Global Veterinary Telemedicine Market Size, Share, Growth, and Industry Analysis By Service Type (Tele-Diagnosis, Tele-Consultation, and other), Technology (Video Conferencing, Mobile Apps, Web-Based Platforms, and other) and By Region Forecast - 2023-2032

-

41133

-

Sep 2023

-

186

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

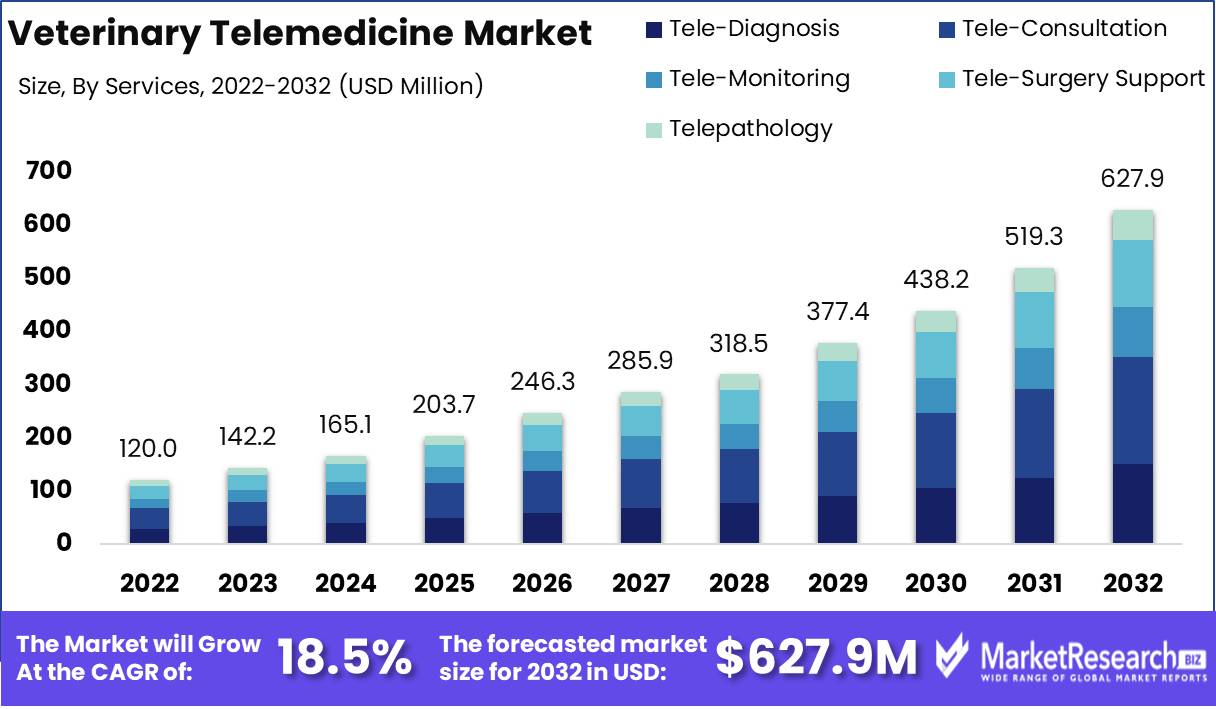

Global veterinary telemedicine market revenue is expected to increase to USD 627.9 Mn in 2032 from USD 120.0 Mn in 2022, and register a revenue CAGR of 18.5% during the forecast period 2023 to 2032.

Key Takeaways

- The global veterinary telemedicine market is on a steeply inclined growth trajectory. By 2022 end, the market was valued at approximately USD 120.0 million, and this is projected to exceed USD 203.7 million by 2025 end, and register a Compound Annual Growth Rate (CAGR) of around 18.5%.

- North America is expected to account for comparatively larger revenue share contribution to the global veterinary telemedicine market between 2023 and 2032, and register a revenue CAGR of around 18.8% during the period.

- Asia Pacific market is expected to continue to register fastest revenue CAGR compared to other regional markets over the forecast period due to larger population and size of pet owners base in countries in the region.

- Continuous technological advancements in AI diagnostics, telehealth platforms, and remote monitoring devices have been driving steady adoption in the recent past. In 2022, usage of AI-powered diagnostic tools registered a 35% increase.

- As per a survey in 2022, 63% of pet owners surveyed expressed a preference for telemedicine for non-emergency pet health consultations due to its convenience factor.

- Advent of veterinary telemedicine has been expanding access to pet care to a significant extent. In 2023, over 40% of telehealth consultations occurred in underserved rural areas, demonstrating potential to bridge healthcare gaps.

Market Overview

Veterinary telemedicine is a rapidly evolving field that leverages technology to enable provision of remote healthcare services for pets and farm and other animals. This innovative approach offers convenience and access to expert veterinary care, bridging geographical or regional gaps and also reducing stress on animals and owners.

More widely used technologies in this market include video conferencing, mobile medical apps, and web platforms to enable real-time consultations between veterinarians and pet owners. Among some of the key services provided include routine check-ups, behavior consultations, and urgent care advice. Processes can entail scheduling appointments, sharing medical records, and prescribing medication. Two common types of telemedicine include synchronous telemedicine during which live consultations occur, and asynchronous telemedicine, entailing messaging and file sharing, which allows for better flexibility in care delivery.

The global veterinary telemedicine market is registering steady revenue growth, driven by factors such as rising pet ownership, increased awareness of pet healthcare, and convenience of remote consultations. Consumption trends indicate a surge in demand for services such as tele-diagnosis, telemonitoring, and telepharmacy. Also, advancements in AI-driven diagnostics and wearable pet tech are adding momentum to market growth. Initiatives promoting telemedicine adoption, advantages like reduced stress for pets and cost savings for owners, are other driving factors.

Driving Factors

Increasing Pet Ownership

A significant surge in pet ownership in countries across the globe has resulted in an incline in demand for veterinary services. Pet ownership in the United States for instance stood at 66% of households (86.9 million homes) owning a pet in 2023.

Advancements in Technology

Ongoing technological innovations, such as AI-driven diagnostics, remote monitoring and connected devices, and setting up of telehealth platforms for animals are enhancing the capabilities and reach of veterinary telemedicine.

Consumer Convenience

Telemedicine offers pet owners the convenience of accessing veterinary care from the comfort of their homes and reduces the need for physical clinic visits.

Remote Areas Access

Veterinary telemedicine is particularly valuable in remote or underserved areas where access to traditional veterinary clinics is limited. This expansion of access leads to increased preference among a growing user base.

COVID-19 Pandemic

The pandemic accelerated the adoption of telemedicine across various sectors, including veterinary care. This shift in behavior is expected to have a prolonged positive impact on revenue growth as an increasing number of consumers to adopt telehealth options for their pets and farm animals.

Restraining Factors

Regulatory Barriers

Stringent and evolving regulations in different regions and countries can raise challenges for veterinary telemedicine providers as compliance with varying licensing and telemedicine laws can be complex and costly.

Poor Internet Access in Rural Areas

Limited access to high-speed Internet in a number of rural or underserved areas can hinder adoption of veterinary telemedicine services.

Resistance to Change

Some pet owners and veterinarians may be hesitant to adopt telemedicine due to a higher preference for traditional in-person consultations. Building trust in virtual healthcare as it is an emerging and growing concept can take some time, and resistance among a larger consumer base can reduce potential revenue.

Opportunities

Subscription-Based Telemedicine Platforms

Service providers can offer subscription-based models for pet owners, which can include access to veterinary consultations, advice, and pet health management tools. These can be recurring revenue streams and stable sources of income while building long-term customer relationships and expand consumer base.

Telemedicine Software Licensing

Developing and licensing telemedicine software platforms to veterinary clinics and hospitals enables companies to generate revenue through licensing fees. Veterinarians can integrate these platforms into their practices to offer telehealth services and expand reach and revenue.

Value-Added Services

Besides consultations, companies can offer value-added services such as telepharmacy solutions, AI-driven diagnostic tools, and remote monitoring devices to expand revenue streams. These offerings can command premium pricing and contribute significantly by enhancing the overall pet healthcare experience.

Segment Analysis

By Services

Tele-consultation segment is expected to account for majority revenue share over the forecast period. This is due to high preference among an increasing number of users for these services as the options enable pet owners to conveniently connect with veterinarians remotely, and facilitates real-time advice and guidance. Another factor supporting revenue growth of the tele-consultation segment includes expanded reach, for emergency and for non-emergency situations. This convenience encourages more frequent usage and contributes significantly to revenue.

By Technology

Artificial Intelligence (AI) solutions segment is expected to account for significantly large revenue share among the technology segments. Included among these technologies are AI-powered diagnostic tools, image analysis algorithms, and these enable access to data-driven insights to enhance the accuracy and efficiency of pet healthcare. AI-driven solutions offer veterinarians advanced diagnostic capabilities, leading to more precise and timely assessments of pet health conditions.

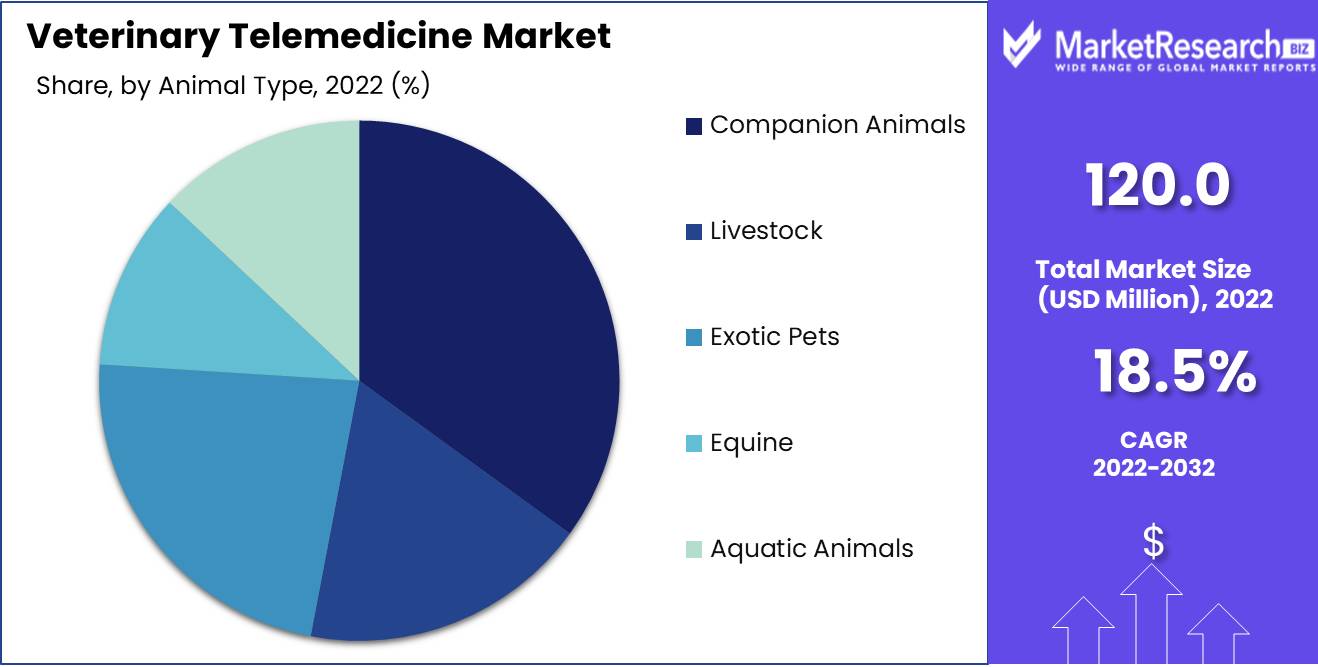

By Animal Type

The companion animal segment, which includes dogs and cats, accounts for a substantially large revenue share contribution to the global veterinary telemedicine market. Larger revenue share can be attributed to these pets typically requiring regular veterinary care and are a focus point for telemedicine services owing to dogs and cats being highly prevalent pets globally.

Market Segmentation

Service Type

- Tele-Diagnosis

- Tele-Consultation

- Tele-Monitoring

- Tele-Surgery Support

- Telepathology

Technology

- Video Conferencing

- Mobile Apps

- Web-Based Platforms

- Wearable Devices

- Artificial Intelligence (AI) Solutions

Animal Type

- Companion Animals (Dogs, Cats)

- Livestock (Cattle, Poultry)

- Exotic Pets (Birds, Reptiles)

- Equine (Horses, Ponies)

- Aquatic Animals (Fish, Aquatic Reptiles)

End-User

- Veterinary Clinics

- Pet Owners

- Livestock Producers

- Research Institutions

- Animal Shelters and Rescues

Revenue Model

- Subscription-Based

- Pay-Per-Use

- Licensing Fees

- Sales of Telehealth Hardware

- Value-Added Services (Telepharmacy, Remote Monitoring)

Regional Analysis

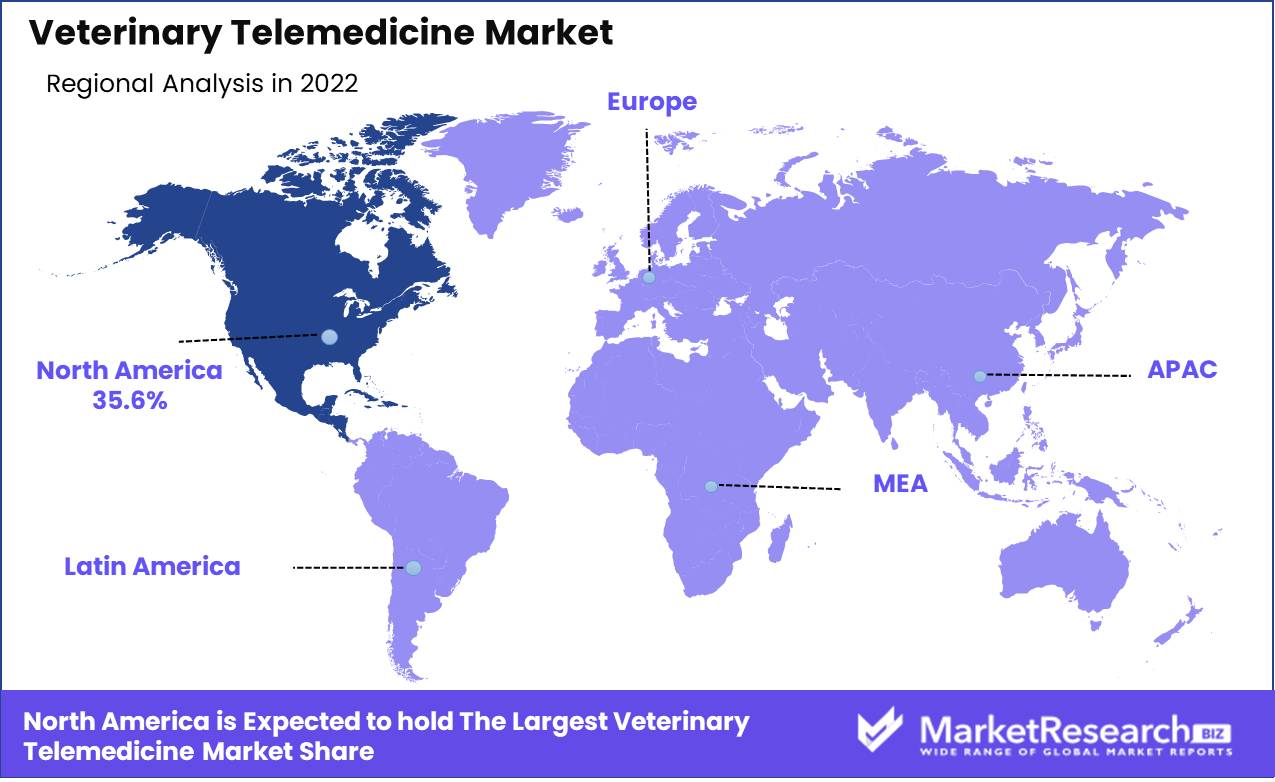

North America

North America dominated the veterinary telemedicine market, North America veterinary telemedicine market revenue CAGR is expected to be around 35.6% between 2023 and 2030, and users and pet owners in countries in the region have been first-movers with regards to exploring and using veterinary telemedicine market. This can also be attributed to high pet ownership rates, robust technological infrastructure, and advanced healthcare practices. Further market revenue potential is also significantly high, as pet owners increasingly adopt telemedicine for their pets' healthcare needs.

Market growth is further supported by ongoing technological developments and advancements, such as integration of AI-powered diagnostics and wearable pet tech, thereby enhancing the efficiency and effectiveness of telemedicine services. In addition, initiatives promoting adoption of telemedicine, along with rising awareness regarding the benefits of remote pet healthcare, are supporting North America market revenue growth.

Europe

Europe is also a major market for veterinary telemedicine owing to growing pet population and a well-established veterinary care system in countries in the region. The market is also registering steady revenue growth as technological advancements, particularly in telehealth platforms and data security, continue to boost consumer confidence in telemedicine services. Also, initiatives by governments and industry stakeholders to standardize and regulate telemedicine practices are providing a conducive environment for revenue growth in this region.

Asia-Pacific

Asia-Pacific market is currently registering a rapid revenue growth rate and this trend is expected to continue over the forecast period. Key factors such as increasing pet ownership, especially in urban areas, and rising awareness regarding benefits of telemedicine are driving market revenue growth. Technological advancements are also crucial growth-driving factors, with mobile apps and web-based platforms making telemedicine accessible to a wider audience. Initiatives by veterinary associations and startups to promote telemedicine services are further supporting revenue growth of the veterinary telemedicine market in Asia-Pacific.

Latin America

Latin America currently accounts for a significantly smaller market share compared to other regions, but is emerging as a lucrative regional market for veterinary telemedicine. Awareness regarding telemedicine is rising among potential users and consumers, especially in countries with an expanding middle class base and increased pet ownership, and technological advancements in telehealth platforms and the expansion of internet connectivity are other key factors expected to support revenue growth of the market.

Middle East & Africa

Veterinary telemedicine has gradually been gaining traction in the Middle East & Africa, but the revenue share is comparatively smaller than that of other emerging markets such as Latin America. Potential for revenue growth, especially in urban areas with a growing pet-owning population, is expected to incline steadily over the forecast period. Technological advancements are opening doors to telemedicine services, and initiatives are being undertaken to improve access to pet healthcare in underserved regions.

Segmentation By Region

North America

- United States

- Canada

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Association of Southeast Asian Nations (ASEAN)

- Rest of Asia Pacific

Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Russia

- Poland

- BENELUX (Belgium, the Netherlands, Luxembourg)

- NORDIC (Norway, Sweden, Finland, Denmark)

- Rest of Europe

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Egypt

- Israel

- Rest of MEA (Middle East & Africa)

Competitive Landscape

The competitive landscape in the global veterinary telemedicine market is rapidly evolving as the demand for remote pet healthcare services continues to rise. Revenue potential in the veterinary telemedicine market expected to increase substantially over the forecast period. A number of leading players in medicine and veterinary services have diversified, each offering unique and technologically-based and advanced solutions and are also focusing on various related aspects that are creating opportunities in the market.

For instance, Petriage is a leading player in the teletriage segment of the market. The company specializes in AI-driven symptom assessment tools that help pet owners understand when health issues are probably arising and also to determine the urgency or need for treatment for the pet. Petriage connects pet owners with veterinarians for remote consultations based on these assessments, making it easier for pet owners to access timely care.

Another strategy is companies are offering comprehensive solutions to ease the trend of veterinary telemedicine into more lucrative markets. For example, VetNOW is known for its teleconsultation and telemedicine platform designed for veterinary practices and animal hospitals. The company provides a comprehensive solution that includes hardware and software, and is designed to enable veterinary clinics to offer remote consultations.

Veterinary telemedicine platforms are also deploying platforms to connect pet owners with licensed veterinarians through intuitive apps with easy-to-use interface for pet owners and veterinarians, offering subscription-based models to enable continuous access to veterinary expertise, proactively manage pet health, and leverage the convenience of remote consultations and support.

Company List

- Petriage

- VetNOW

- TeleVet

- Fuzzy Pet Health

- Vetster

- IDEXX Laboratories

- PawSquad

- Anipanion

- Vetspire

- OneVet

- Petzam

- PetPro Connect

- PetalMD

- AirVet

- VetConsult

- PetCure Oncology

- VetnCare

- TeleVets

- MyTeleVet

- VetHelpDirect

- Doxy.me

- Medici

- VSee

- Hippo Manager

- Virtual Veterinary Specialists

Recent Developments

- In early May 2023, PetHub, Inc. announced the launch its Wellness Tools powered by VetInsight. Using this solution, subscribers can access a suite of innovative features, including round-the-clock veterinary telehealth services, a comprehensive AI symptom checker, and a virtual food and treat finder that provides custom recommendations for pets.

- In November 2022, Dutch, which is a virtual veterinary care provider announced that it was partnering with Synchrony, which is a consumer financial services company, in order to offer Pets Best insurance to its annual veterinary care members. The objective is to bridge the gap in pet insurance in the US, in which it is known that despite over 90 million families owning a pet, a mere 3% of pets are insured across the country. Availability of viable options and the addition of Accident Only also ensures affordable, virtual care solutions for both emergencies and everyday care.

- In mid-June 2022, PetMed Express, Inc. is a US-based online pet pharmacy and Vetster is a veterinary telehealth and pet care marketplace, and these two companies collaborated in order to expand pet and owner access to telehealth. This collaboration is expected to expand telemedicine access to 70,000 veterinarians and over 2 million pet parents. As part of the agreement, PetMeds is the exclusive e-commerce provider of pet medications for Vetster, and the latter company is the exclusive provider of telehealth and telemedicine services to customers of the former.

Report Scope

Report Features Description Market Value (2022) USD 120.0 Mn Forecast Revenue (2032) USD 627.9 Mn CAGR (2023-2032) 18.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Tele-Diagnosis, Tele-Consultation, Tele-Monitoring, Tele-Surgery Support, Telepathology), Technology (Video Conferencing, Mobile Apps, Web-Based Platforms, Wearable Devices, Artificial Intelligence (AI) Solutions), Animal Type (Companion Animals, Livestock, Exotic Pets, Equine, Aquatic Animals), End-User (Veterinary Clinics, Pet Owners, Livestock Producers, Research Institutions, Animal Shelters and Rescues), Revenue Model (Subscription-Based, Pay-Per-Use, Licensing Fees, Sales of Telehealth Hardware, Value-Added Services) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Petriage, VetNOW, TeleVet, Fuzzy Pet Health, Vetster, IDEXX Laboratories, PawSquad, Anipanion, Vetspire, OneVet, Petzam, PetPro Connect, PetalMD, AirVet, VetConsult, PetCure Oncology, VetnCare, TeleVets, MyTeleVet, VetHelpDirect, Doxy.me, Medici, VSee, Hippo Manager, Virtual Veterinary Specialists Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Petriage

- VetNOW

- TeleVet

- Fuzzy Pet Health

- Vetster

- IDEXX Laboratories

- PawSquad

- Anipanion

- Vetspire

- OneVet

- Petzam

- PetPro Connect

- PetalMD

- AirVet

- VetConsult

- PetCure Oncology

- VetnCare

- TeleVets

- MyTeleVet

- VetHelpDirect

- Doxy.me

- Medici

- VSee

- Hippo Manager

- Virtual Veterinary Specialists