Global Sanitary Ware Market Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2027

-

5335

-

May 2023

-

151

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Global Sanitary Ware Market Overview

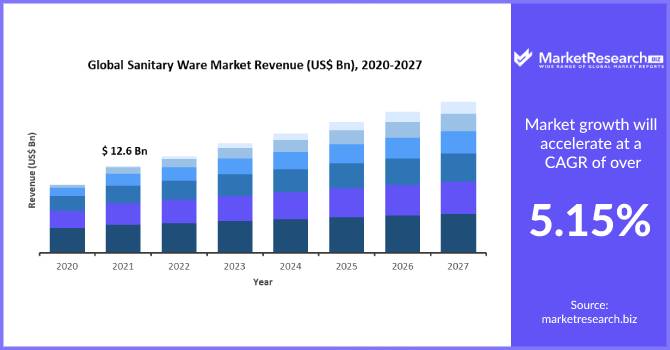

“The global sanitary ware market size is expected to be worth around US$ xx Billion by 2021 from US$ X.xx million in 2031, growing at a CAGR of X.x% during the forecast period 2021 to 2031.”

The report offers insightful and detailed information regarding the various key players operating in the market, their financials, supply chain trends, technological innovations, key developments, apart from future strategies, acquisitions & mergers, and market footprint.

The global sanitary ware market report has been segmented on the basis of product type, material, and region. This report is based on the synthesis, analysis, and interpretation of information gathered regarding the target market from various sources.

Our analysts have analyzed the information and data and gained insights using a mix of primary and secondary research efforts with the primary objective to provide a holistic view of the market.

In addition, an in-house study has been made of the global economic conditions and other economic indicators and factors to assess their respective impact on the market historically, as well as the current impact in order to make informed forecasts about the scenarios in the future.

Sanitary ware is a part of ceramic wares that are installed for residential and commercial infrastructures for sanitary purposes. Ceramic materials such as clay, quartz, kaolinite, etc. are used for the production of sanitary wares.

In addition, steel, acrylic material, and glass are also used for manufacturing sanitary wares. Appliances such as washbasins, bathtubs, sinks, and urinals come under sanitary wares.

These appliances are installed in toilets and bathrooms. Sanitary wares are abrasion-resistant, corrosion-resistant, and glazy surfaces.

They are used for public, residential, and commercial purposes. Sanitary wares are available in different, shapes, sizes, colors, and price ranges – making them convenient and affordable for individuals.

Growing health and hygiene awareness among individuals is a major factor driving the growth of the global market.

Increasing government sanitation and hygiene awareness promotions and programming guidance especially in developing countries, and stringent government rules regarding the installation and use of public washrooms in various countries are propelling the growth of the global market.

Increasing preference for stylish and comfortable sanitary ware products in hotels, restaurants, and lounges is also another factor driving the growth of the target market.

The rising population has led to increasing demand for sanitary wares over the years, which is fueling the growth of the global sanitary ware market over the forecast period.

However, lack of awareness about sanitation and hygiene in emerging economies is a major factor restraining the growth of the global sanitary ware market.

The development of cost-effective sanitary wares and the lack of availability of portable sanitary ware units in developing countries can create high revenue opportunities for players in the target market.

The market in the Asia Pacific dominates the global market in terms of revenue and is expected to maintain its position over the forecast period, owing to growing health awareness and changing preferences of individuals for compact designs and aesthetics in terms of materials, color and shape in the region.

The market in North America accounts for the second-highest revenue share in the global sanitary ware market, followed by the market in Europe, owing to the increasing demand for ceramic sanitary ware in the region. The market in Latin America and Middle East & Africa is expected to witness moderate growth over the forecast period.

Global sanitary ware market segmentation:

Segmentation by product type:

- Toilet Sinks & Water Closets

- Wash Basins

- Pedestals

- Cisterns

Segmentation by material:

- Ceramics

- Pressed Metals

- Acrylic Plastics and Perspex

- Others (Glass Reinforced Polyester, Cast Iron, etc.)

Segmentation by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Roca Sanitario, S.A.

- American Standard Brands

- Kohler Co., Inc.

- Duravit AG

- Sanitec Corporation

- LIXIL Group Corporation

- Jaquar and Company Private Limited

- H&R Johnson

- Villeroy & Boch AG

- TOTO Ltd.