Recipe Apps Market By Type (Free Download and Paid Download), By Application (Android and iOS), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47759

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

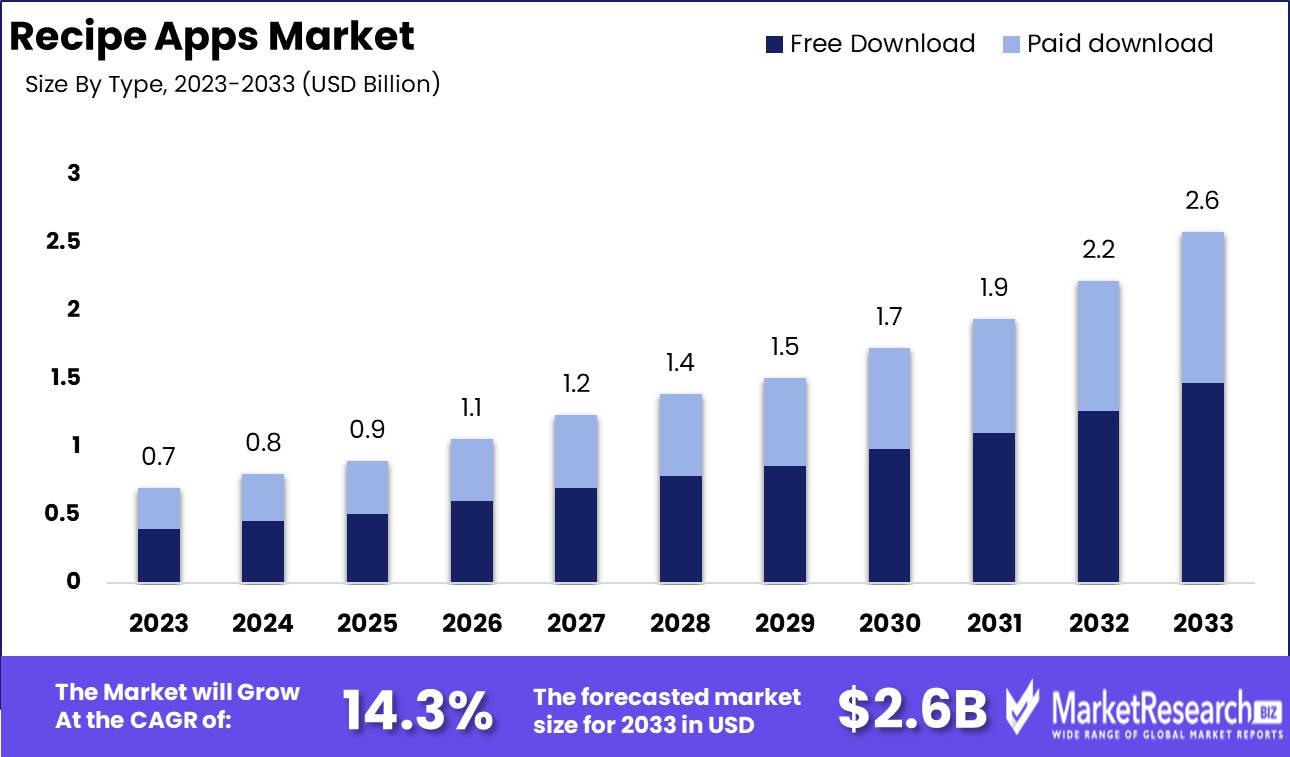

The Recipe Apps Market was valued at USD 0.7 billion in 2023. It is expected to reach USD 2.6 billion by 2033, with a CAGR of 14.3% during the forecast period from 2024 to 2033.

The Recipe Apps Market encompasses digital platforms and mobile applications designed to provide users with access to a wide array of culinary recipes, meal-planning tools, and cooking tutorials. These apps often feature user-friendly interfaces, customizable dietary filters, and integrations with grocery delivery services. As consumers increasingly seek convenient and personalized cooking solutions, the market has seen substantial growth driven by technological advancements and shifting consumer preferences toward home-cooked meals.

The Recipe Apps Market is poised for significant growth, driven by a confluence of rising health consciousness and advancements in technology. The increasing consumer emphasis on healthy eating and home cooking has created substantial demand for platforms that provide nutritious and diverse recipes, dietary tips, and meal-planning features. This trend is catalyzed by a broader shift towards healthier lifestyles, as individuals seek to manage their well-being proactively. Recipe apps are uniquely positioned to meet this need, offering tailored solutions that align with the evolving preferences of health-conscious consumers.

Moreover, the integration of artificial intelligence (AI) and machine learning within recipe apps is expected to revolutionize user engagement and personalization. These technologies enable apps to analyze user behavior, dietary preferences, and feedback to deliver customized recipe suggestions and meal plans. This enhanced personalization not only improves user satisfaction but also fosters long-term engagement. Additionally, the prevalent freemium model in the recipe apps market, where 70% of apps offer basic features for free and premium features at a cost, presents a strategic advantage. It allows users to access essential functionalities without financial commitment, while premium subscriptions unlock advanced features, driving revenue growth. Collectively, these factors indicate a robust and dynamic future for the recipe apps market, underscored by technological innovation and a deepening focus on health and wellness.

Key Takeaways

- Market Growth: The Recipe Apps Market was valued at USD 0.7 billion in 2023. It is expected to reach USD 2.6 billion by 2033, with a CAGR of 14.3% during the forecast period from 2024 to 2033.

- By Type: Free Download apps dominated with a 69.5% market share.

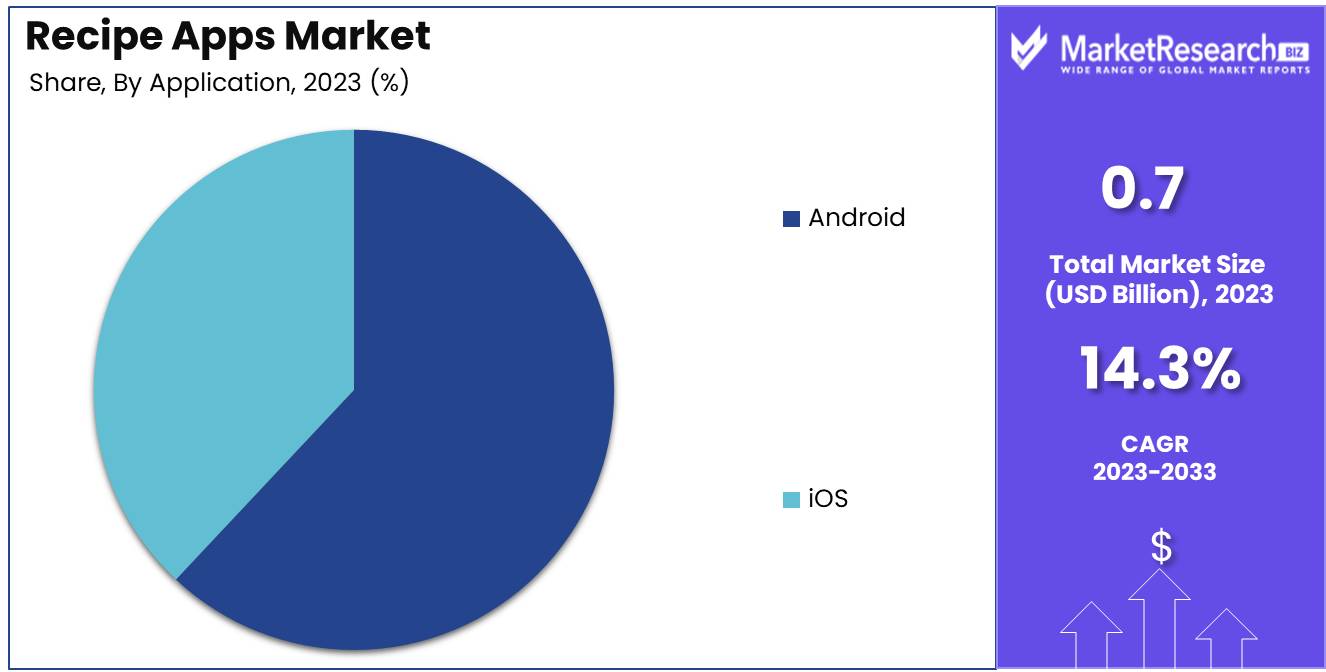

- By Application: Android led the Recipe Apps Market with 62.3%.

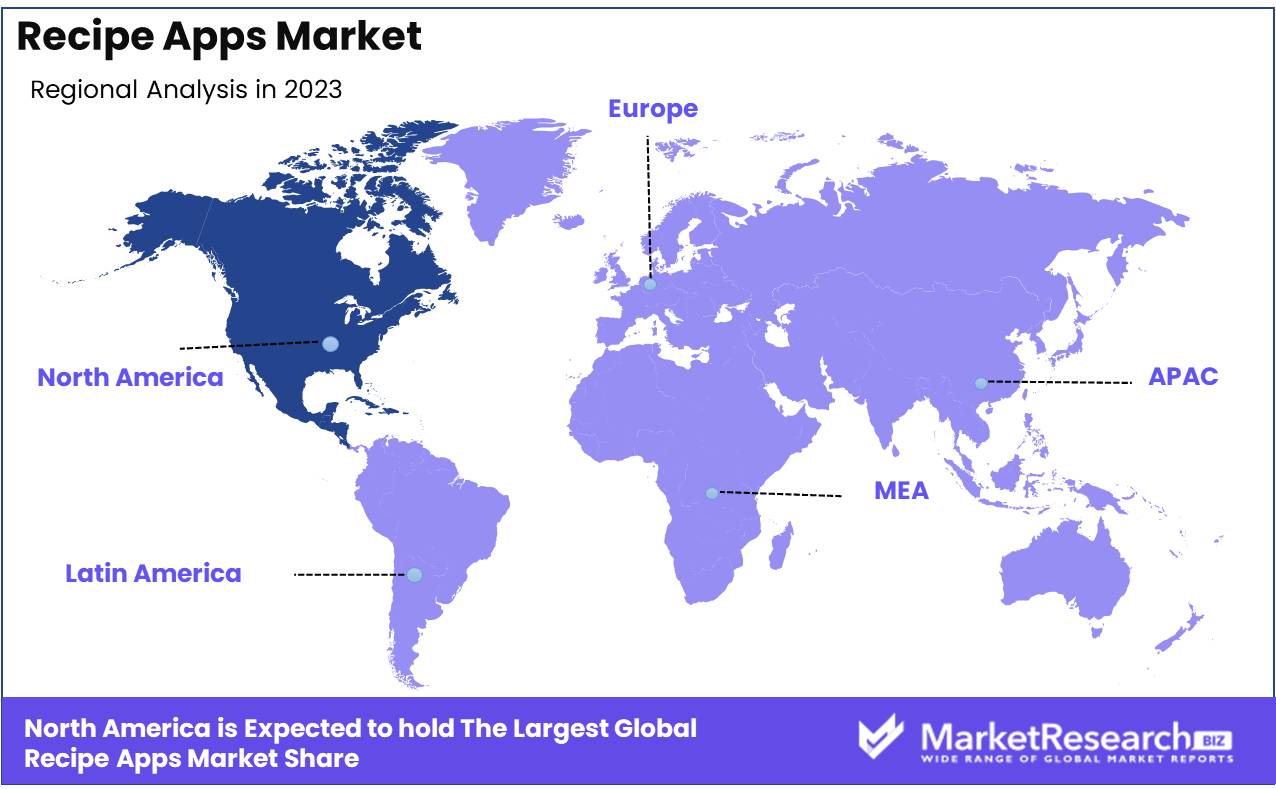

- Regional Dominance: North America dominates the recipe apps market with a 38% share.

- Growth Opportunity: The fusion of smart kitchen devices and personalized recommendations offers substantial growth potential for the global recipe apps market.

Driving factors

Growing Interest in Cooking and Healthy Eating: A Catalyst for Recipe Apps Market Expansion

The surge in consumer interest in cooking and healthy eating is a primary driver of the recipe apps market. This trend is fueled by several factors, including heightened awareness of nutritional benefits, the popularity of home-cooked meals over dining out, and the influence of social media on food culture. According to a report, 85% of Americans have adjusted their food choices towards healthier options in recent years. This shift has created a robust demand for recipe apps that offer diverse, nutritious meal options and cater to dietary preferences such as vegan, gluten-free, and keto diets. Recipe apps leverage this trend by providing users with easy access to a wide array of healthy recipes, often curated by nutritionists and chefs, thereby promoting healthier eating habits and sustaining market growth.

Increasing Adoption of Fast Lifestyles: Driving Demand for Convenient and Accessible Recipe Solutions

The modern fast-paced lifestyle has significantly influenced the adoption of recipe apps. With more individuals juggling busy work schedules and personal commitments, the need for quick, convenient, and reliable meal-planning solutions has become paramount. According to a Study survey, 60% of respondents in the U.S. cited lack of time as a primary reason for seeking meal preparation assistance. Recipe apps cater to this need by offering time-efficient recipes, step-by-step cooking guides, and even grocery shopping integration, simplifying the entire cooking process. These features enable users to save time while ensuring they have access to nutritious and delicious meals, thus driving the growth of the recipe app market.

Personalization and Customization Features: Enhancing User Engagement and Retention

Personalization and customization are crucial factors contributing to the growth of the recipe apps market. Today’s consumers expect personalized experiences that cater to their unique tastes, dietary restrictions, and nutritional goals. Recipe apps that utilize AI and machine learning to provide tailored recipe recommendations based on user preferences, past behaviors, and health metrics are seeing higher engagement and retention rates. For instance, apps that allow users to filter recipes by ingredients they have on hand or adjust serving sizes to meet their dietary needs add significant value. This level of customization not only enhances user satisfaction but also fosters loyalty, as users are more likely to return to an app that consistently meets their specific requirements.

Restraining Factors

Compatibility Issues: Fragmentation Hinders User Experience and Market Penetration

Compatibility issues are a significant restraining factor in the growth of the recipe apps market. These issues arise from the diverse range of devices and operating systems that users employ, each with different technical specifications and software environments. This fragmentation can lead to inconsistent user experiences, where the app performs well on some devices but poorly on others. For example, an app that functions seamlessly on the latest iOS may experience glitches or crashes on older Android versions. Such discrepancies can frustrate users, leading to lower engagement and higher churn rates.

Moreover, the necessity to ensure compatibility across multiple platforms increases the complexity and resource requirements for developers. Ensuring that an app works flawlessly on all potential devices demands extensive testing and constant updates to address new compatibility challenges as they arise with each operating system update. This ongoing need for optimization and troubleshooting can divert resources from innovation and feature development, thereby stalling potential growth.

High Development Costs: Financial Barriers Curtail Market Entry and Innovation

The high costs associated with developing and maintaining recipe apps represent another critical restraining factor for market growth. Developing a robust, user-friendly recipe app involves significant financial investment in various stages, including design, coding, testing, and marketing. The need for high-quality graphics, intuitive user interfaces, and complex functionalities such as personalized recommendations and voice search capabilities further escalates development expenses.

Additionally, ongoing maintenance costs are substantial. These include regular updates to keep up with operating system changes, security patches, and feature enhancements based on user feedback. Smaller companies and startups may find these costs prohibitive, thereby limiting market entry to well-funded entities. This financial barrier reduces competitive diversity and slows innovation, as fewer players are capable of investing in the necessary resources to develop cutting-edge features.

Furthermore, high development costs can impact the pricing strategy of recipe apps. To recoup their investments, developers might opt for premium pricing models or in-app purchases, which could deter potential users who are unwilling or unable to pay. This creates a paradox where high costs reduce the market’s potential user base, thus stunting overall growth.

By Type Analysis

In 2023, Free Download apps dominated with a 69.5% market share.

In 2023, Free Download held a dominant market position in the By Type segment of the Recipe Apps Market, capturing more than a 69.5% share. The Free Download segment's substantial market share can be attributed to several factors. Firstly, the barrier to entry for users is significantly lower, encouraging higher download rates and widespread adoption. Additionally, free apps often leverage advertising and freemium models, providing essential features at no cost while offering premium upgrades for enhanced functionality. This model appeals to a broad user base, from casual home cooks to more dedicated culinary enthusiasts seeking advanced features.

Conversely, the Paid Download segment, though smaller, caters to a niche market willing to invest in comprehensive, ad-free experiences with robust feature sets. These apps typically offer exclusive content, advanced meal planning tools, and integration with grocery delivery services, justifying the upfront cost. Despite its smaller share, the Paid Download segment benefits from a loyal user base and higher average revenue per user (ARPU), contributing to its steady growth. As consumer preferences evolve, the interplay between these segments will shape the competitive landscape of the Recipe Apps Market.

By Application Analysis

In 2023, Android led the Recipe Apps Market with 62.3%.

In 2023, Android held a dominant market position in the By Application segment of the Recipe Apps Market, capturing more than a 62.3% share. This significant lead can be attributed to several factors. Firstly, Android's extensive global user base provides a broader reach for recipe app developers, enabling them to target diverse demographics. The flexibility and open-source nature of the Android platform also encourage innovation and customization, allowing developers to tailor their apps to specific regional cuisines and dietary preferences. Furthermore, Android's integration with a wide array of devices, including smartphones, tablets, and smart home appliances, enhances user accessibility and engagement.

In contrast, iOS, while maintaining a strong presence, appeals primarily to a more affluent user base that is inclined towards premium app experiences. iOS users tend to exhibit higher in-app purchase rates and engagement levels, which can drive monetization for developers. However, the relatively smaller market share compared to Android limits its overall dominance in the Recipe Apps Market. Both platforms exhibit unique strengths, but Android's expansive reach and adaptability have positioned it as the leader in the By Application segment for recipe apps.

Key Market Segments

By Type

- Free Download

- Paid download

By Application

- Android

- iOS

Growth Opportunity

Increased Adoption of Smart Kitchen Devices

The global recipe apps market stands poised for substantial growth, driven by the proliferation of smart kitchen devices. As consumers increasingly integrate technology into their culinary routines, the demand for recipe apps that seamlessly interact with smart appliances is expected to surge. Smart ovens, refrigerators, and cooking assistants that connect to recipe apps enable users to automate and enhance their cooking experiences, offering precision and convenience that traditional methods cannot match. This trend is not only enhancing user engagement but also expanding the customer base for recipe app providers, as more households embrace these innovations.

Personalized Recipe Recommendations

Another critical driver of growth in the recipe apps market is the advancement in personalized recipe recommendations. Leveraging artificial intelligence and machine learning, recipe apps are now capable of offering tailored suggestions based on users' dietary preferences, health goals, and historical cooking data. This personalization significantly enhances user satisfaction and retention, making the apps indispensable tools for meal planning and dietary management. As consumers continue to seek healthier and more personalized food choices, the ability of recipe apps to deliver bespoke recommendations positions them as essential companions in the modern kitchen.

Latest Trends

Healthy and Specialized Diets

The recipe apps market is poised for substantial growth driven by a heightened consumer focus on health and wellness. Apps that cater to specialized diets such as vegan, gluten-free, keto, and paleo are experiencing increased demand. Consumers are not just seeking recipes; they are looking for comprehensive nutritional information, meal planning tools, and integration with health tracking devices. This trend is amplified by rising awareness of dietary-related health issues and a growing preference for personalized nutrition solutions. As a result, recipe app developers are enhancing their platforms with advanced algorithms to offer customized meal plans based on individual dietary needs and health goals, leveraging AI to refine personalization.

Community and Social Sharing

Another significant trend shaping the recipe apps market is the integration of community and social sharing features. Users are increasingly looking for platforms where they can share their culinary creations, exchange recipes, and engage with a community of like-minded food enthusiasts. This social aspect not only boosts user engagement but also fosters a sense of belonging and inspiration among users. Recipe apps are incorporating social media functionalities, allowing users to post photos, write reviews, and follow popular chefs and influencers. Additionally, collaborative cooking features, where users can cook together virtually, are becoming more popular, providing a shared experience that transcends geographical boundaries. This trend is driving higher retention rates and creating vibrant, interactive user communities.

Regional Analysis

North America dominates the recipe apps market with a 38% share.

The global recipe apps market exhibits significant regional variations, each influenced by unique cultural, technological, and economic factors. North America leads the market with a dominant share of 38.0%, driven by high smartphone penetration, advanced digital infrastructure, and a robust culture of culinary innovation. The United States and Canada are key contributors, with a growing consumer preference for convenient and diverse meal-planning solutions. Europe follows, characterized by a strong tradition of culinary arts and increasing health consciousness, particularly in countries like Germany, the UK, and France. The region benefits from a well-established digital ecosystem and high disposable income levels, facilitating widespread adoption of premium recipe apps.

In the Asia Pacific, rapid urbanization and a burgeoning middle class, particularly in China, India, and Japan, are fueling market growth. The region's increasing internet and smartphone user base, coupled with a rising trend in home-cooked meals, supports this expansion. The Middle East & Africa, although at an earlier stage of market development, shows promise with growing smartphone adoption and a rising interest in diverse cuisines, driven by expatriate populations and tourism.

Latin America, led by Brazil and Mexico, is experiencing steady growth, propelled by a combination of improving digital infrastructure and a cultural emphasis on traditional and innovative culinary practices. Despite regional economic challenges, the increasing accessibility of smartphones and internet connectivity is expected to drive further market penetration.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Recipe Apps market showcases a diverse array of key players, each leveraging unique strengths to capture market share in an increasingly competitive landscape. BBC Good Food and Tasty, industry stalwarts, continue to dominate through their extensive recipe libraries and user-friendly interfaces, drawing in a broad demographic. Meanwhile, niche apps like Oh She Glows and Forks Over Knives cater to specific dietary preferences, such as vegan and plant-based diets, reflecting growing consumer demand for health-conscious options.

BigOven and Cookpad Inc. remain pivotal by fostering community engagement, allowing users to share recipes and cooking experiences, thereby enhancing user retention. AJNS New Media GmbH and Gronda GmbH excel in integrating innovative features, including professional chef insights and advanced meal planning tools, appealing to both amateur cooks and culinary professionals.

Tech giants Samsung Electronics and Whirlpool Corp. are strategically positioning their recipe apps within smart kitchen ecosystems, offering seamless integration with their home appliances, which exemplifies the trend toward smart home solutions. Immediate Media Co. Ltd. and Discovery Inc. leverage their vast media resources to provide engaging content that blends cooking with entertainment, enhancing user engagement.

Emerging players like SideChef Inc. and Paprika focus on personalized user experiences and advanced organizational tools, which are crucial for busy modern lifestyles. Le Creuset South Africa Pty Ltd. and Weber Stephen Products HK Ltd. extend their brand value into the digital realm, offering specialized content that complements their premium kitchenware products.

In conclusion, the Recipe app market is characterized by a blend of traditional strengths and innovative approaches, with key players continuously evolving to meet the dynamic needs of a global audience.

Market Key Players

- BBC Good Food

- Tasty

- Oh She Glows

- BigOven

- AJNS New Media GmbH

- Cookpad Inc.

- Discovery Inc.

- Forks Over Knives LLC

- Green Kitchen Stories

- Gronda GmbH

- Immediate Media Co. Ltd.

- Le Creuset South Africa Pty Ltd.

- MAADINFO SERVICES Co.

- Paprika

- Samsung Electronics Co. Ltd.

- SideChef Inc.

- Weber Stephen Products HK Ltd.

- Whirlpool Corp.

- Youmian

- Glo Bakery Corp.

Recent Development

- In May 2024, SideChef partnered with Amazon Fresh to provide users with a streamlined grocery shopping experience. This collaboration enables SideChef users to order ingredients directly through Amazon Fresh, based on selected recipes. The integration promises to simplify meal planning and grocery shopping, aligning with the growing trend of on-demand grocery delivery services.

- In April 2024, Whisk, a leading recipe app, announced a strategic integration with Samsung Smart Appliances. This development aims to create a seamless cooking experience by allowing users to sync recipes directly with their Samsung kitchen devices, including smart ovens and refrigerators. This integration facilitates automated cooking instructions and ingredient management, enhancing convenience for users.

- In February 2024, Yummly launched an AI-powered personalized recommendation feature that uses machine learning to analyze user preferences and dietary restrictions. This feature delivers highly customized recipe suggestions, improving user engagement and satisfaction. The enhanced personalization reflects the increasing demand for tailored digital experiences in the recipe app market.

Report Scope

Report Features Description Market Value (2023) USD 0.7 Billion Forecast Revenue (2033) USD 2.6 Billion CAGR (2024-2032) 14.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Free Download and Paid Download), By Application (Android and iOS) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BBC Good Food, Tasty, Oh She Glows, BigOven, AJNS New Media GmbH, Cookpad Inc., Discovery Inc., Forks over knives LLC, Green Kitchen Stories, Gronda GmbH, Immediate Media Co. Ltd., Le Creuset South Africa Pty Ltd., MAADINFO SERVICES Co., Paprika, Samsung Electronics Co. Ltd., SideChef Inc., Weber Stephen Products HK Ltd., Whirlpool Corp., Youmian, Glo Bakery Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BBC Good Food

- Tasty

- Oh She Glows

- BigOven

- AJNS New Media GmbH

- Cookpad Inc.

- Discovery Inc.

- Forks Over Knives LLC

- Green Kitchen Stories

- Gronda GmbH

- Immediate Media Co. Ltd.

- Le Creuset South Africa Pty Ltd.

- MAADINFO SERVICES Co.

- Paprika

- Samsung Electronics Co. Ltd.

- SideChef Inc.

- Weber Stephen Products HK Ltd.

- Whirlpool Corp.

- Youmian

- Glo Bakery Corp.