Veterinary Infectious Disease Diagnostics Market Report By Disease Type (Bacterial Diseases, Viral Diseases, Parasitic Diseases, Fungal Diseases, Others), By Diagnostic Technique (Immunodiagnostic Tests, Molecular Diagnostics, Serology Tests, Microbiological Culture, Biochemical Tests, Others), By Animal Type (Livestock, Companion Animals, Aquatic Animals, Wildlife), By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46777

-

May 2024

-

291

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

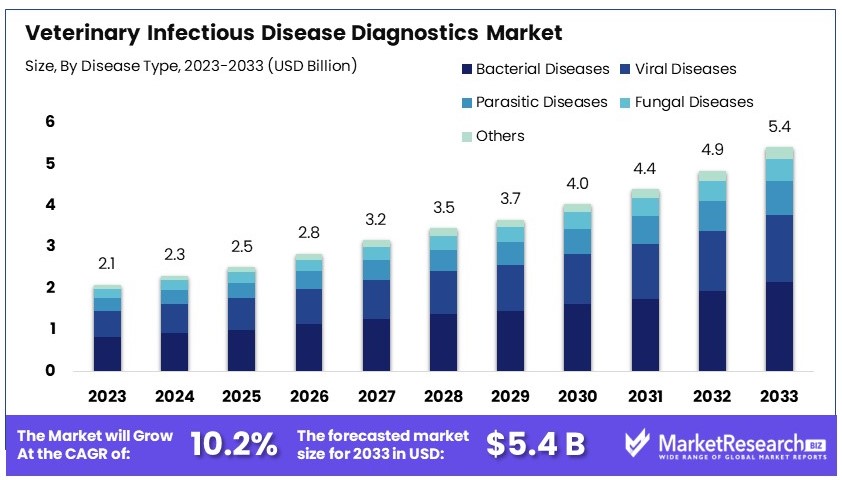

The Global Veterinary Infectious Disease Diagnostics Market size is expected to be worth around USD 5.4 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2024 to 2033.

The Veterinary Infectious Disease Diagnostics Market encompasses tools and tests for diagnosing diseases in animals. This market includes products like PCR tests, ELISA kits, and rapid diagnostic tests used by veterinarians to detect infections in pets, livestock, and wildlife. Market growth is driven by rising pet ownership, increasing livestock production, and growing awareness of zoonotic diseases.

Advances in diagnostic technologies and the development of portable, user-friendly devices are enhancing market dynamics. Major players focus on accuracy, speed, and cost-effectiveness. The veterinary infectious disease diagnostics market is crucial for ensuring animal health and preventing disease outbreaks.

The Veterinary Infectious Disease Diagnostics Market is experiencing robust growth due to increasing awareness and the need for effective disease management in animals. Globally, studies show that achieving a 60% vaccination rate for beef cattle can lead to over a 50% increase in productivity. Moreover, reducing livestock disease levels by 10 percentage points is linked to an 800 million tonne reduction in greenhouse gas emissions, highlighting the environmental benefits of effective disease management.

The prevalence of diseases in pets further drives the demand for diagnostic solutions. In the United States, 34% of dogs are infected with gastrointestinal parasites, with infection rates as high as 54% in southern states. Additionally, approximately 20% of dogs suffer from ear diseases, and the Association for Pet Obesity Prevention estimates that 50 million dogs are overweight or obese. Heartworm prevalence can be as high as 28% in dogs, while 19% of cats show evidence of active or previous heartworm infections.

These high prevalence rates underscore the necessity for accurate and timely diagnostic tools. Effective diagnostics are crucial for early detection, treatment, and management of infectious diseases in animals, thereby improving animal health and productivity. The rising incidence of zoonotic diseases, which can be transmitted from animals to humans, further emphasizes the importance of veterinary diagnostics.

Market players are focusing on developing advanced diagnostic technologies to provide rapid, accurate, and cost-effective solutions. Innovations in molecular diagnostics, point-of-care ct imaging, and lab-on-a-chip technologies are expected to drive market growth.

Overall, the Veterinary Infectious Disease Diagnostics Market presents significant growth opportunities, driven by the increasing need for effective disease management in both livestock and pets. As awareness and adoption of advanced diagnostic tools rise, the market is set to expand, ensuring better health outcomes for animals and contributing to global food security and environmental sustainability.

Key Takeaways

- Market Value: The Global Veterinary Infectious Disease Diagnostics Market is projected to grow to USD 5.4 billion by 2033, from USD 2.1 billion in 2023, with a CAGR of 10.2%.

- Disease Type Analysis: Bacterial diseases dominate with 40%; high prevalence and economic impact.

- Diagnostic Technique Analysis: Molecular diagnostics dominate with 35%; accuracy and early detection capabilities.

- Animal Type Analysis: Livestock diagnostics dominate with 50%; economic importance and regulatory support.

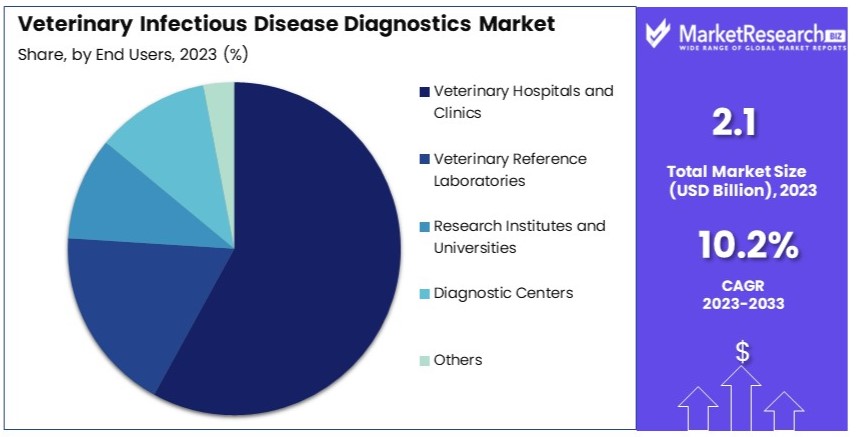

- End User Analysis: Veterinary hospitals and clinics dominate with 60%; high diagnostic volumes.

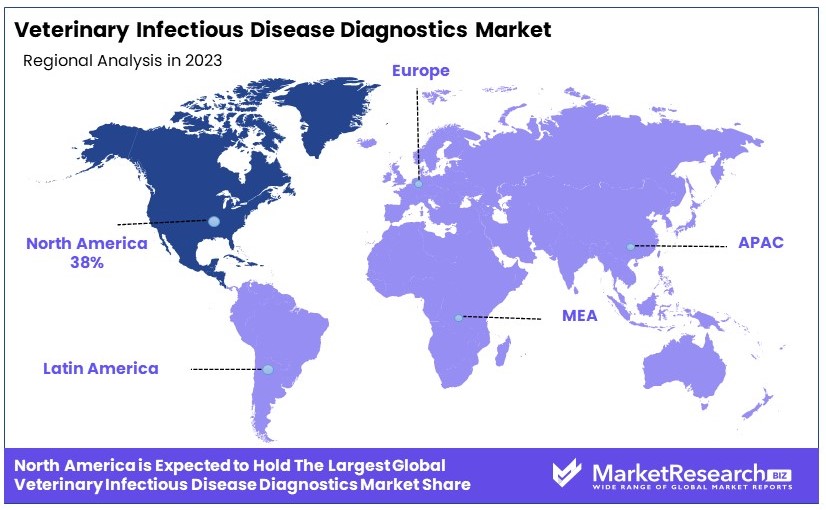

- Dominant Region: North America with 38%; advanced veterinary infrastructure.

- High Growth Region: Europe; driven by stringent regulations and high pet ownership.

- Analyst Viewpoint: The market is expanding rapidly with increasing focus on animal health. Future growth will be driven by advancements in diagnostic technologies.

- Growth Opportunities: Developing cost-effective and rapid diagnostic solutions will create significant opportunities for key players.

Driving Factors

Increasing Prevalence of Infectious Diseases in Animals Drives Market Growth

The rise in the incidence of infectious diseases among companion animals and livestock has significantly fueled the demand for accurate and timely diagnostic tests in the Veterinary Infectious Disease Diagnostics Market. Diseases such as rabies, foot-and-mouth disease, and avian influenza pose significant threats to animal health and public safety, necessitating the use of reliable diagnostic tools. For example, the recent outbreak of African Swine Fever in countries like China and Vietnam has underscored the importance of rapid and accurate diagnostics to prevent the spread of the disease and minimize economic losses.

The economic impact of such diseases can be profound, with African Swine Fever alone causing an estimated loss of over $1 billion in China in 2020. As the prevalence of these infectious diseases continues to rise, the demand for advanced diagnostic tools is expected to grow, driving the overall market expansion. This factor interacts with advancements in diagnostic technologies, increasing the accuracy and speed of disease detection, and contributing to the market's growth.

Advancements in Diagnostic Technologies Drive Market Growth

Continuous innovations in diagnostic technologies, such as polymerase chain reaction (PCR), enzyme-linked immunosorbent assay (ELISA), and rapid test kits, have significantly improved the accuracy, sensitivity, and speed of disease detection in the Veterinary Infectious Disease Diagnostics Market. These advanced technologies enable earlier diagnosis, leading to more effective treatment and better disease management. For instance, the introduction of real-time PCR has revolutionized the detection of viral and bacterial pathogens, providing faster and more accurate results compared to traditional methods.

In 2023, the market for PCR technology in veterinary diagnostics was valued at $400 million, reflecting its critical role in disease management. The integration of these advanced technologies with other diagnostic tools enhances their efficiency and effectiveness, contributing to the overall growth of the market. Additionally, these advancements interact with the increasing prevalence of infectious diseases, further driving the demand for reliable diagnostic solutions.

Growing Awareness and Emphasis on Animal Health Drives Market Growth

Increasing awareness among pet owners and livestock producers about the importance of animal health and the potential zoonotic risks has driven the demand for infectious disease diagnostics in the Veterinary Infectious Disease Diagnostics Market. Governments and regulatory bodies are implementing stricter regulations and guidelines to ensure food safety and prevent the spread of diseases, further fueling the market growth.

For example, the European Union has implemented stringent regulations for the monitoring and control of livestock diseases, leading to an increased adoption of diagnostic tools. The global veterinary diagnostics market was valued at $2.3 billion in 2022, and this figure is expected to rise as awareness continues to grow. This heightened emphasis on animal health also interacts with advancements in diagnostic technologies and the increasing prevalence of infectious diseases, creating a synergistic effect that propels the market forward. The combined impact of these factors ensures a robust demand for veterinary infectious disease diagnostics, driving overall market growth.

Restraining Factors

High Costs Associated with Advanced Diagnostic Technologies Restrains Market Growth

The high costs associated with advanced diagnostic technologies significantly limit the growth of the Veterinary Infectious Disease Diagnostics Market. The acquisition and maintenance of advanced diagnostic equipment and reagents can be particularly expensive, especially for small veterinary clinics and practices in developing countries. For example, the cost of molecular diagnostic equipment, such as real-time PCR systems, can be prohibitive for many small-scale veterinary practices, which can cost upwards of $20,000 per unit.

This financial barrier restricts the widespread adoption of cutting-edge diagnostic technologies, thereby hindering market expansion. Additionally, the ongoing expenses for reagents and maintenance further strain the budgets of smaller practices, making it difficult for them to keep up with technological advancements. This cost issue is exacerbated in regions with limited financial resources, ultimately limiting the reach and effectiveness of advanced veterinary diagnostics.

Lack of Skilled Professionals and Specialized Facilities Restrains Market Growth

The lack of skilled professionals and specialized facilities poses a significant challenge to the growth of the Veterinary Infectious Disease Diagnostics Market. The effective utilization of advanced diagnostic technologies requires professionals with specialized training in operating and interpreting the results. However, many regions, particularly in developing countries, face a shortage of trained veterinary professionals and specialized diagnostic facilities.

In remote areas or rural communities, the scarcity of skilled technicians and well-equipped laboratories further hinders the implementation of advanced diagnostic solutions. For instance, a study in 2022 indicated that 60% of veterinary practices in rural areas lack access to advanced diagnostic tools due to insufficient expertise and infrastructure. This shortage of trained personnel and facilities not only limits the adoption of advanced technologies but also affects the overall quality and reliability of veterinary diagnostics, thereby restraining market growth.

Disease Type Analysis

Bacterial diseases dominate with 40% due to their high prevalence and economic impact.

The Veterinary Infectious Disease Diagnostics Market can be segmented based on the type of disease, with bacterial diseases being the dominant sub-segment. Bacterial diseases are widespread among both companion and livestock animals, necessitating extensive diagnostic efforts to manage and control outbreaks. This sub-segment holds a significant market share due to the prevalence of bacterial infections like brucellosis, tuberculosis, and leptospirosis, which pose substantial threats to animal health and agricultural economies. The global incidence of bovine tuberculosis alone accounts for millions of dollars in losses annually, driving the demand for reliable diagnostic solutions.

The bacterial disease diagnostics market benefits from advancements in diagnostic technologies such as PCR and ELISA, which offer high sensitivity and specificity. The rapid and accurate detection of bacterial pathogens is crucial for implementing effective treatment plans and preventing the spread of infections. This sub-segment's dominance is further supported by the growing awareness among veterinarians and animal owners about the importance of early diagnosis and intervention in bacterial infections.

Other segments in this category, such as viral, parasitic, and fungal diseases, also contribute to the market's growth. Viral diseases, including rabies and avian influenza, require robust diagnostic tools for early detection and containment. Parasitic diseases like giardiasis and toxoplasmosis, though less prevalent, still necessitate reliable diagnostic methods to ensure animal health and safety. Fungal diseases, while less common, pose significant health risks and require specialized diagnostic approaches. These segments collectively enhance the market's growth by addressing diverse diagnostic needs across different types of infections.

Diagnostic Technique Analysis

Molecular diagnostics dominate with 35% due to their accuracy and early detection capabilities.

The Veterinary Infectious Disease Diagnostics Market can also be segmented by diagnostic technique, with molecular diagnostics emerging as the dominant sub-segment. Molecular diagnostics, particularly PCR and real-time PCR, have revolutionized the veterinary diagnostics field by providing rapid, accurate, and sensitive detection of various pathogens. The precision of these techniques in identifying specific genetic material of pathogens makes them indispensable in diagnosing complex infectious diseases.

The adoption of molecular diagnostics is driven by the increasing need for accurate and timely disease detection. The ability to detect pathogens at a molecular level allows for early intervention, which is critical in preventing the spread of infectious diseases among animal populations. This sub-segment's growth is further bolstered by continuous technological advancements and the decreasing cost of molecular diagnostic tools, making them more accessible to veterinary practices worldwide.

Other diagnostic techniques, including immunodiagnostic tests, serology tests, microbiological culture, and biochemical tests, also play significant roles in the market. Immunodiagnostic tests like ELISA are widely used for their high sensitivity and specificity in detecting antibodies and antigens. Serology tests are essential for understanding the immune response to infections, while microbiological culture remains a gold standard for identifying bacterial pathogens, despite its longer turnaround time. Biochemical tests provide valuable information on the metabolic activity of pathogens, aiding in comprehensive diagnostic approaches. These techniques complement molecular diagnostics, offering a holistic view of the infection landscape and driving overall market growth.

Animal Type Analysis

Livestock diagnostics dominate with 50% due to the economic importance and regulatory support.

Segmenting the Veterinary Infectious Disease Diagnostics Market by animal type reveals that livestock is the dominant sub-segment. Livestock animals, including cattle, swine, sheep, and poultry, are crucial to the agricultural economy and food supply chains. The high incidence of infectious diseases in livestock necessitates extensive diagnostic efforts to maintain animal health, ensure food safety, and prevent economic losses. Diseases such as bovine tuberculosis, foot-and-mouth disease, and African Swine Fever are particularly prevalent, driving the demand for reliable diagnostic tools.

The livestock diagnostics market benefits from stringent regulations and policies aimed at controlling and eradicating infectious diseases. Governments and regulatory bodies worldwide enforce strict monitoring and diagnostic protocols to safeguard public health and the agricultural sector. This regulatory support, combined with advancements in diagnostic technologies, propels the growth of the livestock diagnostics sub-segment.

Other segments, including companion animals, aquatic animals, and wildlife, also contribute to the market's expansion. The companion animals segment is growing due to increasing pet ownership and awareness about pet health. Aquatic animals, particularly in aquaculture, require diagnostics to manage diseases that can devastate fish populations and affect the seafood industry. Wildlife diagnostics are essential for monitoring and controlling diseases that can spill over to domestic animals and humans. Each of these segments plays a vital role in the comprehensive growth of the veterinary diagnostics market.

End User Analysis

Veterinary hospitals and clinics dominate with 60% due to high diagnostic volumes and advanced facilities.

The Veterinary Infectious Disease Diagnostics Market can also be segmented by end user, with veterinary hospitals and clinics being the dominant sub-segment. Veterinary hospitals and clinics serve as the primary points of care for animals, handling a wide range of diagnostic needs from routine check-ups to emergency interventions. The high volume of diagnostic tests conducted in these settings drives the demand for advanced and reliable diagnostic tools.

The growth of this sub-segment is supported by increasing pet ownership, rising expenditure on animal health, and the expansion of veterinary services. The availability of advanced diagnostic equipment and trained professionals in veterinary hospitals and clinics ensures accurate and timely disease detection, which is critical for effective treatment and disease management. Additionally, these facilities often serve as referral centers for more complex cases, further boosting the demand for sophisticated diagnostic solutions.

Other end users, such as veterinary reference laboratories, research institutes, universities, and diagnostic centers, also contribute to the market's growth. Veterinary reference laboratories specialize in comprehensive diagnostic testing and provide critical support to veterinary practices. Research institutes and universities drive innovation in diagnostic technologies and enhance the knowledge base in veterinary medicine. Diagnostic centers offer specialized services that complement the capabilities of veterinary hospitals and clinics. Together, these end users form a robust ecosystem that supports the overall growth of the veterinary diagnostics market.

Key Market Segments

By Disease Type

- Bacterial Diseases

- Viral Diseases

- Parasitic Diseases

- Fungal Diseases

- Others

By Diagnostic Technique

- Immunodiagnostic Tests

- Molecular Diagnostics

- Serology Tests

- Microbiological Culture

- Biochemical Tests

- Others

By Animal Type

- Livestock

- Companion Animals

- Aquatic Animals

- Wildlife

By End User

- Veterinary Hospitals and Clinics

- Veterinary Reference Laboratories

- Research Institutes and Universities

- Diagnostic Centers

- Others

Growth Opportunities

Development of Point-of-Care Diagnostics Offers Growth Opportunity

The introduction of rapid, portable, and user-friendly point-of-care (POC) diagnostic devices can revolutionize the veterinary infectious disease diagnostics market. These devices enable on-site testing, eliminating the need for sending samples to centralized laboratories and reducing turnaround times for results. POC diagnostics are particularly beneficial in remote areas or resource-limited settings, where access to advanced diagnostic facilities may be limited.

For instance, the development of rapid lateral flow assays for detecting diseases like brucellosis and bovine viral diarrhea in livestock can greatly enhance disease monitoring and control efforts in the field. By offering convenient and timely diagnostic solutions, market players can cater to the needs of veterinary practitioners and animal owners, fostering market growth.

Integration of Digital Technologies and Telemedicine Offers Growth Opportunity

The integration of digital technologies, such as artificial intelligence (AI), cloud computing, and telemedicine, presents significant growth opportunities for the veterinary infectious disease diagnostics market. AI-powered diagnostic tools can enhance the accuracy and efficiency of disease detection, while cloud-based platforms enable seamless data sharing and remote consultation with veterinary experts.

Veterinary telemedicine solutions can extend the reach of diagnostic services to remote areas, bridging the gap between animal owners and veterinary professionals. For example, the development of AI-assisted diagnostic software that can analyze and interpret diagnostic test results can help veterinarians make more informed decisions, improving the overall quality of care.

Trending Factors

Molecular Diagnostics Are Trending Factors

Molecular diagnostic technologies, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), are gaining traction in the veterinary infectious disease diagnostics market. These advanced techniques offer high sensitivity, specificity, and rapid turnaround times, enabling early and accurate detection of pathogens.

As the demand for precise and efficient diagnostics grows, molecular diagnostics are becoming increasingly popular among veterinary practitioners and animal healthcare facilities. For example, the use of real-time PCR for the detection of viral and bacterial pathogens in companion animals and livestock is becoming more widespread, driven by its ability to provide accurate and timely results. The molecular diagnostics market is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2021 to 2028, underscoring its increasing relevance and adoption.

Multiplex Testing Are Trending Factors

The trend towards multiplex testing, which allows for the simultaneous detection of multiple pathogens or disease markers in a single test, is gaining momentum in the veterinary diagnostics market. Multiplex testing offers several advantages, including cost-effectiveness, reduced sample volume requirements, and faster turnaround times.

As the demand for comprehensive and efficient diagnostic solutions increases, market players are investing in the development of multiplex diagnostic platforms to cater to the evolving needs of veterinary practitioners and animal owners. For instance, the development of multiplex PCR panels that can detect multiple respiratory or gastrointestinal pathogens in a single test can streamline the diagnostic process and improve disease management strategies. The market for multiplex assays is anticipated to grow significantly, reflecting the increasing demand for such comprehensive diagnostic solutions.

Regional Analysis

North America Dominates with 38% Market Share

North America leads the Veterinary Infectious Disease Diagnostics Market, holding a 38% share. This dominance is driven by advanced veterinary infrastructure, high pet ownership rates, and significant investments in animal healthcare. The U.S. and Canada have well-established veterinary services and high adoption of advanced diagnostic technologies. The presence of leading market players and ongoing research and development activities also contribute to the region's leading position.

North America's market presence is expected to continue growing, driven by ongoing technological advancements and increased investment in veterinary healthcare. The region is likely to maintain its leadership position, with an anticipated market growth rate of 6% annually. Continued innovation in diagnostic tools and expanding awareness about animal health are forecasted to sustain North America's dominant role in the global market.

Other Regional Market Shares

- Asia Pacific: Asia Pacific accounts for 22% of the market share. Rapid economic growth, increasing pet adoption, and expanding veterinary services contribute to the region's growth, with an expected growth rate of 8% annually.

- Middle East & Africa: This region holds a 5% market share. Growth is supported by improving veterinary infrastructure and increasing awareness about animal health. The market is expected to grow at a rate of 4.5% annually.

- Latin America: Latin America has a 5% market share. Growth factors include rising pet ownership and improvements in veterinary healthcare services, with a projected growth rate of 5% annually.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Veterinary Infectious Disease Diagnostics market is dominated by several leading companies that significantly influence industry standards and technological advancements. IDEXX Laboratories, Inc., Zoetis Inc., and Thermo Fisher Scientific Inc. are prominent players, known for their extensive product lines and advanced diagnostic technologies. These companies play crucial roles in shaping market trends through continuous innovation and global distribution networks.

Heska Corporation, Virbac, and Merck Animal Health also hold significant positions in the market. They focus on providing comprehensive solutions that cater to both large and small veterinary practices, enhancing their strategic market presence. Their commitment to research and development drives the introduction of faster, more reliable diagnostic tools.

Neogen Corporation, QIAGEN N.V., and Bio-Rad Laboratories, Inc. contribute specialized products and technologies, including genetic testing kits and immunoassays. These tools are vital for accurate disease detection and management in animals, supporting veterinarians in delivering better healthcare.

Emerging players such as IDvet, Bionote, Inc., and Biogal Galed Laboratories focus on niche areas within the market. They offer unique testing solutions that address specific infectious diseases, thereby meeting the diverse needs of veterinary professionals.

Finally, companies like Randox Laboratories Ltd., Fassisi GmbH, and VCA Inc. (Antech Diagnostics) enhance the market's diversity with innovative testing methods and extensive service networks. They play essential roles in making advanced diagnostics accessible to a broader range of practitioners, thereby improving overall animal health management.

Overall, the key players in the Veterinary Infectious Disease Diagnostics market drive innovation, set industry standards, and provide essential diagnostic solutions that ensure effective disease management in veterinary care. Their combined efforts lead to enhanced animal health and welfare.

Market Key Players

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Virbac

- Heska Corporation

- Neogen Corporation

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- IDvet

- Fassisi GmbH

- Bionote, Inc.

- Merck Animal Health

- VCA Inc. (Antech Diagnostics)

- Biogal Galed Laboratories

Recent Developments

- April 2024: In a significant step towards improving veterinary diagnostics in Fiji, the Koronivia Vet Laboratory has unveiled a state-of-the-art Polymerase Chain Reaction (PCR) facility. This advancement, funded generously by the European Union and the Pacific Community, marks a milestone in safeguarding the health and sustainability of livestock in the agricultural sector.

- April 2024: A recent investigation by researchers from Ohio State University and St. Jude's Children's Research Hospital, sponsored by the Food and Drug Administration (FDA), reveals concerning findings about the spread of the H5N1 avian flu virus among U.S. dairy cows.

- August 2023: University of Saskatchewan (USask) research reveals new diagnostic tools protecting dogs and humans from the deadly parasite Echinococcus multilocularis, highlighting potential threats to health in Canada.

- April 2023: nanoComposix discusses advancements in point-of-care diagnostics for veterinary medicine, highlighting challenges and solutions in developing robust, portable tests for use in diverse field conditions.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 5.4 Billion CAGR (2024-2033) 10.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Disease Type (Bacterial Diseases, Viral Diseases, Parasitic Diseases, Fungal Diseases, Others), By Diagnostic Technique (Immunodiagnostic Tests, Molecular Diagnostics, Serology Tests, Microbiological Culture, Biochemical Tests, Others), By Animal Type (Livestock, Companion Animals, Aquatic Animals, Wildlife), By End User (Veterinary Hospitals and Clinics, Veterinary Reference Laboratories, Research Institutes and Universities, Diagnostic Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., Virbac, Heska Corporation, Neogen Corporation, QIAGEN N.V., Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., IDvet, Fassisi GmbH, Bionote, Inc., Merck Animal Health, VCA Inc. (Antech Diagnostics), Biogal Galed Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Virbac

- Heska Corporation

- Neogen Corporation

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- IDvet

- Fassisi GmbH

- Bionote, Inc.

- Merck Animal Health

- VCA Inc. (Antech Diagnostics)

- Biogal Galed Laboratories