Smart Refrigerator Market Door Type Analysis (Single door, Double door, Other), Distribution Channel Analysis(Offline stores, Online stores), End-User Analysis (Residential, Commercial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

12506

-

May 2023

-

176

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

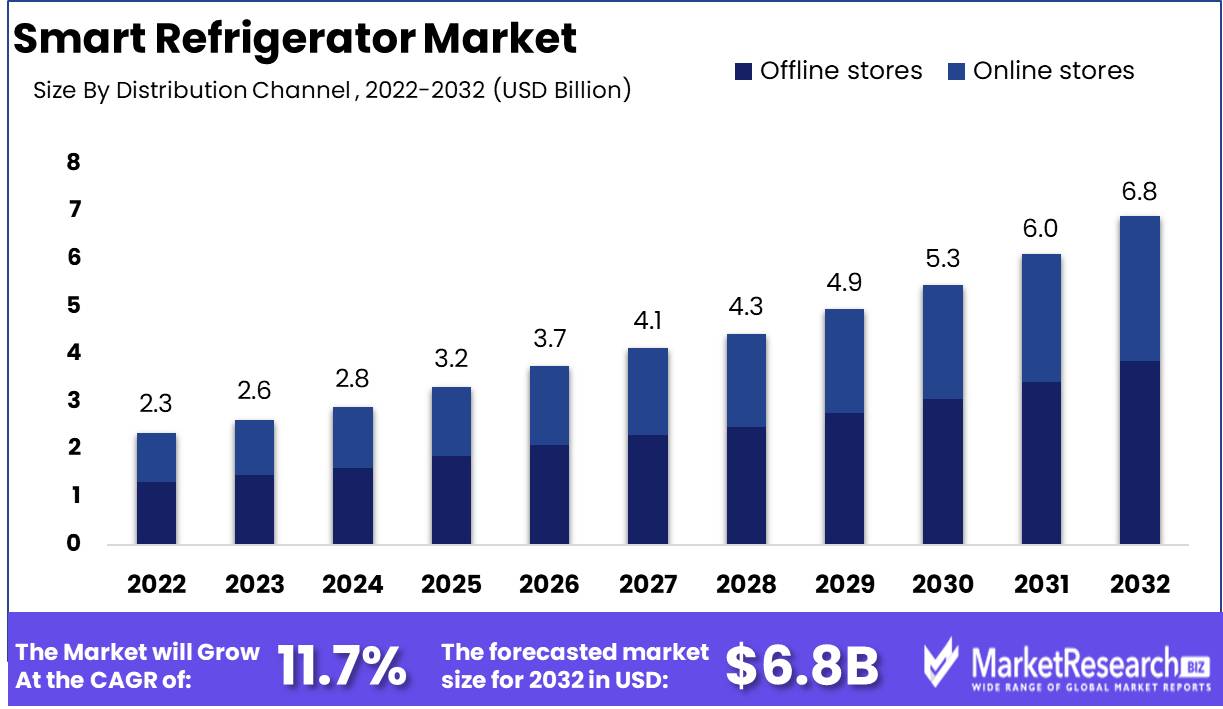

Smart Refrigerator Market size is expected to be worth around USD 6.8 Bn by 2032 from USD 2.3 Bn in 2022, growing at a CAGR of 11.7% during the forecast period from 2023 to 2032.

The smart refrigerator market, a realm of limitless innovation and interconnected marvels, emerges as the archetypal essence of the Internet of Things (IoT). With its sophisticated design and varied functionalities, this technical marvel reveals a compelling world in which grocery list sharing and food management become seamless activities.

Within its elegant exterior are an array of sensors, an intelligent voice assistant that is always ready to help, and a dazzling display screen that calls with its digital appeal. The smart refrigerator market, a paragon of convenience, was masterfully designed to free mortals from the grips of food-related drudgery and to safeguard the integrity of edibles.

For a tour through the intriguing labyrinth of technological prowess. Enter the realm of biometric sensor fusion technology, an astonishing blend of biometric sorcery and sensor wizardry. The arcane techniques of facial recognition and fingerprint unlocking meet here, creating a symphony of security mechanisms that make traditional locks shiver in fear.

Behold, is an arena pulsating with excitement for the smart refrigerator market, enticing foresighted and astute investors. As the unquenchable need for IoT devices grows, companies like Samsung, LG Electronics, and Whirlpool will rise to the top. In their quest for supremacy, these giants march ahead, embracing the mystical forces of machine learning and the enigmatic allure of voice-activated control, delivering upon users a fascinating tapestry of experiences.

The gift bestowed to the common people supports this realm's unrelenting expansion. Marvel at the marvelous powers of the smart refrigerator market, which reduces food waste through an automated system that expertly controls the household's culinary inventory. Its sage-like intelligence updates shopping lists with divine precision and generates meal menus that transcend mortal constraints. It stands guard like a sentry, signaling the approach of expiration dates and the need for replenishment.

Wander now, wander across the diverse landscapes of industry, where the smart refrigerator exerts its seductive power. Behold the transformation in the realm of retail as inventory management undergoes a revolution, the tendrils of smart refrigeration extending far and wide, casting their transformational spell on the mundane. Witness the magic unfold as the fridge becomes an arbitrator of delight, conjuring tailored recommendations and summoning automation to boost the visitor experience in the hotel industry.

Driving factors

Mobile Integration Increases Sales of Smart Refrigerators

One important component is the IT infrastructure and wireless connection, which allows for seamless integration with mobile devices. Smart refrigerators are becoming a component of smart homes, and the ability to monitor and manage them via mobile devices is a significant benefit for consumers.

Smart Refrigerator Market Demand is Driven by Energy Efficiency

Another motivator is advancing technology that creates energy-efficient and convenient gadgets for better living. Smart refrigerators conserve energy and include features like ice dispensers, water filters, and touchscreens to make food management easier. The rise of the consumer electronics industry is also important in driving market growth for smart refrigerators.

Personalization Drives Smart Refrigerator Adoption

Furthermore, client preferences for personalization and customization boost demand for smart refrigerators. Samsung Electronics, for example, introduced a new model that employs voice or touch for grocery management. This level of personalization enables consumers to make the most of their smart refrigerator's features and have a more personalized shopping and maintenance experience.

Regulations Influence the Smart Refrigerator Market

Regulations may have an impact on the smart refrigerator market. Energy rules, for example, may encourage manufacturers to develop more energy-efficient versions, which may impact pricing and market competition. Emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI) may also have an impact on the market by enabling the development of more complex and intelligent smart refrigerators.

The smart Refrigerator Industry is Being Reshaped by Disruptors

New market entrants, alterations in customer preferences, and developments in technology that make particular features obsolete or outmoded could all be potential disruptors in the competitive landscape. For example, a new business may launch a smart refrigerator with game-changing new features that sweep the market, leaving incumbent brands battling to compete.

Restraining Factors

Smart Refrigerators that are Both Efficient and Appealing

As technology advances, so does the way we spend our lives. The development of smart appliances has transformed the way we interact with our everyday household objects. The smart refrigerator market, for example, is packed with features that allow for more efficient cooling and storage, making it an appealing alternative for consumers globally.

Educating for Character

When examining the smart refrigerator market, one of the primary concerns for consumers is the cost. In general, smart appliances cost more than standard appliances, which may turn off potential customers trying to save money. This is especially true for individuals who are not technologically knowledgeable and may not see the benefits of investing in a smart refrigerator.

Simplifying Communication

Businesses may focus on educating clients on the long-term benefits of having a smart refrigerator market to overcome this challenge. These benefits include an increased energy economy, better food preservation, and increased convenience. Businesses may construct a picture of the overall value that smart refrigerators offer, despite their greater initial cost, by stressing five important benefits.

Installation is Simple

Another challenge facing the smart refrigerator market is the need for all equipment to be connected via a single communication interface. This means that, for best performance, all smart devices in the home—not just the refrigerator—need to be connected via a single platform.

Spreading Out the Costs

The issue is that not all smart devices use the same communication interface, making it difficult for consumers to correctly connect everything. Businesses can work on building a common communication interface that can be utilized by all smart devices in the home to address this issue. This eliminates the need for consumers to buy several devices from various companies, simplifying the connectivity procedure.

Door Type Analysis

The double door segment has dominated the smart refrigerator market recently. This is expected to continue. The double door segment led the smart refrigerator market.

Emerging economies are pushing the smart refrigerator market adoption of the double door segment. The middle class's disposable income continues to increase as Asian and African economies grow. This has led to the adoption of smart equipment like smart refrigerators. Large double-door refrigerators with lots of storage and smart capabilities are becoming more popular.

Fresh vegetables are preferred in refrigerators by health-conscious consumers globally. The double door segment stores fresh vegetables, dairy, and beverages. Smart refrigerators in the double door segment also have temperature control, humidity control, and smart connectivity, allowing consumers to remotely control their refrigerators' settings.

The double door segment's growth in the smart refrigerator market can be attributed to several factors, including rising consumer awareness of smart refrigerators' benefits, increased disposable income of emerging economies' middle classes, and the adoption of advanced technologies like artificial intelligence, the Internet of Things, and machine learning.

Distribution Channel Analysis

The offline stores segment dominated the smart refrigerator market. The growth of the offline store segment of the smart refrigerator market has also contributed to emerging economies' economic prosperity. The middle-class population's rising disposable income has led to an increase in smart appliance demand. These economies prefer offline stores because customers can physically check and test things before buying.

Offline stores sell smart refrigerators because they can inspect them. At offline stores, consumers can get discounts, price negotiation, and after-sales services.

The growth of the offline stores segment in the smart refrigerator market may be attributed to factors such as consumer preference for offline stores, rising demand for smart appliances, and availability of discounts and after-sales services in offline stores.

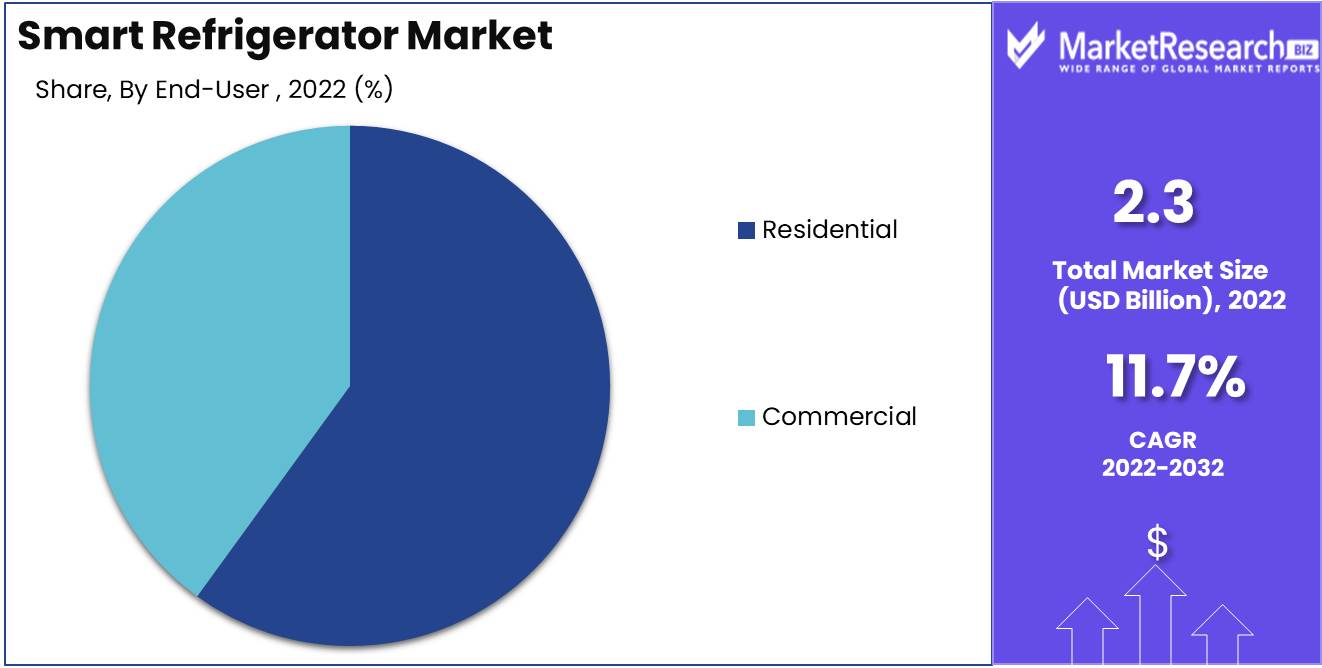

End-User Analysis

The residential segment led the smart refrigerator market. The growth of the residential segment in the smart refrigerator market has also been contributed by emerging economies' economic progress. Demand for smart appliances in residential households has been led by rising middle-class disposable income and the adoption of new technology.

Consumers globally prefer smart refrigerators for residential households because they offer benefits including abundant storage, temperature control, and smart connectivity. The residential segment's smart refrigerators provide voice control and remote monitoring and control.

The residential segment's growth in the smart refrigerator market can be attributed to factors such as the adoption of advanced technologies, consumer awareness of the benefits of smart refrigerators in residential households, and rising middle-class disposable income. Over the next years, it is expected that the residential segment will continue to dominate the smart refrigerator market.

Key Market Segments

Door Type Analysis

- Single door

- Double door

- French door

- Door-in-door

- Side by side

Distribution Channel Analysis

- Offline stores

- Online stores

End-User Analysis

- Residential

- Commercial

Growth Opportunity

Growing Demand for Smart Refrigerators Reduce wasted food

The growth potential presented by smart homes and the Internet of Things is driving the growth of the smart refrigerator market. The rise in popularity of smart homes has increased the demand for smart appliances, such as smart refrigerators that can reduce food waste caused by a lack of monitoring.

Smart Kitchens Propel the Market Expansion of Smart Refrigerators

Smart refrigerators are outfitted with advanced features such as cameras, sensors, and voice assistants, making it simpler to monitor the stored food. As a result, consumers can readily determine which foods have been in the refrigerator for too long, thereby preventing food waste.

Convenience at a Price Smart refrigerators are Costly

The rising demand for smart kitchens and homes is a significant factor propelling the growth of the smart refrigerator market. With the development of the Internet of Things, the need for smart home automation systems, and the pursuit of greater convenience and efficiency, smart refrigerators provide a valuable solution.

Repair Problems and Expensive Costs for Smart Refrigerators

However, smart refrigerators' sophisticated features come at a higher price than their conventional counterparts. High-tech features, such as built-in cameras, voice assistants, and sensors, come with a higher price tag, making them more expensive.

Shortages Slow Progress Spare Parts Problem Smart Refrigerator Market

Despite their benefits, smart refrigerators come with drawbacks that are difficult to disregard as a result. The expensive repair costs associated with the sophisticated features are a significant drawback. The built-in features require an experienced technician to fix any technical issues that come up, increasing repair costs.

Latest Trends

The Smart Refrigerator Market is Driven by Energy Efficiency

The market for smart refrigerators has revolutionized how we store and manage food. We can now control the temperature, humidity, and freshness of our groceries in a more efficient and convenient manner than ever before, thanks to advances in technology. However, as the market for smart refrigerators becomes more competitive, a number of new industry trends are emerging.

Customized Solutions Intelligent refrigerator

As consumers become more conscious of their carbon footprint, the demand for energy-efficient appliances has risen. The market for smart refrigerators is now equipped with high-tech sensors and energy-efficient compressors that reduce energy waste. Furthermore, smart refrigerators now offer additional features that make refrigeration more convenient than ever.

Smart Refrigerator with Voice and Touch Controls

Today's consumers desire solutions that are tailored to their specific requirements. With advancements in machine learning and artificial intelligence, smart refrigerators have become better at comprehending their owners' habits and preferences. For instance, they can learn a family's usage patterns, food preferences, and dietary needs, and even propose meal plans based on this information.

Smart Refrigerator Combines Opulence and Utility

With the incorporation of voice and touch controls, the smart refrigerator market has become more user-friendly. They utilize the principles of machine learning to comprehend voice commands and to respond promptly to them. This feature is especially helpful when you need to add an item to your grocery list rapidly. Similarly, touch screens on the refrigerator door help to make grocery management more accessible; users can utilize them to check the weather, read recipes, and even watch their favorite television programs or listen to music.

Cost is Still a Barrier for Intelligent Refrigerators

As the global economy continues to expand, consumers' purchasing power is also on the rise. This is a significant factor fueling the demand for aesthetically pleasing and functionally useful luxury appliances. Smart refrigerators are the focal point of the contemporary kitchen, featuring clean lines and a variety of colors. The cost of smart refrigerators is justified by their sophisticated features and functionalities, making them a prestigious and worthwhile investment.

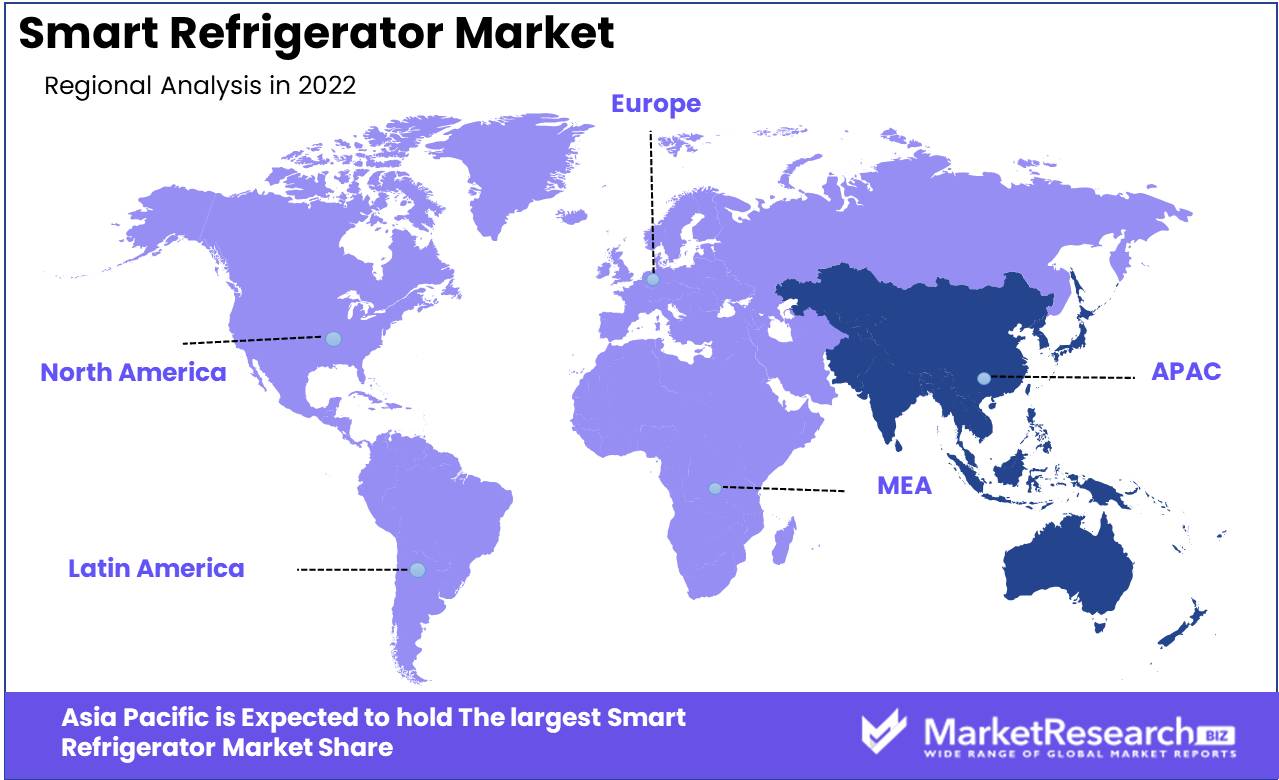

Regional Analysis

Due to the rising demand for smart refrigerators in China, South Korea, and Japan, the Asia Pacific region is one of the fastest-growing markets for intelligent appliances. The Asia Pacific region is moving beyond traditional commerce towards digital connectivity thanks to technological breakthroughs that have expanded the market for intelligent home appliances.

Rapid economic growth and urbanization in the region have transformed consumer lifestyles and shopping habits. This has led to a surge of intelligent appliances that have changed how people live, work, and communicate.

Smart refrigerators are popular in the region due to their unique features and convenience. These appliances enable remote administration, temperature control, recipe, and grocery list suggestions, and voice interaction with virtual assistants like Amazon's Alexa or Google Assistant. These characteristics have increased demand for these refrigerators, driving the market growth.

The use of other intelligent home appliances, such as smart washing machines, air conditioners, and thermostats, has expanded along with the adoption of smart refrigerators. These appliances are energy-efficient, easy to use, and functional.

The growth of intelligent appliances in the Asia Pacific region has also generated a new market for home security and automation, which has contributed to the region's surge. Smart locks, security systems, intelligent lighting, and other goods have been created by manufacturers. Modern, tech-enabled dwellings have attracted renters.

Over the next decade, the region's demand for intelligent home appliances will drive exponential growth in the market. China's massive customer base and strong economy will lead the smart appliance market in the region, followed by Japan and South Korea.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the smart refrigerator market, there are a number of main players. LG, Samsung, Whirlpool, Haier, and Bosch are some examples. Each of these companies has developed unique features, such as voice control and built-in cameras, to differentiate themselves in the market.

LG is a prominent participant in the smart refrigerator market with their popular InstaView Door-in-Door refrigerator, which includes a unique feature that allows the user to view the interior of the refrigerator without opening the door. The Family Hub refrigerator from Samsung, which includes a 21.5-inch touchscreen and Bixby voice control, is another market leader. Whirlpool's Smart French Door refrigerators with voice control and compatibility with Amazon Alexa and Google Assistant are well-known.

Including their Smart Life refrigerator, which has a built-in camera that can be accessed remotely via a mobile app, Haier is a Chinese company that offers a range of smart refrigerators. Last but not least, Bosch offers a range of smart refrigerators with features such as Home Connect, which allows users to control their appliances from a smartphone or tablet.

Top Key Players in Smart Refrigerator Market

- AB Electrolux

- Haier Group Corporation

- LG Electronics

- Samsung Electronics Co. Ltd.

- Whirlpool Corporation

- Siemens AG

- GE Appliance

- Hisense Co. Ltd.

- Midea Group

- Bosch

- Panasonic Corporation

Recent Development

- In 2023, Advancements in sustainable cooling systems were visible in the smart refrigerator market. To reduce environmental impact, manufacturers incorporated eco-friendly refrigerants and energy-saving components.

- In 2022, Automated inventory management features will be available in the smart refrigerator market. They used integrated cameras and computer vision technology to identify and trace objects in real time.

- In 2021, Artificial intelligence (AI) was first used in smart refrigerators for sophisticated food management.

- In 2020, The smart refrigerator market became more interconnected. They integrated with multiple smart home platforms, allowing users to remotely control and monitor their refrigerators using mobile applications.

- In 2019, Energy efficiency in Smart refrigerators saw significant advancements. Advanced cooling technologies and sensors were incorporated by manufacturers to optimize energy consumption and reduce consumers' electricity bills.

Report Scope:

Report Features Description Market Value (2022) USD 2.3 Bn Forecast Revenue (2032) USD 6.8 Bn CAGR (2023-2032) 11.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Door Type Analysis (Single door, Double door, French door, Door-in-door, Side by side), Distribution Channel Analysis(Offline stores, Online stores), End-User Analysis (Residential, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AB Electrolux, Haier Group Corporation, LG Electronics, Samsung Electronics Co. Ltd., Whirlpool Corporation, Siemens AG, GE Appliance, Hisense Co. Ltd., Midea Group, Bosch, Panasonic Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AB Electrolux

- Haier Group Corporation

- LG Electronics

- Samsung Electronics Co. Ltd.

- Whirlpool Corporation

- Siemens AG

- GE Appliance

- Hisense Co. Ltd.

- Midea Group

- Bosch

- Panasonic Corporation