Tanning gel Market By Product Type (Indoor Tanning Gel, Outdoor Tanning Gel, Self-Tanning Gel), By Skin Type (Normal Skin, Sensitive Skin, Dry Skin), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets/Hypermarkets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50474

-

Aug 2024

-

302

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

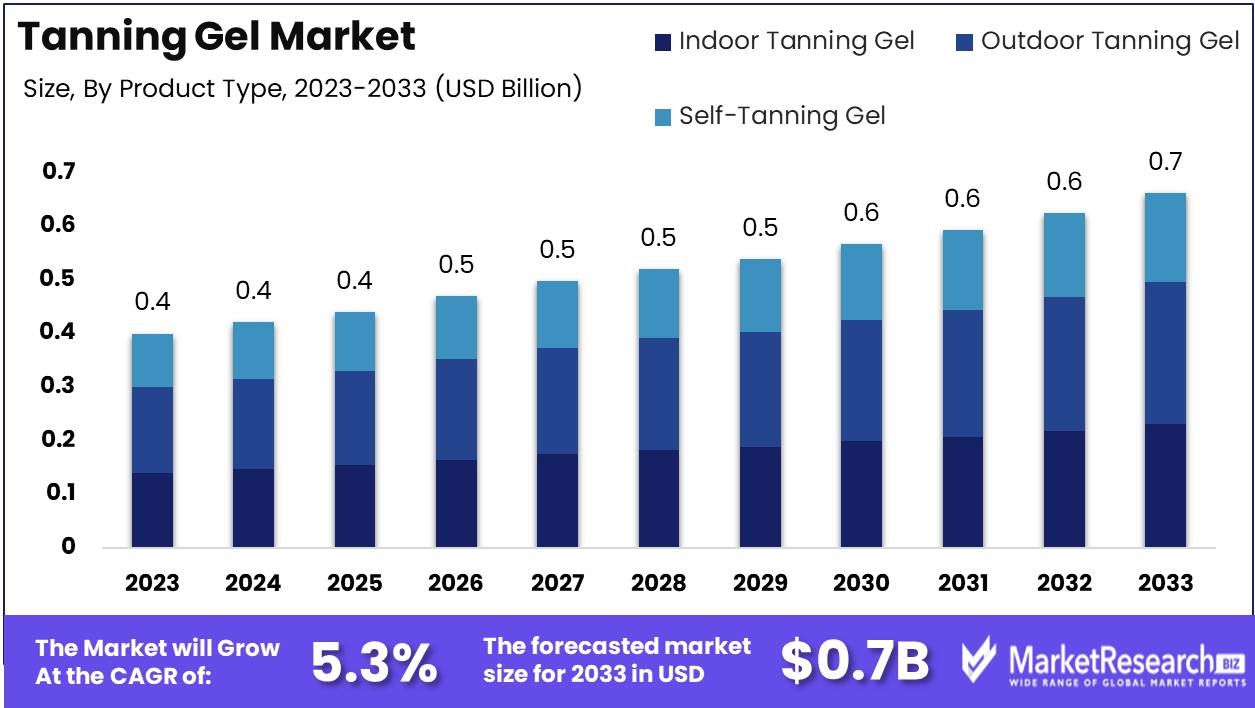

The Global Tanning Gel Market was valued at USD 0.4 Bn in 2023. It is expected to reach USD 0.7 Bn by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Tanning Gel Market focuses on the development, distribution, and consumer use of gels formulated to provide a sun-kissed glow without sun exposure. These products cater to the increasing demand for safe, convenient tanning alternatives that avoid UV damage. Tanning gels, often enriched with skin-nourishing ingredients, offer streak-free, quick-drying applications, making them popular among consumers seeking natural-looking results. The market is driven by innovations in product formulations, enhanced by clear, non-sticky gels that deliver consistent, even tans. Key players leverage these attributes to capture market share in a competitive landscape.

The Tanning Gel Market is experiencing steady growth, driven by consumer demand for safe, effective alternatives to traditional sun tanning. This market is characterized by innovations that address key consumer concerns, such as achieving a natural-looking tan without the risk of UV exposure, streaks, or an orange tint. Products like Babaria's Coconut & Carrot Tanning Jelly SPF30 exemplify this trend, offering a tanning solution that not only provides a sun-kissed appearance but also nourishes the skin with ingredients like coconut oil and carrot extract. This dual benefit is increasingly appealing to consumers who prioritize both aesthetics and skincare.

The market's expansion is further supported by the development of clear, quick-drying formulas designed for convenience and ease of use. These formulations, which typically dry within 10-15 minutes, allow for a streak-free application that appeals to consumers seeking efficient, low-maintenance tanning solutions. The absence of stickiness and the assurance of a natural finish have become significant selling points, driving product adoption across various demographics.

As consumer preferences continue to shift toward health-conscious, time-saving beauty solutions, the Tanning Gel Market is poised for further growth. Companies that focus on product innovation, particularly in enhancing application ease and skin benefits, are likely to lead the market. Leveraging online platforms for distribution and consumer education will be crucial in expanding market reach and building brand loyalty.

Key Takeaways

- Market Value: The Global Tanning Gel Market was valued at USD 0.4 Bn in 2023. It is expected to reach USD 0.7 Bn by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Product Type: Outdoor Tanning Gel makes up 40% of the market, popular for achieving a natural tan in outdoor settings.

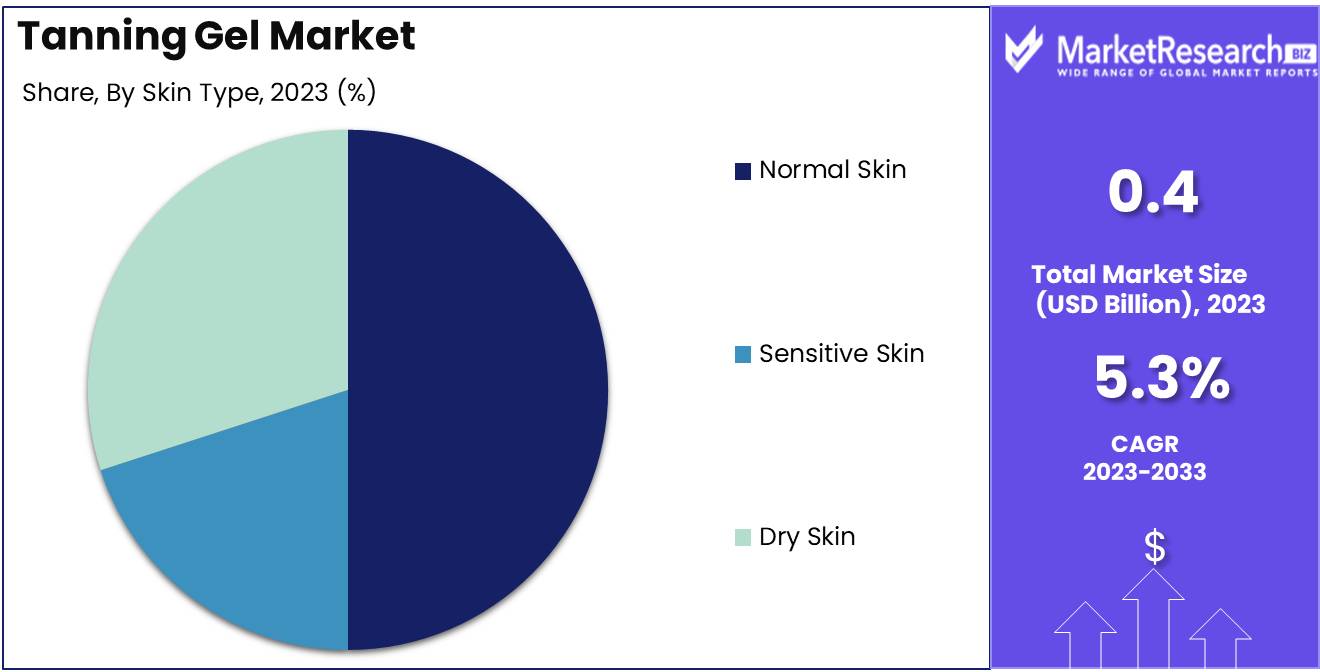

- By Skin Type: Normal Skin is the largest segment, accounting for 50% of the market.

- By Distribution Channel: Online Retail represents 40%, benefiting from the convenience and accessibility of online shopping.

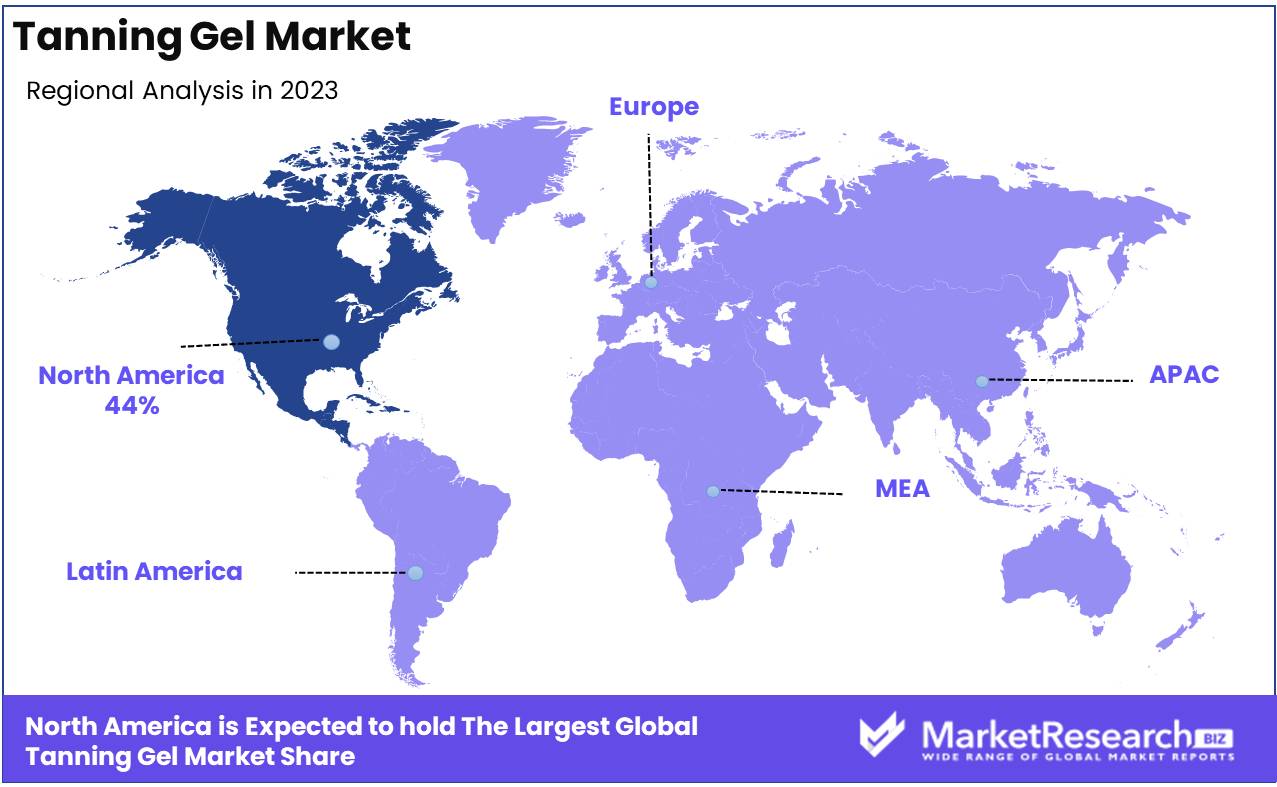

- Regional Dominance: North America holds a 44% market share, driven by a strong preference for tanning products.

- Growth Opportunity: Expanding product lines with SPF and skin-nourishing ingredients can attract health-conscious consumers and drive market growth.

Driving factors

Growing Consumer Demand for Sunless Tanning Products Fuels Market Expansion

The Tanning Gel Market is experiencing significant growth due to the increasing consumer demand for sunless tanning products. This shift is largely driven by the desire for a sun-kissed glow without the risks associated with sun exposure. Sunless tanning products, such as tanning gels, offer a convenient and safer alternative to traditional sunbathing or tanning beds, which are linked to skin damage and an increased risk of skin cancer.

This growing demand is reflected in the broader sunless tanning products market, which is expected to grow during the next few years. The rising popularity of these products is propelling the tanning gel segment, as consumers seek effective and easy-to-apply options to achieve a natural-looking tan.

Rising Awareness of Skin Damage from UV Exposure Drives Market Adoption

The increasing awareness of the dangers of ultraviolet (UV) radiation is a major factor contributing to the growth of the Tanning Gel Market. As public health campaigns and dermatologists continue to highlight the risks of prolonged sun exposure, including premature aging, skin burns, and an elevated risk of melanoma, consumers are increasingly turning to sunless tanning solutions.

Tanning gels provide an attractive option for those looking to maintain their skin’s health while still achieving a tanned appearance. This heightened awareness has led to a growing preference for products that offer a safe alternative to traditional tanning methods, significantly boosting the market for tanning gels.

Increasing Popularity of Cosmetic and Beauty Products Expands Market Opportunities

The overall growth in the cosmetic and beauty industry is another critical driver for the Tanning Gel Market. The global beauty market is reflecting a growing consumer interest in personal grooming and appearance-enhancing products. Tanning gels, as part of the broader cosmetic category, are benefiting from this trend. The increased focus on aesthetics, coupled with the influence of beauty influencers and social media, has heightened consumer awareness and demand for tanning gels.

This trend is particularly strong among younger demographics, who are more inclined to experiment with cosmetic products and seek out new ways to enhance their appearance. The synergy between the rising popularity of beauty products and the demand for sunless tanning options is expected to drive substantial growth in the Tanning Gel Market.

Restraining Factors

Concerns Over Chemical Ingredients in Tanning Gels Hinder Market Growth

One of the primary restraining factors for the Tanning Gel Market is the growing concern among consumers about the chemical ingredients used in these products. As awareness around health and environmental impacts increases, consumers are becoming more cautious about the substances they apply to their skin. Many conventional tanning gels contain synthetic chemicals, such as dihydroxyacetone (DHA), which, while effective in producing a tanned appearance, have raised questions regarding their long-term safety.

This concern is particularly pronounced among health-conscious consumers who prioritize natural and organic products. The fear of potential skin irritation, allergic reactions, or even long-term health risks associated with chemical ingredients is leading some consumers to shy away from tanning gels, thereby restraining market growth. The demand for products free from harmful chemicals is rising, and failure to address these concerns could limit market expansion.

High Competition from Alternative Tanning Products Limits Market Share

The Tanning Gel Market faces intense competition from a variety of alternative tanning products, which poses a significant challenge to its growth. Products such as self-tanning lotions, sprays, and mousses offer similar results and often come with their own unique benefits, such as easier application or a more natural finish. In addition, innovations in the sunless tanning industry, including gradual tanners and hybrid products combining skincare benefits with tanning, are attracting consumers away from traditional tanning gels.

This high level of competition forces tanning gel brands to differentiate themselves through price, formulation, and marketing, often making it difficult to capture and retain market share. As consumers have a wide array of sunless tanning options, the Tanning Gel Market may experience slower growth, particularly in regions where alternative products are more established.

By Product Type Analysis

Outdoor tanning gel constitutes 40% of the Tanning Gel Market by product type.

In 2023, Outdoor Tanning Gel held a dominant market position in the By Product Type segment of the Tanning Gel Market, capturing more than a 40% share. Outdoor tanning gels have gained significant popularity among consumers who prefer natural sun tanning, driven by a desire for a sun-kissed glow during outdoor activities. These products are specifically formulated to accelerate the tanning process under direct sunlight, making them highly sought after, particularly in regions with strong beach and outdoor cultures such as North America and Europe. The appeal of outdoor tanning gels is further enhanced by their ability to provide an even, long-lasting tan while often incorporating skin-protecting and moisturizing ingredients, which cater to the growing consumer demand for multifunctional skincare products.Indoor tanning gels and self-tanning gels also hold significant market shares but cater to different consumer needs. Indoor tanning gels are popular among users who frequent tanning salons, while self-tanning gels appeal to those seeking a tan without sun exposure, especially in urban areas or regions with less sun. However, the preference for a natural-looking tan obtained outdoors continues to drive the dominance of outdoor tanning gels in the market.

By Skin Type Analysis

Normal skin accounts for 50% of the Tanning Gel Market by skin type.

In 2023, Normal Skin held a dominant market position in the By Skin Type segment of the Tanning Gel Market, capturing more than a 50% share. Tanning gels formulated for normal skin types are the most prevalent in the market due to their broad applicability and suitability for a wide consumer base. These products are designed to work effectively without causing irritation, making them accessible to the majority of consumers. The dominance of normal skin formulations is particularly strong in regions like North America and Europe, where consumers prioritize products that offer a balance of efficacy and skin health.Sensitive and dry skin formulations, while important, cater to niche markets. These products often include additional moisturizing cream, moisturizing agents and hypoallergenic ingredients to prevent irritation and dehydration, making them essential for consumers with specific skin concerns. Despite this, the versatility and wide appeal of tanning gels for normal skin ensure they maintain a leading position in the market.

By Distribution Channel Analysis

Online retail represents 40% of the Tanning Gel Market by distribution channel.

In 2023, Online Retail held a dominant market position in the By Distribution Channel segment of the Tanning Gel Market, capturing more than a 40% share. The rise of e-commerce has significantly impacted how consumers purchase tanning products, with online retail becoming the leading distribution channel. Online platforms offer a convenient shopping experience, extensive product ranges, and competitive pricing, which appeal to a broad demographic. This trend is particularly pronounced in regions like North America and Europe, where high internet penetration and advanced logistics support seamless online shopping experiences.Specialty stores and supermarkets/hypermarkets remain important retail channels, especially for consumers who prefer in-person purchases and immediate access to products. The convenience of online shopping, combined with detailed product descriptions and customer reviews, continues to drive the dominance of online retail in the tanning gel market, reflecting broader shifts in consumer buying behavior.

Key Market Segments

By Product Type

- Indoor Tanning Gel

- Outdoor Tanning Gel

- Self-Tanning Gel

By Skin Type

- Normal Skin

- Sensitive Skin

- Dry Skin

By Distribution Channel

- Online Retail

- Specialty Stores

- Supermarkets/Hypermarkets

Growth Opportunity

Development of Natural and Skin-Friendly Tanning Gels

The increasing demand for natural and skin-friendly products presents a significant growth opportunity for the Tanning Gel Market in 2024. As consumers become more concerned about the potential risks associated with chemical ingredients, the development of tanning gels formulated with natural and organic ingredients is expected to gain traction. Companies that invest in research and development to create products that are free from synthetic chemicals, allergens, and irritants are likely to capture a larger share of the market.

This trend aligns with the broader shift toward clean beauty, where transparency in ingredients and safety is paramount. The introduction of such products can appeal to a growing segment of health-conscious consumers, driving both brand loyalty and market growth.

Expansion in Markets with High Sun Protection Awareness

Expanding into markets with a high awareness of sun protection offers another promising opportunity for the Tanning Gel Market. Regions where consumers are particularly conscious of the dangers of UV exposure, such as North America and parts of Europe, are ripe for growth. In these markets, the preference for sunless tanning methods over traditional sunbathing is stronger, creating a favorable environment for the adoption of tanning gels.

Leveraging this awareness to market tanning gels as a safer, skin-protective alternative to sun exposure can further enhance their appeal. By focusing on these regions and educating consumers about the dual benefits of achieving a tan while protecting their skin, companies can effectively expand their market presence and drive sales growth in 2024.

Latest Trends

Increased Use of DHA for Safe and Effective Tanning

In 2024, the Tanning Gel Market is expected to witness a continued reliance on DHA (Dihydroxyacetone) as a key ingredient for achieving safe and effective tanning results. DHA, a colorless sugar, reacts with the amino acids in the skin's surface layer to produce a browning effect that mimics a natural tan. This ingredient has become a cornerstone of sunless tanning products due to its safety profile and efficacy, which has been validated by dermatologists and regulatory bodies.

As consumers increasingly prioritize products that deliver consistent results without compromising skin health, the use of DHA in tanning gels is likely to remain a dominant trend. Manufacturers focusing on optimizing DHA formulations to reduce potential odors and improve the natural appearance of the tan will likely capture a significant share of the market.

Introduction of Tinted and Instant-Effect Tanning Gels

Another key trend shaping the Tanning Gel Market in 2024 is the introduction of tinted and instant-effect tanning gels. These products are designed to offer immediate results, providing consumers with a visible tan as soon as the product is applied. This instant gratification meets the needs of users seeking a quick and easy solution for special events or last-minute plans. Tinted formulas help ensure even application, reducing the risk of streaks and patchiness, which is a common concern with traditional tanning products.

The growing popularity of these innovations reflects consumer demand for convenience and versatility in their beauty routines. Companies that invest in developing and marketing these products are expected to see strong consumer interest and increased market share, as they cater to the evolving preferences of the modern beauty consumer.

Regional Analysis

In 2023, North America dominated the Tanning Gel Market, holding a commanding 44% share.

The North American market for tanning gels is driven by the region's high demand for sunless tanning products, with the United States being a significant contributor. The preference for achieving a sun-kissed glow without the risks associated with UV exposure has led to a surge in the popularity of tanning gels. The market is further supported by a strong beauty and personal care industry, where innovation in product formulations, such as the inclusion of moisturizing and anti-aging ingredients, has resonated well with consumers.

In Europe, the market is also robust, with countries like the United Kingdom, Germany, and France leading the demand. The region's consumers are increasingly aware of the harmful effects of excessive sun exposure, which has shifted preferences towards safer alternatives like tanning gels. Asia Pacific is emerging as a lucrative market, particularly in countries such as Australia and Japan, where skincare and sun protection are highly prioritized. The Middle East & Africa and Latin America are experiencing gradual growth, driven by increasing beauty consciousness and the rising influence of Western beauty trends.

North America's dominance is reinforced by a strong cultural emphasis on appearance and the presence of key market players who continuously innovate and expand their product offerings. The region's consumers are also more inclined towards premium products, which has contributed to the overall growth and market leadership of North America in the tanning gel industry.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Tanning Gel Market is expected to grow steadily in 2024, driven by increasing consumer interest in sunless tanning solutions. Australian Gold and St. Tropez (PZ Cussons) are likely to maintain their leadership positions in the market, capitalizing on their well-established brands and broad product portfolios. These companies have successfully tapped into the premium segment by offering high-quality, innovative products that cater to a diverse range of skin tones and preferences. Their continued investment in R&D, coupled with strong marketing campaigns, will be instrumental in sustaining their dominance, particularly in North America and Europe.

Banana Boat (Edgewell Personal Care) and Sun Bum (S.C. Johnson & Son, Inc.) are anticipated to focus on expanding their reach in emerging markets, particularly in Asia Pacific and Latin America, where the demand for sun care products is on the rise. These companies are expected to leverage their parent companies' extensive distribution networks and brand recognition to drive sales. Additionally, their commitment to offering affordable, yet effective tanning gels will resonate well with cost-conscious consumers in these regions.

L'Oréal S.A. and Neutrogena (Johnson & Johnson) are likely to strengthen their positions through strategic acquisitions and collaborations, aimed at enhancing their product offerings and market penetration. These companies are expected to place a strong emphasis on safety and skin health, addressing the growing consumer concerns about the potential risks associated with tanning products. As the market evolves, key players like Bondi Sands and ProTan will continue to innovate, offering unique formulations and packaging solutions that cater to the preferences of younger, socially conscious consumers.

Market Key Players

- Australian Gold

- St. Tropez (PZ Cussons)

- Banana Boat (Edgewell Personal Care)

- Sun Bum (S.C. Johnson & Son, Inc.)

- Hawaiian Tropic (Edgewell Personal Care)

- Bondi Sands

- Neutrogena (Johnson & Johnson)

- L'Oréal S.A.

- ProTan

- Malibu Sun

Recent Development

- In March 2024, Bondi Sands introduced an eco-friendly tanning gel made from natural ingredients. This product is projected to boost their sales by 20% as it aligns with growing consumer demand for sustainable products.

- In January 2024, Australian Gold released a new tanning gel with added SPF protection, catering to consumers seeking both tanning and sun protection. This launch is expected to increase market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 0.4 Bn Forecast Revenue (2033) USD 0.7 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Indoor Tanning Gel, Outdoor Tanning Gel, Self-Tanning Gel), By Skin Type (Normal Skin, Sensitive Skin, Dry Skin), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets/Hypermarkets) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Australian Gold, St. Tropez (PZ Cussons), Banana Boat (Edgewell Personal Care), Sun Bum (S.C. Johnson & Son, Inc.), Hawaiian Tropic (Edgewell Personal Care), Bondi Sands, Neutrogena (Johnson & Johnson), L'Oréal S.A., ProTan, Malibu Sun Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Australian Gold

- St. Tropez (PZ Cussons)

- Banana Boat (Edgewell Personal Care)

- Sun Bum (S.C. Johnson & Son, Inc.)

- Hawaiian Tropic (Edgewell Personal Care)

- Bondi Sands

- Neutrogena (Johnson & Johnson)

- L'Oréal S.A.

- ProTan

- Malibu Sun