Soft Robotics Market By Type (Soft Grippers, Cobots, Inflated Robots, Exoskeleton), By Component (Hardware, Software), By End-User (Healthcare, Advanced Manufacturing, Food & Beverages, Logistics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51311

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

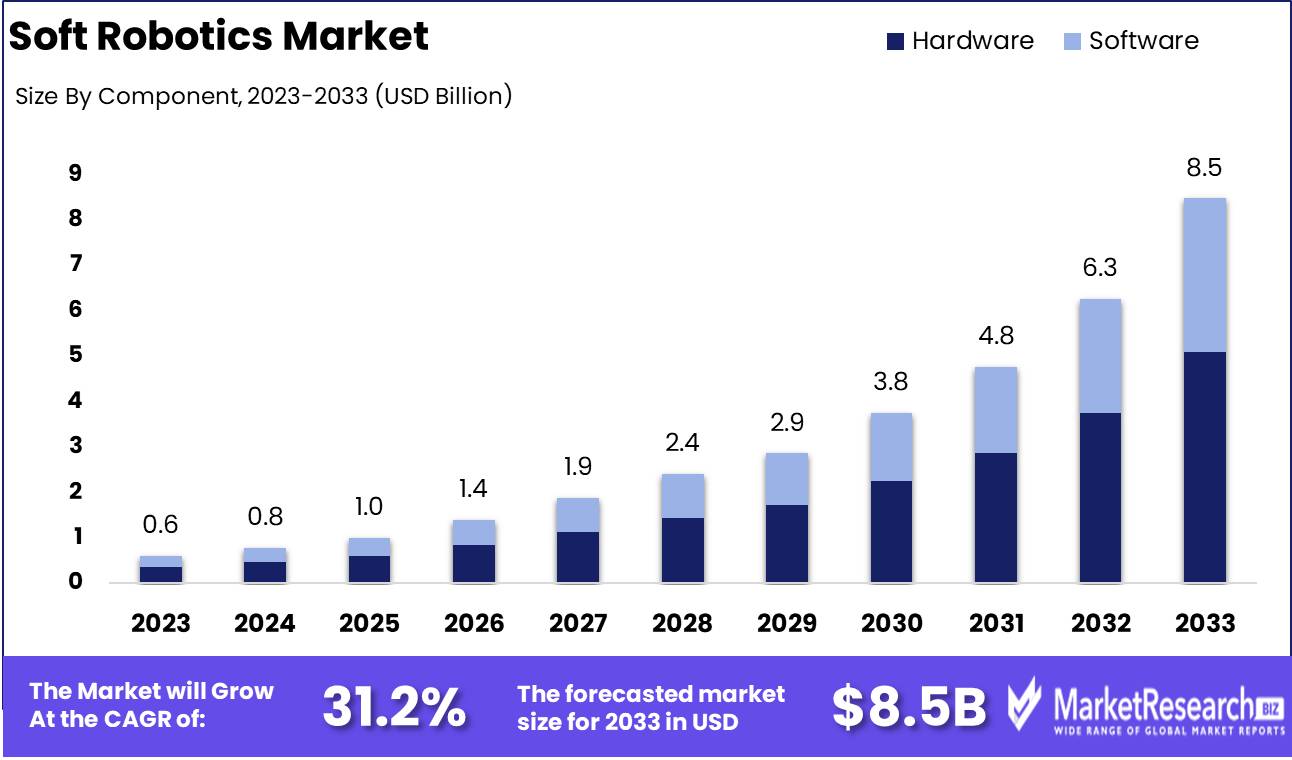

The Soft Robotics Market was valued at USD 0.6 billion in 2023. It is expected to reach USD 8.5 billion by 2033, with a CAGR of 31.2% during the forecast period from 2024 to 2033.

The Soft Robotics market encompasses the development and commercialization of robotic systems that utilize flexible, often bio-inspired materials and designs to perform tasks traditionally challenging for rigid robots. These systems are employed in the healthcare, manufacturing, and agriculture sectors, offering enhanced adaptability, safety, and dexterity in complex environments. Innovations in soft actuators, sensors, and control systems have driven significant market growth, supported by rising demand for automation and advancements in artificial intelligence.

The soft robotics market is poised for substantial growth, driven by advancements in automation, healthcare, and consumer electronics industries. A key factor in this market’s expansion is the rising demand for soft robotics in healthcare and medical devices, particularly in minimally invasive surgery, rehabilitation, and assistive devices. The increasing adoption of soft robotics in these areas underscores the need for more adaptable, flexible, and biocompatible solutions, contributing to improved patient outcomes. Additionally, the trend toward automation in various industrial sectors, such as manufacturing and logistics, further fuels demand, as soft robotics offer enhanced safety and flexibility compared to traditional rigid robotic systems.

However, high costs associated with development and implementation remain a significant barrier to wider adoption. The integration of soft robotics often requires complex and costly materials, along with advanced algorithms for control and functionality. Despite these challenges, growth in wearable robotics, particularly in the healthcare sector, indicates a promising trajectory for the market. The consumer electronics industry also plays a pivotal role, with the integration of soft robotics in devices such as wearables and smartphones driving innovation and further expanding market potential. Overall, the combination of rising healthcare demands, increasing industrial automation, and expanding consumer electronics applications positions the soft robotics market for accelerated growth, albeit tempered by cost-related challenges.

Key Takeaways

- Market Growth: The Soft Robotics Market was valued at USD 0.6 billion in 2023. It is expected to reach USD 8.5 billion by 2033, with a CAGR of 31.2% during the forecast period from 2024 to 2033.

- By Type: Soft Grippers dominated the diverse Soft Robotics market applications.

- By Component: Hardware dominated the soft robotics market by component.

- By End-User: Healthcare dominated the Soft Robotics Market by end-user.

- Regional Dominance: North America dominates the soft robotics market with a 40% largest share.

- Growth Opportunity: The global soft robotics market is set to experience significant growth, driven by advancements in food processing automation and e-commerce logistics integration, creating substantial opportunities for industry expansion.

Driving factors

Increasing Demand for Automation

The global push for automation, driven by industries striving to enhance efficiency, accuracy, and productivity, is one of the most significant factors accelerating the growth of the soft robotics market. Sectors such as manufacturing, healthcare, and logistics are increasingly adopting automated solutions to reduce operational costs and mitigate human errors. Soft robotics, known for their flexibility, adaptability, and gentle handling of complex tasks, are particularly appealing in environments that require a delicate touch, such as in prosthetics or the food industry. The increased demand for robots that can safely interact with humans and handle fragile objects without damage is expected to boost the market, with the automation sector growing by 8-10% annually in some regions, according to industry reports.

Advancements in Technology

Technological advancements in material science, artificial intelligence (AI), and sensor technologies have significantly expanded the capabilities and applications of soft robotics. The integration of AI enables soft robots to learn from their environments, allowing them to perform increasingly complex tasks autonomously. In addition, innovations in soft materials, such as silicone, polymers, and bio-materials, have enhanced the durability, elasticity, and versatility of soft robots, making them suitable for a broader range of applications from surgery to agriculture. These advancements are directly linked to the growing adoption of soft robotics in both industrial and non-industrial applications. For example, the use of AI in soft robotics is expected to contribute to a CAGR of over 35% in sectors like healthcare and logistics.

Advancements in Research and Development

Ongoing investments in research and development (R&D) are a critical driver of the soft robotics market, facilitating continuous innovation and the expansion of potential use cases. Universities, research institutions, and private companies are actively engaged in R&D efforts to improve the functionality, safety, and cost-effectiveness of soft robots. Significant progress has been made in enhancing the robots ability to mimic human dexterity and adaptability, further promoting their use in industries like medical care, where soft robots can assist in complex surgeries or rehabilitation therapies.

Additionally, R&D is helping to reduce the overall costs of production, making soft robots more accessible to smaller companies and emerging markets. R&D spending in this field has been rising steadily, with estimates suggesting a year-on-year increase of 10-12% in some regions, contributing significantly to market expansion.

Restraining Factors

Regulatory Hurdles: Slowing Market Expansion Through Complex Approval Processes

Regulatory challenges are a significant restraining factor in the growth of the soft robotics market. Soft robotics technology often involves novel materials, intricate designs, and unique operational mechanisms that may not fit easily into existing regulatory frameworks. This results in prolonged approval times and increased costs for companies attempting to bring their products to market.

For instance, sectors like healthcare, where soft robotics has significant potential (e.g., in surgical robots or assistive devices), face stringent regulatory requirements for safety and efficacy. The approval process can be time-consuming and may require extensive clinical trials, which delays market entry and restricts innovation. Additionally, differences in regulations across regions such as North America, Europe, and Asia can add complexity for companies looking to expand globally. Harmonizing these regulations is often slow, which further hampers international growth opportunities.

The need for compliance with varying regulations in industrial applications—such as manufacturing or automation also creates additional barriers. Certification processes regarding the safety, performance, and environmental impacts of soft robots can delay the introduction of new products, increase development costs, and deter smaller companies from entering the market. This can lead to a slower pace of growth, as firms spend more time and resources navigating the regulatory landscape instead of focusing on product innovation and market penetration.

Limited Durability: Affecting Performance and Increasing Costs

Durability issues in soft robotics are another critical factor limiting market growth. Soft robots are often constructed from flexible, compliant materials that are prone to wear and tear, reducing their lifespan and reliability compared to traditional, rigid robots. This limited durability makes the technology less attractive for industries requiring high-performance, long-lasting robotic solutions, such as manufacturing, healthcare, and defense.

For example, in industrial applications, robots are expected to operate continuously in harsh environments, where exposure to chemicals, extreme temperatures, or mechanical stress can quickly degrade the soft materials used in soft robots. As a result, companies may be hesitant to adopt soft robotics technology due to concerns over frequent maintenance, higher replacement costs, and potential operational downtime. These concerns directly affect the cost-effectiveness of soft robotics solutions, which is a crucial consideration for many businesses.

In addition, healthcare applications, where soft robots are envisioned for delicate tasks such as assisting in surgeries or patient rehabilitation, may be affected by material fatigue or failure. If a robot’s components degrade quickly, it could pose significant safety risks, thus slowing down adoption in sensitive environments like hospitals or rehabilitation centers. The additional costs of ensuring durability, through advanced materials or more frequent part replacement, can drive up prices for end-users and further restrict the market’s growth potential.

By Type Analysis

In 2023, Soft Grippers dominated the diverse Soft Robotics market applications.

In 2023, Soft Grippers held a dominant market position in the By Type segment of the Soft Robotics Market, driven by their versatility across various industries such as food and beverage, healthcare, and logistics. Soft grippers, characterized by their ability to handle delicate objects without causing damage, are increasingly preferred in automation tasks that require high precision. Their non-intrusive, flexible design allows for the safe manipulation of fragile or irregularly shaped items, which has significantly boosted their adoption.

Cobots, or collaborative robots, are growing rapidly within this segment, owing to their ability to work safely alongside humans in industrial settings. These robots enhance operational efficiency and reduce the risk of workplace accidents.

Inflated Robots are gaining attention for their lightweight, cost-effective nature, particularly in applications where traditional robotics would be too rigid or cumbersome.

Exoskeletons, although still niche, are seeing increasing usage in healthcare for rehabilitation and assistive purposes, as well as in industrial environments to reduce worker fatigue and improve productivity. Together, these technologies are advancing the soft robotics market, each fulfilling unique operational needs.

By Component Analysis

In 2023, Hardware dominated the soft robotics market by component.

In 2023, Hardware held a dominant market position in the By Component segment of the soft robotics market. The hardware segment, which includes actuators, sensors, controllers, and grippers, was the key driver of market growth, accounting for a significant share due to advancements in material sciences and engineering. Increasing demand for sophisticated, flexible robotic systems in industries such as healthcare, manufacturing, and agriculture contributed to the segment's dominance. Innovations in soft robotic components that enhance precision, adaptability, and interaction with dynamic environments bolstered their application across various sectors.

While hardware maintained a strong foothold, the software segment demonstrated steady growth, driven by the integration of artificial intelligence (AI), machine learning (ML), and advanced algorithms to optimize soft robotics' performance and control. The software component, though smaller in market share, is critical in enhancing the intelligence and responsiveness of soft robotic systems, particularly in applications requiring complex decision-making and adaptability. Overall, the combination of cutting-edge hardware and software development positions the soft robotics market for sustained growth as industries continue to seek flexible automation solutions.

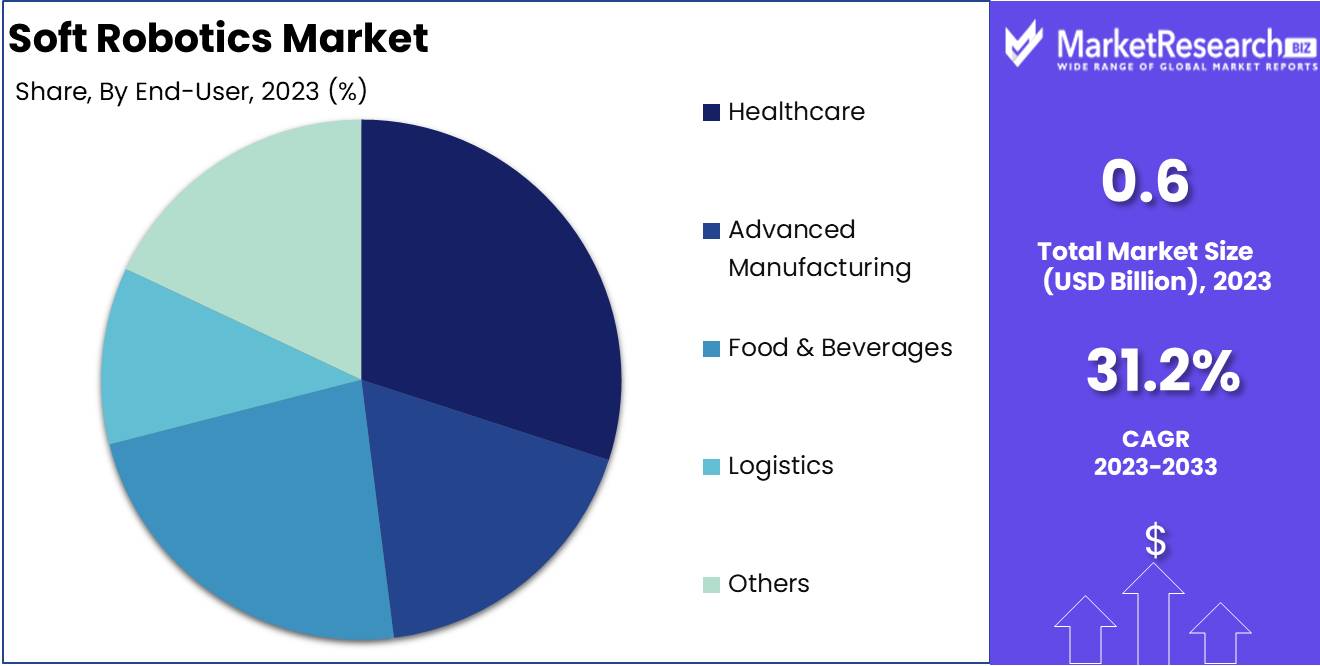

By End-User Analysis

In 2023, Healthcare dominated the Soft Robotics Market by end-user.

In 2023, Healthcare held a dominant market position in the By End-User segment of the Soft Robotics Market, driven by increasing applications in surgical robotics, rehabilitation, and patient assistance. The healthcare sector's significant demand for soft robotics is propelled by the need for precision in minimally invasive surgeries and patient-centric technologies. These advancements have not only improved patient outcomes but have also reduced operational costs, solidifying healthcare's leadership in the market.

The Advanced Manufacturing sector is another key end-user, leveraging soft robotics for automation, flexible manufacturing, and improved safety in human-robot collaboration. This sector benefits from soft robots' ability to adapt to diverse tasks and environments, enhancing productivity while minimizing workplace injuries.

In Food & Beverages, soft robotics is increasingly applied in packaging, handling delicate products, and maintaining hygiene standards. This sector's adoption of automation to meet demand for efficiency and safety has driven its growing share in the soft robotics market.

Logistics has also emerged as a major growth area, utilizing soft robotics for warehousing, inventory management, and transportation. The rise of e-commerce and the need for fast, accurate deliveries are key factors driving adoption in this sector.

Other end-users, including research and education institutions, continue to explore novel applications of soft robotics, contributing to the market's ongoing innovation and diversification across various industries.

Key Market Segments

By Type

- Soft Grippers

- Cobots

- Inflated Robots

- Exoskeleton

By Component

- Hardware

- Software

By End-User

- Healthcare

- Advanced Manufacturing

- Food & Beverages

- Logistics

- Others

Growth Opportunity

Increased Adoption in Food Processing Automation Driving Market Expansion

The global soft robotics market is poised for significant growth, with the food processing sector emerging as a key driver. The demand for automation in food handling, packaging, and processing has increased due to the rising need for efficiency and hygiene. Soft robotic solutions, which are capable of handling delicate and irregular-shaped food items without damaging them, are gaining traction. The adoption of these technologies can be attributed to the growing consumer preference for pre-packaged foods and ready-to-eat meals, alongside stringent regulations regarding food safety and hygiene standards. It is projected that soft robotics applications in food processing will capture a significant share of the market, as businesses look to streamline operations, reduce labor costs, and ensure product quality.

E-commerce Logistics Boom Creating New Opportunities for Soft Robotics Integration

The e-commerce sector, which saw an exponential rise during the pandemic, continues to offer lucrative opportunities for the soft robotics market. Logistics operations, including sorting, packaging, and last-mile delivery, are increasingly utilizing soft robots to optimize efficiency and address labor shortages. Soft robotic solutions, particularly those with adaptive gripping technologies, are ideal for handling diverse product ranges, which is critical in the fast-paced e-commerce environment. As online retailers expand their operations to meet growing demand, the integration of soft robotics in warehouse automation is expected to witness accelerated adoption. This trend is further fueled by advancements in AI and machine learning, enhancing the functionality and efficiency of these robotic systems.

Latest Trends

Diverse Applications Driving Growth

The soft robotics market is poised to experience significant growth, driven largely by its expanding range of applications. Industries such as healthcare, agriculture, and manufacturing are increasingly adopting soft robotic systems for tasks requiring delicate handling and flexibility. In healthcare, soft robotics is gaining traction in rehabilitation and minimally invasive surgeries, providing enhanced precision while reducing patient risk. The agricultural sector also sees potential in soft robots for crop harvesting, as these machines can handle delicate fruits and vegetables without damage. The versatility of soft robotics, along with its ability to adapt to challenging environments and fragile tasks, is expected to drive further market penetration across various sectors.

High Manufacturing Costs Remain a Barrier

While diverse applications create new opportunities, high manufacturing costs remain a key challenge for the soft robotics industry. The production of advanced materials such as soft actuators and sensors, along with the specialized design processes, drives up costs, making the technology less accessible for smaller firms.

Additionally, the complex fabrication techniques required for soft robotics, including 3D printing and molding of soft materials, contribute to significant expenses. These high costs are likely to slow market adoption, particularly in price-sensitive industries. However, advancements in material science and mass production techniques may gradually mitigate these challenges, making soft robotics more cost-effective over time.

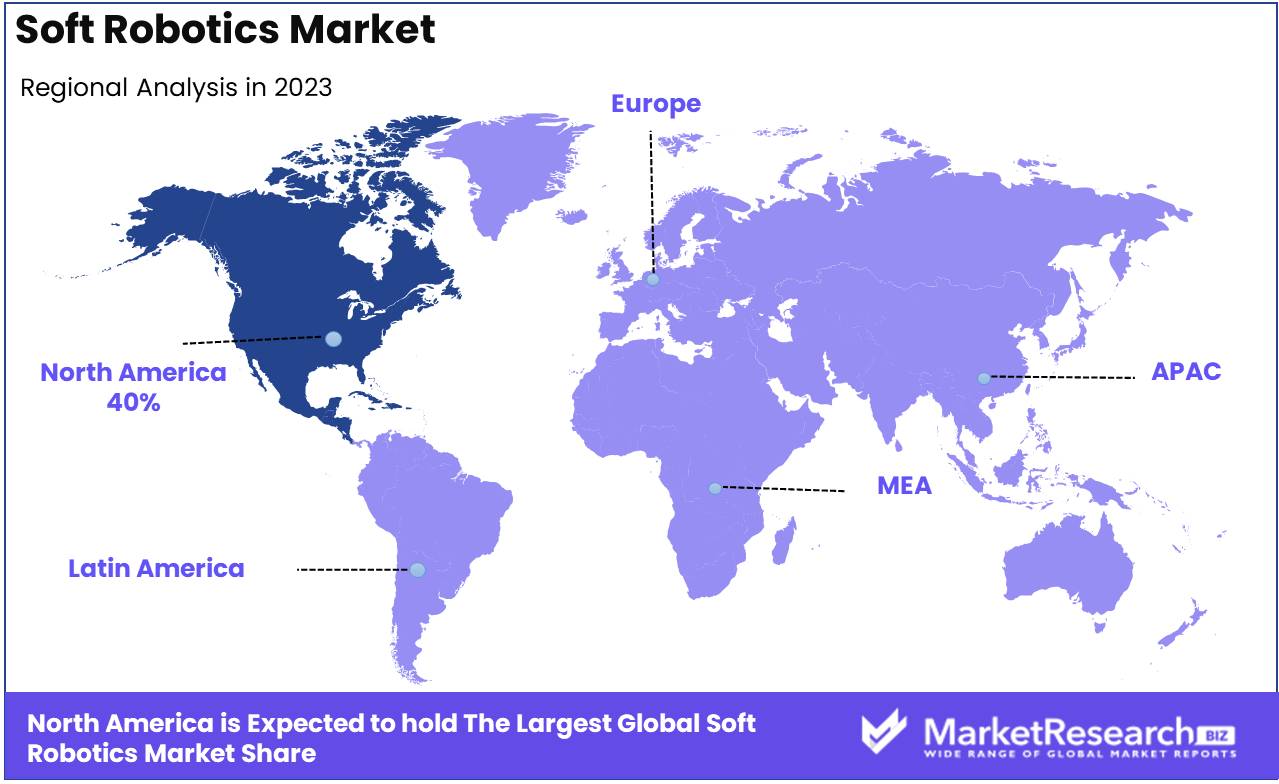

Regional Analysis

North America dominates the soft robotics market with a 40% largest share.

The global soft robotics market exhibits significant regional variance, driven by technological advancements, industry adoption rates, and government support for innovation. North America dominates the market, accounting for over 40% of global revenue, largely due to high R&D investment and the presence of key players like Soft Robotics Inc. and Boston Dynamics. The U.S. and Canada lead the region, bolstered by the healthcare and logistics sectors, which actively integrate soft robotics for automation and efficiency improvements.

Europe is another crucial player, with around 25% market share, driven by demand in the automotive and manufacturing sectors. Germany, France, and the UK spearhead this growth, as these countries increasingly adopt advanced robotics to maintain competitiveness in global markets.

Asia Pacific is poised for the fastest growth, with a projected CAGR of 35%, supported by Japan, China, and South Korea, where manufacturing and consumer electronics sectors are rapidly embracing automation solutions. China's aggressive push for industrial automation, supported by government policies like "Made in China 2025," significantly boosts regional market expansion.

The Middle East & Africa and Latin America represent smaller market segments but are witnessing gradual growth, driven by increasing adoption in sectors such as oil and gas, agriculture, and healthcare. In these regions, soft robotics is emerging as a solution to industry-specific challenges like labor shortages and hazardous working conditions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global soft robotics market is expected to witness significant growth in 2024, driven by advancements in artificial intelligence, materials science, and increasing applications across various industries such as healthcare, manufacturing, and logistics. The key players contributing to this growth are employing innovative technologies and expanding their product portfolios to gain a competitive edge.

Bioservo Technologies AB is recognized for its strength-enhancing exoskeleton gloves, catering to healthcare and industrial sectors, emphasizing ergonomics and human augmentation. Similarly, Cyberdyne Inc. has developed assistive robotic devices for healthcare, particularly in rehabilitation, with a focus on improving patient mobility through its HAL exoskeleton. Ekso Bionics Holdings, Inc. is a leader in robotic exoskeletons, contributing significantly to the medical rehabilitation sector, especially in neuro-recovery applications.

F&P Robotics AG and Festo AG are at the forefront of service robotics, developing highly flexible, safe, and intelligent soft robotic solutions tailored for personal care, hospitality, and industrial automation. Rewalk Robotics Ltd. focuses on robotic exoskeletons for paraplegics, improving mobility and independence, while Righthand Robotics Inc. is a pioneer in autonomous grasping systems, addressing the increasing demand in logistics and e-commerce fulfillment.

Roam Robotics and Soft Robotics Inc. continue to innovate in wearable robotics and adaptive grippers, respectively, while Yaskawa Electric Corporation leverages its stronghold in industrial robotics to expand its presence in soft robotics through advanced automation solutions. Collectively, these companies are shaping the future of the soft robotics market by addressing critical needs across diverse sectors.

Market Key Players

- Bioservo Technologies AB

- Cyberdyne Inc.

- Ekso Bionics Holdings, Inc.

- F&P Robotics AG

- Festo AG

- Rewalk Robotics Ltd.

- Righthand Robotics Inc.

- Roam Robotics

- Soft Robotics Inc.

- Yaskawa Electric Corporation

Recent Development

- In May 2022, Cyberdyne Inc., known for its robotics in healthcare and cleaning applications, continued to see growth in its partnership with Kanagawa Prefecture. Their robot installations, including the Cleaning Robot CL02, have seen financial backing as part of broader government efforts to integrate robotic solutions for public and industrial services.

- In April 2024, Khalifa University of Science and Technology in the UAE partnered with Silal to establish a joint Centre of Excellence in Agri-Robotics and Automation. This collaboration focuses on leveraging advancements in soft robotics to enhance agricultural productivity and sustainability, potentially transforming farming practices in the UAE and beyond.

- In February 2024, RightHand Robotics, known for its autonomous AI robotic picking solutions, entered into a multi-year agreement with Staples Inc. This partnership allows Staples to deploy RightHand Robotics’ "RightPick" system to automate order fulfillment, enhancing efficiency for next-day delivery across the United States. This move addresses the growing need for automation in e-commerce and logistics operations.

Report Scope

Report Features Description Market Value (2023) USD 0.6 Billion Forecast Revenue (2033) USD 8.5 Billion CAGR (2024-2032) 31.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Soft Grippers, Cobots, Inflated Robots, Exoskeleton), By Component (Hardware, Software), By End-User (Healthcare, Advanced Manufacturing, Food & Beverages, Logistics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bioservo Technologies AB, Cyberdyne Inc., Ekso Bionics Holdings, Inc., F&P Robotics AG, Festo AG, Rewalk Robotics Ltd., Righthand Robotics Inc., Roam Robotics, Soft Robotics Inc., Yaskawa Electric Corporation Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bioservo Technologies AB

- Cyberdyne Inc.

- Ekso Bionics Holdings, Inc.

- F&P Robotics AG

- Festo AG

- Rewalk Robotics Ltd.

- Righthand Robotics Inc.

- Roam Robotics

- Soft Robotics Inc.

- Yaskawa Electric Corporation