Global Supercar Market Based on Type(Convertible Supercar, Non-Convertible Supercar), Based on Application(Cash Payment, Financing/Loan, Leasing), Based on Propulsion(ICE , Battery Electric, Hybrid), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

39400

-

April 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

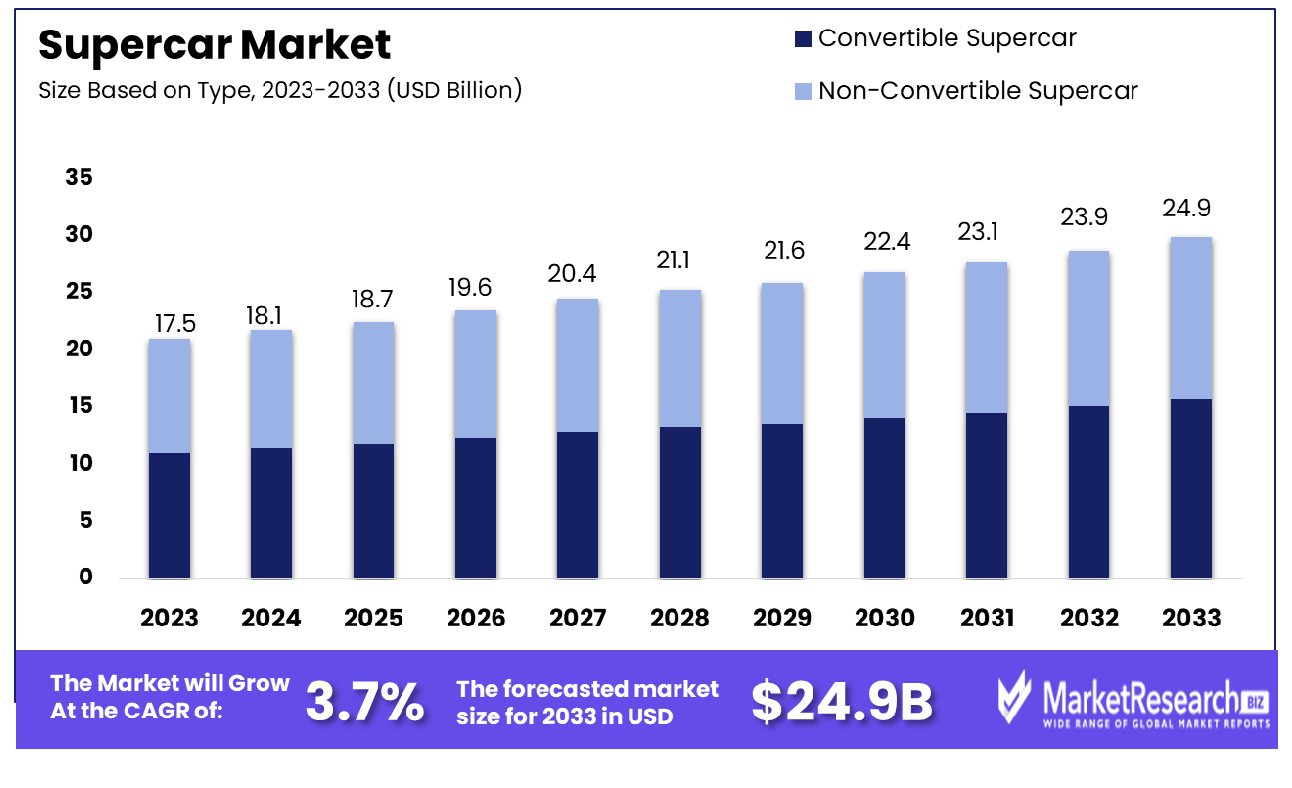

The Global Supercar Market was valued at USD 17.5 billion in 2023. It is expected to reach USD 24.9 billion by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

The sudden rise in population and surge in demand for luxurious cars are some of the main driving factors for the global supercar market expansion. A supercar is a powerful, smooth, and luxurious car. They are defined as exclusive cars because these cars are rarely imported. A supercar is a beast of overall different caliber which has the fastest, most exceptional, powerful, and most magnificent motor vehicles.

According to World Motor Vehicle Production in May 2023, there were 85.4 million motor vehicles were manufactured around the globe, which was a surge of 5.7% as compared to 2021. As the population is increasing, the demand for motor vehicles is also increasing but some of individuals are inclined towards supercars due to their exceptional motor capacity in comparison to other cars.

Supercars are exclusive cars and quite expensive. These are the high-end sports car that costs around USD 100,000. These vehicles are well-known for their power capacity, magnificent speed, and ability to impel everyone on the highways. Supercars have an engine that can generate a hundred horsepower.

This makes sure that the car can ride very fast and speed up very quickly. In certain cases, supercars are used as a race car. A supercar is a specialized vehicle built for speed, but not particularly for racing purposes. These vehicles do not have safety features that are especially required for racing.

Lamborghini Murcielago is one of the most popular supercars, which costs around USD 350,000. Another supercar is the Ferrari F430 which has impelled a huge number of customers, it costs around USD 186,000. The Dodge Viper SRT10 is one of the cheapest supercars in the market costing around USD 89,000. Most individuals cannot afford these ultra-luxurious cars but these can be available for rental purposes.

Some of the companies run rental cars so that individuals can get these luxurious vehicles for a short period. The demand for these supercars will increase due to their magnificent engine and speed which will help in contributing to market expansion in the forecast period.

Key Takeaways

- Market Growth: The Global Supercar Market was valued at USD 17.5 billion in 2023. It is expected to reach USD 24.9 billion by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

- Based on Type: Convertible supercars held a dominant 32.5% market share.

- Based on Application: Financing/loan applications dominated 50% of transactions.

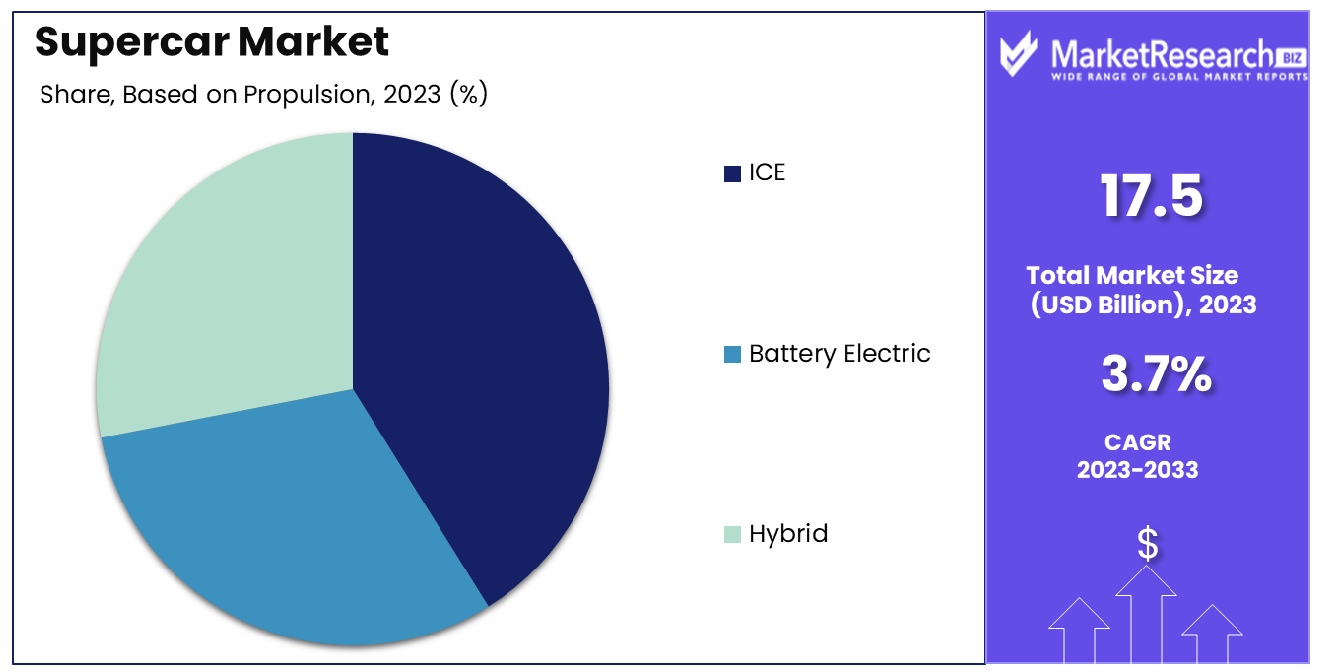

- Based on Propulsion: ICE propulsion systems led with a 35% market share.

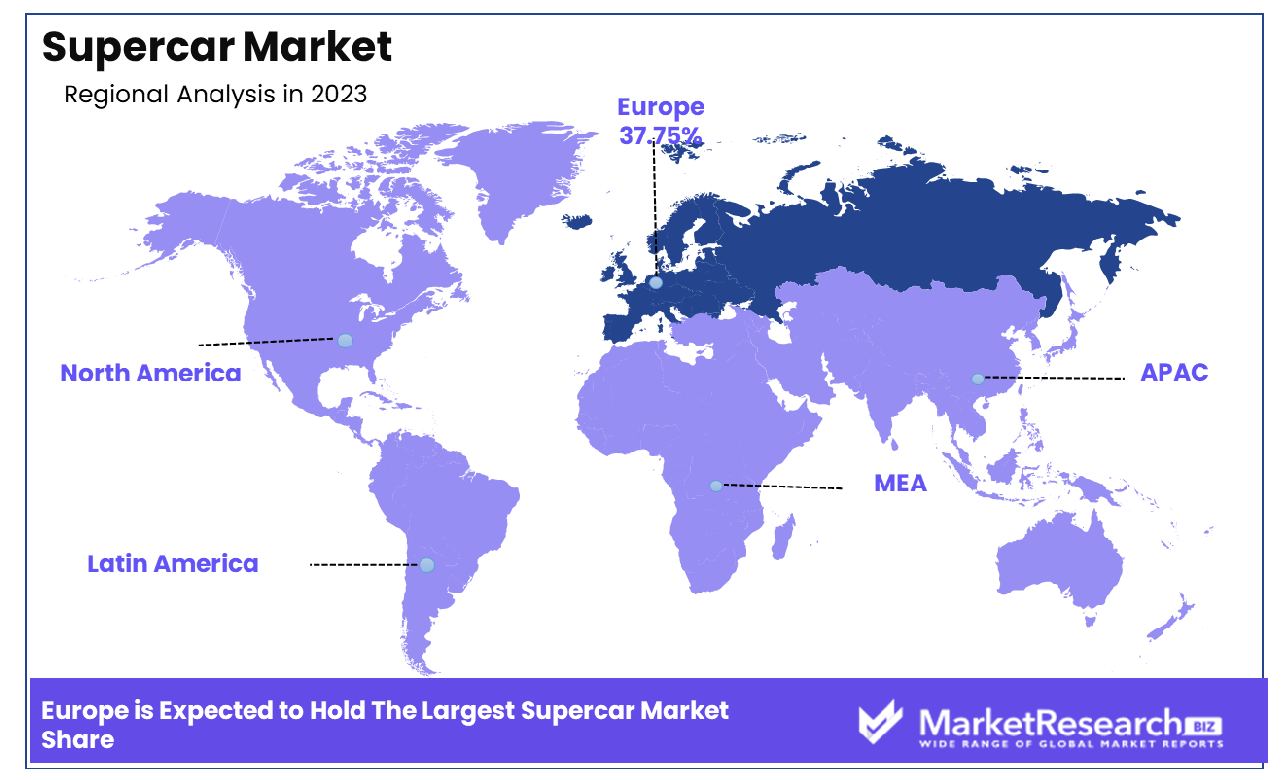

- Regional Dominance: In Europe, supercar market growth reached 37.75% in 2023.

- Growth Opportunity: Advancements in lightweight materials and growing interest in motorsports propel the global supercar market in 2023, offering manufacturers opportunities to meet demand for high-performance, eco-friendly vehicles.

Driving factors

Integration of Hybrid and Electric Powertrains: Steering Towards Sustainability

The supercar market is witnessing a significant transformation with the integration of hybrid and electric powertrains, a shift driven by increasing environmental concerns and regulatory pressures for more sustainable vehicles. This adaptation not only aligns with global sustainability trends but also caters to the growing segment of eco-conscious consumers.

By incorporating advanced technologies that offer improved fuel efficiency and reduced emissions, supercar manufacturers can broaden their market appeal. These innovative powertrains enhance the intrinsic value of supercars, merging environmental responsibility with traditional performance, thus expanding the potential customer base beyond traditional performance enthusiasts to those prioritizing green technology.

Increasing Disposable Income: Fueling Supercar Demand

The correlation between rising disposable incomes and the increased purchasing of luxury goods, including supercars, is robust. As global economies grow and personal wealth increases, more consumers can indulge in high-end products. Supercars, known for their powerful engines and maximal comfort, stand as a symbol of status and luxury.

This trend is particularly pronounced in emerging markets where new wealth creation is accompanied by a desire to display economic success. Consequently, the supercar market benefits directly from economic upturns, as higher disposable incomes translate to a greater propensity to invest in luxury, high-performance vehicles.

Growth in the Automobile Industry: Elevating the Supercar Experience

The overall expansion of the automobile industry has a direct positive impact on the supercar segment. The rising demand for luxurious and comfortable driving experiences propels advancements in automotive technology and design, specifically tailored to meet the expectations of high-net-worth individuals.

This drive for innovation leads to the creation of supercars that are not only faster and more aesthetically pleasing but also equipped with cutting-edge technology and superior comfort features. As a result, the supercar market thrives, powered by both technological advancements and an increasing consumer preference for vehicles that offer an exceptional blend of performance, luxury, and exclusivity.

Restraining Factors

High Maintenance Costs: A Barrier to Supercar Ownership

High maintenance costs represent a significant barrier to the broader adoption of supercars. The exquisite engineering and specialized components that define supercars also contribute to their high upkeep costs, including regular maintenance, repairs, and insurance. For potential buyers, the cost of owning a supercar extends far beyond the initial purchase price, influencing the overall cost of ownership and possibly deterring middle-income consumers from entering the market.

While affluent buyers may not be as sensitive to these costs, the limited market reach due to high maintenance expenses can restrict the overall growth factor potential of the supercar market. Manufacturers may need to address these concerns by innovating cost-effective maintenance solutions or offering inclusive service packages to enhance ownership appeal.

Regulatory and Safety Concerns: Navigating Compliance Challenges

Regulatory and safety concerns present another critical challenge for the supercar industry. As governments worldwide tighten emissions standards and safety regulations, supercar manufacturers must invest heavily in compliance.

This necessity can be both time-consuming and resource-intensive, potentially slowing down the production process and increasing manufacturing costs. These regulations, while ensuring safety and environmental protection, also add layers of complexity to vehicle design and testing, requiring manufacturers to allocate significant resources to research and development.

This scenario may lead to higher prices for end consumers and could limit market expansion as manufacturers struggle to balance innovation with regulatory compliance. Together, these factors form a regulatory environment that could inhibit the rapid growth of the supercar market unless effectively managed by manufacturers through strategic planning and continuous technological advancements.

Based on Type Analysis

In the convertible supercar category, dominance was shown at 32.5% of the market segment.

In 2023, Convertible Supercars held a dominant market position in the Based on Type segment of the Supercar Market, capturing more than a 32.5% share. This robust performance underscores the enduring appeal of convertible models among automotive enthusiasts, driven by their combination of high performance, luxury, and open-air driving experience. Non-convertible supercars, while still significant contenders, trailed slightly behind, indicating a preference shift towards the versatility and allure of convertible variants.

The ascendancy of Convertible Supercars can be attributed to several factors. Firstly, the lifestyle-oriented preferences of affluent consumers increasingly prioritize the enjoyment of driving experiences, making convertible models an attractive choice. Additionally, technological advancements in convertible roof systems have enhanced both functionality and aesthetics, further bolstering their appeal. Furthermore, manufacturers' strategic emphasis on innovation and design in convertible models has resonated well with discerning buyers, contributing to their market dominance.

Nonetheless, Non-Convertible Supercars continue to maintain a substantial market presence, appealing to enthusiasts seeking uncompromised performance and track-focused capabilities. With meticulous engineering and performance-oriented features, these models cater to a distinct segment of the market characterized by enthusiasts who prioritize speed, precision, and driving dynamics.

Looking ahead, the Supercar Market is poised for continued growth rate and innovation, driven by evolving consumer preferences, technological advancements, and sustainable practices. Both Convertible and Non-Convertible Supercars are expected to undergo further refinement and adaptation to meet the changing demands of the market, ensuring a dynamic landscape characterized by diversity and excellence.

Based on Application Analysis

Financing or loan applications dominated, accounting for 50% of the usage in the market.

In 2023, Financing/Loan held a dominant market position in the Based on Application segment of the Supercar Market, capturing more than a 50% share. This significant market dominance underscores the pivotal role of financing and loans in facilitating the acquisition of high-value assets such as supercars. Cash Payment, while still a viable option for certain buyers, trailed behind Financing/Loan, indicating a prevalent preference among consumers for flexible payment solutions.

The prominence of Financing/Loan in the supermarket market can be attributed to several factors. Firstly, the high cost associated with supercars necessitates financial assistance for many potential buyers, making financing options an attractive proposition. Additionally, favorable interest rates and flexible repayment terms offered by financial institutions have encouraged buyers to opt for financing solutions, enabling them to spread the cost of ownership over a longer period.

Leasing, although a viable alternative for some consumers, accounted for a smaller share of the market compared to Financing/Loan. While leasing offers the benefit of lower monthly payments and the flexibility to upgrade to newer models, it may entail restrictions on mileage and customization options, limiting its appeal among certain buyers.

Looking ahead, the Supercar Market is expected to witness continued reliance on financing and loan options as the primary means of acquiring these prestigious vehicles. With ongoing advancements in financial services and evolving consumer preferences, financing solutions are likely to become even more tailored and accessible, further cementing their dominant position within the market landscape.

Based on Propulsion Analysis

Internal combustion engines (ICE) held a 35% dominance in the supercar propulsion market.

In 2023, ICE (Internal Combustion Engine) held a dominant market position in the Based on Propulsion segment of the Supercar Market, capturing more than a 35% share. This notable market dominance underscores the enduring appeal and performance capabilities of traditional combustion engine technology in the supercar segment. While emerging technologies such as Battery Electric and Hybrid propulsion systems are gaining traction, ICE-powered supercars continue to maintain a significant lead.

The prominence of ICE propulsion in the Supercar Market can be attributed to several factors. Firstly, the heritage and legacy associated with combustion engine technology evoke a sense of tradition and authenticity among enthusiasts, fostering a strong preference for ICE-powered supercars. Additionally, the refined performance characteristics and exhaust notes of internal combustion engines contribute to their enduring popularity, providing a visceral driving experience cherished by enthusiasts.

Battery Electric propulsion, although experiencing growth rate and innovation, accounted for a smaller share of the market compared to ICE. While electric supercars offer environmental benefits and instant torque delivery, concerns surrounding range limitations and charging infrastructure continue to pose challenges for widespread adoption among consumers.

Hybrid propulsion, with its combination of internal combustion and electric segment powertrains, represented a viable alternative for buyers seeking a balance between performance and efficiency. However, it trailed behind both ICE and Battery Electric propulsion systems, indicating a gradual transition towards electrification within the supercar segment.

Key Market Segments

Based on Type

- Convertible Supercar

- Non-Convertible Supercar

Based on Application

- Cash Payment

- Financing/Loan

- Leasing

Based on Propulsion

- ICE

- Battery Electric

- Hybrid

Growth Opportunity

Development of Lightweight Materials Fuel Growth in the Global Supercar Market

The global supercar market is poised for significant growth opportunities in 2023, primarily driven by advancements in lightweight materials for manufacturing. Lightweight materials such as carbon fiber, aluminum, and titanium are increasingly being integrated into supercar designs, offering enhanced performance and fuel efficiency while maintaining structural integrity. This trend is revolutionizing the industry, as manufacturers strive to produce faster, more agile, and environmentally sustainable vehicles.

The adoption of lightweight materials enables supercar manufacturers to achieve higher power-to-weight ratios, resulting in superior acceleration and handling characteristics. Furthermore, these materials contribute to improved fuel efficiency and reduced emissions, aligning with the growing demand for eco-friendly automotive solutions.

As environmental concerns continue to shape consumer preferences, the integration of lightweight materials positions supercars as attractive options for performance enthusiasts seeking sustainable transportation solutions.

Growing Interest in Supercar Racing Drives Market Expansion

In addition to technological advancements in manufacturing, the global supercar market is experiencing significant growth opportunities due to the rising interest in supercar racing and motorsports. Events such as the Formula One World Championship, the 24 Hours of Le Mans, and various GT racing series have garnered widespread attention and enthusiasm from automotive enthusiasts worldwide. This surge in interest has fueled demand for high-performance supercars capable of competing at the pinnacle of motorsport.

The allure of supercar racing extends beyond entertainment, serving as a platform for manufacturers to showcase their engineering prowess and technological innovations. Consequently, consumers are drawn to supercars that embody the performance capabilities showcased on the racetrack.

As the popularity of supercar racing continues to soar, manufacturers are capitalizing on this trend by developing cutting-edge vehicles designed to excel in competitive racing environments. This convergence of technology and sporting prowess is driving growth in the global supercar market, presenting lucrative opportunities for manufacturers to capitalize on the burgeoning demand for high-performance automotive excellence.

Latest Trends

Integration of Connectivity and Infotainment Enhances Global Supercar Market

The global supercar market in 2023 is witnessing a significant shift with the integration of advanced connectivity and infotainment systems. As consumer preferences evolve, there is a growing demand for supercars equipped with cutting-edge technology that enhances the driving experience.

Manufacturers are responding by incorporating features such as touchscreen displays, smartphone integration, and voice-activated controls into their vehicles. This trend not only caters to the tech-savvy clientele but also elevates the overall appeal of supercars, transforming them into sophisticated multimedia hubs on wheels.

Rise of Limited Edition and Special Edition Models Drives Market Dynamics

In tandem with technological advancements, the global supercar market is experiencing a surge in the popularity of limited-edition and special-edition models. These exclusive variants offer discerning consumers unique design elements, enhanced performance capabilities, and bespoke customization options.

By releasing limited production runs of special models, manufacturers create a sense of exclusivity and prestige, attracting enthusiasts and collectors alike. Additionally, limited edition releases often command premium prices, contributing to revenue growth and brand image enhancement for manufacturers.

Regional Analysis

In Europe, the supercar market boasts a remarkable 37.75% share, reflecting significant consumer demand for high-performance vehicles.

North America stands as a prominent market for supercars, driven by the presence of affluent consumers with a penchant for luxury and high-performance vehicles. According to recent market data, North America commands a significant share of approximately 30%, buoyed by robust demand from discerning buyers in the United States and Canada.

The region benefits from a mature automotive landscape, coupled with a culture that values automotive innovation and prestige. Moreover, technological advancements and the introduction of environmentally sustainable features in supercars have further catalyzed market growth in this region.

Europe emerges as a dominant force in the global supercar market, boasting a substantial market share of approximately 37.75%. The region's stronghold can be attributed to its rich automotive heritage, strong manufacturing base, and the presence of iconic luxury car brands.

Countries such as Germany, Italy, and the United Kingdom serve as epicenters of supercar production and innovation, fostering a competitive landscape characterized by the relentless pursuit of engineering excellence and aesthetic sophistication. Furthermore, Europe's affluent consumer base, coupled with favorable economic conditions, propels sustained demand for premium supercars across the continent.

The Asia Pacific region showcases immense potential for supercar manufacturers, fueled by rapid urbanization, rising disposable incomes, and a burgeoning population of high-net-worth individuals (HNWIs). Market analysis indicates a steady uptick in supercar sales across key markets such as China, Japan, and Singapore, driven by aspirational lifestyles and a growing appetite for luxury goods. As automotive enthusiasts in Asia Pacific increasingly gravitate towards performance-oriented vehicles, the region emerges as a focal point for market expansion and investment.

Middle East & Africa, and Latin America represent nascent yet promising markets for supercars, characterized by evolving consumer preferences and infrastructural developments. While these regions currently account for relatively smaller market shares, ongoing urbanization, and the proliferation of luxury culture are poised to fuel future growth opportunities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global supercar market was dominated by a cadre of esteemed manufacturers, each contributing to the landscape with their unique blend of innovation, performance, and luxury. Among these key players, Lamborghini, Ferrari, Koenigsegg, Aston Martin, McLaren, Bentley, Bugatti, Audi, Pagani, and Porsche stood at the forefront, defining the standards of excellence within the industry.

Lamborghini and Ferrari, stalwarts of Italian automotive prowess, continued to captivate enthusiasts with their iconic designs and relentless pursuit of speed. Koenigsegg, a Swedish marque, distinguished itself with groundbreaking engineering feats, pushing the boundaries of performance and technology. Aston Martin, synonymous with British elegance and performance, maintained its allure with a blend of heritage and cutting-edge design.

McLaren, renowned for its Formula 1 pedigree, translated its racing expertise into exceptional road-going supercars, captivating discerning buyers worldwide. Bentley, synonymous with opulence and refinement, catered to a niche clientele seeking unparalleled luxury and performance. Bugatti, a paragon of automotive engineering, continued to astound with its uncompromising pursuit of speed and exclusivity.

Audi and Porsche, renowned for their engineering prowess and technological innovation, offered compelling alternatives within the supercar segment, combining performance with everyday usability. Pagani, a boutique manufacturer revered for its artisanal craftsmanship and limited production runs, appealed to aficionados seeking exclusivity and bespoke luxury.

The collective presence of these key players underscores the global appeal and enduring fascination with supercars, as enthusiasts and collectors alike continue to seek out the pinnacle of automotive excellence. In 2023, the supercar market witnessed a convergence of heritage, innovation, and performance, as these esteemed manufacturers continued to push the boundaries of automotive engineering and redefine the notion of automotive perfection.

Market Key Players

- Lamborghini

- Ferrari

- Koenigsegg

- Aston Martin

- McLaren

- Bentley

- Bugatti

- Audi

- Pagani

- Porsche

- Other Key Players

Recent Development

- In March 2024, McLaren unveils sketches of future supercars, blending racing heritage with futuristic innovation. Chief Design Officer Tobias Sühlmann introduces five core design principles: Epic, Athletic, Functional, Focused, and Intelligent. These ensure performance, efficiency, and precision.

- In March 2024, Audi bids farewell to R8 supercar after 17 years, closing production with the final high-performance variant. Speculation arises about an electric successor, aligning with Audi's post-2026 EV commitment.

- In March 2024, XPeng introduces an innovative parachute system for Aeroht flying cars, deploying at 50 meters above ground with a multi-parachute design. Enhances safety for eVTOL vehicles.

Report Scope

Report Features Description Market Value (2023) USD 17.5 Million Forecast Revenue (2033) USD 24.9 Million CAGR (2024-2032) 3.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Type(Convertible Supercar, Non-Convertible Supercar), Based on Application(Cash Payment, Financing/Loan, Leasing), Based on Propulsion(ICE , Battery Electric, Hybrid) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Lamborghini, Ferrari, Koenigsegg, Aston Martin, McLaren, Bentley, Bugatti, Audi, Pagani, Porsche, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Lamborghini

- Ferrari

- Koenigsegg

- Aston Martin

- McLaren

- Bentley

- Bugatti

- Audi

- Pagani

- Porsche

- Other Key Players