternative. Abundant renewable energy potential accelerates hydrogen production through electrolysis. Strategic investments in infrastructure and hydrogen projects offer growth prospects. Technological advancements in electrolyzer efficiency contribute to market share expansion. Initiatives aimed at diversifying energy portfolios and addressing environmental challenges bolster revenue growth. As the region seeks energy diversification, hydrogen emerges as a pivotal player in driving sustainable economic growth and clean energy transitions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The landscape in the global water as fuel market is getting increasingly competitive and evolving rapidly, and this is driven by increasing urgency to transition to cleaner energy sources. Leading players in this landscape include a mix of established energy giants, innovative startups, and research institutions. The dynamism of the market is characterized by a blend of technology advancements, strategic partnerships, and government initiatives.

Siemens holds a significant position in the water as fuel market. With a strong focus on electrolyzer development and integration, the company is leveraging its extensive expertise to drive efficiency improvements and scalability in hydrogen production. Its collaborations with research institutes and its involvement in green hydrogen projects bolster its competitive standing.

ITM Power is a pioneer in electrolyzer technology, and commands a notable presence in the water-as-fuel landscape. Known for its advancements in both PEM and alkaline electrolyzers, ITM Power's solutions cater to a wide range of industries seeking to integrate green hydrogen into their operations. The company's strategic partnerships and project deployments underline its competitive advantage.

Ballard Power Systems is a frontrunner in fuel cell technology, and contributes to the water as fuel market by providing advanced fuel cells for various applications. Its collaborations with industry players and government agencies reinforce its competitive positioning, particularly in the transportation sector where hydrogen fuel cells are gaining momentum.

Enapter, which is an emerging player in this market, specializes in modular hydrogen generators. The company’s innovative approach and emphasis on decentralized hydrogen production align with the market trends. Enapter's compact electrolysers are suited for residential, commercial, and industrial applications, positioning the company as a disruptor in the competitive landscape.

Plug Power indicates high focus on fuel cell solutions for mobility and stationary power applications, and holds a strong position, particularly in the transportation sector. Its partnerships with major companies and involvement in key projects strengthen its competitive presence.

The competitive landscape is further enriched by collaborations between research institutions, governments, and private entities. Initiatives like the European Clean Hydrogen Alliance and regional hydrogen development programs foster an environment of innovation and cooperation.

While established players bring their industry experience and resources to the table, innovative startups are driving disruptive technologies and expanding the market's horizons. The competitive landscape's trajectory hinges on technological advancements, regulatory support, and the ability of companies to provide comprehensive and cost-effective solutions to cater to the diverse needs of industries transitioning to a sustainable energy future.

Top Key Players in Water As Fuel Market

- Siemens AG

- ITM Power

- Ballard Power Systems

- Enapter

- Plug Power

- McPhy Energy

- Nel Hydrogen

- Hydrogenics Corporation

- FuelCell Energy

- Air Liquide

- Linde plc

- Ceres Power

- Green Hydrogen Systems

- Mitsubishi Power

- Thyssenkrupp Industrial Solutions AG

Recent Development

- In 2022, the company Water Fuel Cell Corporation announced that it had developed a water-powered fuel cell that could generate electricity with no emissions. The company is still in the early stages of development, but it hopes to bring its technology to market in the next few years.

- In 2023, the company Hydrogenics announced that it had developed a new type of water-splitting electrolyzer that is more efficient and less expensive than previous models. The company is currently testing its technology with partners in the automotive and energy industries.

- In 2023, the company Aquafuel Energy announced that it had received funding from the US Department of Energy to develop a water-powered fuel cell for use in buses and trucks. The company hopes to have its technology ready for commercialization in the next few years.

Report Scope:

Report Features Description Market Value (2022) USD 3.4 Bn Forecast Revenue (2032) USD 23.3 Bn CAGR (2023-2032) 21.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Competitive Analysis, Segment and Sub-segment Breakdown and Analysis, Trend Analysis, Opportunity & Strategy Reporting Segments Covered Application (Industrial Hydrogen Production, Transportation, Power Generation, Chemical Processes, Others), Technology (Proton Exchange Membrane (PEM) Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis, Photoelectrochemical (PEC) Hydrogen Production, Biological Hydrogen Production), End-Use Industry (Refineries, Manufacturing, Petrochemicals, Utilities, Automotive, Aerospace, Electronics, Others), Product Type (Electrolyzers (PEM, Alkaline, Solid Oxide), Fuel Cells, Hydrogen Storage Systems, Hydrogen Infrastructure, Others), Distribution Mode (On-Site Hydrogen Production, Centralized Hydrogen Production, Pipeline Distribution, Transport Distribution (Cylinders, Tankers), Others) Regional Analysis North America (United States, Canada); Asia Pacific (China, India, Japan, Australia & New Zealand, Association of Southeast Asian Nations (ASEAN), Rest of Asia Pacific); Europe (Germany, U.K., France, Spain, Italy, Russia, Poland, BENELUX [Belgium, the Netherlands, Luxembourg], NORDIC [Norway, Sweden, Finland, Denmark], Rest of Europe); Latin America (Brazil, Mexico, Argentina, Rest of Latin America); Middle East & Africa (Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East & Africa) Competitive Landscape Siemens AG, ITM Power, Ballard Power Systems, Enapter, Plug Power, McPhy Energy, Nel Hydrogen, Hydrogenics Corporation, FuelCell Energy, Air Liquide, Linde plc, Ceres Power, Green Hydrogen Systems, Mitsubishi Power, Thyssenkrupp Industrial Solutions AG Customization Scope Further customization of segments, regions/country-breakdown can be provided upon request. Purchase Options Licenses Available are Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Siemens AG

- ITM Power

- Ballard Power Systems

- Enapter

- Plug Power

- McPhy Energy

- Nel Hydrogen

- Hydrogenics Corporation

- FuelCell Energy

- Air Liquide

- Linde plc

- Ceres Power

- Green Hydrogen Systems

- Mitsubishi Power

- Thyssenkrupp Industrial Solutions AG