Fuel Cell Market By Product(Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, Solid Oxide Fuel Cell, Molten Carbonate Fuel Cell, Others), By Application(Stationary, Transportation, Portable) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43064

-

Jan 2024

-

183

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Fuel Cell Market Size, Share, Trends Analysis

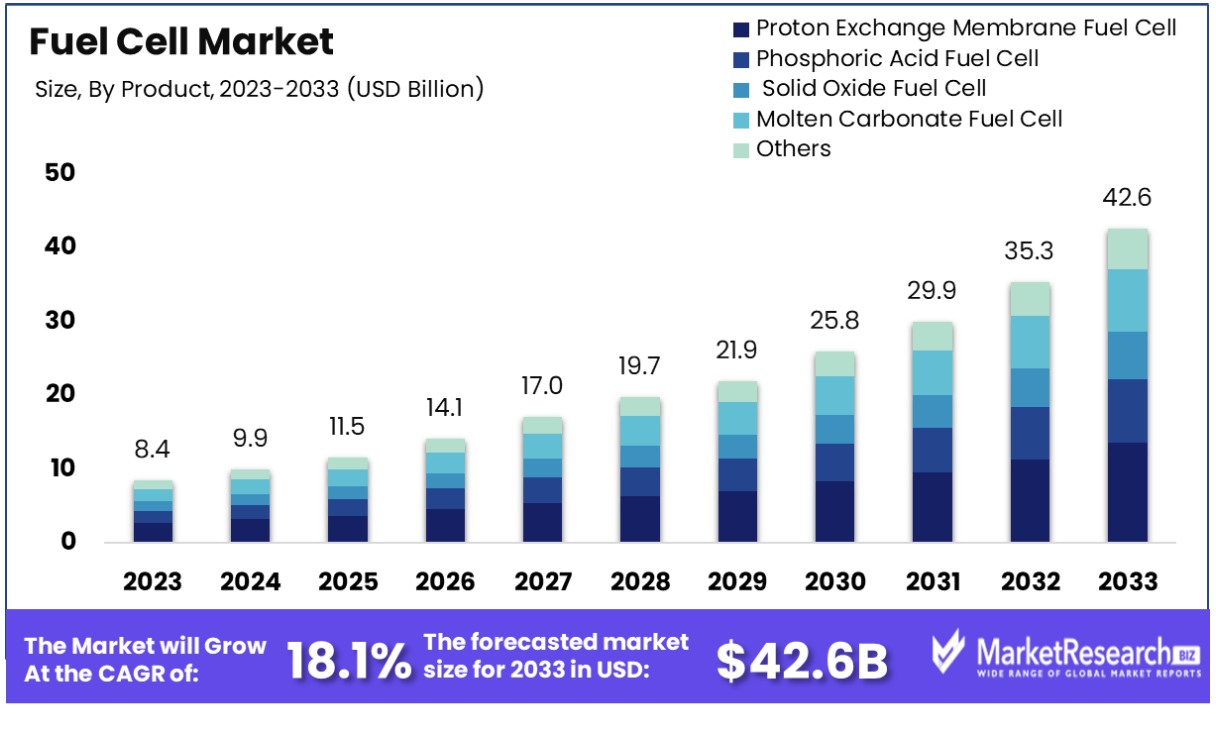

The fuel cell market was valued at USD 8.4 billion in 2023. It is expected to reach 42.6 billion, with a CAGR of 18.11% during the forecast period from 2024 to 2033.

The surge in demand for private-public collaboration and the rise in unconventional energy sources are some of the main key factors for the fuel cell market. Fuel cells are basically, any class of equipment that change the chemical energy of a fuel directly in the form of electricity. Fuel cells are used in the chemical energy of hydrogen or any other fuels to neatly and effectively generate electricity. These fuels are unique and have the potential that it can be used in various types of applications.

An article published by Energy Efficiency and Renewable Energy highlights that the Department of Energy (DOE) in the US is working closely with its industrial partners, universities, national laboratories, and other associates to conquer difficult technical hurdles to fuel cell development. In terms of durability, the applications of fuel cells usually need sufficient performance to be maintained for over longer period. DOE has set vital targets for fuel cell system lifetime under convincing operating situations at 8,000 hours for light-duty vehicles, 30,000 hours for heavy-duty vehicles, and 80,000 hours for distributed power systems.

Fuel cells are used in several types of applications that offer power for applications all across different sectors comprising transportation, residential or commercial buildings, and long-lasting energy storage for the grid in alterable systems. They have many more advantages over the conventional-based technologies that are presently used in different power plants and vehicles. It can be operated at higher efficacy than combustion engines and can transform the chemical energy into the fuels to electrical energy with efficacy which has the potential to reach 60%. These are lower and zero emission as compared to combustion engines.

These hydrogen fuel cells require only water, addressing severe climatic barriers as there are no carbon dioxide productions. There are not at all air pollutants that can make smog and can lead to critical health conditions at the point of operations. These cells are silent and quiet at the time of operations as they have fewer moving parts. The government is also focusing more on research and development to know and understand the fuel cell degradation methodology and making materials as well as the tactics to mitigate their effects. The demand for fuel cells will increase due to its several advantages in various industries that will help in market expansion in the coming years.

Driving Factors

Decarbonization Goals Accelerate Fuel Cell Adoption

The fuel cell market is markedly driven by the imperative to reduce carbon emissions, a central focus for both corporations and governments. Ambitious targets, like the EU's goal to reduce emissions by 55% by 2030 and the US's target of a 50-52% reduction by 2030, necessitate the adoption of clean energy technologies, including fuel cells. Moreover, major corporations, with 63% of Fortune Global 500 companies committing to 2050 emission reduction goals and 47% setting targets for 2030, are increasingly investing in fuel cell technology. This shift towards low-carbon solutions is a crucial factor propelling the growth of the fuel cell market, reflecting a global commitment to combat climate change.

Electric Vehicle Integration Spurs Fuel Cell Demand

The incorporation of fuel cells in electric vehicles, especially in heavy-duty transport, stands out as a major catalyst for growth in the market. Fuel cell electric vehicles (FCEVs) offer advantages like rapid refueling and extended range compared to traditional EVs. Initiatives like MG Motor India's introduction of third-generation hydrogen fuel cell technology and Hyundai's production of fuel cell trucks exemplify this trend. The U.S. Department of Energy's efforts to make hydrogen-powered vehicles a viable option underscores the potential of FCEVs in transforming the transportation sector.

Hydrogen Infrastructure Expansion Supports Fuel Cell Market

The growth of the fuel cell market hinges significantly on the crucial development of hydrogen infrastructure. With 59 hydrogen stations operational in the U.S. and more in planning, alongside significant government investments in hydrogen production and distribution, the groundwork for widespread fuel cell adoption is being laid. The U.S. Department of Energy's commitment to scaling up the clean hydrogen market from under 1 MMTpa to approximately 10 MMTpa by 2030 highlights the concerted effort to establish a robust hydrogen ecosystem, vital for fuel cell technology proliferation.

Advancements in Hydrogen Production Catalyze Fuel Cell Growth

Technological advancements in hydrogen production, such as alkaline and PEM electrolyzers, SOECs, and biomass gasifiers, are pivotal in driving the fuel cell market. Innovations like the NREL's STCH water-splitting technology promise more energy-efficient hydrogen production, essential for the widespread adoption of fuel cells. These advancements in producing green hydrogen, characterized by low cost and zero emissions, are crucial in facilitating the transition to fuel cell technologies across various sectors.

Restraining Factors

High Upfront Costs Limit Fuel Cell Market Accessibility

The fuel cell market is significantly constrained by the high initial purchase prices of fuel cell systems, which are notably higher compared to established technologies like internal combustion engines. This pricing disparity is a major barrier to adoption, especially for cost-sensitive consumers.

For instance, fuel cell systems for telecommunications and industrial applications can range from $9,000 to over $20,000 for a 2.5kW system, and start at under $200,000 for a 120kW system. Although manufacturers are actively working to reduce these costs, the current price points remain prohibitive. The US Department of Energy has set ambitious targets to lower costs to less than $100/kW for annual production exceeding 150,000 units, aiming for a cost reduction of 60-65%. Achieving this target is crucial for increasing the market penetration of fuel cells.

Competition from Established Technologies Challenges Fuel Cell Adoption

Fuel cells face intense competition from more mature technologies such as battery electric vehicles (EVs) and gas engines. These traditional technologies currently hold advantages in terms of cost, market familiarity, and established infrastructure. Overcoming these perceptions is a significant challenge for the fuel cell market.

Customers often prefer known and tested solutions, making it difficult for fuel cells to break into markets where batteries and gas engines have long been dominant. The fuel cell industry needs to demonstrate clear advantages over these established technologies in terms of efficiency, environmental impact, and long-term costs to gain a competitive edge and expand its market share.

Fuel Cell Market Segmentation Analysis

By Product Analysis

Proton Exchange Membrane Fuel Cell (PEMFC) is the dominant product segment in the fuel cell market. This dominance is largely due to PEMFC's high power density, low operating temperature, and quick start-up capabilities, making them suitable for a variety of applications, particularly in transportation and portable power. PEMFCs are widely used in vehicles, backup power systems, and for portable power in consumer electronics due to their compact size and efficiency. The development of hydrogen infrastructure and advancements in PEMFC technology have further solidified this segment's leading position.

Other types like Phosphoric Acid Fuel Cell (PAFC), Solid Oxide Fuel Cell (SOFC), Molten Carbonate Fuel Cell (MCFC), and others are also significant in the market. SOFCs, known for their high operating temperature and efficiency, are preferred in stationary applications. MCFCs are used in large stationary power generation due to their ability to utilize various fuel types. Nevertheless, the fuel cell market is predominantly influenced by the versatility and escalating adoption of Proton Exchange Membrane Fuel Cells (PEMFCs) across various sectors, solidifying their dominance in the industry.

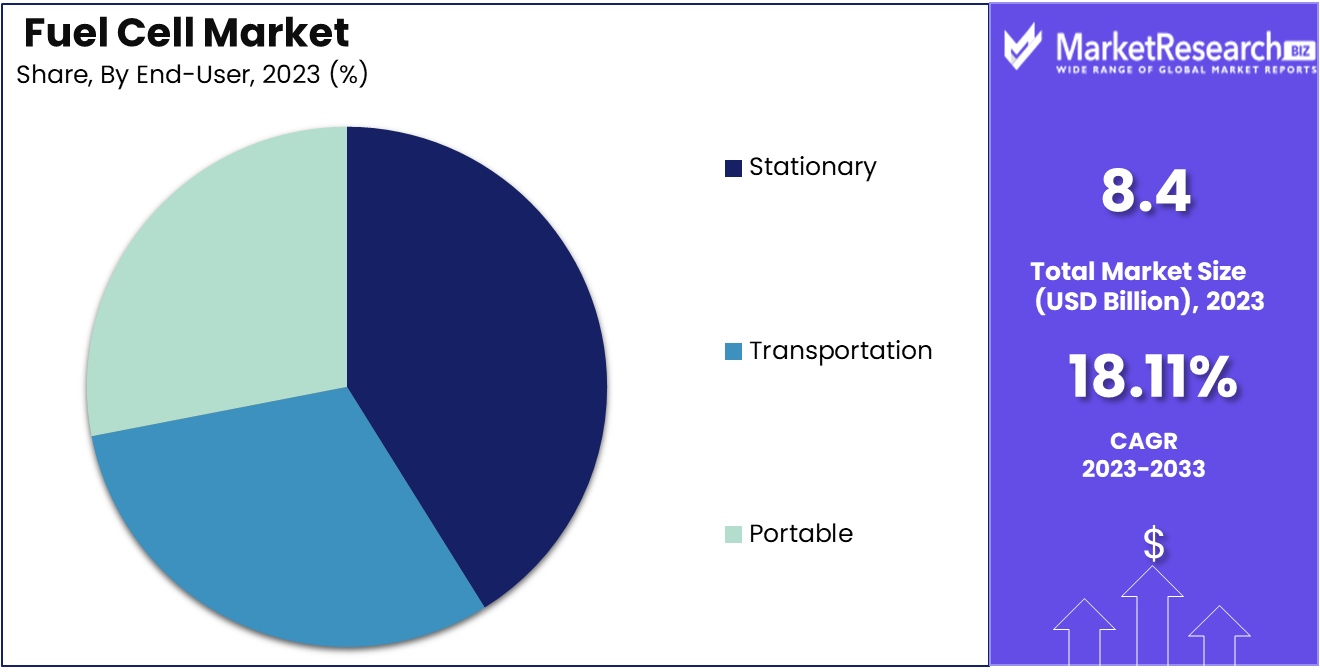

By Application Analysis

The predominant segment in the fuel cell market is stationary applications, constituting 67.5%. These stationary fuel cells find application in diverse settings such as residential, commercial, and industrial environments, serving both as primary and backup power sources. Their popularity is attributed to their capacity to deliver dependable, environmentally friendly, and efficient energy, particularly gaining traction in utilities and industrial power systems. The increasing focus on sustainable energy solutions and the decreasing costs of fuel cell technology play pivotal roles in driving growth within this segment.

Transportation and Portable are also crucial application segments. In transportation, fuel cells are used in vehicles, ranging from cars to buses, offering a clean alternative to traditional combustion engines. Portable fuel cells are emerging in consumer electronics, providing longer-lasting power sources for devices like laptops and cameras. However, the scale of deployment and diversity of use cases in stationary applications, combined with environmental regulations favoring clean energy, make it the most dominant segment in the fuel cell market.

Fuel Cell Industry Segments

By Product

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cell

- Solid Oxide Fuel Cell

- Molten Carbonate Fuel Cell

- Others

By Application

- Stationary

- Transportation

- Portable

Growth Opportunities

Off-Grid Power Solutions: Fuel Cells as a Reliable Alternative

The potential of fuel cells to provide off-grid power in remote areas or during disaster relief scenarios represents a significant growth opportunity in the fuel cell market. Fuel cells offer a more reliable and sustainable alternative to traditional power sources like diesel generators, especially in locations where grid infrastructure is non-existent or compromised.

The primary challenge lies in the higher costs associated with fuel cell technology compared to conventional diesel generators. However, as technological advancements continue to reduce costs and improve efficiency, fuel cells are becoming an increasingly viable solution for off-grid power needs, thus expanding their market potential.

Developing Economies: A Fertile Ground for Fuel Cell Adoption

The fuel cell market has considerable growth potential in developing economies like India and Indonesia, which require reliable power sources and are not deeply entrenched in legacy energy infrastructure. These markets present unique opportunities for the adoption of fuel cells as they seek to establish sustainable and efficient energy solutions.

The main challenges include the higher costs of fuel cell technology and a lack of local technical expertise. But now, with strategic investments and knowledge transfer, these barriers can be overcome, paving the way for the increased adoption of fuel cells in these rapidly developing markets.

Fuel Cell Market Regional Analysis

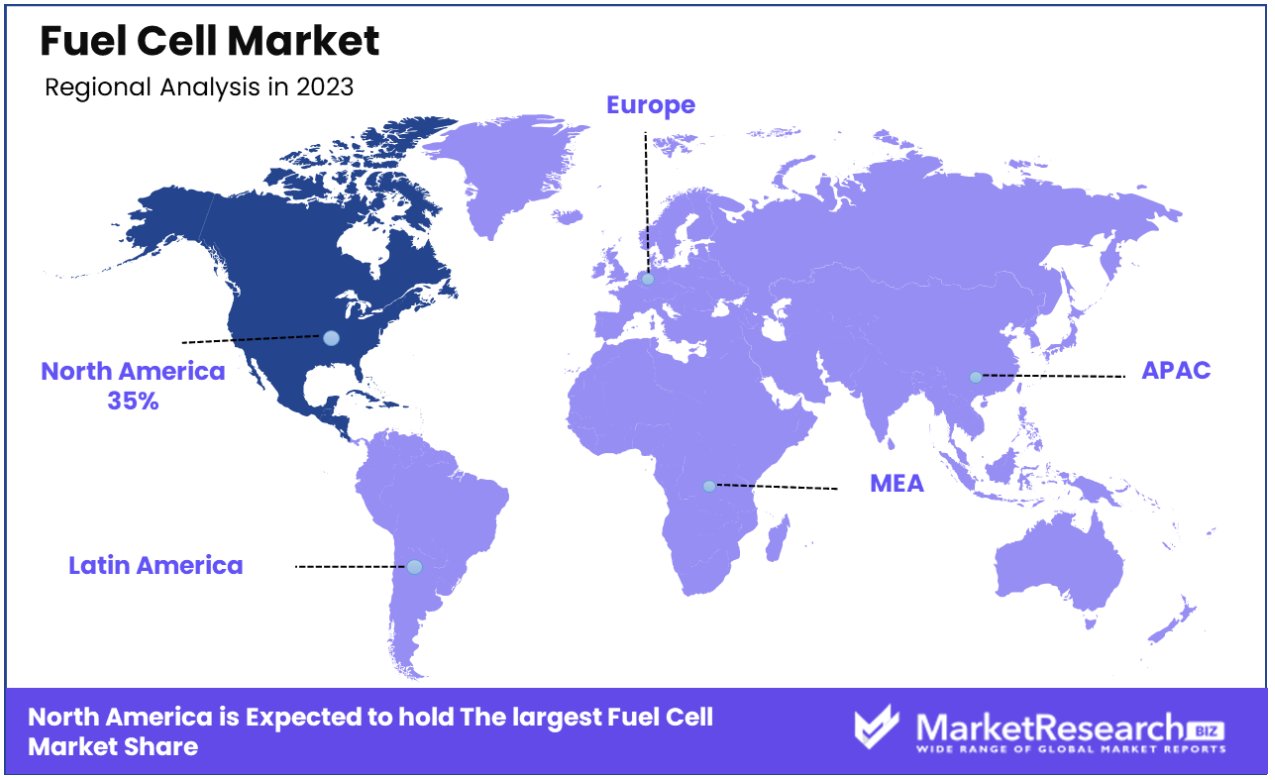

North America Dominates with 35% Market Share in Fuel Cell Market

North America's strong position in the global fuel cell market, holding 35% of the market share, is underpinned by several key factors. The region, especially the United States, has been a pioneer in the innovation and implementation of fuel cell technology. Significant investments in renewable energy and a growing focus on reducing carbon emissions have spurred the development and adoption of fuel cells.

Companies like Plug Power and Ballard Power Systems, leading in fuel cell technology, contribute to the region's dominance. Additionally, government initiatives and subsidies to promote clean energy technologies have played a crucial role in market growth.

The North American fuel cell market stands out for its varied applications across transportation, stationary power, and portable power sectors. The market is witnessing significant growth, primarily driven by the increasing adoption of fuel cell electric vehicles (FCEVs), with a notable emphasis in the United States and Canada. This increasing embrace of FCEVs serves as a significant driver for the market's expansion in the region. The region benefits from well-established infrastructure for fuel cell technology and a strong push towards decarbonizing the energy sector. The presence of a highly skilled workforce and advanced research facilities further strengthens the market dynamics in North America.

Europe: Commitment to Clean Energy Transition

Europe's fuel cell market is driven by the region's commitment to a clean energy transition. Countries like Germany and the UK are investing heavily in hydrogen infrastructure and fuel cell technology. The European Union’s green initiatives and funding for sustainable energy projects support the market growth in this region.

Asia-Pacific: Rapid Market Expansion

In the Asia-Pacific region, the fuel cell market is experiencing rapid expansion, spearheaded by nations such as Japan and South Korea. The region's commitment to reducing dependence on fossil fuels and improving energy security serves as a driving force for market growth. The substantial expansion is particularly propelled by the increasing adoption of fuel cell electric vehicles (FCEVs) and simultaneous efforts in developing hydrogen infrastructure in these countries.

Fuel Cell Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Fuel Cell Market Key Player Analysis

In the dynamic Fuel Cell Market, a sector at the forefront of clean energy technology, the listed companies play a pivotal role in propelling innovation, fostering commercialization, and promoting diverse applications.Plug Power Inc. and FuelCell Energy are significant players, recognized for their advanced fuel cell technologies in power generation and storage solutions. Their strategic positioning emphasizes renewable energy solutions and scalability, significantly influencing the market's growth trajectory.

Panasonic Corporation and Toshiba Energy Systems & Solutions Corporation are renowned for their contributions to residential and commercial fuel cell applications. Their focus on integrating fuel cells into broader energy systems underscores the market's move towards sustainable and efficient energy solutions.

Fuel Cell Industry Key Players

- Ceres Power Holdings

- Hyster-Yale Group

- Doosan Fuel Cell

- Hydrogenics

- AFC Energy

- Cell Impact AB

- Hazer Group Limited

- HydroPhi Technologies Group, Inc.

- SunHydrogen, Inc.

- ITM Power PLC

- MagneGas Corporation

- McPhy Energy SA

- myFC Holding AB

- Nel ASA

- Nikola Corporation

- PowerCell Sweden AB

- PowerHouse Energy Group plc

- FuelCell Energy

- Intelligent Energy Ltd.

- Panasonic Corporation

- Plug Power Inc.

- Toshiba Energy Systems & Solutions Corporation

Fuel Cell Market Recent Development

- In October 2023, TECO 2030 developed hydrogen fuel cells that allow ships and other heavy-duty equipment to be completely emission-free. TECO 2030's top-of-the-line fuel cell is a technically advanced, clean energy generation system. The advantages of the flexible 400kW fuel cell system include top energy efficiency, an inherent safety design, the most advanced dimensions and design of components longevity, as well as quick dynamic load response.

- In June 2023, Bloom Energy signed a deal to implement 2.5 megawatts (MW) of Bloom's Fuel Cell technology in England together with Perenco the Independent oil and natural gas company.

- In May, 2023 Ballard Power Systems has recently received an order for 3.6 milliwatts of fuel cell technology from a European firm that specializes in green energy solutions for stationary power requirements. The contract will see the delivery of 36 100 kW units between 2023-2024.

- In January 2023, Ballard Power Systems has recently announced an order for a fuel cell system that will be used for the Hollandse Kust Noord offshore wind project of CrossWind which is a joint venture of Shell as well as Eneco. This Hollandse Kust Noord offshore wind development, which is located in the southeastern part of the Netherlands is expected to be able to handle 759 MW and generate at least 3.3 TWh per year. Ballard's fuel cell technology will be integrated with the project to aid the project's operations.

Report Scope

Report Features Description Market Value (2023) USD 8.4 Billion Forecast Revenue (2033) USD 42.6 Billion CAGR (2024-2032) 18.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Proton Exchange Membrane Fuel Cell, Phosphoric Acid Fuel Cell, Solid Oxide Fuel Cell, Molten Carbonate Fuel Cell, Others), By Application(Stationary, Transportation, Portable) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Ceres Power Holdings, Hyster-Yale Group, Doosan Fuel Cell, Hydrogenics, AFC Energy, Cell Impact AB, Hazer Group Limited, HydroPhi Technologies Group, Inc., SunHydrogen, Inc., ITM Power PLC, MagneGas Corporation, McPhy Energy SA, myFC Holding AB, Nel ASA, Nikola Corporation, PowerCell Sweden AB, PowerHouse Energy Group plc, FuelCell Energy, Intelligent Energy Ltd., Panasonic Corporation, Plug Power Inc., Toshiba Energy Systems & Solutions Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ceres Power Holdings

- Hyster-Yale Group

- Doosan Fuel Cell

- Hydrogenics

- AFC Energy

- Cell Impact AB

- Hazer Group Limited

- HydroPhi Technologies Group, Inc.

- SunHydrogen, Inc.

- ITM Power PLC

- MagneGas Corporation

- McPhy Energy SA

- myFC Holding AB

- Nel ASA

- Nikola Corporation

- PowerCell Sweden AB

- PowerHouse Energy Group plc

- FuelCell Energy

- Intelligent Energy Ltd.

- Panasonic Corporation

- Plug Power Inc.

- Toshiba Energy Systems & Solutions Corporation