Global Implantable Drug Delivery Devices Market Trends, Analysis, Growth, and Forecast: 2018 to 2027

-

2590

-

May 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

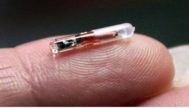

MarketResearch.biz delivers in-depth insights on the global implantable drug delivery devices market in its upcoming report titled, “Global Implantable Drug Delivery Devices Market Trends, Analysis, Growth, and Forecast: 2018 to 2027”. The global implantable drug delivery devices market is estimated to register a CAGR of X.X% in terms of value during forecast period 2018–2027. The report offers in-depth insights, revenue details, and other vital information regarding the global implantable drug delivery devices market, and the various trends, drivers, restraints, opportunities, and threats in the target market till 2027. The report offers insightful and detailed information regarding the various key players operating in the global implantable drug delivery devices market, their financials, supply chain trends, key developments, apart from future strategies, acquisitions & mergers, and market footprint. The global implantable drug delivery devices market report has been segmented on the basis of product type, technology, application, and region.

Implantable drug delivery devices have several advantages over conventional oral or parenteral dosage forms as it allows site specific administration where the drug is needed the most, also it allows significantly lower dosing of drug which in turn minimize potential side effects. Furthermore, it allows sustained release of therapeutic agent whereas enhances efficacy of treatment. Implantable drug delivery devices are generally less burdensome than pills and injections. Moreover, market players are developing biodegradable stents that are naturally-dissolving as it does not require additional surgery for removal of device.

Growing incidence of chronic disease such as cardiovascular diseases, diabetic retinopathy is expected to drive the growth of implantable drug delivery devices market. Moreover, increasing number of collaborations between pharmaceutical companies and technical provider are other factors anticipated to further drive growth of the global implantable drug delivery devices market over the forecast period.

However, device failure and cost associated with the use of device are major factor restraining growth of the global implantable drug delivery devices market.

Technological advancements and innovations focusing on development of safe, efficient and biodegradable devices is expected to create new opportunities for major players in the global implantable drug delivery devices market over the forecast period.

North America market dominates the global implantable drug delivery devices market in terms of revenue contribution as compared to that of markets in other regions. This is attributed by new product approval by US FDA, owing to the huge patient pool and awareness about the application in the region. Europe accounts for second-largest revenue share contribution to the global implantable drug delivery devices market, followed by markets in Latin America, Asia Pacific, and Middle East & Africa respectively. The market in Asia Pacific is projected to register comparatively faster growth in terms of revenue over the next 10 years, owing to the rapid adoption of implantable drug delivery devices and efficiency in birth control.

Global Implantable Drug Delivery Devices Market Segmnetation:

Global implantable drug delivery devices market segmentation, by product type:

- Drug infusion pumps

- Intraocular drug delivery devices

- Contraceptive drug delivery devices

- Stents

- Drug-eluting stents

- Bio absorbable stents

Global implantable drug delivery devices market segmentation, by technology:

- Biodegradable Implants

- Non-Biodegradable Implants

Global implantable drug delivery devices market segmentation, by application:

- Ophthalmology

- Cardiovascular

- Birth control/Contraception

- Others

Global implantable drug delivery devices market segmentation, by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Merck & Co., Inc.

- Allergan, Inc.

- Bausch & Lomb Inc.

- Abbott Laboratories

- Bayer AG

- Psivida Corp

- Medtronic Plc.

- Arrow International

- Boston Scientific Corporation

- Theragenics Corporation