Truffle Oil Market Report By Truffle Type (Black Truffle Oil, White Truffle Oil, Summer Truffle Oil, Winter Truffle Oil, Others), By Production Method (Natural Truffle Extract Infusion, Synthetic Truffle Flavoring, Blend of Natural and Synthetic Flavors), By Nature (Organic, Conventional), By End User (Food & Beverages, Cosmetics & Personal Care Products, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46155

-

May 2024

-

321

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

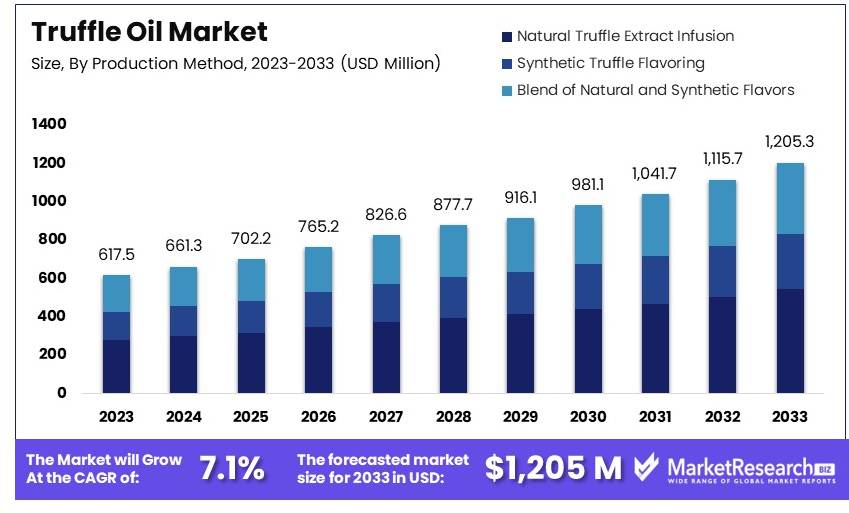

The Global Truffle Oil Market size is expected to be worth around USD 1,205 Million by 2033, from USD 617.5 Million in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

Truffle Oil Market refers to the sector encompassing the production, distribution, and consumption of truffle-infused oil products. Truffle oil, derived from the aromatic fungi known as truffles, is prized for its rich, earthy flavor and versatility in culinary applications. This market segment caters to discerning consumers seeking gourmet ingredients to enhance their culinary experiences.

Growth in the Truffle Oil Market is driven by increasing demand for premium food products, culinary innovation, and a growing appreciation for gourmet cuisine worldwide. Key players in this market include truffle oil producers, gourmet food manufacturers, retailers, and distributors. As consumers continue to seek unique and indulgent culinary experiences, the Truffle Oil Market presents lucrative opportunities for businesses to capitalize on this growing trend.

The Truffle Oil Market is growing steadily, fueled by consumer demand for gourmet foods. Truffle oil, with its unique aroma and flavor, is increasingly used in both home kitchens and restaurants. Key producers of truffle oil include Italy, France, Spain, Australia, and the United States. Italy is renowned for producing high-quality, expensive truffle oils from prized white truffles. It is also the largest exporter, with annual exports worth around $30 million. The European Union, as a whole, exports over $50 million worth of truffle oil each year.

The United States leads as the largest importer of truffle oil, importing over $20 million worth annually. Other significant importers include Canada, Japan, China, and EU countries outside the major production hubs. This robust trade activity underscores the global appreciation for truffle oil and its culinary value.

The market benefits from the growing trend of fine dining and the popularity of truffle oil in enhancing simple dishes. Health benefits, such as rich antioxidant content, further drive consumer interest. The widespread availability of truffle oil in supermarkets, specialty stores, and online platforms increases consumer access. Innovative marketing strategies also play a critical role in boosting visibility and sales.

Product diversification, including variations like white truffle oil, black truffle oil, and infused blends, caters to diverse consumer preferences and expands market reach. The premium pricing of truffle oil appeals to high-end consumers, reinforcing its status as a luxury item.

In conclusion, the Truffle Oil Market shows strong growth potential. Strategic marketing, product innovation, and expanded distribution channels are essential for companies to capitalize on this trend. Investing in these areas can help businesses secure a competitive edge in the thriving truffle oil market.

Key Takeaways

- Market Value: The Global Truffle Oil Market is expected to be worth around USD 1.1 Billion by 2033, from USD 617.5 Million in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

- Truffle Type Analysis: Black truffle oil dominates with 40% due to its rich flavor and versatile culinary use. This segment is favored for its intense aroma and is widely used in gourmet kitchens and upscale restaurants.

- Production Method Analysis: Natural truffle extract infusion dominates with 50% due to consumer preference for authentic taste and perceived health benefits. This method infuses oil with real truffle extracts, ensuring superior quality and flavor.

- Nature Analysis: Conventional truffle oil accounted for 70% of the market in 2023, reflecting its dominant position. This segment is valued for its affordability and wider availability compared to organic options.

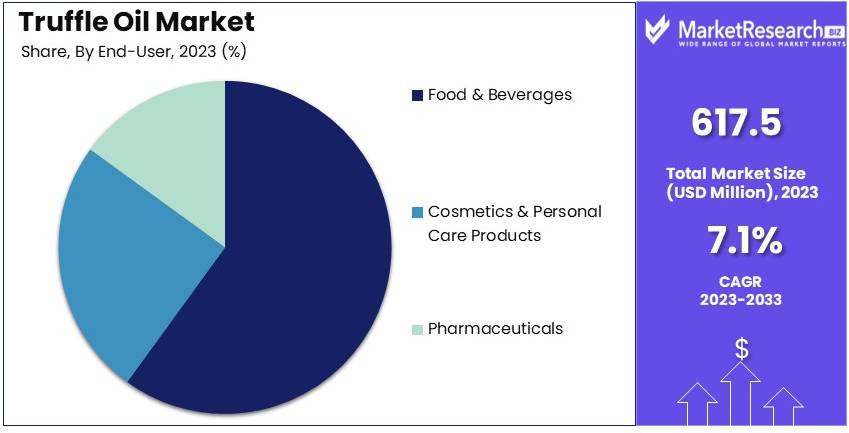

- End User Analysis: Food & beverages dominate with 60% due to extensive culinary applications and consumer demand for gourmet foods. Truffle oil is widely used to enhance the flavor of various dishes, from pasta to salads.

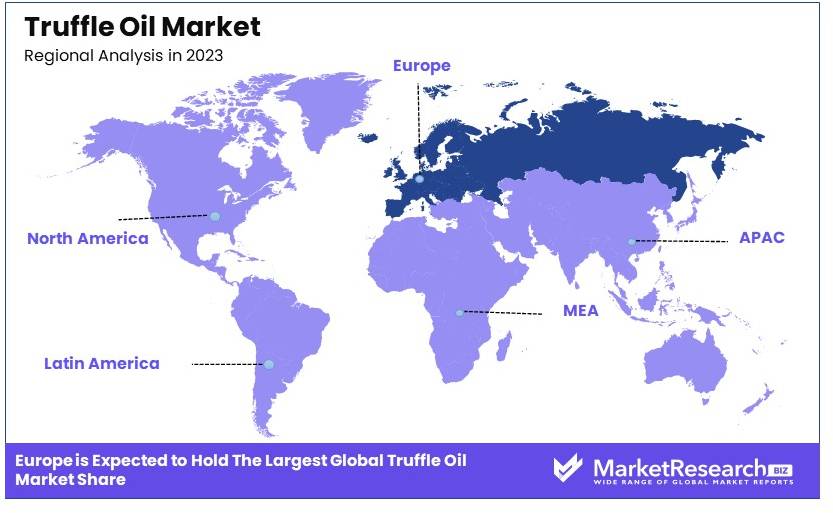

- Europe dominates with 58.6% market share, driven by its rich culinary tradition and high demand for gourmet ingredients, including truffle oil.

- North America holds approximately 22% market share, fueled by the growing popularity of gourmet cuisine and truffle-infused dishes in the region.

- Analyst Viewpoint: The truffle oil market shows robust growth driven by increasing consumer interest in gourmet cooking and luxury food products. The demand for natural and authentic truffle oil varieties is expected to continue rising.

- Growth Opportunities: Key players can capitalize on the expanding demand for gourmet and luxury food products by innovating with new truffle oil blends, expanding product lines, and catering to the growing preference for natural and organic ingredients.

Driving Factors

Growing Popularity of Gourmet and Specialty Foods Drives Market Growth

The rising interest in gourmet and specialty foods has significantly boosted the truffle oil market. Truffle oil, known for its distinct aroma and flavor, has become a favorite among food enthusiasts and chefs. This demand stems from consumers seeking premium culinary experiences, often found in high-end restaurants and upscale dining establishments. These establishments frequently use truffle oil to enhance flavors and create luxurious dining experiences.

For instance, many Michelin-starred restaurants incorporate truffle oil into their menus, which has elevated its status in the culinary world. The premiumization trend in the food industry is a major growth driver, as it aligns with consumers' increasing willingness to explore and pay for unique, high-quality ingredients. In addition, social media has amplified the visibility of gourmet cooking, making truffle oil a trendy ingredient. Food bloggers and influencers often showcase truffle oil in their recipes, further driving consumer interest and demand.

Increase in Disposable Incomes and Changing Lifestyle Trends Drives Market Growth

Rising disposable incomes and changing lifestyle trends are pivotal in the growth of the truffle oil market. As consumers' incomes increase, there is a noticeable shift towards a more indulgent lifestyle. This shift is especially pronounced among urban populations and millennials, who prioritize unique and premium culinary experiences. The willingness to spend on high-quality food products, such as truffle oil, has surged. Truffle oil, often perceived as a luxury item, fits perfectly into this trend of gourmet indulgence.

This increased spending power has led to a broader market for truffle oil beyond just high-end restaurants. Home cooks are now exploring gourmet ingredients, including truffle oil, to replicate restaurant-quality dishes at home. This trend is supported by the proliferation of cooking shows and online recipes that highlight the use of truffle oil. The increase in disposable incomes and evolving consumer preferences towards premium and exotic ingredients significantly drive the market's expansion, fostering a culture of culinary exploration and indulgence.

Expansion of the Foodservice Industry Drives Market Growth

The rapid growth of the foodservice industry has been a major driver for the truffle oil market. Restaurants, cafes, and catering services are continually seeking ways to differentiate themselves and offer unique, flavorful dishes. Truffle oil, with its distinctive taste and aroma, has become a popular ingredient to achieve this differentiation. As the foodservice industry expands, so does the demand for truffle oil as a finishing ingredient or flavor enhancer. This trend is evident in the increasing number of menu items featuring truffle oil across various dining establishments.

The global foodservice industry has been experiencing robust growth, contributing to the increased usage of specialty ingredients like truffle oil. For example, the foodservice market in the United States alone is expected to grow at a CAGR of 4.7% from 2023 to 2028. This growth is closely linked to the rising number of restaurants and cafes that incorporate truffle oil into their culinary offerings. The expansion of the foodservice industry not only boosts the demand for truffle oil but also enhances its visibility and desirability among consumers. This interplay between industry growth and ingredient demand underscores the synergistic effect driving the truffle oil market forward.

Health Benefits and Nutritional Properties Drive Market Growth

The awareness of health benefits and nutritional properties associated with truffle oil is contributing to its market growth. Although synthetic truffle oils do not offer the same health benefits as real truffles, natural truffle oils are rich in antioxidants, vitamins, and minerals. This has increased their popularity among health-conscious consumers. Truffles are known for their high content of essential nutrients, which are believed to support overall health and well-being. As consumers become more health-conscious, the demand for natural and nutritious ingredients has risen.

Health trends play a significant role in shaping food markets, and the truffle oil market is no exception. Consumers are increasingly seeking out ingredients that offer both flavor and health benefits. The market for natural truffle oil is expected to see a substantial rise as more consumers turn towards health-centric dietary choices. Recent studies have shown that natural truffle oil can contain beneficial compounds that support immune health and reduce inflammation. This awareness, coupled with the growing trend towards clean and natural eating, supports the robust growth of the truffle oil market. The integration of health benefits with culinary indulgence makes truffle oil a sought-after product in the market, catering to both gourmet enthusiasts and health-conscious consumers.

Restraining Factors

High Cost and Limited Availability Restrains Market Growth

Genuine truffle oil is derived from real truffles, which are rare and labor-intensive to harvest. This scarcity results in high costs, making truffle oil expensive. In price-sensitive markets or among consumers with limited disposable incomes, this high cost can limit adoption. The limited availability of truffles further exacerbates the issue, leading to supply constraints and price fluctuations.

For instance, the price of truffles can vary significantly based on seasonal availability, impacting the cost of truffle oil. This variability makes it difficult for producers to maintain consistent pricing and supply, which can deter potential buyers. In 2023, the average price of high-quality truffle oil was around $30 per 100ml, a price point that may not be affordable for many consumers. This high cost and limited availability restrict the market's potential growth, particularly in regions where premium pricing is a significant barrier.

Presence of Synthetic and Adulterated Products Restrains Market Growth

The truffle oil market faces significant challenges due to the presence of synthetic and adulterated products. These products are often marketed as genuine truffle oil but lack the authentic flavor and aroma of real truffles. This can undermine consumer trust, as buyers may feel deceived by the lower-quality alternatives. The prevalence of these synthetic options can lead to consumer dissatisfaction, harming the market's reputation.

According to a 2022 survey, nearly 70% of truffle oils available in the market were found to be synthetic or adulterated. This widespread presence of inauthentic products can stifle market growth by reducing consumer confidence and repeat purchases. Moreover, regulatory challenges in differentiating genuine products from fakes further complicate the issue, making it harder for authentic producers to establish a strong market presence. This lack of trust and quality assurance hampers the overall growth of the truffle oil market.

Truffle Type Analysis

In 2023, black truffle oil accounted for 40% of the market share, reflecting its strong position.

The truffle oil market is segmented by truffle type, including black truffle oil, white truffle oil, summer truffle oil, winter truffle oil, and others. Black truffle oil dominates with 40% due to its strong flavor and wide culinary use.

Black truffle oil is the most popular due to its rich, earthy flavor and versatility in cooking. Chefs and home cooks prefer black truffle oil for its ability to enhance various dishes, from pasta to salads. This dominance is driven by the high demand in gourmet kitchens and upscale restaurants. Black truffles, primarily sourced from Europe, are celebrated for their intense aroma and taste, making black truffle oil a sought-after ingredient. In 2023, black truffle oil accounted for 40% of the market share, reflecting its strong position. The high content of aromatic compounds in black truffle oil adds to its appeal, making it a favorite in high-end culinary applications.

White truffle oil is also significant, known for its distinct, garlicky aroma and flavor. While not as dominant as black truffle oil, white truffle oil is preferred in certain gourmet dishes and by chefs looking to add a unique twist. Summer and winter truffle oils, although less popular, have their niches. Summer truffle oil, with its milder taste, is often used in lighter dishes, while winter truffle oil is valued for its robust flavor, suited for hearty meals. The 'others' segment includes blends and lesser-known truffle varieties, catering to specific culinary needs and innovative recipes.

Production Method Analysis

Natural truffle extract infusion dominates with 50%

The production methods for truffle oil include natural truffle extract infusion, synthetic truffle flavoring, and a blend of natural and synthetic flavors. Natural truffle extract infusion dominates with 50% due to consumer preference for authentic taste and health benefits.

Natural truffle extract infusion is the leading production method, holding a significant market share. This method involves infusing oil with real truffle extracts, ensuring an authentic taste and aroma. Consumers increasingly prefer products made from natural ingredients due to their perceived health benefits and superior quality. This method's popularity is reflected in its market dominance, accounting for 50% of the total market in 2023. The growing trend towards clean-label and natural products has further bolstered this segment, as consumers seek transparency and authenticity in their food choices.

Synthetic truffle flavoring, while less popular, plays a crucial role in making truffle oil more accessible and affordable. These products cater to price-sensitive consumers and those looking for budget-friendly gourmet options. The blend of natural and synthetic flavors segment combines the best of both worlds, offering a balance between authenticity and affordability. This segment appeals to a broader audience, providing a mid-range option for consumers who want the truffle experience without the high cost associated with purely natural products.

Nature Analysis

Conventional truffle oil segment accounted for 70% of the market in 2023, highlighting its dominant position.

The truffle oil market is also segmented by nature, encompassing organic and conventional truffle oil. Conventional truffle oil dominates with 70% due to lower cost and wider availability.

Conventional truffle oil holds the largest market share, driven by its affordability and accessibility. Conventional production methods allow for large-scale manufacturing, keeping costs lower than organic options. Many consumers opt for conventional truffle oil due to its cost-effectiveness, especially in regions where organic products are considered a luxury.

Organic truffle oil, while a smaller segment, is growing steadily. The rise in health consciousness and demand for organic products is driving this growth. Consumers who prioritize health benefits and environmental sustainability are willing to pay a premium for organic truffle oil. This segment's growth is supported by increasing awareness of organic farming practices and the health benefits associated with organic products. Although it currently holds a smaller market share, the organic truffle oil segment is expected to expand as more consumers adopt healthier lifestyles.

End User Analysis

Food & beverages dominate with 60% due to extensive culinary applications and consumer demand for gourmet foods.

The end-user segments for truffle oil include food & beverages, cosmetics & personal care products, and pharmaceuticals. Food & beverages dominate with 60% due to extensive culinary applications and consumer demand for gourmet foods.

The food & beverages segment is the largest end-user of truffle oil, reflecting its extensive use in culinary applications. Chefs and home cooks alike use truffle oil to enhance the flavor of a wide range of dishes. This segment accounted for 60% of the market in 2023, underscoring its dominance. The rising trend of gourmet cooking and the popularity of truffle-flavored dishes in restaurants drive this demand. Truffle oil is a staple in many high-end kitchens, used to add a luxurious touch to pasta, risotto, salads, and more.

The cosmetics & personal care products segment is smaller but significant. Truffle oil is increasingly used in skincare products due to its antioxidant properties and rich nutrient content. This segment is growing as consumers seek natural and luxurious ingredients in their beauty products. The pharmaceutical segment, although the smallest, uses truffle oil for its potential health benefits. Research into truffle oil's properties suggests potential applications in health supplements and therapeutic products, supporting this niche market's growth.

Key Market Segments

By Truffle Type

- Black Truffle Oil

- White Truffle Oil

- Summer Truffle Oil

- Winter Truffle Oil

- Others

By Production Method

- Natural Truffle Extract Infusion

- Synthetic Truffle Flavoring

- Blend of Natural and Synthetic Flavors

By Nature

- Organic

- Conventional

By End User

- Food & Beverages

- Cosmetics & Personal Care Products

- Pharmaceuticals

Growth Opportunities

Exploring New Application Areas Offers Growth Opportunity

Truffle oil, traditionally used in culinary applications, has significant potential for expansion into new areas. The cosmetics and personal care industry can benefit from incorporating truffle oil into high-end skincare products and fragrances, leveraging its unique aroma and luxury appeal. The perceived benefits of truffle oil, such as its antioxidant properties, make it an attractive ingredient for premium beauty products.

Additionally, the food industry can explore new products infused with truffle oil, such as popcorn, spreads, and snacks. This trend taps into consumer interest in gourmet and innovative food items. Market analysis shows a growing demand for premium, flavor-infused snacks, with the gourmet snack segment expected to grow at a CAGR of 6.5% from 2023 to 2028. By exploring these new application areas, the truffle oil market can expand its reach and appeal to a broader audience, creating new revenue streams and enhancing market growth.

Leveraging E-Commerce and Direct-to-Consumer Sales Offers Growth Opportunity

The rise of e-commerce and direct-to-consumer sales channels provides a significant growth opportunity for truffle oil manufacturers. Online marketplaces and subscription-based services enable truffle oil producers to reach a global customer base, offering convenience and broader accessibility. E-commerce platforms can showcase niche gourmet products like truffle oil to a diverse audience, enhancing visibility and sales.

According to recent data, e-commerce sales of gourmet food products are projected to grow at a CAGR of 8% from 2023 to 2028. Direct-to-consumer sales models allow manufacturers to build strong customer relationships and provide personalized purchasing experiences. By leveraging these channels, truffle oil brands can effectively market their products, increase customer engagement, and drive sales growth. The convenience and reach of e-commerce and direct-to-consumer sales are pivotal in expanding the truffle oil market and tapping into new consumer segments.

Trending Factors

Sustainability and Ethical Sourcing Are Trending Factors

As consumers become more environmentally conscious, sustainably sourced and ethically produced truffle oil is in high demand. Manufacturers that emphasize sustainable practices, such as responsible harvesting and transparent supply chains, are likely to gain a competitive edge. These practices resonate with eco-conscious consumers who prefer products that align with their values. According to a recent survey, 68% of consumers are willing to pay more for products that are sustainably sourced. This trend underscores the importance of sustainability in driving market growth.

Companies that prioritize ethical sourcing can attract a loyal customer base and enhance their brand image. The focus on sustainability not only meets consumer demands but also contributes to the preservation of truffle habitats, ensuring long-term availability. By integrating sustainable practices, truffle oil manufacturers can tap into this growing market segment and promote themselves as responsible, forward-thinking brands.

Fusion Cuisines and Experimental Flavors Are Trending Factors

The trend towards fusion cuisines and experimental flavors is driving the popularity of truffle oil. Its distinct and versatile flavor makes it a perfect ingredient for innovative culinary creations. Chefs and home cooks are increasingly using truffle oil to add a unique twist to traditional dishes and explore new flavor combinations. This trend is particularly strong in high-end restaurants and among culinary influencers.

Collaborating with these influencers allows truffle oil manufacturers to showcase their products in exciting and creative ways. According to recent market analysis, the fusion cuisine segment is expected to grow at a CAGR of 7.2% from 2023 to 2028. This trend presents a significant opportunity for truffle oil brands to position their products as essential for modern, innovative cooking. By embracing this trend, manufacturers can attract adventurous food enthusiasts and expand their market reach.

Regional Analysis

Europe Dominates with 58.6% Market Share

Europe's dominance in the truffle oil market is driven by several factors. The region's rich culinary heritage and high demand for gourmet food play significant roles. European countries, particularly France and Italy, are renowned for their truffles and truffle products. The presence of established truffle oil producers and a strong market for premium culinary ingredients bolster this dominance. Additionally, European consumers' preference for high-quality and authentic products further drives the demand for truffle oil in the region.

Europe's market dynamics are influenced by its robust food culture and the importance placed on gourmet and luxury food items. The high disposable income and willingness to spend on premium food products among European consumers contribute to the market's growth. The region's well-developed distribution channels and strong emphasis on sustainable and ethical sourcing practices also support the market. European truffle oil producers benefit from local availability of truffles and advanced production techniques, ensuring a steady supply and high-quality products.

Regional Market Shares and Growth Rates

North America:

North America holds a market share of approximately 22%. The region's market growth is driven by increasing consumer interest in gourmet foods and the expanding foodservice industry. The United States, in particular, is a significant contributor, with a growing trend towards culinary experimentation and premium food products. The market is expected to grow at a CAGR of 5.1% from 2023 to 2033.Asia Pacific:

The Asia Pacific region accounts for around 12% of the global truffle oil market. The growing middle class and increasing disposable incomes in countries like China and Japan drive demand for luxury food items, including truffle oil. The region is witnessing a rising interest in Western cuisine and gourmet cooking. The market in Asia Pacific is projected to grow at a CAGR of 6.8% from 2023 to 2033.Middle East & Africa:

The Middle East & Africa region has a smaller market share of about 4%. However, the growing hospitality and tourism sectors, along with an increasing number of high-end restaurants, contribute to the demand for truffle oil. The market in this region is expected to grow at a steady pace, with a CAGR of 4.5% from 2023 to 2033.Latin America:

Latin America holds approximately 3.4% of the truffle oil market share. The region's growth is driven by the rising popularity of gourmet food and increasing disposable incomes in countries like Brazil and Argentina. The market in Latin America is projected to grow at a CAGR of 4.7% from 2023 to 2033.Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Truffle Oil Market features several key players, each with a strategic position and significant market influence. Major companies such as Urbani Truffles USA, Inc., La Tourangelle, Inc., and Sabatino Tartufi lead the market with their extensive product lines and strong brand presence. These companies leverage their expertise and heritage in truffle production to offer high-quality truffle oils, appealing to gourmet food enthusiasts and professional chefs alike.

Urbani Truffles USA, Inc. stands out with its global reach and robust distribution network, ensuring wide availability of its premium truffle oils. La Tourangelle, Inc. emphasizes sustainability and artisanal production methods, which resonate well with eco-conscious consumers. Sabatino Tartufi's innovative approach, including unique flavor blends, helps it capture a diverse customer base.

TruffleHunter Ltd. and Da Rosario Organics focus on organic and natural truffle oils, tapping into the growing demand for health-conscious and clean-label products. Their emphasis on organic certification and natural ingredients strengthens their appeal in niche markets.

Truffolio LLC, AROTZ, and Giuseppe Giusti S.p.A. leverage their European roots, offering authentic truffle oils with rich flavors. These companies benefit from strong brand heritage and consumer trust in traditional European truffle products. Gazzarrini Tartufi and Black Truffle Oil Company emphasize high-quality ingredients and traditional extraction methods, catering to premium market segments.

Emerging players like Truffle Oil Company, Le Truffleist, and Truffle Excellence focus on innovative marketing strategies and expanding their product portfolios to capture market share. Tartuflanghe S.p.A. combines tradition with innovation, offering a range of truffle-infused products that cater to both traditional and modern culinary applications.

In summary, the Truffle Oil Market is shaped by a mix of established and emerging players. Key companies maintain their market influence through quality, innovation, and strategic positioning. Their diverse approaches to production, marketing, and distribution ensure the continued growth and dynamism of the market.

Market Key Players

- Urbani Truffles USA, Inc.

- La Tourangelle, Inc.

- Sabatino Tartufi

- TruffleHunter Ltd.

- Da Rosario Organics

- Truffolio LLC

- AROTZ

- Giuseppe Giusti S.p.A.

- Gazzarrini Tartufi

- Black Truffle Oil Company

- Truffle Oil Company

- Truffle Oils

- Le Truffleist

- Truffle Excellence

- Tartuflanghe S.p.A.

Recent Developments

- On May 2024, Nectaris, a company based in France, is revolutionizing the truffle oil market with its innovative fermentation method. This process allows Nectaris to create a more authentic and flavorful truffle oil compared to traditional methods.

- On April 2024, Oylhaus, a Malaysian company, is making waves in the culinary world with its unique Truffle Garlic Kulim Oil. This oil combines the earthy aroma of truffles with the pungent flavor of garlic, creating a versatile ingredient for various dishes.

- On September 2023, Parade featured an article about Trader Joe's Truffle Ranch. This product likely caught the attention of food enthusiasts and fans of truffle-infused flavors.

- On March 2024, SKKY Partners, a private equity firm, made a significant investment in TRUFF, a premium sauce and condiments brand known for its truffle-infused products.

Report Scope

Report Features Description Market Value (2023) USD 617.5 Million Forecast Revenue (2033) USD 1,205 Million CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Truffle Type (Black Truffle Oil, White Truffle Oil, Summer Truffle Oil, Winter Truffle Oil, Others), By Production Method (Natural Truffle Extract Infusion, Synthetic Truffle Flavoring, Blend of Natural and Synthetic Flavors), By Nature (Organic, Conventional), By End User (Food & Beverages, Cosmetics & Personal Care Products, Pharmaceuticals) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Urbani Truffles USA, Inc., La Tourangelle, Inc., Sabatino Tartufi, TruffleHunter Ltd., Da Rosario Organics, Truffolio LLC, AROTZ, Giuseppe Giusti S.p.A., Gazzarrini Tartufi, Black Truffle Oil Company, Truffle Oil Company, Truffle Oils, Le Truffleist, Truffle Excellence, Tartuflanghe S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Urbani Truffles USA, Inc.

- La Tourangelle, Inc.

- Sabatino Tartufi

- TruffleHunter Ltd.

- Da Rosario Organics

- Truffolio LLC

- AROTZ

- Giuseppe Giusti S.p.A.

- Gazzarrini Tartufi

- Black Truffle Oil Company

- Truffle Oil Company

- Truffle Oils

- Le Truffleist

- Truffle Excellence

- Tartuflanghe S.p.A.