Global Tuberculin Market Report By Type of Tuberculin (PPD (Purified Protein Derivative) Tuberculin, Standard PPD Tuberculin, Fractional PPD Tuberculin, Recombinant Tuberculin), By Strength (5 TU (Tuberculin Units), 10 TU, Others), By Application (Tuberculin Skin Test (TST), Intradermal, Intralesional, Interferon-Gamma Release Assay (IGRA)), By End User (Hospitals, Clinics, Diagnostic Laboratories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47569

-

June 2024

-

325

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

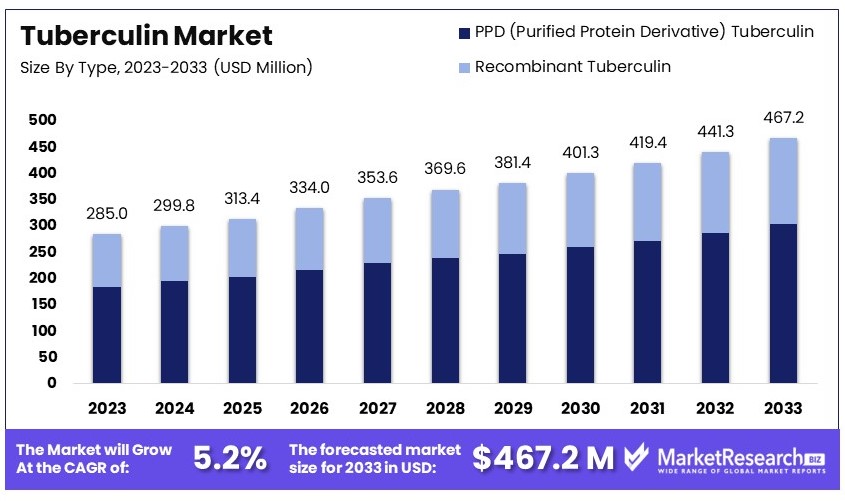

The Global Tuberculin Market size is expected to be worth around USD 467.2 Million by 2033, from USD 285 Million in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Tuberculin Market encompasses the production and distribution of tuberculin, a purified protein derivative used primarily in the diagnosis of tuberculosis (TB). This market serves healthcare providers worldwide, offering diagnostic tools essential for TB screening and monitoring.

With applications spanning from clinical settings to veterinary practices, the market caters to both human and animal health needs. Key players in this sector innovate to enhance diagnostic accuracy and adapt to evolving health standards. As such, the Tuberculin Market is integral for global TB control strategies, positioning itself as critical in public health and safety frameworks.

The Tuberculin Market is positioned at a critical juncture, influenced significantly by the escalating global burden of tuberculosis (TB). In 2022, TB emerged as the second leading cause of death from a single infectious agent, trailing only behind COVID-19, and caused almost twice as many deaths as HIV/AIDS. This alarming statistic underscores the vital role of the Tuberculin Market in public health initiatives, as it provides essential diagnostic tools required for effective TB management and containment.

Furthermore, the TB incidence rate, which measures new cases per 100,000 population annually, increased by 3.9% between 2020 and 2022. This rise reversed the declining trend observed over the past two decades and signals a pressing need for reinforced screening and diagnostic strategies, areas where the Tuberculin Market is uniquely poised to contribute.

India, representing a significant segment of this market, accounted for the highest number of TB cases globally in 2022—2.8 million cases, or 27% of the global total. The case fatality ratio in India stood at 12%, highlighting a substantial mortality rate that further amplifies the demand for effective diagnostic solutions like those provided by the Tuberculin Market.

Given these dynamics, the market's growth prospects appear robust. Key players in the industry are expected to focus on innovation and scaling up production to meet the increasing demand. Strategic expansions in high-burden regions, particularly in parts of Asia and Africa, are likely to be crucial. Additionally, advancements in diagnostic technologies that offer quicker and more accurate results could propel market growth and enhance global TB control efforts.

Key Takeaways

- Market Value: The Global Tuberculin Market was valued at USD 285 Million in 2023, and is expected to reach USD 467.2 Million by 2033, with a CAGR of 5.2%.

- Type of Tuberculin Analysis: Standard PPD Tuberculin leads with 65%, favored for its proven efficacy and widespread use in TB screening.

- Strength Analysis: 5 TU (Tuberculin Units) dominates with 70%, selected for its optimal balance of sensitivity and specificity.

- Application Analysis: Tuberculin Skin Test (TST) holds 80% of the market, essential for its role in global TB screening programs.

- End User Analysis: Hospitals are the primary market stakeholders, accounting for 60% due to their central role in TB diagnosis and treatment.

- Dominant Region: Asia Pacific dominates with a 45% market share, underscoring its large patient base and growing healthcare infrastructure.

- High Growth Region: North America, with approximately 25% of the market, is propelled by advanced healthcare systems and comprehensive TB screening protocols.

- Analyst Viewpoint: The market is moderately competitive with significant potential for growth. Innovations and enhancements in tuberculin types and applications are likely to stimulate further market expansion.

- Growth Opportunities: Key players can differentiate themselves by advancing tuberculin formulations, improving diagnostic specificity, and expanding into under-served regions.

Driving Factors

Increasing Prevalence of Tuberculosis (TB) Drives Market Growth

The escalating global incidence of tuberculosis (TB) is a primary catalyst for the expansion of the Tuberculin Market. According to the World Health Organization (WHO), TB impacts approximately 10 million individuals annually, with a disproportionate prevalence in developing nations. This high incidence rate directly influences the demand for tuberculin, which is essential for the Mantoux Tuberculin Skin Test (TST), a standard diagnostic tool for TB.

For instance, in India, which bears nearly a quarter of the global TB burden, the requirement for tuberculin has seen a consistent rise. As TB remains a significant health issue, the sustained need for effective screening and diagnosis ensures a growing market for tuberculin products, which are vital for early detection and management of the disease.

Global Immunization Programs Boost Market Growth

Global immunization initiatives, such as those led by the World Health Organization (WHO) and various national health bodies, play a significant role in fueling the demand for tuberculin. These programs focus on controlling and eventually eradicating TB through comprehensive screening and vaccination efforts.

The Tuberculin Skin Test (TST) is integral to these campaigns, as it determines previous exposure to TB, which is crucial for the effective administration of the Bacillus Calmette-Guérin (BCG) vaccine. This requirement for TSTs in immunization protocols ensures a steady demand for tuberculin, underpinning market growth. Enhanced public health strategies and increased funding for TB eradication initiatives globally will continue to drive this trend.

Increasing Awareness and Availability of Diagnostic Tests Stimulates Market Growth

The growing awareness of TB's health implications and the critical importance of early detection have significantly influenced the Tuberculin Market. Enhanced diagnostic approaches, such as the Tuberculin Skin Test (TST) and Interferon-Gamma Release Assays (IGRAs), have become more accessible and are increasingly utilized in public health strategies.

In regions like the United States, routine TB screening is advocated by the Centers for Disease Control and Prevention (CDC) for populations at high risk, bolstering the demand for tuberculin. This trend is complemented by educational campaigns and health initiatives that emphasize the necessity of early TB diagnosis, thus amplifying the use of diagnostic tests and, consequently, the consumption of tuberculin. The concerted efforts to elevate diagnostic standards and screening practices are pivotal in driving the market's growth trajectory.

Restraining Factors

Availability of Alternative Diagnostic Tests Restrains Market Growth

The introduction and increasing adoption of alternative TB diagnostic tests significantly restrain the growth of the Tuberculin Market. Tests such as the Interferon-Gamma Release Assays (IGRAs) and molecular diagnostics offer greater accuracy and the ability to distinguish between latent and active TB infections. These advantages make them preferable in settings that can afford more advanced technology, particularly in developed countries.

For instance, the QuantiFERON-TB Gold Plus (QFT-Plus) IGRA test is becoming more prevalent in countries with the resources to support it, reducing dependence on the traditional Tuberculin Skin Test (TST) and subsequently impacting the demand for tuberculin. As these advanced diagnostics become more accessible and favored for their precision, the reliance on tuberculin diminishes, curbing market growth.

Supply Chain Challenges Restrains Market Growth

The complex production and distribution network required for tuberculin poses significant challenges to market growth. Tuberculin production involves rigorous quality control and cold chain logistics to maintain the potency of the product from manufacture to delivery. Disruptions in this supply chain, whether from manufacturing delays or logistical issues, can result in significant tuberculin shortages.

For example, the United States experienced a notable shortage in 2019 due to manufacturing delays, disrupting routine TB screening activities. Such supply chain vulnerabilities can delay delivery, reduce product availability, and hinder the overall growth of the Tuberculin Market, as reliability is crucial for maintaining steady market demand.

Type of Tuberculin Analysis

Standard PPD Tuberculin dominates with 65% due to its established efficacy and widespread adoption in TB screening protocols.

The Type of Tuberculin segment is crucial in understanding the dynamics within the Tuberculin Market. Among the types, Standard PPD (Purified Protein Derivative) Tuberculin emerges as the dominant sub-segment. This sub-segment holds a significant share of the market, approximately 65%, primarily due to its long-standing use and trust in diagnosing Tuberculosis (TB). Standard PPD Tuberculin is the baseline compound used in the Mantoux test, the most common method for detecting TB infection. Its widespread acceptance in global TB control programs, underpinned by endorsements from health organizations like the WHO, underscores its market dominance.

In contrast, Fractional PPD Tuberculin, which involves using smaller doses for testing potentially sensitive populations, plays a complementary role. While less prevalent than its standard counterpart, it is crucial for reducing adverse reactions in certain demographic groups, such as children and HIV-positive individuals, thus supporting inclusive healthcare practices.

Recombinant Tuberculin, although a smaller segment, is gaining traction due to advances in biotechnology that allow for more consistent production quality and potentially enhanced sensitivity and specificity in TB testing. As research continues and awareness of its benefits grows, Recombinant Tuberculin could see increased adoption, particularly in markets driven by innovation.

Strength Analysis

5 TU (Tuberculin Units) leads with 70% market share, favored for its balance between sensitivity and specificity in diagnosing TB.

Within the Strength segment of the Tuberculin Market, the 5 TU (Tuberculin Units) strength is predominant, accounting for about 70% of the segment. This strength is particularly favored in clinical settings due to its effectiveness in balancing sensitivity and specificity, making it the standard dose for the Mantoux Tuberculin Skin Test across diverse populations. The 5 TU dose is sufficient to elicit an immune response in individuals infected with TB, without causing excessive reactions in those who are not infected, thus ensuring reliable test results.

The 10 TU strength, while useful in certain clinical scenarios, especially in populations with a lower likelihood of TB exposure, is less commonly used overall. It may be preferred in settings where background immunity due to BCG vaccination might depress reactivity to the standard 5 TU dose.

Other strengths, including variable dosages that might be used in research settings or in response to specific epidemiological needs, also contribute to the market. These are essential for ensuring that the Tuberculin tests can be adapted to meet the diverse needs of global populations and varying TB exposure levels.

Application Analysis

Tuberculin Skin Test (TST) dominates with 80% of the segment, crucial for its role in widespread TB screening initiatives.

The Application segment of the Tuberculin Market is overwhelmingly dominated by the Tuberculin Skin Test (TST), particularly the Intradermal application, which constitutes about 80% of this market segment. The Intradermal application of TST is the standard method for administering tuberculin to test for TB infection. Its dominance is attributed to its critical role in public health strategies for TB screening worldwide, supported by its cost-effectiveness and well-established protocol.

In contrast, the Intralesional application of TST is much less common and is used in specific clinical investigations or therapeutic settings. Although a minor part of the application segment, its utility in certain therapeutic diagnostics adds valuable flexibility to the overall use of tuberculin.

The Interferon-Gamma Release Assay (IGRA) represents a growing segment but is generally considered an alternative rather than a primary screening tool. Its use is particularly noted in scenarios where TST might not be suitable, such as in patients who have previously received BCG vaccinations or in those who require a single-visit test.

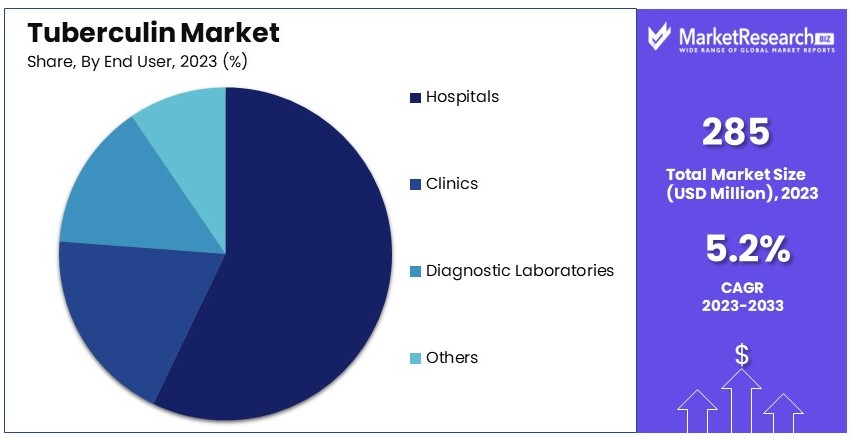

End User Analysis

Hospitals lead with 60% of the market, driven by their pivotal role in TB diagnosis and treatment.

The End User segment is critical for distributing tuberculin products, with hospitals holding the largest share, approximately 60%. Hospitals are primary centers for TB diagnosis and treatment, making them significant consumers of tuberculin. Their central role in handling acute cases and managing public health screenings ensures their dominance in the market.

Clinics and diagnostic laboratories also represent important sub-segments. Clinics often serve as the first point of contact for individuals seeking TB screening, especially in less severe cases or within community health programs. Diagnostic laboratories contribute to the detailed analysis and validation of TB tests, supporting the overall diagnosis and epidemiological tracking.

Other end users, including smaller medical facilities and research institutions, play supportive roles in the market. These entities often deal with specialized cases or conduct research studies, thereby influencing tuberculin use in niche applications and contributing to the overall market dynamics.

Key Market Segments

By Type of Tuberculin

- PPD (Purified Protein Derivative) Tuberculin

- Standard PPD Tuberculin

- Fractional PPD Tuberculin

- Recombinant Tuberculin

By Strength

- 5 TU (Tuberculin Units)

- 10 TU

- Others

By Application

- Tuberculin Skin Test (TST)

- Intradermal

- Intralesional

- Interferon-Gamma Release Assay (IGRA)

By End User

- Hospitals

- Clinics

- Diagnostic Laboratories

- Others

Growth Opportunities

Expanding Tuberculosis Control Programs in Developing Countries Offers Growth Opportunity

The expansion of tuberculosis vaccine treatment and control programs in developing countries presents a significant growth opportunity for the Tuberculin Market. Many of these countries bear a substantial burden of TB, necessitating robust screening and diagnostic efforts. The increasing allocation of international funds, such as those from the Global Fund to Fight AIDS, Tuberculosis, and Malaria, underscores a growing commitment to combating TB.

This financial support not only enhances the implementation of TB programs but also directly boosts the demand for tuberculin as a fundamental component of TB screening. As these programs expand, they offer a continual market for tuberculin products, supporting sustained growth in regions most affected by the disease.

Development of New Tuberculin Formulations and Delivery Methods Offers Growth Opportunity

Innovation in tuberculin formulations and the development of new delivery methods represent key growth opportunities within the Tuberculin Market. Researchers are making strides in creating more stable formulations, such as freeze-dried tuberculin, which can significantly improve the transportation, storage, and handling of these products.

Enhancements in delivery methods, including intradermal and potentially dry powder formulations, aim to simplify the administration process and improve the overall user experience. These advancements could lead to increased adoption of tuberculin-based diagnostics by healthcare providers, driven by the convenience and improved accuracy of these new formulations. As the market for tuberculin evolves, these innovations can attract a broader range of healthcare settings, contributing to market growth.

Trending Factors

Adoption of Point-of-Care Testing Are Trending Factors

The trend towards decentralized and point-of-care testing is a key driver for the Tuberculin Market. The adoption of portable and rapid diagnostic tests, including the traditional Tuberculin Skin Test (TST), is crucial for expanding access to TB screening, especially in remote and resource-limited areas. Innovations that facilitate mobile TB screening capabilities, such as equipping clinics and health workers with portable testing kits, enhance the reach of TB control programs.

This trend is particularly relevant in regions where healthcare infrastructure may be underdeveloped, yet the burden of TB is high. By enabling more widespread and accessible TB testing, the demand for tuberculin is expected to increase, reflecting its critical role in diagnosis and monitoring.

Focus on High-Risk Groups Are Trending Factors

There is a growing trend in targeting TB screening and prevention efforts towards high-risk groups, which is influencing the demand dynamics in the Tuberculin Market. High-risk populations, including healthcare workers, immunocompromised individuals, and specific ethnic or racial groups, require more frequent and routine TB screenings.

Many healthcare facilities have adopted mandatory TB screening protocols using both the TST and newer methods like IGRAs. By focusing on these key groups, the market for tuberculin is buoyed by consistent and specialized demand, ensuring ongoing relevance and utilization of tuberculin in TB prevention strategies. This targeted approach not only enhances the effectiveness of TB control efforts but also supports a steady market for tuberculin products.

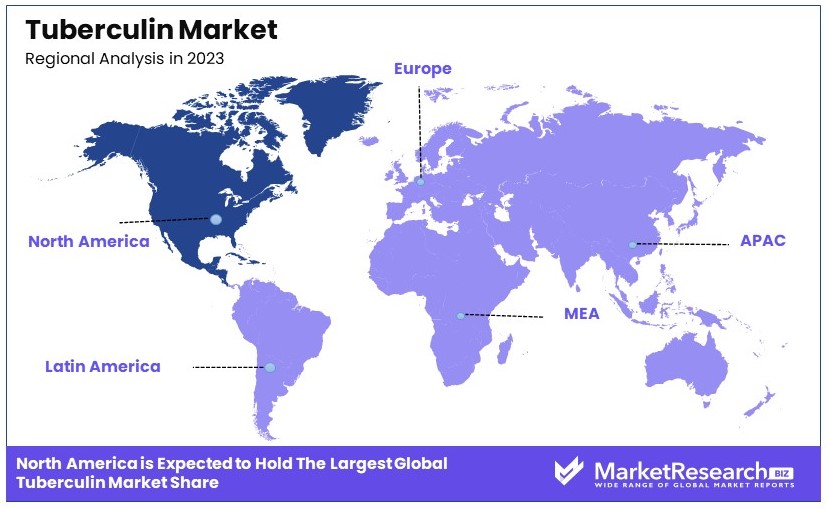

Regional Analysis

Asia Pacific Dominates with 45% Market Share

Asia Pacific's dominance in the Tuberculin Market is primarily driven by the high prevalence of tuberculosis in the region, especially in countries like India and China. These countries account for a significant portion of the global TB burden, necessitating extensive TB screening and control measures. Additionally, government initiatives and international aid to combat TB have bolstered the demand for tuberculin products in this region.

The regional dynamics in Asia Pacific are characterized by a combination of dense populations, high disease prevalence, and increasing healthcare infrastructure developments. These factors collectively enhance the consumption and necessity for reliable TB diagnostic tests. The wide-scale implementation of regular TB screening programs in schools, workplaces, and rural communities also propels the tuberculin market forward in this region.

Looking ahead, the Asia Pacific region is expected to continue its influential role in the global Tuberculin Market. Ongoing health initiatives and the rising healthcare standards, coupled with growing awareness about TB prevention, are likely to sustain and possibly increase the region's market share. Continued investment in healthcare infrastructure and diagnostic technologies also promises further growth potential.

Regional Market Shares:

- North America: Holds approximately 25% of the market share, driven by advanced healthcare systems and standardized TB screening protocols.

- Europe: Accounts for about 20% of the market share, supported by strong public health policies and government funding for TB control.

- Middle East & Africa: Has a smaller market share at around 5%, but is expected to grow due to increasing health awareness and governmental focus on infectious diseases.

- Latin America: Also holds a smaller share at 5%, with growth influenced by improvements in healthcare infrastructure and regional TB control programs.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Tuberculin Market, the landscape is shaped by a diverse array of key players, each contributing to the sector's dynamics through strategic positioning and innovation. Leading companies like Sanofi Pasteur and BD (Becton, Dickinson and Company) play pivotal roles, driving advancements and setting standards in TB screening technologies. Their extensive research capabilities and robust distribution networks enhance their market influence significantly.

Thermo Fisher Scientific Inc. and Bio-Rad Laboratories, Inc. are instrumental in integrating cutting-edge scientific methodologies into the production of Tuberculin, which improves diagnostic accuracy. Their focus on quality and precision in diagnostics reinforces their positions in the market.

Companies such as Zoetis, Inc. and Serum Institute of India Pvt. Ltd. highlight the geographical diversification in the market. Zoetis caters to veterinary needs, expanding the application of Tuberculin beyond human health, while Serum Institute of India leverages cost-effective production to enhance accessibility in emerging markets.

Emerging players like Coris BioConcept and Creative Diagnostics are vital for introducing novel approaches in Tuberculin testing, potentially reshaping market trends and expectations. Their innovative products are crucial for meeting the nuanced demands of modern healthcare landscapes.

Region-specific players such as Japan BCG Laboratory and Statens Serum Institut emphasize localized strategies that align with regional health policies and patient demographics, ensuring tailored solutions that address specific public health challenges.

Overall, the strategic positioning of these key players within the Tuberculin Market is characterized by a blend of innovation, regional penetration, and targeted approaches towards both human and veterinary health, significantly influencing the market’s trajectory and operational dynamics.

Market Key Players

- Sanofi Pasteur

- Zoetis, Inc.

- Thermo Fisher Scientific Inc.

- Par Sterile Products, LLC

- SSI Diagnostica

- Japan BCG Laboratory

- Statens Serum Institut

- Creative Diagnostics

- Span Diagnostics

- Coris BioConcept

- Serum Institute of India Pvt. Ltd.

- Bio-Rad Laboratories, Inc.

- ACON Laboratories, Inc.

- BD (Becton, Dickinson and Company)

- Thermo Fisher Scientific Inc.

- Other Key Players

Recent Developments

- 2023: Revvity has launched T-SPOT.TB for latent tuberculosis (TB) screening in India, utilizing ELISPOT technology for accurate results. This test is particularly effective in immunosuppressed populations and is recommended by the World Health Organization (WHO). It is currently available in over 50 countries.

- 2023: The Serum Institute of India and Mylab Discovery Solutions have introduced a cost-effective point-of-care skin test for latent TB infections. Designed for early detection and treatment, this test aims to make screening more accessible.

- Early detection is crucial for India's goal to eliminate TB by 2025. The National TB Elimination Program emphasizes early diagnosis and treatment of active TB and prevention of TB disease through the treatment of latent TB infections. By focusing on these areas, the program aims to reduce the incidence of TB and achieve the elimination target.

Report Scope

Report Features Description Market Value (2023) USD 285 Million Forecast Revenue (2033) USD 467.2 Million CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Tuberculin (PPD (Purified Protein Derivative) Tuberculin, Standard PPD Tuberculin, Fractional PPD Tuberculin, Recombinant Tuberculin), By Strength (5 TU (Tuberculin Units), 10 TU, Others), By Application (Tuberculin Skin Test (TST), Intradermal, Intralesional, Interferon-Gamma Release Assay (IGRA)), By End User (Hospitals, Clinics, Diagnostic Laboratories, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sanofi Pasteur, Zoetis, Inc., Thermo Fisher Scientific Inc., Par Sterile Products, LLC, SSI Diagnostica, Japan BCG Laboratory, Statens Serum Institut, Creative Diagnostics, Span Diagnostics, Coris BioConcept, Serum Institute of India Pvt. Ltd., Bio-Rad Laboratories, Inc., ACON Laboratories, Inc., BD (Becton, Dickinson and Company), Thermo Fisher Scientific Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Sanofi Pasteur

- Zoetis, Inc.

- Thermo Fisher Scientific Inc.

- Par Sterile Products, LLC

- SSI Diagnostica

- Japan BCG Laboratory

- Statens Serum Institut

- Creative Diagnostics

- Span Diagnostics

- Coris BioConcept

- Serum Institute of India Pvt. Ltd.

- Bio-Rad Laboratories, Inc.

- ACON Laboratories, Inc.

- BD (Becton, Dickinson and Company)

- Thermo Fisher Scientific Inc.

- Other Key Players