Hydrogen Stations Market By Size (Small Station, Medium Station, Large Station), By Type (Onsite, Reforming, Electrolysis, Offsite (By Pressure (Low Pressure, High Pressure), By Mobility (Fixed Hydrogen Station, Mobile Hydrogen Station), By End-Use (Marine, Railways, Commercial Vehicles, Aviation), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42242

-

Dec 2023

-

130

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

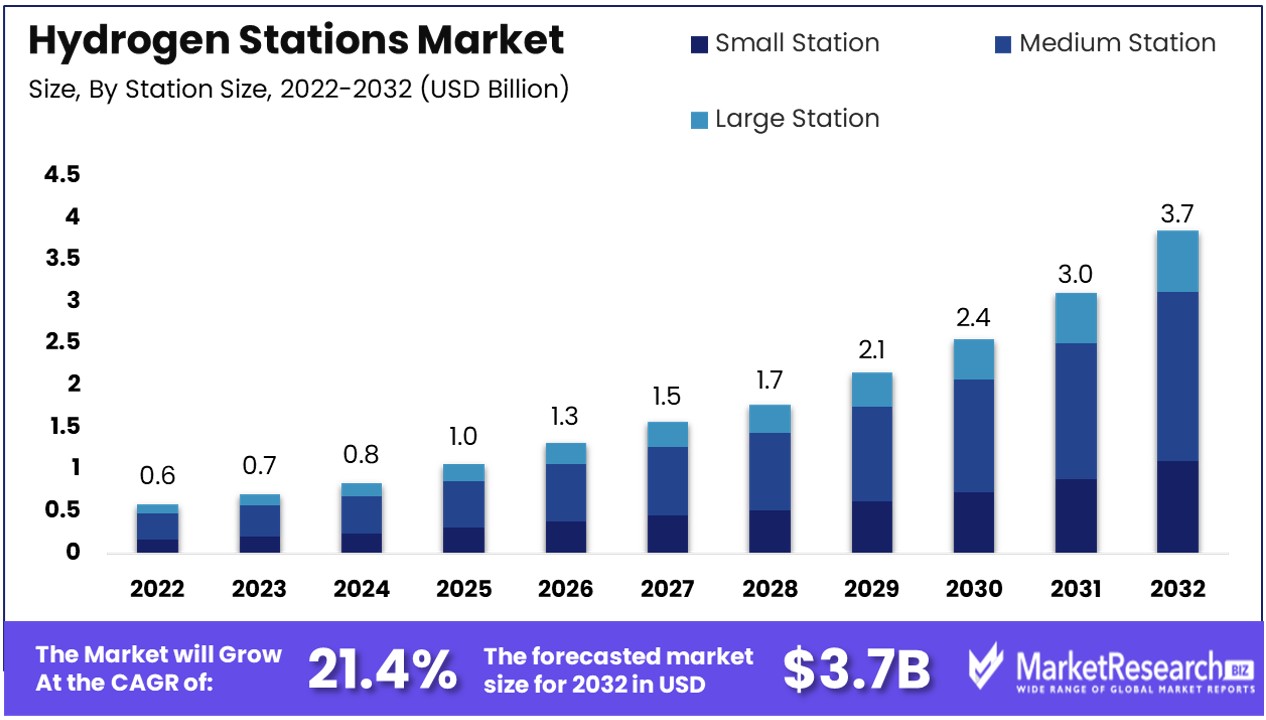

Hydrogen Stations Market size is predicted to reach approximately USD 3.7 Bn by 2032, from a valuation of USD 0.6 Bn in 2022, growing at a CAGR of 21.4% during the forecast period from 2023 to 2032.

Hydrogen stations are fueling sites designed to service hydrogen-powered vehicles such as cars, buses, and trucks. They function similarly to gas stations, allowing drivers to refuel their vehicles. The stations use electrolyzers to produce high-purity hydrogen onsite from water, or get deliveries of hydrogen from industrial plants.

The hydrogen is compressed and stored in tanks at high pressures before being dispensed into vehicles through specialized pumps and hose assemblies. Building out networks of public hydrogen stations is a crucial step to support the adoption of hydrogen fuel cell electric vehicles. As production methods shift to green hydrogen made via renewable energy, hydrogen stations can enable carbon-free transportation powered by a sustainable fuel made from water.

As of 2022, the number of hydrogen fuel cell electric vehicles (FCEVs) on the world's roads increased by 40% compared to 2021, totaling more than 72,000 vehicles, with China having the most, followed by South Korea, Japan, Germany, and the United States. This has showed positive signs for the growth of the Hydrogen Stations Market.

The Hydrogen Stations Market is positioned for robust growth in the coming decade fueled by several key drivers. As more automakers launch hydrogen fuel cell electric vehicles, there is increasing demand for hydrogen refueling infrastructure to support consumer adoption. Government initiatives and policies aimed at building out hydrogen station networks are providing funding and incentives to spur station development.

Regions like Europe, China, South Korea and Japan have set ambitious hydrogen infrastructure targets, which will necessitate rapid growth of the Hydrogen Stations Market. The establishment of regional hydrogen hubs, commitments from major vehicle manufacturers like Toyota, BMW, and Hyundai, and initiatives by international organizations underscore the global push for hydrogen fuel cell technology.

Additionally, advancements that lower capital costs for stations as well as new modular station designs can accelerate market expansion. Partnerships between gas and oil companies, industrial gas providers and station developers are helping establish viable commercial station business models.

As more stations provide green or renewable hydrogen from solar, wind or other low carbon production methods, this can boost consumer demand and support faster market growth. With fuel cell electric heavy trucks starting commercialization as well, the addressable markets for hydrogen stations are growing.

Moreover as adoption of hydrogen-powered electric vehicles ramps up, ample profitable openings exist for companies to establish hydrogen refueling infrastructure. Automakers project over 40 models of FCEVs by 2025, underscoring the need for extensive hydrogen stations networks.

Companies can pursue product innovations like reduced refueling time, cost-efficiencies and scaling up renewable hydrogen production. Investing in modular station designs allows tapping unserved areas. Partnerships between energy majors, mobility providers and governments could accelerate R&D around safe storage and transportation. Standardization of refueling protocols and financial incentives will further widen consumer access.

Developing this backbone for clean mobility allows stakeholders to reap economic and environmental gains. This is because hydrogen energy storage in hydrogen stations facilitates a sustainable and efficient means of storing renewable energy for later use, offering a crucial solution for balancing the intermittent nature of renewable power sources.

Hydrogen Stations Market Dynamics

Zero-Emission Goals Boost Hydrogen Station Development

The push for zero-emission vehicles, particularly hydrogen fuel cell electric vehicles (FCEVs) that produce no tailpipe emissions other than water vapor, is a significant driver for the development of hydrogen stations. As the automotive industry shifts towards sustainable solutions, FCEVs are gaining attention for their environmental benefits. This shift is driving the demand for a robust hydrogen fueling infrastructure, as the viability and attractiveness of FCEVs are directly linked to the availability of hydrogen refueling options.

The expansion of hydrogen stations is crucial for supporting the growing FCEV market, which is seen as a key component in reducing transportation-related emissions. This trend suggests a long-term market growth for hydrogen stations, aligned with global efforts to transition to cleaner transportation technologies.

Green Hydrogen Production from Renewables Propels Infrastructure Growth

The utilization of excess renewable energy from sources like wind and solar to produce green hydrogen via electrolysis is driving the development of hydrogen infrastructure. This approach to hydrogen production is environmentally sustainable and aligns with the broader trend of increasing renewable energy utilization.

The ability to store surplus renewable energy as hydrogen addresses the intermittency issue of renewable sources and enhances the overall efficiency of the energy system. The growing focus on green hydrogen production is thus a key factor in the expansion of hydrogen stations, providing a sustainable and scalable solution for hydrogen fueling infrastructure. This trend is likely to continue, reinforcing the role of hydrogen stations in a renewable energy-powered future.

Government Decarbonization Targets Fuel Hydrogen Infrastructure Expansion

Ambitious decarbonization and zero emissions targets set by many governments are critical in scaling up hydrogen vehicles and infrastructure. Governments worldwide are recognizing hydrogen as a pivotal element in achieving climate goals, particularly in sectors that are challenging to decarbonize, such as transportation and heavy industry.

This governmental support is manifesting in the form of policies, subsidies, and investments aimed at promoting hydrogen technologies and infrastructure. The development of hydrogen stations is essential in this context, providing the necessary fueling infrastructure to support a growing fleet of hydrogen vehicles. This governmental commitment to hydrogen as a key component of climate strategies indicates a sustained expansion of the hydrogen stations market, playing a central role in global efforts to transition to a low-carbon economy.

Limited Scale and Lack of Standardization Challenge Hydrogen Stations Market Growth

The hydrogen stations market faces significant growth challenges due to its limited scale and lack of standardization, particularly in fuelling protocols. With approximately 500 hydrogen stations globally, the infrastructure is not yet widespread, which can deter the adoption of hydrogen fuel cell vehicles.

This scarcity of stations leads to a 'chicken-and-egg' dilemma, where consumers are hesitant to purchase hydrogen vehicles due to insufficient refueling infrastructure, and vice versa. Additionally, the lack of standardization in areas such as fuelling protocols and connector types adds complexity and hinders the harmonization of global hydrogen infrastructure development.

Complex Refueling Process and R&D Hurdles Limit Hydrogen Stations Market Growth

The complexity of refueling hydrogen, coupled with research and development (R&D) challenges, also limits the growth of the hydrogen stations market. Issues encompass the entire chain from production to delivery, including storing hydrogen at high pressures, transporting it safely, and ensuring its delivery at adequate purity levels for mobility use. These challenges demand ongoing R&D to develop more efficient and cost-effective solutions.

The complexity and cost of building and operating hydrogen stations, which require advanced technologies for storage and dispensing, make it a less attractive investment compared to conventional fuel stations or electric vehicle charging infrastructures. This complexity in refueling infrastructure development hampers the market's growth potential.

Hydrogen Stations Market Segmentation Analysis

By Size Analysis

Medium hydrogen stations, holding a market share of 55.6%, are the dominant size segment. These stations offer a balanced solution between capacity and cost, making them ideal for urban settings and fleet operations. They can service a significant number of vehicles, supporting both private and commercial hydrogen fuel cell vehicles. Medium stations are often preferred for their ability to meet the needs of growing hydrogen fuel cell adoption without the extensive space and investment requirements of large stations.

Small stations are suited for areas with limited space or lower demand. Large stations cater to high-demand areas and are essential for industrial applications, offering substantial fueling capacities.

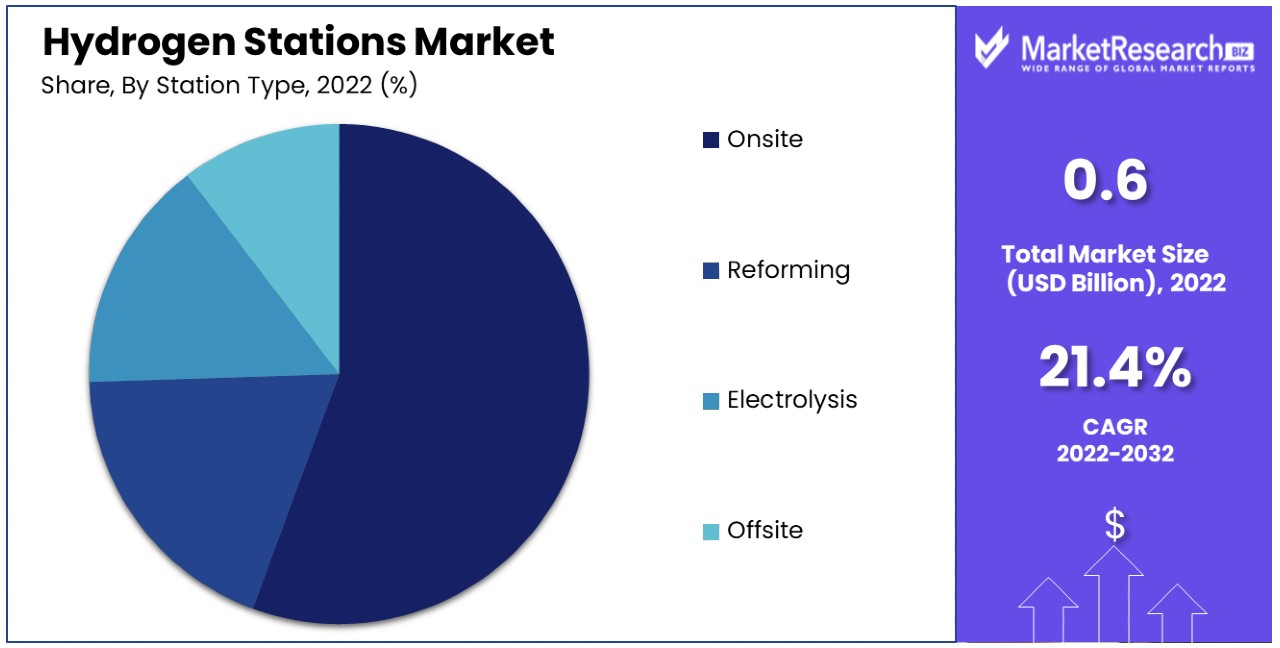

By Station Type Analysis

Onsite hydrogen stations, with a 58.6% Hydrogen Stations Market share, lead this segment. These stations produce hydrogen directly at the point of dispensing, usually through electrolysis or reforming processes. Onsite production is advantageous for ensuring a consistent hydrogen supply and reducing transportation and storage costs. They are particularly suitable for urban areas and locations with accessible renewable energy sources for green hydrogen production.

Reforming and electrolysis are key methods for onsite hydrogen production, with electrolysis gaining traction for green energy. Offsite stations rely on transported hydrogen and are important for areas where onsite production is not feasible.

By Pressure Analysis

High-pressure hydrogen stations dominate the Hydrogen Stations Market with a 76.3% share. These stations compress hydrogen to high pressures, typically around 700 bar, facilitating faster refueling and higher storage efficiency, which is crucial for meeting the demands of modern fuel cell vehicles.

As the automotive industry continues to shift towards hydrogen fuel cell technology, the dominance of high-pressure hydrogen stations underscores their pivotal role in supporting the infrastructure necessary for a sustainable and efficient hydrogen-based transportation system.

Low-pressure stations are used in specific applications where high-pressure storage is not required, such as in certain industrial uses. While their market share is comparatively smaller, the importance of low-pressure stations should not be overlooked, as they cater to specialized needs within the broader hydrogen ecosystem.

By Mobility Analysis

Fixed hydrogen stations, accounting for 65.2% of the market, form the backbone of hydrogen refueling infrastructure. They provide a permanent solution for hydrogen fueling, essential for establishing a reliable network for hydrogen fuel cell vehicles.

Mobile stations offer flexibility and are used in areas with temporary or emerging demand for hydrogen fueling. They also serve demonstration and emergency purposes. While their market share is comparatively smaller, the importance of low-pressure stations should not be overlooked, as they cater to specialized needs within the broader hydrogen ecosystem.

By End-Use Analysis

Commercial vehicles, including buses and trucks, represent the largest end-use segment at 44.6%. The segment’s dominance is driven by the growing adoption of hydrogen fuel cell vehicles in public transportation and logistics, emphasizing the need for reliable refueling infrastructure. The reliability and accessibility of hydrogen stations play a pivotal role in supporting the expanding fleet of hydrogen-powered buses and trucks, ensuring the feasibility and viability of hydrogen as a clean energy solution in the realm of commercial transportation

Beyond road transportation, the hydrogen stations market is witnessing an exploration of hydrogen fuel solutions in the marine, railway, and aviation sectors, marking a strategic move toward decarbonization. Although these segments currently represent smaller shares of the market, they hold substantial potential for future growth. The environmental concerns and regulatory pressures in these sectors are pushing for sustainable alternatives, and hydrogen is emerging as a promising candidate.

Hydrogen Stations Industry Key Segments

By Size

- Small Station

- Medium Station

- Large Station

By Station Type

- Onsite

- Reforming

- Electrolysis

- Offsite

By Pressure

- Low Pressure

- High Pressure

By Mobility

- Fixed Hydrogen Station

- Mobile Hydrogen Station

By End-Use

- Marine

- Railways

- Commercial Vehicles

- Aviation

Hydrogen Stations Market Growth Opportunities

Expanding to Heavy Transport Offers Untapped Growth in Hydrogen Stations Market

The potential expansion of hydrogen stations to support fuel cell trucks, trains, ships, and planes presents a significant yet under-tapped growth opportunity for the market. Currently, the focus has been predominantly on light passenger vehicles.

However, by strategically providing refueling access for heavier modes of transport, hydrogen stations can enable broader adoption of hydrogen fuel cells in these segments. This expansion is crucial in addressing the larger transportation sector's shift away from fossil fuels. The growing interest in sustainable heavy transport solutions indicates a substantial market expansion potential for hydrogen stations in these areas.

Partnering with Municipalities Drives Scale and Utilization in Hydrogen Stations Market

Collaborating with municipal authorities to establish hydrogen stations optimized for taxis, buses, and municipal fleets can significantly drive market scale and utilization. Such partnerships focus on clustered deployments, which not only enhance the efficiency of hydrogen use in public transport but also address consumer concerns about fueling access.

By targeting vehicles that refuel frequently, these stations can achieve higher throughput and efficiency, making the hydrogen infrastructure more viable and visible. This approach, combined with the increasing push for greener public transport solutions, presents a substantial growth opportunity for the hydrogen stations market, especially in urban areas.

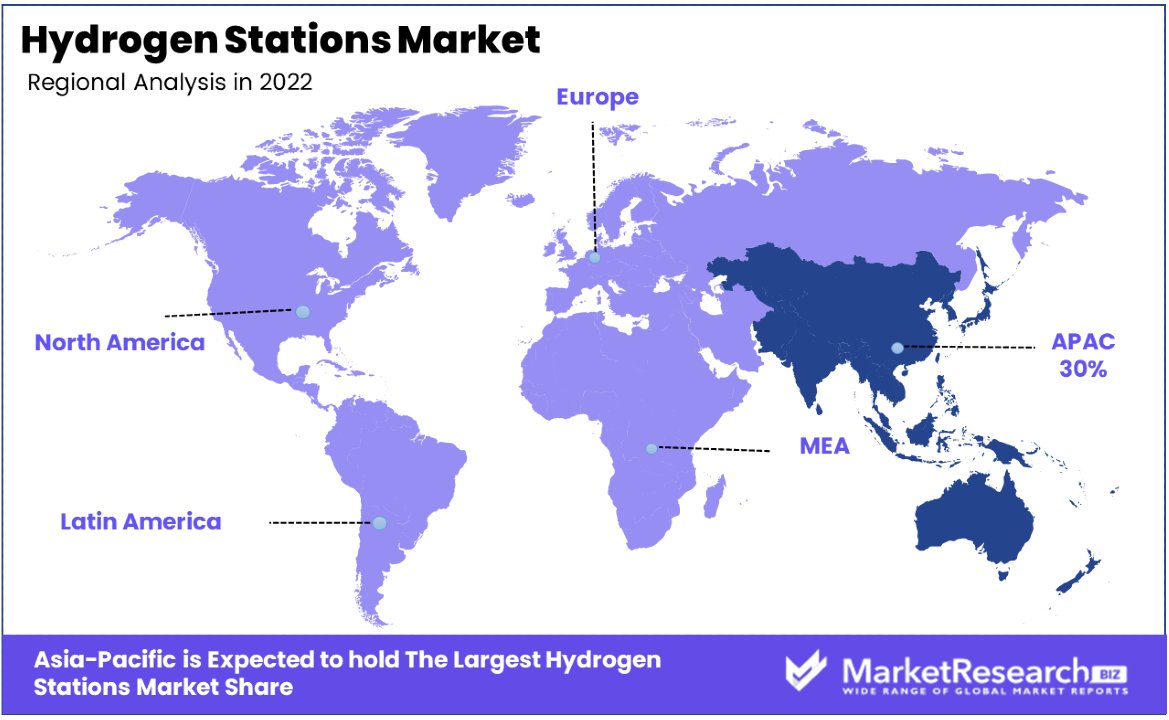

Hydrogen Stations Market Market Regional Analysis

Asia Pacific Dominates with 30% Market Share

Asia Pacific's significant 30% share in the Hydrogen Stations Market is largely due to the region's aggressive push towards clean energy and sustainable transportation. Countries like Japan, South Korea, and China are at the forefront of this transition, implementing national policies that favor hydrogen fuel cell technologies.

The increasing number of hydrogen fuel cell vehicles (FCVs) in these countries drives the need for an extensive hydrogen refueling infrastructure. Additionally, governmental support in the form of subsidies and incentives for hydrogen infrastructure development significantly contributes to the market growth in this region.

The market dynamics in Asia Pacific are influenced by the region's commitment to reducing carbon emissions and combating climate change. This has led to strategic investments in hydrogen technology, including the development of hydrogen refueling stations. The collaboration between governments and major automotive and energy companies in the region accelerates the deployment of hydrogen stations. Furthermore, Asia Pacific's technological advancements in hydrogen production and storage enhance the efficiency and feasibility of these stations.

Europe's Commitment to Green Energy Transition

Europe's hydrogen stations market is driven by the region's strong commitment to the green energy transition and achieving carbon neutrality. The European Union's ambitious targets for reducing greenhouse gas emissions underpin the development of hydrogen infrastructure as a critical component of its energy strategy. European countries are investing in hydrogen technologies, aiming to integrate hydrogen stations into their broader renewable energy and transportation networks.

North America is an Emerging Market with Significant Potential

In North America, particularly in the United States and Canada, the hydrogen stations market is emerging, driven by increasing environmental awareness and the shift towards sustainable energy solutions. The region shows significant potential for market growth, with initiatives to develop hydrogen infrastructure as part of broader clean energy strategies. The partnership between government entities and private companies in North America is crucial for the market’s development, focusing on creating a sustainable and efficient hydrogen refueling ecosystem.

Hydrogen Stations Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Hydrogen Stations Market Key Player Analysis

The hydrogen Stations Market is crucial for the deployment of hydrogen fuel cell vehicles (FCVs), the companies listed are key in shaping this sector's growth and infrastructure. Air Liquide and Linde PLC, as industrial gas giants, are instrumental in the development and operation of hydrogen refueling stations, providing crucial expertise in hydrogen production and supply.

Air Products and Chemicals, Inc., with its extensive experience in gas production and distribution, plays a pivotal role in establishing and managing hydrogen fueling infrastructure, essential for the market's expansion. Ballard Power Systems, specializing in fuel cell technology, contributes to the market through the development of hydrogen-powered systems, showcasing the technological advancements driving hydrogen station viability.

Black and Veatch Holding Company and China Petrochemical Corporation, with their engineering and construction expertise, are key players in building the physical infrastructure required for hydrogen stations, reflecting the industry's move towards large-scale deployment. Cummins Inc. and FuelCell Energy, Inc., known for their power solutions, provide critical components and technologies for efficient hydrogen fueling systems.

FirstElement Fuel, Inc. and H2ENERGY Solutions LTD, focusing specifically on hydrogen fueling solutions, underscore the market's specialization and the growing number of companies dedicated solely to hydrogen infrastructure. ITM Power PLC and NEL ASA, with their expertise in electrolysis, contribute to the market by providing green hydrogen solutions, essential for sustainable hydrogen production.

Nuvera Fuel Cells, LLC and PDC Machines Inc., through their innovative fuel cell and compressor technologies, play crucial roles in enhancing the efficiency and reliability of hydrogen refueling. Shell, traditionally an oil and gas company, is increasingly investing in hydrogen infrastructure, indicating a significant industry shift towards sustainable energy solutions.

Collectively, these prominent players drive the growth of the Hydrogen Stations Market, representing a range of strategies from hydrogen production and supply to infrastructure development and technological innovation, essential for the widespread adoption of hydrogen as a clean fuel alternative.

Major Market Players in Hydrogen Stations Market

- Ballard Power Systems

- FirstElement Fuel, Inc.

- NEL ASA

- Iwatani Corporation

- PDC Machines Inc.

- Cummins Inc.

- Linde PLC

- Air Products and Chemicals, Inc.

- ITM Power PLC

- Powertech Labs Inc

- Peric Hydrogen Technologies Co., Ltd

- H2ENERGY Solutions LTD

- Black and Veatch Holding Company

- China Petrochemical Corporation

- FuelCell Energy, Inc.

- Shell

- McPhy Energy S.A.

- Nuvera Fuel Cells, LLC

- Air Liquide

Recent Developments

- In August 2023, Nikola Corporation recently secured a $16.3 million grant, bringing the total grant amount to $58.2 million, to support the construction of hydrogen refueling stations. This funding, in partnership with Voltera, aims to develop up to 50 HYLA hydrogen stations in North America over the next 5 years.

- In September 2023, a research initiative by the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) and Colorado State University (CSU) aimed at improving consumer confidence in driving hydrogen-fueled vehicles. The researchers propose the adoption of a predictive model, known as prognostics health monitoring (PHM), to anticipate maintenance needs in hydrogen fueling stations.

- On December 5, 2023, Hydrogen Refueling Solutions (HRS), a leading European designer and manufacturer of hydrogen refueling stations, announced its continued partnership with Plug Power Inc. The company has received a new firm order for two specific hydrogen refueling stations from Plug Power, bringing the total number of stations ordered by Plug to seven under their partnership established earlier in the year.

- In August 2023, Ampol, Australia's largest petrol retailer, has partnered with US firm OneH2 to expand the availability of hydrogen service stations in the country. The collaboration aims to accelerate the adoption of hydrogen in Australia, particularly for heavy transport, to reduce emissions.

- In November 2023, Australia's national science agency, CSIRO, in collaboration with Swinburne University of Technology’s Victorian Hydrogen Hub (VH2), has launched a state-of-the-art clean hydrogen refueling station at CSIRO's Clayton site in Victoria. The $2.5 million facility is dedicated to advancing hydrogen research, testing emerging hydrogen technology, and training the next generation on the use of hydrogen stations.

Report Scope

Report Features Description Market Value (2022) US$ 0.6 Bn Forecast Revenue (2032) US$ 3.7 Bn CAGR (2023-2032) 21.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Size (Small Station, Medium Station, Large Station), By Type (Onsite, Reforming, Electrolysis, Offsite (By Pressure (Low Pressure, High Pressure), By Mobility (Fixed Hydrogen Station, Mobile Hydrogen Station), By End-Use (Marine, Railways, Commercial Vehicles, Aviation) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Hilleberg Ab., Johnson Outdoors Inc., The North Face Inc., AMG GROUP, Newell Brands Inc., Oase Outdoors, The Coleman Company, Simex Outdoor International, Kampa, Exxel Outdoors, Bushtec Safari (South Africa), Sawday’s Canopy & Stars Ltd. (UK), Huttopia (France), Wigwam Holidays Ltd (UK), Arena Campsites (Europe), Nightfall Camp Pty Ltd., Getaway House Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ballard Power Systems

- FirstElement Fuel, Inc.

- NEL ASA

- Iwatani Corporation

- PDC Machines Inc.

- Cummins Inc.

- Linde PLC

- Air Products and Chemicals, Inc.

- ITM Power PLC

- Powertech Labs Inc

- Peric Hydrogen Technologies Co., Ltd

- H2ENERGY Solutions LTD

- Black and Veatch Holding Company

- China Petrochemical Corporation

- FuelCell Energy, Inc.

- Shell

- McPhy Energy S.A.

- Nuvera Fuel Cells, LLC

- Air Liquide