Rtd Alcoholic Beverages Market By Product Type (Pre-mixed Cocktails, Pre-mixed Spirits, Other), By Packaging (Bottle, Can), By Distribution Channel (Off-trade, On-trade), By End-User (Residential, Foodservice), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39734

-

July 2023

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

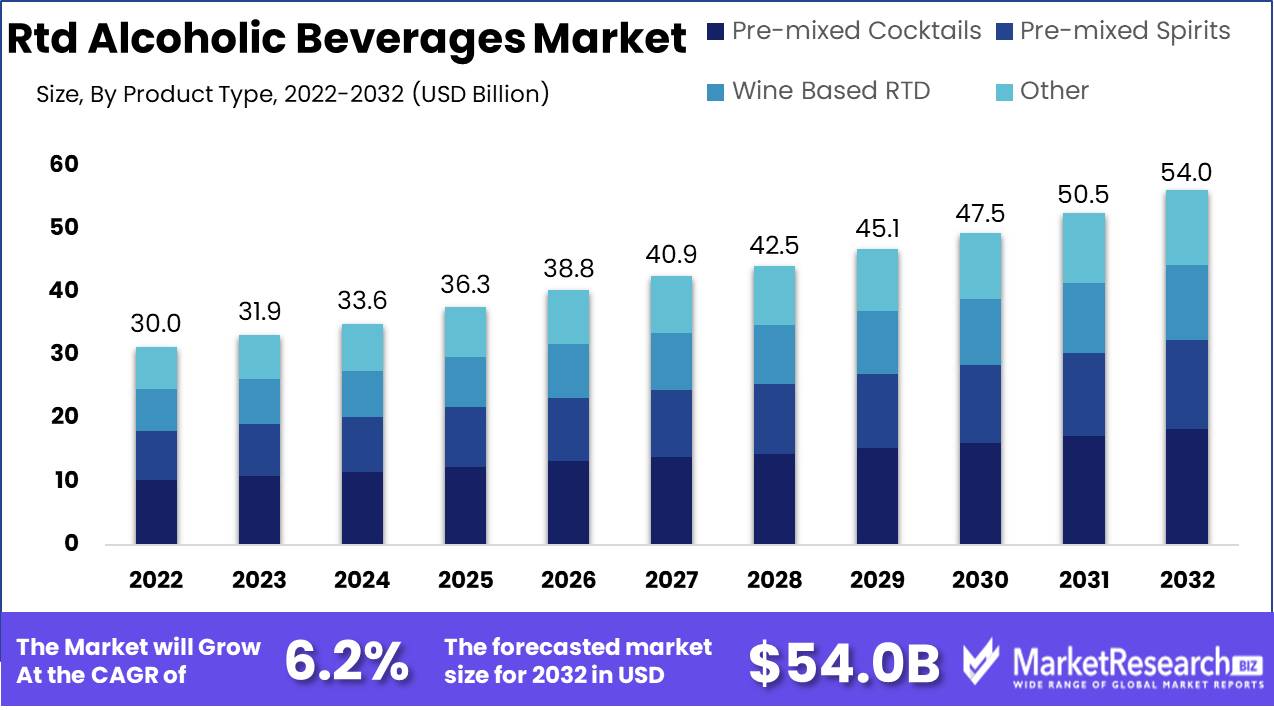

Rtd Alcoholic Beverages Market size is expected to be worth around USD 54.0 Bn by 2032 from USD 30.0 Bn in 2022, growing at a CAGR of 6.2% during the forecast period from 2023 to 2032.

The realm of the RTD alcoholic beverages market has expanded significantly, solidifying its position as a leading segment within the alcoholic beverages industry. The only way to get a good night's rest after a long day of work is to have a drink or two. These libations, which are offered in a variety of flavors, are frequently carbonated or infused with citrus elixirs to enhance their flavor.

The primary goal of the RTD alcoholic beverages market is to provide consumers with a seamless and pleasurable imbibing experience. Designed to be savored on the go or in the midst of convivial gatherings, these beverages have gained significant popularity, making them a popular option for festive gatherings, idyllic excursions, and outdoor affairs. This thriving market strives to accommodate consumers' ever-changing preferences and lifestyles by providing a vast array of flavors and a multitude of packaging options.

The significance of the RTD alcoholic beverages market lies in its capacity to meet the rising demand for convenient, ready-to-drink beverages. In this fast-paced era, consumers, encumbered by their hectic schedules, frequently gravitate toward hassle-free options for their beverage preferences. RTD alcoholic beverages offer a comprehensive cocktail experience without the need for additional ingredients or mixological expertise, making them the optimal solution.

Among the notable innovations embraced by the RTD alcoholic beverages market, the introduction of alcohol-free and low-alcohol options deserves special mention. As the number of health-conscious individuals has increased, so has the demand for alcoholic beverages with a lower alcohol content or no alcohol at all. This innovative paradigm allows brands to broaden their consumer base by catering to those who prefer non-alcoholic alternatives in addition to those who prefer milder alcoholic indulgences.

Driving factors

Changing Drinking Habits

The alcoholic beverage market is always changing in today's globe. The RTD (Ready-to-Drink) alcoholic beverages market has been influenced by customer tastes and drinking habits. RTD beverages have become a market leader as health-conscious consumers want convenience. Drinking habits have changed as consumers pursue healthier lifestyles. Traditional alcoholic beverages like beer and spirits are heavy in calories and unhealthy.

RTD Drinks' Portability

Ready-to-drink cocktails save time and effort by letting consumers enjoy their favorite drinks without measuring or preparing them.RTD beverages' portability lets consumers enjoy their favorite cocktails anywhere. These beverages can be readily taken in portable containers, ensuring a smooth drinking experience without compromising taste or quality for a picnic, beach outing, or casual gathering.

Ready-to-Drink Cocktail Demand Rising

Ready-to-drink cocktails are a key growth driver in the rtd alcoholic beverages market. Pre-mixed cocktails, which require no bartending expertise or specialized equipment, are becoming more and more popular with consumers due to their convenience and simplicity. The best way to enjoy your favorite beverage is to have it delivered by a professional. Young adults and millennials who love cocktails but lack the skills or money to make them at home have embraced this trend.

Increased Outdoor and Social Events

The growth of social events and outdoor activities has driven RTD alcoholic beverages demand. As consumers seek leisure and pleasure, portable and accessible beverage options become essential. Whether it's a music festival, a sporting event, or a casual get-together, people prefer ready-to-drink beverages for convenience. These beverages allow guests to enjoy the event without bringing heavy bar setups or mixing equipment.

E-commerce and Alcohol Delivery Growth

With the tremendous growth of e-commerce and internet platforms, RTD alcoholic beverages are more accessible. E-commerce has made it easier than ever to find and buy ready-to-drink cocktails. Online alcohol delivery has changed how consumers buy and enjoy their favorite drinks. Consumers may easily browse through options, compare pricing, and have their preferred beverages delivered to their doorstep, whether it's a single cocktail or mass purchases for a social gathering.

Restraining Factors

RTD Alcoholic Beverages Market Restraints Overcoming Obstacles to Success

The Ready-to-Drink (RTD) alcoholic beverages market is a major player in the global alcohol industry. This market faces challenges. Regulatory constraints and licensing requirements, competition from traditional alcoholic beverages, health, and wellness concerns, the short shelf life of some RTD products, and variable raw material costs are restraining issues for the industry. Recognizing and effectively addressing these obstacles is crucial for success. This essay explores these restraining forces and ways to overcome them.

Regulations and Licenses Legal Maneuvering

The huge array of regulatory constraints and licensing requirements is one of the primary restraining factors affecting the growth of the RTD alcoholic beverages market. Governments regulate the manufacturing, distribution, and marketing of alcoholic beverages to protect consumers and limit alcohol consumption.

Traditional Alcoholic Beverages Create a Niche for RTD Products

RTD alcoholic beverages face stiff competition from beer, wine, and spirits, despite their rising popularity. RTD products struggle to gain market share because consumers prefer familiar products. Industry players must innovate and differentiate to overcome this hurdle. RTD alcoholic beverages can reach more consumers by offering innovative flavors, appealing packaging, and convenience.

Wellness Issues Customer Health

In recent years, health and wellness considerations have increasingly influenced consumer alcoholic beverage market decisions. Alcohol's harmful effects have been scrutinized as individuals grow more health concerned. This consumer behavior change is a restraining factor for the RTD alcoholic beverages market.

Some RTD products have a short shelf life.

RTD products with short shelf lives can challenge producers and distributors. RTD beverages' freshness and quality influence consumer choice, therefore any compromise can hurt market performance. Industry players should focus on supply chain management and product freshness throughout the distribution phase to counteract this restraining effect. Maintaining product integrity requires strict quality control, including testing and monitoring.

Product Type Analysis

Pre-mixed Cocktails Segment is a dominant force in the RTD alcoholic beverages market. This market gives consumers the convenience of pre-mixed drinks, saving time and effort. Pre-mixed cocktails are popular with consumers who want convenience and quality in their alcoholic beverages.

Economic Growth in Emerging Economies has played a vital effect in driving Pre Mixed Cocktails Segment adoption. As emerging economies continue to flourish, there is a demand for handy alcoholic beverages. Pre-mixed cocktails are popular in these economies due to urbanization and lifestyle changes.

A growing desire for ready-to-drink alcoholic beverages is driving consumer behavior in the Pre-mixed Cocktails Segment. Millennials and young professionals prefer convenience and ease of use. Pre-mixed cocktails let them enjoy their favorite drinks without any effort or preparation.

Packaging Analysis

When it comes to packaging, the Bottle Segment dominates the RTD alcoholic beverages market. Bottles are durable, portable, and brand-visible. Bottles have traditionally been used to package alcoholic beverages.

Economic Growth in Emerging Economies Has Played a Key Role in Driving Bottle Segment Adoption. Consumers in emerging economies are increasingly looking for high-quality packaged alcoholic beverages due to rising disposable income and changing lifestyles. The target audience likes quality bottle packaging.

Consumer behavior in the Bottle Segment favors expensive and attractive packaging. A bottle's appearance affects the alcoholic beverage's taste and experience. Well-designed bottles that protect drink quality and represent personal style and taste attract consumers.

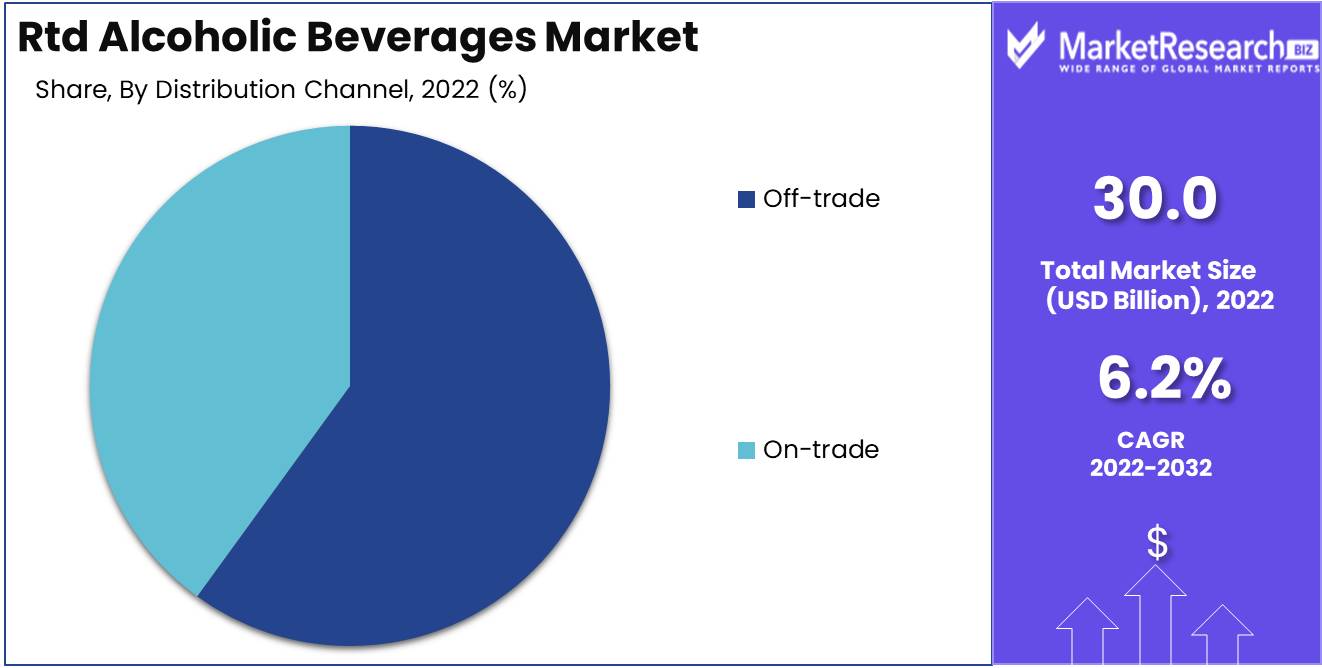

Distribution Channel Analysis

Off-trade channels dominate the RTD alcoholic beverage market. Retail establishments like supermarkets, liquor stores, and convenience stores sell alcoholic beverages off-trade. The ability to purchase your chosen beverage at home is made possible by the distribution channel's ability to provide consumers with the best possible service.

Economic Development in Emerging Economies Has Driven Off Trade Segment Adoption. As earnings rise and consumer habits change, the demand for convenience and accessibility in buying alcoholic beverages has increased. The growth of organized retail and retail chains in emerging economies has helped the off-trade market expand.

Consumer Trends and Segments towards the Off Trade Off Trade Segment are influenced by factors such as convenience, cost, and product diversity. Increasingly, consumers are choosing to purchase goods and services online rather than in-store. Consumers can explore and discover new products thanks to the off-trade segment's large variety of options.

End-User Analysis

Emerging economies' hotel industry growth has boosted this segment's adoption. The best way to enjoy a meal is to have a drink. Consumers can sample new and intriguing drinks in the food service industry, which offers a variety of options.

The RTD alcoholic beverages foodservice segment is expected to develop the fastest. The food service industry's demand for alcoholic beverages will continue to rise as consumers favor dining out and experiential dining. More venues offering unique beverage options will enhance this segment's growth.

Key Market Segments

By Product Type

- Pre-mixed Cocktails

- Pre-mixed Spirits

- Wine Based RTD

- Other Product Types

By Packaging

- Bottle

- Can

By Distribution Channel

- Off-trade

- On-trade

By End-User

- Residential

- Foodservice

Growth Opportunity

RTD Alcoholic Beverages Grow

The Ready-to-Drink (RTD) market for alcoholic beverages has experienced a tremendous growth spike in today's beverage business. RTD has several growth potential due to the rising demand for convenient, delicious, and innovative drinks. This article examines the potential for growth in the RTD alcoholic beverages market, including innovation in flavors and ingredients, expansion into new markets and demographics, collaborations with beverage companies and mixologists, focus on premium and craft RTD offerings, and sustainability initiatives.

Health-Conscious Demand Drives RTD Innovation

Health-conscious consumers desire RTD alcoholic beverages. The RTD alcoholic beverages market can tap into a new group of health-conscious consumers looking for indulgent but mindful drink options by leveraging health and wellness trends. Functional ingredients like botanical extracts and adaptogens can establish a niche market for health-conscious RTD consumers. Transparent labeling and low-calorie or low-sugar alternatives can attract health-conscious consumers.

Digital Expansion Drives RTD Market

The RTD alcoholic beverages market may capitalize on this growth opportunity by embracing digital platforms and e-commerce because the digital age has brought about a new era in consumer behavior. A strong online presence, including captivating social media campaigns, engaging content, and smooth e-commerce experiences, helps firms reach a wider audience and interact directly with consumers. Personalized marketing and targeted online advertising can also attract specific demographics, encouraging market growth.

Influencer Collaborations Drive RTD Innovation

In the RTD alcoholic beverages market, collaborating with influencers and mixologists can be transformative. Partnering with established industry experts, influencers, and mixologists boosts brand credibility and inspires new flavors, ingredients, and presentations. This partnership can create distinct RTD options for consumers seeking new tastes. By harnessing the experience and reach of market and mixologists through smart collaborations, the market may flourish.

Globalization Increases RTD Market Presence

The RTD alcoholic beverages market is growing, and it's important to remember that. Global travel and discovery have led consumers to embrace international flavors and cultures. RTD brands can expand into untapped markets by adding regional flavors, changing packaging, and establishing international distribution networks. Exploring emerging markets and catering to various consumer preferences can boost growth and market expansion.

Latest Trends

Health-Aware RTDs

Consumers have moved toward healthier lifestyles in recent years. This has driven the rise of low-alcohol and non-alcoholic RTD beverages. Consumers want light, refreshing drinks that offer the same fantastic taste but less alcohol. These beverages are gaining market share as health consciousness and moderation rise.

Convenience Boosts RTD Cocktails

Canned and bottled cocktails have become quite popular in the RTD market due to their convenience and adaptability. These ready-to-drink beverages offer a perfect balance of convenience and taste for today's busy lifestyles. Ready-to-drink cocktails are perfect for parties, beach days, and nights. The rise of craft cocktails in practical packaging has made mixology accessible to everyone, allowing them to enjoy excellent cocktails without the need for specialist bartending knowledge.

Hard Seltzers and Canned Wine Demand Rising

Hard seltzers and canned wine are growing rapidly in the RTD alcoholic beverages market. Health-conscious consumers seeking lighter and tastier options have embraced these refreshing options. Hard seltzers, with their minimal calories and tasty tastes, are popular among younger people. The only way to get a good night's rest after a long day of work is to have a good time. The growth of the industry has led to the development of a number of new technologies, including the use of smartphones and tablets.

Functional Wellness RTDs Growing

The majority of consumers now choose to buy products that are made in the United States rather than those that are not. These beverages offer consumers a win-win by combining enjoyment with health benefits. Probiotic-infused cocktails and adaptogenic herbal mixtures are flooding the market to satisfy consumers' self-care and holistic sustenance needs. RTD beverages combine usefulness, taste, and convenience, which fits current lifestyles that prioritize physical and mental health.

Eco-Friendly RTD Packaging

The RTD alcoholic beverages market's expanding use of eco-friendly packaging is the last trend. As sustainability becomes a global priority, consumers seek eco-friendly items. Brands are using recyclable, biodegradable, and compostable packaging to reduce their carbon impact and attract eco-conscious consumers. Eco-friendly packaging improves the environment and positions the brand as socially responsible and forward-thinking.

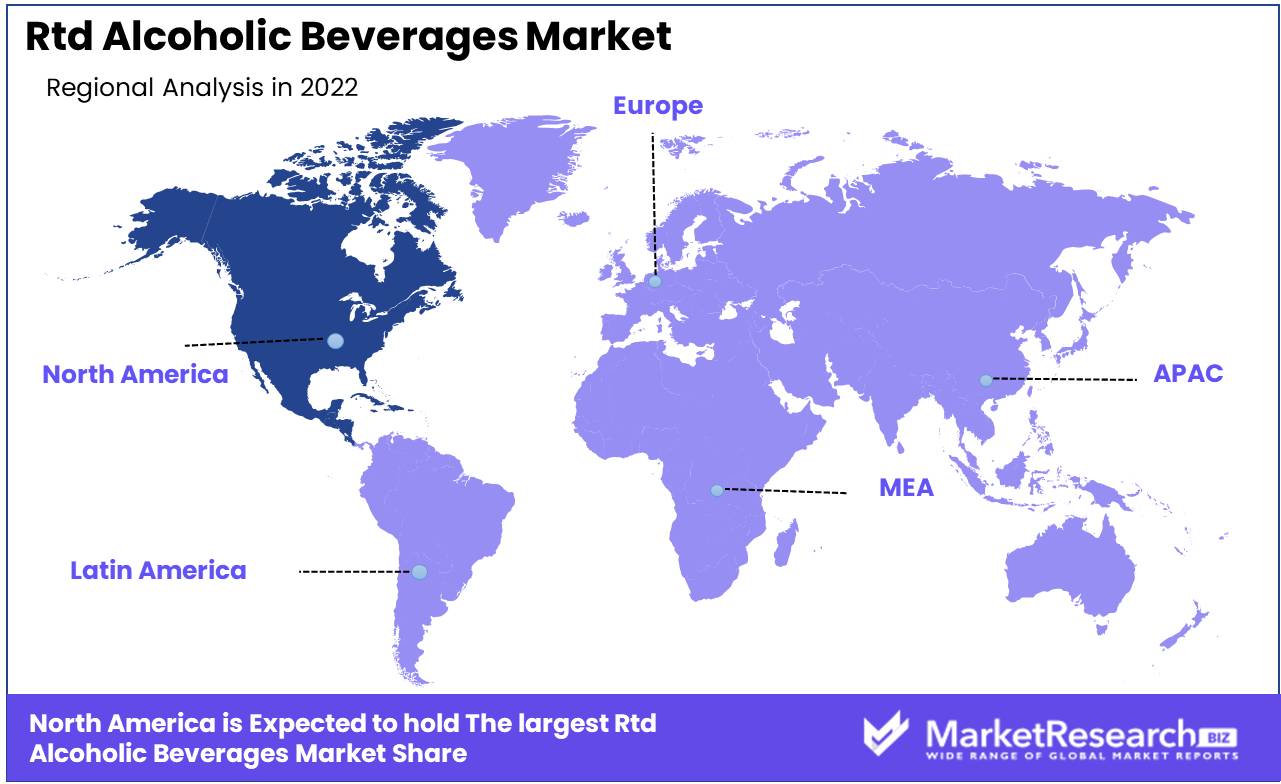

Regional Analysis

The North American RTD alcoholic beverages market has grown significantly in recent years, with one region dominating. North America dominates the industry with its broad consumer base, innovative products, and rising market reach.

The majority of the population in the United States has access to the Internet, therefore it's no surprise that the Internet is a major source of income for many businesses. North America has over 360 million people, giving manufacturers and distributors of ready-to-drink beverages a huge market. The region's beverage consumers also want convenience, variety, and quality.

The North American market also has well-developed distribution and retail infrastructure. RTD alcoholic beverages are easily accessible throughout the region. Consumers have easy access to a wide selection of items, from well-established grocery chains to specialized booze stores, which boosts the market.

North America leads product innovation by tapping into beverage trends. The region has a vibrant craft cocktail culture, which has sparked the development of premium RTD beverages. Craft distilleries and breweries experiment with flavors, ingredients, and packaging, attracting adventurous consumers.

North America influences beyond its own market. Key firms in the region have expanded into foreign markets, cementing their dominance in the RTD alcoholic beverages market. North American brands' success in developed and emerging regions is due to their status as industry trendsetters and pioneers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

A major player in the ready-to-drink (RTD) alcoholic beverages market is Davide Campari - Milano N.V., based in the Netherlands. Since 1860, the company has built a portfolio of well-known brands like Campari, Aperol, SKYY Vodka, and Wild Turkey. The company's website states that it has a global reach and that it has a strong reputation for quality.

UK-based Diageo PLC makes spirits and RTDs. The company owns famous brands like Smirnoff, Johnnie Walker, Guinness, Baileys, and Captain Morgan. Diageo PLC dominates the market with its numerous products thanks to innovation and marketing.

Halewood International Limited, likewise based in the United Kingdom, is a major player in the RTD alcoholic beverages market. Lamb's Rum, Crabbie's Alcoholic Ginger Beer, and Liverpool Gin are significant spirits brands for the company. Quality and innovation have helped Halewood International Limited create a strong domestic and international presence.

Asahi Group Holdings, Ltd., a Japanese multinational brewing and distilling company, has had a major impact on the RTD alcoholic beverages market. Asahi Group Holdings has successfully grown its global presence with popular brands including Asahi Super Dry, Peroni Nastro Azzurro, and Pilsner Urquell.

Australia-based Accolade Wines makes wine. With brands including Hardys, Grant Burge, and St Hallett, the company has successfully penetrated the RTD segment. Accolade Wines' commitment to sustainability and quality has made it a major player in the RTD alcoholic beverages market.

Top Key Players in the Rtd Alcoholic Beverages Market

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (U.K.)

- Halewood International Limited (U.K.)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- Suntory Holdings Limited (Japan)

- Anheuser-Busch InBev SA/NV (Belgium)

- The Brown-Forman Corporation (U.S.)

- United Brands Company, Inc. (U.S.)

- PernodRicard SA (France)

- The Miller Brewing Company (U.S.)

Recent Development

- In 2023, White Claw introduces its eagerly awaited White Claw Hard Seltzer Variety Pack with four incredible new varieties.

- In 2022, Truly Hard Seltzer followed suit by releasing a new Truly Hard Seltzer Lemonade Variety Pack that captivates taste senses.

- In 2021, Bud Light Seltzer will introduce their newest product, the Bud Light Seltzer Hard Soda Variety Pack, in an effort to capture the nation's taste sensibilities.

- In 2020, Michelob Ultra will impress consumers with the introduction of their new Michelob Ultra Hard Lemonade Variety Pack, which has been eagerly anticipated.

- In 2019, the RTD alcoholic beverages market was unexpectedly entered by Corona, one of the world's leading beer brands, with their Corona Hard Seltzer Variety Pack.

Report Scope:

Report Features Description Market Value (2022) USD 30.0 Bn Forecast Revenue (2032) USD 54.0 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pre-mixed Cocktails, Pre-mixed Spirits, Wine Based RTD, Other Product Types), By Packaging (Bottle, Can), By Distribution Channel (Off-trade, On-trade), By End-User (Residential, Foodservice) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Davide Campari-Milano N.V. (Netherlands), Diageo PLC (U.K.), Halewood International Limited (U.K.), Asahi Group Holdings, Ltd. (Japan), Accolade Wines (Australia), Bacardi Limited (Bermuda), Mike's Hard Lemonade Co. (U.S.), Castel Group (France), Suntory Holdings Limited (Japan), Anheuser-Busch InBev SA/NV (Belgium), The Brown-Forman Corporation (U.S.), United Brands Company, Inc. (U.S.), Pernod Ricard SA (France), The Miller Brewing Company (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (U.K.)

- Halewood International Limited (U.K.)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- Suntory Holdings Limited (Japan)

- Anheuser-Busch InBev SA/NV (Belgium)

- The Brown-Forman Corporation (U.S.)

- United Brands Company, Inc. (U.S.)

- PernodRicard SA (France)

- The Miller Brewing Company (U.S.)