Southeast Asia China And India Sulphur Market By Grade(Food Grade, Agricultural Grade, Rubber Grade, Industrial Grade, Pharma Grade, Others), By Product(Oil-Filled Powder Sulfur, Non-Oil Filled Powder Sulfur), By Fineness(200 Mesh, 300 Mesh, 325 Mesh, 400 Mesh, 500 Mesh, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

17642

-

March 2024

-

111

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

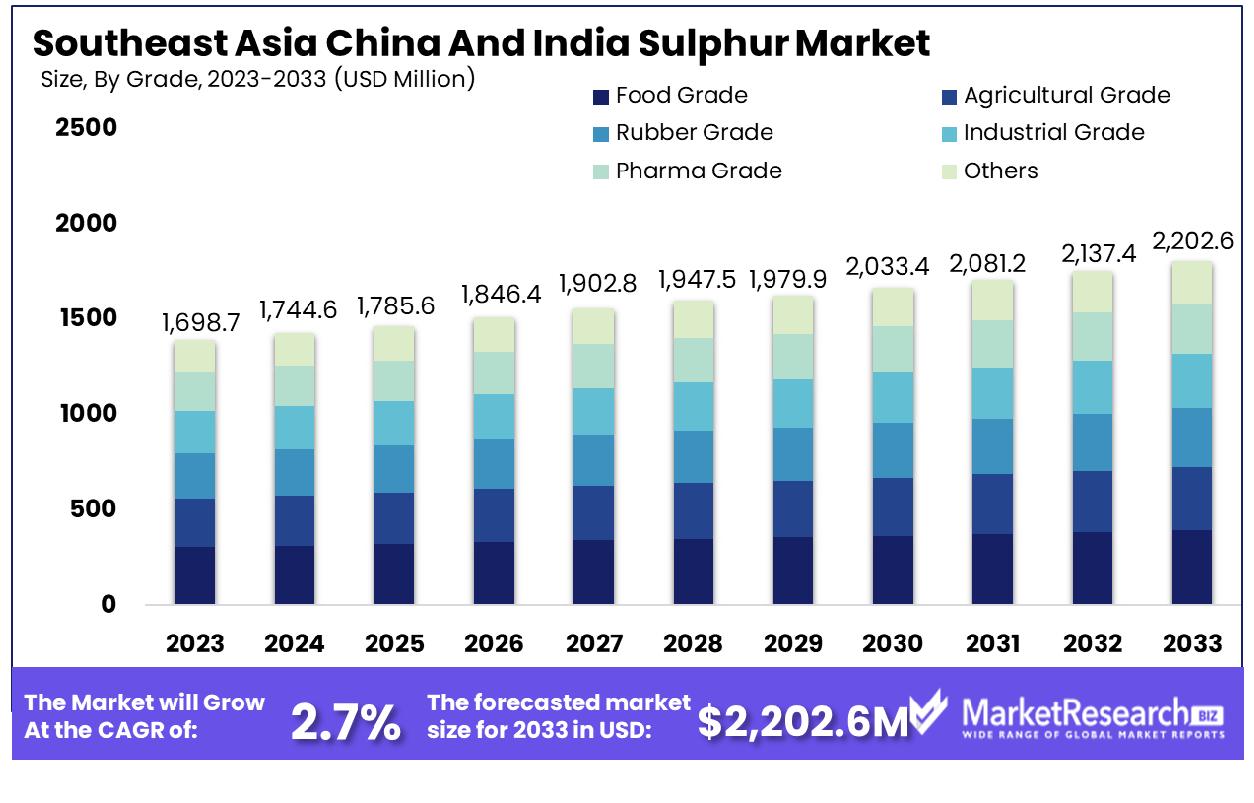

The Global Southeast Asia China And India Sulphur Market was valued at USD 1,698.7 million in 2023. It is expected to reach USD 2,202.6 million by 2033, with a CAGR of 2.7% during the forecast period from 2024 to 2033.

The Southeast Asia, China, and India Sulphur Market refer to the collective demand, supply, and dynamics surrounding the trade and utilization of sulphur within these key regions. As a vital component in various industrial processes, including fertilizer production, petrochemicals, and pharmaceuticals, the market encapsulates the intricate interplay of factors such as extraction methods, pricing current trends, regulatory landscapes, and technological advancements.

Its significance lies in its pivotal role in sustaining agricultural productivity, supporting industrial growth rate, and fostering innovation across diverse sectors. Understanding the nuances of this market is imperative for strategic decision-making among executives, offering insights into opportunities, risks, and competitive positioning.

In the dynamic landscape of Southeast Asia, China, and India sulphur market, several factors converge to shape its trajectory. The demand for sulphur, a vital component in agricultural practices, has witnessed a notable surge owing to evolving agricultural techniques and increasing focus on crop yield optimization. Our analysis reveals a nuanced picture, underpinned by a blend of emerging current trends and persistent challenges.

One significant trend is the integration of ammonium thiosulfate (ATS) in starter and/or sidedressed nitrogen fertilizers, which has garnered attention for its potential to enhance grain yield. Trials conducted showcase a promising yield benefit, ranging from 3 to 34 bu/acre, with an average increase of 11 bu/acre. However, the efficacy of applying sulphur solely through starter fertilizers remains a subject of scrutiny, with limited success observed in trials, indicating the need for further optimization in sulphur application methodologies.

Moreover, empirical data spanning three decades highlights a notable uptick in using sulfur-containing fertilizers across Midwestern croplands. From 1985 to 2015, sulphur application rates escalated at a rate of 0.10 kg S/ha/yr, marking a substantial increase from 1.3 to 4.9 kg S/ha/yr. This surge in sulphur utilization outpaces the rapid growth observed in other major nutrient fertilizers, underscoring the burgeoning significance of sulphur in contemporary agricultural paradigms.

As stakeholders navigate this evolving landscape, opportunities for innovation and optimization abound. Strategic investments in research and development, coupled with a nuanced understanding of regional dynamics, will be instrumental in capitalizing on emerging opportunities and addressing prevailing challenges. The Southeast Asia, China, and India sulphur market, poised at the intersection of agricultural advancement and market dynamics, presents a compelling arena for informed decision-making and strategic foresight.

Key Takeaways

- Market Growth: The Global Southeast Asia China And India Sulphur Market was valued at USD 1,698.7 million in 2023. It is expected to reach USD 2,202.6 million by 2033, with a CAGR of 2.7%during the forecast period from 2024 to 2033.

- By Grade: In the grade category, Food Grade emerged as the dominating segment within its field.

- By Product: Regarding products, Oil-Filled Powder Sulfur stood out as the leading segment among its counterparts.

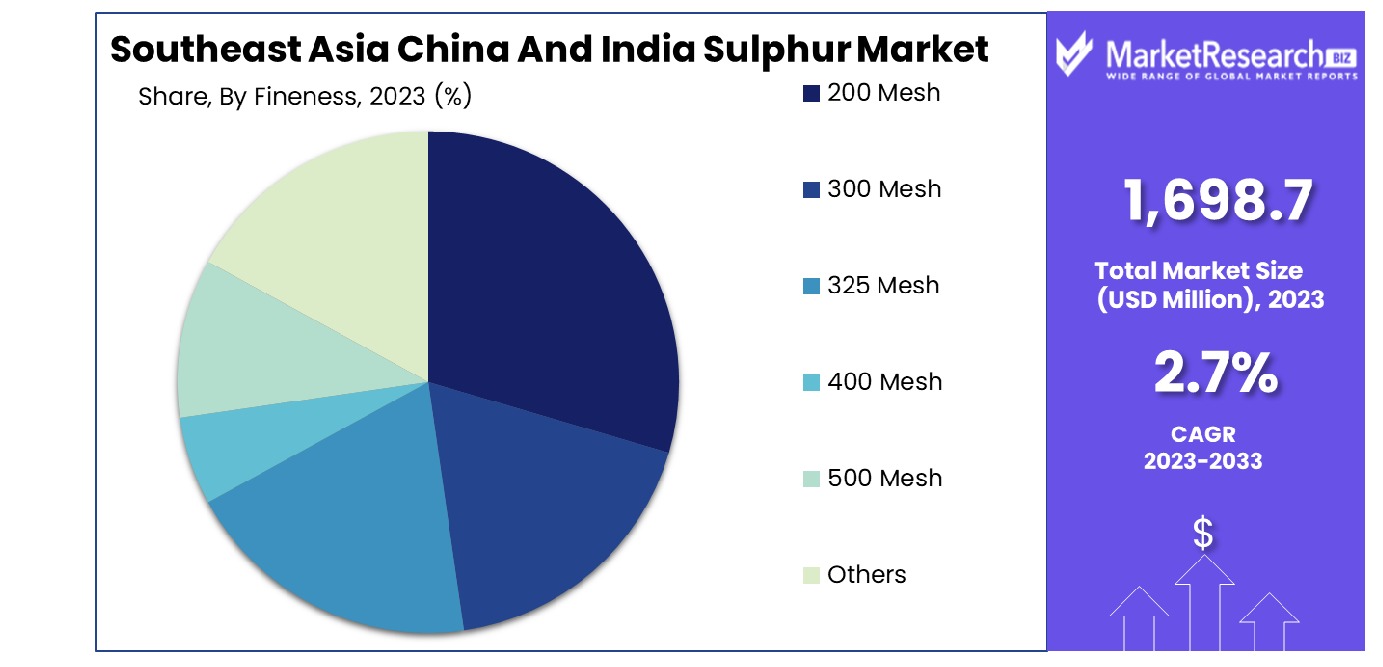

- By Fineness: For fineness, the 200 Mesh specification was identified as the predominant segment in its classification.

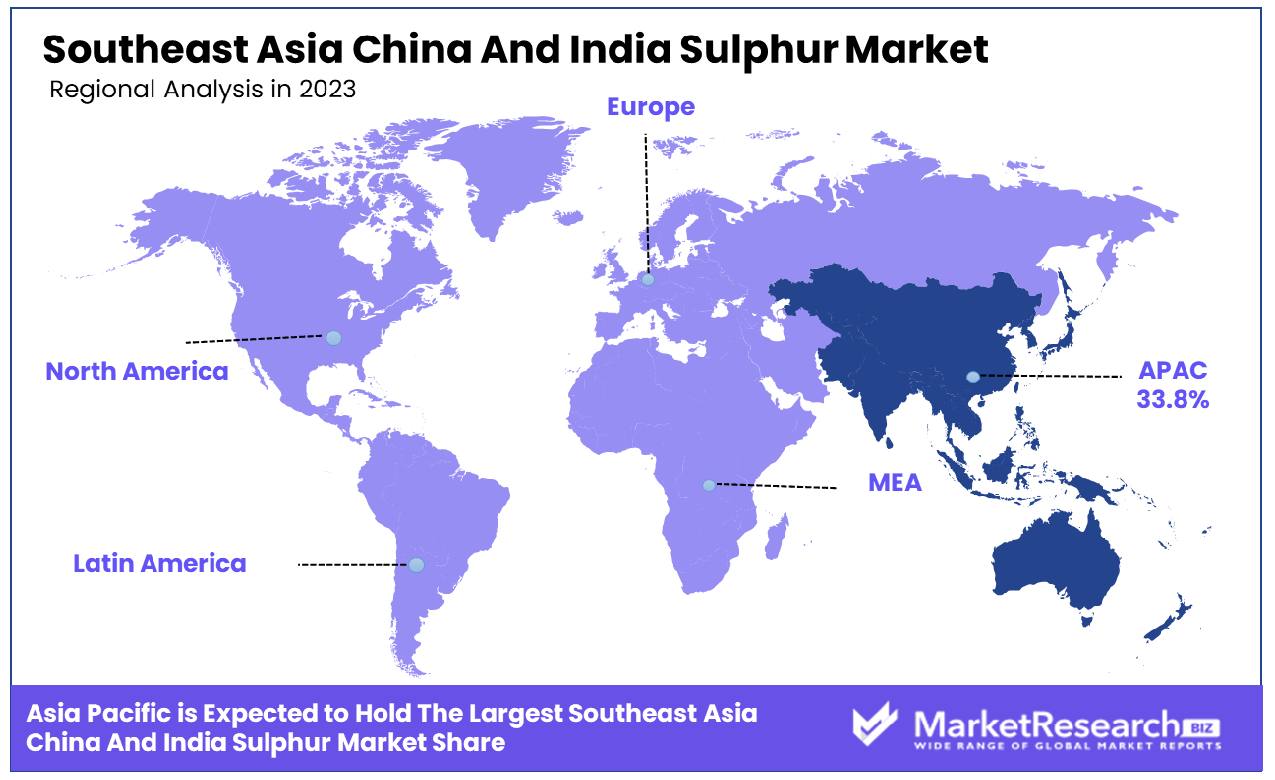

- Regional Dominance: The Asia-Pacific region leads in the sulphur market with China contributing 33.8% of demand.

- Growth Opportunity: The sulfur market in Southeast Asia, China, and India is poised for growth in 2023, driven by industrial demand, sustainable innovations, and environmental regulations, promising enhanced agricultural and industrial applications.

Driving factors

Agriculture Demand for Sulfur Driving Market Expansion

The agriculture sector's demand for sulfur, primarily used in fertilizers to enhance crop yield and soil health, stands as a significant catalyst for the growth of the Southeast Asia, China, and India Sulfur Market. The region, characterized by its vast agricultural lands and the need to support an ever-growing population, has seen a steady increase in the utilization of sulfur-containing fertilizers.

Statistically, the agriculture sector's consumption of sulfur has been on an upward trajectory, aligning with the efforts to achieve food security and sustainable agricultural practices. This demand is underpinned by the recognition of sulfur's essential role in plant nutrition, particularly in protein synthesis and enzyme function, making it critical for crop development. The escalating agricultural productivity targets in these regions necessitate the continued growth in sulfur demand, directly influencing the sulfur market's expansion.

Chemical and Petrochemical Industries' Growth Fuelling Sulfur Demand

The burgeoning growth of the chemical and petrochemical industries in Southeast Asia, China, and India acts as a powerful engine driving the sulfur market forward. Sulfur is a key raw material in the production of numerous chemicals, including sulfuric acid, which is pivotal for manufacturing fertilizers, inorganic salts, detergents, and dyes. The expansion of these industries is reflective of the broader industrialization and urbanization sulfur trends sweeping through the region, with a marked increase in production capacities and the establishment of new chemical plants.

The chemical and petrochemical sector's growth trajectory is supported by favorable government policies, investment in research and development, and a rising demand for chemical products, contributing to a heightened demand for sulfur. This scenario is further bolstered by the region's position as a global manufacturing hub, necessitating substantial volumes of sulfur for diverse industrial applications.

Environmental Regulations and Cleaner Production Practices Enhancing Sulfur Utilization

Environmental regulations and the adoption of cleaner production practices have emerged as pivotal factors shaping the sulfur market in Southeast Asia, China, and India. Stricter environmental standards aimed at reducing air and water pollution are pushing industries towards the use of sulfur-based technologies for emissions control and waste treatment. For instance, the desulfurization of fossil fuels and industrial gases to curb sulfur dioxide emissions is a direct response to environmental mandates, driving the demand for sulfur in the region.

Moreover, the shift towards cleaner production methods is not only a compliance measure but also a strategic move by companies to align with global sustainability current trends and consumer preferences for environmentally friendly products. This transition is evidenced by the adoption of advanced technologies that utilize sulfur more efficiently, minimizing waste and environmental impact. The convergence of environmental policies and the push for sustainability are thus instrumental in steering the sulfur market towards growth, reflecting an increasing emphasis on responsible and eco-friendly industrial practices.

Restraining Factors

Environmental Regulations Impact on the Southeast Asia, China, and India Sulphur Market

The implementation of stringent environmental regulations across Southeast Asia, China, and India plays a pivotal role in shaping the sulphur market. These regulations, aimed at reducing air pollution and limiting the release of hazardous substances, significantly impact the operations of industries that emit sulphur, such as the oil and gas, and chemical manufacturing sectors. For instance, the Chinese government's policies to combat air pollution have led to the closure of numerous small and inefficient factories that failed to meet the new environmental standards. This regulatory environment has a dual effect on the sulphur market.

On one hand, it constrains production capacities and increases compliance costs for sulfur-emitting industries, thereby limiting the supply of sulphur. On the other hand, it fosters innovation and the development of cleaner technologies, such as sulphur recovery technologies and the advancement of low-sulphur fuel standards. Consequently, while the immediate effect of these regulations may be restrictive, they also drive demand for cleaner, sustainable solutions in the long run, potentially stabilizing market growth through the increased adoption of environmental technologies and practices.

Fluctuating Crude Oil Prices' Influence on the Southeast Asia, China, and India Sulphur Market

Crude oil prices are inherently volatile, influenced by geopolitical tensions, supply-demand imbalances, and global economic indicators. This volatility directly impacts the sulphur market, given that a significant portion of sulphur production is a byproduct of the oil refining process. When oil prices are high, refineries operate at peak capacity to meet energy consumption demand, leading to an increase in sulphur supply.

Conversely, low oil prices can result in reduced refinery throughput and, subsequently, a decrease in sulphur production. This volatility introduces unpredictability for the sulphur market in Southeast Asia, China, and India, affecting planning and pricing strategies for market participants. The impact is particularly pronounced in these regions due to their heavy reliance on crude oil imports and the significant role of the energy sector in their economies.

Additionally, fluctuating oil prices can influence the cost of sulphur recovery and processing technologies, further affecting the market dynamics. As a result, stakeholders in the sulphur market must navigate these fluctuations carefully, incorporating risk management strategies to mitigate the impact of crude oil price volatility on supply, demand, and pricing structures. This environment encourages market participants to seek alternative sulphur sources and invest in technologies that can either reduce reliance on oil-derived sulphur or enhance efficiency in sulphur recovery and utilization.

By Grade Analysis

In the grade category, Food Grade emerged as the dominant segment observed.

In 2023, the Southeast Asia, China, and India Sulphur Market was characterized by distinct segments, with Food Grade emerging as a dominant player in the By Grade category. This category encompasses various grades of sulphur, including Agricultural Grade, Rubber Grade, Industrial Grade, Pharma Grade, and others. The ascendancy of Food Grade sulphur can be attributed to stringent food safety regulations and the growing demand for high-quality food products across these regions. The adherence to food safety standards necessitates the utilization of superior-grade sulphur in agricultural practices, which, in turn, ensures the production of safe and high-quality food products.

The Agricultural Grade segment also witnessed significant growth, driven by the expanding agricultural sector in these economies. The application of sulphur in agriculture, primarily as a nutrient and soil conditioner, has bolstered crop yields, further propelling market growth. Similarly, the Rubber Grade segment has seen a notable increase, fueled by the burgeoning automotive target industry in Southeast Asia, China, and India. Sulphur is indispensable in the vulcanization process of rubber, enhancing the strength and elasticity of rubber products.

Moreover, the Industrial Grade segment has experienced steady growth, owing to its widespread use in various industrial processes, including the manufacture of sulphuric acid, which is pivotal in numerous chemical syntheses. The Pharma Grade segment, although smaller in comparison, plays a critical role in the pharmaceutical target industry, underscoring the importance of high-purity sulphur in drug formulation and production.

By Product Analysis

Regarding products, Oil-Filled Powder Sulfur stood out as the leading segment.

In 2023, Oil-Filled Powder Sulfur held a dominant market position in the "By Product" segment of the Southeast Asia, China, and India Sulphur Market. This category, which includes both Oil-Filled Powder Sulfur and Non-Oil Filled Powder Sulfur, has been the subject of extensive analysis to understand its market dynamics, growth factors, and future projections.

The preference for Oil-Filled Powder Sulfur can be attributed to its superior qualities, including enhanced stability and ease of handling, which are pivotal in various industrial applications. This product variant has been instrumental in catering to the burgeoning demands of the agricultural sector, particularly in fertilizer production, a critical area of focus within these regions known for their substantial agricultural outputs. Furthermore, the Oil-Filled Powder Sulfur has seen increased adoption in the chemical manufacturing target industry, where its properties are leveraged in the production of sulphuric acid, a fundamental chemical in numerous industrial processes.

The market's inclination towards Oil-Filled Powder Sulfur is also bolstered by ongoing technological advancements and innovation in product formulation and application methods. These advancements have enhanced the efficiency and effectiveness of Oil-Filled Powder Sulfur, thereby reinforcing its market position.

Conversely, the Non-Oil Filled Powder Sulfur segment, while significant, has experienced a relatively slower growth trajectory. The limitations associated with handling and stability, compared to its oil-filled counterpart, have somewhat constrained its market penetration.

Looking forward, the Sulphur market in Southeast Asia, China, and India is anticipated to witness sustained growth. The expansion can be attributed to increasing agricultural activities, rising demand for sulphuric acid in the chemical target industry, and continued investments in research and development. The strategic focus on enhancing product features and exploring new applications for Sulphur will likely further solidify the market position of Oil-Filled Powder Sulfur, ensuring its continued dominance in the foreseeable future.

By Fineness Analysis

For fineness, the 200 Mesh classification notably dominated the market segment.

In 2023, 200 Mesh held a dominant market position in the By Fineness segment of Southeast Asia, China, and India Sulphur Market, which is categorized into various mesh sizes, including 200 Mesh, 300 Mesh, 325 Mesh, 400 Mesh, 500 Mesh, and Others. This prominence of the 200 Mesh category can be attributed to its widespread applicability across various industrial processes, including the manufacturing of sulfuric acid, the vulcanization of rubber, and as a fungicide in the agricultural sector. The optimal particle size of 200 Mesh sulphur facilitates its efficient integration into diverse chemical reactions, enhancing its demand across the aforementioned regions.

The market dynamics for sulphur, segmented by fineness, are significantly influenced by industrial growth, technological advancements, and the agricultural needs of Southeast Asia, China, and India. These economies, being at varying stages of industrial development, present a robust demand for sulphur, driven by their expanding manufacturing sectors, increased agricultural activities, and the rising need for cleaner energy sources. The 200 Mesh segment, in particular, benefits from these factors, as its applications are crucial for the production processes within these industries.

Moreover, the strategic importance of the 200 Mesh sulphur segment is underscored by its role in environmental protection measures. Its use in desulfurization processes and in producing fertilizers that minimize soil acidity highlights its contribution to sustainable industrial practices. As such, the market for 200 Mesh sulphur is expected to sustain its growth trajectory, supported by industrial expansion and environmental sustainability initiatives in these regions.

Future market current trends are likely to be shaped by advancements in sulphur processing technologies, regulatory frameworks aimed at environmental protection, and the evolving needs of the agriculture and manufacturing sectors. The strategic positioning of the 200 Mesh segment, therefore, remains pivotal within the broader sulphur market landscape in Southeast Asia, China, and India.

Key Market Segments

By Grade

- Food Grade

- Agricultural Grade

- Rubber Grade

- Industrial Grade

- Pharma Grade

- Others

By Product

- Oil-Filled Powder Sulfur

- Non-Oil Filled Powder Sulfur

By Fineness

- 200 Mesh

- 300 Mesh

- 325 Mesh

- 400 Mesh

- 500 Mesh

- Others

Growth Opportunity

Promising Growth Prospects in Southeast Asia

The sulfur market in Southeast Asia has been identified as harboring significant growth potential throughout 2023. The region's increasing industrial activities, particularly in sectors such as agriculture, chemicals, and rubber manufacturing, are key drivers behind this expansion. Additionally, the strategic geographical positioning of Southeast Asian countries facilitates the exportation of sulfur and its derivatives to demanding markets, further amplifying growth opportunities.

The implementation of stringent environmental regulations across the globe has also necessitated the adoption of cleaner technologies and practices in industries, leading to a surge in demand for sulfur for desulfurization processes. This trend is expected to bolster the market's growth, as stakeholders capitalize on these emerging opportunities.

Moreover, government initiatives aimed at enhancing agricultural outputs through the use of sulfur-based fertilizers contribute to the positive outlook for the sulfur market in this region. Thus, the growth of the sulfur market in Southeast Asia can be attributed to a confluence of industrial expansion, regulatory policies, and strategic market positioning.

Sustainable Innovations Driving Market Growth

Sustainable innovations are increasingly becoming a cornerstone for the growth of the sulfur market, particularly in China and India. These economies are witnessing a paradigm shift towards the development and adoption of environmentally friendly sulfur-based products, responding to the global call for sustainability. Innovations in sulfur utilization, such as advanced sulfur concrete and sulfur-extended asphalt, are paving the way for sustainable construction practices.

These technologies not only contribute to the reduction of carbon footprints but also offer enhanced durability and cost-effectiveness, making them highly attractive to both public and private sector projects. Furthermore, the agricultural sector in China and India is transforming with the introduction of sulfur-coated urea fertilizers, which provide a slow-release mechanism for improved crop yield and minimized environmental impact. The development of such innovative, sustainable products is instrumental in driving the sulfur market's growth in these countries, aligning with global sustainability goals and local economic development objectives.

Latest Trends

Precision Agriculture and Desulfurization Technologies in Southeast Asia

The integration of precision agriculture alongside advancements in desulfurization technologies has significantly shaped the sulfur market dynamics within Southeast Asia. The adoption of precision agriculture methods is being propelled by the increasing demand for efficient agricultural practices, aiming to enhance crop yield and optimize sulfur utilization. This trend is observed in the growing implementation of targeted fertilization strategies, which rely on precise sulfur applications to meet the specific nutrient requirements of crops.

Moreover, the advancement in desulfurization technologies, particularly in industrial sectors, has emerged as a critical factor in reducing sulfur emissions and improving air quality. The technologies being developed and deployed in this region focus on capturing sulfur from various industrial processes, thereby mitigating environmental impacts and aligning with global sustainability goals. These innovations not only contribute to the preservation of ecological balance but also foster a circular economy by enabling the recycling and reuse of sulfur.

Sustainable Sulfur Extraction and Recycling Innovations

Sustainable sulfur extraction and recycling innovations are increasingly becoming a focal point in the global effort to address environmental concerns while meeting the sulfur demand across industries, including Southeast Asia, China, and India. The shift towards sustainable extraction techniques emphasizes minimizing the environmental impact of sulfur extraction processes. Techniques such as the Claus process, which converts hydrogen sulfide from industrial gases into elemental sulfur, are being optimized for greater efficiency and lower emissions. This approach not only reduces the carbon footprint associated with sulfur extraction but also enhances the overall sustainability of the target industry.

Recycling innovations play a crucial role in the sulfur market's evolution, offering a pathway to repurpose sulfur waste into valuable products. Advanced recycling methods are being developed to convert sulfur waste from industrial processes into fertilizers, construction materials, and other chemicals, thus promoting a circular economy. These innovations are particularly relevant in regions like Southeast Asia, China, and India, where industrial growth presents both challenges and opportunities for sustainable sulfur management.

Regional Analysis

The Asia-Pacific sulphur market is dominated by China, holding a significant 33.8% market share of the market.

The Southeast Asia, China, and India sulphur market is a segment with diverse dynamics and opportunities, reflecting the varied economic landscapes and industrial demands of these regions. In North America, the market is characterized by stable demand, primarily driven by the oil and gas industry, which utilizes sulphur in the production of sulfuric acid, a critical component in various industrial processes. The European market, while showing moderate growth, focuses on sustainable and environmentally friendly sulphur recovery technologies, aligning with the region's stringent environmental regulations.

The Asia Pacific region, however, stands out as the dominant player in the global sulphur market, accounting for approximately 33.8% of the market, with China being the most significant contributor. This dominance is attributed to the extensive industrial base, rapid urbanization, and the growing agrochemicals sector, which extensively utilizes sulphur for fertilizer production. Southeast Asia, along with India, further bolster the Asia Pacific market, driven by agricultural demands and the development of infrastructure projects requiring sulphur-related products.

Middle East & Africa and Latin America, though smaller in comparison, are witnessing growth in demand for sulphur, primarily for agricultural purposes and in oil refining. These regions are expected to present new opportunities for market expansion, driven by economic development and increased sulphur extraction capacities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global Southeast Asia, China, and India sulphur market in 2023, the landscape is significantly shaped by the contributions and strategic positions of key players including Grupa Azoty, Kaycee Chem Industries, M.K. Chemical Industries, Jordan Sulphur, Golden Chemicals Sulphur, J K Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS, and Jaishil Sulphur. These entities have established themselves as pivotal in the sulphur market dynamics through their diversified product offerings, technological advancements, and strategic market positioning.

Grupa Azoty, as one of Europe's leaders in chemical manufacturing, extends its influence into the Southeast Asia, China, and India markets by leveraging its robust production capabilities and expansive product portfolio. The company's focus on innovation and sustainability has positioned it as a key supplier capable of meeting the evolving demands within these regions.

Kaycee Chem Industries and M.K. Chemical Industries, with their specialized focus on sulphur and chemical products, have carved out significant niches. Their dedication to quality and customer service has ensured a stable market presence, particularly in niche applications where quality and consistency are paramount.

Jordan Sulphur and Golden Chemicals Sulphur bring to the market a rich history in sulphur processing and distribution, emphasizing their strategic locations and logistical capabilities. This geographic positioning enables them to efficiently supply the vast and rapidly growing markets of Southeast Asia, China, and India.

Emerging major players like Solar Chemferts Pvt Ltd and JAINSON CHEMICALS have demonstrated remarkable agility in adapting to market current trends, focusing on sustainable practices and innovative solutions to meet the specific needs of the agriculture and industrial sectors.

American region Elements stands out for its emphasis on high-purity chemical production, catering to the sophisticated demands of high-tech industries, thereby marking its significance in the global supply chain of critical materials.

J K Industries and Jaishil Sulphur have strengthened their market positions through strategic partnerships, quality enhancements, and expanding their distribution networks to ensure accessibility and reliability for customers across the targeted regions.

Collectively, these companies are instrumental in the sulphur market's growth trajectory within Southeast Asia, China, and India. Their efforts in embracing technological innovations, environmental stewardship, and market expansion strategies are pivotal in shaping the market's future direction.

Market Key Players

- Grupa Azoty

- Kaycee Chem Industries

- M. K. CHEMICAL INDUSTRIES

- Jordan Sulphur

- Golden Chemicals, Sulphur.

- J K Industries

- Solar Chemferts Pvt Ltd

- American Elements

- JAINSON CHEMICALS, and Jaishil Sulphur

Recent Development

- In October 2023, Leader Energy signed an MoU with BASF Stationary Energy Storage GmbH to develop long-duration energy storage projects in Southeast Asia using NGK Insulators' NAS batteries.

- In March 2022, Scientists stressed the importance of modeling aerosol impacts on climate change, highlighting the complexity and regional effects of anthropogenic aerosols, which can cool or warm the atmosphere, affecting global climatic factors patterns.

Report Scope

Report Features Description Market Value (2023) USD 1,698.7 Million Forecast Revenue (2033) USD 2,202.6 Million CAGR (2024-2032) 2.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Food Grade, Agricultural Grade, Rubber Grade, Industrial Grade, Pharma Grade, Others), By Product(Oil-Filled Powder Sulfur, Non-Oil Filled Powder Sulfur), By Fineness(200 Mesh, 300 Mesh, 325 Mesh, 400 Mesh, 500 Mesh, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Grupa Azoty, Kaycee Chem Industries, M. K. CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals, Sulphur., J K Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS, and Jaishil Sulphur & Chemical Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Grupa Azoty

- Kaycee Chem Industries

- M. K. CHEMICAL INDUSTRIES

- Jordan Sulphur

- Golden Chemicals, Sulphur.

- J K Industries

- Solar Chemferts Pvt Ltd

- American Elements

- JAINSON CHEMICALS, and Jaishil Sulphur