Somatostatin Analogs Market Report By Indication (Acromegaly, Neuroendocrine Tumors (NETs), Cushing's Syndrome, Carcinoid Syndrome, Gastrointestinal Disorders, Others), By Type of Analog (Octreotide (Sandostatin), Lanreotide (Somatuline), Pasireotide (Signifor), Others), By End User (Hospitals, Clinics, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

15945

-

May 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

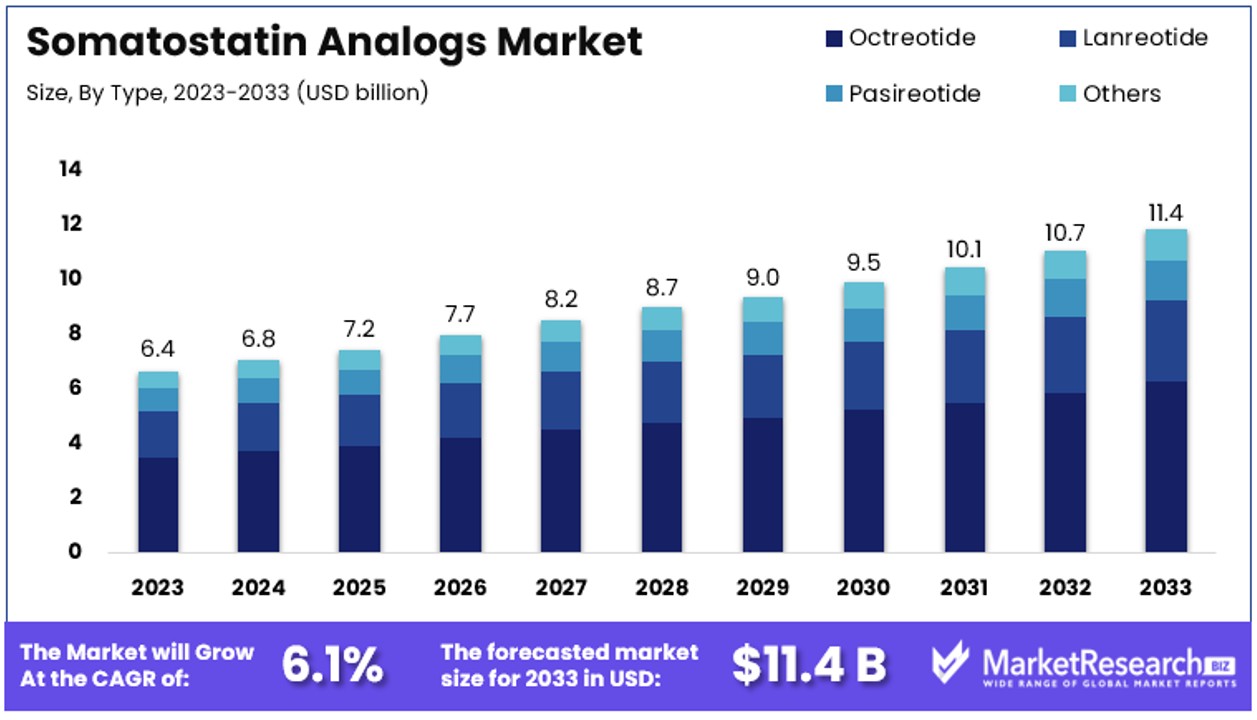

The Global Somatostatin Analogs Market size is expected to be worth around USD 11.4 Billion by 2033, from USD 6.4 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Somatostatin Analogs Market focuses on drugs that mimic somatostatin, a hormone regulating endocrine and nervous system functions. These analogs treat conditions like acromegaly, carcinoid tumors, and Cushing's syndrome by inhibiting excess hormone production. The market is driven by rising incidences of these disorders and increasing awareness about their treatments.

Major players include pharmaceutical companies investing in research and development to enhance drug efficacy and patient outcomes. Growth is supported by advancements in biotechnology and expanding healthcare infrastructure. This market is crucial for developing therapies that improve quality of life for patients with hormonal imbalances and related conditions.

The Somatostatin Analogs Market is experiencing steady growth, driven by increasing incidences of hormonal disorders such as acromegaly and neuroendocrine tumors. These drugs, which mimic the hormone somatostatin, play a critical role in managing conditions by inhibiting excess hormone secretion. The market benefits from advancements in biotechnology and growing healthcare infrastructure, which enhance drug efficacy and accessibility.

A significant trend supporting market expansion is the broad application of peptides, with over 170 peptides in active clinical development. These peptides are being explored for various therapeutic uses, including cancer treatment. This diverse potential underscores the importance of continued investment in peptide research and development, promising significant advancements in treatment options.

Pharmaceutical companies are heavily investing in R&D to develop more effective and targeted somatostatin analogs, aiming to improve patient outcomes and expand their market share. This investment is crucial, given the increasing demand for innovative therapies that can address unmet medical needs.

Additionally, the market's growth is supported by rising awareness among healthcare professionals and patients about the benefits of somatostatin analogs. This awareness is driving higher adoption rates, further supported by favorable reimbursement policies in several regions.

In conclusion, the Somatostatin Analogs Market is poised for robust growth, driven by technological advancements, expanding therapeutic applications of peptides, and increasing healthcare investments. Stakeholders in this market, including pharmaceutical companies and healthcare providers, should focus on innovation and strategic collaborations to capitalize on emerging opportunities and enhance patient care.

Key Takeaways

- Market Value: The Global Somatostatin Analogs Market is forecasted to reach approximately USD 11.4 Billion by 2033, marking a significant increase from USD 6.4 Billion in 2023. This growth is projected at a CAGR of 6.1% during the forecast period spanning from 2024 to 2033.

- Acromegaly accounts for the largest segment in the Somatostatin Analogs Market, holding a substantial 40% share.

- Among the different types of analogs, Octreotide commands a majority share of 55% owing to its broad applicability across various indications, including Acromegaly, Neuroendocrine Tumors (NETs), and emergency settings for acute variceal bleeds.

- North America emerges as the dominant region in the Somatostatin Analogs Market, capturing a significant market share of 41.2%.

- Europe follows closely behind, holding a substantial 30% share of the market. The region's emphasis on healthcare advancements and its large patient population contribute to its significant presence in the global market.

- Analyst Viewpoint: From an analyst viewpoint, the dominance of Acromegaly in the market underscores the critical role of Somatostatin Analogs in managing endocrine and gastrointestinal disorders. Additionally, the market's growth trajectory reflects increasing prevalence rates, advancements in diagnostic techniques, and the efficacy of these medications in improving patient outcomes.

- Growth Opportunities: The projected growth of the Somatostatin Analogs Market presents significant opportunities for market players to capitalize on emerging trends, expand their product portfolios, and explore untapped regional markets.

Driving Factors

Rising Prevalence of NETs and Acromegaly Drives Market Growth

The increasing prevalence of neuroendocrine tumors (NETs) and acromegaly significantly boosts the Somatostatin Analogs Market. These conditions, characterized by abnormal hormone production, are effectively managed with somatostatin analogs. As the aging population grows and unhealthy lifestyles persist, the incidence of these disorders rises, enhancing market demand. Improved diagnostic techniques further contribute to this trend, enabling earlier and more accurate detection of NETs and acromegaly. According to the American Cancer Society, the incidence of NETs has been increasing at approximately 6% per year over the past few decades. This steady rise underscores the critical need for effective treatment options like somatostatin analogs.

The combination of an aging population and better diagnostic tools creates a favorable environment for market expansion. As more patients are diagnosed with NETs and acromegaly, the demand for treatments that can effectively manage these conditions is expected to increase. This trend is further supported by healthcare providers’ growing awareness and patients' proactive approach to seeking medical advice, leading to higher treatment adoption rates. The interplay of these factors significantly enhances the growth potential of the Somatostatin Analogs Market.

Expanding Therapeutic Applications Drives Market Growth

The broadening range of therapeutic applications for somatostatin analogs propels market growth. Beyond treating NETs and acromegaly, these analogs are being explored for conditions like polycystic ovary syndrome (PCOS), endocrine disorders, and certain cancers. Recent studies indicate promising results in using somatostatin analogs for Cushing's disease, a rare endocrine disorder. This expansion into new therapeutic areas diversifies the market and attracts investment in research and development.

The versatility of somatostatin analogs in addressing multiple medical conditions enhances their market appeal. This versatility is crucial for pharmaceutical companies aiming to expand their product portfolios and tap into new revenue streams. The ongoing research into additional applications underscores the market's potential for growth and innovation. As these new uses are clinically validated and approved, the market is likely to see increased adoption and demand, further driving its expansion.

Advancements in Drug Delivery Systems Drive Market Growth

Innovative drug delivery systems significantly drive the growth of the Somatostatin Analogs Market. Efforts to develop long-acting depot formulations and transdermal patches aim to improve patient compliance and treatment efficacy. Products like Somatuline® Depot, a long-acting somatostatin analog, have gained approval for treating acromegaly and NETs, exemplifying these advancements. These innovative delivery methods reduce administration frequency, enhancing the overall patient experience and treatment adherence.

The development of advanced drug delivery systems enhances the market's competitive edge by offering more convenient and effective treatment options. These advancements not only improve patient outcomes but also attract healthcare providers looking for efficient therapies that align with patient needs. The integration of these advanced delivery systems with existing treatment protocols creates a synergistic effect, further boosting market growth and adoption.

Restraining Factors

High Cost of Treatment Restrains Market Growth

The high cost of somatostatin analog treatments limits their accessibility, especially in developing regions. These treatments are generally expensive, making them less affordable for patients in low-income areas and countries with limited healthcare budgets. This financial barrier is significant, as it restricts the market's reach and hinders growth.

For instance, in countries with inadequate reimbursement policies, patients may struggle to afford these therapies, leading to lower adoption rates. This issue is exacerbated in regions where healthcare systems are underfunded or lack sufficient infrastructure to support expensive treatments. Consequently, the high cost of somatostatin analogs poses a significant challenge to market expansion, particularly in less developed markets, reducing the potential patient base and limiting overall market growth.

Patent Expiries and Generic Competition Restrain Market Growth

Patent expiries and the subsequent rise of generic competition present substantial challenges to the Somatostatin Analogs Market. As patents for key somatostatin analog formulations expire, generic manufacturers can enter the market, offering similar treatments at lower prices. This increased competition can lead to significant price erosion, diminishing the market share and revenue of branded products.

The availability of cheaper generics makes it difficult for original manufacturers to maintain their pricing strategies and profit margins. This trend is expected to intensify as more patents expire, further complicating the market dynamics. The resulting price competition from generics not only affects revenue growth but also pressures companies to innovate continually and justify the premium pricing of their branded products.

Indication Analysis

Acromegaly dominates with 40% due to effective treatment outcomes and growing awareness.

The Somatostatin Analogs Market is a crucial sector within the pharmaceutical industry, particularly in the management of various endocrine and gastrointestinal disorders. Among the indications for Somatostatin Analogs, Acromegaly holds the largest market share. This condition, characterized by excessive growth hormone production, significantly impacts patient quality of life and can lead to serious health complications.

The dominant position of Acromegaly in the Somatostatin Analogs Market can be attributed to several factors. Firstly, the rising prevalence of Acromegaly, partly due to improvements in diagnostic techniques, has led to an increase in treatment demand. Secondly, the effectiveness of Somatostatin Analogs in controlling hormone levels and symptom management in Acromegaly patients has made them the standard of care, further boosting their adoption.

The remaining segments, including Neuroendocrine Tumors (NETs), Cushing's Syndrome, Carcinoid Syndrome, Gastrointestinal Disorders, and others, also contribute to the market's growth but to a lesser extent. These conditions benefit from the hormone-regulating effects of Somatostatin Analogs, yet the specificity and prevalence of Acromegaly make it the standout segment in terms of market impact and growth trajectory.

Type of Analog Analysis

Octreotide dominates with 55% due to broad applicability across multiple indications.

Octreotide, sold under the brand name Sandostatin, is the leading type of Somatostatin Analog used in the treatment of Acromegaly and other related conditions. Its dominance in the market is primarily due to its efficacy and the extensive body of clinical evidence supporting its use in a wide range of indications.

The utility of Octreotide extends beyond Acromegaly, encompassing the treatment of symptoms associated with Neuroendocrine Tumors (NETs) and its use in emergency settings to manage acute variceal bleeds, among others. This broad applicability ensures its strong presence in the market, capturing a significant share compared to other analogs like Lanreotide and Pasireotide.

Other analogs, while effective, are more niche in their application or newer to the market, leading to a smaller market share. Lanreotide, for instance, is tailored more towards NETs but has not yet reached the widespread adoption seen with Octreotide. Pasireotide offers promising results in specific patient subsets but faces barriers in broader clinical application due to its side effect profile.

End User Analysis

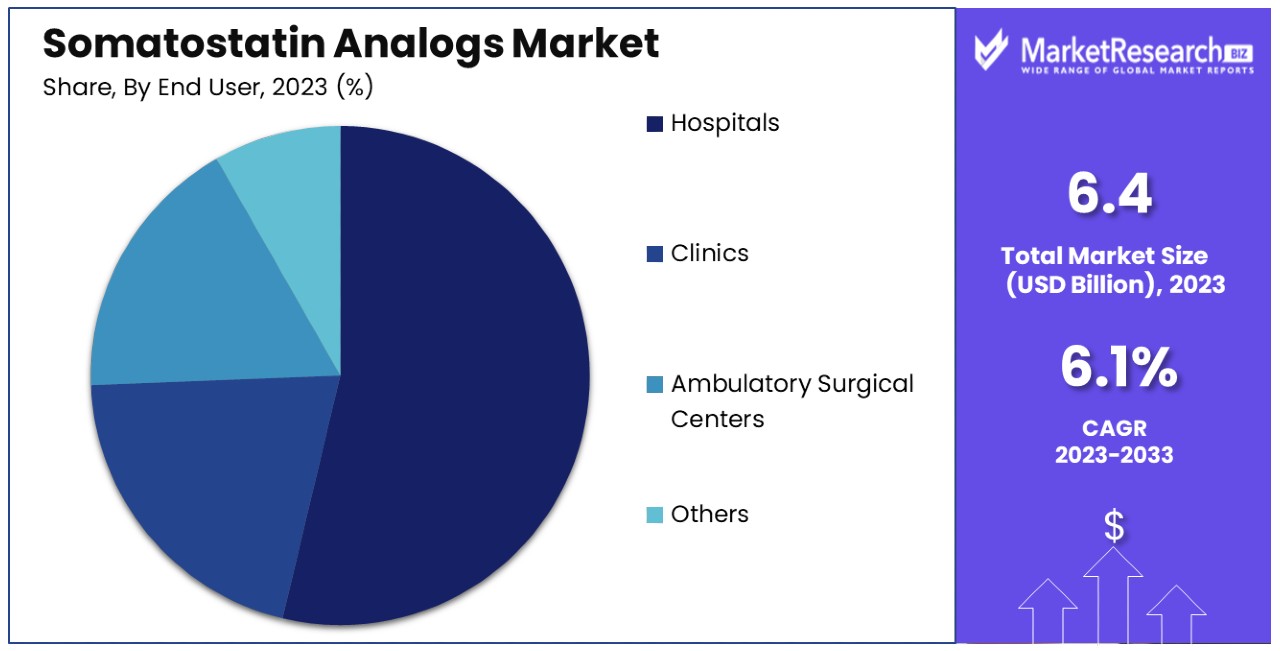

Hospitals dominate with 65% due to comprehensive care facilities and high patient influx.

Hospitals are the primary end users of Somatostatin Analogs, largely due to their role as comprehensive care centers for serious health conditions like Acromegaly and NETs. The capability of hospitals to provide a full spectrum of care—from diagnostic services to complex treatments and follow-up—makes them critical in the administration of these medications.

The dominance of hospitals in the Somatostatin Analogs Market is supported by the high volume of patients they handle, which allows for more frequent use of these drugs compared to other settings. Furthermore, the complexity of the conditions treated with Somatostatin Analogs often requires the multidisciplinary approach that hospitals are equipped to offer.

Other end users, such as clinics, ambulatory surgical centers, and others, play vital roles by offering specialized care or serving as accessible points of care for patients not requiring hospital admission. These settings enhance the overall market by catering to a broader patient base and facilitating easier access to treatment in less acute cases, supporting the market's expansion and accessibility.

Key Market Segments

By Indication

- Acromegaly

- Neuroendocrine Tumors (NETs)

- Cushing's Syndrome

- Carcinoid Syndrome

- Gastrointestinal Disorders

- Others

By Type of Analog

- Octreotide (Sandostatin)

- Lanreotide (Somatuline)

- Pasireotide (Signifor)

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

Growth Opportunities

Development of Novel Somatostatin Analogs Offers Growth Opportunity

The development of novel somatostatin analogs presents significant growth opportunities for the market. Pharmaceutical companies are investing in research to create analogs with better efficacy, safety, and dosing flexibility. These advancements aim to address unmet medical needs and broaden the therapeutic applications of somatostatin analogs.

For instance, researchers are working on analogs with enhanced receptor selectivity and longer half-lives, which could lead to improved treatment outcomes and higher patient compliance. This innovation is crucial as it not only improves patient care but also expands the market by introducing more effective and user-friendly treatments. The continuous development of new formulations ensures that the market remains dynamic and responsive to evolving medical needs, thereby driving sustained growth.

Expansion in Emerging Markets Offers Growth Opportunity

The expansion into emerging markets like Asia-Pacific and Latin America offers substantial growth opportunities for the Somatostatin Analogs Market. These regions are experiencing increased healthcare spending, greater awareness of neuroendocrine disorders, and better access to advanced treatments. By focusing on these markets, pharmaceutical companies can significantly enlarge their customer base.

Adapting to local healthcare needs and pricing strategies is crucial to tapping into these opportunities. The surge in healthcare investments and infrastructure development in these regions supports the adoption of advanced treatments, including somatostatin analogs, thereby driving market growth. Engaging with emerging markets not only diversifies revenue streams but also enhances global market reach.

Trending Factors

Focus on Rare Diseases and Orphan Drug Designations Are Trending Factors

The focus on rare diseases and the pursuit of orphan drug designations are trending factors in the Somatostatin Analogs Market. Pharmaceutical companies are increasingly targeting rare conditions like neuroendocrine tumors, leveraging orphan drug status to gain benefits such as market exclusivity, tax credits, and faster regulatory approvals.

This focus drives innovation, as companies invest in developing novel treatments to meet the specific needs of rare disease patients. The incentives associated with orphan drug designation encourage more research and development, leading to a greater availability of specialized somatostatin analogs. This trend not only boosts market growth but also enhances treatment options for patients with rare diseases.

Emphasis on Patient-Centric Care and Improved Quality of Life Are Trending Factors

The emphasis on patient-centric care and quality of life is a significant trend in the Somatostatin Analogs Market. There is a growing demand for treatments that offer better convenience and fewer side effects. This trend has led to the development of long-acting depot formulations, transdermal patches, and other innovative drug delivery systems.

These advancements aim to reduce the treatment burden on patients and improve adherence to therapy. By focusing on patient comfort and ease of use, companies are enhancing the appeal of their products, driving market growth, and aligning with the broader healthcare trend of prioritizing patient experience and outcomes.

Regional Analysis

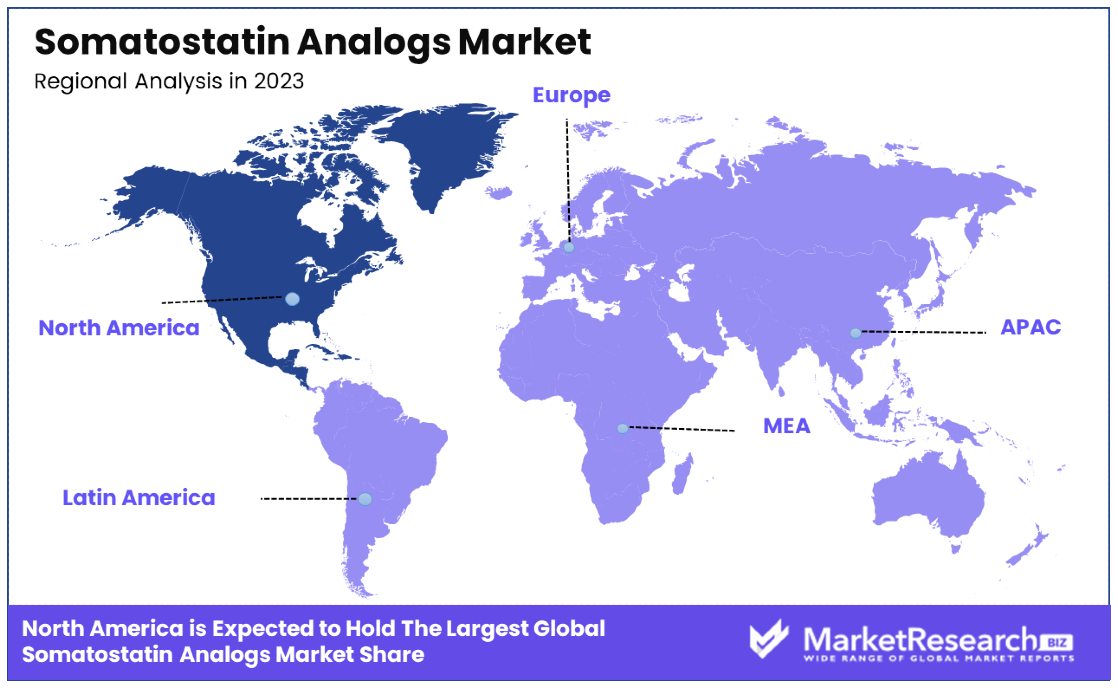

North America Dominates with 41.2% Market Share

North America's dominance in the Somatostatin Analogs Market, holding a 41.2% share, is driven by advanced healthcare infrastructure, high R&D investments, and favorable reimbursement policies. The region's strong focus on innovation and access to cutting-edge medical technologies enhances the availability and development of somatostatin analogs. Additionally, the presence of leading pharmaceutical companies and increased prevalence of neuroendocrine tumors and acromegaly contribute significantly to this high market share.

The well-established healthcare system in North America supports the widespread adoption of somatostatin analogs. High awareness and diagnostic capabilities lead to early detection and treatment of relevant conditions. The region's robust regulatory framework also facilitates the swift approval and market entry of new analogs, ensuring continuous market growth. Moreover, patient-centric care initiatives and the availability of advanced drug delivery systems further boost market performance.

Europe

Europe holds a 30% share of the Somatostatin Analogs Market. The region benefits from a comprehensive healthcare system, significant investment in medical research, and a strong pharmaceutical industry. Europe’s regulatory support for orphan drugs and rare disease treatments also enhances market growth, making it a key player in the global market landscape.

Asia Pacific

Asia Pacific accounts for 20% of the market, driven by rising healthcare expenditure, increasing awareness of neuroendocrine disorders, and improving access to advanced treatments. The region's growing middle class and expanding healthcare infrastructure contribute to its significant market share. Additionally, emerging economies in this region present substantial growth opportunities for pharmaceutical companies.

Middle East & Africa

The Middle East & Africa region holds a 5.2% market share. Growth is supported by improving healthcare infrastructure and increasing awareness of hormonal disorders. However, market expansion is limited by economic constraints and lower healthcare spending compared to other regions. Nonetheless, ongoing investments in healthcare development are expected to enhance market performance gradually.

Latin America

Latin America has a 3.6% share of the market. The region's growth is driven by rising healthcare investments and increasing diagnosis rates of neuroendocrine tumors. Despite economic challenges, the region shows potential for growth as healthcare access and medical infrastructure continue to improve, offering opportunities for market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Somatostatin Analogs Market features a dynamic competitive landscape with several notable companies influencing its trajectory. Among these, Ipsen Pharma and Novartis AG stand out due to their extensive research portfolios and established market presence, which position them as leaders in this niche. Their strategic positioning is strengthened by robust global networks and advanced therapeutic developments.

Pfizer Inc., another significant player, leverages its vast resources and R&D capabilities to enhance its market share, thereby impacting market dynamics considerably. Sun Pharmaceutical Industries Ltd and Fresenius Kabi AG complement the competitive spectrum by focusing on affordability and accessibility, expanding their influence in emerging markets.

Emerging companies like Dauntless Pharmaceuticals, Chiasma Inc., and Crinetics Pharmaceuticals introduce innovative approaches and specialized treatments that disrupt traditional market patterns. Their focus on niche segments and novel therapeutic options allows them to carve out unique positions within the market.

Furthermore, Amryt Pharma plc and Midatech Pharma PLC are critical for their pioneering drug delivery technologies and targeted therapy solutions, which are set to redefine treatment paradigms.

Collectively, these companies drive the market through strategic innovation, geographic expansion, and therapeutic advancements, shaping the industry landscape and influencing future growth trajectories.

Market Key Players

- Ipsen Pharma

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd

- Dauntless Pharmaceuticals

- Chiasma Inc.

- Midatech Pharma PLC

- Crinetics Pharmaceuticals

- Amryt Pharma plc

- Fresenius Kabi AG

Recent Developments

- The US Food and Drug Administration (FDA) approved oral octreotide (Mycapssa, Chiasma) delayed-release capsules for the long-term maintenance treatment of patients with acromegaly who previously responded to and tolerated octreotide or lanreotide injections. This new oral formulation of octreotide is the first and only oral somatostatin analog approved by the FDA, providing a much-needed alternative to chronic injections for people living with acromegaly.

- On November 1, 2022, a research study published in the journal Scientific Reports found that the combination of ulinastatin and a somatostatin analogue substantially reduced the rate of complications in acute pancreatitis when compared to somatostatin analogue monotherapy. The study compared the effectiveness and safety of somatostatin derivatives alone to ulinastatin combined with somatostatin or octreotide in the treatment of acute pancreatitis, suggesting that this combination therapy may be a promising approach for managing this condition.

Report Scope

Report Features Description Market Value (2023) USD 6.4 Billion Forecast Revenue (2033) USD 11.4 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Indication (Acromegaly, Neuroendocrine Tumors (NETs), Cushing's Syndrome, Carcinoid Syndrome, Gastrointestinal Disorders, Others), By Type of Analog (Octreotide (Sandostatin), Lanreotide (Somatuline), Pasireotide (Signifor), Others), By End User (Hospitals, Clinics, Ambulatory Surgical Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ipsen Pharma, Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd, Dauntless Pharmaceuticals, Chiasma Inc., Midatech Pharma PLC, Crinetics Pharmaceuticals, Amryt Pharma plc, Fresenius Kabi AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Novartis AG

- Sun Pharmaceutical Industries Ltd

- Midatech Pharma PLC

- Ipsen Pharma

- Chiasma Inc.

- Peptron, Inc

- Crinetics Pharmaceuticals

- Dauntless Pharmaceuticals

- Camurus AB

- Teva Pharmaceuticals Inc

- Pfizer Inc.