Silicones Market By Type (Elastomers, Fluids, Resins), By Application (Sealants, Rubber, Coatings, Emulsions, Others (Greases, etc.), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

20785

-

June 2023

-

168

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

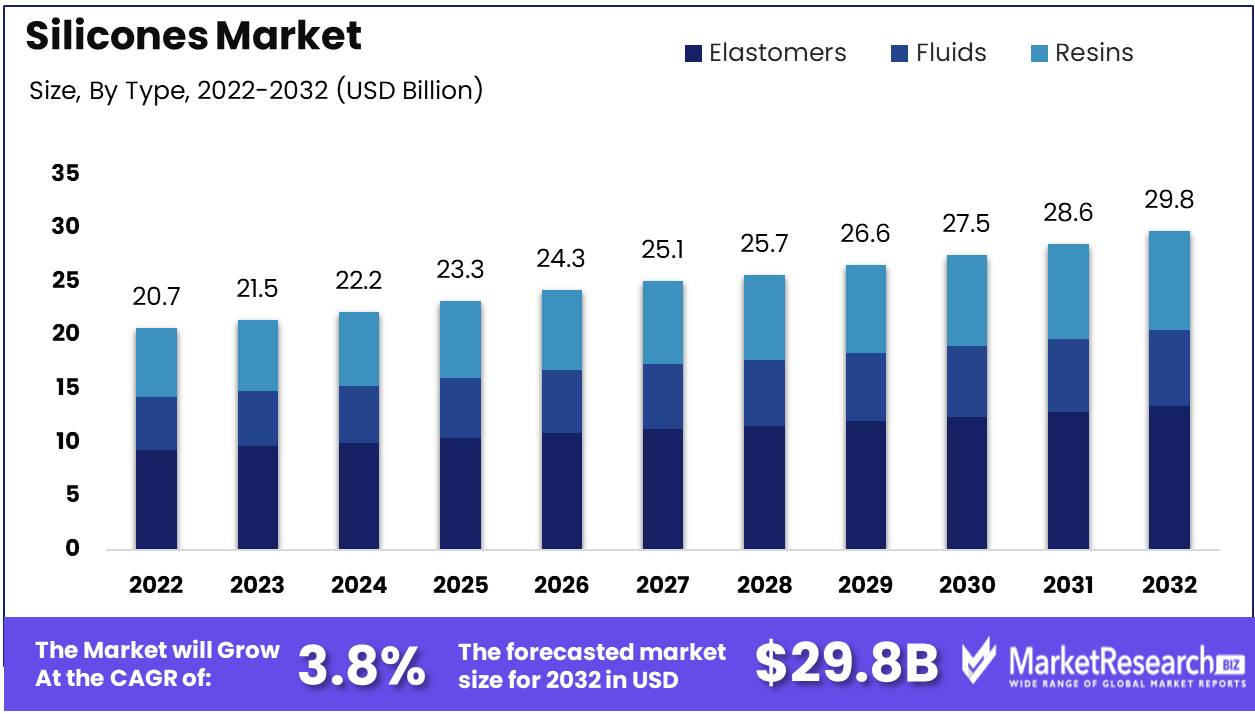

The Silicones Market size is expected to be worth around USD 29.8 Bn by 2032 from USD 20.7 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

Silicones, a versatile group of synthetic compounds primarily composed of silicon, oxygen, carbon, and hydrogen, have experienced substantial growth and diversification in recent years. The global silicone market encompasses a wide array of applications, including automotive, construction, electronics, healthcare, personal care products, and more.

Construction materials and electronics industries account for the vast majority of the silicone market. Silicones have proven ideal for construction purposes due to their weather resistance, durability and versatility. Applications include high-rise buildings, green buildings, facades and other infrastructure. Within electronics applications silicone is often utilized due to its electrical insulation properties for semiconductors, memory processors, electronic control units and connectors.

Silicones market is currently going through an incredible transformation, with notable developments contributing to its development and evolution. Elkem recently showcased their groundbreaking application of silicone in additive manufacturing - specifically, parts manufactured through Liquid Deposition Modeling technology (LDM). LDM enables functional parts made solely out of authentic silicone elastomers - opening new opportunities for applications and innovation.

DuPont, one of the major players, launched novel silicone blends designed specifically to address various skin conditions in April 2023. Their products included low-cyclosiloxane silicone elastomer blends and resin blends which demonstrate how adaptable silicone compounds can be. Now being utilized in cosmetic and healthcare products designed to cater to an ever more health conscious and beauty minded consumer base.

Dow, an internationally recognized chemical conglomerate from the U.S., announced its foray into photovoltaic (PV) manufacturing with its DOWSIL product line launch in March 2023. DOWSIL features six silicone sealants and adhesive solutions designed to ease module assembly for PV modules, further cementing silicone materials' place as renewable energy technologies support the transition towards sustainable and eco-friendly energy sources.

Key trends driving silicone market growth include rising demand for lightweight yet high-performance materials in automotive and aerospace, leading to greater use of silicone-based solutions that offer superior thermal and mechanical properties while simultaneously reducing overall weight. Furthermore, due to 5G and IoT technologies driving advances within electronics manufacturing companies and semiconductor industries alike, silicones have seen increased use as encapsulation and thermal interface materials in various applications such as electronics packaging.

Driving Factors

Increasing Demand in Construction and Automotive Industries

The construction and automotive sector is experiencing increased market requirements for silicone. These adaptable substances are utilized in a vast array of products, including sealants, adhesives, lubricants, and coatings. Their remarkable performance and durability have boosted their popularity, resulting in a significant increase in demand for silicone-based solutions in these industries.

A Growing Popularity in Personal Care Products

The silicone market size has witnessed substantial growth within the realm of personal care products, encompassing items such as shampoos, conditioners, and body lotions. These remarkable properties inherent to silicones have significantly improved the texture and overall efficacy of these products, making them exceedingly attractive to consumers. Consequently, there is a continuous and steady increase in the demand for personal care products that utilize silicone as a key ingredient.

Expanding Role in the Electronics Sector

The demand for electronics is increasing rapidly, especially in emerging economies. Silicones play an important role in this industry, particularly in applications involving electrical insulation and protection. As electronic devices become more prevalent in these economies, the demand for silicone-based solutions has increased dramatically to meet the expanding requirements of this sector.

The Thriving Application in Adhesives and Sealants

Diverse end-use industries are experiencing an increase in demand for silicone adhesives and sealants. Recognized for their exceptional performance and sturdiness, these products have gained immense popularity in the construction and automotive industries. Their ability to encapsulate and adhere to components effectively makes them indispensable in these industries.

Advancements in the Medical and Healthcare Sector

From implantable devices to medical conduits, the medical and healthcare industry is embracing the use of silicones in a variety of applications. Silicones' biocompatibility, flexibility, and fluid resistance make them suitable for a variety of medical applications. The expansion of this industry has bolstered the demand for silicone-based products, strengthening their position in healthcare applications.

Restraining Factors

Fluctuating Prices of Raw Materials

Fluctuating prices of basic materials used in the production of silicones represent one of the greatest obstacles facing the silicone market. Sand, methanol, silicon metal, and methyl chloride are examples of these basic materials. The prices of these inputs are susceptible to market fluctuations, supply shortages, and geopolitical tensions, all of which can have an effect on the ultimate price of silicone products. This can result in disruptions to the supply chain, stockpiles, and production delays.

Strict Regulations Regarding the Utilization of Silicones

The strict regulations governing their use, particularly in the healthcare and food packaging industries, are another major factor restraining the silicone market's growth. Silicones are frequently used in medical applications such as implants, ducting, and gaskets, where the material must adhere to stringent safety and quality standards. Similarly, silicones are frequently used in applications involving food packaging, where the material must adhere to stringent regulations governing food contact materials. These regulations can restrict the use of specific varieties of silicones and increase the cost of compliance. Noncompliance with these regulations can result in product recalls, legal liabilities, and brand reputation injury.

Health and Environmental Concerns

In recent years, there has been a rise in concern regarding the potential health and environmental effects of certain silicones, such as cyclic volatile methyl siloxanes (VMS), found in personal care products. According to studies, cVMS can accumulate in the environment and may have deleterious effects on aquatic organisms. This has prompted demands for stricter regulation of these materials and a shift to more sustainable alternatives. These concerns may restrict the use of certain types of silicones in some applications, thereby slowing the silicone market's expansion.

High Production Costs and Limited Raw Material Availability

Silicone production is a complex, energy-intensive process requiring substantial capital expenditures and specialized machinery. This can result in high production costs that are passed on to the final consumers. Furthermore, in some regions, such as Europe and North America, the availability of raw materials for silicone production is limited due to a dearth of domestic production and import restrictions. This can create supply chain risks and reduce silicone manufacturers' competitiveness.

Type Analysis

The Elastomers Segment, which accounts for the largest market share, has dominated the Silicones Market. Elastomers are elastomeric materials known for their resistance to extreme temperatures and conditions. They have a unique property that allows them to stretch and revert to their original shape, making them ideal for automotive, aerospace, and industrial applications, among others.

The adoption of the Elastomers Segment in the Silicones Market has been fueled by the economic growth of emerging economies. As these economies grow, they require durable, high-quality materials that can withstand the severe conditions they must endure. In this regard, the Elastomers Segment is optimal, as it has demonstrated dependability under similar conditions. In addition, countries such as China, India, and Brazil have increased their construction and automotive production, thereby increasing the market demand for these high-quality elastomeric materials.

The attitude of consumers toward the Elastomers Segment is also a major contributor to its market dominance. Consumers' awareness of the environment and the need to reduce their carbon footprint is growing. Elastomers are renowned for their durability and sustainability, thus satisfying the demand for eco-friendly materials. As a result, consumer demand for sustainable products is on the rise, driving the Elastomers Segment of the Silicones Market.

End-Use Industry Analysis

The Construction Segment holds the greatest market share, dominating the Silicones Market. Due to their longevity and durability, silicone-based materials are extensively utilized in the construction industry. Silicone-based materials like sealants, coatings, and adhesives are widely used in construction projects like roofs, facades, and insulation.

The adoption of the Construction Segment of the Silicones Market has been primarily driven by the economic growth in emerging economies. The accelerated urbanization of emerging economies such as China and India has led to the construction of new buildings and infrastructure. With the growing demand for energy-efficient buildings, silicone-based insulation materials are in high demand.

Additionally, consumer attitudes toward the Construction Segment of the Silicones Market are changing. Consumers are becoming increasingly aware of the negative environmental impact of conventional building materials. As a result, there is a growing demand for eco-friendly and sustainable building materials, and silicone-based materials are an optimal solution.

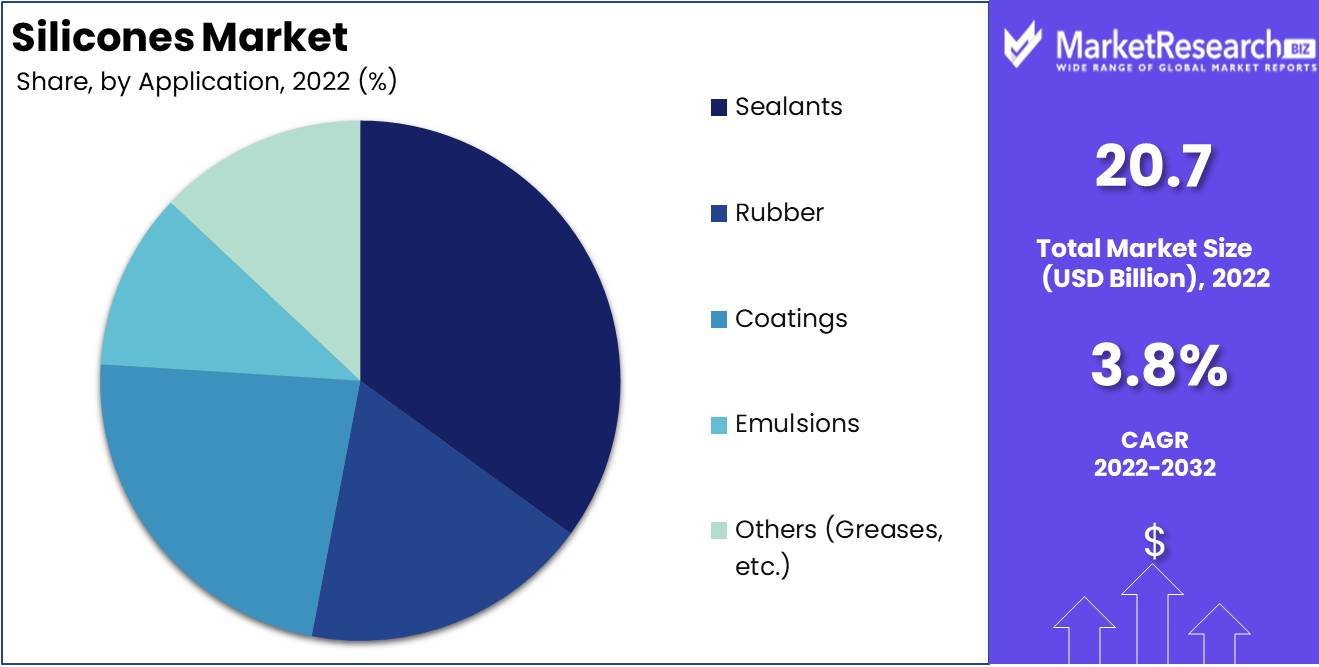

Application Analysis

With a majority of the market share, the Sealants Segment dominates the Silicones Market. Sealants are widely used in the building and construction industry for their primary sealing properties. They are also utilized in industries such as the automotive, aerospace, and marine sectors.

The Silicones Market's adoption of the Sealants Segment has been propelled by the economic growth of emerging economies. As these economies grow, construction activities increase, driving the demand for high-quality sealants. The adaptability of silicone-based sealants makes them suitable for a variety of applications, assuring their widespread use.

The behavior of consumers towards the Sealants Segment is also crucial to its market dominance. Even in the building and construction industry, consumers increasingly demand eco-friendly and sustainable goods. Silicone-based sealants are ideal because they require less energy to implement and pose no environmental risk.

Key Market Segments

By Type

- Elastomers

- Fluids

- Resins

By End-user

- Construction

- Consumer Goods

- Transportation

- Energy

- Electrical & Electronics

- Paper

- Textiles

- Others (Health Care, etc.)

By Application

- Sealants

- Rubber

- Coatings

- Emulsions

- Others (Greases, etc.)

Growth Opportunity

Silicone-based products in the healthcare and personal care industries

The healthcare and personal care industries utilize silicone-based products for a variety of applications. The biocompatibility, flexibility, and mechanical strength of medical-grade silicone make it an ideal material for medical devices, implants, and prosthetics. Due to an increase in the prevalence of chronic diseases, an aging population, and a rise in the demand for minimally invasive surgeries, the use of silicone-based products is expected to increase significantly in the healthcare industry.

Silicone-Based Coatings and Paints in the Automotive and Construction Industries

Silicone-based coatings and paints are utilized in a variety of automotive and construction applications due to their superior thermal resistance, durability, and weather resistance. Silicone coatings are commonly used in the construction industry to defend buildings and infrastructure from severe weather, industrial coating, ultraviolet radiation, and corrosion.

Silicone-based 3D printing materials are anticipated to be in high demand due to developments in 3D printing technology

Recent advancements in 3D printing technology have generated substantial demand for innovative materials, such as silicone-based 3D printing materials. The mechanical strength, flexibility, and biocompatibility of silicone-based 3D printing materials make them ideal for a variety of applications, including medical devices and implants. Demand for silicone-based 3D printing materials is anticipated to be driven by the rising demand for personalized medical devices and the expanding use of 3D printing in the healthcare industry.

Development of New and Innovative Products with Improved Biocompatibility and Durability

Anticipated market developments are poised to propel the silicone industry's expansion. These advancements are primarily attributed to the creation of groundbreaking products featuring superior attributes like biocompatibility and durability. Recent progress in materials science and engineering has ushered in a new era, leading to the emergence of silicone-based products characterized by heightened biocompatibility, extended durability, and enhanced thermal stability, among other essential properties.

Latest Trends

Increasing Use of Silicone-Based Products in Sustainable Technologies

Increased demand for sustainable technologies has spurred the development of novel silicone-based product applications. Using silicone in electric vehicles is one of the most key developments. EVs use silicone-based materials for a variety of applications, including insulation, refrigeration, and sealing. Silicone products are ideal for electric vehicles because they are lightweight, extremely durable, and resistant to high temperatures, which is essential for battery life.

Growing Demand for High-Performance Silicone Adhesives and Sealants

To guarantee the safe and efficient operation of their systems, the aerospace and defense industries require superior sealing and bonding solutions. Due to their high strength, resistance to chemicals and UV radiation, and durability, silicone-based products are optimal for these applications. Aerospace and defense industries have a growing demand for high-performance silicone adhesives and sealants due to their superior bonding and sealing capabilities in extreme environments.

The packaging industry is experiencing a growing demand for silicone-based materials

Packaging is another significant market for silicone-based products, with demand being driven by the expanding popularity of sustainable and environmentally friendly packaging solutions. Due to their superior barrier properties, which can enhance product preservation, safety, and shelf life, silicone-based materials are ideal for packaging food, pharmaceuticals, and other products. In addition, silicone products are highly inert, making their use in food and medical applications safe.

Increasing Use of Silicone Elastomers in Medical Devices and Implants

Due to their unique mechanical properties, biocompatibility, and stabilizability, silicone elastomers are increasingly utilized in the medical device and implant industries. In a variety of medical applications, such as catheters, prosthetics, implants, and medical tubing, silicone products are utilized. As the population ages and the demand for medical devices rises, it is anticipated that silicone elastomers will be in high demand.

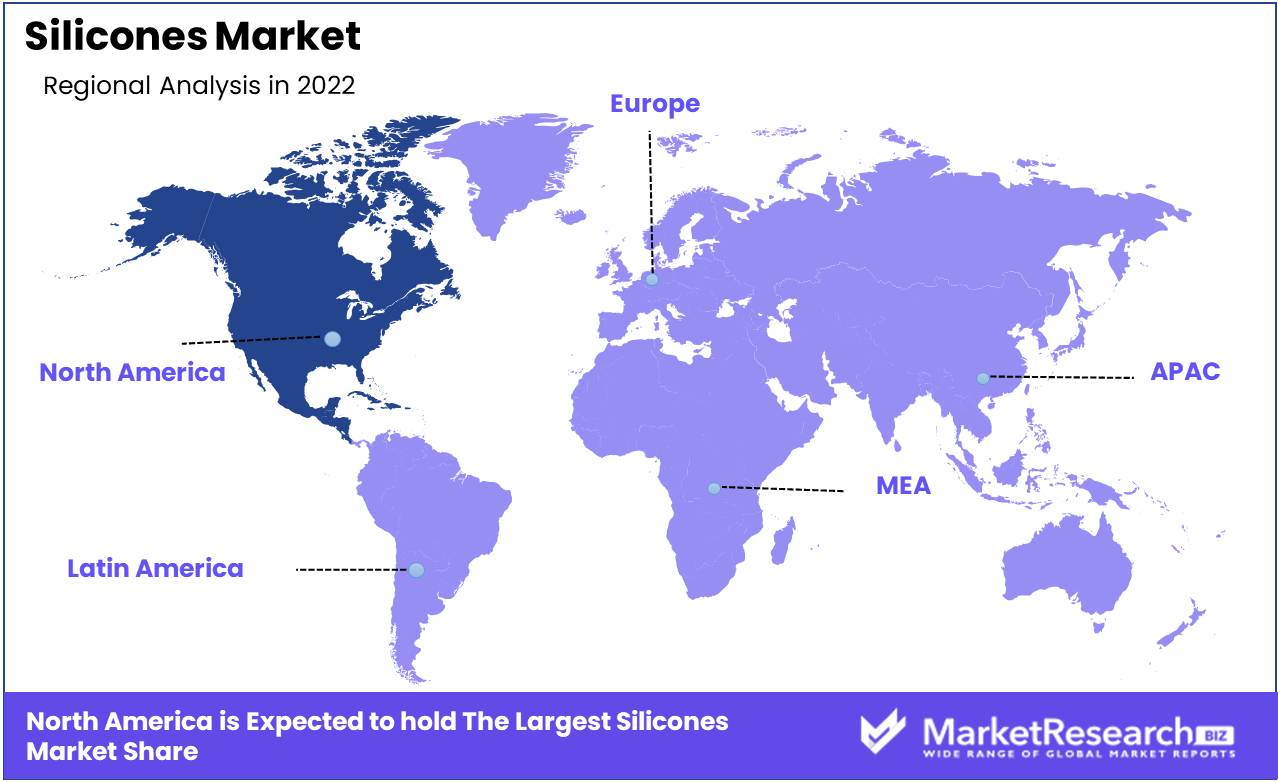

Regional Analysis

North America has a robust industrial infrastructure, especially in the automotive, electronics, construction, and healthcare industries. This robust infrastructure provides a firm basis for Silicones' widespread use in a variety of applications. Silicones' expansion and dominance have been fuelled by the region's mature industries, as well as its culture of innovation and technological advances.

Silicone-related technological advancements and research are thriving in North America. Universities, research institutions, and industry actors in this region are constantly seeking to improve the properties and discover new applications for silicone-based materials. This emphasis on research and development fosters innovation, enabling North America to maintain a competitive advantage in the global Silicones market.

Silicones are produced by a number of market leaders and manufacturers in North America. These businesses have extensive knowledge, production capabilities, and distribution networks, allowing them to satisfy the diverse needs of a variety of industries and customers. The presence of these key market participants strengthens North America's market dominance and contributes to its ability to establish market trends and influence the global silicone market.

The dominance of North America in the Silicones market extends beyond its borders. The region's market participants have a significant global presence, exporting silicone-based products to international markets. Frequently, North American businesses function as industry leaders, establishing standards for quality, innovation, and technological progress. This global influence further strengthens North America's market dominance.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Dow Corning Corporation is one of the largest participants in the Silicones Market, offering an extensive variety of fluids, rubbers, and resins. The company has been emphasizing on product innovation to meet the changing demands of the Silicones Market and has a strong global presence.

Wacker Chemie AG is another major player in the Silicones Market, offering silicones, polymers, and solutions, among other products. The company is known for its commitment to sustainability and has been investing in R&D to produce eco-friendly products.

Momentive Performance Materials Inc. is a global leader in the Silicones Market, with products for diverse end-use industries including automotive, construction, and healthcare. The company places a strong emphasis on developing innovative customer-focused solutions.

Shin-Etsu Chemical Co., Ltd. is a leading Silicones Market supplier, providing products for the electronic, construction, and automotive industries. The company has been investing in R&D to come up with new and innovative products and has a strong global presence.

Elkem Silicones is a major company in the Silicones Market, offering an extensive selection of sealants, resins, and fluids. The company has been investing in research and development to come up with eco-friendly solutions as part of its commitment to sustainability.

Top Key Players in Silicones Market

- Dow Corning Corporation

- Wacker Chemie AG

- Elkem Silicones

- Shin-Etsu Chemical Co.

- Momentive Performance Materials Inc

- Evonik Industries AG

- KCC Corporation

- Siltech Corporation

- BASF SE

Recent Development

- In October 2023, Elkem presented silicone parts printed using the AMSil™ and AMSil SILBIONE™ range. These silicone solutions utilize Additive Manufacturing/3D Printing with LDM (Liquid Deposition Modeling) technology to produce functional parts from 100% genuine silicone elastomers.

- In April 2023, DuPont introduced new silicone blends designed to address various skin conditions. These innovative products include both low-cyclosiloxane silicone elastomer blends and silicone resin blends.

- In March 2023, U.S.-based chemical conglomerate Dow launched a photovoltaic (PV) product line with six silicone-based sealants and adhesives solutions for PV module assembly. This new product line, named DOWSIL, is designed to enhance module performance and offers solutions for various aspects of PV module assembly.

- In August 2023, Wacker Chemie announced the expansion of its silicone production capacity in China. The expansion is expected to be completed in 2024 and will increase Wacker's silicone production capacity in China by 25%.

Report Scope

Report Features Description Market Value (2022) USD 20.7 Bn Forecast Revenue (2032) USD 29.8 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Elastomers, Fluids, Resins)

By End-user (Construction, Consumer Goods, Transportation, Energy, Electrical & Electronics, Paper, Textiles, Others (Health Care, etc.))

By Application (Sealants, Rubber, Coatings, Emulsions, Others (Greases, etc.)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of Asia Pacific; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dow Corning Corporation, Wacker Chemie AG, Elkem Silicones, Shin-Etsu Chemical Co., Momentive Performance Materials Inc, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Dow Corning Corporation

- Wacker Chemie AG

- Elkem Silicones

- Shin-Etsu Chemical Co.

- Momentive Performance Materials Inc

- Evonik Industries AG

- KCC Corporation

- Siltech Corporation

- BASF SE