Global Robot Kitchen Market By Type(Hardware, Software), By Application(House, Commercial, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

41580

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

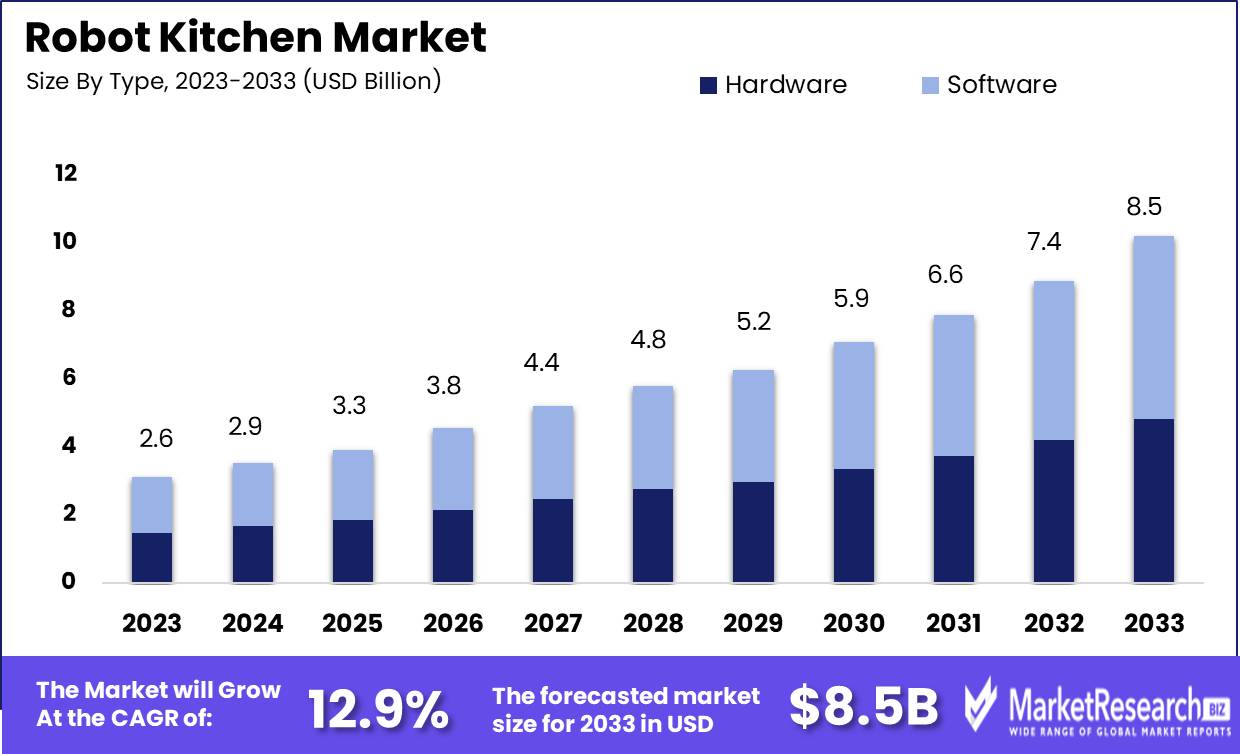

The Global Robot Kitchen Market was valued at USD 2.6 billion in 2023. It is expected to reach USD 8.5 billion by 2033, with a CAGR of 12.9% during the forecast period from 2024 to 2033.

The Robot Kitchen Market encompasses an emerging sector focused on integrating robotics technology into culinary environments to enhance efficiency, precision, and consistency in food preparation. This market leverages advanced automation, artificial intelligence, and machine learning to develop solutions that automate cooking processes, from ingredient handling to meal presentation.

Targeted at restaurants, commercial kitchens, and tech-savvy households, these innovations promise significant labor cost reductions and high culinary standards. This sector appeals to executives and product managers looking for scalable, innovative solutions to streamline operations and elevate the dining experience in their establishments.

The Robot Kitchen Market continues to burgeon as technological advancements redefine the culinary landscape. Moley Robotics' groundbreaking introduction of the world's first fully robotic kitchen stands as a testament to the sector's potential, to revolutionize traditional cooking methodologies. Capable of automating an extensive array of cooking tasks and preparing over 5,000 meals at once, this innovation underscores the transformative power of AI-driven culinary solutions.

Moreover, Sweetgreen's Infinite Kitchen automated system has demonstrated tangible benefits within the industry. Stores integrating this technology experienced a notable 10% surge in average ticket sales, emphasizing the financial advantages and operational enhancements offered by robot kitchen technology.

These developments signify a pivotal shift in the culinary landscape, with automation emerging as a cornerstone of efficiency and innovation. As consumer demands for convenience and quality escalate, businesses are increasingly turning to robotic solutions to streamline operations and elevate customer experiences. The convergence of robotics and culinary arts not only augments productivity but also unlocks new realms of creativity and customization. By leveraging sophisticated automation technologies, companies can transcend traditional constraints and redefine culinary possibilities.

In this dynamic market environment, stakeholders must remain vigilant to capitalize on emerging trends and opportunities. With the rapid pace of technological evolution, early adopters stand to gain a competitive edge, positioning themselves as pioneers in the realm of automated culinary solutions. As the Robot Kitchen Market continues to evolve, astute businesses must embrace innovation to stay ahead of the curve and meet the evolving needs of discerning consumers.

Key Takeaways

- Market Growth: The Global Robot Kitchen Market was valued at USD 2.6 billion in 2023. It is expected to reach USD 8.5 billion by 2033, with a CAGR of 12.9% during the forecast period from 2024 to 2033.

- By Type: In software, dominance prevails with a share of 34.3%.

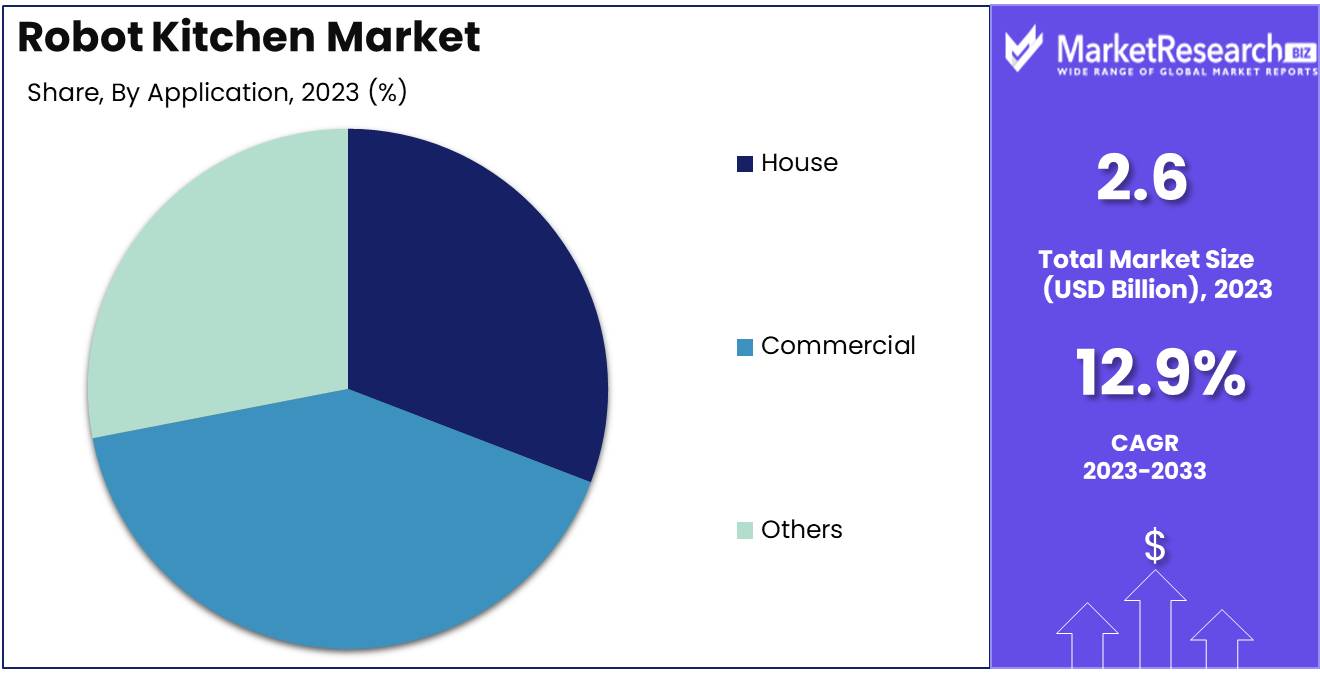

- By Application: Commercial applications lead, commanding 36.0% of the market share.

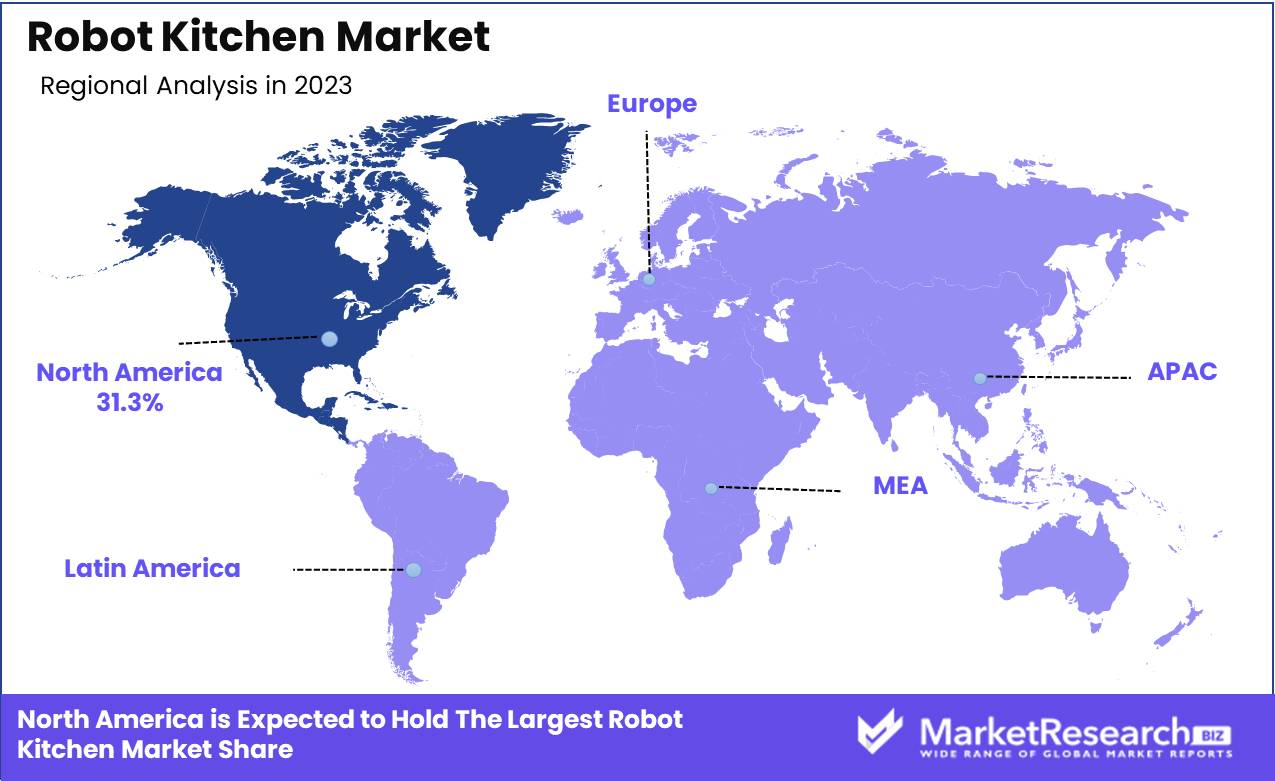

- Regional Dominance: North America holds a 31.3% share in the Robot Kitchen Market.

- Growth Opportunity: The global robot kitchen market is expanding due to rising health-consciousness and IoT integration, enhancing meal preparation with convenience, personalized diets, and smart home connectivity.

Driving factors

Increasing Demand from End-Users

The Robot Kitchen Market experiences a surge in demand propelled by evolving consumer preferences for convenience, efficiency, and hygiene. End-users, including households and commercial establishments, seek automated solutions to streamline cooking processes and enhance food preparation. This demand is accentuated by the growing urban population, which often faces time constraints and values convenience.

According to recent market research, the global demand for robot kitchen appliances is projected to grow at a CAGR of 15% over the next five years, reaching a market value of $10 billion by 2027. This substantial growth is largely attributed to heightened consumer interest in smart kitchen technologies and the desire for personalized culinary experiences.

Technological Advancements in Robotics

The relentless innovation in robotics drives significant advancements in the Robot Kitchen Market, revolutionizing food preparation and culinary automation. Breakthroughs in artificial intelligence, machine learning, and sensor technologies empower robots to perform increasingly complex tasks with precision and efficiency. These technological strides enable the development of sophisticated robotic kitchen appliances capable of chopping, cooking, and even plating dishes autonomously.

As a result, market players continually introduce cutting-edge products that cater to diverse consumer needs and preferences. With the integration of IoT connectivity and cloud-based platforms, these robots offer enhanced functionality and user experiences, further propelling market growth. The ongoing research and development in robotics are poised to fuel the expansion of the Robot Kitchen Market, driving innovation and shaping the future of food service automation.

Labor Shortages in the Food Service Industry

The pervasive labor shortages plaguing the food service industry amplify the demand for robotic solutions in kitchen operations. With an increasingly competitive labor market and rising wages, restaurants and food service establishments encounter challenges in recruiting and retaining skilled kitchen staff. Consequently, businesses turn to automation as a strategic imperative to mitigate labor constraints and optimize operational efficiency.

By deploying robot kitchen assistants for repetitive tasks such as food prep and cooking, establishments can streamline workflows, reduce labor costs, and maintain consistent quality standards. This trend is particularly pronounced in regions facing acute labor shortages, where the adoption of robotic kitchen solutions offers a viable alternative to traditional staffing models. As a result, the Robot Kitchen Market experiences heightened traction among food service operators seeking to adapt to evolving labor dynamics and ensure operational resilience.

Restraining Factors

High Cost of Robot Kitchen Installation and Maintenance

The Robot Kitchen Market faces a significant hurdle in the form of the high upfront costs associated with the installation and ongoing maintenance of robotic kitchen systems. While automation promises long-term efficiency gains and cost savings, the initial investment required for acquiring and integrating robotic solutions can be prohibitive for many businesses, especially small and medium-sized enterprises (SMEs).

According to market analysis, the average cost of implementing a fully automated kitchen setup ranges from $100,000 to $500,000, depending on the scale and complexity of the installation. Additionally, recurring expenses for software updates, hardware maintenance, and technical support further contribute to the total cost of ownership. Consequently, cost-conscious stakeholders may hesitate to embrace robotic kitchen technologies, preferring conventional methods despite their inherent limitations.

Lack of Skilled Personnel to Operate and Maintain Robot Kitchens

A critical constraint hindering the widespread adoption of robot kitchen systems is the scarcity of qualified personnel proficient in operating and maintaining these advanced technologies. While robotics offer the promise of automation and efficiency, their effective utilization hinges on the availability of skilled technicians capable of programming, troubleshooting, and optimizing robotic functionalities. However, the demand for such specialized talent outstrips the available supply, exacerbating the skills gap within the food service industry.

As a result, businesses encounter challenges in recruiting and retaining skilled personnel, impeding the seamless integration of robotic kitchen solutions into their operations. Moreover, the complexity of robotic systems necessitates ongoing training and upskilling initiatives to ensure workforce competency, adding another layer of complexity to adoption efforts. Addressing this skills shortage through targeted training programs and educational initiatives is crucial to unlocking the full potential of the Robot Kitchen Market and facilitating its sustained growth.

By Type Analysis

In the Robot Kitchen Market, software solutions hold a dominant share, comprising 34.3% of the market.

In 2023, Software held a dominant market position in the By Type segment of the bearings market, capturing more than a 34.3% share. This significant share underscores the growing importance of software-driven solutions within the bearings industry. Software-based bearings offer enhanced monitoring, predictive maintenance, and performance optimization capabilities, catering to the evolving needs of industries such as manufacturing, automotive, and aerospace. The adoption of Industry 4.0 practices, characterized by the integration of digital technologies for smart and efficient operations, has propelled the demand for software-enabled bearings.

Conversely, Hardware accounted for the remaining share, reflecting its enduring significance despite the rising prominence of software solutions. Hardware-based bearings remain indispensable components across various mechanical systems, providing essential support and motion control functionalities. While software solutions offer advanced features, hardware components continue to serve as the foundational elements within machinery and equipment.

The market dynamics within the By Type segment indicate a dual trajectory, with software solutions witnessing rapid adoption while hardware components maintain their integral role. As industries increasingly prioritize automation, efficiency, and data-driven decision-making, the demand for software-driven bearings is expected to escalate further. However, the enduring relevance of hardware-based bearings ensures a balanced market landscape, catering to diverse industry requirements and preferences.

Looking ahead, technological advancements, particularly in areas such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics, will continue to shape the bearings market landscape. Both hardware and software segments are poised to benefit from these advancements, driving innovation, efficiency gains, and market expansion. Amidst these developments, stakeholders must navigate the evolving market dynamics strategically, capitalizing on opportunities while addressing challenges to maintain competitiveness and foster sustainable growth.

By Application Analysis

Commercial applications lead with a dominant share of 36.0% in overall usage.

In 2023, Commercial held a dominant market position in the By Application segment of the bearings market, capturing more than a 36.0% share. This significant share highlights the widespread utilization of bearings across various commercial applications, including industrial machinery, automotive components, and construction equipment. Commercial applications necessitate reliable and high-performance bearings to ensure smooth operations, minimize downtime, and enhance overall productivity. The robust demand from commercial sectors underscores the critical role of bearings in supporting diverse industrial operations and infrastructure development projects.

Additionally, House accounted for a notable share within the By Application segment, emphasizing the significance of bearings in residential settings. Bearings find application in household appliances, HVAC systems, and recreational equipment, among others, contributing to the comfort, convenience, and functionality of residential spaces. While the share of House applications may be comparatively lower than Commercial, it reflects the pervasiveness of bearings in everyday household items, essential for ensuring operational efficiency and longevity.

Furthermore, Others encompass various niche and specialized applications within the bearings market. These applications span sectors such as aerospace, marine, and medical devices, where bearings play critical roles in enabling precise motion control, stability, and reliability. Although Others may constitute a smaller share within the By Application segment, they represent vital segments with distinct requirements and technological demands.

Looking forward, the bearings market is poised for continued growth across all application segments, driven by factors such as industrial automation, infrastructure development, and technological advancements. Stakeholders must anticipate evolving market dynamics, tailor offerings to specific application needs, and capitalize on emerging opportunities to sustain competitiveness and foster market expansion.

Key Market Segments

By Type

- Hardware

- Software

By Application

- House

- Commercial

- Others

Growth Opportunity

Rising Interest in Healthy Eating Habits

The global robot kitchen market is poised for substantial growth, primarily driven by a rising interest in healthy eating habits. As consumers become increasingly health-conscious, there is a notable shift towards automated solutions that offer convenience without compromising nutritional value. Robot kitchens, equipped to prepare meals with precise ingredient control and minimal waste, align well with this trend.

The ability of these systems to cater to personalized dietary requirements enhances their appeal, particularly among individuals with specific health-related food preferences. This consumer shift is expected to contribute significantly to the market's expansion, as the demand for healthier, technology-driven meal preparation solutions continues to rise.

Integration with Internet of Things (IoT)

Another critical growth driver for the robot kitchen market is the integration with the Internet of Things (IoT). By incorporating IoT technologies, robot kitchens can achieve enhanced functionality and interconnectivity, allowing for seamless operation within smart home ecosystems. This integration facilitates features such as remote monitoring, automatic inventory updates, and real-time adjustments to cooking processes, which significantly enhance user convenience and efficiency.

The ability to integrate with other smart devices and adapt to user routines and preferences positions IoT-enabled robot kitchens as a key technological advancement in modern home automation. This integration not only attracts tech-savish consumers but also opens up new avenues for innovation and market expansion.

Latest Trends

Integration of Robotic Arms for Ingredient Handling

In 2023, the global robot kitchen market witnessed a significant advancement through the integration of robotic arms for ingredient handling. This technological enhancement is primarily driven by the need for increased efficiency and precision in the kitchen. Robotic arms, equipped with sensors and advanced programming, can manage tasks ranging from basic ingredient sorting to complex food preparation processes.

The adoption of these robotic arms can be attributed to their ability to reduce human error and enhance productivity, leading to a more streamlined cooking environment. Additionally, this trend reflects a broader shift towards automation in culinary operations, aiming to meet the growing demand for high-quality, consistently prepared food. As this technology continues to evolve, it is expected to further transform kitchen dynamics, potentially increasing the market's growth trajectory.

Customization Options for Personalized Cooking Experiences

The robot kitchen market is also embracing the trend of customization, offering consumers personalized cooking experiences tailored to individual preferences and dietary requirements. This shift is facilitated by advancements in artificial intelligence and machine learning, which allow robotic systems to adapt to various cooking styles and recipes.

Customization in robotic kitchens not only enhances consumer engagement by allowing more control over the cooking process but also caters to the increasing demand for bespoke dietary options. The capability to adjust recipes, portion sizes, and cooking methods on demand adds a significant value proposition, positioning these robotic solutions as not merely appliances but as integral parts of the modern culinary landscape. This personalization aspect is likely to attract a broader consumer base, fostering further market expansion.

Regional Analysis

In 2023, North America held a 31.3% share of the global robot kitchen market.

The Robot Kitchen Market exhibits significant growth across various global regions, each demonstrating unique market dynamics and opportunities influenced by regional consumer behaviors and technological adoption rates.

North America is the dominating region with a market share of 31.3%, driven by a strong inclination towards technological innovation and a high adoption rate of smart home devices. The United States leads in this sector due to its robust tech infrastructure and consumer willingness to adopt new technologies for convenient living.

In Europe, the market is expanding steadily, with a focus on efficiency and sustainability. European consumers show a strong preference for devices that offer energy efficiency and reduce food waste, aligning with the broader regional goals of environmental sustainability. The presence of key market players and technological partnerships further stimulate the growth in this region.

Asia Pacific is witnessing the fastest growth rate, fueled by increasing urbanization and rising disposable incomes, particularly in countries like China, Japan, and South Korea. These countries are pioneering in robotics, and their integration into the kitchen reflects the region's embrace of automation to enhance lifestyle and culinary experiences.

The Middle East & Africa region shows emerging market potential, with growth driven by luxury real estate projects that incorporate advanced technologies, including robot kitchens, as a standard amenity. The market here is expected to expand as more consumers become aware of the benefits of automated cooking solutions.

Lastly, Latin America is gradually adopting robot kitchen technologies, with growth primarily centered in major urban centers where there is greater exposure to and acceptance of new technologies. Economic stabilizations and improving living standards are likely to boost market growth in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Robot Kitchen Market has seen significant contributions from key players, each bringing unique innovations and technological advancements to the forefront. Among these, Moley Robotics stands out with its fully automated kitchen solution, integrating advanced robotics to streamline meal preparation, thereby setting a high standard in terms of both efficiency and culinary precision.

Herox and Sony, traditionally not centered on kitchen technology, have ventured into this market with robust R&D initiatives, aiming to leverage their technological prowess in robotics and electronics. Their entry not only diversifies the market but also intensifies the competitive landscape, encouraging innovation.

Samsung and Nvidia are pivotal in enhancing the computational and AI capabilities of robotic kitchen systems. Samsung's integration of IoT and smart home compatibility in their products improves user interactivity, while Nvidia’s GPU technologies and AI platforms play a critical role in processing complex algorithms required for robotic cooking tasks.

QSR Automation and Miso Robotics focus on the commercial sector, particularly quick-service restaurants. Their solutions aim to improve service speed and consistency, key factors driving adoption among fast-food operators. QSR Automation’s dedication to refining the operational workflow complements Miso Robotics’ focus on automating cooking processes, together addressing both the front and back-end needs of the industry.

Lastly, Spyce is notable for its data-driven approach to culinary services, using robotics to deliver personalized and precisely cooked meals, demonstrating how data analytics can transform food service operations.

These companies collectively push the boundaries of what robotic technology can achieve in the kitchen, significantly impacting both domestic and commercial food preparation landscapes. Their continued innovation and market expansion are likely to drive further growth and transformation in this sector.

Market Key Players

- Moley

- Herox

- Sony

- Samsung

- Nvidia

- QSR Automation

- Miso Robotics

- Spyce

Recent Development

- In April 2024, Astribot unveils the humanoid robot S1, boasting AI capabilities to perform various tasks including cooking. Its release hints at future automation trends in hospitality and kitchens, potentially reshaping job markets.

- In April 2024, TUD's CeTI Cluster of Excellence unveils CeTIBAR, a cutting-edge robot kitchen. It's a real-world lab for human-robot interaction research, promoting dialogue and understanding of new technologies.

- In April 2024, Wonderchef launches Chef Magic, an all-in-one kitchen robot, aiming for Rs 200 crore in sales within 3 years. With over 200 recipes and advanced features, it revolutionizes home cooking.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 8.5 Billion CAGR (2024-2032) 12.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Hardware, Software), By Application(House, Commercial, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Moley, Herox, Sony, Samsung, Nvidia, QSR Automation, Miso Robotics, Spyce Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Moley

- Herox

- Sony

- Samsung

- Nvidia

- QSR Automation

- Miso Robotics

- Spyce