Quantum Computing Market By Component (Hardware and Software), By Deployment(On-premise, and Cloud), By Application(Machine Learning ,Optimization, Biomedical Simulations and Other ), By End-user(Healthcare , BFSI, Automotive, and Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast Period 2024-2033

-

50849

-

Sept 2024

-

253

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

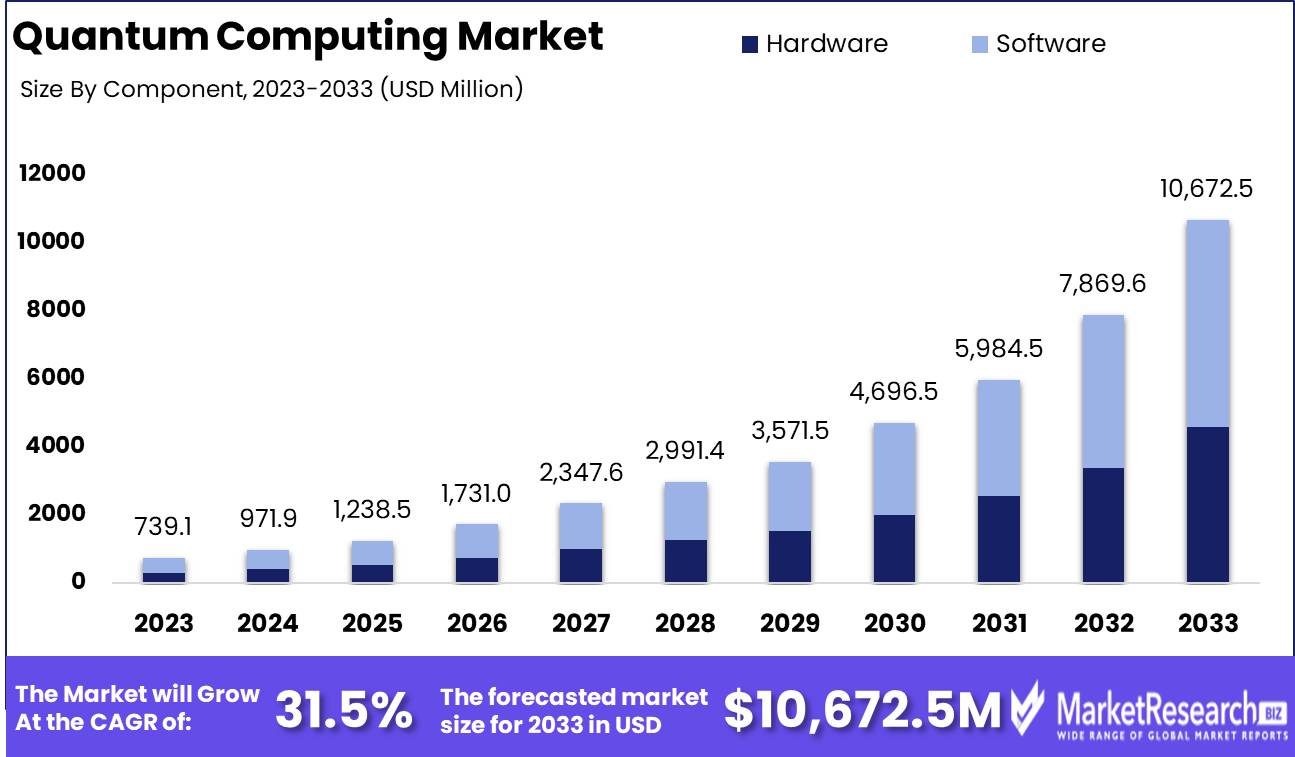

Quantum Computing Market was valued at USD 739.1 Million in 2023. It is expected to reach USD 10,672.5 Million by 2033, with a CAGR of 31.5% during the forecast period from 2024 to 2033.

The Quantum Computing Market represents a rapidly evolving sector focused on leveraging quantum mechanics to solve complex computational problems at unprecedented speeds. Unlike classical computing, which relies on binary data, quantum computing uses qubits to perform simultaneous calculations, potentially transforming industries such as cryptography, pharmaceuticals, and financial modeling. This market is driven by advancements in quantum algorithms, hardware development, and increasing investments from both private and public sectors. As organizations seek to gain competitive advantages through enhanced processing capabilities, the quantum computing market is poised for significant growth, fundamentally altering the landscape of technology and innovation.

The quantum computing market is poised at a critical inflection point, with significant advancements signaling the onset of tangible economic impacts across key industries. According to McKinsey's 2023 Quantum Technology Monitor, the automotive, chemicals, financial services, and life sciences sectors are expected to be the first to realize substantial gains from quantum computing, potentially unlocking up to $1.3 trillion in value by 2035. This projection underscores the strategic imperative for industry leaders to invest in quantum technologies to secure early-mover advantages. Notably, investor confidence is robust, as evidenced by the $2.35 billion invested in quantum technology start-ups in 2022 alone. This influx of capital highlights the market’s recognition of quantum computing transformative potential.

Recent developments further affirm the accelerated pace of innovation within this space. For instance, PsiQuantum's opening of an advanced R&D facility in the UK, backed by £9 million from the UK government, demonstrates the increasing global commitment to advancing quantum research and infrastructure. Concurrently, the quest for quantum supremacy continues to drive hardware innovation, with major players like Google, IBM, and Rigetti Computing achieving significant milestones. IBM’s introduction of the Quantum Hummingbird processor, featuring a higher qubit count, exemplifies the ongoing enhancements in quantum hardware, which are critical to achieving broader commercial viability. As these advancements converge, the quantum computing market is on the cusp of transitioning from experimental to practical applications, heralding a new era of technological disruption and value creation across multiple sectors.

Key Takeaways

- Market Growth: The Quantum Computing Market is projected to grow from USD 739.1 million in 2023 to USD 10,672.5 million by 2033, at a CAGR of 31.5%.

- Analyst Viewpoint: Quantum computing is at a pivotal stage, expected to generate up to $1.3 trillion in value by 2035, with significant early benefits in automotive, chemicals, financial services, and life sciences sectors.

- By Component Analysis: The software segment leads the quantum computing market, capturing 58.7% of the market share in 2023.

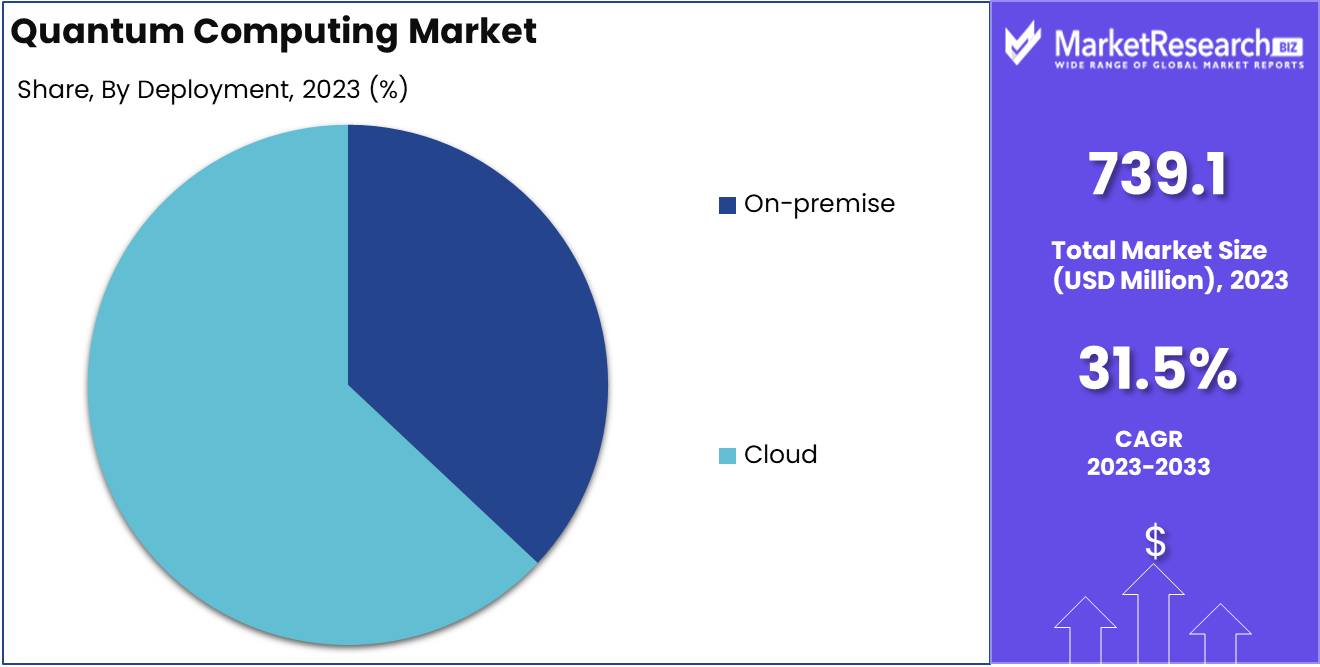

- By Deployment Analysis: Cloud deployment dominates the quantum computing market, holding a 63% share in 2023.

- By Application: Machine learning is the leading application of quantum computing, accounting for 42% of the market in 2023.

- By End-user: Healthcare is the top end-user in the quantum computing market, with a 28.2% share in 2023.

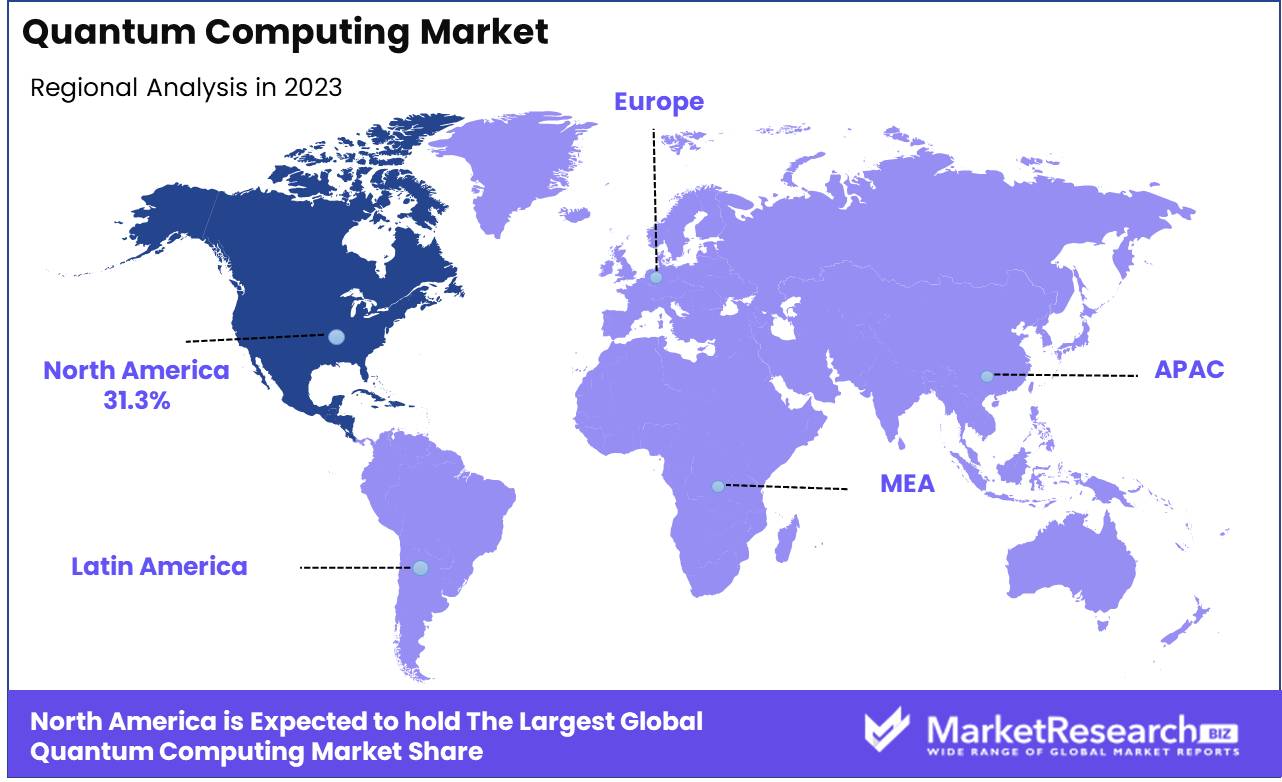

- Regional Dominance: North America is the leading region in the quantum computing market, representing 31.3% of the global market share.

- Driving Factor: Quantum cloud services are making quantum computing more accessible, driving market growth.

- Restraining Factor: Technical complexity and scalability issues are key obstacles to quantum computing adoption.

Driving factors

Emergence of Quantum Cloud Services

Increasing Demand Across Industries Fuels Quantum Computing Market Growth

The Quantum Computing Market is experiencing significant growth driven by the increasing demand across various industries, including healthcare, finance, automotive, and logistics. The healthcare industry, for example, is leveraging quantum computing to accelerate drug discovery processes and optimize treatment protocols, potentially reducing costs and improving patient outcomes. In the finance sector, quantum algorithms are being developed to enhance risk analysis and portfolio optimization, contributing to the market's expansion.Additionally, the automotive industry is exploring quantum computing for optimizing supply chain logistics and developing autonomous vehicle technologies, further driving market growth. This cross-industry demand is creating a robust foundation for the expansion of quantum computing applications, making it a key factor in the market's overall growth trajectory.

Emergence of Quantum Cloud Services Boosts Accessibility and Adoption

The emergence of quantum cloud services is another pivotal driving factor contributing to the growth of the Quantum Computing Market. These services enable businesses and research institutions to access quantum computing resources without the need for significant capital investment in hardware. Major players like IBM, Google, and Microsoft have introduced quantum cloud platforms, allowing users to experiment with quantum algorithms and develop applications across various sectors. This accessibility has led to a surge in quantum computing adoption, particularly in regions with strong IT infrastructure.

Moreover, government initiatives in countries like the United States and China, where significant funding is being allocated to quantum technology research, are further supporting the growth of quantum cloud services. These initiatives, combined with private sector investments, are creating a conducive environment for the widespread adoption of quantum computing, making it a critical factor in the market's expansion.

Restraining Factors

Technical Complexity and Scalability Limitations: A Barrier to Quantum Computing Adoption

The technical complexity and scalability limitations inherent in quantum computing serve as significant restraining factors for the market's growth. Quantum computers rely on qubits, which are highly sensitive to external disturbances, necessitating extremely precise control and error correction. This complexity not only limits the scalability of quantum systems but also increases the cost and time required for research and development (R&D).

A 2023 survey from the National Institute of Standards and Technology (NIST) highlights that only 12% of organizations exploring quantum computing have successfully scaled their quantum projects beyond experimental stages. This low scalability rate is a key barrier, impeding broader adoption across industries such as finance, healthcare, and logistics, which require scalable solutions to justify significant investments. Furthermore, this complexity demands highly specialized skills, contributing to a shortage of qualified professionals, which in turn slows market expansion. Despite the promising potential of quantum computing, these technical challenges continue to restrain the market by limiting the pace of commercialization.

High Resource Requirements: Elevated Costs and Infrastructure Demands

Quantum computing high resource requirements, particularly in terms of energy consumption, infrastructure, and specialized talent, are major restraining factors that limit its market growth. For instance, maintaining quantum computers at near absolute zero temperatures to prevent qubit decoherence demands highly advanced and expensive cooling systems. The energy costs alone can be prohibitive, with estimates suggesting that a fully operational quantum computer may require up to 10,000 times more energy than a conventional supercomputer, depending on the application.

In addition, significant investments in infrastructure are needed to house quantum systems. Data from the Quantum Computing Report (2023) indicates that setting up a basic quantum computing lab can cost upwards of $10 million, with operational costs adding an additional 20-30% annually. This level of financial commitment is often beyond the reach of smaller enterprises and even some larger organizations, leading to slower adoption rates across industries like automotive, aerospace, and pharmaceuticals.

Moreover, the private sector's cautious investment approach reflects these high costs. While government initiatives in countries like the U.S. and China have led to substantial public funding for quantum research, private investments remain comparatively conservative. In 2022, global private investments in quantum computing totaled approximately $2 billion, a fraction of the over $300 billion invested in artificial intelligence during the same period. This disparity highlights the perceived risks associated with the high resource demands of quantum computing, further restraining the market’s growth potential.

By Component Analysis

Software Segment Dominates with 58.7% Market Share in 2023

In 2023, the Software segment held a dominant position in the "By Component" segment of the Quantum Computing Market, capturing more than 58.7% of the market share. This significant share underscores the critical role software plays in the advancement and commercialization of quantum computing technologies. As quantum computing continues to evolve, software solutions are increasingly crucial for algorithm development, quantum simulation, and overall system optimization. The high demand for quantum software is driven by its applicability across various industries, such as pharmaceuticals, finance, and cryptography, where quantum algorithms are being developed to solve complex problems that classical computers cannot efficiently address.

Conversely, the Hardware segment, while also vital to the quantum computing ecosystem, accounted for a smaller portion of the market. Hardware development in quantum computing is inherently challenging due to the complexities involved in creating stable qubits and maintaining quantum coherence. Despite these challenges, the Hardware segment remains essential as advancements in quantum processors, error correction, and qubit technology are fundamental to the realization of fully functional quantum computers.

The Hardware segment is expected to witness steady growth as research progresses and more robust and scalable quantum systems are developed. However, in the current market landscape, software remains the driving force behind the practical application and adoption of quantum computing technologies, positioning it as the leading component within the industry.

By Deployment Analysis

Cloud Dominates the Quantum Computing Market by Deployment with a 63% Share in 2023

In 2023, the Quantum Computing Market saw significant segmentation in deployment methods, highlighting the prominence of cloud-based solutions. Notably, Cloud held a dominant market position in the "By Deployment" segment, capturing more than a 63% share. This substantial portion underscores the increasing reliance on cloud platforms for quantum computing operations, driven by their scalability, ease of access, and reduced overhead costs compared to traditional on-premise setups.

On the other hand, On-premise solutions, while still relevant, have observed a more limited adoption. The data suggests a gradual shift in preference towards cloud solutions, as organizations aim to leverage the advanced computational capabilities of quantum computing without the need for extensive physical infrastructure. This trend is indicative of a broader movement within the technology sector towards cloud-based services, offering a glimpse into the evolving dynamics of quantum computing deployment.

By Application

Machine Learning Dominates Quantum Computing Market in 2023 with 42% Share In 2023, Machine Learning held a dominant market position in the Quantum Computing Market by Application segment, capturing more than a 42% share. This leadership can be attributed to the growing demand for advanced data processing and predictive analytics across various industries, which quantum computing significantly enhances. The ability of quantum computing to process vast datasets and improve machine learning algorithms has accelerated adoption in this segment, making it the primary driver of market growth.

Optimization emerged as the second most significant application area, accounting for approximately 25% of the market share. Industries such as logistics, energy, and manufacturing increasingly rely on quantum optimization techniques to solve complex problems more efficiently than classical computing allows. The focus on reducing operational costs and improving efficiency has driven substantial investments in this area.

Biomedical Simulations followed, with around 15% of the market share, driven by the need for more accurate and faster simulations in drug discovery and personalized medicine. Quantum computing potential to simulate molecular interactions at a quantum level offers unprecedented precision, making it a vital tool in biomedical research.

Financial Services accounted for approximately 10% of the market, as the sector continues to explore quantum computing for risk analysis, fraud detection, and portfolio optimization. The financial industry's pursuit of faster, more accurate computational methods for managing complex financial models has spurred growth in this segment.

Electronic Material Discovery captured about 5% of the market share, driven by the need for advanced materials in electronics and semiconductors. Quantum computing enables the discovery of new materials with unique properties, enhancing the development of next-generation electronic devices.The remaining

Others category, which includes niche applications such as quantum cryptography and weather forecasting, represented the final 3% of the market. While these applications are still in the exploratory stage, their future potential could contribute significantly to the market as the technology matures.

By End-user

Healthcare Dominates the Quantum Computing Market with a 28.2% Share in 2023 In 2023, Healthcare held a dominant market position in the "By End-user" segment of the Quantum Computing Market, capturing more than a 28.2% share. This significant market presence is largely attributable to the sector's increasing reliance on quantum computing for advancements in drug discovery, personalized medicine, and complex data analysis. The ability of quantum computing to process and analyze vast datasets at unprecedented speeds has proven invaluable in addressing some of the most challenging problems in healthcare, such as genomic sequencing and the development of new treatment protocols.

Following Healthcare, the Banking, Financial Services, and Insurance (BFSI) sector emerged as a key player in the market, accounting for a substantial share. Quantum computing potential to revolutionize cryptography, optimize trading algorithms, and enhance risk management has driven its adoption within this industry. As financial institutions seek to secure sensitive data and optimize operations, this is becoming increasingly integral to their technological strategies.

The Automotive sector also demonstrated significant engagement with quantum computing, driven by the need for advanced simulation and optimization capabilities in areas such as autonomous vehicle development, battery research, and supply chain management. As the industry moves towards electric and self-driving vehicles, quantum computing offers critical support in solving complex optimization problems that traditional computing methods struggle to address.

Energy and Utilities is another key end-user segment leveraging quantum computing, particularly in areas like energy distribution, resource optimization, and the development of new materials for energy storage. The sector's push towards renewable energy sources and the optimization of existing infrastructure aligns well with the capabilities of quantum computing, enabling more efficient and sustainable energy solutions.

The Chemical industry has increasingly adopted quantum computing to accelerate research in molecular modeling and the development of new materials. The ability to simulate chemical reactions with high accuracy allows for more efficient experimentation and innovation, particularly in the development of pharmaceuticals, agrochemicals, and new materials.

Manufacturing is also tapping into quantum computing to enhance various aspects of production, from process optimization to the design of new products. By utilizing quantum algorithms, manufacturers can solve complex problems related to supply chain logistics, product design, and material science, leading to more efficient production cycles and innovative product offerings.

The Transportation and Logistics sector has begun to explore quantum computing as a means to optimize routing, scheduling, and supply chain management. As the demand for faster and more efficient logistics grows, quantum computing Industry offers a powerful tool to address these challenges, particularly in global logistics networks.

Finally, the "Others" category, which includes sectors such as retail, telecommunications, and government, is gradually recognizing the potential of quantum computing. Although these industries currently represent a smaller share of the market, their adoption of quantum technologies is expected to grow as they seek to leverage its advantages in areas such as data analysis, customer experience enhancement, and cybersecurity.

Key Market Segments

By Component

- Hardware

- Software

By Deployment

- On-premise

- Cloud

By Application

- Machine Learning

- Optimization

- Biomedical Simulations

- Financial Services

- Electronic Material Discovery

- Others

By End-user

- Healthcare

- BFSI

- Automotive

- Energy and Utilities

- Chemical

- Manufacturing

- Transportation and Logistics

- Others

Growth Opportunity

Expanding Technological Advancements

The global quantum computing market is poised for significant growth in 2024, driven by rapid technological advancements. Key innovations in quantum processors and quantum error correction are accelerating the development of more powerful and reliable quantum systems. This technological progress is expected to reduce the entry barriers for various industries, allowing more sectors to explore the applications.

Industries such as pharmaceuticals, finance, and materials science stand to benefit immensely from quantum computing ability to solve complex problems at unprecedented speeds. As a result, companies investing in quantum research and development are likely to gain a competitive edge in their respective markets.

Latest Trends

Growing Demand for Cybersecurity Solutions

The rising threat of cyberattacks is another critical factor driving growth in the quantum computing market. As traditional encryption methods become increasingly vulnerable to sophisticated hacking techniques, The market offers a promising solution. Quantum cryptography, specifically Quantum Key Distribution (QKD), is emerging as a game-changer in securing sensitive data against quantum-level threats.

Governments and enterprises worldwide are expected to increase investments in quantum-based cybersecurity solutions to protect critical infrastructure and confidential information. This surge in demand for robust cybersecurity measures is anticipated to be a significant growth driver for the market in 2024.

Advancements in Quantum Hardware and Software

The year 2024 is poised to be transformative for quantum computing, marked by significant advancements in both hardware and software. On the hardware front, the focus is shifting from merely increasing qubit count to improving qubit quality and coherence time, which are critical for achieving quantum supremacy. Innovations in error correction and noise reduction are expected to enhance the reliability and scalability of quantum systems.

Meanwhile, quantum software is becoming increasingly sophisticated, with improved algorithms and development environments that are more user-friendly. This evolution is lowering the barrier to entry for businesses, enabling more companies to explore quantum solutions. The convergence of these hardware and software advancements is anticipated to accelerate the deployment of quantum computing in real-world applications, bringing the technology closer to mainstream adoption.

Regional Analysis

North America

North America leads the global quantum computing market, accounting for 31.3% of the market largest share. This dominance is driven primarily by the United States, which is a hub for technological innovation and home to major companies and research institutions. The U.S. government and private sector investments, such as the National Quantum Initiative Act and funding from tech giants like IBM and Google, have accelerated the development and commercialization of quantum technologies. Canada also contributes significantly, with strong research programs and public-private partnerships in quantum computing. The region's advanced infrastructure and strong intellectual property laws further enhance its leadership position.Europe

Europe represents a significant portion of the quantum computing market, characterized by robust R&D initiatives and a supportive regulatory environment. Germany, France, and the UK are at the forefront, with substantial investments in national quantum strategies. Germany, in particular, has allocated significant funding to quantum research, positioning itself as a key player in the European quantum landscape. The UK, through its National Quantum Technologies Programme, and France, with its Quantum Plan, are also making substantial strides. Countries like Spain, the Netherlands, and Italy are fostering innovation through academic collaborations and government support. However, Europe faces challenges in matching North America’s pace due to fragmented efforts across the continent.Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the quantum computing market, driven by significant investments and strategic initiatives in countries like China, Japan, and South Korea. China, with its ambitious national strategies and substantial state funding, is emerging as a formidable competitor to North America, focusing on quantum supremacy and encryption technologies. Japan is advancing quantum research through government-industry collaborations, while South Korea is prioritizing quantum computing in its ICT strategies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

As the global quantum computing market evolves rapidly in 2024, a few key players continue to shape the landscape, each bringing unique strengths and strategic initiatives to the table.

IBM Corporation stands out with its long-term commitment to quantum research, leveraging the IBM Quantum Network to foster an ecosystem of partners and clients exploring real-world applications. IBM's open-source quantum development platform, Qiskit, has solidified its role as a leader in quantum software.

Google Quantum AI has made significant strides, particularly with its quantum supremacy claim, which set a benchmark for computational power. The company’s focus on error correction and scalable quantum architectures positions it as a formidable competitor in the race towards practical quantum computing.

Microsoft Corporation differentiates itself with a full-stack approach, emphasizing its Azure Quantum service that integrates quantum computing with classical cloud infrastructure. This hybrid strategy enhances accessibility and practical application development, catering to a broad range of industries.

Amazon Web Services (AWS) continues to build on its cloud dominance, with Amazon Braket offering a diverse selection of quantum hardware and simulators, making quantum technology accessible to a wider audience of developers and researchers.

Market Key Players

- IBM Corporation

- Google Quantum AI

- Microsoft Corporation

- Amazon Web Services, Inc

- Atos Quantum

- D-Wave Quantum Inc.

- Intel

- Hitachi

- QC Ware

- Zapata Computing

- Toshiba Corporation

- Other Key Players

Recent Developments

- D-Wave Systems: In February 2024, D-Wave launched its latest 1,200+ qubit Advantage prototype, making it accessible through its Leap real-time quantum cloud service. This initiative provides users with immediate access to the cutting-edge hardware and includes complimentary usage for new subscribers.

- Rigetti Computing: In November 2023, Rigetti secured Phase 2 funding from DARPA, with a potential value of up to USD 1.5 million. This funding is intended to support the development of benchmarks for assessing the performance of large-scale quantum computers in practical, real-world scenarios.

- Google: In May 2023, Google committed USD 50 million towards quantum computing research and development, in collaboration with the University of Chicago and the University of Tokyo. This investment is part of Google’s broader strategy to advance quantum technologies and drive innovation in the field.

Report Scope

Report Features Description Market Value (2023) USD 739.1 Mn Forecast Revenue (2033) USD 10,672.5 Mn CAGR (2024-2032) 31.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component Analysis(Hardware, Software), By Deployment(On-premise, Cloud), By Application(Machine Learning, Optimization, Biomedical Simulations, Financial Services, Electronic Material Discovery, Others ) By End-user(Healthcare, BFSI, Automotive, Energy and Utilities, Chemical, Manufacturing, Transportation and Logistics, Others ) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Oracle, IBM Corporation, Nuance Communications, Inc., LivePerson, AlphaChat, Chatfuel, Botsify, Amazon.com, Inc., Verint Systems, Inc., Inbenta Holdings Inc., Baidu Inc., NVIDIA Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation

- Google Quantum AI

- Microsoft Corporation

- Amazon Web Services, Inc

- Atos Quantum

- D-Wave Quantum Inc.

- Intel

- Hitachi

- QC Ware

- Zapata Computing

- Toshiba Corporation

- Other Key Players