Trail Camera Market By Pixel Size (Below 8 MP, 8 to 12 MP, 12 MP to 16 MP, 17 MP to 21 MP, 22 MP to 30 MP, Above 30 MP), By Application(Wildlife Monitoring & Research, Security, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

13136

-

March 2024

-

189

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

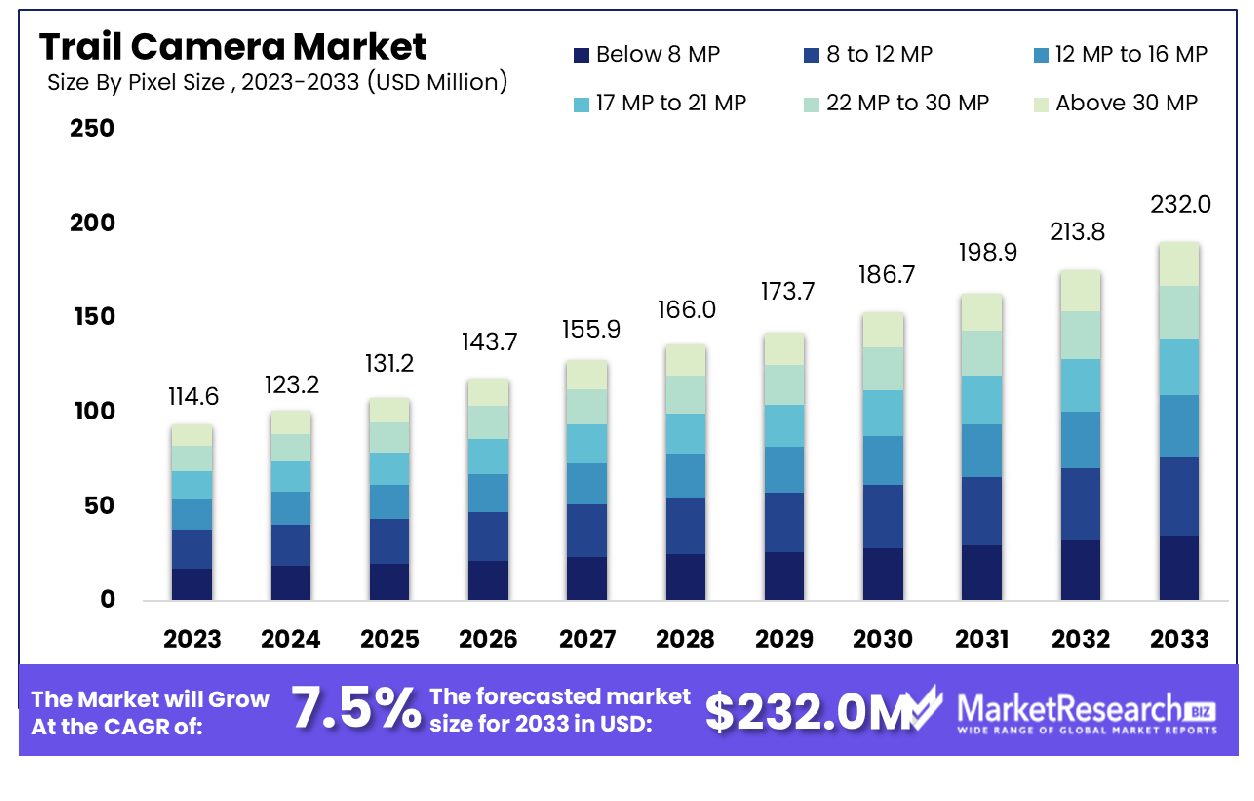

The trail camera market was valued at USD 114.6 Million in 2023. It is expected to reach USD 232.0 Million by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033. The surge in demand for advanced technologies, the rise in need by zoologists and biologists, and applications for the scope of out-of-door security are some of the main key driving factors for the trail camera market.

A trail camera is also called the game camera or the wildlife camera that specializes in the outdoor surveillance device which is made for capturing images or videos of wildlife and other objects in their natural surroundings. These digital cameras are generally used by hunters, zoologists, natural enthusiasts, and researchers to understand animal behavior, study biodiversity and improve wildlife management efforts.

These are equipped with motion sensors and infrared technologies that allow them to identify movement and capture images, even in low-light surroundings without disturbing the animals or the subjects. Such devices generally have features such as weather-resistant casings and can be installed on trees or other outdoor structures. Images and videos recorded by a trial camera offer precious insights into the animal environments, population dynamics, and migration structures that help conservationists and wildlife researchers in their efforts to know and safeguard the diverse ecosystem.

Inside Archery in March 2024, highlights that Browning Trails Cameras has launched its 5 new cameras that will be accessible in 2024. It embraces the latest technology in cellular trail cameras. The Defender Pro Scout Max HD cellular trails camera has 1080 high-quality full HD images from the field that are a minimum of 5 times which is larger than the previous images. It also includes GPS-tagged images, a 100-foot detection range, and a new innovative high-gain antenna system to provide optimum possible signal receptions in inaccessible locations.

Moreover, Zeiss in November 2023, the Secacam brand announced in June, that Zeiss would present the Zeiss Secacam 5 and Zeiss Secacam 7 and its first trail cameras to the market. The trail cameras have exceptional image quality, weather-resistant technology, simple installations and operations, and more network coverage in the field. The new Zeiss trail cameras have been available since December 2023, at an RRP of €229 for the ZEISS Secacam 5 and an RRP €279 for the ZEISS Secacam 7 in over 35 countries in Europe.

In modern wildlife conservation and research, trial cameras play an important role by offering non-intrusive monitoring of animal behavior and ecosystems. They support collecting precious information for conservative efforts by improving the understanding of biodiversity and promoting sustainable wildlife management practices without direct human intrusion. The demand for trail cameras will increase due to their requirement in wildlife conversations which will help in the market expansion in the coming years.

Key Takeaways

- Market Growth: The Trail Camera Market was valued at USD 114.6 Million in 2023. It is expected to reach USD 232.0 Million by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

- By Pixel Size: With pixel sizes ranging from 8 to 12 MP, trail cameras capture high-resolution images, dominating 59.2% market share.

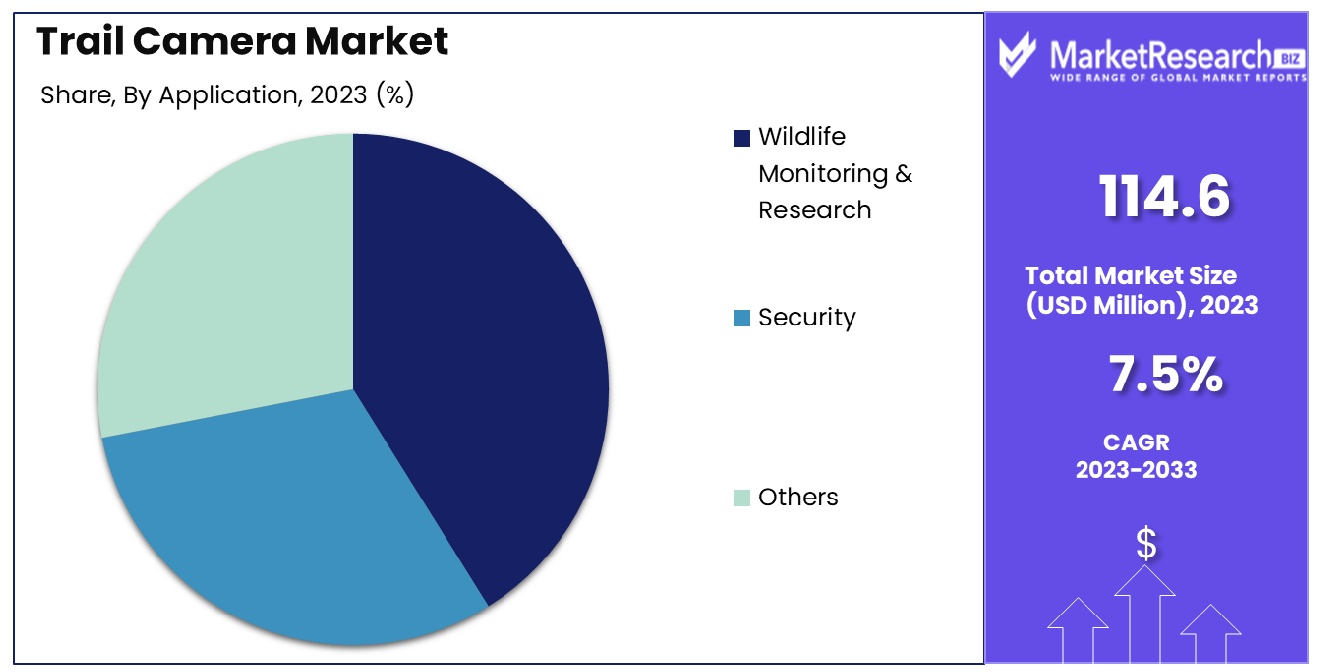

- By Application: In wildlife monitoring and research applications, they hold a commanding 62.6% market share.

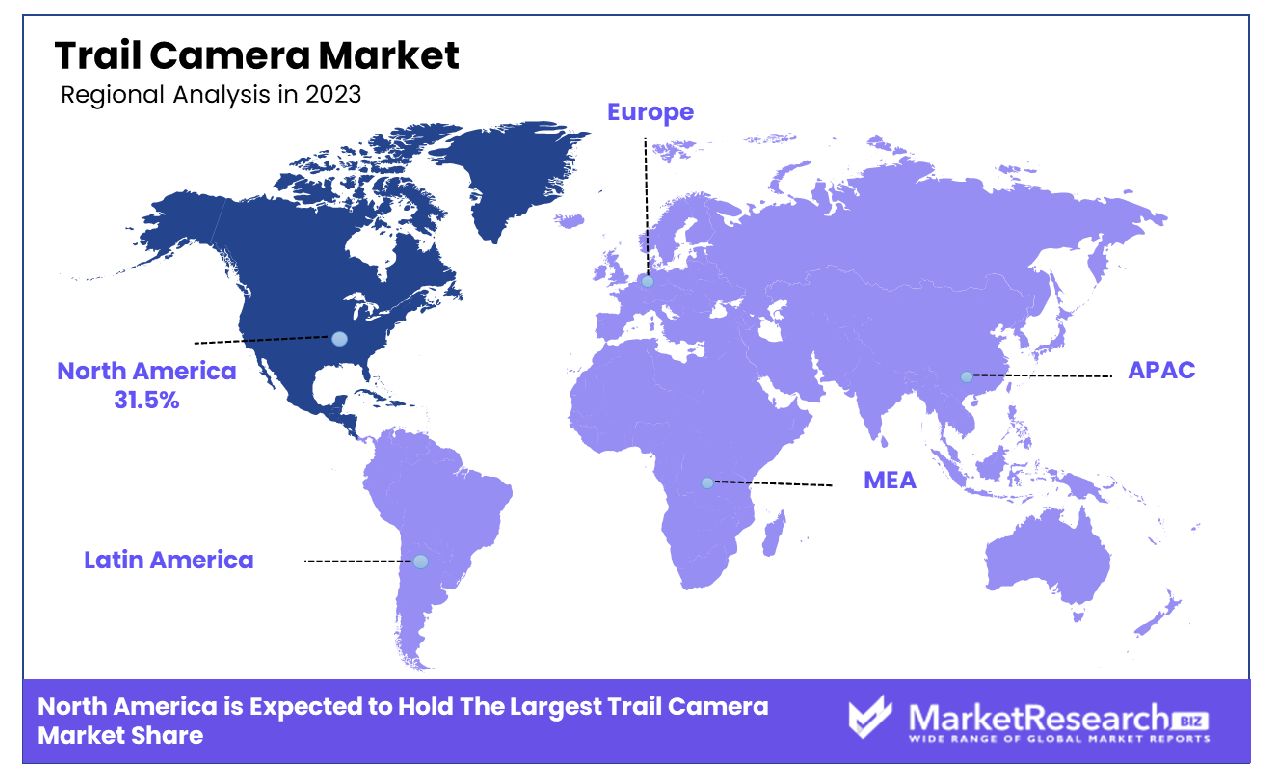

- Regional Dominance: North America leads the trail camera market with a significant 31.5% market share.

- Growth Opportunity: The integration of advanced wireless connectivity, expansion into ecotourism and wildlife research sectors, and development of AI and ML capabilities drive growth in the trail camera market.

Driving factors

Technological Advancements in Camera Technology

The trail camera market has experienced a significant growth rate, primarily driven by continuous advancements in camera technology. Innovations such as high-resolution imaging, improved night vision capabilities, and extended battery life have enhanced the functionality and reliability of trail cameras. These technological enhancements enable users to capture clearer images and videos in a variety of environmental conditions, thereby increasing their appeal across a wide range of applications, including wildlife monitoring, security surveillance, and outdoor recreation.

Rising Popularity of Wildlife Monitoring and Research

Another critical factor contributing to the expansion of the trail camera market is the increasing interest in wildlife conservation and research. The deployment of trail cameras plays a pivotal role in observing and studying wildlife behavior without human interference, offering valuable data for conservation efforts. This interest drives demand from governmental and non-governmental organizations dedicated to ecological studies and biodiversity, further propelling market growth.

Enhanced Demand for Security and Surveillance Solutions

The application of trail cameras for security and surveillance purposes has seen a noteworthy surge. The discrete nature and the ability to operate in remote areas without the need for an external power source make trail cameras ideal for monitoring properties, detecting unauthorized activities, and ensuring perimeter security. This demand is amplified by the rising concerns over property safety and wildlife-related threats in rural and semi-urban areas, thereby contributing to the market's overall growth trajectory.

Restraining Factors

High Initial Investment and Maintenance Costs

The deployment of trail cameras across various sectors, including wildlife monitoring and security, is significantly hindered by the high initial investment and maintenance costs associated with these devices. The complexity of technology integrated into trail cameras, such as night vision, motion sensors, and high-resolution imaging, contributes to their elevated price points.

Furthermore, the necessity for regular maintenance and potential repairs adds an ongoing financial burden to users. This factor notably restricts market expansion, particularly among individual consumers and small-scale entities with limited budgets. The high cost not only limits the accessibility of these devices to a wider audience but also impacts the pace of adoption in emerging markets where cost sensitivity is more pronounced.

Privacy Concerns and Regulatory Challenges

Privacy concerns and the burgeoning regulatory landscape present significant challenges to the trail camera market. The increasing use of trail cameras in both wildlife observation and surveillance activities raises concerns over privacy infringement, especially when cameras are installed in areas without explicit consent from individuals who might be recorded. This apprehension is further amplified by the lack of a unified regulatory framework governing the deployment and use of such cameras across different jurisdictions.

Regulatory challenges not only vary by region but also evolve as technology advances, creating a complex compliance environment for manufacturers and users alike. These concerns and the need for compliance with diverse regulations can deter potential users, thereby restraining market growth. The industry must navigate these challenges carefully to ensure sustainable growth, balancing technological advancements with ethical considerations and regulatory compliance.

By Pixel Size Analysis

8 to 12 MP pixel size dominates with a substantial 59.2% market share.

In 2023, the 8 to 12 MP segment firmly established its dominance within the By Pixel Size category of the Trail Camera Market, commanding an impressive market share exceeding 59.2%. This segment's prominence underscores its relevance and appeal among consumers seeking an optimal balance between image quality and storage efficiency.

The Below 8 MP segment, while still present in the market landscape, faced stiff competition from its higher resolution counterparts. With advancements in technology and evolving consumer preferences, the demand for higher-resolution trail cameras surged, driving the substantial market share captured by the 8 to 12 MP segment.

The 8 to 12 MP segment's robust performance can be attributed to several factors. Firstly, cameras falling within this range offer sufficient resolution for capturing clear and detailed images, catering to the diverse needs of wildlife enthusiasts, hunters, and outdoor enthusiasts. Additionally, these cameras strike a balance between image clarity and file size, making them practical and versatile for various applications.

Moreover, manufacturers within this segment have continued to innovate, incorporating features such as enhanced image sensors, improved lens quality, and advanced image processing algorithms. These technological advancements have further propelled the appeal and adoption of 8 to 12-MP trail cameras among consumers.

Looking ahead, while the 8 to 12 MP segment currently reigns supreme, the market landscape is dynamic, with continuous technological advancements and evolving consumer preferences. As such, stakeholders must remain vigilant and adaptive to capitalize on emerging opportunities and navigate potential challenges within the pixel-size segment of the Trail Camera Market.

By Application Analysis

Wildlife monitoring and research lead applications with 62.6% market share.

In 2023, Wildlife Monitoring & Research held a dominant market position in the "By Application" segment of the Trail Camera Market, capturing more than a 62.6% share. This significant share underscores the pivotal role of trail cameras in wildlife monitoring and research activities globally. Wildlife conservation efforts, coupled with the increasing need for understanding animal behavior and habitat dynamics, have propelled the demand for trail cameras across various ecosystems and conservation projects.

The robust adoption of trail cameras by wildlife monitoring and research organizations can be attributed to their effectiveness in capturing high-resolution images and videos, enabling researchers to conduct non-invasive observations of wildlife in their natural habitats. Furthermore, advancements in trail camera technology, such as improved battery life, motion sensors, and remote connectivity options, have enhanced their utility and reliability in long-term monitoring projects.

Security emerged as another prominent application segment within the Trail Camera Market. The heightened concerns regarding property security, trespassing, and wildlife-related damages have driven the integration of trail cameras into security surveillance systems. These cameras offer discreet monitoring capabilities in remote or sensitive areas, providing property owners, law enforcement agencies, and wildlife conservationists with valuable insights into potential security threats and unauthorized activities.

Additionally, trail cameras find applications across various other sectors, including outdoor recreational activities, forestry, and scientific research. The versatility of these cameras, coupled with their durability and weather-resistant features, makes them indispensable tools for capturing wildlife behavior, assessing ecosystem health, and monitoring natural phenomena.

Looking ahead, the Trail Camera Market is poised for sustained growth, fueled by ongoing advancements in camera technology, increasing investments in wildlife conservation initiatives, and rising awareness regarding the importance of environmental monitoring. As organizations continue to prioritize data-driven decision-making and environmental stewardship, the demand for trail cameras is expected to witness steady expansion across diverse application segments.

Key Market Segments

By Pixel Size

- Below 8 MP

- 8 to 12 MP

- 12 MP to 16 MP

- 17 MP to 21 MP

- 22 MP to 30 MP

- Above 30 MP

By Application

- Wildlife Monitoring & Research

- Security

- Others

Growth Opportunity

Advancements in Wireless Connectivity

The integration of advanced wireless connectivity technologies into trail cameras presents a significant growth opportunity for the market. This development can be attributed to the increasing demand for real-time wildlife monitoring and the need for efficient data transmission from remote locations.

The adoption of technologies such as 4G LTE and Wi-Fi enables users to access images and videos remotely, enhancing the usability and appeal of trail cameras for wildlife researchers, hunters, and outdoor enthusiasts. Moreover, advancements in wireless connectivity are expected to drive innovation, leading to the introduction of new features such as live streaming and instant alerts, further expanding the market's potential.

Expansion into Ecotourism and Wildlife Research

The expansion of the trail camera market into the ecotourism and wildlife research sectors represents a considerable growth opportunity. Ecotourism initiatives increasingly rely on non-intrusive methods to observe and study wildlife, positioning trail cameras as an essential tool for these purposes.

Additionally, the growing emphasis on biodiversity conservation and wildlife research necessitates detailed, long-term monitoring of species in their natural habitats. By catering to these sectors, manufacturers can diversify their product offerings and tap into new revenue streams, while contributing to conservation efforts and scientific research.

Development of AI and Machine Learning Capabilities

Incorporating artificial intelligence (AI) and machine learning (ML) capabilities into trail cameras offers a pathway to significant market growth. These technologies can automate the identification and classification of wildlife, providing users with valuable insights and data analytics.

The ability to quickly analyze vast amounts of image and video data not only enhances the user experience but also opens up new applications for trail cameras in research, security, and smart monitoring solutions. As AI and ML technologies continue to evolve, their integration into trail cameras is expected to drive product innovation, improve operational efficiency, and attract a broader customer base.

Latest Trends

Integration of Advanced Technologies in Trail Cameras

The Trail Camera Market is witnessing a significant transformation, primarily driven by the integration of advanced technologies. Innovations such as wireless connectivity, high-definition video recording, and solar-powered operations are becoming standard features in the latest trail cameras. These technological advancements have enhanced the functionality and convenience of trail cameras, making them indispensable tools for wildlife monitoring, research, and hunting activities.

The incorporation of wireless technology allows for real-time data transmission, enabling users to access footage remotely without the need to physically retrieve the camera. This feature is particularly beneficial for monitoring in remote or inaccessible areas. Additionally, the adoption of solar-powered units addresses the challenge of battery replacement, ensuring continuous operation and reducing the environmental impact.

The market's inclination towards these technological enhancements can be attributed to the growing demand for efficient, user-friendly, and eco-conscious solutions in wildlife monitoring and management practices.

Rising Demand for Trail Cameras in Ecological Research and Conservation Efforts

Parallel to technological advancements, there is an increasing trend of utilizing trail cameras in ecological research and conservation efforts. Researchers and conservationists are leveraging these devices to gather valuable data on wildlife behavior, population dynamics, and habitat use without intruding on natural habitats.

The passive monitoring capability of trail cameras offers a non-invasive method to observe and record wildlife over extended periods, providing insights that are critical for formulating effective conservation strategies. This trend is further supported by the growing awareness and concern over biodiversity loss and the need for sustainable management practices. Consequently, the trail camera market is experiencing a surge in demand from the scientific community and conservation organizations.

This demand is expected to continue rising as these cameras become more accessible and as their role in environmental conservation becomes increasingly recognized. The growth in this segment highlights the expanding application scope of trail cameras beyond traditional uses, underscoring their importance in addressing contemporary environmental challenges.

Regional Analysis

North America commands a substantial 31.5% market share in the trail camera industry.

The global trail camera market showcases varying dynamics across different regions, each influenced by distinct factors shaping consumer preferences, technological advancements, and regulatory landscapes.

In North America, the trail camera market commands a notable share, accounting for approximately 31.5% of the global market. This dominance can be attributed to the region's robust outdoor recreation culture, coupled with a strong affinity for wildlife observation and hunting activities. Additionally, the presence of leading manufacturers and technological innovators further fuels market growth in this region. According to recent industry data, North America boasts a considerable adoption rate of trail cameras, with annual sales consistently reflecting an upward trajectory.

In Europe, the trail camera market exhibits steady growth, driven by increasing interest in wildlife conservation efforts, outdoor sports, and surveillance applications. With stringent wildlife protection regulations in place across several European countries, there exists a burgeoning demand for high-quality, ethically designed trail cameras that facilitate non-invasive monitoring and research activities. Market analysts estimate Europe to hold a significant share of the global trail camera market, although specific percentage figures may vary based on evolving consumer preferences and regional economic factors.

Asia Pacific emerges as a promising frontier for the trail camera market, fueled by rising disposable incomes, expanding urbanization, and a growing trend towards eco-tourism and outdoor recreational pursuits. Countries such as China, Japan, and Australia witness escalating demand for trail cameras, driven by a burgeoning interest in nature photography, wildlife observation, and agricultural surveillance. The region's vast geographical diversity and rich biodiversity further contribute to the market's growth potential, attracting both local and international manufacturers seeking to capitalize on emerging opportunities.

In the Middle East & Africa and Latin America regions, the trail camera market demonstrates gradual but promising growth trajectories, propelled by a burgeoning interest in wildlife conservation efforts, outdoor leisure activities, and agricultural surveillance applications. Despite facing certain socio-economic challenges and infrastructural limitations, these regions showcase untapped potential for market expansion, with increasing awareness about the benefits of trail cameras in enhancing wildlife management practices and bolstering security measures in rural areas.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Trail Camera Market in 2023 continues to experience significant growth, driven by advancements in camera technology, rising interest in wildlife research, and the increasing adoption of trail cameras for security purposes. Within this context, the performance and strategies of key players such as Wildgame Innovations (Good Sportsman Marketing, LLC), Browning Trail Cameras, Vista Outdoor Operations LLC, SPYPOINT, Boly Media Communications Inc., Covert Scouting Cameras, Inc., Reconyx Inc., Cuddeback, Easy Storage Technologies Co., Ltd., and MINOX GmbH merit close examination.

Wildgame Innovations and Browning Trail Cameras, noted for their innovation and robust product offerings, have solidified their positions by focusing on high-quality imagery and user-friendly features, catering to both the novice and the seasoned wildlife enthusiasts. Vista Outdoor Operations LLC, with its diverse portfolio, has leveraged cross-brand synergies to enhance product development and market penetration.

SPYPOINT has carved a niche by integrating cellular technology in trail cameras, offering real-time data transmission that appeals to a tech-savvy customer base. Similarly, Boly Media Communications Inc. has emphasized innovation in motion sensor technology, enhancing camera responsiveness and reliability.

Covert Scouting Cameras, Inc. and Reconyx Inc. have focused on durability and battery life, addressing key consumer concerns about remote deployment. Cuddeback, with its fast trigger speed, has targeted users interested in capturing high-speed wildlife movements.

Easy Storage Technologies Co., Ltd., while less known, has made strides in storage and data management solutions for trail cameras, a critical area as users generate increasing volumes of data. Lastly, MINOX GmbH has leveraged its expertise in optics to produce trail cameras with exceptional image clarity, appealing to a segment of the market prioritizing image quality.

Market Key Players

- Wildgame Innovations (Good Sportsman Marketing, LLC)

- Browning Trail Cameras

- Vista Outdoor Operations LLC

- SPYPOINT

- Boly Media Communications Inc.

- Covert Scouting Cameras, Inc.

- Reconyx Inc.

- Cuddeback

- Easy Storage Technologies Co., Ltd.

- MINOXGmbH.

Recent Development

- In February 2024, Xiaomi unveils the game-changing Xiaomi 14 series in India, featuring a Leica camera, Snapdragon 8 Gen 3 processor, IP68 water/dust resistance, and Redmi Buds 5 with 46dB noise cancellation. (Source: BLive News)

- In February 2024, CBS Sports plans groundbreaking production for Super Bowl LVIII with 165 cameras, including 48 with super-slow-motion capabilities and innovative "doink" cameras in goal-post uprights, marking the first 1080p HDR and 4K HDR broadcast.

- In January 2024, Samsung unveils groundbreaking camera innovations with the Galaxy S24 series, including AI-based upscaling for Motion Photos and enhanced video editing. Features to extend to older models via One UI 6.1 update.

Report Scope

Report Features Description Market Value (2023) USD 114.6 Million Forecast Revenue (2033) USD 232.0 Million CAGR (2024-2032) 7.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pixel Size (Below 8 MP, 8 to 12 MP, 12 MP to 16 MP, 17 MP to 21 MP, 22 MP to 30 MP, Above 30 MP), By Application(Wildlife Monitoring & Research, Security, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Wildgame Innovations (Good Sportsman Marketing, LLC), Browning Trail Cameras, Vista Outdoor Operations LLC, SPYPOINT, Boly Media Communications Inc., Covert Scouting Cameras, Inc., Reconyx Inc., Cuddeback, Easy Storage Technologies Co., Ltd., MINOXGmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Wildgame Innovations (Good Sportsman Marketing, LLC)

- Browning Trail Cameras

- Vista Outdoor Operations LLC

- SPYPOINT

- Boly Media Communications Inc.

- Covert Scouting Cameras, Inc.

- Reconyx Inc.

- Cuddeback

- Easy Storage Technologies Co., Ltd.

- MINOXGmbH.