Global Protein Detection Systems Market By product & services(Consumable, Instruments, Services), By Application(Diagnosis, Drug Discovery, Development, Other Applications), By End Use(Contract Research Organizations, Academic Research Institutes, Pharmaceuticals & Biotechnology Companies , Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45775

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

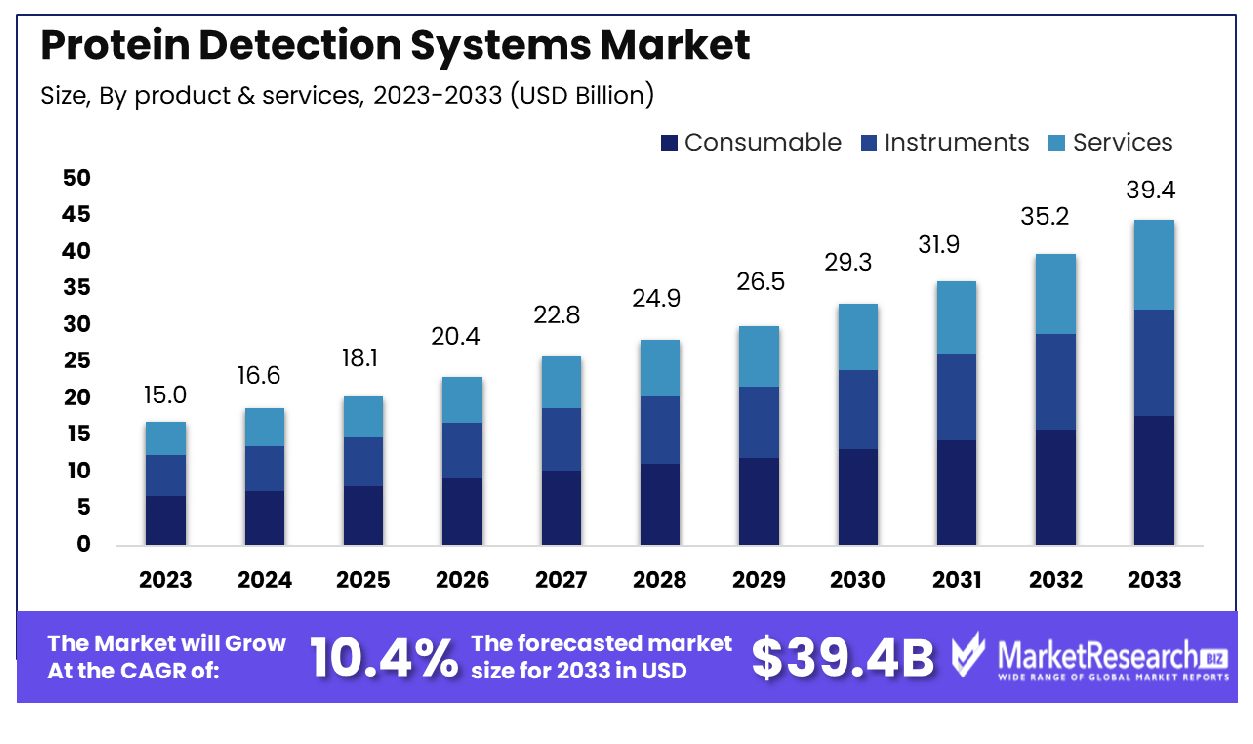

The Global Protein Detection Systems Market was valued at USD 15.0 billion in 2023. It is expected to reach USD 39.4 billion by 2033, with a CAGR of 10.4% during the forecast period from 2024 to 2033.

The Protein Detection Systems Market encompasses technologies and methodologies utilized for identifying and quantifying proteins in biological samples. These systems are integral in various applications, including medical diagnostics, pharmaceutical development, and biological research. Key technologies include enzyme-linked immunosorbent assays (ELISA), mass spectrometry, and western blotting, among others.

The market's growth is driven by advancements in proteomics, rising demand for personalized medicine, and the increasing prevalence of chronic diseases. Companies within this sector focus on enhancing the sensitivity, accuracy, and throughput of detection systems, catering to the needs of healthcare providers, researchers, and biopharmaceutical firms aiming for precise protein analysis and biomarker discovery.

The Protein Detection Systems Market is witnessing significant growth driven by advancements in proteomics and increasing research in disease diagnostics and therapeutic development. The rising global burden of cardiovascular diseases (CVD), which affected approximately 56.9% of the population between 2017 and 2020 as reported by NHANES, underscores the critical need for enhanced diagnostic tools.

CVD encompasses conditions such as coronary heart disease, heart failure, and stroke, with ischemic heart disease being the leading cause. Despite a 30.8% reduction in the age-standardized death rate for ischemic heart disease from 1990 to 2019, it remains a significant cause of mortality globally. This persistent prevalence highlights the importance of precise and early detection systems in improving patient outcomes.

Protein detection systems play a crucial role in identifying biomarkers associated with various diseases, including CVD. The integration of advanced technologies such as multiplex assays, immunohistochemistry, and mass spectrometry has enhanced the sensitivity and specificity of these systems, facilitating early diagnosis and personalized treatment strategies.

Furthermore, the increasing investment in healthcare infrastructure and the expansion of research activities in genomics and proteomics are expected to propel market growth. The emphasis on personalized medicine and the growing demand for targeted therapeutics further contribute to the market’s expansion.

Key Takeaways

- Market Growth: The Global Protein Detection Systems Market was valued at USD 15.0 billion in 2023. It is expected to reach USD 39.4 billion by 2033, with a CAGR of 10.4% during the forecast period from 2024 to 2033.

- By product & services: Consumable products lead to market demand, driven by their essential role in research and development processes.

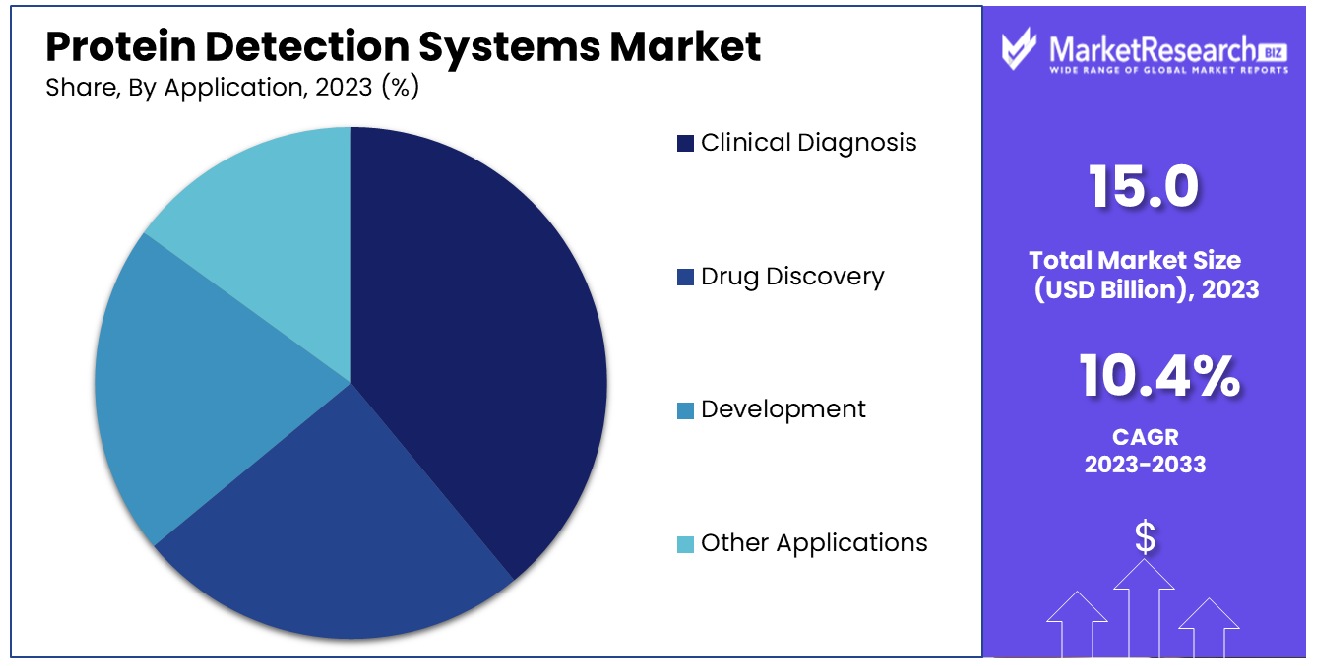

- By Application: Drug discovery applications heavily influence market dynamics due to ongoing innovations and emerging technologies.

- By End Use: Pharmaceuticals and biotechnology firms represent the primary end users, reflecting a focused market orientation.

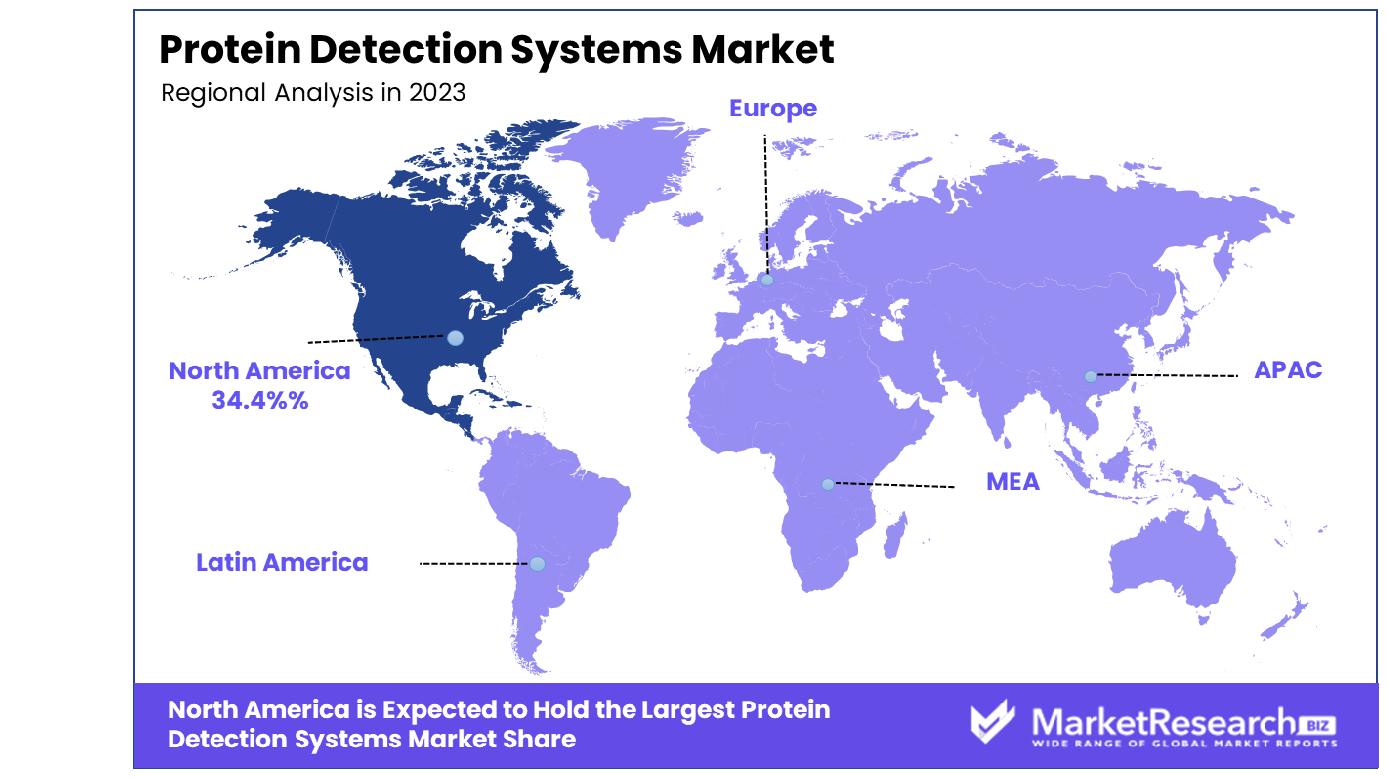

- Regional Dominance: North America holds a 34.4% share of the protein detection systems market.

- Growth Opportunity: The 2023 growth in the global protein detection systems market is driven by strategic pharmaceutical partnerships and enhanced multiplexing capabilities, boosting innovation, efficiency, and adoption in research and clinical diagnostics.

Driving factors

Expansion of the Biopharmaceutical Industry and Focus on Protein-Based Drugs

The expansion of the biopharmaceutical industry, coupled with an increasing focus on protein-based drugs, is significantly propelling the growth of the Protein Detection Systems Market. The biopharmaceutical sector, which is expected to continue expanding at a compound annual growth rate (CAGR) of approximately 7%, has witnessed a surge in the development and approval of protein-based therapeutics, such as monoclonal antibodies and recombinant proteins.

This expansion is driven by the efficacy and specificity of protein-based drugs in treating various chronic and rare diseases, leading to a higher demand for sophisticated protein detection systems. These systems are essential for ensuring the quality, efficacy, and safety of biopharmaceutical products, thereby directly influencing market growth.

Rising Investments in Healthcare Research Infrastructure

Rising investments in healthcare research infrastructure are a crucial driving force behind the growth of the Protein Detection Systems Market. Governments and private entities are increasingly allocating funds to enhance research capabilities, with global R&D spending in the healthcare sector reaching over $200 billion annually.

This influx of investment facilitates the adoption of advanced technologies and equipment, including cutting-edge protein detection systems. Enhanced research infrastructure supports more extensive and sophisticated studies on protein functions and interactions, which are critical for drug discovery and development, thereby accelerating the demand for advanced protein detection solutions.

Growing Focus on Personalized Medicine and Precision Diagnostics

The growing focus on personalized medicine and precision diagnostics is another pivotal factor contributing to the expansion of the Protein Detection Systems Market. Personalized medicine, which is anticipated to achieve a market size of $3.18 billion by 2025, relies heavily on precise protein detection to tailor treatments to individual genetic profiles. This approach enhances the effectiveness of therapies and minimizes adverse effects, thus driving the demand for high-accuracy protein detection technologies.

Precision diagnostics, which utilize specific protein biomarkers for early and accurate disease diagnosis, further boost the market as they require sophisticated detection systems to deliver reliable and actionable insights. The integration of personalized medicine and precision diagnostics creates a robust demand for advanced protein detection systems, thereby significantly enhancing market growth.

Restraining Factors

High Cost of Protein Detection Systems

The high cost of protein detection systems is a significant restraining factor impacting the growth of the Protein Detection Systems Market. Advanced protein detection technologies, such as mass spectrometry and next-generation sequencing, often require substantial investment in both acquisition and maintenance. These systems can range from $100,000 to several million dollars, depending on their capabilities and the required throughput.

The high initial costs and ongoing operational expenses can be prohibitive, particularly for smaller research institutions and emerging biopharmaceutical companies with limited budgets. This financial barrier limits the widespread adoption of cutting-edge protein detection technologies, thereby constraining market growth. Additionally, the need for highly skilled personnel to operate and maintain these sophisticated systems adds to the overall cost, further restricting market expansion.

Limited Sensitivity and Specificity of Current Detection Methods

The limited sensitivity and specificity of current protein detection methods present another critical challenge to the growth of the Protein Detection Systems Market. Many existing detection techniques, such as enzyme-linked immunosorbent assays (ELISAs) and western blotting, often struggle with detecting low-abundance proteins or distinguishing between closely related protein isoforms.

This limitation reduces their effectiveness in applications requiring high precision, such as early disease diagnosis and the development of targeted therapies. The inherent constraints of these methods can lead to false positives or negatives, undermining the reliability of diagnostic results and research findings.

Consequently, the limited performance of current detection technologies hinders their utility in advancing personalized medicine and precision diagnostics, thereby restricting market growth. This challenge underscores the need for continued innovation and development of more sensitive and specific protein detection systems to meet the evolving demands of the healthcare and biopharmaceutical industries.

By product & services Analysis

Consumable products and services dominate the market landscape, catering to the ongoing needs of the pharmaceutical and biotechnology sectors.

In 2023, consumables held a dominant market position within the by-product & services segment of the Protein Detection Systems Market. Consumables, including reagents, kits, and antibodies, constituted a substantial portion of market revenue due to their recurrent demand in various protein detection applications. The frequent usage of these consumables in research and diagnostic laboratories significantly contributed to their leading market share. The rise in research activities and the growing prevalence of diseases requiring protein analysis further bolstered the demand for consumables.

The instruments segment, encompassing mass spectrometers, chromatography systems, and electrophoresis apparatus, also demonstrated substantial growth. Technological advancements in instrumentation have enhanced the sensitivity and accuracy of protein detection, thereby driving the adoption of sophisticated instruments. The increasing focus on proteomics research and the development of advanced analytical tools have been pivotal in propelling the instruments segment forward.

Services, including contract research, sample preparation, and data analysis, represented a growing segment within the protein detection systems market. The outsourcing trend among pharmaceutical and biotechnology companies to specialized service providers has been a key driver. This trend is attributed to the need for cost-effective solutions and expertise in protein analysis, which has led to an increased reliance on third-party service providers.

Overall, the protein detection systems market is characterized by a diverse product and service landscape, with consumables leading the segment, followed by instruments and services. The continuous advancements in technology and the expanding applications of protein detection are expected to sustain the growth trajectory of this market segment in the coming years. The integration of advanced technologies and the increasing demand for high-throughput and precise protein analysis are anticipated to further enhance market dynamics.

By Application Analysis

Drug discovery applications wield significant influence, driving innovation and investment within the pharmaceutical industry.

In 2023, drug discovery held a dominant market position within the by-application segment of the Protein Detection Systems Market. This segment's prominence is primarily attributed to the burgeoning demand for advanced protein analysis tools in the identification and validation of drug targets. The pharmaceutical and biotechnology industries have increasingly relied on protein detection systems to expedite the drug discovery process, enhancing the accuracy and efficiency of target identification and lead optimization. The significant investment in research and development by major pharmaceutical companies has further propelled the growth of this segment.

Clinical diagnosis represented a substantial portion of the market, driven by the increasing prevalence of chronic diseases and the need for precise diagnostic tools. Protein detection systems have become integral to clinical diagnostics, offering high sensitivity and specificity in detecting biomarkers associated with various diseases. The rise in personalized medicine and the growing emphasis on early disease detection have amplified the demand for advanced protein detection technologies in clinical settings.

The development segment, encompassing protein engineering and modification applications, has shown notable growth. This segment benefits from the expanding scope of proteomics research and the need for innovative approaches in protein modification and engineering. The continuous advancements in genetic engineering and synthetic biology have further augmented the adoption of protein detection systems in developmental applications.

Other applications, including environmental monitoring and food safety, also contributed to the market, albeit to a lesser extent. The diverse utility of protein detection systems across various sectors underscores their versatility and broad applicability.

Overall, the protein detection systems market is significantly influenced by its application in drug discovery, followed by clinical diagnosis, development, and other applications. The ongoing advancements in proteomics and the increasing demand for targeted therapeutic approaches are expected to sustain the growth momentum of the drug discovery segment, reinforcing its leading position in the market. The expanding applications in clinical diagnostics and development are also poised to contribute to the market’s robust growth trajectory.

By End-Use Analysis

Pharmaceuticals and biotechnology companies stand as primary end-users, fueling demand for consumables and driving drug discovery advancements.

In 2023, pharmaceuticals and biotechnology companies held a dominant market position within the by-end-use segment of the Protein Detection Systems Market. This segment’s dominance is driven by the extensive application of protein detection systems in drug discovery, development, and clinical trials. The growing focus on personalized medicine and targeted therapies has necessitated advanced protein analysis, leading to increased adoption of these systems by pharmaceutical and biotechnology firms. The substantial investments in research and development by these companies have further fueled the demand for sophisticated protein detection technologies.

Contract Research Organizations (CROs) also accounted for a significant market share, reflecting the trend toward outsourcing research activities to specialized service providers. CROs have increasingly utilized protein detection systems to provide high-quality, cost-effective research services, supporting pharmaceutical and biotechnology companies in their drug discovery and development processes. The need for efficient and scalable research solutions has bolstered the growth of the CRO segment.

Academic research institutes represented a crucial segment, driven by the ongoing advancements in proteomics research and the emphasis on basic scientific research. These institutions have been pivotal in pioneering new methodologies and applications for protein detection systems, contributing to the overall technological advancement of the market. The availability of funding for research projects and collaborations with industry players has supported the growth of this segment.

Other end users, including diagnostic laboratories and environmental monitoring agencies, contributed to the market's diversity. These sectors leverage protein detection systems for various applications, including disease diagnostics and environmental monitoring, highlighting the versatility of these technologies.

Overall, the protein detection systems market is predominantly influenced by the extensive use by pharmaceuticals and biotechnology companies, followed by contract research organizations, academic research institutes, and other sectors. The increasing focus on innovative drug development and the expanding scope of proteomics research is expected to sustain the growth momentum in the pharmaceuticals and biotechnology segment. The continuous advancements in technology and the broadening application landscape are anticipated to further enhance market dynamics in the coming years.

Key Market Segments

By product & services

- Consumable

- Instruments

- Services

By Application

- Clinical Diagnosis

- Drug Discovery

- Development

- Other Applications

By End Use

- Contract Research Organizations

- Academic Research Institutes

- Pharmaceuticals & Biotechnology Companies

- Others

Growth Opportunity

Partnerships with Pharmaceutical and Biotech Companies

The global protein detection systems market has witnessed significant growth opportunities in 2023, driven largely by strategic partnerships with pharmaceutical and biotechnology companies. These collaborations are pivotal in advancing research and development, particularly in drug discovery and personalized medicine. By leveraging the expertise and resources of pharmaceutical giants, protein detection system manufacturers can enhance the precision and efficiency of their technologies.

This synergy facilitates the development of innovative solutions that cater to the increasing demand for advanced diagnostic tools and therapeutic interventions. Additionally, these partnerships enable companies to access broader markets, increase their technological capabilities, and accelerate the commercialization of new products. The collaborative approach is expected to significantly contribute to the market’s expansion, fostering innovation and improving patient outcomes on a global scale.

Enhancement of Multiplexing Capabilities

The enhancement of multiplexing capabilities represents a crucial growth opportunity for the protein detection systems market in 2023. Multiplexing allows simultaneous detection and quantification of multiple proteins, thereby increasing throughput and reducing sample requirements. This advancement is particularly beneficial in complex biological research and clinical diagnostics, where the ability to analyze multiple biomarkers concurrently is essential.

Companies are investing in the development of high-throughput multiplexing platforms that offer greater sensitivity, specificity, and cost-effectiveness. These enhanced capabilities not only streamline workflows but also provide comprehensive insights into protein interactions and disease mechanisms. As a result, the market is poised to experience robust growth, driven by the increasing adoption of advanced multiplexing technologies in both research and clinical settings. This trend underscores the market’s potential for innovation and its critical role in advancing precision medicine and biomarker discovery.

Latest Trends

Development of Sensitive and Specific Protein Detection Assays

In 2023, the global protein detection systems market has been significantly influenced by the development of highly sensitive and specific protein detection assays. These advanced assays are crucial for detecting low-abundance proteins, which are often critical biomarkers for various diseases. The push for greater sensitivity and specificity has led to innovations in assay design, including the incorporation of novel detection technologies such as enhanced chemiluminescence, fluorescence, and mass spectrometry.

These improvements are essential for increasing the accuracy and reliability of protein quantification and characterization. Consequently, there is a marked increase in the application of these assays in clinical diagnostics, research laboratories, and pharmaceutical development. The trend towards more sensitive assays aligns with the growing need for precise and early disease detection, thereby supporting advancements in personalized medicine and targeted therapies.

Rise in Demand for Personalized Medicine Driving Protein Diagnostics

The rise in demand for personalized medicine is a major driver of the protein detection systems market in 2023. Personalized medicine emphasizes tailored therapeutic approaches based on individual patient profiles, necessitating accurate and comprehensive protein diagnostics. Protein detection systems play a pivotal role in identifying specific biomarkers that can guide the development of personalized treatment plans.

This trend is propelling the adoption of advanced protein detection technologies, including multiplex assays and next-generation sequencing platforms, which enable detailed protein profiling and biomarker discovery. The shift towards personalized healthcare is also fostering collaborations between diagnostic companies and healthcare providers to develop patient-specific diagnostic tools. As a result, the market is experiencing robust growth, driven by the need for advanced diagnostic solutions that support the paradigm shift towards personalized and precision medicine. This trend underscores the critical role of protein detection systems in enhancing patient care and treatment outcomes.

Regional Analysis

North America holds a 34.4% share in the global protein detection systems market.

The global protein detection systems market exhibits varied growth dynamics across different regions, with North America leading the market. Holding a commanding market share of 34.4%, North America is driven by advanced healthcare infrastructure, significant R&D investments, and a high prevalence of chronic diseases necessitating extensive protein analysis. The region's strong presence of key market players further reinforces its dominance.

Europe follows as a significant market, propelled by robust biotechnological advancements and favorable governmental policies supporting life sciences research. Germany, France, and the UK are pivotal contributors within Europe, with a notable emphasis on proteomics research and clinical diagnostics.

In the Asia Pacific, the market is experiencing rapid growth, attributed to increasing healthcare expenditures, expanding biopharmaceutical industries, and a rising focus on precision medicine. Countries such as China, India, and Japan are at the forefront, leveraging substantial investments in biotechnology and the growing demand for advanced diagnostic tools. The region's increasing involvement in global clinical trials further accentuates its market potential.

The Middle East & Africa region presents a developing market scenario, with growth primarily driven by improving healthcare infrastructure and increasing awareness of advanced diagnostic technologies. The UAE and South Africa are notable contributors, focusing on enhancing their healthcare capabilities and adopting modern diagnostic techniques.

Latin America showcases moderate growth, with Brazil and Mexico being key markets. The region's growth is supported by a growing biopharmaceutical sector and increasing investments in healthcare. However, economic constraints and limited healthcare infrastructure in some areas pose challenges to market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global Protein Detection Systems Market in 2023 showcases a robust landscape, characterized by significant contributions from several leading companies. Promega Corporation and Merck KGAA stand out for their extensive portfolios in molecular biology and biochemistry, offering innovative solutions that drive advancements in protein detection.

Horiba and Jeol are pivotal in providing sophisticated analytical instruments, enhancing the precision and efficiency of protein analysis. PerkinElmer and Qiagen are recognized for their comprehensive range of diagnostic tools and sample preparation technologies, catering to diverse research needs.

Sartorius AG and Shimadzu Corporation contribute significantly through their high-performance laboratory instruments and automation solutions, facilitating streamlined workflows in protein detection. Thermo Fisher Scientific and Agilent Technologies continue to dominate with their expansive product lines, integrating cutting-edge technologies that enhance sensitivity and specificity in protein assays. Analytik Jena and Bio-Rad Laboratories are notable for their innovative electrophoresis and imaging systems, which are essential in protein separation and quantification processes.

Bruker Corporation and Cleaver Scientific are acknowledged for their advanced spectroscopy and electrophoresis products, respectively, which play critical roles in proteomic research. Danaher Corporation and Eurofins Scientific leverage their extensive expertise in life sciences and contract research, providing comprehensive solutions that support drug discovery and development. Waters Corporation’s contributions, particularly in liquid chromatography, are crucial in enhancing the analytical capabilities of protein detection systems.

Collectively, these companies drive the market forward through continuous innovation, strategic partnerships, and a focus on enhancing the accuracy and efficiency of protein detection technologies, thus meeting the evolving demands of scientific research and clinical diagnostics.

Market Key Players

- Promega Corporation Merck KGAA

- Horiba

- Jeol

- PerkinElmer

- Qiagen

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific

- Agilent Technologies

- Analytik Jena

- Bio-Rad Laboratories

- Bruker Corporation

- Cleaver Scientific

- Danaher Corporation

- Eurofins Scientific

- Waters Corporation

Recent Development

- In March 2024, POSTECH researchers developed protein-based microcapsules, enabling rapid and effective detection of target molecules directly from biological samples. The innovation holds promise for early disease detection and personalized treatment.

- In March 2024, University of Bath scientists developed a forensics spray using jellyfish protein to detect fingerprints rapidly and safely. The water-soluble dye emits fluorescence, aiding crime scene investigations.

- In February 2024, MIT and Dana-Farber Cancer Institute researchers uncovered how early-stage colon cancer cells evade the immune system by activating the SOX17 gene, potentially offering new treatment avenues.

Report Scope

Report Features Description Market Value (2023) USD 15.0 Billion Forecast Revenue (2033) USD 39.4 Billion CAGR (2024-2032) 10.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By product & services(Consumable, Instruments, Services), By Application(Diagnosis, Drug Discovery, Development, Other Applications), By End Use(Contract Research Organizations, Academic Research Institutes, Pharmaceuticals & Biotechnology Companies , Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Promega Corporation Merck KGAA, Horiba, Jeol, PerkinElmer, Qiagen, Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, Agilent Technologies, Analytik Jena, Bio-Rad Laboratories, Bruker Corporation, Cleaver Scientific, Danaher Corporation, Eurofins Scientific, Waters Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Promega Corporation Merck KGAA

- Horiba

- Jeol

- PerkinElmer

- Qiagen

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific

- Agilent Technologies

- Analytik Jena

- Bio-Rad Laboratories

- Bruker Corporation

- Cleaver Scientific

- Danaher Corporation

- Eurofins Scientific

- Waters Corporation