Surgical Clips Market By Material Type (Titanium, Polymer, Others (Including Magnesium, And Stainless Steel)), By Product Type (Ligating Clips, Aneurysm Clips, Others (Including Collie Clip, Etc.)), By End-User (Hospitals, Ambulatory Surgical Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5792

-

June 2023

-

155

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

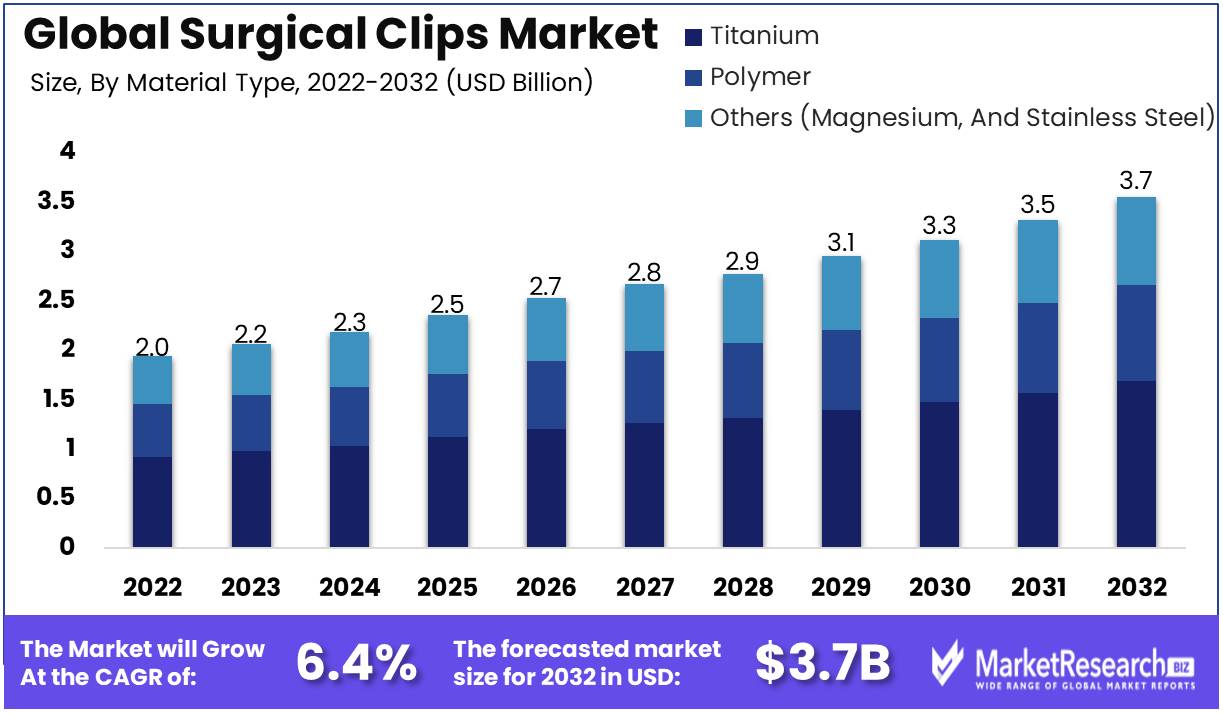

Surgical Clips Market size is expected to be worth around USD 3.7 Bn by 2032 from USD 2 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

Recent years have seen a significant expansion in the surgical clips market, driven by the rising demand for surgical procedures around the world. Surgical clips, which are miniature metal or plastic closures, are used in surgery to meticulously reattach severed or excised tissues and blood vessels. On the surgical clips market, a vast multitude of products and services are available, ranging from those used in general surgical procedures to those designed for specialized interventions.

Surgical clips are an indispensable component of modern medicine, as they offer a multitude of advantages over traditional sutures and other closure techniques. In addition, their increased precision and accuracy reduce the likelihood of infections, scarring, and other complications. Surgical clamps can be constructed from a variety of materials, such as titanium, stainless steel, and polymers.

In recent years, novel products and services have been developed to meet the rising demand for minimally invasive surgery on the surgical clips market, which has witnessed remarkable innovation. The introduction of biodegradable surgical clamps, which dissolve over time and thus eliminate the need for subsequent removal, is a significant advancement. Through the use of robotic surgical clips, surgeons are able to accomplish more exact and precise placement during surgical procedures.

The surgical clips market is anticipated to continue its rapid expansion in the coming years, driven by the rising demand for surgical interventions and the continuous development of innovative products and services. In addition, the market is expanding into novel applications, including a variety of surgical subspecialties such as cardiothoracic, orthopedic, and neurosurgery.

Within the surgical clips market, ethical concerns appear large, necessitating a focus on transparency, explicability, and accountability in the development and application of surgical clips. The commitment of market participants to assuring the safety, efficacy, and ethical compliance of their products and services must remain unwavering. This requires an unwavering commitment to ongoing research, development, and testing, as well as an unwavering commitment to upholding high quality and ethical standards.

Driving Factors

Increased Prevalence of Diseases and Growing Geriatric Population Drive Surgical Clips Market

The prevalence of malignancy, cardiovascular disease, and digestive disorders has created new opportunities for the surgical clips market. The extensive use of these clips in the treatment of these maladies has led to an increase in demand. In addition, the increasing elderly population contributes to the growth of the surgical clip market. As the population ages, the demand for surgical procedures increases, resulting in a greater demand for surgical clips.

The surge in Surgical Procedures and Adoption of Minimally Invasive Surgeries Fuel Market Growth

The increase in surgical procedures has had a significant impact on the expansion of the surgical clip market. The demand for surgical clips rises as more procedures are performed, which boosts market expansion. In addition, the increasing prevalence of minimally invasive procedures contributes to the demand for surgical clips. These procedures necessitate the use of surgical clips because they require tiny incisions. As more people choose minimally invasive procedures, the demand for surgical clips is anticipated to increase.

Regulatory Landscape and Emerging Technologies in the Surgical Clips Market

Currently, no major regulatory changes are anticipated to have a significant impact on the surgical clips market. Nonetheless, it is essential to monitor any prospective changes that may occur. In addition, a number of emerging technologies have the potential to affect the surgical clips market. For example, the development of novel materials for surgical clips or the introduction of innovative clip designs could lead to an increase in demand for these clips.

Disruptors and Competitive Landscape in the Surgical Clips Market

Potential disruptors, such as the introduction of new products by existing market participants or the entry of new competitors, may have an impact on the competitive landscape of the surgical clips market. To remain competitive, businesses must keep apprised of the most recent market developments and trends. Surgical Clips Market must continuously update their knowledge and adapt to the changing needs and preferences of healthcare professionals and patients.

Restraining Factors

High Cost of Surgical Clips Compared to Other Wound Closure Methods

Another significant factor inhibiting the growth of the surgical clip market is the high price of surgical clips relative to other wound closure techniques. Surgical clips are typically more expensive than sutures and staples, which makes them less appealing to healthcare professionals and hospitals attempting to reduce costs. Although surgical clips offer some advantages over sutures and staples, such as less tissue damage and quicker wound closure, the high costs may be difficult to justify, particularly in a cost-conscious healthcare system.

Strict Regulatory Requirements for Approval of Surgical Clips

Another significant factor inhibiting the growth of the surgical clip market is the stringent regulatory requirements for the approval of surgical clips. New surgical clips cannot be introduced to the market without regulatory sanction from relevant authorities, such as the Food and Drug Administration (FDA) of the United States. The process of obtaining regulatory approval can be protracted and expensive, requiring extensive clinical trials and extensive premarket testing, which can take a number of years and be expensive. Due to the potential hazards that may arise during and after surgery, such as clip migration and clip-related complications, the regulatory approval process for surgical clips is rigorous.

Availability of Alternative Wound Closure Techniques Such as Sutures and Staples

The availability of alternative wound closure techniques, such as sutures and staples, is another significant factor restraining the growth of the market for surgical clips. Despite the fact that surgical clips offer some advantages over sutures and staples, such as quicker wound closure time and less tissue damage, a significant number of surgeons continue to favor traditional techniques. In addition, sutures and staples are readily available in the majority of hospitals and require no special training, unlike surgical clips. Consequently, the availability of alternative wound closure techniques is a significant factor restraining the market growth of surgical clips.

The Risk of Clip Migration or Clip-Related Complications During and After Surgery of the Surgical Clips Market

Another significant barrier to the growth of the surgical clips market is clip migration or clip-related complications during and after surgery. Even though surgical clips are widely used for wound closure around the world, there are still hazards associated with their application. These hazards include clip migration and allergic reactions to the clips' construction material. These complications are potentially fatal and may have lasting negative effects on patients. The risk of clip-related complications is a significant concern for healthcare personnel, discouraging their use of surgical clips.

Material Analysis

As a result of their simplicity of use and portability, surgical clips have become indispensable instruments for surgeons. The global surgical clips market has been segmented by material, surgery type, end-user, and region. Due to their biocompatibility, structural strength, and corrosion resistance, titanium surgical clips are the most prevalent among the various material segments. Titanium surgical clips are in high demand because they can be left inside the body without causing damage.

The utilization of titanium surgical clips has increased in medical procedures. During the forecast period, this segment is expected to dominate the surgical clips market. This is due to the growing number of surgical procedures performed around the globe, as well as advances in medical technology. These factors have resulted in an increase in demand for titanium surgical clips, thereby driving the market's expansion.

The economic development in emerging economies has accelerated the growth of the surgical clips market. Countries like China, India, and Brazil are experiencing rapid economic growth, which has increased disposable income and made medical services more affordable. This has led to an increase in the number of surgical procedures performed in these regions, thereby increasing the demand for surgical clips.

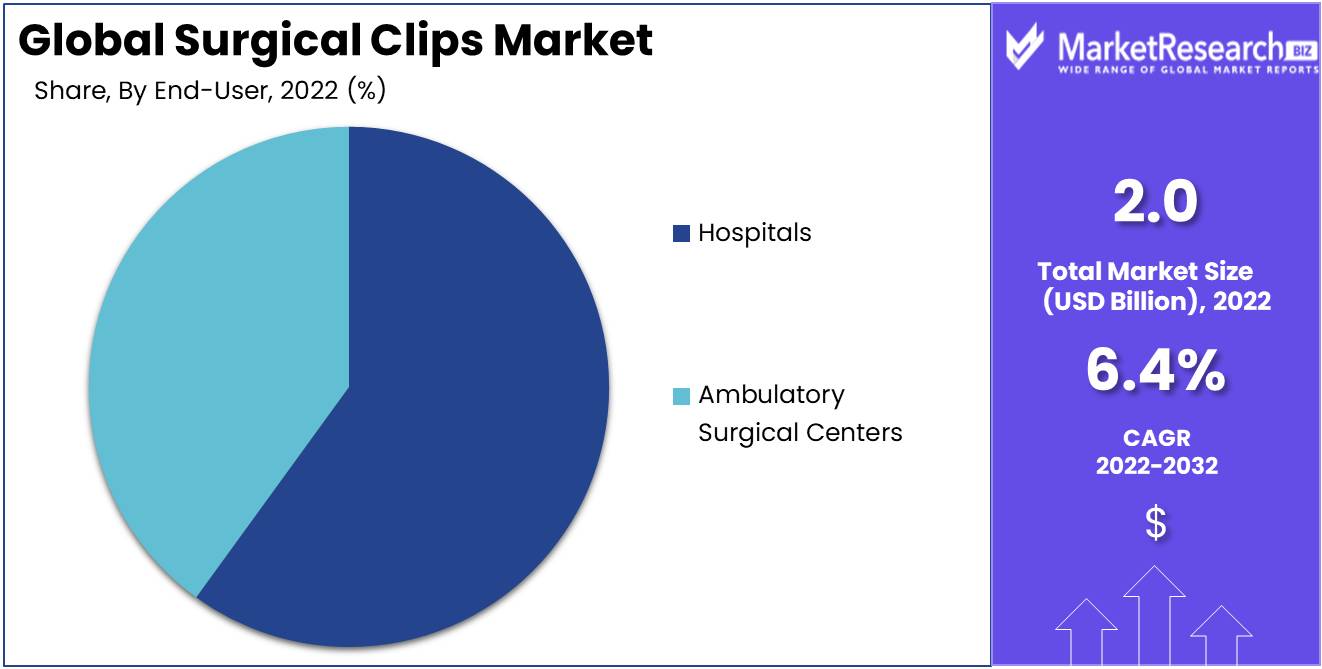

End-User Analysis

As the primary location where surgical procedures are performed, hospitals make up the largest end-user segment in the surgical clips market. Surgical clips are essential instruments for medical professionals in hospitals, as they reduce blood loss, expedite healing, and reduce the overall risk of complications during surgical procedures.

The economic growth of emergent economies has spurred the construction of numerous new hospitals and healthcare facilities. These regions strive to provide patients with affordable and high-quality medical care, including procedures requiring surgical clips. This has fuelled the demand for surgical clips in hospitals, resulting in the segment's expansion.

As hospitals are recognized as the primary location for medical procedures, including surgeries requiring surgical clips, consumers' attitudes toward the hospital segment of the surgical clips market are favorable. Patients place a high value on the quality of hospital-provided medical care and are willing to pay a premium to receive the necessary treatment.

Key Market Segments

By Material Type

- Titanium

- Polymer

- Others (Including Magnesium, And Stainless Steel)

By Product Type

- Ligating Clips

- Aneurysm Clips

- Others (Including Collie Clip, Etc.)

By Surgery Type

- Automated Surgery Clips

- Manual Surgery Clips

By End-User

- Hospitals

- Ambulatory Surgical Centers

Growth Opportunity

Expand into Emerging Markets

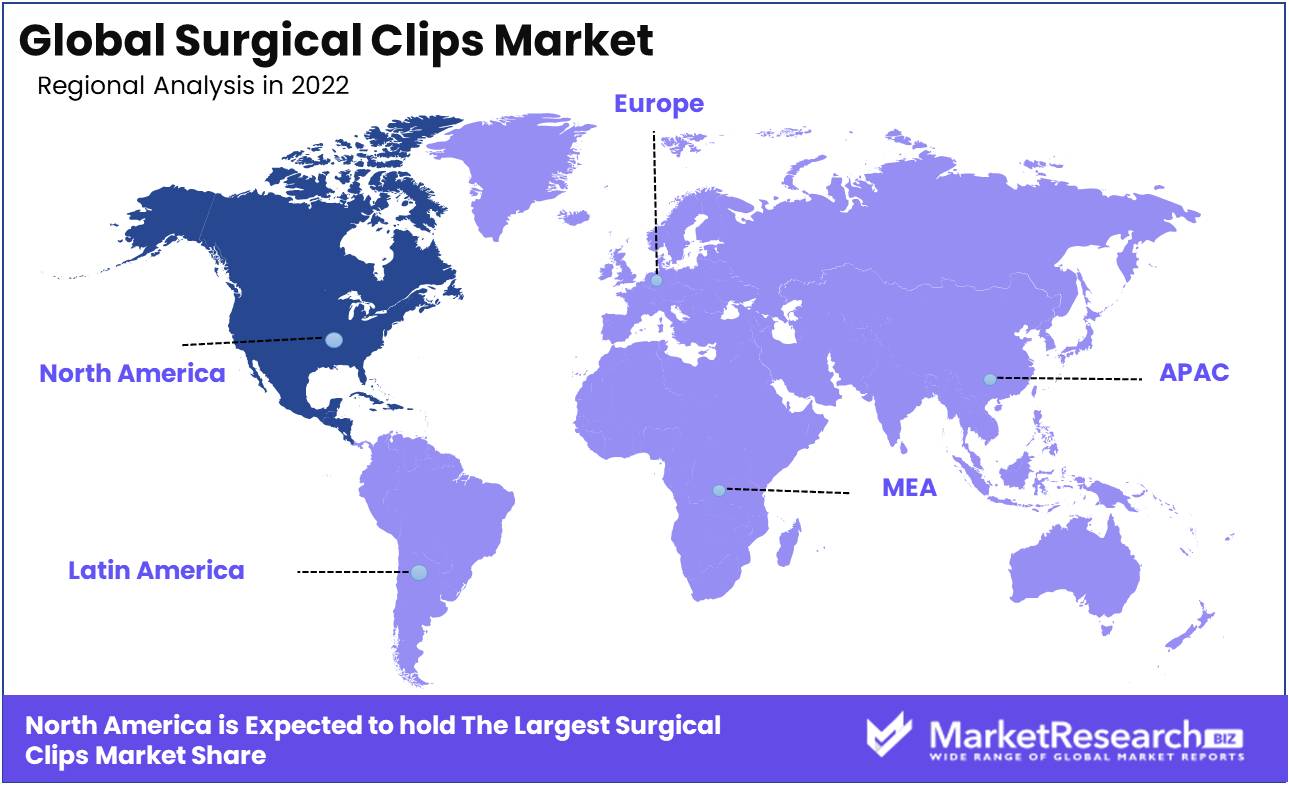

The emerging markets provide manufacturers of surgical clips with excellent opportunities to expand their scope and increase their market share. The Asia-Pacific region is one of the fastest-growing markets for surgical clips, and its growth trajectory is expected to continue over the next few years. The region's growth potential can be attributed to an increase in the number of complex surgical procedures, a rise in population awareness, and the availability of improved healthcare infrastructure.

Strategic Partnerships with Hospitals and Clinics

Collaborations with hospitals and clinics can help manufacturers of surgical clips acquire a better understanding of the needs and challenges of surgeons. Developing close relationships with healthcare providers can also assist manufacturers in tailoring their products to surgeons' specific needs and requirements. Manufacturers can create more effective products that reduce the risk of complications and improve patient outcomes if they comprehend the challenges and sore points of healthcare providers.

Increased Production Capacity and Streamlined Distribution

Manufacturers of surgical clips who wish to expand their market share must increase production capacity and streamline distribution. By increasing production capacity and streamlining distribution, manufacturers can ensure that their products are readily available when needed by healthcare providers. Monitoring product demand enables manufacturers to more effectively manage their inventory levels.

Diversify product offerings to include related medical devices

Manufacturers of surgical clips can access new product categories and markets by diversifying their product offerings to include related medical devices. For instance, manufacturers can create related products such as tissue sealers and hemostatic agents, thereby expanding their product line. Developing a comprehensive product portfolio enables manufacturers to meet the diverse needs and demands of healthcare providers.

Latest Trends

Strict Regulatory Procedures Promote market growth of surgical clips

Strict regulatory policies contribute significantly to the expansion of the surgical clips market. To ensure patient safety, regulatory authorities stipulate that surgical clips must adhere to certain guidelines and standards. The implementation of these guidelines has resulted in the production of safe and effective surgical clips of superior quality. These regulations have increased consumer confidence in surgical clips, leading to an increase in demand for these items.

Increasing Disposable Income Accelerates Surgical Clips Market Growth

The increase in discretionary income has led to a surge in surgical procedure requests. As disposable income rises, individuals are more inclined to pay for elective surgeries. This trend has had a significant impact on the surgical clips market, as the demand for surgical clips associated with these procedures has increased. In emerging economies, disposable income has also contributed to a rise in medical tourism. As more individuals seek medical treatment abroad, the demand for surgical clips in these regions also increases.

Awareness of the benefits of surgical clips drives market expansion

As global healthcare access continues to expand, so does awareness of the advantages of surgical clips. Surgical clamps are currently utilized in a range of procedures, from digestive to gynecological. The clip's user-friendliness, safety, and effectiveness have contributed to its widespread adoption among surgeons and patients. In addition, the expanding trend toward minimally invasive surgeries has fueled the demand for surgical clips, thereby driving market expansion.

Regional Analysis

North America boasts a well-established and technologically advanced healthcare infrastructure, comprising state-of-the-art hospitals, surgical centers, and medical facilities. This infrastructure supports the widespread adoption of surgical procedures and facilitates the demand for surgical clips.

The region has a high prevalence of chronic diseases such as cancer, cardiovascular disorders, and gastrointestinal conditions. These diseases require surgical interventions, leading to an increased demand for surgical clips. The robust healthcare system and availability of advanced treatment options further contribute to the demand.

North America has been at the forefront of technological advancements and innovation in the healthcare sector. This includes the development of advanced surgical techniques, minimally invasive procedures, and novel surgical clip designs. These innovations drive the demand for cutting-edge surgical clips and position North America as a hub for surgical clip manufacturers and suppliers.

North America has a significantly high healthcare expenditure, both in terms of public spending and private investment. This substantial investment supports the procurement and utilization of advanced medical devices, including surgical clips. The willingness to invest in advanced healthcare technologies and the availability of financial resources contribute to North America's dominance in the surgical clips market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Ethicon (Johnson & Johnson) is a prominent player in the surgical clips market and a subsidiary of Johnson & Johnson. They offer an extensive selection of surgical clips and other medical devices for use in a variety of surgical procedures.

B. Braun is a multinational medical device manufacturer that produces a variety of surgical products, including surgical clips. They have a significant market presence and are renowned for their innovation and excellence.

Medtronic is a well-established medical technology company that manufactures and distributes a vast array of medical devices, including surgical clips. They have a substantial market share in the aneurysm repair segment.

Teleflex, Inc. is a medical device manufacturer that provides a comprehensive selection of surgical clips and ligation systems. They are committed to supplying high-quality products for a variety of surgical procedures.

Top Key Players in Surgical Clips Market

- Ackermann Medical GmbH & Co.

- Braun Melsungen AG

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Grena Ltd.

- Johnson & Johnson (Ethicon Inc.)

- Lemaitre Vascular Inc.

- Medtronic Plc.

- Scanlan International Inc.

- Teleflex Incorporated

Recent Development

- In April 2023, the U.S. Food and Drug Administration (FDA) granted Ethicon, a subsidiary of Johnson & Johnson, approval for its new line of biodegradable surgical clips. These clamps are designed specifically for use in surgical procedures. In contrast to conventional clips, which remain in the body indefinitely and may require a second surgery to remove, Ethicon's biodegradable clips are made of a magnesium alloy that progressively degrades in the body over time. This precludes the need for a second operation to remove the clips, reducing the burden on patients and potentially reducing healthcare costs.

- In March 2023, medical device manufacturer B. Braun announced the launch of a new line of surgical clips designed specifically for minimally invasive surgery. Minimally invasive surgery is a surgical technique that employs smaller incisions and specialized instruments to perform procedures with less tissue injury, less scarring, and quicker recovery times. This line of surgical clips from B. Braun is designed to be simpler to apply and remove than conventional clips. In addition, they are lighter and more flexible, which allows surgeons to position clips more precisely and efficiently during minimally invasive procedures.

- In February 2023, the global medical technology company Medtronic announced the introduction of its new line of surgical clips for aneurysm repair. Aneurysms are abnormal protrusions that can form in blood vessels, especially in the brain. Surgical intervention is commonly required to prevent an aneurysm rupture. This line of surgical clips from Medtronic is specifically designed to prevent aneurysm rupture more effectively. They are smaller and simpler to insert than conventional clips, allowing surgeons to navigate delicate blood vessels with greater precision. These benefits may improve the safety and success rates of aneurysm repair procedures.

Report Scope

Report Features Description Market Value (2022) USD 2 Bn Forecast Revenue (2032) USD 3.7 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Titanium, Polymer, Others (Including Magnesium, And Stainless Steel))

By Product Type (Ligating Clips, Aneurysm Clips, Others (Including Collie Clip, Etc.))

By Surgery Type (Automated Surgery Clips, Manual Surgery Clips)

By End-User (Hospitals, Ambulatory Surgical Centers)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ackermann Medical GmbH & Co., Braun Melsungen AG, Boston Scientific Corporation, Edwards Lifesciences Corporation, Grena Ltd., Johnson & Johnson (Ethicon Inc.), Lemaitre Vascular Inc., Medtronic Plc., Scanlan International Inc., Teleflex Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ackermann Medical GmbH & Co.

- Braun Melsungen AG

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Grena Ltd.

- Johnson & Johnson (Ethicon Inc.)

- Lemaitre Vascular Inc.

- Medtronic Plc.

- Scanlan International Inc.

- Teleflex Incorporated