Smart Plantation Management Systems Market By Type(Irrigation systems, Plant growth monitoring systems, Harvesting systems), By Crop(Fruits, Coffee, Oilseeds, Sugarcane, Cotton, Others (cocoa, coconuts, areca nuts, and tea)), By Component(Hardware, Software), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

44130

-

March 2024

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

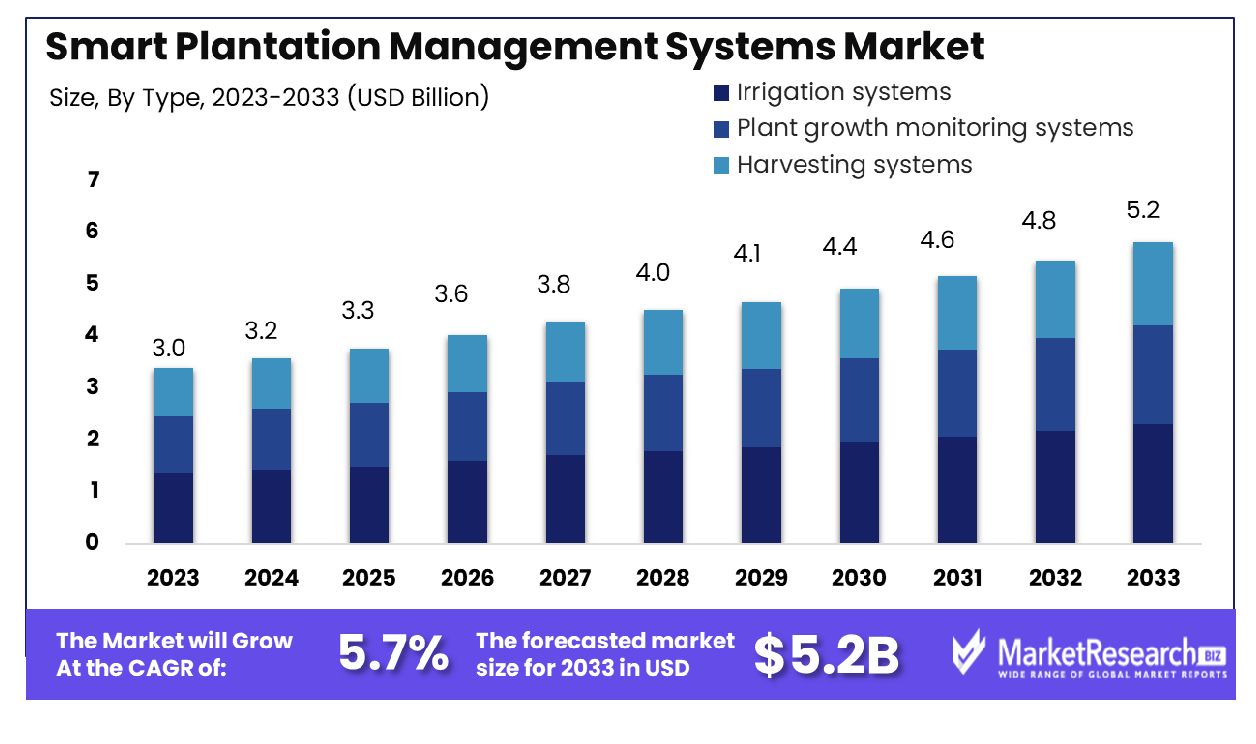

The smart plantation management systems market will be valued at USD 3.0 billion by 2023. It is expected to reach USD 5.2 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033. The surge in demand for plantation intelligence, decrease in wastage and manpower, and new advanced technologies are some of the main key driving factors for the smart plantation management systems market.

Smart plantation management systems use advanced technologies like the Internet of Things, data analytics, and sensors to improve the efficacy and productivity of agricultural operations. Such systems allow the real-time monitoring of environmental situations, crop status, and soil health. Automated data gathering and analysis help farmers make informed decisions on irrigation, pest control, and fertilization, reducing the environmental impact and enhancing resource usage.

Combination with weather predictions and forecast analytics improves crop planning and risk management. Moreover, smart plantation management systems often incorporate remote access and control characters, permitting farmers to handle their operations from anywhere. By using advanced technologies, these systems pay to eco-friendly and accurate agricultural practices, nurturing boost yields, less expenses, and enhanced agricultural sustainability.

Using a smart plantation management system is important for modern agriculture due to its several advantages. Firstly, it improves precision agriculture by offering real-time data on environmental situations, crop status, and soil health by making farmers make informed decisions. This leads to enhanced resource usage, decreased environmental impact, and boosts overall efficacy.

Smart systems offer supervision and control permitting farmers to handle their plantation effectively from everywhere by saving time and effort. Predictive analytics and integration with weather predictions contribute to enhancing crop planning, farming forecasts, and risk mitigation.

Additionally, such systems support eco-friendly methods by decreasing water and chemical usage by promoting sustainable farming techniques. The implementation of smart plantation management systems is domineering for urban agriculture by promoting sustainability, increasing productivity, and ensuring the long-term viability of agricultural practices. The demand for smart plantation management systems will increase due to their usage of plantation intelligence and advanced technologies that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Smart Plantation Management Systems Market will be valued at USD 3.0 billion by 2023. It is expected to reach USD 5.2 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033

- By Type: Irrigation Systems, Smart irrigation systems enhance water use efficiency, reducing waste in plantation management practices.

- By Crop: Fruits, Precision agriculture for fruits increases yield quality and quantity, optimizing growth conditions effectively.

- By Component: Hardware, Robust hardware components are crucial for reliable data collection and control in smart plantations.

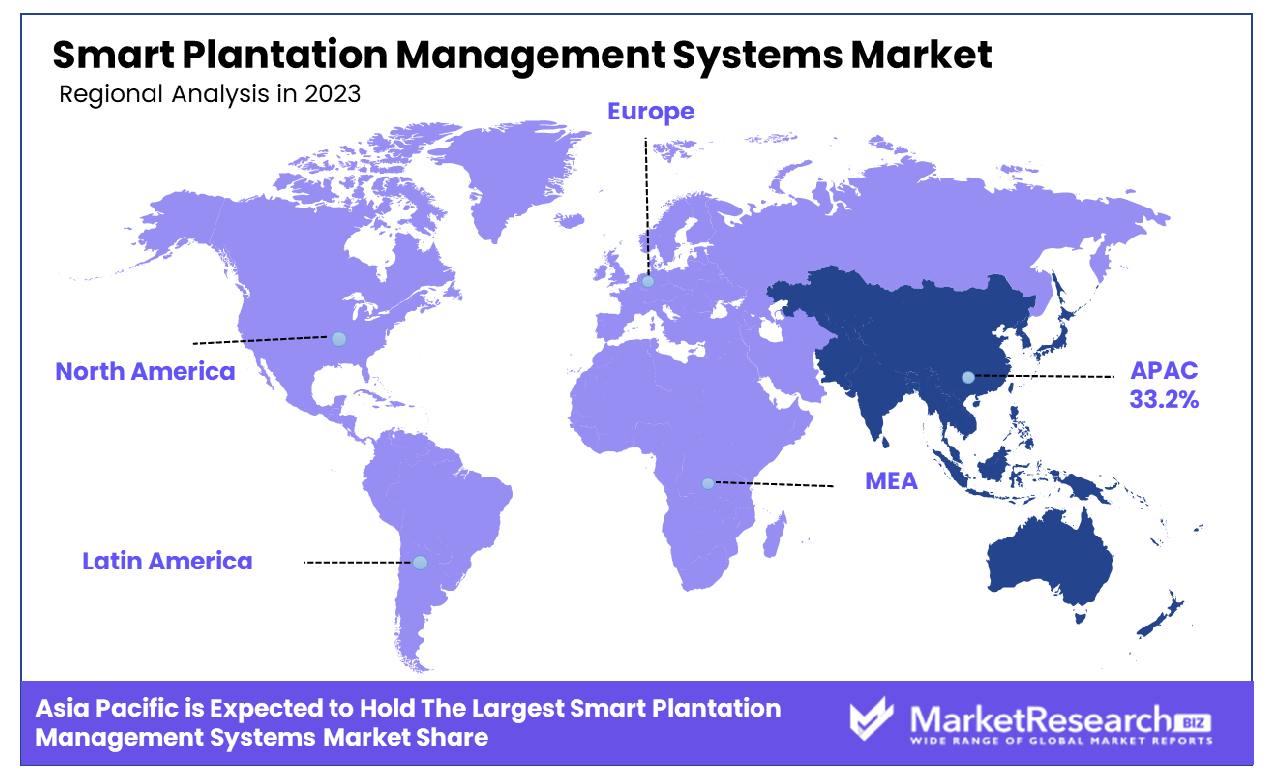

- Regional Dominance: The Smart Plantation Management Systems Market in Asia Pacific commands a 33.2% global market share.

- Growth Opportunity: In 2023, Smart Plantation Management Systems enhance agricultural resilience and sustainability by using IoT, AI, and remote sensing for efficient resource use, addressing climate change impacts.

Driving factors

Enhanced Efficiency through Plantation Intelligence and Data Mining

The integration of plantation intelligence and data mining by farmers significantly fuels the expansion of the Smart Plantation Management Systems Market. This trend stems from the technologies' capabilities to analyze vast amounts of data, thereby optimizing crop yield forecasts and enabling precise agricultural practices. Such digital tools empower farmers with actionable insights, leading to improved decision-making processes.

By leveraging data analytics, farmers can identify the most productive cultivation methods, optimal planting times, and efficient resource allocation strategies. This adoption is instrumental in enhancing agricultural productivity and sustainability, propelling market growth.

Resource Optimization Reducing Wastage

A pivotal factor contributing to the growth of the Smart Plantation Management Systems Market is the reduction in the wastage of resources and manpower. Smart plantation management systems employ advanced sensors and IoT technologies to monitor crop health, soil conditions, and water levels in real-time. This technology-driven approach minimizes the overuse of water, fertilizers, and pesticides, aligning with sustainable farming practices.

Moreover, it optimizes labor deployment, reducing reliance on manual labor through automation. Consequently, this not only conserves natural resources but also significantly cuts down operational costs, making the adoption of smart plantation systems economically attractive to farmers.

The Synergistic Impact of Data Mining and Smart Plantation Adoption

The rise in the adoption of data mining and smart plantation systems among farmers marks a transformative phase in the agriculture sector. These systems collect and analyze data from various sources, including satellite imagery, weather forecasts, and soil sensors, to provide comprehensive insights into plantation management. The convergence of data mining with smart plantation management systems enhances the precision of agricultural activities, from irrigation to pest control.

This synergy not only boosts crop yields but also promotes sustainable farming practices by ensuring judicious use of resources. The cumulative effect of these advancements fosters a more efficient, productive, and environmentally friendly agricultural ecosystem, significantly driving market growth in the smart plantation management sector.

Restraining Factors

Data Privacy and Security Concerns: A Barrier to Adoption

Data privacy and security concerns significantly hinder the growth of the Smart Plantation Management Systems Market. These systems accumulate vast amounts of sensitive information, encompassing crop yields, weather conditions, soil health, and operational details of farms. The potential risk of data breaches or unauthorized access poses a considerable threat to the adoption of such technologies.

Farmers and plantation owners may be reluctant to deploy smart plantation management systems due to fears of compromising their data integrity and the privacy of their operations. This apprehension not only affects the rate of adoption among potential users but also impacts the trust in digital agricultural solutions. Ensuring robust security measures and transparent data handling practices is crucial to mitigating these concerns and facilitating market growth.

Scalability and Interoperability Issues: Hindrances to Widespread Implementation

Scalability and interoperability issues present significant challenges to the expansion of the Smart Plantation Management Systems Market. As farms and plantations aim to scale up smart management solutions across vast or diverse agricultural lands, they often face difficulties due to the lack of standardized protocols and the compatibility of different systems. This fragmentation impedes the seamless integration of new technologies into existing agricultural frameworks, thereby limiting the potential benefits of smart plantation management.

The inability to efficiently scale and ensure interoperability across various platforms and devices restrains the market's growth potential. Addressing these challenges through the development of universal standards and compatible systems is essential for enabling broader adoption and maximizing the impact of smart plantation technologies on the agricultural industry.

By Type Analysis

Irrigation Systems, Smart irrigation optimizes water usage, enhancing sustainability in modern agricultural practices efficiently.

In 2023, irrigation systems segment held a dominant market position in the "By Type" segment of the Smart Plantation Management Systems Market, which notably encompasses irrigation systems, plant growth monitoring systems, and harvesting systems. This prominence of irrigation systems can be attributed to their critical role in optimizing water use efficiency, reducing waste, and enhancing crop yields in various agricultural sectors. The integration of advanced technologies such as IoT, AI, and remote sensing within these systems has further elevated their efficacy, enabling precise water delivery tailored to the specific needs of plants based on real-time data.

The surge in adoption of smart irrigation systems is largely driven by the increasing awareness among farmers and plantation managers of the need to conserve water resources amidst escalating concerns over water scarcity globally. Additionally, government initiatives and subsidies aimed at promoting sustainable farming practices have significantly contributed to the expansion of this market segment.

Meanwhile, plant growth monitoring systems have experienced steady growth, facilitated by advancements in sensor technology and data analytics. These systems offer valuable insights into plant health, nutrient levels, and soil moisture, thereby empowering growers to make informed decisions that bolster plant development and productivity.

Harvesting systems, although at a nascent stage compared to irrigation and monitoring systems, are witnessing gradual adoption. Innovations in robotics and automation have started to redefine harvesting processes, promising to alleviate labor shortages and enhance efficiency in the coming years.

By Crop Analysis

Fruits, Precision agriculture for fruits boosts yield and quality, leveraging data-driven insights effectively.

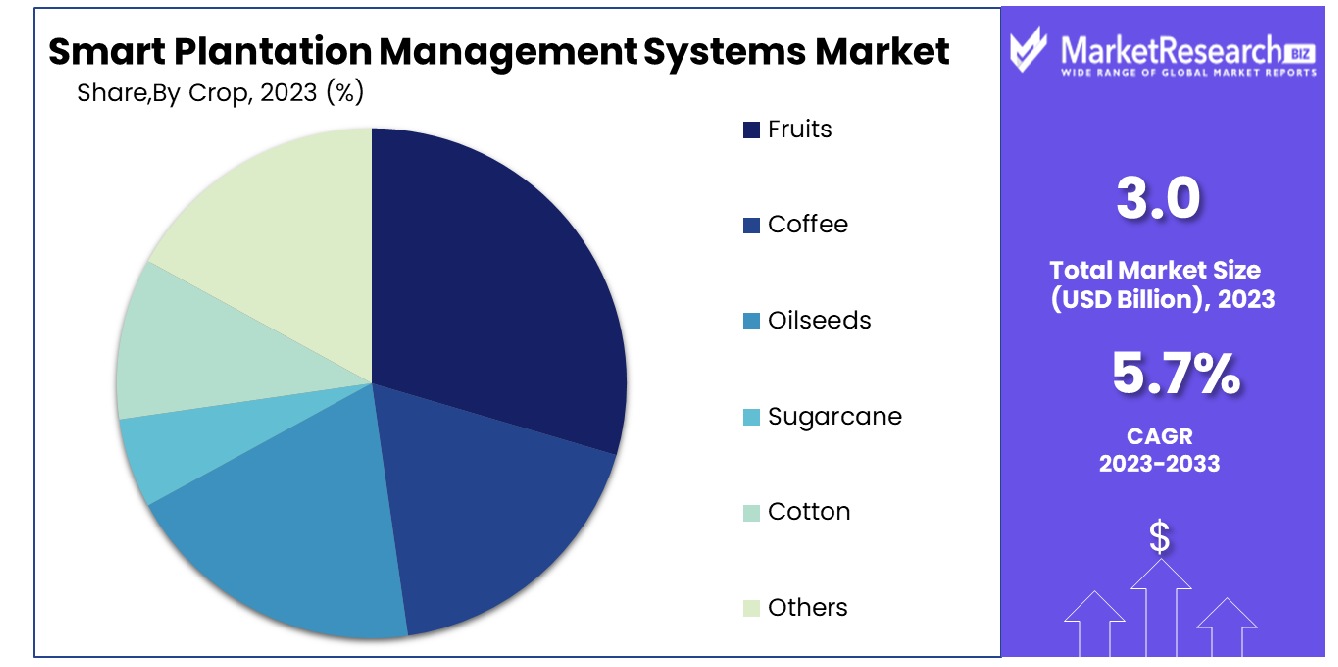

In 2023, fruits segment held a dominant market position in the "By Crop" segment of the Smart Plantation Management Systems Market, which comprehensively includes fruits, coffee, oilseeds, sugarcane, cotton, and other crops such as cocoa, coconuts, areca nuts, and tea. The leading status of fruits within this segment can be ascribed to the escalating global demand for fresh produce coupled with the pressing need for sustainable and efficient farming practices to bolster yield and quality.

The adoption of smart plantation management systems in fruit segment cultivation is primarily driven by the sector's sensitivity to environmental conditions and susceptibility to pests and diseases. Technologies such as precision agricultural products, automated irrigation systems, and crop health monitoring tools have become indispensable for maximizing fruit production while minimizing resource use and environmental impact.

Coffee, another significant crop within this segment, benefits from smart management systems through optimized irrigation and targeted disease management, which are crucial for sustaining quality and production levels. Similarly, oilseeds, sugarcane, and cotton have seen an uptick in the adoption of such technologies, aimed at improving crop resilience, yield, and operational efficiencies.

The "Others" category, encompassing cocoa, coconuts, areca nuts, and tea, also presents notable opportunities for the integration of smart technologies. These crops, often grown in environmentally sensitive or geographically challenging areas, stand to gain significantly from precision farming techniques that ensure sustainable production practices.

By Component Analysis

Hardware, Robust hardware components are crucial for deploying reliable smart plantation management systems.

In 2023, hardware held a dominant market position in the "By Component" segment of the Smart Plantation Management Systems Market, distinctly comprising hardware and software components. This dominance can be attributed to the essential role of hardware in the foundation and operational efficiency of smart plantation systems.

Hardware components, including sensors, GPS devices, irrigation controllers, and drones, are integral for data collection, monitoring, and execution of various agricultural operations. Their capability to provide real-time, actionable insights on environmental conditions, soil moisture levels, and crop health has been pivotal in enhancing decision-making processes for farmers and plantation managers.

The burgeoning demand for hardware in smart plantation management systems is driven by the escalating need for precision agriculture practices that optimize resource use and maximize yield output. As the agricultural sector continues to embrace technological advancements, the investment in durable, high-quality hardware that withstands agricultural environments has become indispensable.

Conversely, the software segment, while also showing significant growth, supports the hardware through data analysis, visualization, and decision support systems. It plays a crucial role in interpreting the vast amounts of data collected by hardware components, transforming it into insightful information for efficient plantation management. However, the initial setup cost and more tangible impact of hardware on operational improvements have contributed to its predominant market share.

Key Market Segments

By Type

- Irrigation systems

- Plant growth monitoring systems

- Harvesting systems

By Crop

- Fruits

- Coffee

- Oilseeds

- Sugarcane

- Cotton

- Others (cocoa, coconuts, areca nuts, and tea)

By Component

- Hardware

- Software

Growth Opportunity

Climate Change Resilience

The global Smart Plantation Management Systems Market in 2023 stands at the forefront of addressing the pressing challenges posed by climate change to agriculture. With increasing incidences of extreme weather events, water scarcity, and temperature fluctuations, the demand for resilient plantation management solutions has surged. These systems offer the potential to significantly mitigate the adverse effects of climate change on crop productivity and sustainability.

By leveraging advanced technologies such as IoT, AI, and remote sensing, smart plantation management systems can monitor environmental conditions in real time, enabling precise adjustments to farming practices. This capability not only enhances the resilience of agricultural operations to climate variability but also supports the long-term sustainability of farming ecosystems. As such, the integration of climate-smart technologies in plantation management is not merely an operational upgrade but a strategic necessity in the face of global climate challenges.

Resource Optimization and Efficiency

In parallel, the optimization of resource usage stands out as a pivotal opportunity for the Smart Plantation Management Systems Market in 2023. These systems harness data-driven insights and automation to ensure that water, fertilizers, and pesticides are utilized in the most efficient manner possible. The precision agriculture facilitated by these technologies minimizes waste and maximizes yield, catering to the dual objectives of economic and environmental sustainability.

For instance, smart irrigation systems adjust watering schedules based on soil moisture and weather predictions, significantly reducing water consumption. Similarly, targeted application of fertilizers and pesticides, guided by precise data on crop health and soil conditions, reduces the environmental footprint of plantation operations. This emphasis on resource optimization not only bolsters farm profitability but also aligns with growing regulatory and societal expectations for sustainable agricultural practices.

Latest Trends

Emphasis on Sustainability and Environmental Monitoring

In the landscape of global agriculture, 2023 marks a pivotal year for the Smart Plantation Management Systems Market, reflecting a pronounced emphasis on sustainability and environmental monitoring. This trend is driven by escalating environmental concerns and the imperative to maintain ecological balance while pursuing agricultural productivity. Smart plantation management systems have evolved to include sophisticated modules for monitoring environmental parameters, including soil health, water usage, carbon footprint, and overall ecosystem impact.

These technologies not only facilitate the precise application of resources, thus minimizing waste and enhancing yield but also ensure that plantation activities are in harmony with environmental sustainability objectives. The integration of sensors and IoT technologies for real-time monitoring underscores a strategic shift towards proactive environmental stewardship in plantation management, catering to the demands of both regulatory bodies and a more environmentally conscious marketplace.

Focus on Data Analytics and Decision Support

Another defining trend of 2023 in the Smart Plantation Management Systems Market is the intensified focus on data analytics and decision support. In the context of increasing complexity and volatility in global agricultural markets, the capacity to harness data for informed decision-making is invaluable. Smart plantation management systems are increasingly leveraging advanced analytics, AI, and machine learning algorithms to process vast datasets, yielding insights that drive efficiency, productivity, and resilience.

These decision support tools empower farmers and plantation managers with predictive analytics for crop health, yield optimization, and risk management, transforming data into a strategic asset. This trend not only enhances the operational efficiency of plantations but also positions them to adapt more swiftly to market changes and environmental challenges, reinforcing the strategic importance of data-driven decision-making in modern agriculture.

Regional Analysis

The Smart Plantation Management Systems Market in Asia Pacific commands a significant 33.2% market share.

The global market for Smart Plantation Management Systems (SPMS) is undergoing significant transformation, driven by technological advancements and a growing emphasis on sustainable agricultural practices. This analysis delves into the regional dynamics of the SPMS market, highlighting North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America to provide a comprehensive understanding of the landscape.

North America, with its robust technological infrastructure and high adoption rate of smart agriculture solutions, is a prominent player in the SPMS market. The region's commitment to enhancing crop yield and efficiency through innovative technologies supports the market's growth. Europe follows closely, where environmental sustainability initiatives and the integration of IoT and AI in agriculture foster a conducive environment for the SPMS market. The emphasis on reducing carbon footprints and improving farm productivity are key drivers in this region.

Asia-Pacific, commanding a dominating 33.2% share of the market, stands out as the leading region. This can be attributed to its vast agricultural landscape, rapid technological adoption, and the pressing need for efficient water management systems due to varying climatic conditions. The region's burgeoning population and rising food demand further necessitate advanced plantation management solutions.

The Middle East & Africa region, though nascent, is witnessing growth due to increasing awareness and government initiatives aimed at modernizing agriculture to ensure food security. The adoption of SPMS in this region is primarily driven by water scarcity challenges and the need for optimized irrigation systems.

Latin America, with its diverse climatic zones and expansive agricultural sectors, is increasingly adopting SPMS. The focus is on enhancing productivity and sustainability amid changing weather patterns, which is crucial for the region's staple crops like soybeans and maize.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global Smart Plantation Management Systems Market has witnessed significant contributions from key players, each bringing unique innovations and strategic insights to the forefront of agricultural technology. Companies like Yara International ASA and Koch AG & Energy Solutions L.L.C. are pivotal in integrating advanced nutrient management and energy-efficient solutions, respectively, into smart plantation systems. Their efforts emphasize the critical role of sustainable input management in enhancing crop yield and environmental stewardship.

Coromandel International Limited and Agriculture Solutions Inc. have been instrumental in tailoring nutrient and soil management solutions to meet the diverse needs of the Asia-Pacific and North American markets. Their localized approach ensures that smart plantation systems are adaptable and relevant across different agricultural contexts.

Hafia Groups and Sapec Agro S.A. stand out for their advancements in water-efficient irrigation and pest management technologies, crucial for mitigating the impacts of climate variability. The innovation in these areas underscores the importance of water conservation and eco-friendly pest control in sustaining agricultural productivity.

Meanwhile, technology-focused companies like Robert Bosch GmbH, Deere & Company, and Netafim are redefining the landscape with IoT-based monitoring, autonomous machinery, and precision irrigation systems. Their contributions are key to realizing the potential of data-driven agriculture, enhancing operational efficiency, and reducing environmental impact.

Emerging major players such as Synelixis Solutions, DTN, AgroWebLab Co., Ltd, Tevatronics, and SemiosBio Technologies are bringing forward innovative solutions in data analytics, weather prediction, and crop health monitoring. These technologies offer plantation managers unprecedented insights into plantation dynamics, further enabling informed decision-making and resilience against climate challenges.

Market Key Players

- Yara International ASA (Norway)

- Koch AG & Energy Solutions L.L.C. (U.S.)

- Coromandel International Limited (India)

- Agriculture Solutions Inc. (Canada)

- Hafia Groups (Israel)

- Sapec Agro S.A. (Portugal)

- Kugler Company (U.S.)

- Van Iperen International B.V. (Netherlands)

- U.S. AG LLC (U.S.)

- Robert Bosch GmbH (Germany)

- Deere & Company (U.S.)

- Netafim (Israel)

- Synelixis Solutions (Greece), DTN (U.S.)

- AgroWebLab Co., Ltd (AWL) (China)

- Tevatronics (Israel)

- SemiosBio Technologies (Canada)

Recent Development

- In March 2024, Ghana's agricultural sector is poised for transformation with emerging trends like precision farming and vertical farming. Capacity building, tech startups, and infrastructure development are vital for success.

- In February 2024, Gallagher Animal Management pioneers agricultural technology, evolving from electric fencing to innovative solutions like virtual fencing and precision livestock management. Their commitment to farmers remains steadfast through tradition and innovation.

- In February 2024, TrinaTracker unveils an enhanced Vanguard 1P Smart Tracking Solution with an improved multi-motor system, installation efficiency, and advanced Smart Control System, aiming for heightened energy production and seamless integration of intelligent features.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Billion Forecast Revenue (2033) USD 5.2 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Irrigation systems, Plant growth monitoring systems, Harvesting systems), By Crop(Fruits, Coffee, Oilseeds, Sugarcane, Cotton, Others (cocoa, coconuts, areca nuts, and tea)), By Component(Hardware, Software) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Yara International ASA (Norway), Koch AG & Energy Solutions L.L.C. (U.S.), Coromandel International Limited (India), Agriculture Solutions Inc. (Canada), Hafia Groups (Israel), Sapec Agro S.A. (Portugal), Kugler Company (U.S.), Van Iperen International B.V. (Netherlands), U.S. AG LLC (U.S.), Robert Bosch GmbH (Germany), Deere & Company (U.S.), Netafim (Israel), Synelixis Solutions (Greece), DTN (U.S.), AgroWebLab Co., Ltd (AWL) (China), Tevatronics (Israel), SemiosBio Technologies (Canada) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Yara International ASA (Norway)

- Koch AG & Energy Solutions L.L.C. (U.S.)

- Coromandel International Limited (India)

- Agriculture Solutions Inc. (Canada)

- Hafia Groups (Israel)

- Sapec Agro S.A. (Portugal)

- Kugler Company (U.S.)

- Van Iperen International B.V. (Netherlands)

- U.S. AG LLC (U.S.)

- Robert Bosch GmbH (Germany)

- Deere & Company (U.S.)

- Netafim (Israel)

- Synelixis Solutions (Greece), DTN (U.S.)

- AgroWebLab Co., Ltd (AWL) (China)

- Tevatronics (Israel)

- SemiosBio Technologies (Canada)