Prosthetic Heart Valve Market Report By Type of Valves (Transcatheter Heart Valve, Transcatheter Aortic Valve, Transcatheter Mitral Valve, Tissue Heart Valve, Tissue Aortic Valve, Tissue Mitral Valve, Mechanical Heart Valve, Mechanical Aortic Valve, Mechanical Mitral Valve), By End Users, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46312

-

May 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

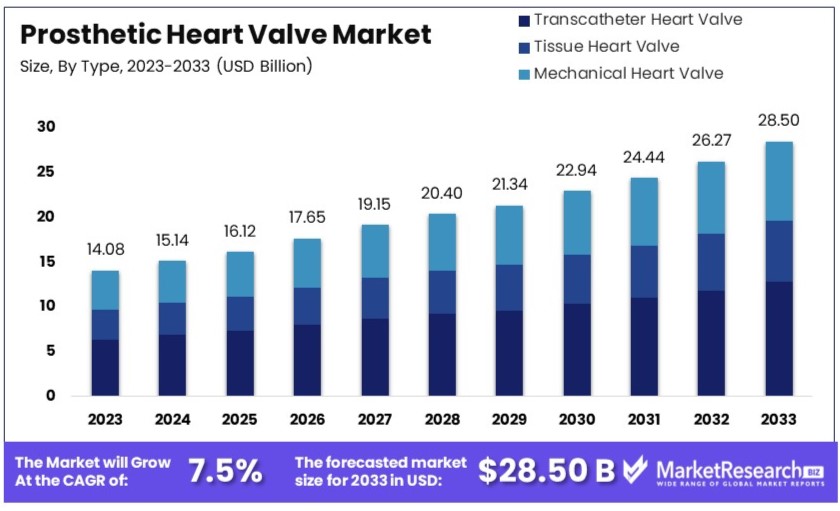

The Global Prosthetic Heart Valve Market size is expected to be worth around USD 28.50 billion by 2033, from USD 14.08 billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

The Prosthetic Heart Valve Market focuses on artificial heart valves used to replace damaged ones. These valves help patients with severe heart valve diseases. The market includes mechanical valves, bioprosthetic valves, and transcatheter valves. Mechanical valves are durable and last long. Bioprosthetic valves are made from animal tissues and offer natural functionality.

Transcatheter valves are less invasive, reducing recovery time. The market growth is driven by the aging population, rising heart disease cases, and advancements in medical technology. Key players include Medtronic, Edwards Lifesciences, and Abbott. The market is vital for improving patient outcomes and reducing healthcare costs.

The Prosthetic Heart Valve Market is expected to see strong growth due to the increasing prevalence of heart disease. Heart disease remains the leading cause of death in the United States, with 702,880 deaths recorded in 2022, equating to a death rate of 210.9 per 100,000 population. Coronary artery disease, the most common type of heart disease, affects approximately 18.2 million adults aged 20 and over.

Prosthetic heart valves are critical in treating severe heart valve diseases, which can result from various heart conditions, including coronary artery disease. Advances in medical technology have significantly improved the design and functionality of these valves, making them more effective and durable. This technological progress is driving the adoption of prosthetic heart valves, providing better outcomes for patients.

The Centers for Disease Control and Prevention (CDC) highlights that cardiovascular diseases, including heart disease and stroke, are major health concerns. The high incidence of these conditions underscores the urgent need for effective treatments, including prosthetic heart valves. These devices play a crucial role in managing heart valve diseases by replacing damaged valves and restoring normal heart function.

Moreover, the aging population is a significant factor contributing to market growth. As the population ages, the incidence of heart valve diseases is expected to rise, increasing the demand for prosthetic heart valves.

Prosthetic Heart Valve Market is positioned for robust growth. The high prevalence of heart disease, ongoing technological advancements, and an aging population are key factors driving this market. With continuous improvements in prosthetic valve technology, the market is set to meet the increasing demand and improve patient outcomes.

Key Takeaways

- Market Value: The Prosthetic Heart Valve Market is expected to grow from USD 14.08 billion in 2023 to approximately USD 28.50 billion by 2033, at a CAGR of 7.5%.

- Type of Valves Analysis: Tissue heart valve segment dominates with 43.2% due to enhanced biocompatibility and lower complication risks.

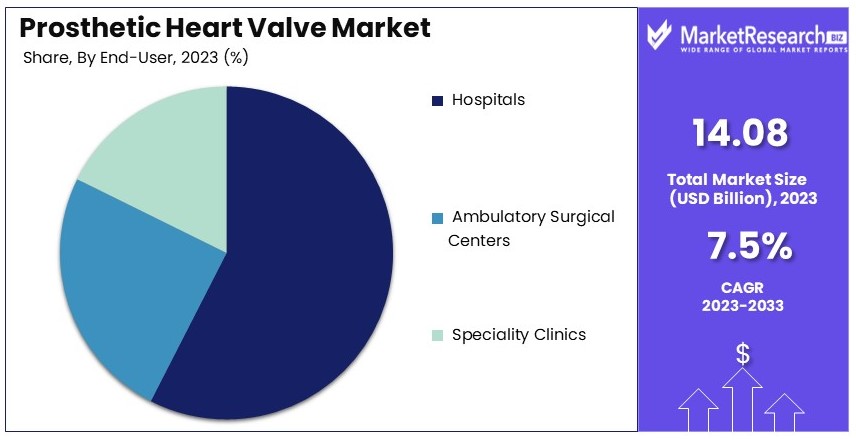

- End Users Analysis: Hospital segment dominates with 65.9% due to comprehensive care facilities and advanced medical infrastructure.

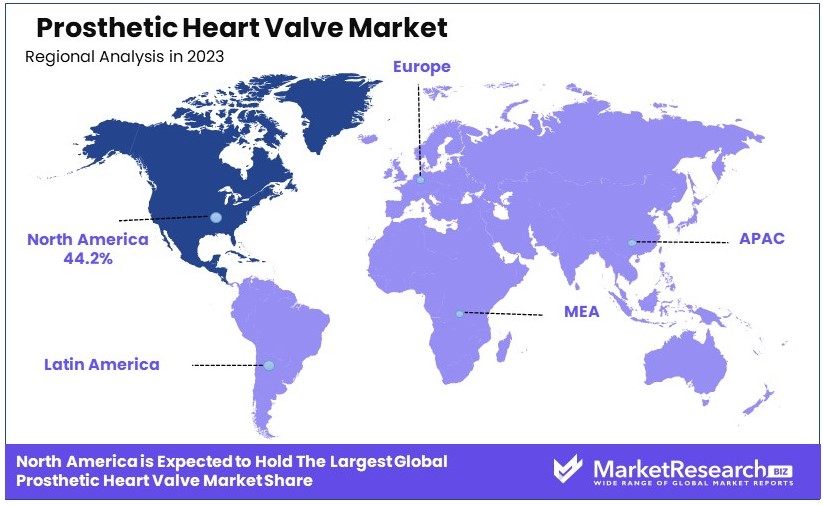

- Dominant Region: North America dominates with 44.2% market share, driven by advanced healthcare infrastructure and high prevalence of heart valve diseases.

- High Growth Region: Europe holds about 30% market share, supported by significant healthcare investments and an aging population.

- Analyst Viewpoint: The overall market is experiencing steady growth with moderate competition, driven by technological advancements and increasing prevalence of heart valve diseases. Future trends include greater adoption of minimally invasive procedures and improved valve durability.

Driving Factors

Increasing Prevalence of Cardiovascular Diseases Drives Market Growth

The primary driver for the prosthetic heart valve market is the rising incidence of cardiovascular diseases globally. Cardiovascular diseases are the leading cause of death worldwide, with an estimated 17.9 million deaths annually according to the World Health Organization (WHO). The aging population, along with lifestyle factors such as sedentary behavior and unhealthy diets, contribute to the increasing number of patients requiring heart valve replacement surgeries. This significant patient pool drives the demand for prosthetic heart valves, as these devices offer effective treatment options for various heart conditions.

In the United States alone, around 5 million people are diagnosed with heart valve disease each year, many of whom require surgical intervention. As the prevalence of cardiovascular diseases continues to rise, the need for prosthetic heart valves is expected to grow. This demand is further fueled by advancements in medical diagnostics and early detection of heart conditions, enabling timely and effective treatment. The interaction between the aging population, lifestyle changes, and improved healthcare services creates a robust demand for prosthetic heart valves, thereby propelling market growth.

Technological Advancements in Heart Valve Replacement Drive Market Growth

Technological innovations in prosthetic heart valve designs and materials have significantly enhanced the durability, biocompatibility, and performance of these devices. Developments such as transcatheter heart valves (THVs) have revolutionized the market by providing less invasive treatment options, reducing recovery times, and offering solutions for patients considered high-risk for traditional open-heart surgeries. These advancements are driving adoption rates among both patients and healthcare providers, expanding the prosthetic heart valve market.

The Edwards SAPIEN transcatheter heart valve, for instance, has demonstrated excellent outcomes in clinical trials, becoming a preferred choice for many patients. The continuous improvement in valve technology not only improves patient outcomes but also broadens the applicability of these devices to a wider range of patients, including those who are older or have comorbidities. As a result, technological advancements are a key factor in the market's expansion, enhancing the overall treatment landscape and patient experience.

Increasing Healthcare Expenditure and Access to Medical Services Drive Market Growth

The growing healthcare expenditure globally, coupled with improving access to medical services in developing regions, is boosting the demand for prosthetic heart valves. As healthcare infrastructures expand and economies develop, more patients gain access to advanced medical treatments, including heart valve replacement surgeries. Government initiatives and insurance coverage for cardiac procedures further facilitate market growth, making prosthetic heart valves more accessible to a larger patient population.

In India, the expansion of health insurance coverage has led to increased access to heart valve surgeries for patients who previously could not afford them. The rise in healthcare spending enables hospitals and clinics to adopt advanced technologies, improving patient outcomes and driving the demand for prosthetic heart valves. This increased accessibility is complemented by efforts to enhance public awareness about cardiovascular health, leading to higher diagnosis rates and timely interventions. The combined effect of increased healthcare expenditure and improved access to medical services creates a favorable environment for market growth, ensuring that more patients receive the necessary treatments.

Restraining Factors

High Cost of Prosthetic Heart Valve Surgeries Restrains Market Growth

One of the primary constraints affecting the prosthetic heart valve market is the high cost associated with these surgeries. The expenses for valve devices, hospitalization, and follow-up care are substantial, which limits access for patients in lower-income brackets and regions with underdeveloped healthcare systems. Despite technological advancements and reduced procedural costs, the price of transcatheter heart valves remains a significant barrier.

For instance, the average cost of a transcatheter aortic valve replacement (TAVR) procedure in the United States ranges from $30,000 to $50,000. This high cost makes the procedure inaccessible for many patients without adequate insurance coverage. The financial burden on healthcare systems and patients hinders the widespread adoption of these life-saving devices, thereby restraining market growth. In countries with limited healthcare funding, this issue is particularly pronounced, affecting overall market expansion.

Risk of Complications and Long-term Durability Concerns Restrain Market Growth

Despite technological advancements, concerns about the long-term durability and potential complications associated with prosthetic heart valves remain. Mechanical valves are prone to thrombosis and require lifelong anticoagulation therapy. On the other hand, bioprosthetic valves can degenerate over time, necessitating reoperation. These factors significantly influence the decision-making process of patients and physicians, especially for younger patients who may need multiple valve replacements throughout their lives.

For example, bioprosthetic valves typically have a limited lifespan of approximately 10 to 15 years. This limitation necessitates reoperation in younger patients, which adds to the overall healthcare costs and patient burden. The potential for complications and the need for subsequent surgeries deter some patients from opting for prosthetic heart valve replacements, thus restraining market growth. These concerns also affect the perceived value and reliability of prosthetic heart valves, impacting market adoption rates.

Type of Valves Analysis

Tissue heart valve segment dominates with 43.2% due to enhanced biocompatibility and lower complication risks.

The Prosthetic Heart Valve Market is segmented into transcatheter heart valves, tissue heart valves, and mechanical heart valves. Among these, the tissue heart valve segment dominates with a market share of 43.2%, driven by its enhanced biocompatibility and lower risk of complications compared to mechanical valves.

Tissue heart valves, comprising tissue aortic valves and tissue mitral valves, are preferred for their natural materials that minimize the need for lifelong anticoagulation therapy, making them suitable for a broad patient demographic, particularly older adults. The aging population and increasing prevalence of heart valve diseases have significantly contributed to the growth of this segment. Additionally, advancements in tissue valve technologies, such as improved durability and reduced calcification, have bolstered their adoption rates.

The tissue aortic valve sub-segment is particularly dominant due to the high incidence of aortic valve diseases and the relatively higher success rates of these procedures. This sub-segment benefits from ongoing research and development efforts aimed at extending the lifespan of tissue valves, thus reducing the need for reoperations. For example, newer models of tissue aortic valves have been shown to last longer than previous generations, offering patients improved quality of life.

Conversely, the transcatheter heart valve segment, which includes transcatheter aortic valves and transcatheter mitral valves, is experiencing rapid growth due to its minimally invasive nature. These valves are particularly beneficial for high-risk patients who are not suitable candidates for open-heart surgery. The transcatheter aortic valve sub-segment leads within this category, driven by the rising adoption of transcatheter aortic valve replacement (TAVR) procedures. These procedures have shown excellent clinical outcomes and are increasingly covered by insurance, further supporting their growth.

Mechanical heart valves, comprising mechanical aortic valves and mechanical mitral valves, account for a smaller market share. However, they remain a critical option for younger patients due to their long-term durability. The primary challenge for mechanical valves is the need for lifelong anticoagulation therapy, which can lead to complications and affect patient quality of life. Despite these drawbacks, mechanical valves are essential for patients who require a durable solution and are able to manage the associated risks.

End Users Analysis

Hospital segment dominates with 65.9% due to comprehensive care facilities and advanced medical infrastructure.

In the Prosthetic Heart Valve Market, the end user segment is divided into hospitals, ambulatory surgical centers, and specialty clinics. Hospitals dominate this segment, accounting for 65.9% of the market share. This dominance is attributed to the comprehensive care facilities and advanced medical infrastructure available in hospitals, which are essential for complex procedures like heart valve replacements.

Hospitals are equipped with state-of-the-art technology and skilled healthcare professionals, making them the preferred choice for both patients and surgeons. The ability to provide intensive care and manage complications during and after surgery ensures better patient outcomes, driving the preference for hospital settings. Moreover, hospitals often serve as centers for clinical trials and research, fostering innovation in heart valve technologies and contributing to market growth.

Ambulatory surgical centers (ASCs) are gaining traction as an alternative to hospital-based surgeries due to their cost-effectiveness and convenience. ASCs offer a more patient-friendly environment and shorter hospital stays, which can reduce the overall cost of care. The growing acceptance of minimally invasive procedures, such as transcatheter heart valve replacements, is boosting the demand for ASCs. These centers are particularly beneficial for patients undergoing low-risk procedures, as they provide high-quality care without the need for extended hospital stays.

Specialty clinics, while representing a smaller share of the market, play a crucial role in providing specialized care for heart valve patients. These clinics focus on specific aspects of cardiac care, offering tailored treatments and follow-up services. Specialty clinics are often involved in early diagnosis and management of heart valve diseases, contributing to improved patient outcomes and increased demand for prosthetic heart valves.

The dominance of hospitals in this market segment is supported by government initiatives and health insurance policies that cover complex cardiac procedures. The expansion of healthcare infrastructure in developing regions further boosts the hospital segment's growth. As healthcare systems continue to evolve, hospitals are expected to maintain their leading position due to their ability to offer comprehensive and advanced medical care.

Key Market Segments

By Type of Valves

- Transcatheter Heart Valve

- Transcatheter Aortic Valve

- Transcatheter Mitral Valve

- Tissue Heart Valve

- Tissue Aortic Valve

- Tissue Mitral Valve

- Mechanical Heart Valve

- Mechanical Aortic Valve

- Mechanical Mitral Valve

By End Users

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Growth Opportunities

Expansion of Transcatheter Heart Valve Replacement (THVR) Procedures Offers Growth Opportunity

Transcatheter heart valve replacement (THVR) procedures present significant growth opportunities within the prosthetic heart valve market. These minimally invasive procedures provide numerous advantages over traditional open-heart surgeries, such as reduced recovery times, lower complication rates, and shorter hospital stays. Technological advancements continue to enhance the safety and efficacy of THVR devices, driving market expansion. The aging population and rising prevalence of valvular heart diseases further fuel demand for less invasive treatment options.

The adoption of transcatheter aortic valve replacement (TAVR) has grown substantially, with companies like Edwards Lifesciences and Medtronic leading the way. Edwards Lifesciences' SAPIEN 3 transcatheter heart valve, for example, has shown superior outcomes in clinical trials, leading to its widespread market adoption. As these procedures become more accessible and trusted, the market for transcatheter heart valves is expected to expand significantly, offering substantial growth opportunities for industry players.

Technological Innovations in Heart Valve Design and Materials Offer Growth Opportunity

Technological advancements in heart valve design and materials represent another significant growth opportunity for the prosthetic heart valve market. Innovations such as bioresorbable and tissue-engineered heart valves aim to overcome existing limitations, including durability and the need for lifelong anticoagulation therapy. Companies investing in research and development to enhance heart valve longevity, biocompatibility, and functionality are well-positioned to capitalize on these innovations.

LivaNova's Perceval Sutureless heart valve, featuring a self-anchoring frame and porcine tissue, is a notable advancement in heart valve technology. Such innovations improve patient outcomes and reduce long-term healthcare costs. The market is shifting towards next-generation materials and designs that offer better performance and lower complication rates. This trend indicates a robust potential for growth, driven by the continuous development and adoption of advanced heart valve technologies.

Trending Factors

Rise in Hybrid Heart Valve Procedures Are Trending Factors

Hybrid heart valve procedures, combining surgical and transcatheter techniques, are becoming a significant trend in the prosthetic heart valve market. These procedures offer a tailored approach to treating complex valve diseases unsuitable for traditional surgery or transcatheter methods alone. Advancements in surgical techniques and new hybrid devices, such as sutureless valves and hybrid operating rooms with advanced imaging technology, drive this trend.

The use of hybrid procedures involving transcatheter and surgical techniques has been successfully applied in treating patients with aortic valve diseases at leading medical centers. Hybrid procedures provide improved clinical outcomes and reduced healthcare costs, positioning them as a key trend in heart valve replacement. The integration of these advanced methods into routine practice is expected to enhance patient care and expand the market.

Growing Adoption of Minimally Invasive Surgical Techniques Are Trending Factors

Minimally invasive surgical techniques are gaining popularity in the treatment of cardiovascular diseases, including heart valve replacement surgeries. These techniques offer benefits over traditional open-heart surgeries, such as smaller incisions, reduced trauma, shorter hospital stays, and faster recovery times. As patient demand for less invasive options increases, healthcare providers and manufacturers invest in developing advanced minimally invasive surgical instruments and techniques.

Medtronic's Avalus pericardial surgical heart valve, designed specifically for minimally invasive procedures, exemplifies this trend by offering superior hemodynamics and ease of implantation. The growing adoption of these techniques drives market growth, particularly for surgical heart valves that can be implanted using minimally invasive approaches. This trend highlights the market's evolution towards less invasive, patient-friendly treatment options.

Regional Analysis

North America Dominates with 44.2% Market Share

North America's dominance in the prosthetic heart valve market is driven by several factors. The region has a high prevalence of cardiovascular diseases, with the American Heart Association reporting millions affected annually. Advanced healthcare infrastructure and high healthcare expenditure support widespread adoption of prosthetic heart valves. Additionally, strong presence of leading companies like Edwards Lifesciences and Medtronic, coupled with continuous technological advancements, further propels the market.

Regional characteristics such as a well-established healthcare system, high patient awareness, and favorable reimbursement policies significantly influence the market. The U.S. and Canada have numerous specialized cardiac centers offering advanced treatments. Clinical trials and research initiatives are prevalent, driving innovation and early adoption of new technologies. This robust ecosystem fosters a favorable environment for market growth.

Europe: 30% Market ShareEurope holds 30% of the prosthetic heart valve market, driven by a well-developed healthcare system and high prevalence of cardiovascular diseases. Countries like Germany, France, and the UK lead in technological adoption and research initiatives. Government support and reimbursement policies also play crucial roles.

Asia Pacific: 18% Market ShareAsia Pacific accounts for 18% of the market, with rapid growth expected due to increasing healthcare expenditure, improving healthcare infrastructure, and a large patient pool. China, Japan, and India are key contributors, focusing on expanding access to advanced cardiac treatments and procedures.

Middle East & Africa: 5% Market ShareThe Middle East & Africa region holds a 5% market share, with growth driven by improving healthcare infrastructure and increasing prevalence of heart diseases. The market is slowly expanding as access to advanced medical treatments improves and investments in healthcare increase.

Latin America: 3% Market ShareLatin America has a 3% market share, with Brazil and Mexico leading the region. Growth is supported by improving healthcare systems, increasing awareness about heart valve diseases, and gradual adoption of advanced medical technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The prosthetic heart valve market is highly competitive, with several key players driving innovation and market growth. Abbott Laboratories, Medtronic plc, and Edwards Lifesciences Corporation lead the market with their advanced product offerings and strong R&D investments. These companies are strategically positioned through extensive global reach and comprehensive product portfolios that cater to various patient needs.

Medtronic's focus on transcatheter valve technologies has significantly impacted market dynamics, enhancing minimally invasive treatment options. Edwards Lifesciences' SAPIEN series is renowned for its clinical success, strengthening its market influence. Abbott Laboratories leverages its robust distribution network and continuous innovation to maintain a competitive edge.

Companies like Boston Scientific Corporation and LivaNova PLC also play vital roles, focusing on technological advancements and expanding their presence in emerging markets. Artivion, Inc., and JenaValve Technology, Inc., contribute to niche segments with specialized valve solutions.

Meril Life Sciences Pvt. Ltd and Labcor Laboratorios Ltda emphasize cost-effective solutions, catering to price-sensitive regions. Emerging players such as Micro Interventional Devices, Inc., and Colibri Heart Valve, LLC, are innovating to gain market share.

Overall, these key players' strategic initiatives, including mergers, acquisitions, and partnerships, drive market expansion and influence the competitive landscape. The combined efforts of these companies continue to advance prosthetic heart valve technologies, improving patient outcomes and expanding market reach.

Market Key Players

- Abbott Laboratories

- Meril Life Sciences Pvt. Ltd

- Medtronic plc

- Labcor Laboratorios Ltda

- Edwards Lifesciences Corporation

- Artivion, Inc.

- JenaValve Technology, Inc.

- Boston Scientific Corporation

- LivaNova PLC

- CryoLife, Inc.

- St. Jude Medical, Inc.

- Braile Biomedica

- Micro Interventional Devices, Inc.

- Colibri Heart Valve, LLC

- Labcor Laboratórios Ltda.

- TTK Healthcare Limited

Recent Developments

- On February 2024, Artivion, Inc. announced data from its On-X Aortic Heart Valve Low INR post-market study presented in a Late-Breaking Science session at the 37th European Association for Cardio-Thoracic Surgery (EACTS) Annual Meeting in Vienna, Austria. Real-world interim results for all patients confirm that the On-X Aortic Valve remains safe and effective with low-dose warfarin. The trial consisted of 510 participants who have only an On-X aortic prosthetic heart valve implant.

- On October 2023, Artivion, Inc. presented real-world data from a post-market study at the 37th European Association for Cardio-Thoracic Surgery Annual Meeting in Vienna, Austria. The study focused on On-X Aortic Heart Valve Replacement Patients treated with low-dose warfarin.

- Researchers at Imperial College London announced that replacement heart valves that grow inside the body are a step closer to reality following their studies. Surgery to replace faulty heart valves has been possible for more than 60 years, but the treatment has medical drawbacks, both with mechanical or biological valves. The new approach developed by Sir Magdi Yacoub's team at Harefield and Imperial aims to produce a living valve in the body, which would be able to grow with the patient.

Report Scope

Report Features Description Market Value (2023) USD 14.08 Billion Forecast Revenue (2033) USD 28.50 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Valves (Transcatheter Heart Valve, Transcatheter Aortic Valve, Transcatheter Mitral Valve, Tissue Heart Valve, Tissue Aortic Valve, Tissue Mitral Valve, Mechanical Heart Valve, Mechanical Aortic Valve, Mechanical Mitral Valve), By End Users (Hospitals, Ambulatory Surgical Centers, Specialty Clinics) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, Meril Life Sciences Pvt. Ltd, Medtronic plc, Labcor Laboratorios Ltda, Edwards Lifesciences Corporation, Artivion, Inc., JenaValve Technology, Inc., Boston Scientific Corporation, LivaNova PLC, CryoLife, Inc., St. Jude Medical, Inc., Braile Biomedica, Micro Interventional Devices, Inc., Colibri Heart Valve, LLC, Labcor Laboratórios Ltda., TTK Healthcare Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott Laboratories

- Meril Life Sciences Pvt. Ltd

- Medtronic plc

- Labcor Laboratorios Ltda

- Edwards Lifesciences Corporation

- Artivion, Inc.

- JenaValve Technology, Inc.

- Boston Scientific Corporation

- LivaNova PLC

- CryoLife, Inc.

- St. Jude Medical, Inc.

- Braile Biomedica

- Micro Interventional Devices, Inc.

- Colibri Heart Valve, LLC

- Labcor Laboratórios Ltda.

- TTK Healthcare Limited