Liquid Fertilizers Market By Source (Organic, Synthetic), By Nutrient Type (Nitrogen, Phosphorus, Potassium, Micronutrients), By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Other), By Application (Fertigation, Foliar, Soil, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5578

-

May 2023

-

176

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

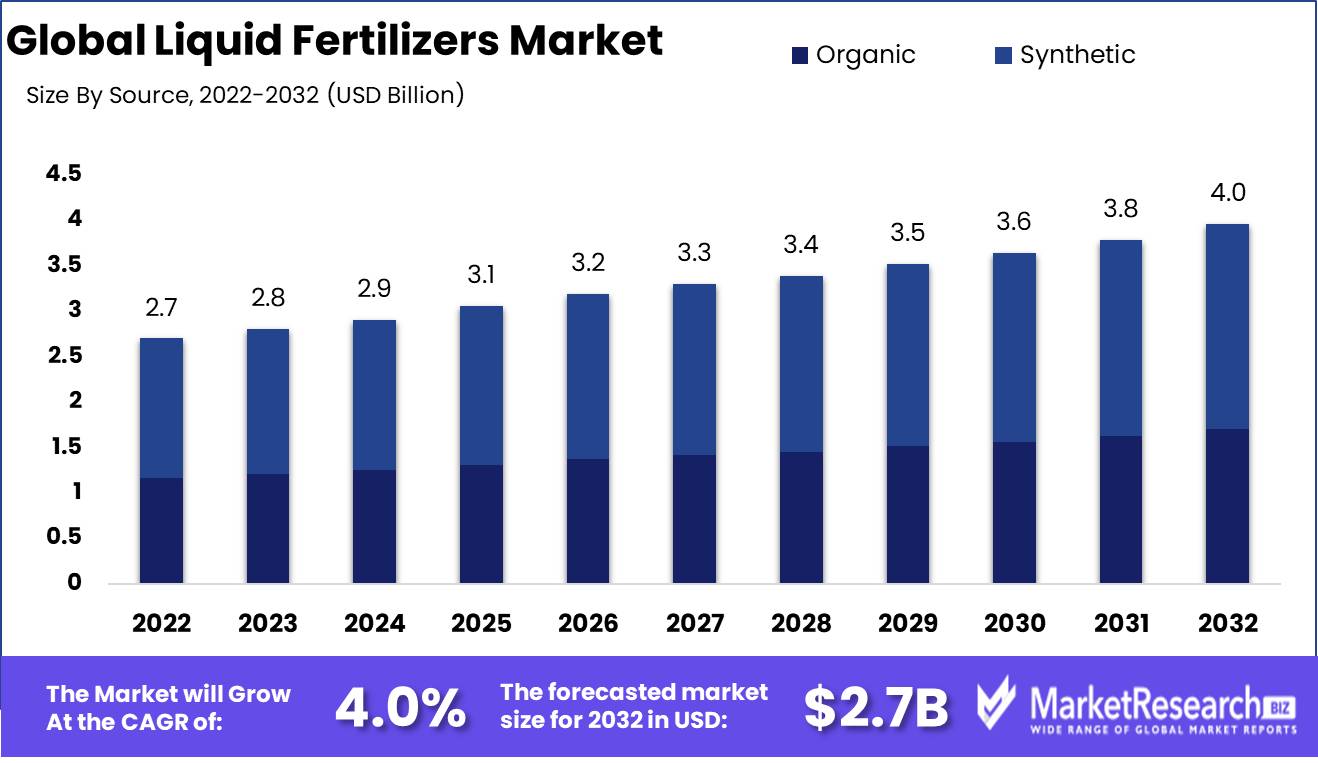

Liquid fertilizers market size is expected to be worth around USD 4.0 Bn by 2032 from USD 2.7 Bn in 2022, growing at a CAGR of 4.0% during the forecast period from 2023 to 2032.

Liquid fertilizers, known as liquid plant nutrients, play a crucial role in modern agriculture. As the demand for sustainable and efficient farming practices continues to grow, liquid fertilizers have emerged as a popular choice among farmers and agriculture enthusiasts worldwide. Liquid fertilizers can be defined as concentrated solutions of essential nutrients that are directly absorbed by plants through the soil or foliage. Their primary goal is to provide plants with the necessary nutrients in a readily available form, facilitating their growth, development, and overall health. Unlike traditional solid fertilizers, which need to be broken down by soil microorganisms before being absorbed by plant roots, liquid fertilizers ensure quicker and more efficient nutrient uptake.

The importance and advantages of liquid fertilizers cannot be overstated. Apart from their convenience of application, liquid fertilizers provide a highly customizable approach to plant nutrition. Farmers can tailor the nutrient composition of liquid fertilizers to cater to the specific needs of different crops, growth stages, and soil conditions. This precision allows for optimal nutrient utilization and helps in avoiding over- or under-fertilization, leading to increased crop productivity and quality.

One notable innovation in the liquid fertilizers market is the incorporation of advanced technologies. Companies are investing heavily in research and development to create cutting-edge liquid fertilizers that encompass various beneficial additives. These additives include bio-stimulants, micronutrients, organic matter, and microbial inoculants, which enhance nutrient absorption, root development, soil fertility, and overall plant health. Such innovations have revolutionized the field of liquid fertilizers, providing farmers with efficient tools to maximize crop yields and minimize environmental impact.

The growth of the liquid fertilizers market can be attributed to its versatile applications. Apart from supporting the growth and yield of crops, find application in turf management, golf course maintenance, landscaping, and even in household gardening. The use of liquid fertilizers in these various sectors has contributed significantly to the overall market expansion.

Numerous industries have recognized the potential of liquid fertilizers and are actively investing in this market. The agricultural sector, including both conventional and organic farming, is the primary consumer. However, the market is also gaining traction in the pharmaceutical and cosmetic industries, where liquid fertilizers are used as additives in products aimed at promoting hair and nail health. The remarkable growth of the global liquid fertilizers market can be attributed to the collective efforts of these diverse industries.

Driving factors

Agriculture and Horticulture Growth

Agriculture and horticulture feed the growing world population. With limited arable land and rising environmental concerns, agricultural productivity must be maximized without compromising sustainability. This has led to sophisticated farming methods and novel nutrient management, where liquid fertilizers are beneficial. Due to their capacity to deliver targeted and quick nourishment to the crops, liquid fertilizers such nitrogen-based compounds, phosphorous, and potassium-rich solutions have gained popularity.

Effective Nutrient Management

Sustainable agriculture requires efficient nutrient management. Nutrient discharge from granular or solid fertilizers pollutes water and soil. Liquid fertilizers provide precision application, minimizing environmental impact and ensuring crops get critical nutrients. Liquid fertilizers allow farmers to customize fertilizer compositions to different crops, growth stages, and soil conditions. This tailored strategy promotes healthy plant growth and eliminates over-fertilization and nutrient waste, encouraging environmentally responsible farming.

Precision farming

Smart farming, often known as precision farming, optimizes agricultural operations using advanced technologies and data-driven methods. This method optimizes resource efficiency, waste, and crop yields. Precision farming can improve nutrient management and boost the liquid fertilizers market. Farmers may collect accurate soil, nutrient, and plant health data using precision farming technology like remote sensing, GPS, and GIS. This data-driven method applies liquid fertilizers at the correct time, in the right amount, and in the most nutrient-deficient locations.

Environmental Changes

Environmental and sustainability considerations have driven liquid fertilizer usage in agriculture and horticulture in recent years. Farmers and governments are pursuing environmentally friendly food production methods to combat climate change, water scarcity, and soil degradation. Liquid fertilizers are greener than granular ones. First, their water-soluble nature prevents nutrient runoff into water bodies and environmental damage. Second, irrigation systems efficiently apply liquid nutrients, saving water and energy.

Restraining Factors

Raw material price volatility

The liquid fertilizers market is hampered by several problems. Raw material prices may fluctuate. The market price and availability of liquid fertilizers depend on raw material costs. NPK are the main ingredients in liquid fertilizers. These minerals are necessary for plant growth. However, crop demand, supply chain interruptions, geopolitical events, and global market circumstances can affect raw material prices. Liquid fertilizer manufacturing costs can rise dramatically if nitrogen, phosphorus, or potassium prices spike. This may effect product pricing in the market.

Compliance and Regulations

The liquid fertilizers market also confronts regulatory and compliance issues. Fertilizer safety, quality, and sustainability are generally regulated by governments. Such regulations can affect liquid fertilizer makers and suppliers. Licenses, maximum allowable limits for elements or compounds, and labeling and packaging rules are regulatory requirements. These laws ensure liquid fertilizers are safe for humans and the environment. It needs monitoring regulatory changes and spending in R&D to manufacture items that fulfill new criteria. These requirements also add costs, which can affect liquid fertilizer prices.

Formulation/Application Issues

Another liquid fertilizers market restraint is formulation and application issues. Creating and applying liquid fertilizers that meet crop nutrient needs is difficult. To make a balanced liquid fertilizer, nitrogen, phosphorous, potassium, and other micronutrients are mixed. Research and experimentation are needed to achieve the required nutritional content and product stability and solubility. Dosage precision, compatibility with other agrochemicals, and application methods make liquid fertilizer application difficult. Underdosing reduces crop productivity, while overdose pollutes the environment and damages plants.

Organic and Alternative Fertilizers

Organic and alternative liquid fertilizers have increased competition in the market. Farmers and growers are moving away from conventional fertilizers due to environmental concerns. Compost, manures, and bio-based products nourish soil with natural nutrients. Biofertilizers and bio-stimulants use beneficial microorganisms and plant growth-promoting chemicals to boost nutrient availability and plant growth. The liquid fertilizers market faces competition from organic and alternative fertilizers. alternative and Organic fertilizers are more environmentally friendly and sustainable than liquid fertilizers.

Weather and Fertilizer Use

Weather impacts liquid fertilizer use and efficacy. Water, temperature, and rainfall affect crop growth and nutrient uptake. Liquid fertilizers can be affected by droughts, floods, and high temperatures. Due to water shortages, liquid fertilizers may be less effective. However, heavy rain or flooding can dilute liquid fertilizers, reducing their efficiency. Extreme temperatures accelerate nutrient loss through volatilization or denitrification, limiting liquid fertilizer efficacy.

Source Analysis

The liquid fertilizers market has been largely dominated by the Synthetic Segment. This segment has gained significant popularity and adoption due to its numerous benefits and advantages. Synthetic fertilizers are chemically formulated and are designed to provide specific nutrients to the plants. They are highly efficient in terms of nutrient delivery and are easily soluble in water, making them convenient and easy to use.

Consumer trends and behaviors towards the Synthetic Segment in the liquid fertilizers market are characterized by the preference for easy-to-use and cost-effective products. Farmers are increasingly looking for solutions that can improve crop productivity and reduce labor costs. Synthetic fertilizers offer a wide range of nutrients, allowing farmers to cater to the specific requirements of their crops. The convenience and reliability of synthetic fertilizers have made them a popular choice among farmers.

Nutrient Type Analysis

Among the various nutrient types, the Nitrogen Segment has dominated the liquid fertilizers market. Nitrogen is an essential element for plant growth and plays a crucial role in various physiological processes. It promotes vegetative growth, enhances chlorophyll production, and improves overall plant performance. Nitrogen-based fertilizers are widely used in agriculture due to their ability to provide quick and significant nutrient uptake.

Consumer trends and behaviors towards the Nitrogen Segment in the liquid fertilizers market reflect the importance of maximizing crop productivity and efficiency. Farmers are increasingly aware of the role of nitrogen in plant growth and are keen on incorporating nitrogen-based fertilizers into their farming practices. The ability of these fertilizers to provide quick and efficient nutrient uptake has made them highly desirable among farmers. Additionally, the cost-effectiveness of nitrogen-based fertilizers further drives their adoption.

Crop Type Analysis

Fruits & Vegetables Segment has emerged as the dominating segment in the liquid fertilizers market. Fruits and vegetables are high-value crops, and their demand has been steadily increasing due to changing dietary patterns and increased awareness of health and wellness. Liquid fertilizers offer several benefits for fruits and vegetables, including enhanced nutrient uptake and improved crop quality by crop protection chemicals.

Consumer trends and behaviors towards the Fruits & Vegetables Segment in the liquid fertilizers market reflect the focus on quality and nutrition. Consumers are increasingly conscious of the nutritional value of fruits and vegetables and are willing to pay a premium for high-quality produce. Liquid fertilizers offer a way to enhance crop quality, improve taste, and increase the nutrient content of fruits and vegetables. Farmers are responding to this demand by incorporating liquid fertilizers into their precision farming practices.

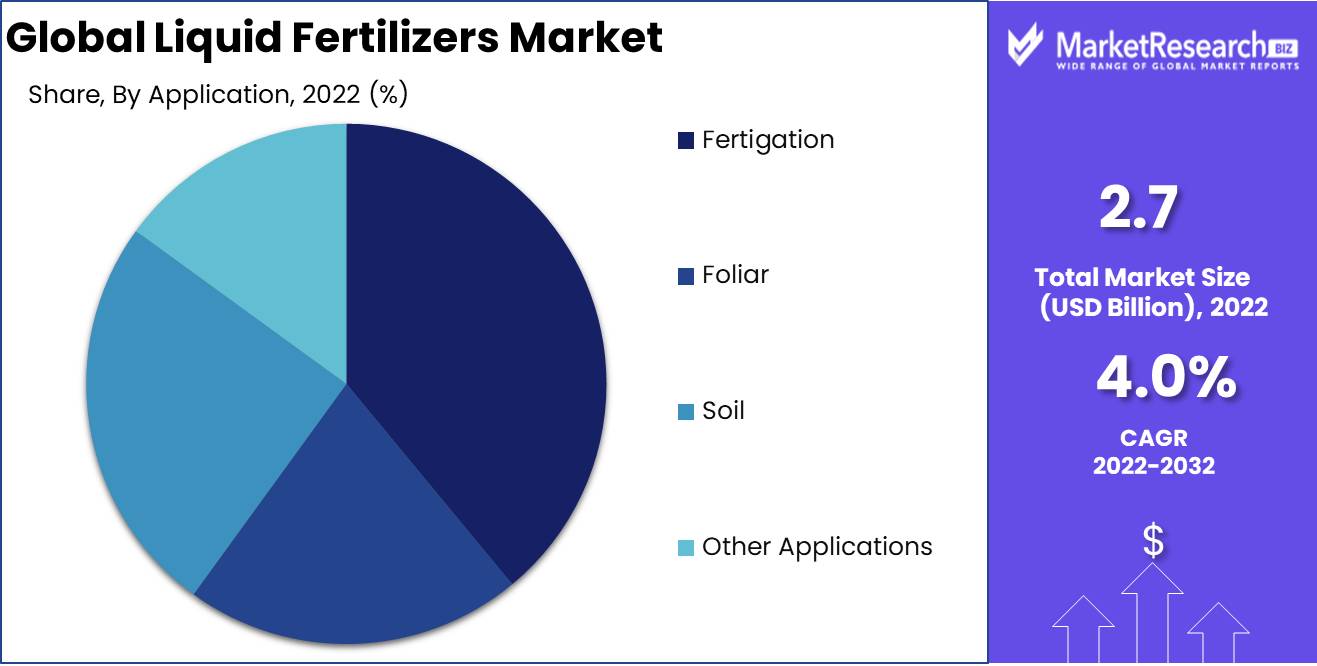

Application Analysis

The Fertigation Segment has emerged as the dominant segment in the liquid fertilizers market. Fertigation refers to the process of applying fertilizers through irrigation systems, allowing for efficient nutrient delivery directly to the plant roots. This method offers numerous advantages, including improved water and nutrient-use efficiency, reduced labor costs, and increased crop productivity.

Consumer trends and behaviors towards the Fertigation Segment in the liquid fertilizers market reflect the demand for efficient and sustainable farming practices. Fertigation allows farmers to optimize resource utilization and minimize wastage, making it an attractive option for environmentally conscious farmers. Additionally, the convenience and time-saving attributes of fertigation have made it a preferred choice among farmers who are looking for ways to increase productivity and reduce labor costs.

Key Market Segments

By Source

- Organic

- Synthetic

By Nutrient Type

- Nitrogen

- Phosphorus

- Potassium

- Micronutrients

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Other Crop Types

By Application

- Fertigation

- Foliar

- Soil

- Other Applications

Growth Opportunity

Diverse Agricultural Needs

Customized and customised formulations are a major potential opportunity. Farmers have diverse soil, crop, and nutrient needs. Companies can improve efficacy and crop yield for farmers by customizing liquid fertilizers. Customization may include NPK ratios or micronutrients for specific locations in liquid fertilizers. The liquid fertilizers market offers farmers solutions for maximum nutrient uptake and crop development and output.

Agricultural Development

Growth in emerging agricultural markets is another liquid fertilizers market opportunity. To meet food demand, farmers in these regions are embracing modern farming practices. Liquid fertilizer firms can launch their specialized products to these areas and give farmers contemporary agricultural techniques by grasping this chance. Liquid fertilizers improve crop production and profitability, therefore market penetration methods can involve partnerships with local distributors, agricultural associations, and educational campaigns.

Product Adoption and Loyalty

Companies must work with farmers and agricultural associations to succeed in the liquid fertilizers market. Companies can create products and services that solve farmers' problems by knowing their demands. Companies can promote collaboration by educating farmers about liquid fertilizers and sustainable farming. Involving agricultural associations in research and development helps meet market demands. Companies may improve their liquid fertilizers market position and customer loyalty by forming strong partnerships with farmers and agricultural associations.

Improve Efficiency and Nutrient Utilization

Precision application technology can boost the liquid fertilizers market. Variable-rate technology and GPS-guided equipment allow farmers to accurately apply liquid fertilizers to each crop, enhancing nutrient utilization and lowering waste. Liquid fertilizer businesses can help farmers improve crop production, nutrient distribution, and environmental impact by investing in precise application systems. Technology helps farmers and the agriculture industry.

Sustainable and Eco-Friendly Fertilizers

Sustainable items are in high demand in today's eco-conscious world. The liquid fertilizers market has enormous growth potential. Companies can attract sustainable consumers by creating and promoting environmentally friendly liquid fertilizers. Eco-conscious farmers and customers prefer products that reduce fertilizer runoff, greenhouse gas emissions, and soil health.

Latest Trends

Growth of Water-Soluble Liquid Fertilizers

Recent demand for water-soluble liquid fertilizers has increased. Farmers are utilizing these fertilizers to boost crop yields and nutrient absorption as they face limited arable land and changing climates. Water-soluble liquid fertilizers are easy to dose and apply, letting growers customize crop nutrients. This controlled strategy improves plant health, production, and environmental impact by reducing nutrient runoff and waste. Water-soluble liquid fertilizers help agribusinesses balance economic success and environmental responsibility.

Micronutrient and Controlled-Release Liquid Fertilizers

Micronutrient and controlled-release liquid fertilizers are in demand alongside water-soluble ones. These formulations provide a balanced blend of key micronutrients, which soil often lacks, to meet plant nutritional needs. Controlled-release nutrients enable crop development and high yields. Farmers can reduce crop anomalies and nutrient shortages by using micronutrient and controlled-release liquid fertilizers. Technology-driven farming reduces nutrient losses, environmental impact, and resource efficiency.

Fertigation and Foliar Application

Farmers fertilized soil traditionally. Fertigation and foliar spraying have transformed nutrient delivery. Fertigation applies liquid nutrients through irrigation systems, whereas foliar application sprays them on foliage. These innovative application technologies circumvent soil barriers to efficiently collect nutrients and supply them at important growth stages. Farmers can maximize fertilizer uptake, reduce waste, and increase yields via fertigation and foliar spray. This novel method allows accurate nutrient management, decreasing fertilization costs and optimizing resource use.

Organic and bio-based liquid fertilizers

Organic and bio-based liquid fertilizers have grown due to worldwide sustainability efforts. Farmers are using eco-friendly alternatives to meet consumer demand for chemical-free produce and protect human and environmental health. Organic and bio-based liquid fertilizers deliver nutrients with minimal environmental impact. Organic liquid fertilizers promote soil health, nutrient absorption, and plant growth in harmony with nature by harnessing helpful microbes. Sustainable fertilizers improve soil fertility, reduce chemical inputs, and benefit farmers and the environment over time.

Digital Agriculture and Smart Fertilization

Smart fertilization and digital agriculture are becoming more popular as agriculture digitizes. Precision farming, remote sensing, and data analytics help farmers maximize fertilizer use and crop development. Farmers may examine soil fertility, monitor nutrient needs, and customize fertilization plans using real-time data and advanced analytics. This data-driven method eliminates fertilizer waste, improves resource efficiency, reduces environmental impact, and increases profitability. Digital agriculture helps farmers to make informed decisions, driving sustainable growth in the liquid fertilizers business.

Optimizing Growth and Sustainability

Finally, market developments are transforming the liquid fertilizers sector. This industry is being shaped by water-soluble liquid fertilizers, micronutrient and controlled-release liquid fertilizers, fertigation and foliar application methods, organic and bio-based liquid fertilizers, and digital agriculture. Stay educated and embrace these disruptive developments to maximize agricultural growth and sustainability. These innovations can boost agricultural yields, boost profits, and help agriculture become more sustainable.

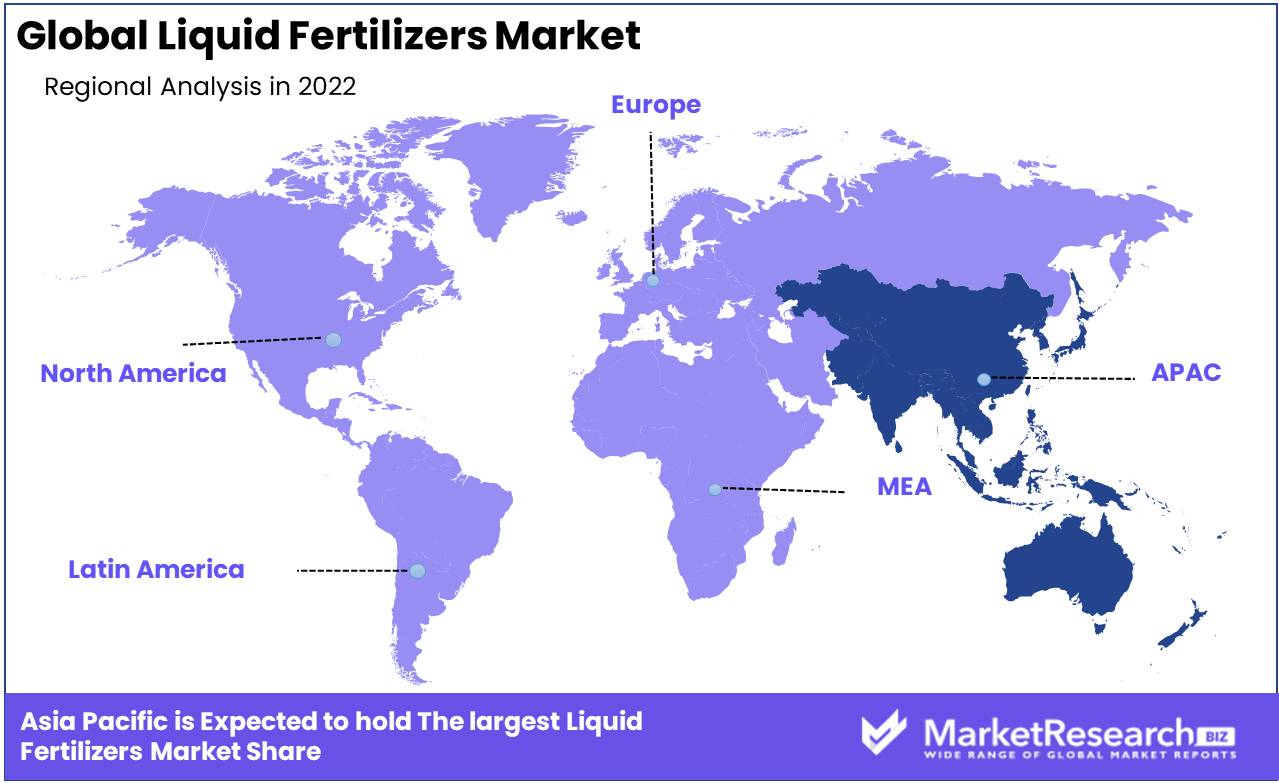

Regional Analysis

The Asia-Pacific region dominates the global market for liquid fertilizers. In the fast-paced world of agriculture, the demand for liquid fertilizers has consistently increased, and it should come as no surprise that the Asia-Pacific region has emerged as the market leader. With a combination of fertile lands, advanced farming techniques, and an increasing demand for sustainable agricultural practices, Asia-Pacific countries have positioned themselves as industry leaders in liquid fertilizers.

Liquid fertilizers are cutting-edge solutions that improve crop yield and have several advantages over conventional solid fertilizers. They provide plants with a readily available source of essential nutrients, resulting in efficient absorption and use. This not only contributes to healthier crops, but also reduces nutrient loss and environmental contamination.

The Asia-Pacific region is comprised of numerous countries with diverse agricultural landscapes and climates. China, India, Japan, Australia, and South Korea are key contributors to this booming market. Due to their large agricultural sectors and persistent efforts to increase crop yields in a sustainable manner, demand for liquid fertilizers has increased significantly in these nations.

The Asia-Pacific region's dominance in the market for liquid fertilizers is bolstered by its robust manufacturing capabilities. Particularly Chinese companies have made significant investments in production facilities and R&D, allowing them to not only meet domestic demand but also export to other regions. This has provided them with a competitive advantage, allowing them to dominate the global market for liquid fertilizers.

The Asia-Pacific region has an extensive network of distributors, retailers, and agricultural cooperatives, ensuring that farmers in both urban and rural areas have seamless access to liquid fertilizers. The region has positioned itself as a dependable and cost-effective source of liquid fertilizers through its extensive logistical capabilities and efficient supply chains.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Nutrien Ltd. is a major player in the liquid fertilizers market. Nutrien, a multinational company focused on sustainable agriculture, offers a variety of liquid fertilizers for different crops and areas. The company's R&D has produced novel formulas that improve crop nutrition and environmental stewardship. Nutrien dominates the liquid fertilizers because to its sustainability and market presence.

Norwegian agribusiness Yara specializes in agricultural nutrition and resource efficiency. Yara's liquid fertilizer offering helps farmers maximize yields and reduce environmental impact. Precision farming and superior agronomic solutions have helped the company dominate the worldwide liquid fertilizers market. Yara's commitment on responsible agriculture and customer-centricity solidifies its position as an industry leader.

ICL, a leading worldwide specialty minerals and chemicals firm, has entered the liquid fertilizers market with unique products. The company's liquid fertilizers improve plant performance and resilience while addressing nutrient deficits. ICL uses its agronomy and precision farming skills to develop innovative formulations that boost crop yields and sustain agriculture. ICL dominates the liquid fertilizers due to its R&D.

German-based K+S Aktiengesellschaft dominates the global liquid fertilizers market. The company sells liquid fertilizers for various crops and farming methods. K+S Aktiengesellschaft's liquid fertilizers offer exact nourishment to crops, improving yields, using cutting-edge technology and constant innovation. The company's experience and commitment to sustainable agriculture make it market-leading.

Chilean speciality plant nutrition and chemical business SQM SA has made considerable liquid fertilizer market gains. The company's extensive liquid fertilizer line meets crop nutrient needs for optimal development and yield. Farmers worldwide appreciate SQM's focus on nutrient use efficiency and environmental impact. SQM dominates the liquid fertilizers market with a strong distribution network and customer-focused strategy.

The Mosaic Company, a global liquid fertilizer producer and marketer, concentrates phosphate and potash crop nutrients. The Mosaic Company offers liquid fertilizer solutions to optimize nutrient uptake, crop health, and yields using its crop nutrition expertise.

Top Key Players in liquid fertilizers market

- Nutrien Ltd.

- Yara

- ICL

- K+S Aktiengesellschaft

- SQM SA

- The Mosaic Company

- EuroChem Group

- Yara International ASA

- Agrium Inc

- Ptashcrop Corportation Of Sackatchewan Inc

- EuroChem Group

- (MOS)

- JSC Belaruskali

- HELM AG

- ICL-group ltd

- Borealis AG

- Sinofert holding limited

- K+S Aktiengesellschaft

- PhosAgro Group of Companies

- Haifa Negev technologies LTD

- DFPCL

- HELM AG AgroLiquid

- ARTAL SMART AGRICULTURE and Plant Food Company Inc.

- Seksaria Foundries Limited

- Nexus Cast.and Sneh Precast Products

Recent Development

- In 2023, Yara International ASA, a Norwegian fertilizer manufacturer, is one of the biggest. To capitalize on Brazil's increasing agricultural market, the company increased production capacity. Brazil produces soybeans, corn, and other crops, thus fertilizer consumption is likely to rise.

- In 2022, Canadian fertilizer giant Nutrien Ltd. The company acquired OCI Nitrogen's US operations to extend its reach and market share in the booming US agricultural sector. The US produces maize, soybeans, and other crops, therefore fertilizer consumption is likely to rise.

- In 2021, One of the world's major fertilizer companies is Israel Chemicals Ltd. The corporation wants to increase production capacity in India to diversify its production base and meet Indian farmers' changing needs. India produces wheat, rice, and other crops, therefore fertilizer need is likely to rise.

- In 2020, American fertilizer firm Mosaic is one of the largest in the world. The company's new fertilizer factory in Florida capitalizes on the southeast's agricultural potential. The southeastern US produces maize, soybeans, and other crops, and fertilizer consumption is likely to rise.

Report Scope:

Report Features Description Market Value (2022) USD 2.7 Bn Forecast Revenue (2032) USD 4.0 Bn CAGR (2023-2032) 4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Synthetic)

By Nutrient Type (Nitrogen, Phosphorus, Potassium, Micronutrients)

By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Other Crop Types)

By Application (Fertigation, Foliar, Soil, Other ApplicationsRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nutrien Ltd., Yara, ICL, K+S Aktiengesellschaft, SQM SA, The Mosaic Company, and EuroChem Group, Yara International ASA, Agrium Inc, Ptashcrop Corportation Of Sackatchewan Inc, EuroChem Group, (MOS), JSC Belaruskali, HELM AG, ICL-group ltd, Borealis AG, Sinofert holding limited, K+S Aktiengesellschaft, PhosAgro Group of Companies, Haifa Negev technologies LTD, DFPCL, HELM AG AgroLiquid, ARTAL SMART AGRICULTURE and Plant Food Company Inc., Seksaria Foundries Limited, Nexus Cast.and Sneh Precast Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nutrien Ltd.

- Yara

- ICL

- K+S Aktiengesellschaft

- SQM SA

- The Mosaic Company

- EuroChem Group

- Yara International ASA

- Agrium Inc

- Ptashcrop Corportation Of Sackatchewan Inc

- EuroChem Group

- (MOS)

- JSC Belaruskali

- HELM AG

- ICL-group ltd

- Borealis AG

- Sinofert holding limited

- K+S Aktiengesellschaft

- PhosAgro Group of Companies

- Haifa Negev technologies LTD

- DFPCL

- HELM AG AgroLiquid

- ARTAL SMART AGRICULTURE and Plant Food Company Inc.

- Seksaria Foundries Limited

- Nexus Cast.and Sneh Precast Products