Super Abrasive Market By Product (Diamond, Cubic Boron Nitride), By Application (Construction, Transportation, Oil & Gas, Electrical & Electronics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

26687

-

July 2023

-

162

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

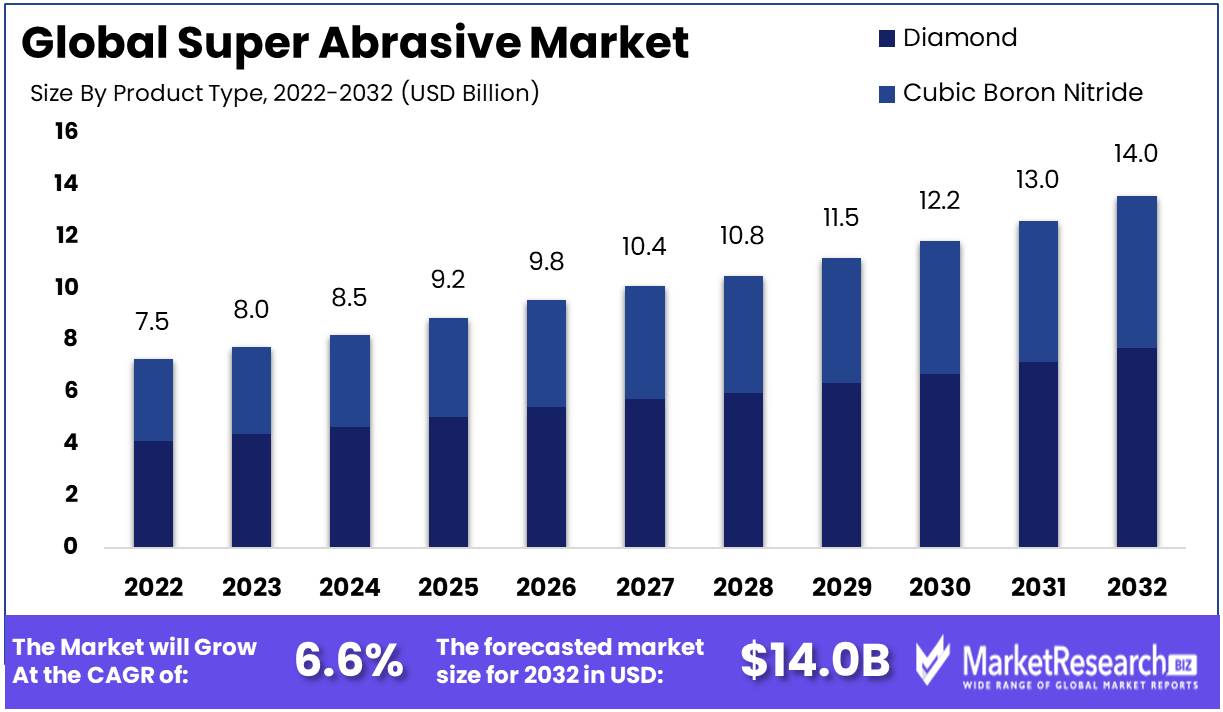

Super Abrasive Market size is expected to be worth around USD 14 Bn by 2032 from USD 7.5 Bn in 2022, growing at a CAGR of 6.6% during the forecast period from 2023 to 2032.

In the domain of industrial enchantment, behold the mysterious super abrasive market, a captivating collection of synthetic diamonds and cubic boron nitride (CBN) materials, revered for their unrivaled hardness and lauded for their proficiency in cutting, grinding, and polishing applications. Oh, how lofty and grand is their mission to bestow upon the world high-performance tools and materials that withstand the tempestuous winds of extreme conditions and emerge victorious, delivering results that surpass the domain of conventional abrasives. The super abrasive market, an indispensable element in the great machine of progress, dances to the celestial symphony of enhancing productivity, embracing precision, and embracing efficiency, resonating through the corridors of multiple industries.

The same goes for the rest of the world as well. Technological artisans engage in a dance of creation, spawning novel diamond and CBN materials, each with enhanced properties to quench the insatiable appetite of contemporary industries. Polycrystalline diamond (PCD) and polycrystalline cubic boron nitride (PCBN) are alchemical miracles that transform cutting, drilling, and milling applications into a display of precision and efficiency. Oh, their siren song, a promise of unparalleled wear resistance and tool life, enchants the domains of hard and abrasive material machining.

Behold the celestial ballet of investments from a variety of industries, each attuned to the allure of its potential, as the sun rises over the super abrasive market. Companies imbue their products and services with the allure of super abrasives because therein lies the secret to attaining a coveted competitive advantage. Behold, in the tapestry of automotive beauty, the pervasive use of super abrasive tools to carve engine components such as the majestic crankshafts, camshafts, and cylinder heads. And in the celestial heights of aerospace grandeur, marvel at the reliance on super abrasive grinding wheels, which elegantly craft turbine blades and other vital components in a precision dance that soars through the air.

Ah, numerous are the forces that drive the expansion of the super abrasive market, a hypnotic web that enchants industries seeking to surpass the limits of productivity and quality. A cosmic melody reverberates, signaling the need for cutting, grinding, and polishing instruments that govern supreme and wield the scepter of superiority. A divine decree mandates the birth of lightweight and fuel-efficient materials in the automotive and aerospace industries, and a clarion call summons the harder and more advanced materials, effortlessly machined by the guiding hand of super abrasives. And in harmony with the cosmic symphony, the chorus of sustainability and environmental impact resounds, giving birth to eco-friendly and energy-efficient super abrasive tools and materials, their dance a tribute to the preservation of our cosmic home.

Driving Factors

Increasing Demand for Precision Machining and High-Performance Tools

In the modern era, precision machining and high-performance tools have become indispensable to numerous industries, including the automotive, aerospace, and electronics sectors, among others. The need for superior quality and precision in manufacturing processes is the primary driver of the increasing demand for these instruments. This article examines the driving forces behind the rising demand for precision machining and high-performance tools, including the advancements in super abrasive market materials and manufacturing processes, the growth of the manufacturing and industrial sectors, and the pursuit of increased productivity and cost efficiency.

Developments in Ultra-Abrasive Materials and Production Techniques

The development of super abrasive market materials and manufacturing techniques is one of the primary forces behind the increasing demand for precision machining and high-performance tools. Diamond and cubic boron nitride (CBN) are examples of super abrasives that possess exceptional hardness, thermal stability, and abrasion resistance. These characteristics make them ideal for cutting, grinding, and shaping materials that would otherwise be challenging to machine. Continuous research and development efforts have resulted in the introduction of new, high-performance super abrasive market materials. The development of polycrystalline diamond (PCD) and polycrystalline cubic boron nitride (PCBN) materials, for instance, has revolutionized the machining capabilities of numerous industries.

Growth of Industries such as Automotive, Aerospace, and Electronics

The expansion of industries like automotive, aerospace, and electronics has been a major factor in the growing demand for precision machining and high-performance tools. Due to the critical nature of their components and implementations, these industries require impeccable precision and accuracy. Precision machining is crucial to the production of engine components, powertrain components, braking systems, and more in the automotive industry. With the continuous advancements in automotive technology, there is a growing demand for high-performance instruments that can guarantee the precise manufacturing of complex parts, resulting in enhanced vehicle performance and dependability.

Expansion of Manufacturing and Industrial Sectors

The global expansion of the manufacturing and industrial sectors has contributed substantially to the growing demand for precision machining and high-performance tools. As an increasing number of nations endeavor to enhance their manufacturing capacities, the demand for innovative machining solutions continues to increase. Rapid industrialization and urbanization in emerging economies have increased the demand for products of superior quality. This demand, combined with the expanding emphasis on automation and efficiency, has increased the need for precise machining and high-performance tools. Manufacturers are continually searching for methods to increase their productivity, decrease their expenses, and increase the competitiveness of their products in both the domestic and international super abrasive markets.

Restraining Factors

High Production Costs and Early Investments

The high production costs and initial investments required to establish manufacturing facilities are one of the most significant factors inhibiting the super abrasive market. Super abrasive substances, such as diamond and cubic boron nitride (CBN), are renowned for their extraordinary hardness and durability. To harness these unique properties, however, requires intricate manufacturing processes, specialized apparatus, and skilled labor. These factors all contribute to the high production costs of ultra-abrasive materials.

Limited Awareness and Utilization in Certain Industries

Despite the fact that super abrasive materials offer numerous advantages over conventional abrasives, there is still a lack of understanding and application in certain industries. Numerous businesses and professionals in industries such as automotive, aerospace, and precision engineering are unaware of the advantages and potential applications of extremely abrasive materials. This lack of awareness frequently results in a preference for conventional abrasive materials, thereby impeding the growth of the market for super abrasives.

Potential Safety and Health Concerns

Another factor restraining the super abrasive market is the potential safety and health risks associated with their handling and application. Super abrasive materials, such as diamond and CBN, are extremely rigid and can pose dangers if not handled correctly. There is the potential for particle discharge during the machining processes, which can cause respiratory problems if inhaled. In addition, the dust generated during cutting and grinding operations may contain fine particulates of extremely abrasive materials, which may cause skin irritations or eye injuries if proper precautions and protective measures are not in place. Due to these safety and health concerns, some industries may be hesitant to implement super abrasives, particularly if they lack the required safety protocols and training.

The Threat of Competition from Conventional Abrasive Materials

Competition from conventional abrasive materials is the last factor restraining the super abrasive market. Despite the fact that super abrasive materials offer exceptional hardness and durability, conventional abrasives such as aluminum oxide and silicon carbide are still extensively used in a variety of industries. These conventional abrasives are well-established on the market and regarded as cost-effective alternatives for a variety of applications. Additionally, the reduced initial costs associated with conventional abrasive materials can make them more appealing to businesses with a focus on minimizing expenses.

Product Analysis

The Diamond Segment is the dominant competitor in the extremely competitive super abrasive market. Its success has been fuelled by the economic growth in emerging economies, where industries seek high-quality abrasives for industrialization and expansion. Due to its superior performance, durability, and accuracy, the Diamond Segment has become the industry standard in the automotive, aerospace, and electronics sectors.

Trends and behaviors of consumers have also played a significant role in the Diamond Segment's market dominance. As consumers become more aware of the benefits of ultra abrasives, they prioritize quality and durability. Its market position is strengthened by the Diamond Segment's capacity to produce exceptional results, reduce interruption, and increase overall output. Increasing demand for high-precision cutting and grinding tools, particularly in the automotive and aerospace industries, will also contribute to its anticipated accelerated growth.

The Diamond Segment is well-positioned to profit from the expanding emphasis on sustainability and environmental tolerance. Diamonds, unlike conventional abrasives, are a natural resource, making them a more sustainable alternative. This precisely aligns with eco-friendly practices, resonating with consumers and driving the Diamond Segment's expansion.

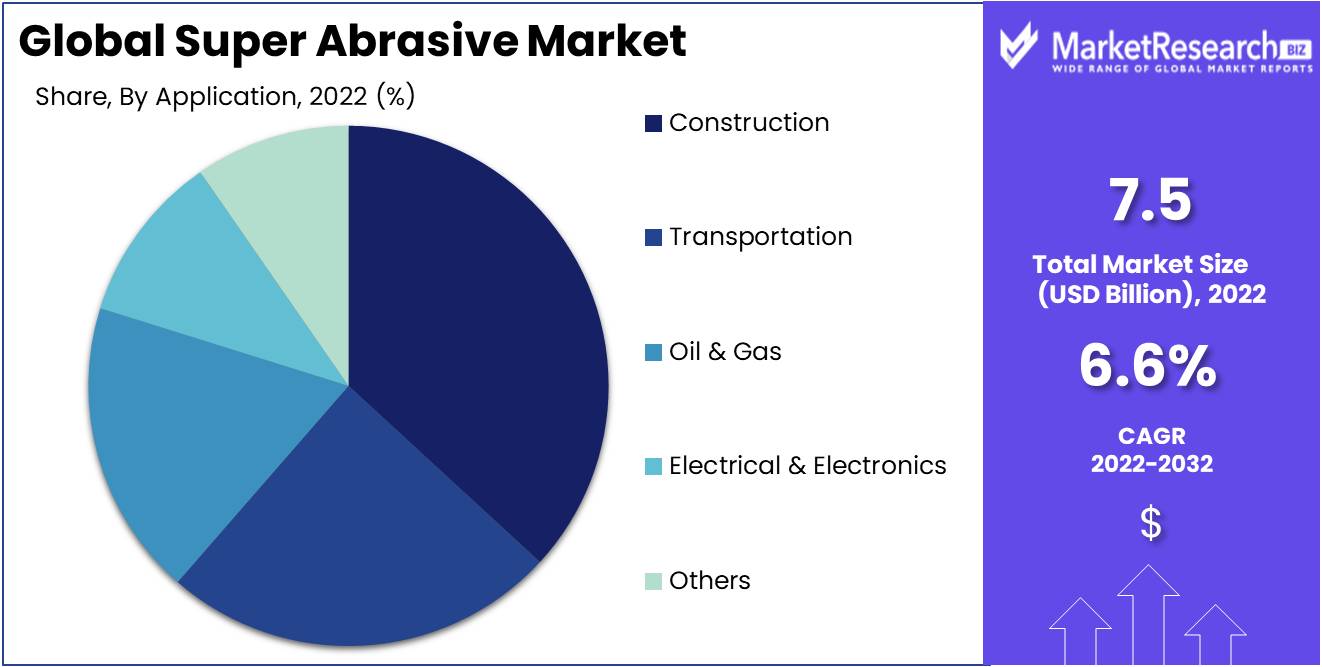

Application Analysis

The expansion of global construction activities is a major factor in the dominance of the Construction Segment. As infrastructure development gains prominence on a global scale, the demand for high-performance abrasives increases. The Construction Segment rises to the occasion by providing tools and abrasives designed specifically to withstand the severe conditions encountered in construction applications. It is favored by contractors and architects in search of dependable solutions due to its ability to produce consistent and effective results.

Economic growth in developing nations plays a crucial role in driving the construction segment of the super abrasive market. As these economies invest in ambitious infrastructure projects, the demand for long-lasting and effective abrasives becomes critical. This demand is met head-on by the Construction Segment, which is aligned with the development trajectories of emerging markets and has established itself as a reliable partner for their construction endeavors.

The dominance of the Construction Segment is strengthened by its capacity to exceed consumer expectations. In the construction industry, consumers prioritize quality, efficacy, and durability in their initiatives. The tools and abrasives of the Construction Segment provide precisely this: superior quality, increased productivity, and extended tool life. Its ability to consistently produce exceptional results has resulted in widespread consumer adoption and confidence.

Key Market Segments

By Product

- Diamond

- Cubic boron nitride

By Application

- Construction

- Transportation

- Oil & gas

- Electrical & electronics

- Other Applications

Growth Opportunity

Expansion into Emerging Markets with Expanding Manufacturing Sectors

Expansion into emerging markets with thriving manufacturing sectors is one of the greatest growth opportunities in the super abrasive market. China, India, Brazil, and Mexico have experienced significant growth in their manufacturing sectors, generating demand for superior super abrasive products. By targeting these markets strategically, businesses can capitalize on the growing demand and establish a firm presence, thereby expanding their customer base and revenue streams.

Collaboration with Tool Manufacturers and End Users for Application Specific Solutions

Promoting collaboration with tool manufacturers and end-users to develop application-specific super abrasive market solutions is an additional growth opportunity. As industries become increasingly specialized, the demand for specialized instruments increases. By actively engaging with tool manufacturers and end-users, companies in the super abrasive market can gain valuable insights into the unique challenges they face, allowing them to develop customized solutions that improve efficiency and productivity.

Adoption of Advanced Bonding and Shaping Technologies

Advanced bonding technologies, such as electroplated bonding, resin bonding, and brazing, enable greater control over the bond strength, resulting in super abrasive market tools with superior resistance to wear and extended tool life. In addition, the development of sophisticated shaping technologies, such as laser cutting and computer numerical control (CNC) machining, enables the production of intricate, custom-designed Super Abrasive tools with precise dimensions and intricate geometries.

Latest Trends

The Rising Demand for Superabrasives in Grinding and Cutting Applications

The unrivaled performance of super abrasives in grinding and cutting applications is one of the most important reasons for their rising popularity. In these procedures, traditional abrasives such as aluminum oxide and silicon carbide have been used extensively for decades. Nevertheless, the superior hardness and heat resistance of diamond and CBN super abrasives have rendered their conventional counterparts obsolete.

The Utilization of Super Abrasives in Precision Machining and High-Speed Cutting

In industries such as aerospace, automotive, and medicine, precision machining plays a crucial function. Utilization of super abrasives is required for the production of intricate components with extremely close tolerances. The extraordinary hardness and wear resistance of diamond and CBN super abrasives allow manufacturers to achieve unrivaled machining precision.

The Rise of Electroplated and Metal-Bonded Super Abrasive Tools

Innovative tooling solutions have emerged on the market in response to the increasing demand for super abrasives. Due to their exceptional performance and adaptability, electroplated and metal-bonded super abrasive tools have acquired considerable traction. Utilizing the unique properties of diamond and CBN super abrasives, these instruments deliver outstanding results across a broad spectrum of applications.

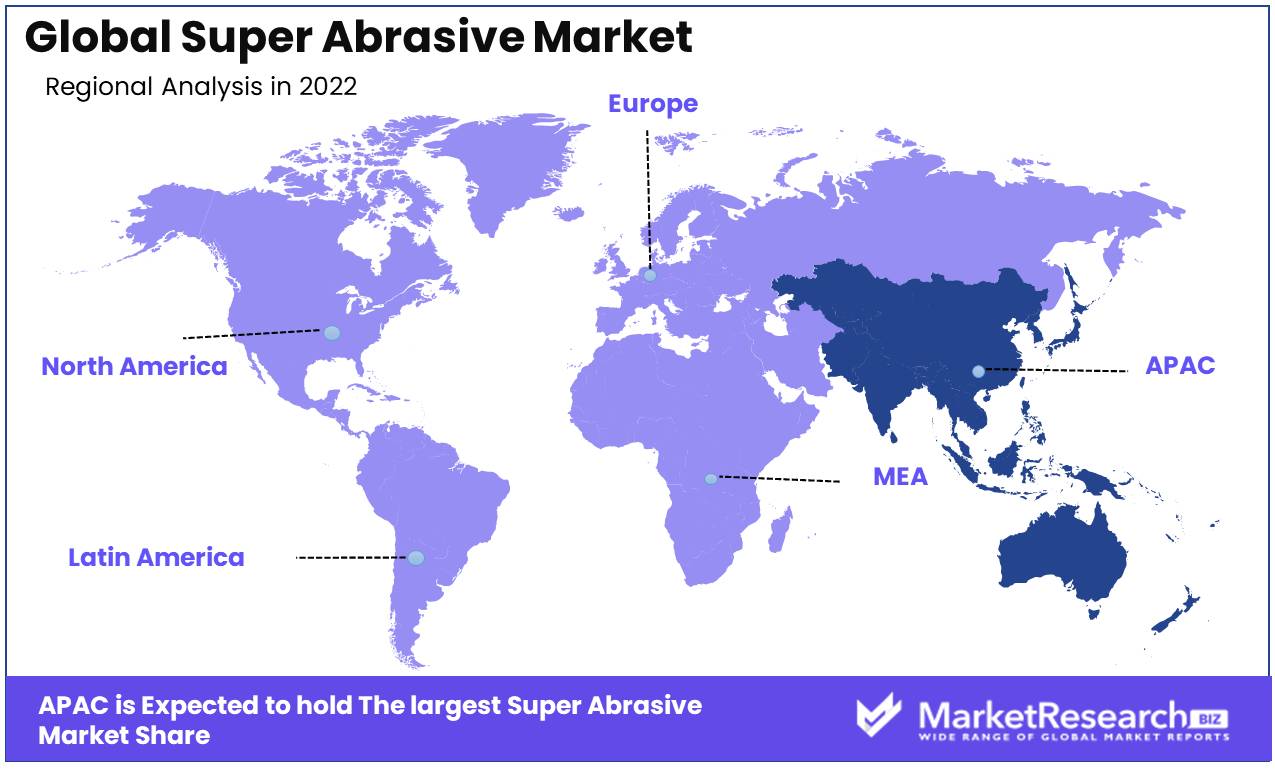

Regional Analysis

Asia-Pacific Region Dominates the Superabrasive Market, the Asia-Pacific region has emerged as the dominant force in the super abrasive market. With its rapid economic growth, technological advancements, and skilled workforce, countries in this region have solidified their position as leaders in the production and consumption of super abrasive materials.

The Asia-Pacific region, comprising countries such as China, India, Japan, and South Korea, boasts a significant share of the global super abrasive market. China, in particular, leads the region's super abrasive production and export, thanks to its abundant reserves of natural diamonds and CBN. The country's well-established manufacturing infrastructure and competitive pricing have made it a preferred destination for super abrasive suppliers and consumers worldwide.

One of the reasons behind the region's supremacy in the super abrasive market is its focus on research and development. Governments, academic institutions, and industry players in the Asia-Pacific are actively collaborating to enhance the performance and efficiency of super abrasive materials. Continuous innovation and the pursuit of cutting-edge technologies have enabled them to stay ahead of the competition.

Moreover, the Asia-Pacific region benefits from the booming manufacturing and construction sectors. As the region continues to experience rapid urbanization and infrastructure development, the demand for super abrasive tools is soaring. This surge in demand, coupled with the region's ability to meet it through local production, has solidified its leading position in the market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key players such as 3M, Asahi Diamond Industrial Co. Ltd., Carborundum Universal Limited, Guangdong CHANWAY INDUSTRIAL Co. Ltd., Eagle Superabrasives, and VSM AG dominate the super abrasive market. Each business has carved out its own niche through research, innovation, and customer-centric strategies.

3M, a well-known multinational conglomerate, has proven its prowess in numerous industries, including the super abrasive market. The company provides an extensive selection of super abrasive solutions to meet the requirements of numerous industries. With a strong emphasis on research and development, 3M consistently introduces innovative products that improve customer experiences. Their ultra abrasive product line consists of diamond and CBN abrasive technologies, which have applications in grinding, cutting, and polishing with high precision.

Asahi Diamond Industrial Co., Ltd., a prominent Japanese corporation, is a leader in the global super abrasive industry. Asahi Diamond Industrial Co., Ltd., which has a lengthy history spanning several decades, specializes in the development, production, and distribution of diamond tools and highly abrasive materials. They offer a wide variety of products, such as diamond wheels, diamond dressers, diamond micron granules, and other associated machinery. Their dedication to product quality and customer satisfaction has established them as a dependable and trustworthy market partner.

The Indian multinational corporation Carborundum Universal Limited (CUMI) has a significant presence in the super abrasive market. CUMI provides cutting-edge products to diverse industrial sectors, including automotive, aerospace, and manufacturing. Their highly abrasive products include renowned grinding wheels, cutting tools, and bonded abrasives. The dedication of CUMI to innovation and customer-centric solutions has helped the company establish a global presence.

Guangdong CHANWAY INDUSTRIAL Co., Ltd., a leading Chinese manufacturer, has garnered considerable renown in the super abrasive market. CHANWAY INDUSTRIAL specializes in the production of diamond and CBN wheels and provides high-quality products to clients worldwide. Their commitment to sophisticated manufacturing techniques and stringent quality control measures has established them as an industry leader.

Top Key Players in Superabrasive Market

- 3M

- Asahi Diamond Industrial Co. Ltd.

- Carborundum Universal Limited

- Guangdong CHANWAY INDUSTRIAL Co. Ltd.

- Eagle Superabrasives

- VSM AG

- TOYODA VAN MOPPES LTD

- SUPER ABRASIVES

- Radiac Abrasives

- KURE GRINDING WHEEL

- Mirka Ltd.

- NORITAKE CO. LIMITED

- Saint-Gobain

- SuperAbrasives Inc.

- ADVANCED SUPER ABRASIVES INC

- Euro Superabrasives Limited.

- EFS SUPER ABRASIVES

- Shannon Abrasives.

- Midland Abrasives Ltd

- P.B.R. Abrasives (W’ton) Limited

Recent Development

- In 2023, Saint-Gobain Abrasives unveiled, in a game-changing revelation, a highly specialized line of super abrasives designed specifically for the demanding requirements of the aerospace industry. This long-awaited release provides aerospace manufacturers with advanced cutting, grinding, and finishing capabilities, serving as a catalyst for increased productivity, efficiency, and precision. Saint-Gobain Abrasives' innovative product line exemplifies their dedication to stretching technological boundaries and solidifies their position as industry leaders.

- In 2022, 3M has recently announced the expansion of its production facilities in China, highlighting its commitment to meeting the rising demand for super abrasives. By substantially increasing its output capacity, 3M intends to meet the expanding market demands and ensure the timely availability of abrasives of superior quality. This strategic move exemplifies 3M's forward-thinking approach and resolve to elevate the super abrasive industry by nurturing seamless production capabilities in a key manufacturing hub.

- In 2021, Denka, a prominent actor in the super abrasive market, has partnered with Element Six, a renowned provider of technology solutions, to advance super abrasive materials. This strategic alliance promises to unleash unheard-of manufacturing opportunities for next-generation super abrasives with enhanced performance characteristics. Denka and Element Six are well-positioned to develop innovative solutions that will influence the future of the industry by combining their respective areas of expertise.

- In 2020, Tyrolit, a global leader in abrasive solutions, successfully acquired Mirka, a prominent manufacturer of super abrasives, in an effort to strengthen its market position. This strategic alliance strengthens Tyrolit's position on the super abrasive market and broadens its product offering, giving consumers access to a greater variety of high-quality abrasives. The merger provides Tyrolit with access to Mirka's extensive knowledge base and innovative capabilities, bolstering its pursuit of excellence and market leadership.

Report Scope

Report Features Description Market Value (2022) USD 7.5 Bn Forecast Revenue (2032) USD 14.0 Bn CAGR (2023-2032) 6.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Diamond, Cubic boron nitride)

By Application (Construction, Transportation, Oil & gas, Electrical & electronics, Other Applications)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M, Asahi Diamond Industrial Co. Ltd., Carborundum Universal Limited, Guangdong CHANWAY INDUSTRIAL Co. Ltd., Eagle Superabrasives, VSM AG, TOYODA VAN MOPPES LTD, SUPER ABRASIVES, Radiac Abrasives, KURE GRINDING WHEEL, Mirka Ltd., NORITAKE CO.,LIMITED, Saint-Gobain, SuperAbrasives Inc., ADVANCED SUPERABRASIVES INC, Euro Superabrasives Limited., EFS SUPER ABRASIVES, Shannon Abrasives., Midland Abrasives Ltd, P.B.R. Abrasives (W’ton) Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Super Abrasive Market Overview

- 2.1. Super Abrasive Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Super Abrasive Market Dynamics

- 3. Global Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Super Abrasive Market Analysis, 2016-2021

- 3.2. Global Super Abrasive Market Opportunity and Forecast, 2023-2032

- 3.3. Global Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Super Abrasive Market Analysis By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Diamond

- 3.3.4. Cubic Boron Nitride

- 3.4. Global Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Super Abrasive Market Analysis By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Construction

- 3.4.4. Transportation

- 3.4.5. Oil & Gas

- 3.4.6. Electrical & Electronics

- 3.4.7. Others

- 4. North America Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Super Abrasive Market Analysis, 2016-2021

- 4.2. North America Super Abrasive Market Opportunity and Forecast, 2023-2032

- 4.3. North America Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Super Abrasive Market Analysis By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Diamond

- 4.3.4. Cubic Boron Nitride

- 4.4. North America Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Super Abrasive Market Analysis By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Construction

- 4.4.4. Transportation

- 4.4.5. Oil & Gas

- 4.4.6. Electrical & Electronics

- 4.4.7. Others

- 4.5. North America Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 4.5.1. North America Super Abrasive Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Super Abrasive Market Analysis, 2016-2021

- 5.2. Western Europe Super Abrasive Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Super Abrasive Market Analysis By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Diamond

- 5.3.4. Cubic Boron Nitride

- 5.4. Western Europe Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Super Abrasive Market Analysis By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Construction

- 5.4.4. Transportation

- 5.4.5. Oil & Gas

- 5.4.6. Electrical & Electronics

- 5.4.7. Others

- 5.5. Western Europe Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 5.5.1. Western Europe Super Abrasive Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Super Abrasive Market Analysis, 2016-2021

- 6.2. Eastern Europe Super Abrasive Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Super Abrasive Market Analysis By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Diamond

- 6.3.4. Cubic Boron Nitride

- 6.4. Eastern Europe Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Super Abrasive Market Analysis By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Construction

- 6.4.4. Transportation

- 6.4.5. Oil & Gas

- 6.4.6. Electrical & Electronics

- 6.4.7. Others

- 6.5. Eastern Europe Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 6.5.1. Eastern Europe Super Abrasive Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Super Abrasive Market Analysis, 2016-2021

- 7.2. APAC Super Abrasive Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Super Abrasive Market Analysis By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Diamond

- 7.3.4. Cubic Boron Nitride

- 7.4. APAC Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Super Abrasive Market Analysis By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Construction

- 7.4.4. Transportation

- 7.4.5. Oil & Gas

- 7.4.6. Electrical & Electronics

- 7.4.7. Others

- 7.5. APAC Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 7.5.1. APAC Super Abrasive Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Super Abrasive Market Analysis, 2016-2021

- 8.2. Latin America Super Abrasive Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Super Abrasive Market Analysis By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Diamond

- 8.3.4. Cubic Boron Nitride

- 8.4. Latin America Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Super Abrasive Market Analysis By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Construction

- 8.4.4. Transportation

- 8.4.5. Oil & Gas

- 8.4.6. Electrical & Electronics

- 8.4.7. Others

- 8.5. Latin America Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 8.5.1. Latin America Super Abrasive Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Super Abrasive Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Super Abrasive Market Analysis, 2016-2021

- 9.2. Middle East & Africa Super Abrasive Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Super Abrasive Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Super Abrasive Market Analysis By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Diamond

- 9.3.4. Cubic Boron Nitride

- 9.4. Middle East & Africa Super Abrasive Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Super Abrasive Market Analysis By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Construction

- 9.4.4. Transportation

- 9.4.5. Oil & Gas

- 9.4.6. Electrical & Electronics

- 9.4.7. Others

- 9.5. Middle East & Africa Super Abrasive Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 9.5.1. Middle East & Africa Super Abrasive Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Super Abrasive Market Analysis, Opportunity and Forecast, By Region, 2016-2032

- 10.1. Global Super Abrasive Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region, 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Super Abrasive Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. 3M

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Asahi Diamond Industrial Co. Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Carborundum Universal Limited

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Guangdong CHANWAY INDUSTRIAL Co. Ltd.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Eagle Superabrasives

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. VSM AG

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. TOYODA VAN MOPPES LTD

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. SUPER ABRASIVES

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Radiac Abrasives

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. KURE GRINDING WHEEL

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Mirka Ltd.

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. NORITAKE CO.,LIMITED

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Saint-Gobain

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. SuperAbrasives Inc.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. ADVANCED SUPERABRASIVES INC

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Euro Superabrasives Limited.

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. EFS SUPER ABRASIVES

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Shannon Abrasives.

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. Midland Abrasives Ltd

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. P.B.R. Abrasives (W’ton) Limited

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Super Abrasive Market Revenue (US$ Mn) Market Share By Product in 2022

- Figure 2: Global Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 3: Global Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 4: Global Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 5: Global Super Abrasive Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Super Abrasive Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Super Abrasive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 10: Global Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 11: Global Super Abrasive Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 13: Global Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 14: Global Super Abrasive Market Share Comparison by Region (2016-2032)

- Figure 15: Global Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 16: Global Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 17: North America Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 18: North America Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 19: North America Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 20: North America Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 21: North America Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 26: North America Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 27: North America Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 29: North America Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 30: North America Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 31: North America Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 32: North America Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 33: Western Europe Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 34: Western Europe Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 35: Western Europe Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 36: Western Europe Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 37: Western Europe Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 42: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 43: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 45: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 46: Western Europe Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 48: Western Europe Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 49: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 50: Eastern Europe Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 51: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 52: Eastern Europe Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 53: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 58: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 59: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 61: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 62: Eastern Europe Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 64: Eastern Europe Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 65: APAC Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 66: APAC Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 67: APAC Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 68: APAC Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 69: APAC Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 74: APAC Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 75: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 77: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 78: APAC Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 80: APAC Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 81: Latin America Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 82: Latin America Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 83: Latin America Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 84: Latin America Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 85: Latin America Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 90: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 91: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 93: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 94: Latin America Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 96: Latin America Super Abrasive Market Share Comparison By Application (2016-2032)

- Figure 97: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 98: Middle East & Africa Super Abrasive Market Attractiveness Analysis By Product, 2016-2032

- Figure 99: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Market Share By Applicationin 2022

- Figure 100: Middle East & Africa Super Abrasive Market Attractiveness Analysis By Application, 2016-2032

- Figure 101: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Super Abrasive Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 106: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Figure 107: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 109: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Figure 110: Middle East & Africa Super Abrasive Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Super Abrasive Market Share Comparison By Product (2016-2032)

- Figure 112: Middle East & Africa Super Abrasive Market Share Comparison By Application (2016-2032)

List of Tables

- Table 1: Global Super Abrasive Market Comparison By Product (2016-2032)

- Table 2: Global Super Abrasive Market Comparison By Application (2016-2032)

- Table 3: Global Super Abrasive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Super Abrasive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 7: Global Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 8: Global Super Abrasive Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 10: Global Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 11: Global Super Abrasive Market Share Comparison by Region (2016-2032)

- Table 12: Global Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 13: Global Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 14: North America Super Abrasive Market Comparison By Application (2016-2032)

- Table 15: North America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 19: North America Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 20: North America Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 22: North America Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 23: North America Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 24: North America Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 25: North America Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 26: Western Europe Super Abrasive Market Comparison By Product (2016-2032)

- Table 27: Western Europe Super Abrasive Market Comparison By Application (2016-2032)

- Table 28: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 32: Western Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 33: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 35: Western Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 36: Western Europe Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 38: Western Europe Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 39: Eastern Europe Super Abrasive Market Comparison By Product (2016-2032)

- Table 40: Eastern Europe Super Abrasive Market Comparison By Application (2016-2032)

- Table 41: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 45: Eastern Europe Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 46: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 48: Eastern Europe Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 49: Eastern Europe Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 51: Eastern Europe Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 52: APAC Super Abrasive Market Comparison By Product (2016-2032)

- Table 53: APAC Super Abrasive Market Comparison By Application (2016-2032)

- Table 54: APAC Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 58: APAC Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 59: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 61: APAC Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 62: APAC Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 63: APAC Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 64: APAC Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 65: Latin America Super Abrasive Market Comparison By Product (2016-2032)

- Table 66: Latin America Super Abrasive Market Comparison By Application (2016-2032)

- Table 67: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 71: Latin America Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 72: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 74: Latin America Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 75: Latin America Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 77: Latin America Super Abrasive Market Share Comparison By Application (2016-2032)

- Table 78: Middle East & Africa Super Abrasive Market Comparison By Product (2016-2032)

- Table 79: Middle East & Africa Super Abrasive Market Comparison By Application (2016-2032)

- Table 80: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 84: Middle East & Africa Super Abrasive Market Revenue (US$ Mn) Comparison By Application (2016-2032)

- Table 85: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 87: Middle East & Africa Super Abrasive Market Y-o-Y Growth Rate Comparison By Application (2016-2032)

- Table 88: Middle East & Africa Super Abrasive Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Super Abrasive Market Share Comparison By Product (2016-2032)

- Table 90: Middle East & Africa Super Abrasive Market Share Comparison By Application (2016-2032)

- 1. Executive Summary

-

- 3M

- Asahi Diamond Industrial Co. Ltd.

- Carborundum Universal Limited

- Guangdong CHANWAY INDUSTRIAL Co. Ltd.

- Eagle Superabrasives

- VSM AG

- TOYODA VAN MOPPES LTD

- SUPER ABRASIVES

- Radiac Abrasives

- KURE GRINDING WHEEL

- Mirka Ltd.

- NORITAKE CO. LIMITED

- Saint-Gobain

- SuperAbrasives Inc.

- ADVANCED SUPERABRASIVES INC

- Euro Superabrasives Limited.

- EFS SUPER ABRASIVES

- Shannon Abrasives.

- Midland Abrasives Ltd

- P.B.R. Abrasives (W’ton) Limited