Scaffolding Market By Type (Supported scaffolding, Suspended scaffolding, Cantilever Scaffolding, Rolling scaffolding), By Material (Steel, Aluminum, Wood, Others), By Application (Construction industry, Electrical maintenance, Temporary stage, Ship Building, Oil & Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

7294

-

July 2024

-

153

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

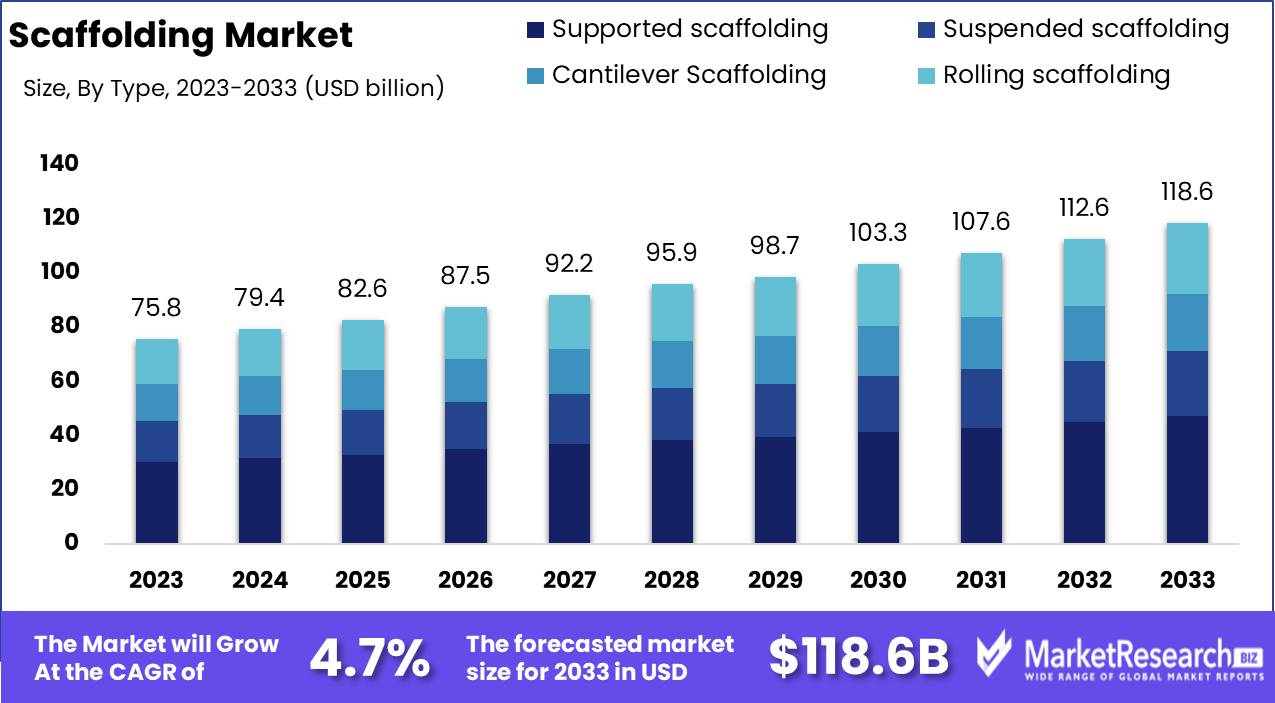

The Global Scaffolding Market was valued at USD 75.8 Bn in 2023. It is expected to reach USD 181.6 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

The Scaffolding Market encompasses the design, manufacture, and distribution of temporary structures used to support work crews and materials during construction, maintenance, and repair of buildings and other structures. This market includes various types of scaffolding systems, such as tube and clamp, Cuplock, and frame scaffolding, made from materials like aluminum, steel, and wood. The sector is driven by construction industry growth, urbanization, and increasing demand for efficient, safe, and versatile scaffolding solutions. Advances in materials and assembly techniques continue to enhance the functionality and safety of scaffolding systems.

The Scaffolding Market is witnessing robust growth, driven by rapid urbanization, increased construction activities, and the ongoing need for infrastructure development. The demand for efficient and safe scaffolding solutions has led to significant advancements in materials and design. Aluminum scaffolding, for example, has become increasingly popular due to its extended lifespan of over 30 years compared to the 10-20 years typical of galvanized steel. Additionally, aluminum is approximately 30% lighter, enhancing ease of transport and assembly, which is a critical factor in large-scale construction projects.

The Scaffolding Market is witnessing robust growth, driven by rapid urbanization, increased construction activities, and the ongoing need for infrastructure development. The demand for efficient and safe scaffolding solutions has led to significant advancements in materials and design. Aluminum scaffolding, for example, has become increasingly popular due to its extended lifespan of over 30 years compared to the 10-20 years typical of galvanized steel. Additionally, aluminum is approximately 30% lighter, enhancing ease of transport and assembly, which is a critical factor in large-scale construction projects.Innovations in scaffolding systems, such as the Cuplock system, are transforming the market by improving efficiency and reducing labor costs. The Cuplock system can be assembled up to 50% faster than traditional tube and clamp systems, allowing crews to erect approximately 100 square meters per hour compared to the 50-70 square meters per hour achievable with traditional methods. This significant improvement in assembly time translates to cost savings and increased productivity on construction sites.

The market is also shaped by stringent safety regulations and standards, which drive the adoption of advanced scaffolding systems designed to ensure worker safety and structural stability. Manufacturers are focusing on developing products that not only comply with these regulations but also offer enhanced durability and versatility.

The scaffolding market benefits from the growing emphasis on maintenance and renovation of existing structures, particularly in developed regions. This trend is expected to sustain demand for scaffolding solutions, as older buildings require regular upkeep and modernization.

Key Takeaways

- Market Value: The Global Scaffolding Market was valued at USD 75.8 Bn in 2023. It is expected to reach USD 181.6 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

- By Type: Supported Scaffolding constitutes 40% of the market, essential for providing stable and secure work platforms.

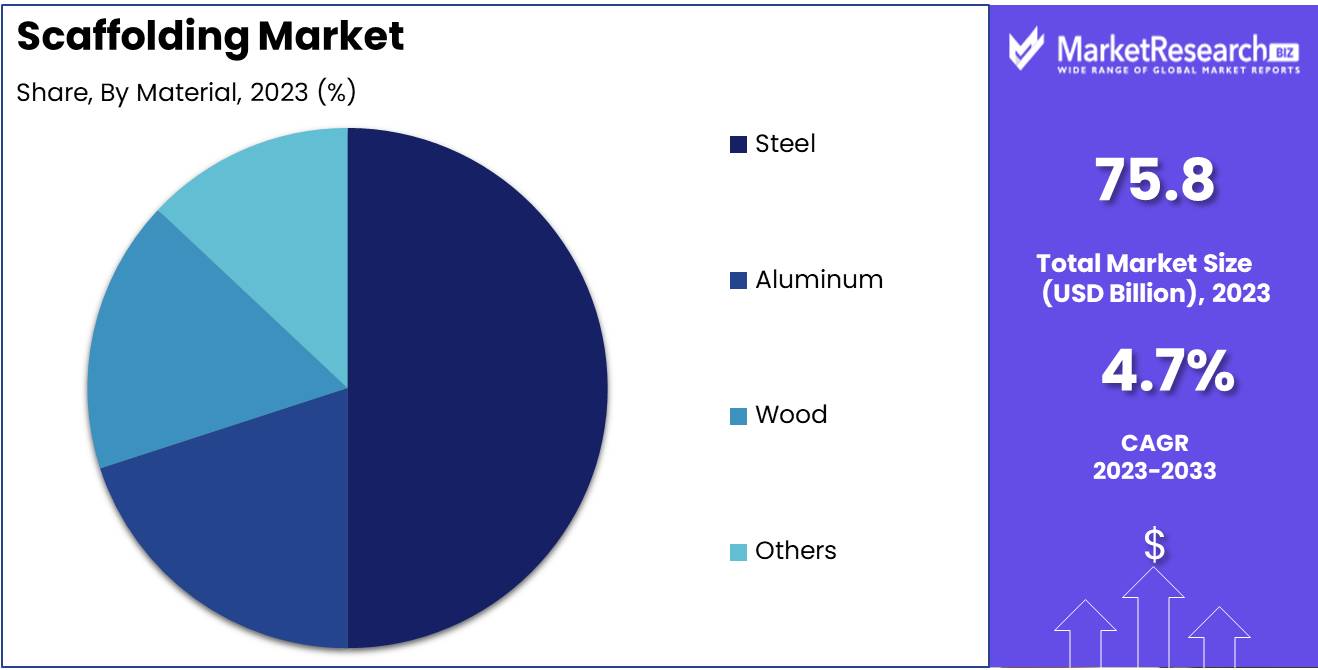

- By Material: Steel is the preferred material, making up 50%, known for its strength and durability.

- By Application: Construction Industry utilizes 60% of scaffolding, highlighting its critical role in building and infrastructure projects.

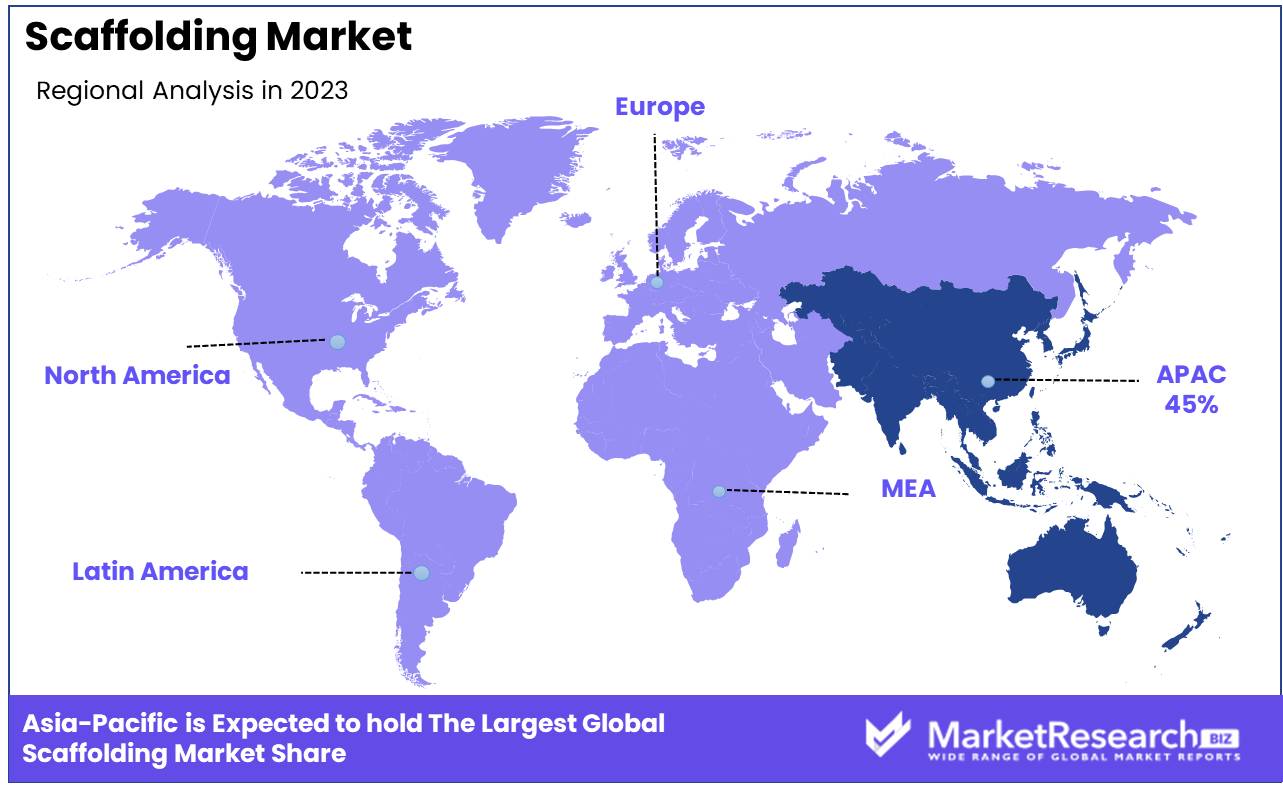

- Regional Dominance: Asia Pacific leads with a 45% market share, supported by rapid urbanization and infrastructure development.

- Growth Opportunity: Integrating advanced safety features and modular designs can enhance efficiency and safety, attracting more users in the construction sector.

Driving factors

Growth in Construction and Infrastructure Projects

The scaffolding market is significantly driven by the expansion of construction and infrastructure projects globally. As urbanization continues to accelerate, there is a rising need for residential, commercial, and industrial buildings, which directly boosts the demand for scaffolding. Government initiatives focused on developing smart cities and enhancing public infrastructure, including roads, bridges, and public facilities, further fuel cell market growth.

Major infrastructure projects in emerging economies, such as China's Belt and Road Initiative and India's Smart Cities Mission, contribute to a substantial increase in the requirement for scaffolding systems. This robust growth in construction activities underpins the expansion of the scaffolding market.

Increasing Emphasis on Worker Safety

The increasing emphasis on worker safety is another critical factor propelling the growth of the scaffolding market. Stringent safety regulations and standards imposed by government bodies and international organizations mandate the use of high-quality scaffolding to ensure the safety of construction workers. The Occupational Safety and Health Administration (OSHA) in the United States, for example, enforces rigorous safety standards that necessitate the use of secure and reliable scaffolding systems.

This regulatory landscape compels construction companies to invest in advanced scaffolding solutions that provide enhanced stability and safety features, thereby driving market growth. Additionally, the rising awareness among employers about the importance of worker safety and the potential cost savings from reduced workplace accidents further bolster the adoption of scaffolding.

Rising Demand for Renovation and Maintenance Services

The rising demand for renovation and maintenance services is also a significant driver of the scaffolding market. As existing infrastructure ages, there is a growing need for repair, refurbishment, and maintenance activities. Older buildings, bridges, and other structures require frequent upkeep to meet current safety standards and functional requirements. This trend is particularly evident in developed regions where the infrastructure is mature and requires ongoing maintenance.

Substantial investments are being made in the renovation of historical buildings and upgrading public infrastructure, which necessitates extensive scaffolding usage. The increasing frequency of renovation projects contributes to a steady demand for scaffolding solutions.

Restraining Factors

High Costs of High-Quality Scaffolding Materials

One of the significant restraining factors for the scaffolding market is the high cost associated with high-quality scaffolding materials. Premium scaffolding systems, which are essential for ensuring safety and compliance with regulatory standards, often come with a substantial price tag. These costs include not only the initial purchase price but also maintenance, transportation, and storage expenses.

For many small to medium-sized construction firms, the financial burden of investing in high-quality scaffolding can be prohibitive. This can lead to a preference for lower-cost alternatives, which may not provide the same level of safety and durability, ultimately limiting the market growth for premium scaffolding products.

Stringent Regulatory Requirements

Stringent regulatory requirements present another challenge to the scaffolding market. While these regulations are crucial for ensuring the safety of construction workers and the quality of construction projects, they also impose additional costs and complexities on scaffolding providers. Compliance with safety standards set by organizations such as OSHA in the United States or the European Union's Construction Products Regulation (CPR) requires significant investment in quality assurance, training, and certification processes.

These regulatory burdens can slow down the adoption of new scaffolding technologies and increase operational costs for manufacturers and construction companies. Moreover, the continuous evolution of these regulations means that scaffolding providers must constantly update their products and practices to remain compliant, further straining their resources and potentially inhibiting market growth.

By Type Analysis

Supported scaffolding held a dominant market position in the By Type segment of the Scaffolding Market, capturing more than a 40% share.

In 2023, Supported scaffolding held a dominant market position in the By Type segment of the Scaffolding Market, capturing more than a 40% share. This dominance is driven by the widespread application of supported scaffolding in construction, maintenance, and repair projects. Its versatility, stability, and ease of assembly make it a preferred choice for a wide range of construction activities, from residential buildings to large commercial projects.

Suspended scaffolding is also significant, especially in high-rise construction and maintenance projects where ground support is not feasible. This type of scaffolding allows for work to be conducted at great heights and is often used for tasks such as window cleaning, exterior painting, and repairs.

Cantilever scaffolding is utilized for specific construction needs where standard scaffolding cannot be erected on the ground. It is commonly used in situations where there are obstacles on the ground or in narrow spaces.

Rolling scaffolding offers mobility and is particularly useful for projects that require frequent relocation, such as painting, plastering, and maintenance work. Its ease of movement and flexibility make it a valuable tool in specific scenarios.

By Material Analysis

Steel held a dominant market position in the By Material segment of the Scaffolding Market, capturing more than a 50% share.

In 2023, Steel held a dominant market position in the By Material segment of the Scaffolding Market, capturing more than a 50% share. This dominance is driven by the high strength, durability, and load-bearing capacity of steel scaffolding, making it the preferred choice for a wide range of construction and maintenance projects. Steel scaffolding is particularly favored for large-scale and high-rise constructions due to its robustness and ability to withstand harsh environmental conditions. The market benefits from continuous technological advancements in steel production, which enhance the material's performance and safety standards.

Aluminum scaffolding is also significant in the market, known for its lightweight properties and ease of assembly and transportation. It is particularly popular in projects where quick setup and shared mobility are essential, such as interior work and temporary structures.

Wood scaffolding remains in use in certain regions and specific types of construction, particularly where traditional building methods are prevalent. It is often chosen for its cost-effectiveness and ease of availability.

Others, including composite materials and hybrid scaffolding systems, cater to niche markets and specific applications where traditional materials may not be suitable. These innovative materials are gaining attention for their unique properties, such as enhanced strength-to-weight ratios and resistance to corrosion.

By Application Analysis

In 2023, Construction industry held a dominant market position in the By Application segment of the Scaffolding Market, capturing more than a 60% share.

In 2023, Construction industry held a dominant market position in the By Application segment of the Scaffolding Market, capturing more than a 60% share. This dominance is driven by the extensive use of scaffolding in residential, commercial, and industrial construction projects. Scaffolding is essential for providing safe and stable platforms for workers at various heights, facilitating tasks such as masonry, painting, plastering, and installation of building components. The market benefits from the booming construction activities in emerging economies, urbanization, and significant investments in infrastructure development.

Electrical maintenance applications also represent a significant segment, utilizing scaffolding for tasks such as the installation, repair, and maintenance of electrical systems. The market share for this segment is notable but smaller compared to the construction industry due to its specific use case and the typically smaller scale of projects.

Temporary stage applications involve the use of scaffolding for constructing stages and platforms for events, concerts, and performances. While this is a vital market segment, its share is modest due to the intermittent and event-driven nature of demand.

Ship Building requires scaffolding for the construction, repair, and maintenance of ships. The scaffolding used in this sector must withstand harsh marine environments and support complex structures. Although important, the market share for shipbuilding applications is smaller compared to construction due to the specialized and niche nature of the industry.

Oil & Gas industry applications utilize scaffolding for maintenance, inspection, and construction activities on offshore and onshore facilities. The need for high safety standards and robust scaffolding systems is critical in this sector. Despite its significance, the market share remains smaller compared to the broader construction industry due to the specialized requirements and limited number of projects.

Others, including sectors like aerospace, manufacturing, and refurbishment of historic buildings, also use scaffolding. These applications are diverse but collectively hold a smaller market share due to their specific and varied nature.

Key Market Segments

By Type

- Supported scaffolding

- Suspended scaffolding

- Cantilever Scaffolding

- Rolling scaffolding

By Material

- Steel

- Aluminum

- Wood

- Others

By Application

- Construction industry

- Electrical maintenance

- Temporary stage

- Ship Building

- Oil & Gas

- Others

Growth Opportunity

Development of Lightweight and Durable Scaffolding Materials

The development of lightweight and durable scaffolding materials presents a significant opportunity for the global scaffolding market in 2024. Advances in material science have led to the creation of scaffolding systems that are both robust and easy to handle. These materials, such as aluminum and advanced composites, reduce the overall weight of scaffolding structures without compromising on strength and safety.

Lightweight scaffolding is particularly beneficial for projects that require frequent assembly and disassembly, as it enhances efficiency and reduces labor costs. Furthermore, the durability of these materials ensures a longer lifespan, providing cost savings over time. Companies that invest in the development and promotion of these innovative materials are likely to capture a significant share of the market by meeting the evolving needs of construction firms.

Expansion of Modular and Mobile Scaffolding Solutions

The expansion of modular and mobile scaffolding solutions is another promising growth area for the scaffolding market. Modular scaffolding systems, which can be easily assembled, disassembled, and reconfigured, offer unparalleled flexibility and efficiency. These systems are ideal for complex construction projects that require scaffolding to adapt to different stages and environments.

Mobile scaffolding, equipped with wheels and easy mobility features, enhances the convenience and speed of moving scaffolding across various locations on a construction site. This is particularly advantageous for large-scale projects where scaffolding needs to be frequently repositioned. The increasing adoption of modular and mobile scaffolding solutions is expected to drive market growth as construction companies seek to improve productivity and reduce downtime.

Latest Trends

Adoption of Automated and Robotic Scaffolding Systems

The adoption of automated and robotic scaffolding systems is emerging as a transformative trend in the global scaffolding market for 2024. Automation technology in scaffolding offers significant advantages, including increased efficiency, precision, and safety. Robotic systems can be programmed to assemble and disassemble scaffolding structures quickly and accurately, reducing the reliance on manual labor and minimizing human error.

This not only accelerates project timelines but also enhances worker safety by reducing the physical demands and risks associated with scaffolding assembly. Companies investing in automation technology are poised to benefit from improved productivity and reduced labor costs, making this a key trend to watch in the scaffolding industry.

Use of BIM (Building Information Modeling) for Scaffold Planning

The use of Building Information Modeling (BIM) for scaffold planning is another trend that is gaining traction in the scaffolding market. BIM technology allows for the creation of detailed 3D models and simulations of scaffolding structures within the context of the entire construction project. This enables precise planning and visualization, ensuring that scaffolding designs are optimized for safety, efficiency, and cost-effectiveness.

By incorporating BIM into scaffold planning, construction companies can identify potential issues and conflicts before they arise on-site, leading to smoother project execution. The integration of BIM also facilitates better coordination among different stakeholders, enhancing communication and collaboration. As BIM adoption continues to grow, its application in scaffold planning is expected to drive significant improvements in project outcomes.

Regional Analysis

Asia Pacific dominated the Scaffolding Market, capturing a significant 45% market share.

In 2023, Asia Pacific dominated the Scaffolding Market, capturing a significant market share of around 45%. This dominance is driven by rapid urbanization, extensive infrastructure development, and booming construction activities in countries such as China, India, and Southeast Asian nations. China and India, in particular, are witnessing massive investments in residential, commercial, and industrial construction projects, fueling the demand for scaffolding. The region's growing population and the need for modern infrastructure contribute significantly to market growth.

North America holds a substantial share in the scaffolding market, driven by steady construction activities and stringent safety regulations. Key contributors include the United States and Canada, with a mature construction industry and a focus on renovation and sustainable practices.

Europe maintains a significant market share, supported by established construction practices and strong safety regulations. Major markets such as Germany, the UK, and France demand innovative scaffolding solutions for both new constructions and historical building maintenance.

This region shows promising potential due to extensive infrastructure projects in Saudi Arabia, the UAE, and South Africa. Economic diversification efforts in the GCC countries drive construction investments, though overall market share is modest due to economic disparities.

Latin America is a growing market for scaffolding, led by Brazil and Mexico. Increasing urbanization and infrastructure investments boost demand, though the market remains smaller compared to developed regions due to economic variability and political instability.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the scaffolding market is characterized by a strong presence of both global and regional players, each contributing to the sector's dynamic growth. Wilhelm Layher Holding GmbH & Co. KG leads with its innovative solutions and extensive product portfolio, setting benchmarks in safety and efficiency.

Safway Group Holding LLC and PERI GmbH are also at the forefront, known for their robust engineering capabilities and comprehensive service offerings. These companies excel in large-scale projects, providing tailored solutions that address complex construction challenges.

Altrad Group and ULMA Construction focus on versatility and adaptability, offering modular scaffolding systems that cater to diverse construction needs. Their commitment to research and development ensures continuous improvement and adherence to stringent safety standards.

MJ-Gerüst GmbH and Waco Kwikform Limited have strong regional footprints, with products that emphasize ease of assembly and cost-effectiveness. These companies cater primarily to mid-sized projects, balancing quality with affordability.

Stepup Scaffold, LLC and ADTO Industrial Group Co., Ltd. are expanding rapidly, driven by increasing urbanization and infrastructure development, particularly in emerging markets. Their competitive pricing and extensive distribution networks make them formidable contenders.

Changli XMWY Formwork Scaffolding Co., Ltd. and Beijing Kangde focus on high-quality manufacturing and export, leveraging their manufacturing efficiency to offer competitive prices globally.

The scaffolding market in 2024 is influenced by technological advancements, regulatory standards, and the push for safer, more efficient construction practices. Key players that innovate and adapt to these trends will continue to dominate the industry landscape.

Market Key Players

- Wilhelm Layher Holding GmbH & Co. KG

- Safway Group Holding LLC

- PERI GmbH

- Altrad Group

- ULMA Construction

- MJ-Gerüst GmbH

- Waco Kwikform Limited

- Stepup Scaffold, LLC

- ADTO Industrial Group Co., Ltd.

- Changli XMWY Formwork Scaffolding Co., Ltd.

- Beijing Kangde

Recent Development

- In March 2024, Altrad Group acquired a regional scaffolding company to expand its market presence in Europe. This acquisition is expected to increase their market share by 12%.

- In January 2024, PERI GmbH launched a new lightweight scaffolding system designed to enhance safety and efficiency in construction projects. This new system aims to reduce setup time and improve worker safety.

Report Scope

Report Features Description Market Value (2023) USD 75.8 Bn Forecast Revenue (2033) USD 181.6 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Supported scaffolding, Suspended scaffolding, Cantilever Scaffolding, Rolling scaffolding), By Material (Steel, Aluminum, Wood, Others), By Application (Construction industry, Electrical maintenance, Temporary stage, Ship Building, Oil & Gas, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Wilhelm Layher Holding GmbH & Co. KG, Safway Group Holding LLC, PERI GmbH, Altrad Group, ULMA Construction, MJ-Gerüst GmbH, Waco Kwikform Limited, Stepup Scaffold, LLC, ADTO Industrial Group Co., Ltd., Changli XMWY Formwork Scaffolding Co., Ltd., Beijing Kangde Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Wilhelm Layher Holding GmbH & Co. KG

- Safway Group Holding LLC

- PERI GmbH

- Altrad Group

- ULMA Construction

- MJ-Gerüst GmbH

- Waco Kwikform Limited

- Stepup Scaffold, LLC

- ADTO Industrial Group Co., Ltd.

- Changli XMWY Formwork Scaffolding Co., Ltd.

- Beijing Kangde