Tobacco Market By Product(Cigarettes, Smokeless Tobacco, Cigars & Cigarillos, Next Generation Products, Kretek, Others), By Distribution channel(Supermarket/Hypermarket, Convenience Stores, Tobacco Shops, Online, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43448

-

Feb 2024

-

179

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

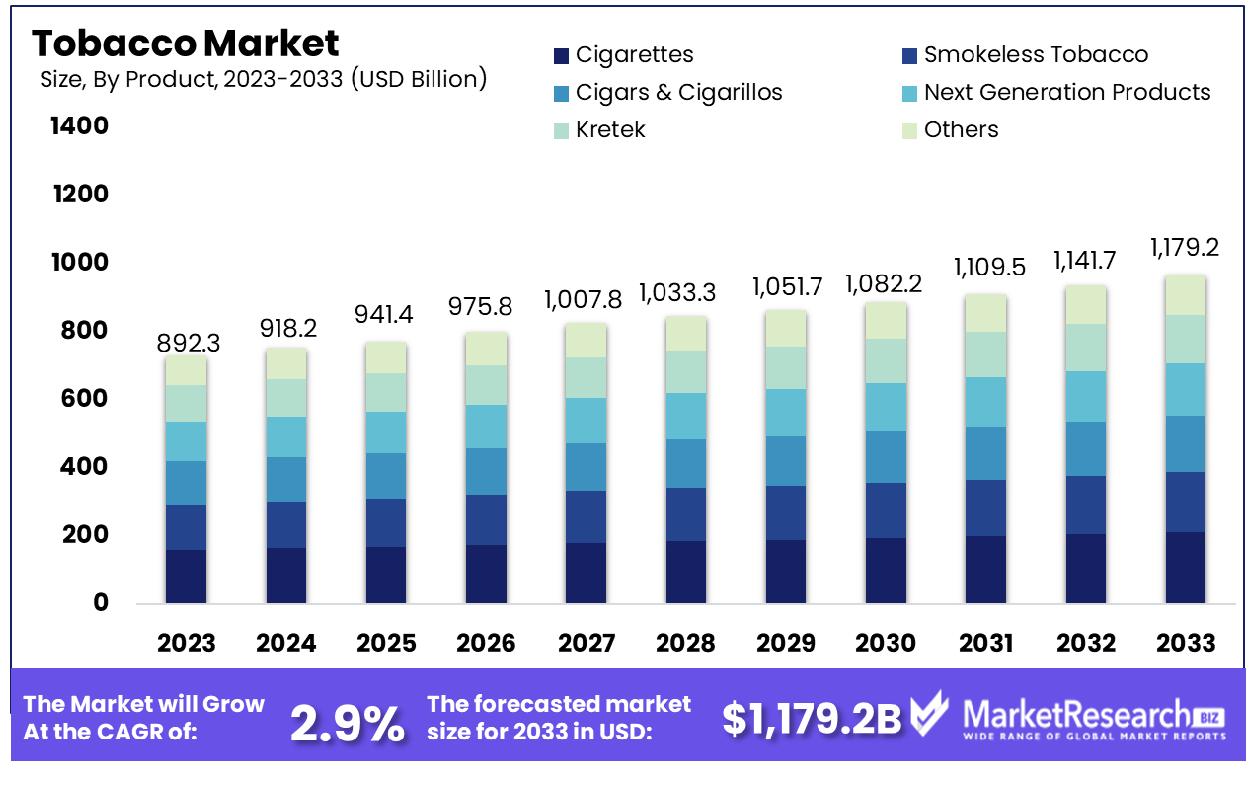

The tobacco market was valued at USD 892.3 billion in 2023. It is expected to reach USD 1,179.2 billion by 2033, with a CAGR of 2.9% during the forecast period from 2024 to 2033. The surge in demand for various tobacco products, rise in urbanization and upsurge in global populations are some of the main key driving factors for the tobacco market.

Refers to the leaves of tobacco plants that have been dried and processed for the consumers to roll up and smoke. It is one of the main elements in cigarettes and chewing tobacco. The tobacco plant is typically cultivated in tropical America. It is broadly yielded in warm regions, especially in the US and China. Tobacco is one of the important sources of tax revenue for the government worldwide.

It is consumed in different forms that comprise cigars, and smokeless products like snuffs and pipe tobacco. It also comprises of the sowing seeds in fields and nurturing the seeds into seedlings which are transferred to bigger fields where they grow properly. The tobacco leaves are yielded by hand and then dried through different techniques like air curing, sun curing, and fire curing. The presence of nicotine in tobacco acts as a stimulant that releases neurotransmitters like dopamine which gives ultimate pleasure and relaxation.

Tobacco smoke is made up of several chemicals that are quite dangerous and harmful to smokers and non-smokers. Even breathing a small amount of tobacco smoke can impact health. More than 7,000 chemicals are present in tobacco smoke, of which 100 chemicals are harmful comprised of hydrogen cyanide, ammonia, and carbon monoxide. According to a report published by WHO in July 2023, there are more than 8 million people who die due to consuming tobacco every year, among that 1.3 billion are estimated as non-smokers who are exposed to secondhand smoke. There are around 80% of the global population which has 1.3 billion tobacco users belongs to low and middle-income regions.

Cigarettes are the most common famous tobacco products due to their accessibility, convenience, and cost-effectiveness. Many tobacco manufacturers are launching new products that are substantially less harmful than other conventional products to maintain the consumer’s demand. There is the emergence of new nicotine products that are referred to as substitute items of tobacco. The demand for tobacco will increase due to its high consumption among individuals which will lead to market expansion in the coming years.

Key Takeaways

- Market Growth: Tobacco Market was valued at USD 892.3 billion in 2023. It is expected to reach USD 1,179.2 billion by 2033, with a CAGR of 2.9% during the forecast period from 2024 to 2033.

- By Product: Cigarettes lead the tobacco market, holding a dominant share of 82.3% by product category.

- Distribution channel: Supermarkets and hypermarkets are the leading distribution channels, commanding 53.2% of the market.

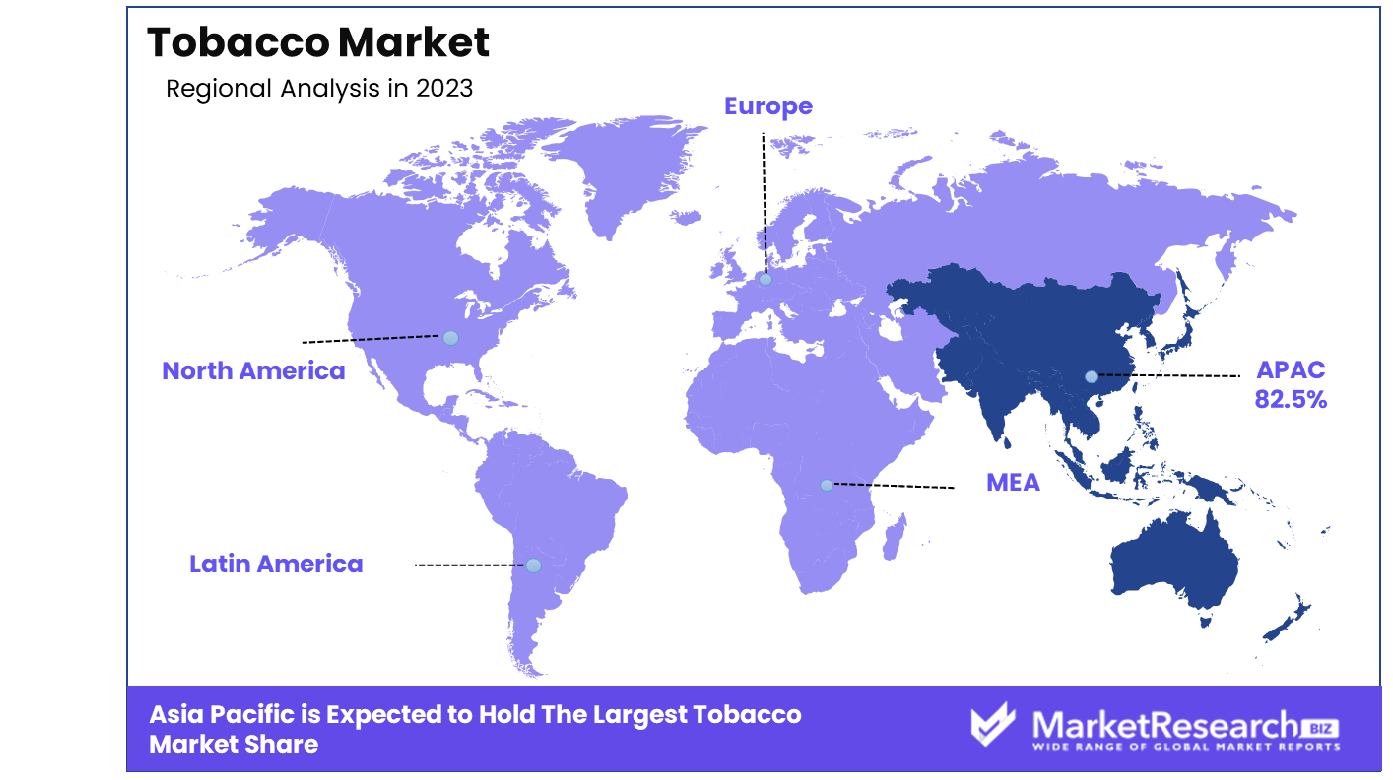

- Regional Dominance: Asia Pacific Dominates with 82.5% Market Share in Tobacco Industry

- Growth Opportunity: Mergers and acquisitions drive growth and resilience in the tobacco market, while product innovation sustains consumer interest and competitive relevance.

Driving factors

Product Innovation Catalyzes Tobacco Market Expansion

Innovative product development significantly drives the tobacco market. The advent of e-cigarettes, heat-not-burn devices, and flavored tobacco has been pivotal in attracting a new demographic, particularly younger users. The e-cigarette market, in particular, is experiencing robust growth, projected to expand over 20% annually through 2023. These novel products cater to evolving consumer preferences, offering alternatives to traditional smoking and propelling market diversification.

Strategic Brand Marketing Enhances Tobacco Appeal

Creative brand marketing campaigns are central to the tobacco industry's growth. Major companies like Philip Morris deploy influential campaigns, such as "Be Marlboro," to position smoking as a fashionable choice. These marketing strategies effectively resonate with consumer aspirations, reinforcing smoking as a desirable lifestyle choice, thus driving market growth.

Addiction Sustains Tobacco Market Demand

The inherently addictive nature of cigarettes underpins the tobacco market's resilience. Nicotine addiction creates a consistent customer base, with users continuing to smoke despite well-known health risks. This dependency factor ensures a steady demand for tobacco products, sustaining the industry's growth amidst various challenges.

Restraining Factors

Health Awareness Reduces Tobacco Consumption

The tobacco market is grappling with significant challenges due to growing health concerns. In developed countries, there is an increasing awareness of the health risks associated with smoking pipe, primarily due to robust anti-smoking education and campaigns. For instance, in the United States, cigarette smoking rates have seen a dramatic decline, plummeting by over 50% since 1965. This trend reflects a broader societal shift towards health-conscious behaviors, where more consumers are actively avoiding tobacco products to mitigate health risks, leading to a considerable contraction in the tobacco market's potential consumer base.

Rising Alternatives Erode Traditional Tobacco Market

The emergence and growing popularity of alternatives to traditional cigarette smoking, such as nicotine gums, patches, vaping, and smokeless tobacco products, pose a significant challenge to the tobacco market. These alternatives are increasingly being adopted by consumers, especially among younger demographics, as they are perceived to be less harmful or offer a pathway to quit smoking. For instance, e-cigarette usage among US adults has doubled from 2014 to 2023. This shift towards alternative nicotine delivery systems is gradually displacing traditional cigarette sales, reshaping the landscape of the tobacco market and its future growth trajectory.

By Product Analysis

Cigarettes Dominate The Market, Constituting 82.3% Of Product Offerings.

In the tobacco industry, Cigarettes are the dominant product segment, holding an overwhelming 82.3% market share. This prevalence is rooted in the historical and cultural significance of cigarettes, as well as the extensive global distribution networks established by leading tobacco major tobacco companies. Cigarettes are often marketed as symbols of sophistication and adult choice, which continues to appeal to a broad consumer base despite growing health awareness. The availability of a wide range of brands and styles, including light, ultra-light, menthol, and clove cigarettes, contributes to their market dominance.

Other product segments like Smokeless Tobacco products, Cigars & Cigarillos, Next Generation Products (like e-cigarettes and vaping products), Kretek, and Others also hold significant shares. Smokeless tobacco caters to users preferring non-smoking options, while cigars and cigarillos are often associated with luxury and leisure. Next-generation products are growing rapidly, driven by consumer perceptions of being safer alternatives to traditional smoking. Kretek, particularly popular in Indonesia, adds diversity to the product mix. However, the entrenched position and widespread acceptance of cigarettes reinforce their dominance in the market.

By Distribution Channel Analysis

Supermarket/Hypermarket Channels Dominate Distribution, Accounting For 53.2% Market Share.

Supermarkets/Hypermarkets emerge as the leading distribution channel for tobacco products, accounting for 53.2% of the market. This dominance is attributed to their extensive reach, convenience, and the ability to offer a wide assortment of tobacco products under one roof. Supermarkets and hypermarkets are accessible to a broad consumer base, providing visibility and easy availability for various brands.

Convenience Stores, Tobacco Shops, Online platforms, and Other channels also play significant roles in tobacco distribution. Convenience stores offer quick access to tobacco products, especially for impulse purchases. Specialized shops provide a range of premium and artisanal products, catering to connoisseurs. Online sales channels have been growing, offering the convenience of home delivery and often a broader selection. Despite these alternatives, the sheer scale, accessibility, and consumer preference for supermarkets/hypermarkets cement their position as the primary distribution channel in the tobacco market.

Key Market Segments

By Product

- Cigarettes

- Smokeless Tobacco

- Cigars & Cigarillos

- Next Generation Products

- Kretek

- Others

By Distribution channel

- Supermarket/Hypermarket

- Convenience Stores

- Tobacco Shops

- Online

- Others

Growth Opportunity

Mergers and Acquisitions: Catalyzing Expansion in the Tobacco Market

Mergers and acquisitions within the tobacco industry present significant opportunities for growth and market consolidation. By strategically merging or acquiring major companies, tobacco companies can expand their market reach, reduce operational costs, and diversify their product portfolios through the inclusion of acquired brands. This consolidation not only strengthens their position in the market but also enhances their capacity to innovate and respond to competitive pressures. As the industry navigates regulatory challenges and shifting consumer preferences, strategic mergers and acquisitions offer a pathway to sustained growth and resilience.

Product Innovation: Driving Consumer Engagement in the Tobacco Market

The continuous innovation in tobacco products, encompassing aspects like flavor, size, ingredients, and nicotine content, plays a pivotal role in driving market growth. In an industry where consumer preferences are constantly evolving, product innovation is crucial to maintaining consumer interest and loyalty. Innovations that cater to specific consumer tastes or health concerns, such as reduced nicotine products or new flavor profiles, can attract new customers and retain existing ones. By focusing on innovative product development, smoking tobacco cigarette companies can effectively navigate market shifts and remain relevant in a highly competitive industry.

Latest Trends

Shift Towards Non-Combustible Products

The tobacco industry is witnessing a significant shift towards non-combustible products, such as e-cigarettes, vaping devices, and heated tobacco products. This trend is driven by consumer demand for alternatives perceived as less harmful than traditional cigarettes. Market analysis indicates an increasing investment in research and development by key industry players to innovate and expand their non-combustible product portfolios.

Enhanced Regulatory Scrutiny

Governments worldwide are intensifying regulations on tobacco products, focusing on public health. This includes stricter packaging requirements, marketing restrictions, and bans on flavored tobacco products. Such regulatory measures aim to reduce tobacco additive consumption, particularly among younger demographics, thereby impacting market dynamics and forcing companies to adapt their strategies and product offerings.

Regional Analysis

Asia Pacific Dominates with 82.5% Market Share in Tobacco Industry

The overwhelming 82.5% market share of the tobacco industry in Asia Pacific can be attributed to several key factors. Primarily, the region hosts some of the world’s largest tobacco additive markets, including China and India, where consumption is deeply ingrained in cultural practices. Moreover, the region’s lenient regulatory frameworks and lower taxes compared to Western countries encourage higher consumption. Additionally, a large proportion of the rural population in these countries is employed in farming, which supports the industry’s supply chain.

The tobacco market in Asia Pacific is characterized by high demand for traditional tobacco products like cigarettes and bidis. However, there's a growing trend towards smokeless tobacco products among younger demographics. Despite increasing health awareness, the penetration of anti-smoking campaigns remains limited in many parts of this region. The market is also witnessing a surge in the popularity of alternative tobacco products like e-cigarettes, although their use varies widely across countries due to differing regulatory environments.

Europe's Position in the Tobacco Market

Europe’s tobacco market, with its stringent regulatory environment, focuses more on harm reduction and public health initiatives. The region sees a steady demand for traditional tobacco products, but there is a growing consumer shift towards smoke-free alternatives like vaping and e-cigarettes. The market is also seeing an increase in demand for premium tobacco products, influenced by consumer preferences for quality and exclusivity.

North America's Tobacco Market Dynamics

In North America, the tobacco market is experiencing a shift in consumption patterns, with traditional cigarette smoking on a decline and a rising interest in alternative tobacco products like e-cigarettes and vaping devices. This shift is largely driven by increasing health consciousness and stringent regulations on smoking. The market also sees significant demand for premium cigars and smokeless tobacco products, reflecting a niche yet profitable segment.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global tobacco market, the listed companies have established themselves as dominant forces, each wielding significant influence in different segments and geographies. Philip Morris International is a key player known for its innovative approach, particularly with the introduction of reduced-risk products like IQOS. Their global presence and substantial R&D investment make them a trendsetter in the industry.

Altria Group, primarily focused on the U.S. market, has a diverse product portfolio that includes leading cigarette brands and a stake in the burgeoning e-cigarette market, showcasing its adaptive strategy in a changing regulatory landscape.

British American Tobacco stands out for its extensive global reach and diverse product range, including vapor and tobacco heating products. Their strategy of acquisition and expansion into alternative and nicotine products positions them as a forward-thinking market leader.

Market Key Players

- Philip Morris International

- Altria Group

- British American Tobacco

- ITC Ltd.

- Japan Tobacco

- China National Tobacco Corporation

- Imperial Brands

- KT&G

- Swisher International

- Vector Group

- Tata Global Beverages

- Tetley

- Twinings

- Harney & Sons

- Dilmah

Recent Development

- In November 2023, Organigram revealed a new C$124.6m investment from BAT which it called a ‘transformative transaction’, bolstering its ‘already strong balance sheet’ and enabling it to accelerate its international growth plans.

- In November 2023, Philip Morris International revealed the launch of its most recent heat-not-burn tobacco heating device, called BONDS by IQOS, and its tobacco sticks that are specially designed for use are referred to as BENDS. A revolutionary supplement to the world's most popular smoking system for tobacco, IQOS and BONDS IQOS give adults who may otherwise smoke cigarettes a practical, easy-to-maintain, and compact option that is smoke-free. Based on scientific research the product is an option for smoking cigarettes helping to move towards an un-smoking future.

- In August 2023, UAE’s Global Investment Holding bought a 30% stake in Eastern Company, the largest cigarette manufacturer in Egypt, for $625Mn1,2. The UAE firm will also provide $150Mn for tobacco procurement. PMI and JTI were among the bidders although their offers presented a conflict of interest

Report Scope

Report Features Description Market Value (2023) USD 892.3 Bn Forecast Revenue (2033) USD 1,179.2 Bn CAGR (2024-2032) 2.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Cigarettes, Smokeless Tobacco, Cigars & Cigarillos, Next Generation Products, Kretek, Others), By Distribution channel(Supermarket/Hypermarket, Convenience Stores, Tobacco Shops, Online, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Tobacco Corporation, Imperial Brands, KT&G, Swisher International, Vector Group, Tata Global Beverages, Tetley, Twinings, Harney & Sons, Dilmah Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Philip Morris International

- Altria Group

- British American Tobacco

- ITC Ltd.

- Japan Tobacco

- China National Tobacco Corporation

- Imperial Brands

- KT&G

- Swisher International

- Vector Group

- Tata Global Beverages

- Tetley

- Twinings

- Harney & Sons

- Dilmah