Pulp Market By Type of Pulp (Wood Pulp and Non-Wood Pulp), By Grade (Chemical Pulp, Mechanical Pulp, Recycled Pulp), By End Use Industry (Packaging, Printing, Building and Construction), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49162

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

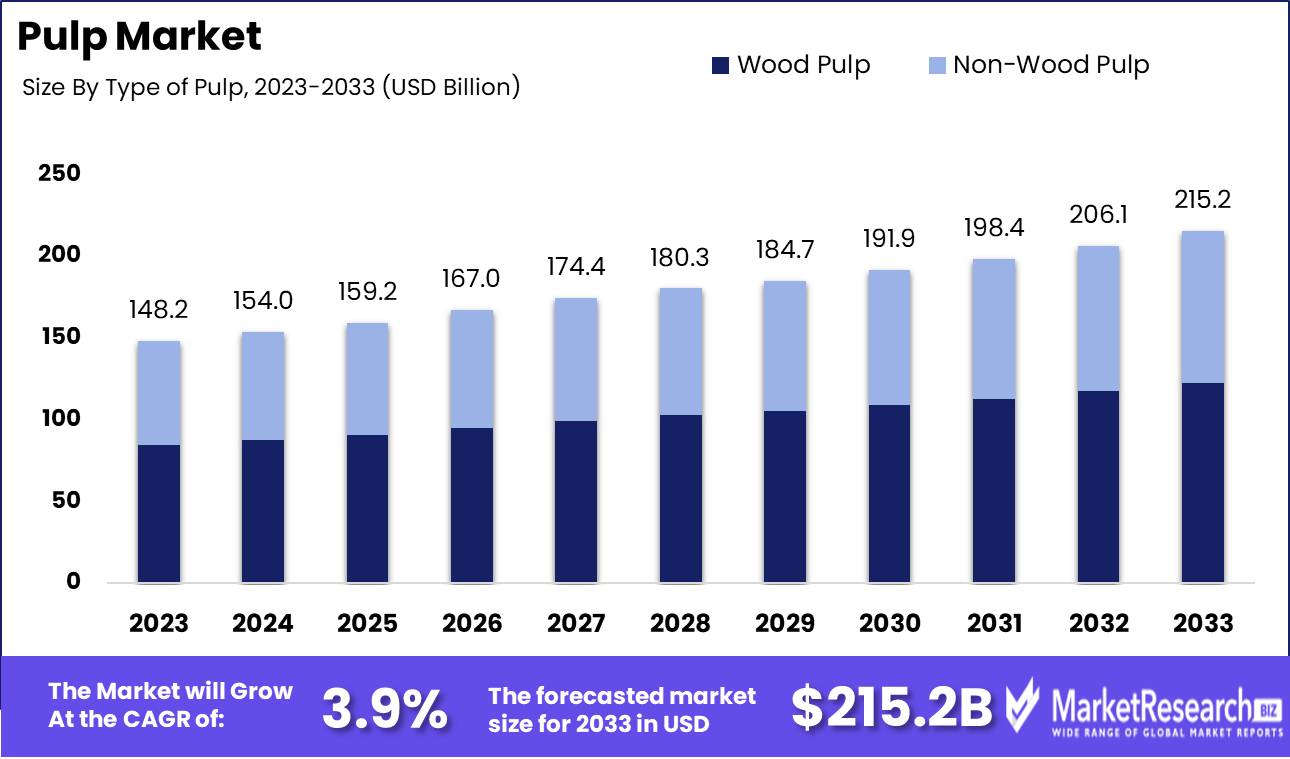

The Pulp Market was valued at USD 148.2 billion in 2023. It is expected to reach USD 215.2 billion by 2033, with a CAGR of 3.9% during the forecast period from 2024 to 2033.

The pulp market encompasses the global production and distribution of pulp, a fibrous material derived primarily from wood, but also from non-wood sources such as bamboo and recycled waste paper. This market is pivotal in the paper and textile industries, supplying raw materials essential for manufacturing paper, packaging, hygiene products, and specialty textiles. The demand within the pulp market is driven by factors including rising packaging needs due to e-commerce, sustainability trends favoring eco-friendly materials, and technological advancements in pulp production processes.

The global pulp market is positioned for steady growth, primarily influenced by an increasing consumer preference for sustainable packaging solutions and enhanced awareness of hygiene and sanitation. The shift toward environmentally friendly packaging is notably accelerating demand for paper-based products. As organizations and consumers alike seek alternatives that align with global sustainability goals, the pulp industry benefits significantly from this trend, given its critical role in the production of eco-friendly packaging materials.

Moreover, the rise in consumer awareness concerning hygiene has catalyzed the demand for tissue and hygiene products. This shift is not only a reflection of changing consumer habits but also of broader health and wellness trends that prioritize cleanliness and personal care. However, the industry faces challenges imposed by stricter environmental regulations, which mandate rigorous standards for waste management and sustainable practices. Despite these hurdles, the market's trajectory remains positive, with projections indicating robust growth in the demand for paper and paperboard products for both packaging and tissue applications. This growth is expected to be sustained by the ongoing innovations and adaptations within the industry, aimed at overcoming environmental challenges while meeting the escalating consumer demand.

Key Takeaways

- Market Growth: The Pulp Market was valued at USD 148.2 billion in 2023. It is expected to reach USD 215.2 billion by 2033, with a CAGR of 3.9% during the forecast period from 2024 to 2033.

- By Type of Pulp: Wood Pulp dominates the Pulp Market with sustainable, superior fiber quality.

- By Grade: Chemical Pulp dominates the Pulp Market, with Mechanical and Recycled following.

- By End Use Industry: Packaging dominates the Pulp Market, driven by sustainability and innovation.

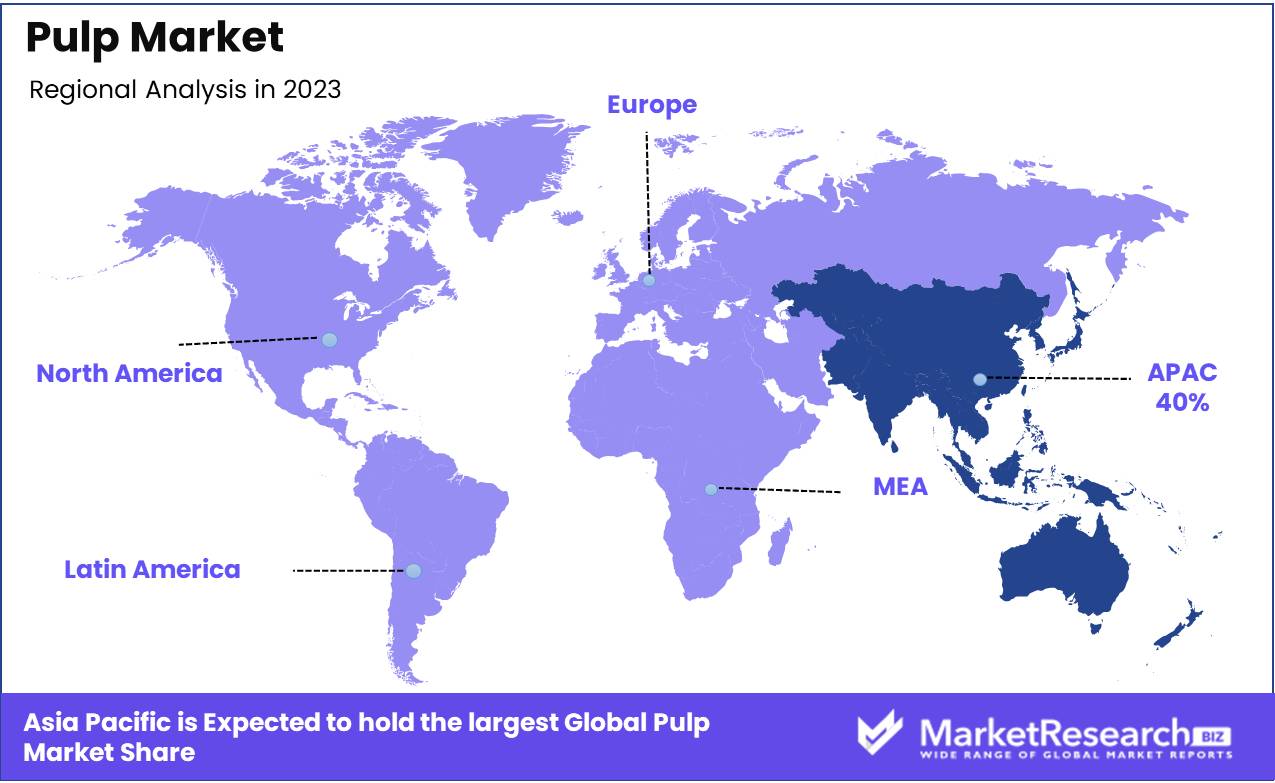

- Regional Dominance: Asia Pacific dominates the global pulp market, leading with a 40% largest share.

- Growth Opportunity: The global pulp market is set to grow significantly, driven by rising demands in personal care and chemical-grade pulp.

Driving factors

Increased Demand for Paper and Packaging Products

The pulp market is experiencing significant growth primarily due to the escalating demand for paper and packaging products. As global trade and e-commerce activities expand, there is a corresponding increase in the need for packaging solutions, which predominantly utilize pulp-based materials. This is particularly evident in sectors like retail and food services, where the demand for effective and sturdy packaging continues to rise. Statistically, the global packaging industry has witnessed growth rates of approximately 3-4% annually, a trend that is expected to persist, thereby directly influencing the pulp market's expansion.

Rising Demand for Sustainable and Eco-friendly Packaging

Environmental sustainability has become a central focus for industries and consumers alike, leading to a surge in demand for eco-friendly packaging solutions. Pulp-based packaging options are highly favored in this shift because they are biodegradable, recyclable, and generally have a lower carbon footprint compared to plastic alternatives. This trend is supported by increasing regulatory pressures and consumer preferences for sustainable products. For instance, several governments have implemented regulations that encourage the use of environmentally friendly materials, which has further propelled the growth of the pulp industry as manufacturers seek compliant, sustainable raw materials.

Heightened Consumption of Chemical Wood Pulp

Chemical wood pulp, known for its strength and high-quality finish, is increasingly preferred for various applications, including high-end paper products and specialty packaging. The demand for this type of pulp is driven by its superior properties, such as enhanced durability and better printability, which are essential for both consumer and industrial applications. The global market for chemical wood pulp has seen robust growth, with projections indicating continued expansion, spurred by innovations in pulp processing technologies that enhance its appeal and functionality.

Restraining Factors

High Initial Investment: A Barrier to Entry and Expansion

The pulp industry is characterized by significant capital requirements due to the high cost of establishing and maintaining pulp mills. These costs include the acquisition of advanced machinery, sustainable technologies, and compliance with environmental regulations. High initial investments act as a major barrier to entry for new players and can restrict the expansion capabilities of existing firms. This limitation affects market growth by reducing competition and innovation within the industry. The necessity for substantial financial resources can deter smaller players and startups from entering the market, thus potentially leading to a concentration of market power among a few large entities.

Availability of Wood Resources: A Critical Dependency with Geographic Limitations

The availability of wood resources is another crucial factor influencing the pulp market. Pulp production is heavily dependent on a steady supply of wood, which varies significantly by geographic region. Areas rich in forest resources have a competitive advantage, while regions with limited wood availability may face higher raw material costs due to the need for imports. This geographical disparity can lead to uneven market growth rates across different regions. Furthermore, factors such as deforestation, environmental regulations, and competition from other industries (like timber and paper) for wood resources compound the impact on the pulp market, limiting production capacities and elevating operational costs.

By Type of Pulp Analysis

Wood Pulp dominates the Pulp Market with sustainable, superior fiber quality.

In 2023, Wood Pulp held a dominant market position in the "By Type of Pulp" segment of the Pulp Market, which primarily includes Wood Pulp and Non-Wood Pulp categories. This predominance can be attributed to its extensive utilization across various industries, including paper manufacturing, textile production, and specialty cellulose products. Wood Pulp's significant market share is driven by its superior fiber quality, which is essential for producing high-strength paper products, and its sustainable sourcing practices, appealing to environmentally conscious consumers and businesses.

Conversely, the Non-Wood Pulp segment, comprising sources like bamboo, straw, and other fibrous materials, caters to a niche but growing market focused on sustainability and reduced environmental impact. Although this segment represents a smaller proportion of the market, it is gaining traction due to rising demand for eco-friendly and innovative pulp solutions, particularly in regions with limited wood resources but abundant agricultural waste products. The dynamic between these two segments underscores a broader industry trend toward diversification and sustainability in raw material sourcing.

By Grade Analysis

Chemical Pulp dominates the 2023 Pulp Market, with Mechanical and Recycled following.

In 2023, Chemical Pulp held a dominant market position in the By Grade segment of the Pulp Market, reflecting its extensive utility across various industries due to its superior strength and brightness, essential for high-quality paper production. Chemical pulp, processed using chemicals to break down the lignin and separate fibers, commands a significant market share due to its ability to produce a cleaner, more uniform texture, which is highly valued in paper manufacturing for printing and writing purposes.

Following closely, Mechanical Pulp is appreciated for its cost-effectiveness and high yield. This grade of pulp retains most of the wood's original structure, resulting in a product with a high retention of lignin, which imparts natural brightness but lower strength. Mechanical pulp is predominantly used in newsprint and other applications where strength is less critical.

Lastly, Recycled Pulp underscores the industry's shift towards sustainability. This segment has been gaining traction as environmental regulations tighten and consumer preference shifts towards eco-friendly products. Recycled pulp is primarily used in packaging solutions and tissue paper products, reflecting a robust commitment to reducing the industry's environmental footprint while meeting the economic criteria of various stakeholders.

By End Use Industry Analysis

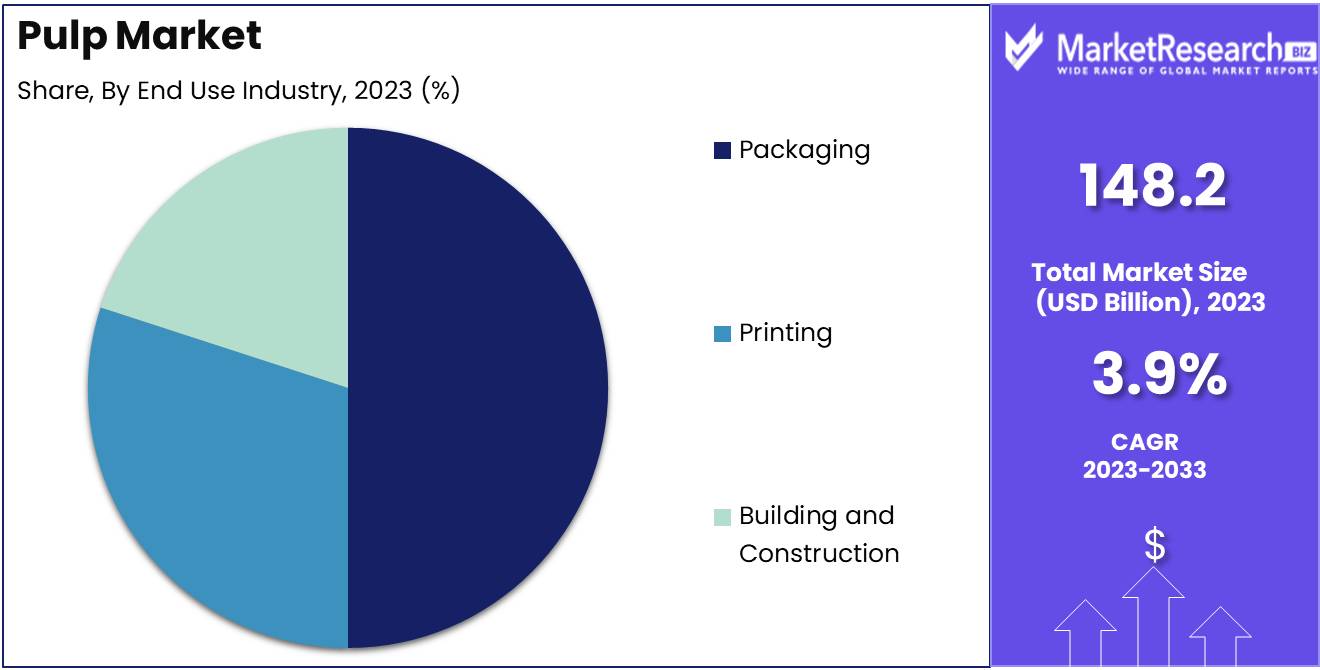

Packaging dominates Pulp Market, driven by sustainability and innovation.

In 2023, Packaging held a dominant market position in the By End Use Industry segment of the Pulp Market. The prominence of packaging in this segment can be attributed to the increasing demand for sustainable packaging solutions across various sectors. Companies are transitioning towards eco-friendly packaging options to align with global sustainability goals, thereby fueling the growth in pulp demand for packaging applications. This trend is supported by innovations in packaging design and materials that leverage pulp due to its biodegradability and recyclability.

Additionally, the Printing segment also showcases considerable utilization of pulp, primarily driven by the need for high-quality, durable paper products in both commercial and educational sectors. Despite the digital transformation, specific niches within the printing industry, such as luxury packaging and specialty publications, continue to demand premium pulp-based paper.

The Building and Construction segment further integrates pulp primarily for specialty products like acoustical panels and insulation, aligning with the rising construction activities globally. Pulp's attributes of thermal insulation and soundproofing enhance its adoption in modern construction practices, marking its critical role across multiple facets of the industry.

Key Market Segments

By Type of Pulp

- Wood Pulp

- Non-Wood Pulp

By Grade

- Chemical Pulp

- Mechanical Pulp

- Recycled Pulp

By End Use Industry

- Packaging

- Printing

- Building and Construction

Growth Opportunity

Rising Demand for Personal Care and Hygiene Products

The global pulp market is poised for significant expansion, primarily driven by the surging demand for personal care and hygiene products. As global awareness and expenditures on health and hygiene continue to rise, manufacturers of personal care products are increasing their utilization of high-quality pulp to meet consumer expectations for softness, strength, and absorbency in products such as facial tissues, diapers, and sanitary pads. This trend is expected to significantly bolster market growth, as pulp remains a critical raw material for these products.

Adoption of Chemical Grade Pulp

Another pivotal growth opportunity within the pulp market stems from the increased adoption of chemical-grade pulp. This type of pulp is integral in producing higher-end and specialty paper products that require greater purity, such as filter papers and pharmaceutical products. The shift towards more sustainable and biodegradable products across various industries, including food and beverage, pharmaceuticals, and electronics, underpins the growing preference for chemical-grade pulp. Its enhanced properties, such as superior consistency and reduced impurities, make it increasingly preferred over mechanical pulp and recycled paper, thereby amplifying its market demand.

Latest Trends

Sustainable and Eco-Friendly Pulp Production

The pulp industry continues to evolve significantly with sustainability at its core. The push towards eco-friendly production practices is primarily driven by increasing environmental regulations and the growing consumer demand for sustainable products. Companies are investing in cleaner and more energy-efficient technologies to reduce the carbon footprint of pulp production processes. This trend is further supported by the adoption of closed-loop systems and the increased use of renewable energy sources in manufacturing facilities. The market's shift towards sustainable practices not only helps in meeting regulatory requirements but also enhances brand reputation and consumer loyalty, thereby potentially increasing market share in competitive sectors.

Digitalization and Changing Paper Consumption Patterns

Digitalization is significantly influencing the pulp market, altering traditional paper consumption patterns. As the world leans more towards digital media, the demand for traditional printing and writing paper has seen a relative decline. However, this trend has concurrently spurred growth in specialized pulp products designed for packaging and hygiene products, driven by the e-commerce boom and increased hygiene awareness post-pandemic. Advanced analytics and IoT integration in pulp production processes are enabling manufacturers to optimize operations and improve efficiency, leading to lower production costs and enhanced output quality. The industry's pivot towards digital solutions is not only a response to changing consumer habits but also a strategic move to harness technology for operational excellence and sustainability. This digital shift is expected to continue to reshape the pulp market landscape, with a focus on innovative uses for pulp and the development of new market segments.

Regional Analysis

Asia Pacific dominates the global pulp market, leading with a 40% largest share.

The global pulp market exhibits significant regional variations, with Asia Pacific leading the charge, accounting for over 40% of the global market share. This dominance is attributed to the region's robust demand from the paper and packaging industries, driven by rapid urbanization and increasing e-commerce activities. China and Indonesia are key players, with substantial investments in advanced pulp processing technologies enhancing their competitive edge.

North America, holding approximately 25% of the market share, follows as a major player, primarily due to the established presence of numerous paper manufacturing companies and the rising trend of sustainable packaging. The United States and Canada are pivotal markets within this region, benefiting from abundant raw material availability and technological advancements.

Europe, with a market share of around 20%, remains a significant contributor, supported by stringent environmental regulations promoting the use of recycled pulp. Germany, Sweden, and Finland are notable markets, given their strong industrial base and focus on eco-friendly practices.

Latin America and the Middle East & Africa, though smaller in comparison, are experiencing steady growth. Latin America, holding about 10% of the market share, is propelled by Brazil's vast forestry resources, while the Middle East & Africa region, accounting for roughly 5%, sees growth driven by increasing infrastructural developments and rising literacy rates.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global pulp market, International Paper remains a front-runner, leveraging extensive operations and strategic sustainability initiatives to meet the growing demand for eco-friendly paper products. Georgia-Pacific Corporation distinguishes itself with innovative production techniques that prioritize energy efficiency, reinforcing its commitment to reducing environmental impact.

Nine Dragons Paper (Holdings) Ltd. continues to dominate the Asian market, expanding its capacity to meet the burgeoning demand in the region. Stora Enso Oyj, based in Helsinki, Finland, excels in integrating digital technology into its operations, enhancing both efficiency and product quality.

Sappi Limited focuses on high-grade specialty pulp, catering to niche markets with specific quality requirements. Meanwhile, Kimberly-Clark Corporation uses its pulp primarily for the production of personal care products, staying ahead through constant innovation in material science.

UPM-Kymmene Oyj emphasizes sustainable forestry practices, aligning with global environmental standards to appeal to a conscientious consumer base. Svenska Cellulosa Aktiebolaget (SCA) invests heavily in eco-efficient technologies, maintaining a competitive edge in the sustainable products market.

Oji Holding Corporation and Nippon Paper Industries Co., Ltd. lead in technological advancements in Japan, focusing on diversified products including bio-materials. The Smurfit Kappa Group and WestRock capitalize on their global reach, offering tailored solutions across various regions, thus maintaining their significant influence in both emerging and established markets. Collectively, these key players drive innovation and sustainability, shaping the dynamics of the global pulp industry.

Market Key Players

- International Paper

- Georgia-Pacific Corporation

- Nine Dragon Paper (Holdings) Ltd.

- Stora Enso Oyj (Helsinki, Finland)

- Sappi Limited

- Kimberly-Clark Corporation

- UPM-KymmeneOyj

- Svenska CellulosaAktiebolaget (SCA)

- Oji Holding Corporation

- Nippon Paper Industries Co., Ltd.

- The Smurfit Kappa Group

- WestRock

Recent Development

- In April 2024, The UPM mill in Uruguay, with a capacity of 2.1 million tonnes, began operations. It is anticipated to reach full capacity by the end of the year, adding considerable volume to the global pulp supply.

- In March 2024, this project began ramping up, expecting to produce about 800,000 tonnes of bleached eucalyptus kraft (BEK) within the year. This expansion represents a significant boost in the global capacity for low-cost kraft pulp.

Report Scope

Report Features Description Market Value (2023) USD 148.2 Billion Forecast Revenue (2033) USD 215.2 Billion CAGR (2024-2032) 3.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Pulp (Wood Pulp and Non-Wood Pulp), By Grade (Chemical Pulp, Mechanical Pulp, Recycled Pulp), By End Use Industry (Packaging, Printing, Building and Construction) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape International Paper, Georgia-Pacific Corporation, Nine Dragon Paper (Holdings) Ltd., Stora Enso Oyj (Helsinki, Finland), Sappi Limited, Kimberly-Clark Corporation, UPM-KymmeneOyj, Svenska CellulosaAktiebolaget (SCA), Oji Holding Corporation, Nippon Paper Industries Co., Ltd., The Smurfit Kappa Group, WestRock Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- International Paper

- Georgia-Pacific Corporation

- Nine Dragon Paper (Holdings) Ltd.

- Stora Enso Oyj (Helsinki, Finland)

- Sappi Limited

- Kimberly-Clark Corporation

- UPM-KymmeneOyj

- Svenska CellulosaAktiebolaget (SCA)

- Oji Holding Corporation

- Nippon Paper Industries Co., Ltd.

- The Smurfit Kappa Group

- WestRock