Small Caliber Ammunition Market By Size (5.56mm, 7.62mm, 9 mm, 50 caliber, Shotshells), By Applications (Military, Civilian, Law Enforcement Agencies), By Casing Type (Brass and Steel), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49294

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

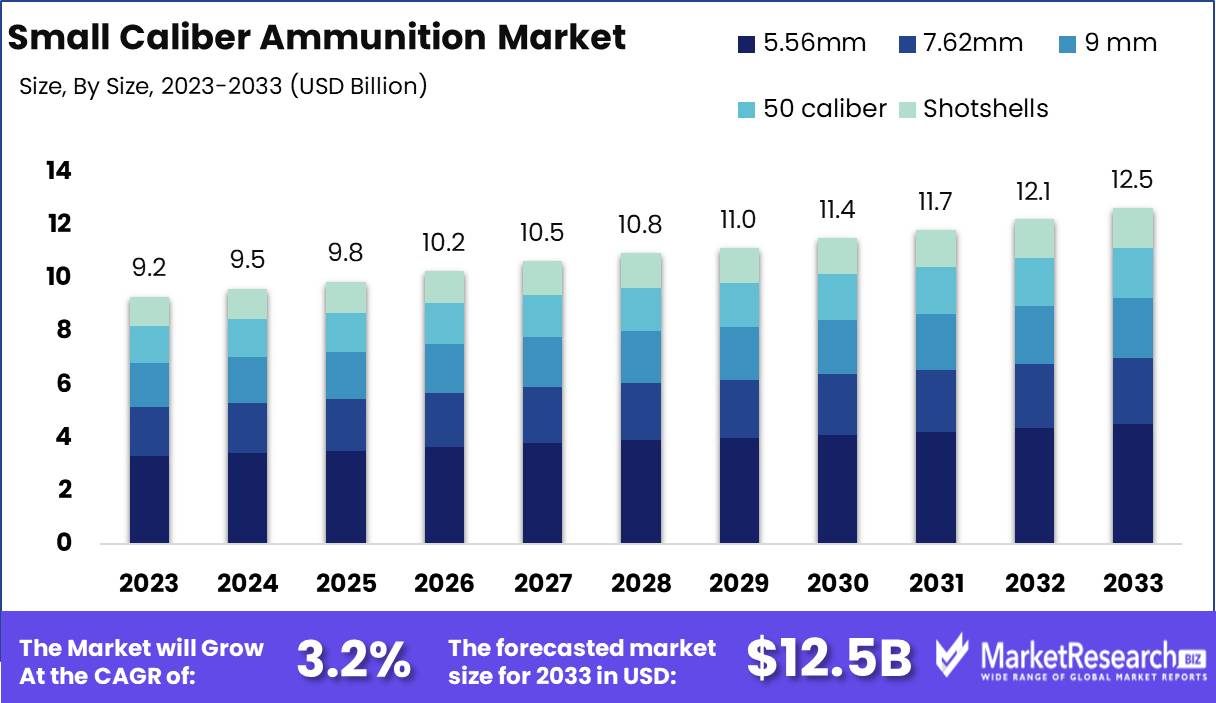

The Small Caliber Ammunition Market was valued at USD 9.2 billion in 2023. It is expected to reach USD 12.5 billion by 2033, with a CAGR of 3.2% during the forecast period from 2024 to 2033.

The Small Caliber Ammunition Market encompasses the production and distribution of ammunition with a diameter of 0.50 inches or less, commonly used in firearms such as rifles, pistols, and revolvers. This market is driven by the demand from the military, law enforcement, and civilian sectors for defense, hunting, and sporting activities. Key factors influencing growth include technological advancements in ammunition design, rising defense budgets, and increasing participation in shooting sports.

The small caliber ammunition market is poised for significant growth, driven by various factors. Firstly, rising defense expenditure globally is a primary catalyst. As nations bolster their military capabilities in response to evolving geopolitical tensions, the demand for small-caliber ammunition is set to surge. This trend is particularly evident in regions experiencing heightened security concerns, where governments prioritize defense budget allocations to modernize and expand their armed forces.

Concurrently, increased civilian ownership of firearms, primarily for recreational shooting and personal protection, is propelling market demand. Civilian demand for small-caliber ammunition is projected to rise by 5% annually, underscoring a robust consumer base that complements military usage.

However, the market is not without its challenges. Compliance with international regulations, such as the Arms Trade Treaty (ATT), imposes additional operational costs, estimated to increase by 8-10%. These regulatory requirements necessitate stringent control measures, impacting manufacturing and distribution processes. Moreover, environmental concerns associated with lead pollution from ammunition are gaining traction. Lead contamination poses significant ecological risks, prompting increased scrutiny and potential regulatory restrictions. This environmental aspect could stymie market growth as manufacturers may need to invest in sustainable alternatives or face operational limitations.

Key Takeaways

- Market Growth: The Small Caliber Ammunition Market was valued at USD 9.2 billion in 2023. It is expected to reach USD 12.5 billion by 2033, with a CAGR of 3.2% during the forecast period from 2024 to 2033.

- By Size: 5.56mm caliber segment dominated due to widespread military and law enforcement use.

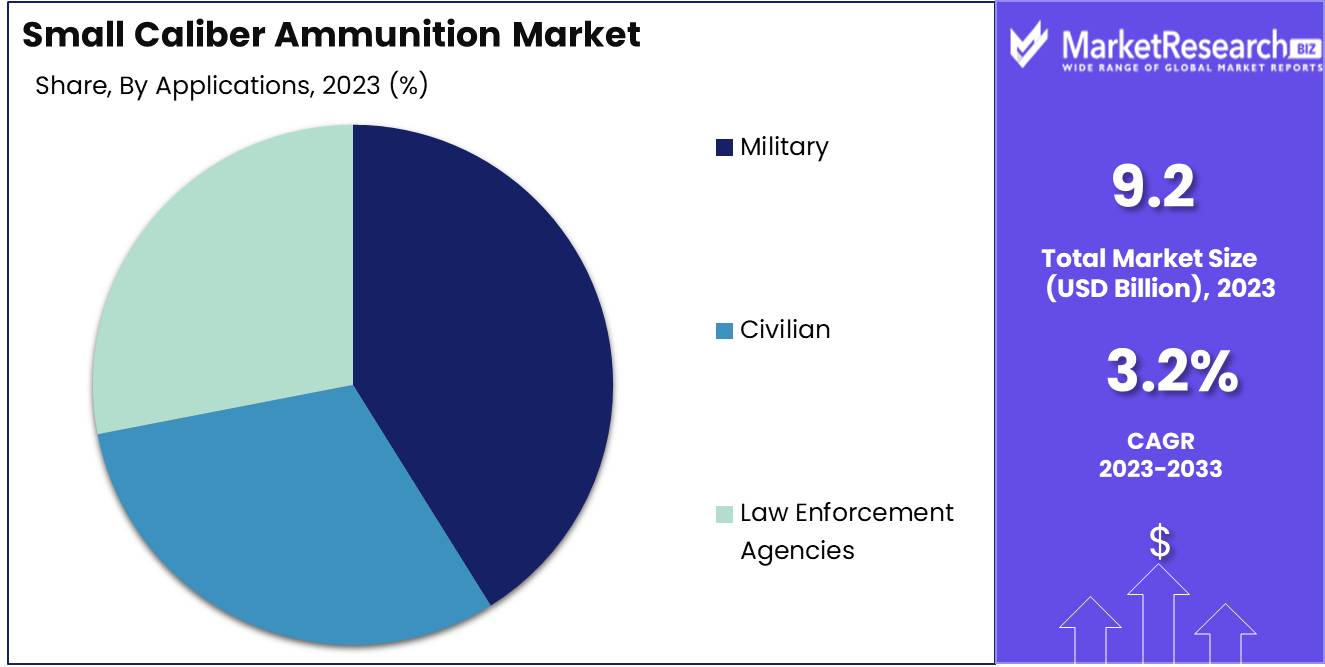

- By Applications: The Military dominates the Small Caliber Ammunition Market by applications.

- By Casing Type: Brass dominated the small caliber ammunition casing market.

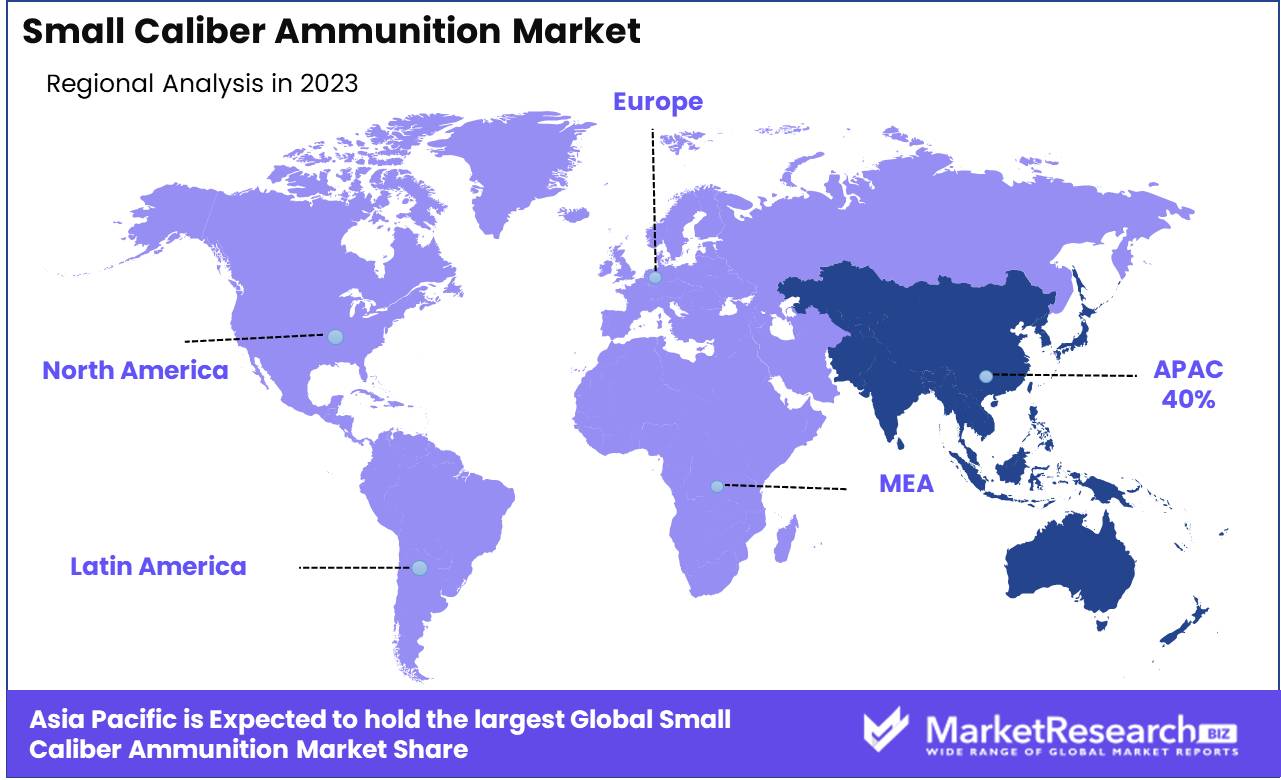

- Regional Dominance: Asia Pacific leads with a 40% market share, driven by rising defense expenditures.

- Growth Opportunity: The global small-caliber ammunition market is driven by military modernization and law enforcement demands, highlighting robust growth and lucrative opportunities for the industry.

Driving factors

Geopolitical Conflicts and Tensions: A Catalyst for Increased Demand

Geopolitical conflicts and tensions are primary drivers of the small-caliber ammunition market. The resurgence of geopolitical instability in various regions, such as the Middle East, Eastern Europe, and Asia, has increased demand for small-caliber ammunition. Countries embroiled in or preparing for potential conflicts require substantial ammunition supplies for both defensive and offensive operations. The ongoing conflicts and the threat of terrorism have necessitated the need for continuous replenishment of ammunition stockpiles, thereby driving market growth.

For instance, according to a data report, the global military expenditure reached $2 trillion in 2022, reflecting a 3.7% increase from the previous year, underscoring the influence of geopolitical tensions on defense budgets and related expenditures, including small caliber ammunition. This uptick in expenditure correlates with increased procurement and consumption of small-caliber ammunition, as nations aim to ensure military readiness and operational efficiency.

Rising Military Expenditure: Fueling Market Expansion

Rising military expenditure globally is a significant factor contributing to the growth of the small-caliber ammunition market. Many countries are increasing their defense budgets to enhance their military capabilities and preparedness. This rise in military spending directly translates to higher investment in ammunition procurement.

For example, the United States, the largest defense spender, allocated approximately $778 billion to its defense budget in 2022, marking a 4.4% increase from the previous year. This substantial budget allocation includes significant investments in small-caliber ammunition to support training, active deployments, and stockpiling needs. Similarly, countries like China and India have also shown considerable increases in their defense budgets, further propelling the demand for ammunition.

The continuous rise in military expenditure across various nations ensures a steady flow of funds toward the procurement of small-caliber ammunition, thereby bolstering market growth.

Military Modernization Programs: Advancing Ammunition Technology and Usage

Military modernization programs are integral to the growth of the small-caliber ammunition market. These programs aim to upgrade existing military hardware, including firearms and ammunition, to improve efficiency, accuracy, and lethality. Modernization efforts often involve adopting advanced ammunition types that offer superior performance characteristics, such as enhanced range, accuracy, and reduced weight.

Countries like the United States, Russia, and China are at the forefront of military modernization initiatives. For instance, the U.S. Army’s Next Generation Squad Weapon (NGSW) program is focused on developing new small-caliber ammunition that provides greater lethality and range compared to existing munitions. This program not only drives demand for new ammunition types but also sets a precedent for other nations to follow suit, thereby expanding the market.

Moreover, modernization programs often include the establishment of new production facilities and the upgrade of existing ones to manufacture advanced ammunition. This industrial expansion further stimulates market growth by increasing production capacity and innovation within the sector.

Restraining Factors

Regulatory Restrictions: A Major Impediment to Market Expansion

Regulatory restrictions significantly hinder the growth of the small-caliber ammunition market. Governments worldwide impose stringent regulations on the production, sale, and possession of ammunition to ensure public safety and control criminal activities. These regulations often include rigorous licensing requirements, limitations on the quantities that can be purchased, and extensive background checks for buyers. For instance, in the United States, the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) enforces laws that require ammunition manufacturers to comply with federal standards, which can increase operational costs and limit production capabilities.

Additionally, international regulations, such as those imposed by the European Union, mandate compliance with environmental standards to reduce the ecological impact of ammunition manufacturing. These requirements can necessitate costly investments in cleaner production technologies and processes, further constraining market growth. The cumulative effect of these regulatory barriers is a slowdown in market expansion as manufacturers face increased costs, limited market access, and reduced consumer demand due to the complexity and difficulty of purchasing ammunition legally.

Supply Chain Disruptions: Undermining Market Stability and Growth

Supply chain disruptions present another significant challenge to the small-caliber ammunition market. The production and distribution of ammunition are highly dependent on a stable and efficient supply chain, which encompasses raw material procurement, manufacturing, logistics, and retail distribution. Any disruptions in this chain can have far-reaching impacts on market growth.

The COVID-19 pandemic, for example, highlighted the vulnerabilities in global supply chains, leading to shortages of essential components such as primers and propellants. These shortages resulted in decreased production capacities and delays in order fulfillment, directly impacting market supply and driving up prices. Moreover, geopolitical tensions and trade restrictions can also disrupt the flow of raw materials and finished products. For instance, sanctions on key supplier countries or conflicts affecting major shipping routes can create bottlenecks that impede the timely delivery of goods.

In addition to these factors, natural disasters and logistical challenges, such as port congestion and transportation strikes, can further exacerbate supply chain issues. The cumulative effect of these disruptions is a volatile market environment where supply cannot consistently meet demand, thereby restraining overall market growth and stability.

By Size Analysis

In 2023, 5.56mm caliber dominated due to widespread military and law enforcement use.

In 2023, The 5.56mm caliber held a dominant market position in the "By Size" segment of the Small Caliber Ammunition Market. This dominance can be attributed to its widespread use in military and law enforcement applications, as it is the standard caliber for NATO forces and various police departments globally. The 5.56mm caliber is favored for its balance of accuracy, manageable recoil, and effective range, making it suitable for both assault rifles and carbines.

The 7.62mm caliber also commands a significant share, particularly in applications requiring greater stopping power and penetration, such as in designated marksman rifles and machine guns. This caliber is popular in both military and hunting circles due to its superior ballistic performance.

The 9mm caliber remains a staple in the handgun market, highly preferred for personal defense, law enforcement sidearms, and competitive shooting due to its balance of power, low recoil, and widespread availability.

The .50 caliber, known for its use in heavy machine guns and sniper rifles, caters to specialized military applications requiring long-range engagement and anti-material capabilities.

Shotshells, primarily used in shotguns, continue to see demand in hunting, sport shooting, and law enforcement. Their versatility in load types and applications from birdshot to slugs ensures their continued relevance across various sectors.

By Applications Analysis

The Military dominates the Small Caliber Ammunition Market by applications.

In 2023, The Military held a dominant market position in the Small Caliber Ammunition Market's "By Applications" segment. The demand for small-caliber ammunition in military applications is driven by ongoing defense modernization programs, increased military expenditure, and the need for advanced ammunition to enhance combat effectiveness. Military operations worldwide require a continuous supply of reliable and high-performance ammunition, contributing to the significant market share held by this segment.

Meanwhile, the Civilian segment has shown substantial growth due to rising interest in shooting sports and personal defense. Increased participation in recreational shooting activities and the growing popularity of hunting have further boosted the demand for small-caliber ammunition among civilians.

Law Enforcement Agencies also represent a crucial segment, driven by the necessity for ammunition in training and operational activities. The ongoing focus on public safety and crime prevention has led to the steady procurement of small-caliber ammunition by various law enforcement bodies.

By Casing Type Analysis

In 2023, Brass dominated the small caliber ammunition casing market.

In 2023, Brass held a dominant market position in the casing type segment of the small-caliber ammunition market. Brass, renowned for its superior durability and corrosion resistance, continued to be the preferred choice for ammunition casing due to its reliability and performance advantages. The superior workability of brass allows for precise manufacturing, which enhances the overall performance of ammunition. This material's widespread use can be attributed to its ability to withstand high pressure and its resistance to environmental factors, which ensures longevity and consistent performance.

Conversely, steel casings, while more cost-effective, have not achieved the same level of market penetration as brass. Steel is less resistant to corrosion and has lower malleability compared to brass, which can impact the performance and durability of ammunition. As a result, steel casings are typically used in applications where cost reduction is a priority over performance.

Key Market Segments

By Size

- 5.56mm

- 7.62mm

- 9 mm

- 50 caliber

- Shotshells

By Applications

- Military

- Civilian

- Law Enforcement Agencies

By Casing Type

- Brass

- Steel

Growth Opportunity

Military Modernization Programs

The global small-caliber ammunition market is poised for significant growth, driven primarily by ongoing military modernization programs. Nations worldwide are prioritizing the enhancement of their defense capabilities, leading to increased procurement of advanced small-caliber ammunition. For instance, the U.S. Army's Next Generation Squad Weapons (NGSW) program is set to replace existing weapon systems with more advanced and efficient alternatives, thereby escalating the demand for modern ammunition. Similarly, countries in the Asia-Pacific region, such as China and India, are significantly increasing their defense budgets to upgrade their military arsenals, further propelling market growth.

Law Enforcement and Security Demands

In addition to military modernization, the rising demand from law enforcement and security agencies is a key growth driver for the small-caliber ammunition market. The increasing focus on homeland security, coupled with the need to combat rising crime rates and terrorism, necessitates the procurement of advanced ammunition for police and security forces. For example, the ongoing security challenges in regions like the Middle East and North Africa (MENA) are compelling governments to bolster their internal security measures, thereby driving the market for small-caliber ammunition.

Latest Trends

High Demand for Specific Calibers

The small caliber ammunition market is experiencing a significant uptick in demand for specific calibers. This trend is largely driven by the increasing need for specialized ammunition in both military and civilian applications. For military purposes, calibers such as 5.56mm and 7.62mm are seeing heightened demand due to ongoing global conflicts and the modernization of military forces. On the civilian side, the popularity of recreational shooting sports and personal defense has spurred the demand for popular calibers like 9mm and .223 Remington. This focused demand is pushing manufacturers to enhance their production capacities and streamline their supply chains to meet the rising requirements efficiently.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the small-caliber ammunition market. Innovations in materials science and manufacturing processes are leading to the development of more efficient and reliable ammunition. One notable advancement is the increased use of composite materials, which enhance the durability and performance of bullets.

Additionally, the incorporation of smart technology, such as sensors and tracking systems, is revolutionizing the way ammunition is utilized and monitored. These technological strides are not only improving the accuracy and effectiveness of small-caliber ammunition but also ensuring better compliance with environmental and safety standards. Consequently, manufacturers who invest in these technologies are likely to gain a competitive edge in the market.

Regional Analysis

Asia Pacific leads with a 40% market share, driven by rising defense expenditures.

The Small Caliber Ammunition Market demonstrates varied dynamics across different regions, reflecting the influence of geopolitical factors, defense expenditures, and civilian demand. In North America, the market is propelled by substantial defense spending, particularly in the United States, which remains one of the largest consumers globally. The region accounted for approximately 35% of the market share in 2023, driven by both military procurement and civilian usage in sports and hunting. In Europe, the market is bolstered by increased defense budgets and the modernization of military arsenals, with significant contributions from countries like Germany, France, and the United Kingdom. Europe's market share stood at around 25% in the same year, reflecting steady growth despite economic uncertainties.

The Asia Pacific region emerges as the dominating market for small-caliber ammunition, capturing approximately 40% of the global largest market share. This dominance is attributed to rising defense expenditures in countries such as China, India, and South Korea, coupled with growing concerns over regional security. The demand is further augmented by civilian applications and increasing participation in shooting sports.

In the Middle East & Africa, geopolitical tensions and regional conflicts drive the demand for ammunition, with key markets including Saudi Arabia, UAE, and South Africa. The region contributed nearly 12% to the global market, highlighting its strategic importance despite relatively smaller economic scales.

Lastly, Latin America shows moderate growth, with Brazil and Mexico leading the demand due to their defense modernization programs and civilian markets. The region holds a market share of about 8%, reflecting ongoing development and stability in demand patterns. Overall, the Asia Pacific region’s significant share underscores its pivotal role in the global small-caliber ammunition market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global small-caliber ammunition market is characterized by significant contributions from key industry players, each driving innovation and production efficiency. Aguila Ammunition, known for its high-quality products, continues to expand its market reach by emphasizing competitive pricing and superior performance. Northrop Grumman Corporation and General Dynamics Corporation leverage their extensive defense portfolios to enhance the reliability and effectiveness of their ammunition offerings, catering primarily to military and law enforcement agencies.

BAE Systems PLC and Denel SOC Ltd maintain their positions through robust R&D investments and strategic partnerships, focusing on technologically advanced solutions. Remington Arms Company LLC, despite facing financial challenges in the past, strives to regain market share by restructuring and launching new product lines that appeal to both civilian and professional users.

CBC Global Ammunition and RUAG Group enhance their market presence through diversification and geographical expansion, tapping into emerging markets in Asia and the Middle East. MESKO and Nammo AS capitalize on their established reputations in Europe, emphasizing precision and high-performance ammunition.

Olin Corporation and CCI Ammunition sustain their leadership in the North American market by continuously improving manufacturing processes and product quality. Elbit Systems Ltd and Ordnance Factory Board (OFB) bolster their capabilities by integrating advanced technologies and expanding production capacities to meet rising demand.

PT Pindad and Sellier & Ballot focus on competitive pricing strategies and expanding their distribution networks, particularly in Southeast Asia and Eastern Europe. Vista Outdoor, Inc. and KNDS N.V. drive growth through strategic acquisitions and innovation in ammunition design and materials.

Thales Group, with its comprehensive defense solutions, continues to be a pivotal player, contributing to the market through advanced ammunition technologies and global supply chain management. Collectively, these companies shape the competitive landscape of the small-caliber ammunition market, emphasizing innovation, quality, and strategic expansion.

Market Key Players

- Aguila Ammunition

- Northrop Grumman Corporation

- General Dynamics Corporation

- BAE Systems PLC

- Denel SOC Ltd

- Remington Arms Company LLC

- CBC Global Ammunition

- RUAG Group

- MESKO

- Nammo AS

- Olin Corporation

- CCI Ammunition

- Elbit Systems Ltd

- Ordnance Factory Board (OFB)

- PT Pindad

- Sellier & Ballot

- Vista Outdoor, Inc.

- KNDS N.V.

- Thales Group

Recent Development

- In February 2024, The Sporting Products Business of Vista Outdoor was acquired by the Czechoslovak Group for USD 1.91 billion. This acquisition expands Czechoslovak Group's ammunition product range, including brands such as Federal, CCI, HEVI-Shot, Remington, and Speer.

- In January 2024, Nammo AS received USD 95 million from the Norwegian government to boost its production, particularly focusing on 155mm artillery ammunition.

- In January 2024, Federal Premium Ammunition introduced a new line of centerfire rifle ammunition featuring the Federal Fusion Tipped design. This innovative design incorporates a polymer tip to enhance ballistic performance, offering shooters improved accuracy and extended range.

Report Scope

Report Features Description Market Value (2023) USD 9.2 Billion Forecast Revenue (2033) USD 12.5 Billion CAGR (2024-2032) 3.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Size (5.56mm, 7.62mm, 9 mm, 50 calibers, Shotshells), By Applications (Military, Civilian, Law Enforcement Agencies), By Casing Type (Brass and Steel) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Aguila Ammunition, Northrop Grumman Corporation, General Dynamics Corporation, BAE Systems PLC, Denel SOC Ltd, Remington Arms Company LLC, CBC Global Ammunition, RUAG Group, MESKO, Nammo AS, Olin Corporation, CCI Ammunition, Elbit Systems Ltd, Ordnance Factory Board (OFB), PT Pindad, Sellier & Ballot, Vista Outdoor, Inc., KNDS N.V., Thales Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aguila Ammunition

- Northrop Grumman Corporation

- General Dynamics Corporation

- BAE Systems PLC

- Denel SOC Ltd

- Remington Arms Company LLC

- CBC Global Ammunition

- RUAG Group

- MESKO

- Nammo AS

- Olin Corporation

- CCI Ammunition

- Elbit Systems Ltd

- Ordnance Factory Board (OFB)

- PT Pindad

- Sellier & Ballot

- Vista Outdoor, Inc.

- KNDS N.V.

- Thales Group