Ultra-Fast Fashion Market By Product Type (Topwear, Bottomwear, Outerwear, Dresses, Shoes, Bags & Accessories), By End-Use (Women, Men, Children), By Distribution Channel (Online Stores, Retail Stores, Omnichannel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

27764

-

Jul 2024

-

190

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

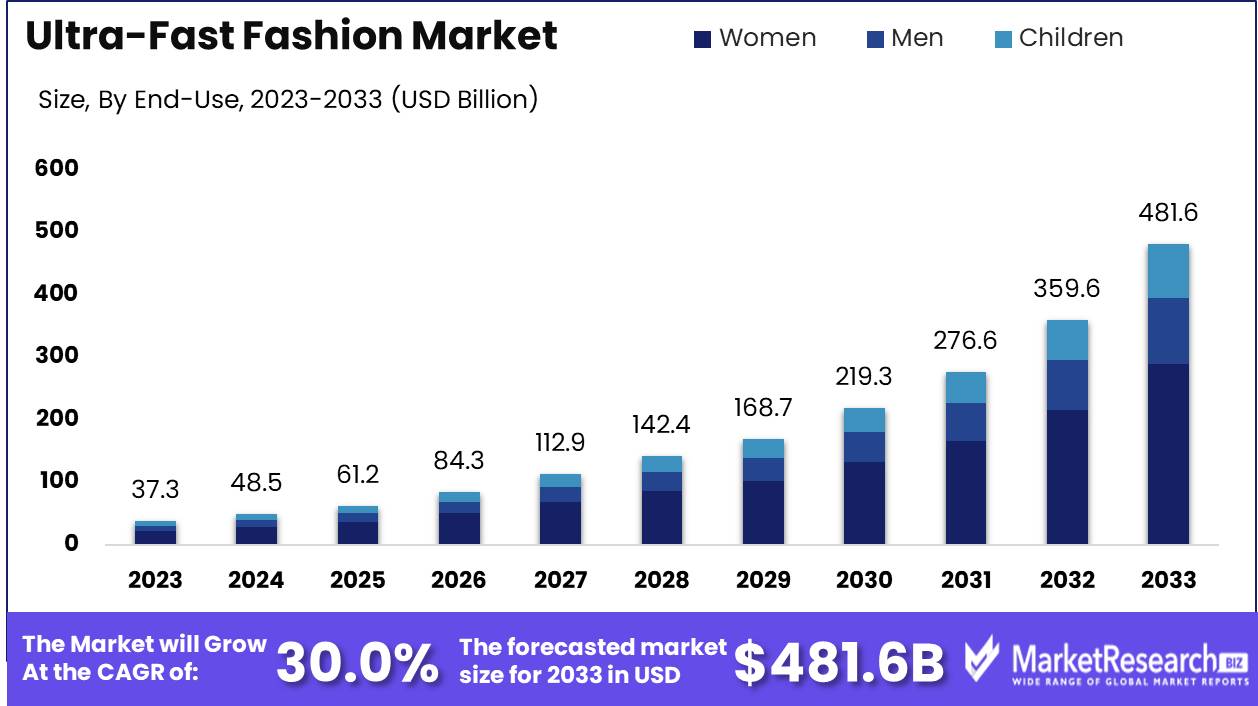

The Global Ultra-Fast Fashion Market was valued at USD 37.3 Bn in 2023. It is expected to reach USD 481.6 Bn by 2033, with a CAGR of 30% during the forecast period from 2024 to 2033.

The Ultra-Fast Fashion Market epitomizes the rapid production and distribution cycle of clothing, often taking weeks or even days from design to retail. This market leverages advanced supply chain technologies, data analytics, and consumer insights to meet the dynamic and immediate fashion preferences of consumers. Companies like SHEIN exemplify this trend by introducing thousands of new styles daily. While ultra-fast fashion captures current trends at an unprecedented speed, it also faces criticism for contributing to environmental degradation, evidenced by significant textile waste and overproduction issues, such as the massive clothing waste piles in Chile's Atacama Desert.

The Ultra-Fast Fashion Market represents a significant evolution in the apparel industry, driven by the need for speed and immediacy in meeting consumer demand. Companies such as SHEIN have perfected the art of ultra-fast fashion, releasing over 2,000 new styles daily, underscoring their agility in design, production, and distribution. This capability is underpinned by sophisticated supply chain management, real-time data analytics, and a deep understanding of consumer preferences, enabling them to stay ahead of rapidly changing fashion trends.The environmental implications of ultra-fast fashion are profound. Nearly 85% of textile are discarded annually, contributing to mounting landfill waste. The environmental footprint of this market is starkly illustrated by the satellite imagery of a massive pile of unused clothing in Chile's Atacama Desert, highlighting the severe issue of overproduction. This waste not only reflects inefficiencies in the production cycle but also poses significant environmental challenges, necessitating a reevaluation of sustainable practices within the industry.

The future of the Ultra-Fast Fashion Market hinges on balancing the demand for rapid trend turnover with sustainable practices. Companies must innovate to integrate eco-friendly materials, circular fashion principles, and waste reduction strategies into their operations. As regulatory pressures and consumer awareness about environmental impacts increase, the market will likely see a shift towards more sustainable business models. The challenge lies in maintaining the pace and affordability that define ultra-fast fashion while addressing its environmental and social implications. This dual focus on speed and sustainability will be critical for market leaders aiming to achieve long-term success in this dynamic industry.

Key Takeaways

- Market Value: The Global Ultra-Fast Fashion Market was valued at USD 37.3 Bn in 2023. It is expected to reach USD 481.6 Bn by 2033, with a CAGR of 30% during the forecast period from 2024 to 2033.

- By Product Type: Topwear constitutes 25% of the market, popular for its frequent style updates and trend responsiveness.

- By End-Use: Women are the predominant consumers, making up 60% of the market, driven by fast-changing fashion trends.

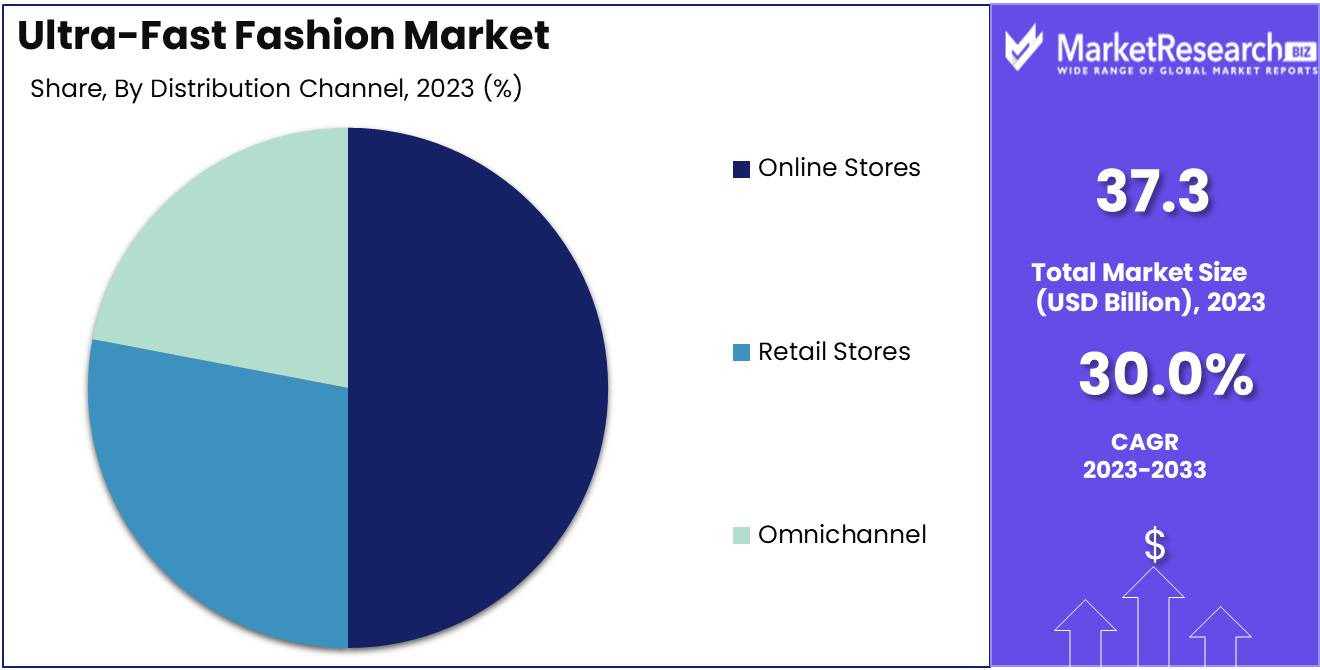

- By Distribution Channel: Online Stores lead with 50%, providing convenience and a wide range of options.

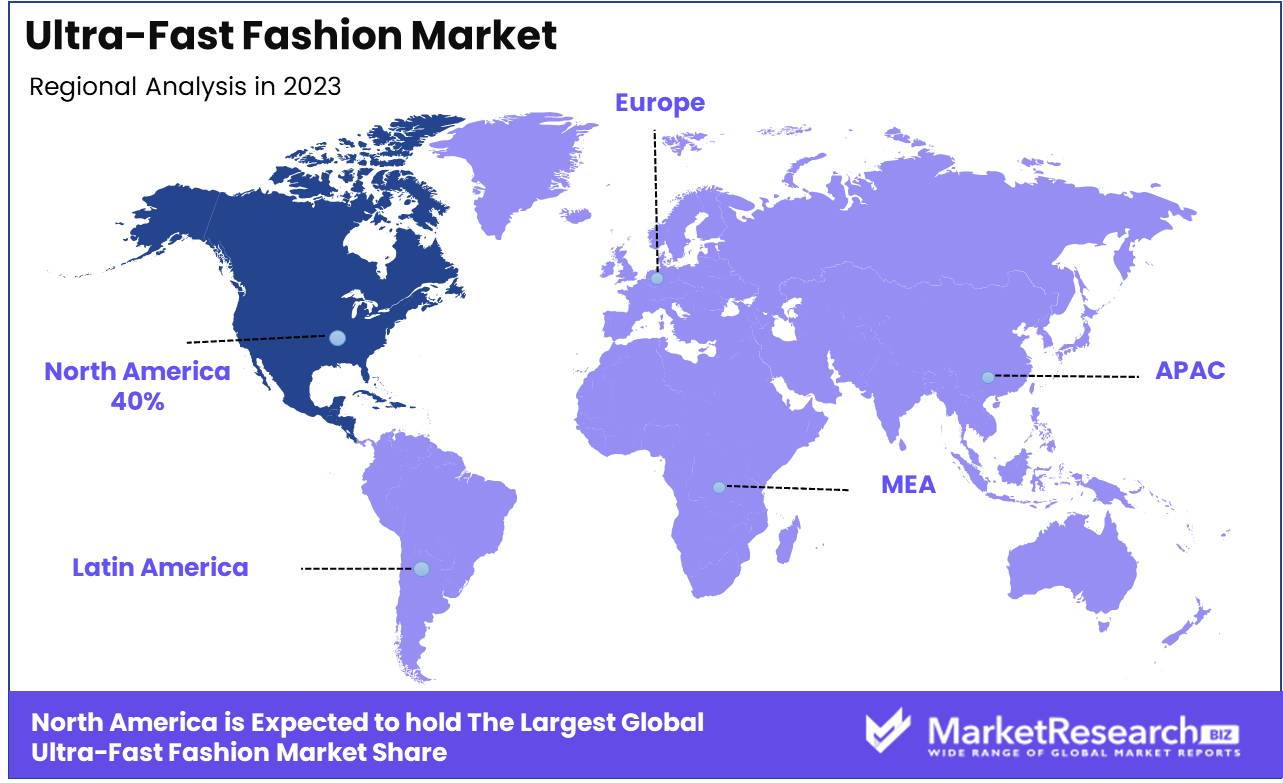

- Regional Dominance: North America holds a 40% market share, influenced by high consumer demand for the latest fashion at affordable prices.

- Growth Opportunity: Leveraging data analytics for real-time trend prediction and inventory management can enhance responsiveness to consumer preferences and boost market growth.

Driving factors

Increasing Consumer Demand for Trendy and Affordable Clothing

The growth of the ultra-fast fashion market is primarily driven by the escalating consumer demand for trendy and affordable clothing. Modern consumers, especially younger demographics, prioritize staying up-to-date with the latest fashion trends without incurring high costs. This shift in consumer behavior is fueled by a desire for frequent wardrobe updates and the availability of low-cost apparel options that mimic high-fashion designs.

Retailers in the ultra-fast fashion segment cater to this demand by offering an extensive variety of styles at competitive prices, thus ensuring high turnover rates and consistent market expansion.

Growth in Social Media Influence and Marketing

Social media platforms have become crucial drivers of the ultra-fast fashion market, significantly influencing consumer purchasing decisions. Platforms like Instagram, TikTok, and Snapchat serve as virtual runways where influencers and celebrities showcase the latest fashion trends. The real-time nature of social media allows ultra-fast fashion brands to quickly identify and respond to emerging trends, often within days.

Social media marketing, coupled with influencer endorsements, amplifies brand visibility and appeal. This dynamic creates a cycle where consumer demand and brand supply are in constant synchronization, fostering rapid market growth.

Rapid Production and Distribution Capabilities

The backbone of the ultra-fast fashion market's growth lies in its rapid production and distribution capabilities. Brands in this sector leverage advanced manufacturing technologies and efficient supply chain management software to drastically reduce the time from design to retail. This agility enables them to introduce new collections at an unprecedented pace, aligning with the fast-changing fashion trends driven by social media.

The ability to quickly restock popular items and introduce fresh designs keeps consumers engaged and continually coming back for new purchases, further boosting market growth.

Restraining Factors

Environmental and Ethical Concerns

A significant restraining factor for the ultra-fast fashion market is the growing awareness and concern about environmental and ethical issues associated with this segment. Ultra-fast fashion is often criticized for contributing to significant environmental degradation due to its rapid production cycles, which lead to excessive waste and pollution. The labor practices in this industry are frequently scrutinized, with reports of poor working conditions and unfair wages in factories.

These concerns are increasingly resonating with consumers who prioritize sustainability and ethical production, leading to potential shifts in purchasing behavior towards more responsible fashion choices. As awareness continues to grow, the ultra-fast fashion market may face heightened pressure to adopt more sustainable and ethical practices, which could impact profit margins and production processes.

High Competition from Established Fashion Brands

The ultra-fast fashion market also faces intense competition from established fashion brands. Traditional fashion houses and well-known retail brands are not only adapting to faster production cycles but also leveraging their brand loyalty, quality, and sustainable practices to retain their customer base. These established brands have robust marketing strategies, extensive distribution networks, and the financial resources to compete effectively.

As they continue to innovate and incorporate elements of fast fashion into their offerings, they pose a significant challenge to ultra-fast fashion brands. This high level of competition can limit market share and slow down the growth trajectory of ultra-fast fashion companies.

By Product Type Analysis

Topwear held a dominant market position in the By Product Type segment of the Ultra-Fast Fashion Market, capturing more than a 25% share.

In 2023, Topwear held a dominant market position in the By Product Type segment of the Ultra-Fast Fashion Market, capturing more than a 25% share. This dominance is driven by the high demand for trendy tops, t-shirts, blouses, and shirts that form the staple of many wardrobes. Consumers frequently update their topwear collections to stay current with fast-changing fashion trends, making it a high-turnover category. The ability to produce and market new designs quickly is a key factor in the success of topwear in the ultra-fast fashion segment, appealing to fashion-conscious consumers seeking the latest styles at affordable prices.

Bottomwear, including premium denim jeans, trousers, and skirts, also represents a significant portion of the market. However, its share is smaller compared to topwear due to lower purchase frequency and higher price points.

Outerwear such as jackets, coats, and blazers cater to seasonal demand and specific fashion trends. While important, its market share remains modest due to its seasonal nature and higher cost.

Dresses are a popular category in ultra-fast fashion, particularly for special occasions and events. Despite their popularity, the market share for dresses is less dominant compared to more versatile and frequently purchased topwear.

Shoes and Bags & Accessories play crucial roles in the overall fashion ensemble. These categories are essential for completing outfits but have smaller market shares due to their higher prices and less frequent purchasing cycles compared to clothing items like topwear.

By End-Use Analysis

Women held a dominant market position in the By End-Use segment of the Ultra-Fast Fashion Market, capturing more than a 60% share.

In 2023, Women held a dominant market position in the By End-Use segment of the Ultra-Fast Fashion Market, capturing more than a 60% share. This significant market share is driven by the strong consumer base of women who prioritize fashion and frequently update their wardrobes with the latest trends. Women's fashion is characterized by a wide variety of styles and items, including dresses, tops, skirts, and accessories, which cater to different occasions and preferences. The ultra-fast fashion model, with its rapid production and quick turnaround of new styles, aligns well with the high demand for diverse and constantly updated women's fashion items.

Men represent an important segment, with increasing interest in fashion and personal style. The growth of men's fashion in the ultra-fast segment is notable but less dominant than women's due to traditionally lower frequency of purchase and less variety in product offerings.

Children form a growing market segment, driven by parents' demand for stylish and affordable clothing for their kids. While the market for children's ultra-fast fashion is expanding, its share remains smaller compared to adults due to the different purchasing dynamics and lower overall spending power.

By Distribution Channel Analysis

Online Stores held a dominant market position in the By Distribution Channel segment of the Ultra-Fast Fashion Market, capturing more than a 50% share.

In 2023, Online Stores held a dominant market position in the By Distribution Channel segment of the Ultra-Fast Fashion Market, capturing more than a 50% share. The rapid growth of e-commerce and the increasing preference for online shopping drive this dominance. Online stores offer a vast selection of products, convenient shopping experiences, and quick delivery options, which are particularly appealing to consumers seeking the latest fashion trends. The ability to leverage data analytics and social media marketing allows online retailers to tailor their offerings and reach a broader audience efficiently.

Retail Stores continue to play a significant role, providing consumers with the opportunity to try on clothes and make instant purchases. Despite their importance, their market share is smaller compared to online stores due to the growing shift towards digital shopping platforms and the convenience of online retail.

Omnichannel approaches, which integrate both online and offline shopping experiences, are gaining traction. Retailers adopting omnichannel strategies aim to provide seamless customer experiences across various touchpoints, enhancing customer satisfaction and loyalty. Although this segment is growing, its market share is still developing compared to the dominant online and traditional retail channels.

Key Market Segments

By Product Type

- Topwear

- Bottomwear

- Outerwear

- Dresses

- Shoes

- Bags & Accessories

By End-Use

- Women

- Men

- Children

By Distribution Channel

- Online Stores

- Retail Stores

- Omnichannel

Growth Opportunity

Adoption of Sustainable Practices and Materials

In 2024, the global ultra-fast fashion market is expected to see significant growth opportunities through the adoption of sustainable practices and materials. With increasing consumer awareness about environmental issues, brands that integrate eco-friendly materials and sustainable production processes into their business models can attract a broader customer base.

Innovations such as using recycled fabrics, implementing zero-waste manufacturing techniques, and promoting circular fashion practices can differentiate ultra-fast fashion brands in a competitive market. By addressing environmental and ethical concerns, companies can enhance their brand reputation and appeal to the growing segment of eco-conscious consumers, driving market growth.

Expansion of Digital and Direct-to-Consumer Sales Channels

The expansion of digital and direct-to-consumer (DTC) sales channels presents a substantial opportunity for the ultra-fast fashion market in 2024. The shift towards online shopping, accelerated by the COVID-19 pandemic, continues to reshape consumer purchasing behaviors. Ultra-fast fashion brands that invest in robust e-commerce platforms and leverage social media for direct sales can capitalize on this trend. Enhancing online presence through engaging content, influencer collaborations, and targeted digital marketing can drive traffic and sales.

DTC sales channels allow brands to gather valuable consumer data, enabling personalized marketing strategies and fostering customer loyalty. This direct engagement with consumers not only increases sales but also builds strong brand-consumer relationships, contributing to sustained market growth.

Latest Trends

Use of AI and Big Data for Trend Prediction and Inventory Management

In 2024, the global ultra-fast fashion market is expected to be significantly influenced by the use of artificial intelligence (AI) and big data analytics for trend prediction and inventory management. AI algorithms can analyze vast amounts of data from social media, fashion shows, and consumer preferences to forecast emerging trends with high accuracy. This enables ultra-fast fashion brands to swiftly adapt to changing fashion landscapes and meet consumer demands promptly.

Big data analytics enhance inventory management by predicting stock requirements and reducing overproduction and waste. Efficient inventory management not only cuts costs but also ensures that the right products are available at the right time, driving sales and customer satisfaction.

Integration of AR/VR for Virtual Try-Ons and Shopping Experiences

The integration of augmented reality (AR) and virtual reality (VR) technologies is set to revolutionize the shopping experience in the ultra-fast fashion market in 2024. AR and VR provide consumers with immersive and interactive ways to try on clothes virtually, enhancing the online shopping experience. Virtual try-ons allow customers to visualize how garments will look and fit without needing to visit physical stores, thus increasing convenience and reducing return rates.

This technology not only enhances customer engagement but also encourages more online purchases, which is crucial for brands looking to expand their digital footprint. As consumers seek more personalized and engaging shopping experiences, the adoption of AR and VR is likely to become a standard offering in the ultra-fast fashion industry.

Regional Analysis

In 2023, North America dominated the Ultra-Fast Fashion Market, capturing a significant market share.

In 2023, North America dominated the Ultra-Fast Fashion Market, capturing a significant market share of around 40%. This dominance is driven by the region's strong consumer demand for the latest fashion trends at affordable prices, a robust e-commerce infrastructure, and the presence of major ultra-fast fashion brands. The United States is the key contributor, with young consumers increasingly opting for trendy and inexpensive clothing that can be easily purchased online.

Europe holds a substantial share in the ultra-fast fashion market, driven by a fashion-conscious population and established fashion hubs like Paris, Milan, and London. The market features a blend of traditional retailers and new online-only brands, with sustainability concerns increasingly influencing consumer choices.

Asia Pacific is experiencing rapid growth in the ultra-fast fashion market, fueled by a large, young population and rising disposable incomes. Key markets like China, India, and South Korea benefit from increasing internet penetration, cultural trends, and strong manufacturing capabilities.

This region shows promising potential, supported by rising urbanization and a young demographic. Leading markets like the UAE and South Africa are adopting global fashion trends, though overall market share remains modest due to economic disparities and varying internet penetration levels.

Latin America is a growing market for ultra-fast fashion, led by Brazil and Mexico. The region benefits from a youthful population, increasing internet usage, and social media influence, although market share remains smaller compared to developed regions due to economic variability and lower spending power.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the ultra-fast fashion market is characterized by rapid production cycles, trend responsiveness, and aggressive digital marketing. Shein leads the market with its vast, data-driven supply chain and extensive product range, delivering new styles to consumers at an unprecedented pace. Their direct-to-consumer model and efficient logistics network enable them to dominate globally.

Boohoo Group plc and Missguided leverage strong online presences and influencer partnerships to maintain relevance among younger demographics. Their agility in design and manufacturing processes allows them to quickly capitalize on emerging trends.

ASOS balances fast fashion with a commitment to sustainability, increasingly integrating eco-friendly materials and ethical practices into its operations. Their vast product offerings and focus on customer experience solidify their position as a key player.

Fashion Nova thrives on celebrity endorsements and social media-driven marketing, creating a strong brand identity that resonates with a diverse consumer base. Their ability to rapidly produce and market trendy, affordable apparel ensures a loyal following.

Market Key Players

- Shein

- Boohoo Group plc

- Missguided

- ASOS

- Fashion Nova

- Others

Recent Development

- In February 2024, Shein launched a new collection designed using AI to predict fashion trends. This innovative approach aims to quickly respond to consumer preferences and increase sales.

- In April 2024, Boohoo Group plc acquired a popular fashion startup to expand its product range and market presence. This acquisition is expected to increase their market share by 20%.

Report Scope

Report Features Description Market Value (2023) USD 37.3 Bn Forecast Revenue (2033) USD 481.6 Bn CAGR (2024-2033) 30% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Topwear, Bottomwear, Outerwear, Dresses, Shoes, Bags & Accessories), By End-Use (Women, Men, Children), By Distribution Channel (Online Stores, Retail Stores, Omnichannel) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Shein, Boohoo Group plc, Missguided, ASOS, Fashion Nova, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Shein

- Boohoo Group plc

- Missguided

- ASOS

- Fashion Nova

- Other Key Players