Virtual Fitting Room Market By Component (Hardware, Software, Services), By Application (Apparel, Beauty & Cosmetic, Eyewear, Footwear, Others), By End-use (Physical Store, Virtual Store), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51142

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

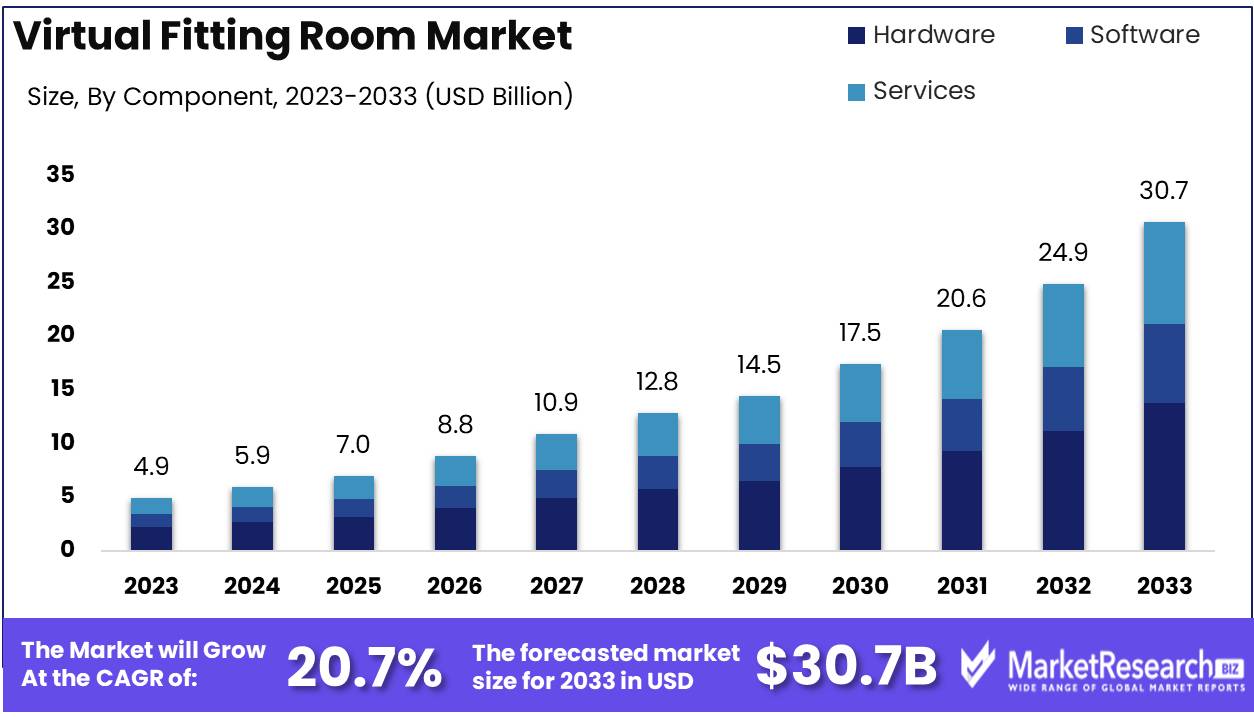

The Virtual Fitting Room Market was valued at USD 4.9 billion in 2023. It is expected to reach USD 30.7 billion by 2033, with a CAGR of 20.7% during the forecast period from 2024 to 2033.

The Virtual Fitting Room Market encompasses digital solutions that allow consumers to try on clothing, accessories, and footwear virtually using augmented reality (AR), artificial intelligence (AI), and 3D imaging technologies. This market is driven by the growing demand for personalized shopping experiences, reducing return rates, and enhancing online retail engagement. As e-commerce expands, virtual fitting rooms provide a seamless way for customers to visualize products, improving satisfaction and decision-making.

The Virtual Fitting Room (VFR) market is poised for significant growth, driven by the increasing penetration of e-commerce and advancements in technologies such as augmented reality (AR) and artificial intelligence (AI). As online shopping gains further momentum, consumers demand more personalized and interactive experiences, which VFR solutions are uniquely positioned to offer. These tools allow customers to virtually try on products, thus bridging the gap between online and physical shopping experiences. The application of AI enhances the accuracy of virtual fittings by analyzing body measurements and recommending the best product fit, while AR improves the visual representation of products, increasing consumer confidence and reducing returns.

However, high implementation costs continue to present a challenge, particularly for smaller retailers. Despite these barriers, major brands are investing in VFR technologies, viewing them as a long-term strategy to improve customer engagement and satisfaction.

Additionally, the expansion of VFR applications into new retail verticals such as beauty, eyewear, and footwear is expected to fuel market growth. As retailers diversify their digital strategies, the VFR market is expected to grow rapidly, especially in regions where e-commerce is expanding at a faster pace. The ability of VFR technologies to create seamless and interactive shopping experiences will be critical in helping retailers maintain a competitive edge in an increasingly digital-first environment.

Key Takeaways

- Market Growth: The Virtual Fitting Room Market was valued at USD 4.9 billion in 2023. It is expected to reach USD 30.7 billion by 2033, with a CAGR of 20.7% during the forecast period from 2024 to 2033.

- By Component: Hardware dominated the Virtual Fitting Room Market components.

- By Application: Apparel dominated the Virtual Fitting Room Market by application.

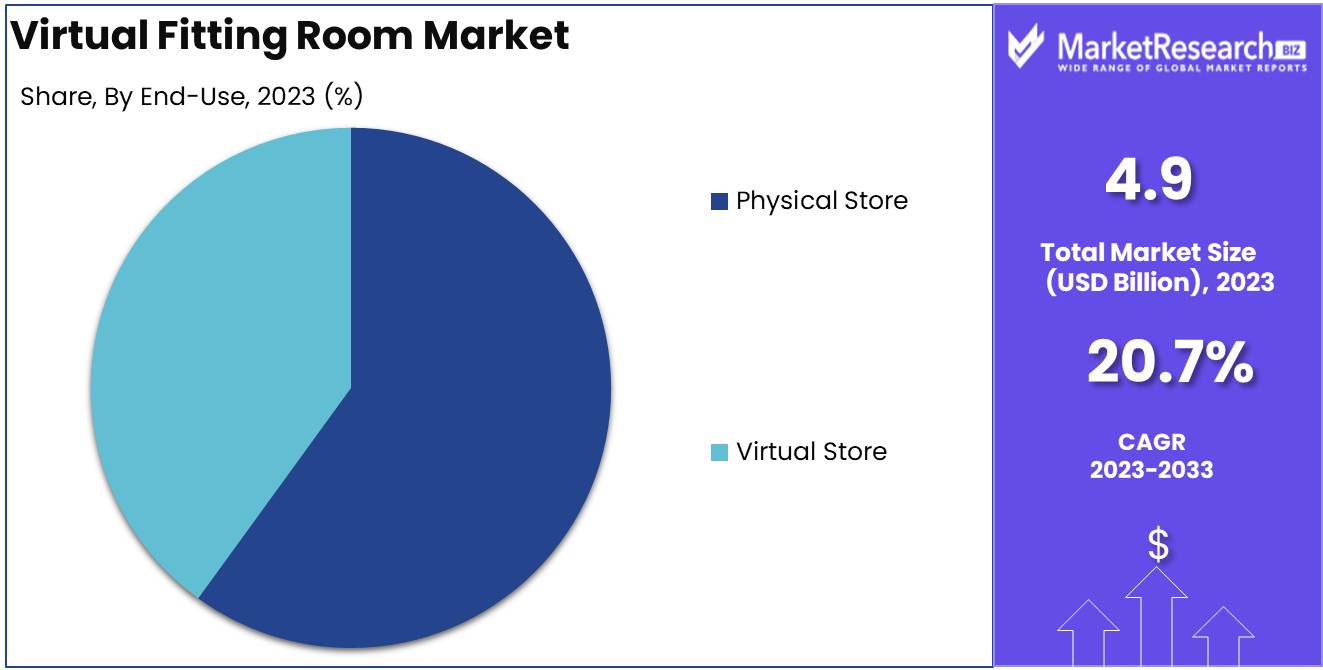

- By End-use: Physical stores dominated the virtual fitting room market.

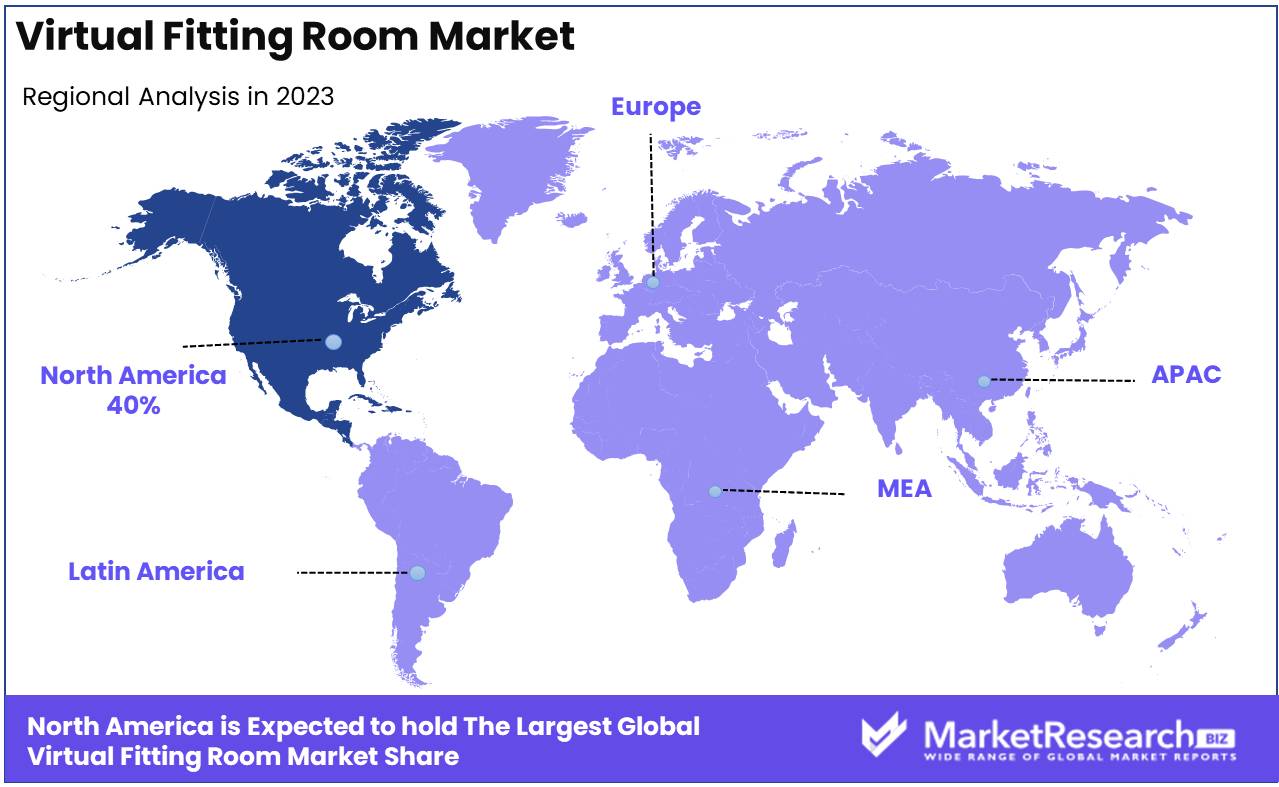

- Regional Dominance: North America dominates the virtual fitting room market with a 40% largest share.

- Growth Opportunity: The global virtual fitting room market will witness substantial growth, driven by advancements in body scanning technologies and expanding support services, enhancing customer satisfaction and market penetration.

Driving factors

Growth of E-commerce Driving Virtual Fitting Room Market Expansion

The rapid expansion of the e-commerce sector is a primary driver of the virtual fitting room market. The global e-commerce market is expected to grow significantly, driven by increasing consumer demand for online shopping experiences. This surge has created a pressing need for innovative solutions to enhance customer satisfaction and reduce return rates, both of which are addressed by virtual fitting rooms (VFRs). Traditional e-commerce platforms often struggle with size misalignments and fit issues, leading to high return rates. Virtual fitting rooms allow customers to visualize how clothes will fit on their bodies, significantly reducing the likelihood of incorrect purchases. As online retail continues to grow, so will the demand for advanced tools that mimic in-store experiences, positioning VFR technology as a vital component in enhancing user experience and driving sales.

Furthermore, as e-commerce becomes more competitive, retailers are increasingly adopting VFR solutions to differentiate themselves, improve customer engagement, and drive conversions. These factors collectively contribute to the increased adoption of VFR technology, which is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years.

Technological Advancements in AR and VR Revolutionizing Virtual Fitting Room Solutions

Technological innovations in augmented reality (AR) and virtual reality (VR) are critical to the growth of the virtual fitting room market. AR and VR technologies form the foundation of VFRs, enabling realistic, interactive, and personalized fitting experiences. AR allows customers to superimpose clothing on their real-world image, while VR can immerse users in virtual environments where they can experiment with different garments. Advances in these technologies, such as improved tracking algorithms, real-time body mapping, and higher-resolution imaging, have made virtual fitting experiences more seamless and accurate.

The improvement in these technologies has driven adoption across various retail segments, as customers now enjoy highly accurate virtual try-on experiences. Moreover, with the rise of artificial intelligence (AI) and machine learning (ML), retailers can offer even more personalized and adaptive experiences based on users’ past preferences and body dimensions. As these technologies continue to evolve, the quality and functionality of virtual fitting rooms will improve, further accelerating market growth.

Integration with Mobile and Web Platforms Enhancing Accessibility and Usability

The widespread integration of virtual fitting rooms with mobile and web platforms has expanded their accessibility and convenience, contributing significantly to market growth. As mobile commerce (m-commerce) grows in popularity, retailers are embedding VFR solutions within mobile apps and websites, allowing customers to try on clothes from anywhere, at any time. This integration aligns with the increasing use of smartphones for online shopping, a market that is projected to reach a value of $3.56 trillion.

Incorporating virtual fitting rooms into mobile and web platforms not only boosts customer engagement but also enhances the overall shopping experience by making it more interactive and personalized. Consumers expect seamless digital interactions, and retailers are responding by integrating advanced VFR technologies into their mobile applications. Additionally, the integration facilitates data collection for retailers, enabling personalized marketing and better inventory management, which drives overall operational efficiency. The growth of mobile shopping further intensifies the need for VFR solutions, positioning this technology as a key tool for driving customer satisfaction and reducing operational costs.

Restraining Factors

Limited Physical Experience: A Barrier to Adoption and Consumer Confidence

The absence of a tangible, physical interaction with products in virtual fitting rooms presents a significant restraining factor in the market’s growth. For many consumers, the tactile experience such as the feel of fabric or the actual draping of clothing is a crucial part of the purchasing process, particularly in fashion retail. Without this physical interaction, virtual fitting rooms may struggle to build the same level of consumer trust and confidence that traditional fitting rooms offer. This limitation can lead to higher product return rates, as customers may not feel entirely certain about their purchase decisions. Consequently, many retailers remain hesitant to fully embrace virtual fitting rooms due to potential logistical costs associated with increased returns.

As a result, this technological gap slows market adoption, particularly among consumers who prefer an in-store shopping experience, thereby restricting the overall market growth. In essence, the inability of virtual fitting rooms to fully replicate the sensory components of traditional retail environments remains a key barrier to achieving widespread consumer acceptance.

Consumer Privacy Concerns: Heightened Data Sensitivity and Regulatory Compliance Challenges

Consumer privacy concerns stand as another critical factor impeding the growth of the virtual fitting room market. The technology often requires access to personal information, such as body measurements, images, or even videos, to provide an accurate virtual fitting experience. While this data is essential for improving the precision of the virtual fitting, it raises significant concerns among consumers regarding the safety and security of their personal information.

A growing number of consumers are becoming increasingly aware of the risks associated with sharing personal data, particularly in light of recent high-profile data breaches and heightened global concerns over digital privacy. In a 2023 survey, nearly 60% of consumers expressed hesitation about sharing biometric data with retailers due to fears of misuse or inadequate protection. Additionally, stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States further complicate the market landscape. These regulations impose strict guidelines on how companies must handle sensitive consumer data, increasing operational costs for companies that need to ensure compliance.

By Component Analysis

In 2023, Hardware dominated the Virtual Fitting Room Market components.

In 2023, Hardware held a dominant market position in the "By Component" segment of the Virtual Fitting Room Market. The hardware segment, which includes devices such as cameras, 3D scanners, and sensors, is critical for capturing user dimensions and movements accurately. These technologies enable precise virtual fitting, a key factor driving their extensive adoption in both online and in-store retail environments. The increased focus on enhancing the customer experience by offering real-time body measurement capabilities has further bolstered the demand for advanced hardware solutions.

The software segment also plays a significant role, providing the interface and algorithms required for rendering virtual outfits on users. Integration of AI and AR within software platforms allows for improved customization and user engagement, enhancing the accuracy and functionality of virtual try-ons.

The services segment includes consultation, maintenance, and support services, crucial for the seamless functioning of hardware and software solutions. This segment is expected to witness steady growth due to rising demand for customization, integration, and technical support in deploying virtual fitting room systems across various retail platforms.

By Application Analysis

In 2023, Apparel dominated the Virtual Fitting Room Market by application.

In 2023, Apparel held a dominant market position in the "By Application" segment of the Virtual Fitting Room Market, driven by the increasing adoption of e-commerce platforms and advancements in augmented reality (AR) technologies. The growing demand for personalized shopping experiences has fueled the integration of virtual fitting rooms in online fashion retail, allowing customers to visualize apparel before purchasing. This has led to enhanced customer satisfaction, reduced return rates, and improved sales conversions.

Beauty & Cosmetics followed closely, as virtual try-on solutions for makeup and skincare products have gained popularity, particularly through mobile applications. The use of AR in this segment allows customers to test different products virtually, providing a more immersive and interactive experience. The Eyewear segment has also seen significant adoption, with virtual fitting rooms enabling users to try on glasses and sunglasses in real time, improving purchasing decisions.

Footwear remains a growing segment, leveraging 3D scanning and AR technology to offer virtual shoe try-ons. Finally, Others, which include accessories and jewelry, have also experienced growth, benefitting from similar technological advancements and changing consumer preferences.

By End-use Analysis

In 2023, Physical stores dominated the virtual fitting room market.

In 2023, Physical stores held a dominant market position in the end-use segment of the virtual fitting room market. The widespread adoption of virtual fitting rooms in brick-and-mortar retail outlets allowed these stores to enhance customer experience and reduce return rates. Shoppers increasingly leveraged virtual fitting technologies to try on products, especially in the fashion and apparel sectors, contributing to higher customer satisfaction. Physical stores benefitted from integrating virtual fitting solutions to streamline in-store shopping experiences, offering personalized sizing recommendations and reducing physical contact during fittings. Retailers implemented these solutions to bridge the gap between traditional and online shopping behaviors, leading to increased customer engagement.

Conversely, virtual stores experienced significant growth due to the rising prominence of e-commerce and digital platforms. Virtual fitting rooms became an essential tool for online retailers to improve conversion rates by allowing customers to visualize clothing on their own bodies before making purchases. The scalability and lower infrastructure costs of virtual stores enabled them to capitalize on the shift toward digital retail, making the virtual fitting room an indispensable tool for minimizing returns and enhancing the online shopping experience. These factors contributed to their notable market share in 2023.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Apparel

- Beauty & Cosmetic

- Eyewear

- Footwear

- Others

By End-use

- Physical Store

- Virtual Store

Growth Opportunity

Body Scanning Technologies

The adoption of advanced body scanning technologies is expected to revolutionize the virtual fitting room market in 2024. These technologies enable precise body measurements, allowing consumers to visualize how clothing fits without physically trying them on. This accuracy enhances the shopping experience, reduces return rates, and builds consumer trust. Companies leveraging 3D body scanning are expected to gain a competitive advantage, as the technology aligns with the increasing demand for customized and accurate fitting experiences in online shopping. With advancements in artificial intelligence (AI) and machine learning (ML), body scanning solutions are likely to become more sophisticated, leading to higher market penetration.

Support Services Growth

The rise of support services, including after-sales customer service, technical support, and maintenance, is also expected to drive growth in the VFR market. As retailers and brands integrate virtual fitting room solutions, the need for continuous service and system updates will grow. Companies providing comprehensive support services will likely benefit from long-term partnerships with retailers, ensuring the seamless functioning of VFR technologies. This development not only supports market growth but also fosters consumer satisfaction and loyalty, further boosting demand for virtual fitting room solutions.

Latest Trends

AI Integration Driving Personalization and Efficiency

The integration of artificial intelligence (AI) in virtual fitting rooms (VFR) is poised to revolutionize the market. AI-powered algorithms are enhancing customer experiences by enabling highly personalized garment recommendations, based on user data such as body measurements, preferences, and purchasing history. Through machine learning, AI can continuously improve the accuracy of virtual try-ons, minimizing the discrepancy between virtual and real-life fits.

Furthermore, AI-driven analytics offer retailers valuable insights into consumer behavior, driving better inventory management and marketing strategies. This trend is expected to significantly reduce product returns, a persistent issue in online fashion retail, and improve overall customer satisfaction.

Accelerated Retailer Adoption of Virtual Fitting Rooms in E-Commerce and Brick-and-Mortar Stores

The adoption of virtual fitting rooms by retailers is accelerating, driven by the increasing demand for digital solutions in both e-commerce and physical stores. A growing number of fashion brands are expected to incorporate VFR technology into their online platforms, responding to consumer preferences for convenient and interactive shopping experiences.

Additionally, brick-and-mortar stores are experimenting with augmented reality (AR) mirrors and VFR kiosks, allowing customers to try on clothes virtually without physically changing outfits. The flexibility and convenience offered by VFRs are anticipated to boost conversion rates, streamline shopping experiences, and expand the market's reach across various retail channels.

Regional Analysis

North America dominates the virtual fitting room market with a 40% largest share.

The global virtual fitting room market is experiencing significant growth, with North America leading the sector. North America accounted for the largest market share, contributing approximately 40% of the global market in 2023. The region’s dominance can be attributed to its advanced retail ecosystem, high adoption of augmented reality (AR) and artificial intelligence (AI) technologies, and the strong presence of major industry players, including Amazon, Walmart, and Shopify. The increasing demand for personalized shopping experiences, coupled with the growth of e-commerce, has further fueled the adoption of virtual fitting rooms in the region.

Europe is also a key player in the virtual fitting room market, holding a considerable market share. Countries such as the UK, Germany, and France are at the forefront of integrating AR technologies in retail due to a robust fashion industry and growing consumer demand for immersive experiences.

Asia Pacific is expected to witness the fastest growth, driven by rising smartphone penetration, a burgeoning e-commerce sector, and increased consumer spending in countries like China, Japan, and South Korea.

The Middle East & Africa and Latin America are emerging markets, with gradual adoption driven by digital transformation in the retail sector and increasing investment in e-commerce infrastructure, particularly in Brazil, South Africa, and the UAE.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Virtual Fitting Room (VFR) market is driven by a combination of technological advancements and changing consumer preferences. Key players such as Else Corp, Fit Analytics, FX Gear Inc., and Magic Mirror are at the forefront of innovation, leveraging AI, machine learning, and 3D visualization technologies to enhance user experience. These companies offer solutions that enable consumers to virtually try on clothing, reducing the need for physical trials and improving the overall shopping experience, particularly for e-commerce retailers.

Else Corp and Fit Analytics are recognized for their AI-based fit prediction algorithms, which help retailers reduce return rates by offering highly accurate sizing recommendations. FX Gear Inc. and Magic Mirror focus on immersive 3D visualization technology, creating lifelike virtual try-ons that engage consumers more effectively.

MeMo Labs Inc., 3DLOOK Inc., and Zugara, Inc. are expanding their market presence by integrating their virtual fitting solutions with augmented reality (AR) to meet the growing demand for interactive shopping experiences. Visual Look, triMirror, and Sensemi DMCC offer competitive software-as-a-service (SaaS) models, making virtual fitting technology accessible to small and medium-sized retailers.

Autumn Rock Limited (AstraFit), Metail, Sizebay, and Fision AG emphasize the customization of fitting rooms to meet diverse body types, while Virtusize Co. Ltd. and Reactive Reality AG focus on enhancing user interface design and compatibility with various e-commerce platforms.

Overall, these players are crucial in driving innovation and adoption in the virtual fitting room market, positioning themselves strategically in a competitive landscape.

Market Key Players

- Else Corp

- Fit Analytics

- FX Gear Inc.

- Magic Mirror

- MeMo Labs Inc.

- 3DLOOK Inc.

- Zugara, Inc.

- Visual Look

- triMirror

- Sensemi DMCC

- Autumn Rock Limited (AstraFit)

- Metail

- Sizebay

- Fision AG

- Virtusize Co. Ltd.

- Reactive Reality AG

Recent Development

- In April 2024, Zugara, a pioneer in AR for retail, launched a new AI-powered virtual fitting room solution for fashion retailers. This updated technology provides enhanced accuracy in virtual try-ons and integrates seamlessly with mobile and web platforms, catering to the growing demand for personalized online shopping experiences.

- In March 2024, Visualook, a virtual fitting room software provider, expanded its operations into Europe, partnering with several luxury brands. The platform allows users to try on high-fashion items virtually, focusing on reducing returns and enhancing customer satisfaction through more precise fit recommendations.

- In September 2023, Hugo Boss partnered with Reactive Reality to launch a 3D digital dressing room. This initiative provides customers with an immersive experience, allowing them to try on clothing virtually in real time. The collaboration is considered a milestone in the fashion industry, aimed at connecting consumers to online stores with greater ease and convenience.

Report Scope

Report Features Description Market Value (2023) USD 4.9 Billion Forecast Revenue (2033) USD 30.7 Billion CAGR (2024-2032) 20.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Apparel, Beauty & Cosmetic, Eyewear, Footwear, Others), By End-use (Physical Store, Virtual Store) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Else Corp, Fit Analytics, FX Gear Inc., Magic Mirror, MeMo Labs Inc., 3DLOOK Inc., Zugara, Inc., Visual Look, triMirror, Sensemi DMCC, Autumn Rock Limited (AstraFit), Metail, Sizebay, Fision AG, Virtusize Co. Ltd., Reactive Reality AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Else Corp

- Fit Analytics

- FX Gear Inc.

- Magic Mirror

- MeMo Labs Inc.

- 3DLOOK Inc.

- Zugara, Inc.

- Visual Look

- triMirror

- Sensemi DMCC

- Autumn Rock Limited (AstraFit)

- Metail

- Sizebay

- Fision AG

- Virtusize Co. Ltd.

- Reactive Reality AG