Veterinary Artificial Insemination Market By Animal Type (Cattle, Swine, Sheep, Canine, Others), By Product (Normal Semen, Sexed Semen), By end-use (Veterinary Hospitals, Veterinary Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

15852

-

July 2024

-

190

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

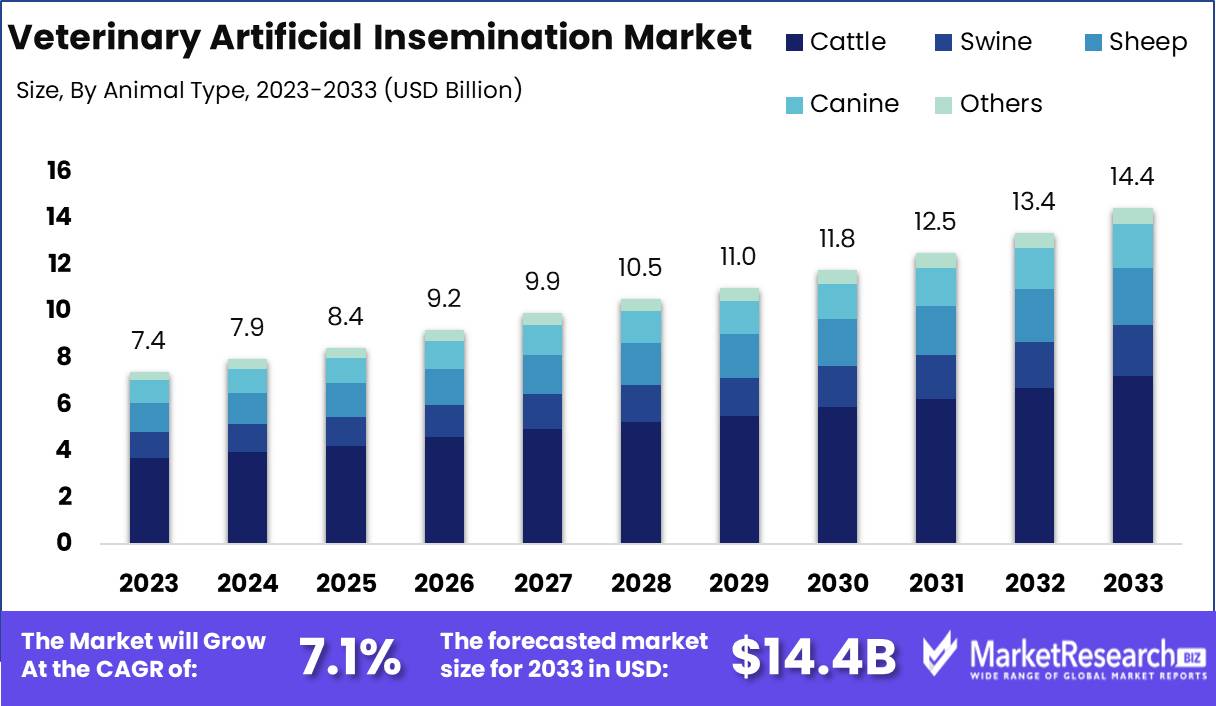

The Global Veterinary Artificial Insemination Market was valued at USD 7.4 Bn in 2023. It is expected to reach USD 14.4 Bn by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Veterinary Artificial Insemination (AI) Market encompasses the array of products, services, and technologies utilized in the artificial insemination of animals, particularly livestock. This market includes semen collection, preservation, and storage solutions, as well as insemination devices and procedures designed to enhance reproductive efficiency and genetic quality in animals. Veterinary AI is integral to improving herd genetics, boosting fertility rates, and optimizing breeding cycles, thus contributing to enhanced productivity and profitability in the animal husbandry industry.

The Veterinary Artificial Insemination Market is poised for significant growth driven by advancements in reproductive technologies and increasing demand for high-quality livestock. One of the critical innovations propelling this market is the use of flexible catheters in sheep AI, which has demonstrated an increase in conception rates by approximately 10-15% compared to rigid catheters, particularly in anatomically challenging cases. This technological enhancement not only improves reproductive outcomes but also underscores the importance of tailored AI solutions to address species-specific reproductive challenges.

Moreover, the ability to extend the viability of frozen semen beyond 10 years presents substantial opportunities for long-term genetic planning and preservation. This capability allows livestock producers to maintain genetic diversity and strategically plan breeding programs over extended periods, mitigating risks associated with genetic bottlenecks and ensuring the sustained improvement of herd quality. The integration of advanced semen preservation techniques into AI practices signifies a pivotal shift towards more sustainable and forward-looking livestock management.

As the market evolves, stakeholders must focus on continuous innovation and the adoption of best practices in AI procedures. This includes investing in research and development to enhance AI technologies and expand their applicability across different animal species. Additionally, educational initiatives aimed at training veterinary professionals in advanced AI techniques will be crucial in maximizing the benefits of these technologies. By leveraging these advancements, the Veterinary Artificial Insemination Market is set to play a pivotal role in the transformation of the animal husbandry sector, driving productivity, efficiency, and genetic excellence.

Key Takeaways

- Market Value: The Global Veterinary Artificial Insemination Market was valued at USD 7.4 Bn in 2023. It is expected to reach USD 14.4 Bn by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Animal Type: Cattle account for 50% of the market, predominantly used for dairy and beef production enhancements.

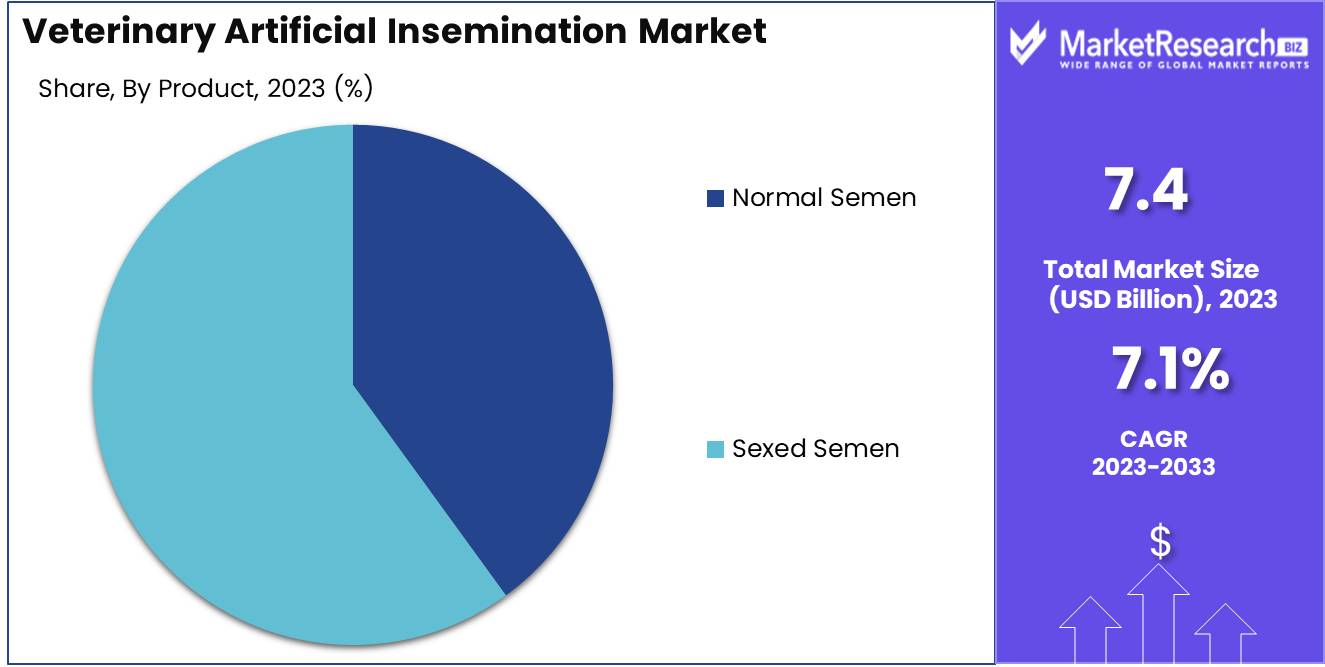

- By Product: Sexed Semen dominates with 60%, preferred for producing specific genders in livestock.

- By End-Use: Veterinary Hospitals are the major users, holding 45%, offering specialized reproductive services.

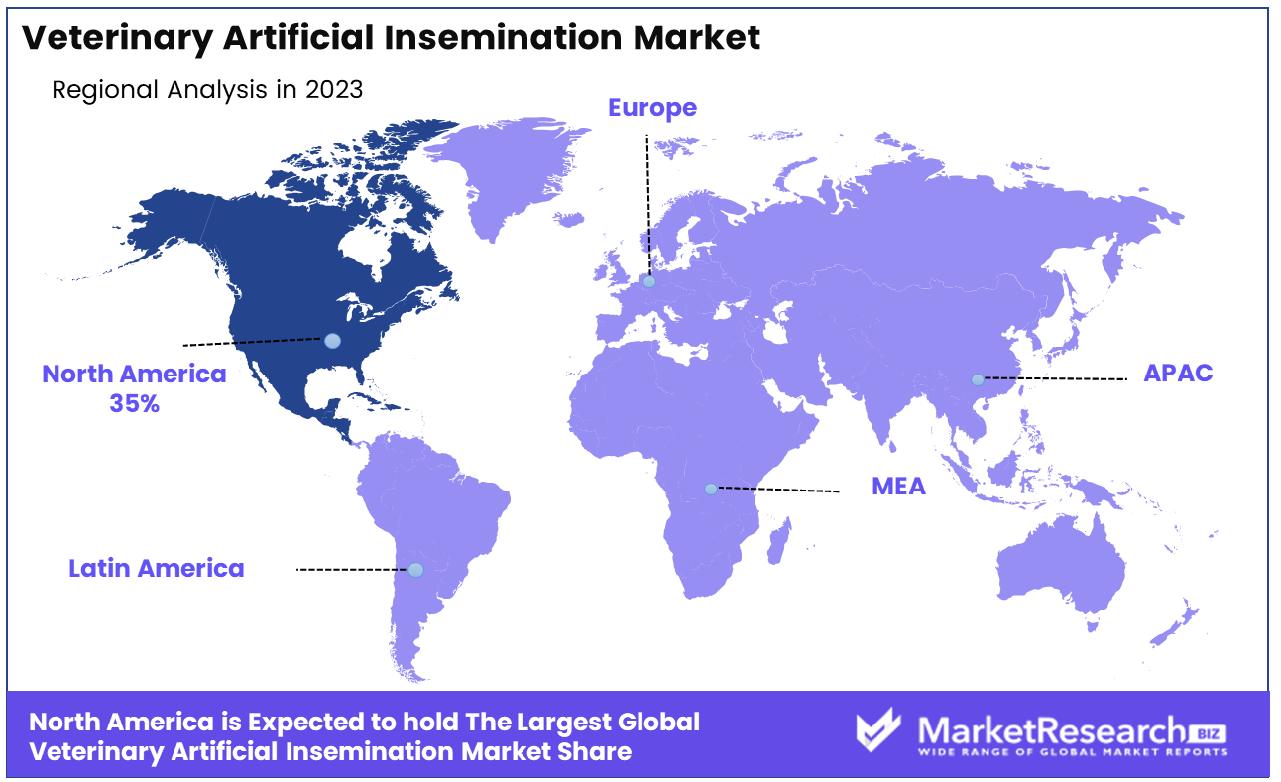

- Regional Dominance: North America has a 35% market share, supported by advanced agricultural practices and high demand for livestock products.

- Growth Opportunity: Developing new genetic evaluation techniques to improve success rates in cattle breeding offers a significant growth opportunity.

Driving factors

Increasing Demand for High-Quality Livestock

The surge in global demand for high-quality livestock is a primary driver for the Veterinary Artificial Insemination market. As consumers prioritize superior meat and dairy products, farmers are increasingly turning to AI to ensure the production of genetically superior animals. This demand is particularly strong in developed countries where livestock quality directly correlates with market prices and consumer preferences. Furthermore, AI allows for the selective breeding of livestock, enhancing desirable traits such as disease resistance, growth rates, and reproductive performance, thereby increasing overall herd productivity and profitability.

Advancements in Artificial Insemination Technology

Technological advancements in artificial insemination have significantly propelled market growth. Innovations such as automated semen collection, improved cryopreservation techniques, and enhanced sperm sorting methods have increased the efficiency and success rates of AI procedures. These advancements reduce the overall time and labor required, making AI more accessible and cost-effective for a broader range of livestock producers. Additionally, the development of portable AI equipment has enabled more widespread adoption, particularly in remote or rural areas, thereby expanding the market reach.

Growing Awareness of Animal Health and Breeding Practices

Increased awareness and education regarding animal health and optimal breeding practices are driving the adoption of veterinary AI. Farmers are becoming more knowledgeable about the benefits of AI in maintaining animal welfare, preventing diseases, and improving genetic quality. This heightened awareness is supported by veterinary associations and agricultural extension services, which promote AI as a best practice for sustainable livestock management. Consequently, the market for veterinary AI is experiencing robust growth as farmers seek to improve both the health and productivity of their herds.

Restraining Factors

High Costs Associated with Artificial Insemination

The high costs related to artificial insemination represent a significant barrier to market growth. These costs include specialized equipment, semen purchases, and veterinary services. For small-scale farmers, these expenses can be prohibitive, limiting their ability to adopt AI technologies. Additionally, the financial burden is exacerbated in developing regions where economic constraints are more pronounced, and agricultural funding is limited.

Limited Availability of Skilled Professionals

Another critical challenge facing the Veterinary Artificial Insemination Market is the limited availability of skilled professionals. The successful implementation of AI techniques requires specialized knowledge and training, which are not universally accessible. This scarcity of trained personnel restricts the widespread adoption of AI, particularly in rural or underdeveloped areas where veterinary services are already sparse. Efforts to address this gap through education and training programs are essential to overcoming this barrier.

By Animal Type Analysis

In 2023, Cattle held a dominant market position in the By Animal Type segment of the Veterinary Artificial Insemination Market, capturing more than a 50% share.

In 2023, Cattle held a dominant market position in the By Animal Type segment of the Veterinary Artificial Insemination Market, capturing more than a 50% share. This significant market share is driven by the extensive use of artificial insemination in cattle breeding to enhance genetic quality, improve milk production, and increase meat yield. The high adoption rates of advanced breeding techniques among cattle farmers, particularly in regions with intensive dairy and beef tallow production.

Swine also represent a substantial segment in the veterinary artificial insemination market, driven by the need to improve reproductive efficiency and genetic quality in pig farming. However, their market share is smaller compared to cattle due to the lower global volume of swine farming.

Sheep are another important animal type in this market, particularly in regions where sheep farming is prevalent. The use of artificial insemination in sheep helps enhance wool production and meat quality. Despite this, the market share for sheep is less than that for cattle due to the more niche nature of sheep farming.

Canine artificial insemination is primarily utilized in the breeding of high-value or purebred dogs, offering controlled breeding environments and genetic enhancements. However, its market share remains modest compared to livestock due to the smaller scale of the industry.

Others include various animal types such as goats and horses, where artificial insemination is applied to improve breeding outcomes. Their collective market share is relatively small due to the specialized and limited application in these animal categories.

By Product Analysis

In 2023, Sexed Semen held a dominant market position in the By Product segment of the Veterinary Artificial Insemination Market, capturing more than a 60% share.

In 2023, Sexed Semen held a dominant market position in the By Product segment of the Veterinary Artificial Insemination Market, capturing more than a 60% share. The dominance of sexed semen is attributed to its ability to predetermine the sex of the offspring, which is particularly valuable in dairy and beef cattle industries where female calves are preferred for milk production and male calves for meat extract production. This technology enhances herd management efficiency and economic returns, driving its widespread adoption.

Normal Semen also holds a significant market share, being widely used due to its cost-effectiveness and availability. While normal semen is essential for various breeding programs, its market share is smaller compared to sexed semen due to the added value and higher demand for sexed semen in livestock management.

By End-Use Analysis

In 2023, Veterinary Hospitals held a dominant market position in the By End-Use segment of the Veterinary Artificial Insemination Market, capturing more than a 45% share.

In 2023, Veterinary Hospitals held a dominant market position in the By End-Use segment of the Veterinary Artificial Insemination Market, capturing more than a 45% share. Veterinary hospitals are equipped with advanced facilities and experienced veterinary professionals, making them the preferred choice for artificial insemination procedures. They offer comprehensive reproductive services, including semen collection, storage, and insemination, ensuring high success rates in breeding programs. The increasing awareness and demand for professional veterinary services to improve livestock productivity and genetic quality further bolster the market position of veterinary hospitals.

Veterinary Clinics also play a crucial role in providing artificial insemination services, particularly in rural and semi-urban areas. They offer accessible and affordable breeding solutions to small and medium-scale farmers. However, their market share is smaller compared to veterinary hospitals due to limited resources and facilities.

Others include research institutions, breeding centers, and individual breeders who utilize artificial insemination for specific breeding programs. While important, their collective market share is relatively modest due to the specialized nature of their operations.

Key Market Segments

By Animal Type

- Cattle

- Swine

- Sheep

- Canine

- Others

By Product

- Normal Semen

- Sexed Semen

By end-use

- Veterinary Hospitals

- Veterinary Clinics

- Others

Growth Opportunity

Development of Cost-Effective and User-Friendly AI Techniques

One of the most promising opportunities for the Veterinary Artificial Insemination Market in 2024 lies in the development of cost-effective and user-friendly AI techniques. Innovations that reduce costs while maintaining or improving success rates will make AI more accessible to a broader range of livestock producers, including small-scale and emerging farmers. For example, simplified AI kits and training programs can empower farmers to perform AI independently, reducing reliance on veterinary professionals and cutting overall expenses. This democratization of AI technology is expected to drive significant market growth.

Expansion in Developing Regions

The expansion of the Veterinary Artificial Insemination Market into developing regions presents substantial growth potential. As these regions experience economic development and an increasing focus on agricultural productivity, the demand for advanced breeding techniques is expected to rise. Governments and international organizations are likely to support this growth through funding and initiatives aimed at improving food security and livestock quality. Consequently, the Veterinary Artificial Insemination Market is poised to benefit from increased investment and adoption in these emerging markets.

Latest Trends

Use of Sex-Sorted Semen for Desired Offspring Traits

A notable trend in the Veterinary Artificial Insemination Market is the use of sex-sorted semen to produce offspring with specific traits. This technology allows farmers to predetermine the sex of their livestock, aligning production with market demands. For instance, dairy farmers may prefer female calves for milk production, while beef producers might favor males for their growth characteristics. The ability to control the sex ratio of offspring enhances herd management efficiency and profitability, driving market adoption.

Integration of AI with Genetic Improvement Programs

The integration of AI with genetic improvement programs represents a significant trend in 2024. By combining AI with advanced genetic analysis, farmers can select for desirable traits with greater precision and predictability. This synergy enhances the effectiveness of breeding programs, leading to rapid genetic improvements across livestock populations. The incorporation of genomic data into AI practices not only improves breeding outcomes but also supports long-term herd health and productivity, contributing to sustainable livestock management practices.

Regional Analysis

North America leads the Veterinary Artificial Insemination Market with a 35% share.

In 2023, North America dominated the Veterinary Artificial Insemination Market, capturing 35% of the market share. This dominance is attributed to the advanced veterinary healthcare infrastructure, high adoption of advanced breeding technologies, and significant investments in animal husbandry in the United States and Canada. The region's strong focus on improving livestock productivity and the presence of key market players further bolster market growth. Additionally, government initiatives and funding to support the dairy and meat industries drive the demand for veterinary artificial insemination services.

Europe follows North America with significant market participation, driven by the high standards of animal husbandry and extensive adoption of artificial insemination techniques in countries like Germany, France, and the UK. Stringent regulations and a strong emphasis on animal welfare further enhance the adoption of these technologies.

Asia Pacific is experiencing rapid growth due to the increasing awareness of advanced breeding techniques and rising investments in the livestock sector in countries like China, India, and Japan. The growing demand for high-quality animal products and improvements in veterinary healthcare infrastructure support market expansion.

Middle East & Africa show promising potential, supported by increasing investments in livestock farming and growing awareness about advanced breeding techniques. However, the market share remains modest due to limited access to advanced veterinary services and economic constraints.

Latin America is emerging as a growing market, with Brazil and Argentina leading the demand for veterinary artificial insemination. The region benefits from the improving agricultural sector and increasing investments in livestock breeding.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

IMV Technologies leads with its comprehensive suite of AI products and solutions, focusing on innovation and technological advancement. Their commitment to research and development positions them as a crucial player in enhancing fertility rates and genetic diversity.

Neogen Corporation emphasizes biosecurity and genetic solutions, providing advanced diagnostic tools that complement their AI offerings. Their integration of biotechnology ensures high success rates and operational efficiency.

Bovine Elite, LLC specializes in bovine genetics and reproductive technologies, offering a range of semen and embryos from superior genetics. Their niche expertise in cattle genetics makes them pivotal in the AI market for bovines.

Agtech, Inc. focuses on delivering cost-effective and high-quality AI supplies and services, catering to both small-scale and large-scale livestock operations. Their extensive distribution network enhances their market penetration.

Zoetis Inc. leverages its extensive portfolio in animal health to provide AI solutions that improve livestock productivity. Their global reach and strong R&D capabilities make them a formidable competitor.

Merck Animal Health integrates advanced pharmaceuticals with AI technologies to enhance reproductive success rates. Their comprehensive approach to animal health supports their leadership in the AI market.

Jorgensen Laboratories and PBS Animal Health both offer a wide range of veterinary supplies, including AI equipment, emphasizing quality and accessibility for veterinary practitioners.

Revival Animal Health focuses on comprehensive health solutions, including AI products, aimed at enhancing overall animal welfare.

Swine Genetics provides specialized genetic materials and AI services for the swine industry, contributing to improved breeding programs and genetic traits.

Santa Cruz Biotechnology, Inc. offers innovative biotechnological solutions, including AI products, driving advancements in veterinary reproductive technologies.

Market Key Players

- IMV Technologies

- Neogen Corporation

- Bovine Elite, LLC

- Agtech, Inc.

- Zoetis Inc.

- Merck Animal Health

- Jorgensen Laboratories

- PBS Animal Health

- Revival Animal Health

- Swine Genetics

- Santa Cruz Biotechnology, Inc.

Recent Development

- In March 2024, ABS Global launched a new AI technology for livestock breeding, enhancing genetic accuracy and reproductive efficiency.

- In February 2024, Select Sires Inc. expanded its AI product line to include advanced fertility solutions, boosting livestock productivity and farmer profitability.

Report Scope

Report Features Description Market Value (2023) USD 7.4 Bn Forecast Revenue (2033) USD 14.4 Bn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Cattle, Swine, Sheep, Canine, Others), By Product (Normal Semen, Sexed Semen), By end-use (Veterinary Hospitals, Veterinary Clinics, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IMV Technologies, Neogen Corporation, Bovine Elite, LLC, Agtech, Inc., Zoetis Inc., Merck Animal Health, Jorgensen Laboratories, PBS Animal Health, Revival Animal Health, Swine Genetics, Santa Cruz Biotechnology, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IMV Technologies

- Neogen Corporation

- Bovine Elite, LLC

- Agtech, Inc.

- Zoetis Inc.

- Merck Animal Health

- Jorgensen Laboratories

- PBS Animal Health

- Revival Animal Health

- Swine Genetics

- Santa Cruz Biotechnology, Inc.