Global Shapewear Market By Fabric Type Analysis (Nylon, Spandex, Cotton, Lycra), By Distribution Channel Analysis (Online, Supermarkets/ Hypermarkets, Other), End-User Analysis (Women, Men), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

30164

-

May 2023

-

181

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

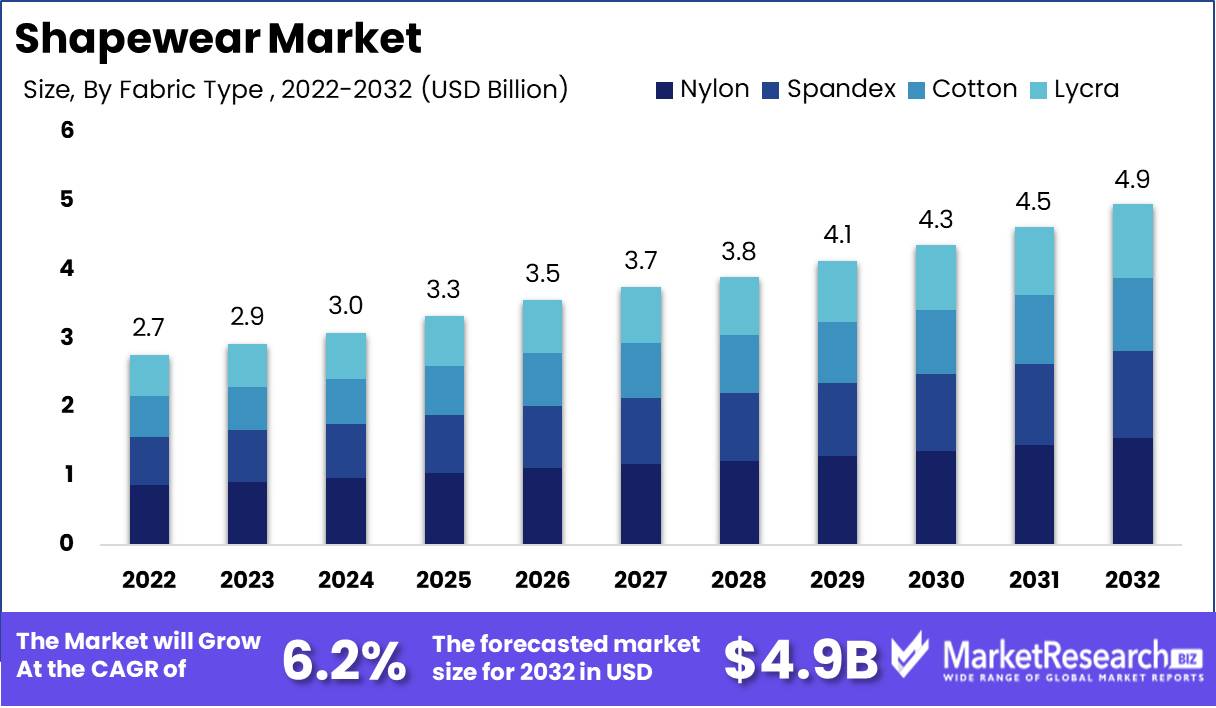

Global Shapewear Market size is expected to be worth around USD 4.9 Bn by 2032 from USD 2.7 Bn in 2022, growing at a CAGR of 6.2% during the forecast period from 2023 to 2032.

The business world of manufacturers is permeated with encouragement, urging them to embark on the noble path of body positivity and inclusivity, where a kaleidoscope of human forms shines in their marketing campaigns. This avant-garde movement does not stop there; it seeks to overthrow the oppressive grasp of unrealistic body standards by imbuing its branding with the very essence of body acceptance and self-love.

A new ethical dilemma has emerged in the shapewear market, casting a pall over the labor conditions involved in its production. Throughout the supply chain, a clarion call for brilliance and accountability echoes, imploring the industry's participants to employ their power with newfound integrity. The clarion call now demands equitable wages and safe work environments so that shapewear champions can flourish.

Ecological echoes have begun to reverberate within the sacred halls of the shapewear industry, imploring its practitioners to tread gently upon the Earth. The pioneers of this movement explore the mysteries of eco-friendly materials such as recycled fabrics and organic fibers in their pursuit of sustainability. With each step, they strive to reduce their carbon footprint, unveiling a symphony of manufacturing processes that reduces waste and pollution.

Even in the midst of a labyrinth of ethical concerns, shapewear continues to serve as a beacon of solace and relief for those who choose to embrace its form-fitting embrace. Its transformative properties instill wearers with a newfound sense of confidence by deftly refining the contours of the corporeal canvas and highlighting prized features. Thus, shapewear finds its place as a reliable companion for special occasions or moments of sartorial inclination.

Prioritize comfort and fit in your pursuit of the perfect garment, for the fitting process can be fraught with restrictions and discomfort, potentially unleashing a box full of bodily ailments. Seek divine harmony between shapewear and thy divine figure by selecting the correct size and design that resonates with thy divine form. Consider the level of compression that your heart desires, for in that decision lies the secret to fashion nirvana.

Driving factors

Increasing Demand for Body Shaping Products Driven by Women's Fitness Awareness:

The increasing awareness of fitness and body shaping is one of the significant factors that has led to a rise in the demand for body shaping and sculpting products among women. This demand has also been fuelled by the increasing popularity of shapewear as a comfortable and practical alternative to conventional undergarments.

Online Retailing Increases the Demand for Shapewear Products:

Expanding e-commerce and online retailing channels for the distribution of shapewear has also contributed to its increasing popularity. Technological advances have resulted in the creation of innovative and more effective shapewear products that accommodate various body types.

Demand for Shapewear is Driven by a Rise in Disposable Income:

Increasing disposable income, particularly in developing nations, is a key factor in the expansion of the personal grooming and appearance market. This is because higher expenditure on personal grooming and appearance results from this trend. The increasing popularity of athleisure and activewear, which frequently include shapewear elements, has also contributed to its demand.

Essential Shapewear in the Wardrobes of Working Women:

As the number of working women who prioritize their appearance and presentation has increased, shapewear has become a wardrobe staple. The trend of wearing bodycon dresses and tight-fitting clothing has also contributed significantly to the growth of this market. The growth of social media and influencers who promote shapewear as a solution has also positively impacted the market.

The Bodycon Trend and Social Media's Influence on the Shapewear Market:

As with any industry, there may be regulatory changes that could impact the shapewear market. Consumer safety and product labeling are two aspects that regulatory bodies may scrutinize.

Innovative Technologies in the Shapewear Industry 3D Printing and Advanced Fabrics:

Emerging technologies such as 3D printing and advances in fabric technology may have a substantial impact on the shapewear market. A fabric with the ability to modulate body temperature and enhance muscle performance has the potential to revolutionize the industry.

Potential Challenges for the Shapewear Market Regulatory Oversight and Consumer Safety:

New entrants with disruptive business models and advancements in direct-to-consumer sales channels are two potential disruptors that could have an impact on the competitive landscape of the shapewear market. Emerging trends or alterations in consumer behavior may have an impact on the shapewear market. We may see a shift toward eco-friendly shapewear products due to the increasing emphasis on sustainable and natural materials.

Restraining Factors

Challenges in the Expanding Shapewear Market:

In recent years, the market for shapewear has grown significantly, as an increasing number of people seek out these products to enhance their body shapes. As with any other product, however, shapewear faces its own set of restraining factors, including health concerns related to prolonged use, the availability of alternative body shaping products, limited sizes and options for plus-size women, negative perceptions and stigma associated with wearing shapewear, rising competition from counterfeit products, and low-quality shapewear products, leading to brand dilution and customer trust issues.

Concerns Relating to the Prolonged Use of Tight and Restrictive Shapewear:

The majority of shapewear products are designed to be tight-fitting and restrictive, which can cause discomfort, hinder breathing, and promote the development of yeast and bacteria in the genital and urinary tracts. In addition to causing dehydration, exhaustion, and syncope, the increase in body temperature caused by these products can also result in desiccation. In addition, prolonged use of tight-fitting and restrictive shapewear can cause digestive issues, such as acid reflux, bloating, and constipation, because these products can drive the stomach upwards, compress the intestines, and force acid into the esophagus.

Alternative Body Shaping Products and Treatments, Including Cosmetic Surgeries, Body Sculpting Procedures, and Exercise Programs:

The availability of alternative body shaping products and treatments, such as cosmetic surgery, body sculpting procedures, and exercise regimens, has also hindered the shapewear market's growth potential. These products and treatments provide longer-lasting, more natural-looking results than shapewear. While shapewear can help level out lumps and bumps, it cannot produce the dramatic body transformation that an increasing number of consumers seek.

Limiting Plus-Size and Curvy Women's Sizes and Options Leads to Market Exclusion and Dissatisfaction:

The limited sizes and options for plus-size and voluptuous women are another factor restraining the shapewear market, leading to market exclusion and dissatisfaction. Despite the fact that many companies have begun to offer plus-size options, these products frequently lack the same variety and variety of styles as those for average-sized consumers. Consequently, plus-size and curvy women frequently feel neglected by the market and are compelled to forego shapewear entirely.

Negative Perceptions and Stigma Associated with Wearing Shapewear:

The negative perception and stigma associated with shapewear also pose a significant obstacle for the shapewear market. Many individuals view shapewear as unattractive, uncomfortable, and even deceptive. They believe that wearing shapewear is an acknowledgment of insecurity and low self-esteem. In addition, some individuals believe that shapewear conveys the message that women should be ashamed of their bodies and labor to conceal perceived flaws.

Fabric Type Analysis

Different fabrics offer varying levels of support, comfort, and durability, making fabric type a crucial component of shapewear products. The nylon segment has emerged as the dominant player in the shapewear market due to its combination of stretchability, flattering fit, and durability.

The adoption of nylon shapewear has been spurred by economic growth in emergent economies, where people are becoming increasingly health-conscious and searching for ways to maintain a fit and toned physique. These economies are witnessing a significant rise in disposable income, which is leading to an increase in expenditure on products related to fitness.

Consumers today seek shapewear products that not only provide optimum support but also provide comfort and can be worn for extended periods of time. These requirements are met by the nylon segment of the shapewear market, which offers a combination of stretchability, breathability, and durability, making them ideal for everyday wear.

Due to a number of factors, the nylon segment of the shapewear market is anticipated to register the highest growth rate in the coming years. Initially, the demand for nylon shapewear is driven by the rising demand for shapewear products that offer a flattering fit and are pleasant to wear.

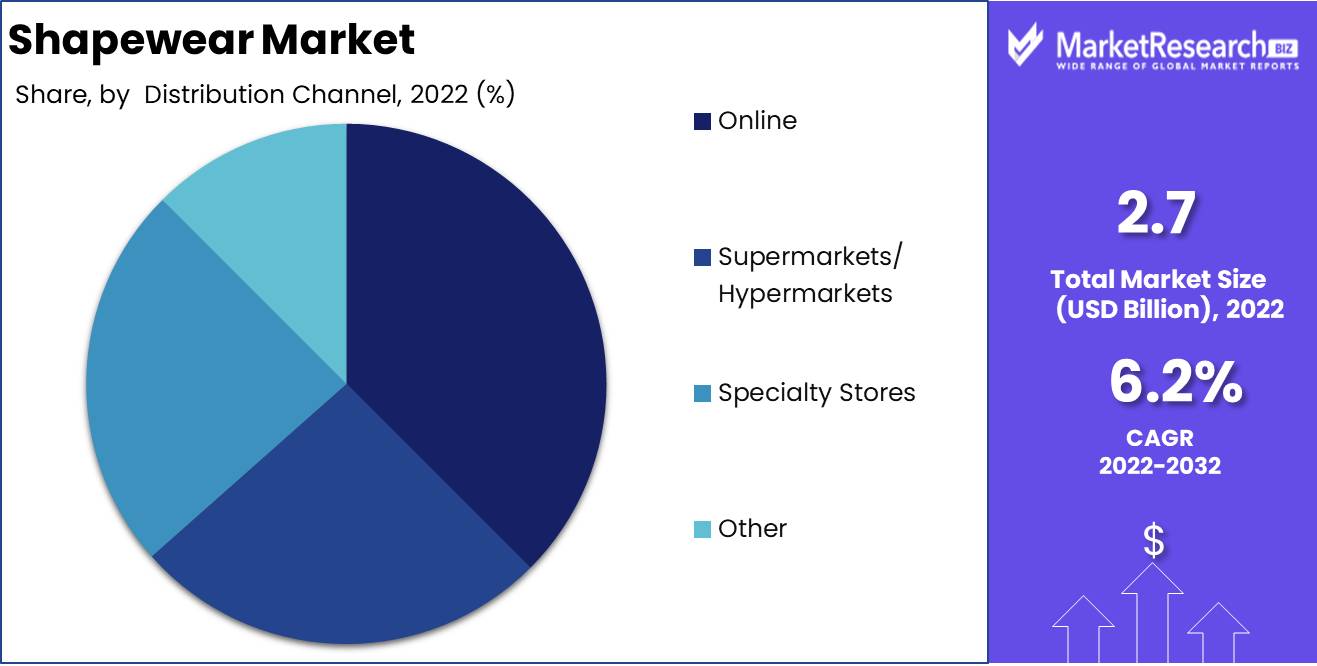

Distribution Channel Analysis

The advent of e-commerce platforms has dramatically altered the retail landscape, and the shapewear market is no exception. The online retail segment has become the dominant player in the shapewear market, providing consumers with a convenient and stress-free purchasing experience.

The adoption of online retail in the shapewear market has been driven by economic growth in emergent economies, where people are becoming increasingly tech-savvy and seeking convenient shopping options. These economies are witnessing a significant rise in discretionary income, which is leading to a rise in online spending.

E-commerce platforms offer consumers convenience, a vast selection of products, and competitive pricing, all of which attract consumers to online purchasing. Consumers prefer to peruse and purchase shapewear products from the comfort of their own homes, making online retailing in the shapewear market no exception.

Due to a number of factors, it is anticipated that the online retail segment of the shapewear market will register the highest growth rate over the coming years. The adoption of online retailing in the shapewear market is primarily driven by the ease and convenience of online purchasing.

End User Analysis

The market for shapewear is dominated by the women's segment, with women constituting a significant portion of the market. Women are becoming increasingly aware of their physical appearance, and shapewear products have emerged as an effective method to enhance their bodies and boost their confidence.

The adoption of shapewear products by women has been driven by economic growth in emergent economies, where women are increasingly entering the workforce and gaining economic independence. This increase in discretionary income is leading to a rise in expenditure on fashion and beauty products, including shapewear.

Women seek shapewear products that not only enhance their bodies but also provide comfort and durability. The growing trend of body positivity has also contributed to the rise in popularity of shapewear among women, who now view it as a means to accentuate their natural curves rather than hide them.

Due to a number of factors, the women's segment of the shapewear market is anticipated to register the highest growth rate in the coming years. First, the increasing trend of body positivity is driving the adoption of shapewear products designed to accentuate women's natural curves.

Key Market Segments

By Fabric Type Analysis

- Nylon

- Spandex

- Cotton

- Lycra

By Distribution Channel Analysis

- Online

- Supermarkets/ Hypermarkets

- Specialty Stores

- Other

End-User Analysis

- Women

- Men

Growth Opportunity

As Smart Technologies and Eco-Friendly Products Drive Growth, the Shapewear Market Soars:

The market for shapewear is experiencing unprecedented growth due to the rising prominence and perception of body-shaping garments as a means of improving physical appearance and health. With the recent expansion into the men's shapewear market, as well as the incorporation of smart technologies and eco-friendly products, the shapewear market has even greater growth potential.

Fitness Tracking and Body Shaping are Revolutionized by Shapewear with Smart Features:

The incorporation of smart and tech-enabled features in shapewear, such as sensors and monitoring systems for enhanced body shaping and fitness tracking, exemplifies the paramount scope of technology. These technologies allow individuals to monitor their fitness progress, caloric intake, and any potential health hazards. The inclusion of such features provides the user with a comprehensive bundle to get the most out of their shapewear, thereby increasing the product's appeal to the consumer.

Meeting the Demand for Eco-Friendly Fashion:

Moreover, sustainability is a major factor in the market for shapewear, and the development of eco-friendly and sustainable products satisfies the increasing demand for sustainable fashion. The environmentally conscious market segment is an unexplored market that requires investigation. The development of sustainable shapewear products enables consumers to feel happy and has a positive effect on the environment.

Collaboration in Fashion Drives Shapewear to Mainstream Success:

Significant opportunities exist for shapewear brands to integrate their products into mainstream collections, product offerings, and marketing strategies through collaborations and partnerships with fashion brands and designers. This integration brings the market for shapewear closer to consumers who are actively interested in mainstream fashion.

The Shapewear Market Grows in Emerging Markets, Fueling Growth and Innovation:

In addition, emerging markets such as Asia-Pacific and the Middle East & Africa, which are experiencing rapid expansion in the fashion and cosmetics industry, offer significant opportunities for the shapewear market. The emerging markets offer enormous potential for shapewear brands to establish themselves, explore, expand, and proliferate.

Latest Trends

Increasing Demand for Shapewear with Seamless and Invisible Details:

The increasing prevalence of seamless and undetectable features is one of the most significant trends in shapewear. Customers seek body-shaping options that are discrete, comfortable, and do not sacrifice quality. Manufacturers are developing shapewear that is seamless, lightweight, and pleasant to wear for extended periods of time to meet this demand. Seamless shapewear has been on the rise in popularity for some time and continues to be a client favorite.

The Emergence of Athleisure and Shapewear Inspired by Activewear:

The emergence of shapewear inspired by athleisure and activewear is an additional significant trend in the shapewear industry. Customers seek products that integrate functionality and fashionability. Compared to conventional shapewear, shapewear that is inspired by these trends is typically more fashionable and comfortable. Customers appreciate being able to wear shapewear in and out of the gym, and athleisure-inspired shapewear offers this functionality.

Advanced Fabrics and Materials Integration:

Manufacturers are constantly on the watch for novel and inventive materials with which to create superior shapewear products. In recent years, advanced fabrics such as bamboo and cellulite-reducing fabrics, which provide enhanced body shaping and health advantages, have been incorporated into fashion. Customers prefer these materials because they are more comfortable, breathable, and environmentally favorable.

Increasing Options for Customization and Personalization:

Customers have distinct preferences and requirements when it comes to shapewear, and manufacturers are catering to these preferences and requirements by providing more customization and personalization options. Size, color, and design are just a few examples of customization options. Customers can obtain shapewear tailored to their individual body type, preferences, and sense of fashion.

Increased Utilization of Social Media and Influencer Marketing:

In terms of shaping the shapewear market, social media has become a potent instrument. As a consequence, numerous shapewear manufacturers use social media to market and sell their products. The use of influencers demonstrates how shapewear can enhance one's appearance and bolster confidence. Social media enables manufacturers to expand their reach and communicate with a larger audience.

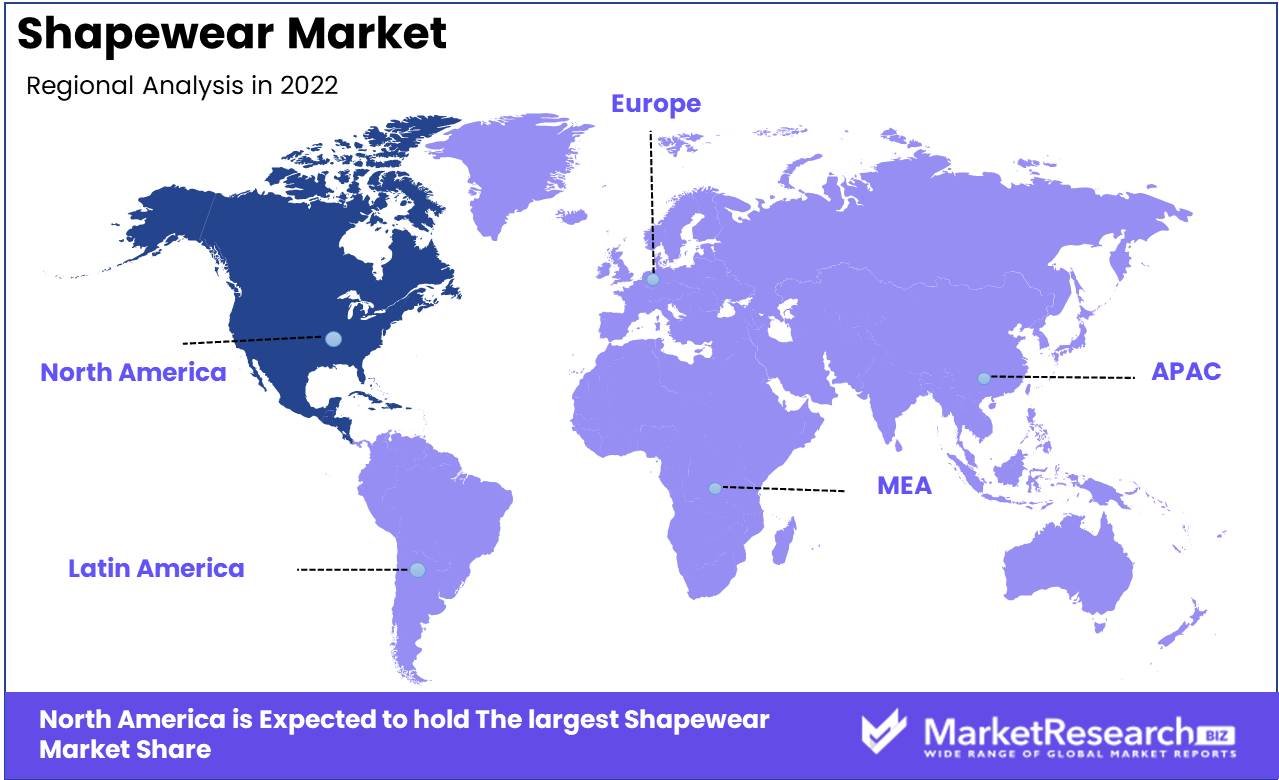

Regional Analysis

North America dominates the shapewear market, holding an impressive 38.8% market share. Recent research demonstrates the region's dominance in a highly competitive market that is anticipated to continue growing in popularity.

The purpose of shapewear is to enhance the appearance of the body. In recent years, it has gained popularity due to its ability to help people feel more confident and at ease in their skin. As a result of the rise of social media and the emphasis on attaining the ideal physique, shapewear has become a popular choice for many.

According to an industry study for shapewear, North America leads in terms of revenue, followed closely by Europe and Asia-Pacific. However, the dominance of North America can be attributed to a variety of factors.

First, the region has a sizeable population that places a premium on physical appearance and health. The demand for shapewear is being driven by a culture of fitness and health consciousness. Consumers are inclined to invest in products that enhance their appearance and well-being.

Secondly, North America is home to several influential shapewear brands with a substantial impact on the market. These brands have the resources and reach necessary to advertise their products broadly and establish themselves as industry leaders.

In North America, the online retail industry has contributed significantly to the development of the shapewear market. The region's developed e-commerce market has facilitated consumers' access to shapewear products. Additionally, online retailers can provide a broader selection of products at competitive prices, which has helped to increase demand.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

With the increased emphasis on health and fitness, a large number of individuals are searching for non-invasive approaches to attain the ideal body shape. This has increased the demand for shapewear, which is designed to enhance the body's shape and contour.

Spanx Inc., founded by Sara Blakely in 2000, is one of the leading competitors in the shapewear market. Throughout the years, Spanx has become synonymous with shapewear and a household name. The company provides an extensive selection of shapewear products, including leggings, bodysuits, and pants, in a variety of sizes and designs.

Miraclesuit, which was founded in 1991 by Jay Feinberg, is another significant player in the shapewear market. The company offers a variety of shapewear products, such as bodysuits, camisoles, and waist cinchers, that are designed to provide a slimming effect and enhance the body's natural curves.

Yummie is yet another well-known brand that offers shapewear products for women. Heather Thomson founded the company in 2008, and it offers a variety of products designed to smooth and shape the body, including leggings, tanks, and camisoles.

Top Key Players in the Shapewear Market

- Spanx, Inc.

- Leonisa

- Ann Chery

- Hanesbrands Inc.

- Contourglobal PLC

- Miraclesuit

- CPS Shapers Pvt. Ltd.

- Swee Shapewear Pvt Ltd

- Triumph International

- Jockey International, Inc.

- Yummie

- Other Players

Recent Development

- In 2021, Inclusive sizing Shapewear brands expanded their size ranges to accommodate a broader variety of body types.

- In 2022, Comfort and functionality will be prioritized. Improved comfort shapewear features adjustable straps, permeable panels, and targeted compression zones.

- In 2023, customizable options will be available. The shapewear market was comprised of brands that offered personalized or adaptable shapewear to accommodate individual preferences.

Report Scope:

Report Features Description Market Value (2022) USD 2.7 Bn Forecast Revenue (2032) USD 4.9 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Fabric Type Analysis (Nylon, Spandex, CottonLycra), By Distribution Channel Analysis (Online, Supermarkets/ Hypermarkets, Specialty Stores, Other), End-User Analysis (Women, Men, Plus-size, Maternity, Activewear) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Spanx, Inc., Leonisa, Ann Chery, Hanesbrands Inc., Contourglobal PLC, Miraclesuit, CPS Shapers Pvt. Ltd., Swee Shapewear Pvt Ltd, Triumph International, Jockey International, Inc., Other Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Spanx, Inc.

- Leonisa

- Ann Chery

- Hanesbrands Inc.

- Contourglobal PLC

- Miraclesuit

- CPS Shapers Pvt. Ltd.

- Swee Shapewear Pvt Ltd

- Triumph International

- Jockey International, Inc.

- Yummie

- Other Players

Frequently Asked Questions (FAQ)

Wearing shapewear, including waist cinchers and girdles, provides a number of benefits. It can help to conceal a muffin top or bulge by smoothing the curves of your body. It also often provides added support for the abdomen and back, which may be helpful for those who have had recent abdominal surgery or who are recovering from back pain. In some cases, it can provide additional support for the bustline.

The global shapewear market was valued at US$ 2.6 Bn in 2020 and is expected to register a CAGR of over 8% to reach a value of US$ 6 Bn by 2031.

A bodysuit costs US$ 35 upwards depending on the brand, while a waist cincher costs somewhere from US$ 15-20.