Healthcare Contract Development and Manufacturing Organization Market Service Type( Drug Development Services, Drug Manufacturing Services, Biopharmaceutical Development and Manufacturing Services , Pharmaceutical Packaging Services, Others), End User(, Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Contract Research Organizations (CROs) , Others ), Therapeutic Area, Oncology, Cardiovascular, Neurology, Infectious Diseases, Metabolic Disorders, Others ), By Region And Companies - Industry Segment Outlook, Market Assessm

-

45727

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

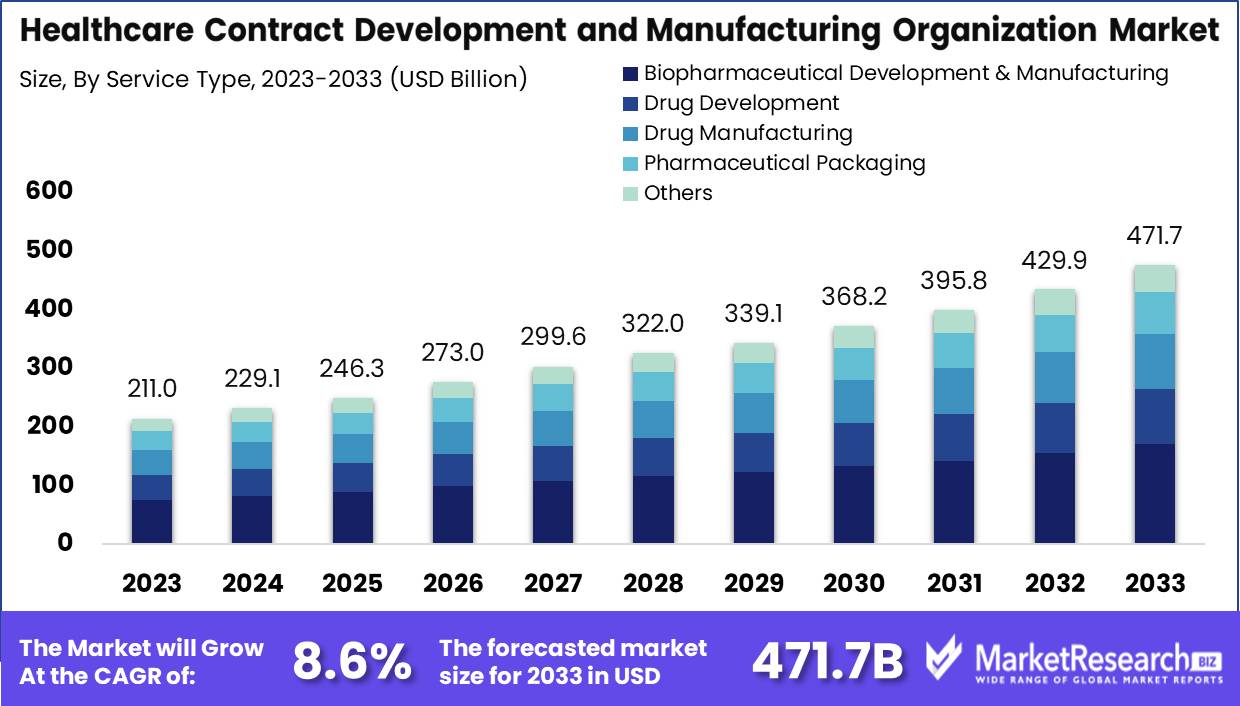

The healthcare contract development and manufacturing organization market was valued at USD 211 billion in 2023. It is expected to reach USD 471.7 billion by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

The surge in demand in the pharmaceutical sector is a main driving factor for the healthcare CDMO market. Healthcare CDMOs offer outsourcing services to multiple pharma companies on a contractual basis. To decrease operation flow and expenses, pharma organizations seek out healthcare CDMOs to a large extent. The domain of CDMOs is not restricted to producing drugs, but they also conduct R&D to develop innovative formulas. CDMO organizations basically cover all the services that are required for making a drug. For example, Yourway, a biopharma organization, provides all relevant solutions, comprising of analysis, formulation, coating, temperature-controlled logistics, and various distribution services all across the world pharmaceutical and biotech firms.

Many pharmaceutical companies are seeking CDMOs as drug development is complex and it needs to meet the deadlines or the production demand. It is also cost-effective and consumes time. CDMOs help to decrease infrastructure expenses by eliminating the requirement for investment in additional production and manufacturing workspace. CDMOs make it possible to meet the production demand on time with the capability to alter the production volume, add drug variation, or add the cost of labor, facility workspace, etc.

In the biopharmaceutical sector, there are several new advanced technologies are being used in both drug discovery and the production process. Biopharmaceutical and biotech organizations are more focused on making drug discovery but CDMOs aim more at the process development and production flow. CDMOs contribute substantially to a better healthier life by supporting continually biopharmaceutical firms in developing biopharma for many diseases. As the demand for new drug discoveries and surge in R&D has increased, the healthcare CDMO market will witness exceptional growth during the forecast period.Russia-Ukraine War Impact

The war's impact on global pharmaceuticals has restricted the pharma producer’s funding and operation, as well as pharma exporters' market interest in Russia, Ukraine, and other countries. According to an article that was published by BW Healthcare World, Russia accounts for more than 2.4% of India’s pharma exports, and there was a certain loss of some business for the Indian exporter. Certainly, Russia contributes 50% of pharma exports to CIS regions. India is the third largest pharma exporter to Ukraine. Some Indian organizations have funding in Russia with close connections to the Russian market. Before the onset of the war, some payments were halted for many Indian pharma exporters who had distributed the products to Russia and other CIS regions. Manufacturers have faced issues regarding the surge in the cost of aluminum foil for pharma packaging for which Ukraine is the major source of supply.Key Takeaways

- Market Growth: The healthcare contract development and manufacturing organization market was valued at USD 211 billion in 2023. It is expected to reach USD 471.7 billion by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

- By Service Type: In 2023, Biopharmaceutical Development and Manufacturing Services led the CDMO market, driven by biologics demand.

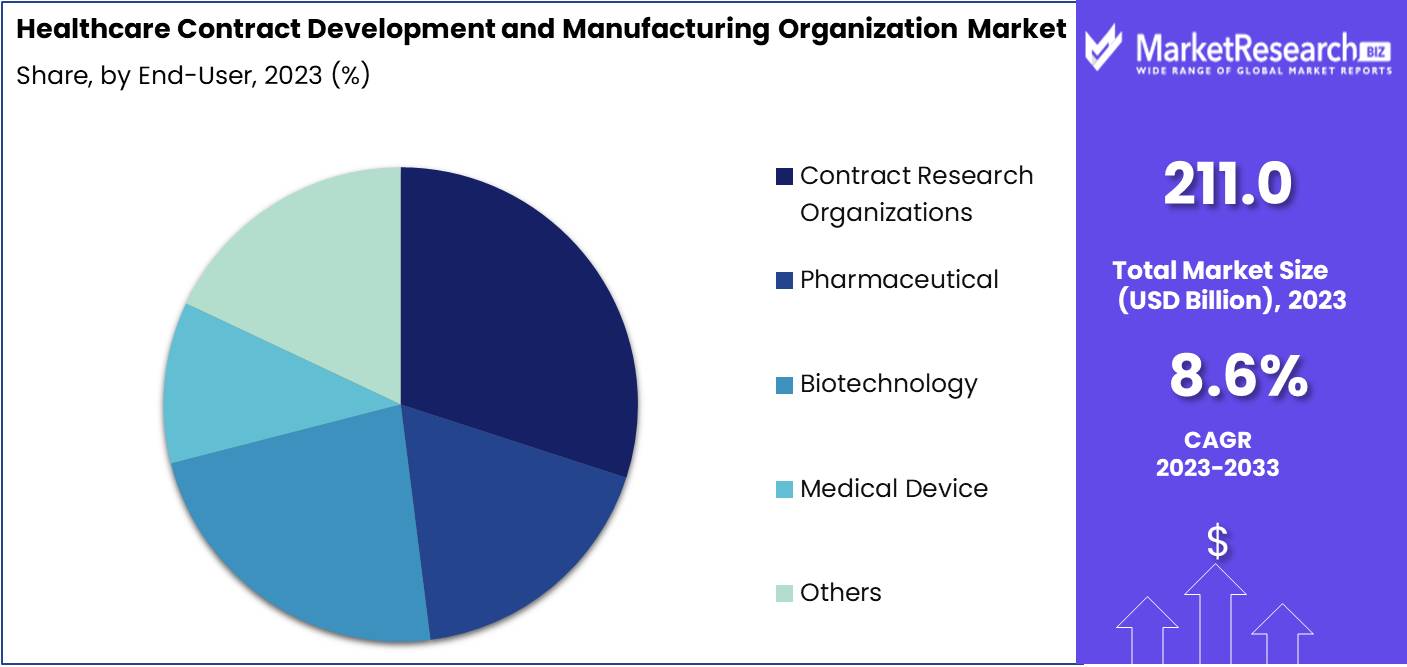

- By End-user: In 2023, CROs dominated the CDMO market, primarily serving pharmaceutical, biotechnology, and medical device companies.

- By Therapeutic Area: In 2023, oncology led CDMO market growth across diverse therapeutic areas.

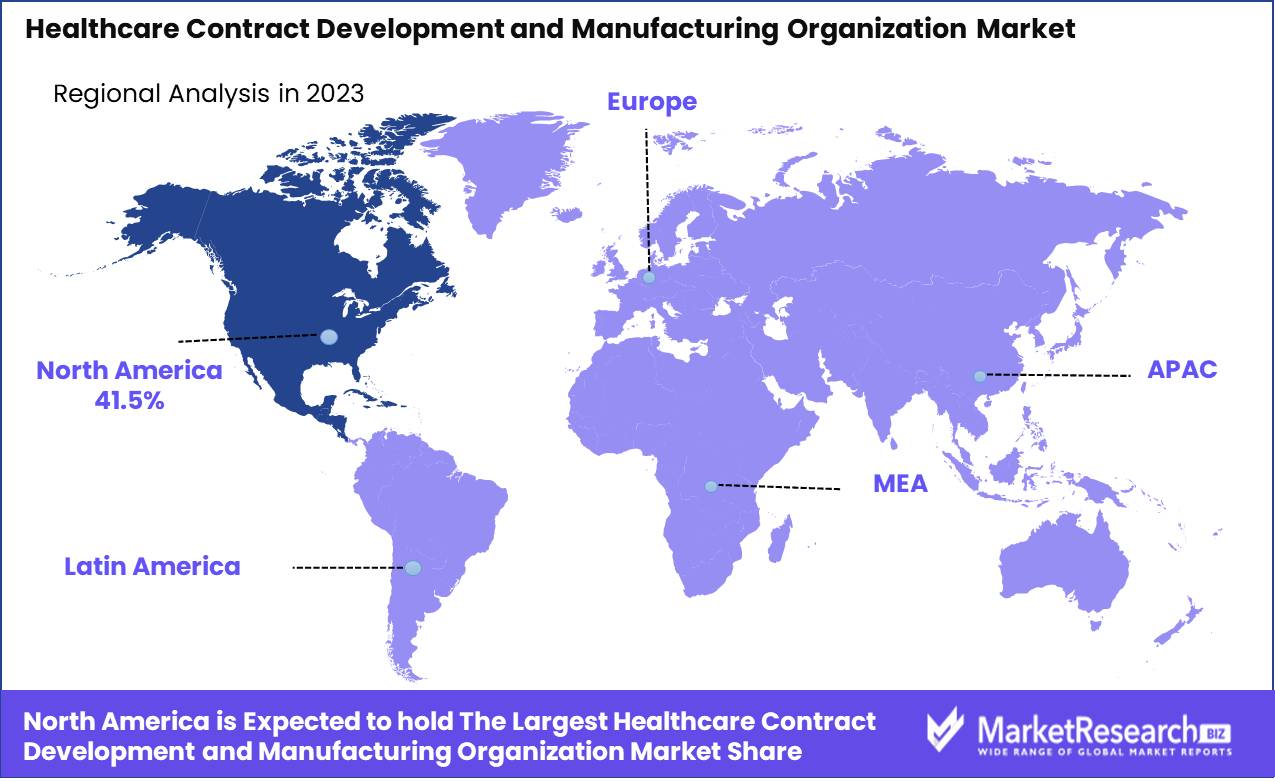

- Regional Dominance: North America leads the Healthcare CDMO market with a 41.5% share; Asia Pacific grows fastest.

- Growth Opportunity: The global healthcare CDMO market is set to grow significantly, driven by medical device demand and new pharmaceutical launches.

Driving factors

Market Growth Projection: A Catalyst for Expansion and Investment

The healthcare Contract Development and Manufacturing Organization (CDMO) market is projected to experience significant growth in the coming years, driven by a confluence of factors that signal robust expansion and investment opportunities. This growth is typically quantified in market research reports, which often predict compound annual growth rates (CAGR) reflecting the increasing demand for outsourced pharmaceutical services. For instance, reports may cite a CAGR of approximately 8% to 9% over a decade, suggesting a market that is rapidly expanding due to the escalating need for efficient, scalable, and specialized production capacities in the pharmaceutical industry.

This projection acts as a catalyst for various strategic moves within the industry, including increased investment from existing players to expand their operational capabilities, and attracting new entrants looking to capitalize on this burgeoning demand. It also reassures stakeholders of the viability and sustained demand in the market, underpinning financial and strategic decisions ranging from mergers and acquisitions to capacity expansions and technological upgrades.

Increasing Research and Development (R&D) Activities: Fueling Demand for Specialized Services

The escalation in research and development activities within the pharmaceutical and biotechnology sectors fundamentally drives the demand for CDMO services. As companies push to innovate and develop new drugs, the complexity and cost of R&D activities surge, making the case for outsourcing more compelling. CDMOs offer a cost-effective alternative to in-house production, providing specialized services such as advanced drug formulation, clinical trial materials manufacturing, and regulatory compliance support.

This relationship is symbiotic; as R&D activities increase, so does the reliance on CDMOs. This not only broadens the scope of opportunities for these organizations but also encourages them to invest in cutting-edge technologies and expand their service offerings to cater to more complex and diverse drug pipelines. The increasing burden of chronic diseases, coupled with the rapid advancement in personalized medicines and biologics, further exacerbates this demand, positioning CDMOs as critical partners in the drug development ecosystem.

Technological Complexity: Advancing Capabilities and Enhancing Market Differentiation

The rise in technological complexity within pharmaceutical manufacturing is a pivotal growth driver for the CDMO market. As drug formulations and therapeutic modalities become more complex, the expertise and technological capabilities required to manufacture these drugs escalate correspondingly. Advanced therapies, such as cell and gene therapies, require highly specialized manufacturing processes that are difficult and costly to develop in-house.

CDMOs that invest in advanced manufacturing technologies, such as continuous manufacturing, bioreactors for cell culture, and lyophilization for stability enhancement, provide substantial value to pharmaceutical companies. These technological investments enable CDMOs to handle more complex products, reduce production times, and improve yield, which in turn enhances their market attractiveness and competitive positioning. This technological prowess not only drives market growth by meeting current demands but also by anticipating future needs, thereby establishing CDMOs as indispensable players in the pharmaceutical value chain.

Restraining Factors

Regulatory Compliance Challenges: A Double-Edged Sword in Market Expansion

Regulatory compliance represents a significant barrier to entry and expansion in the Healthcare Contract Development and Manufacturing Organization (CDMO) market. The stringent regulations governing pharmaceuticals and medical devices globally ensure patient safety and product efficacy but also introduce complex hurdles for market participants. For instance, differences in regulatory requirements from one region to another complicate the landscape, requiring CDMOs to navigate a maze of legal standards and approval processes. This not only slows down the time-to-market for new therapies but also escalates operational costs, impacting profitability and strategic agility.

Quality Control and Assurance: Upholding Standards Amidst Growing Demand

Quality control and assurance are paramount in the CDMO industry, directly impacting the market's growth trajectory. As these organizations take on increasing responsibilities drug development to manufacturing the highest quality standards becomes more challenging and crucial. The cost and complexity of implementing robust quality systems can deter market entry for smaller players, thus influencing market dynamics by favoring larger, more established entities capable of making the necessary investments in quality control infrastructure.

By Service Type Analysis

In 2023, Biopharmaceutical Development and Manufacturing Services led the CDMO market, driven by biologics demand.

Biopharmaceutical Development and Manufacturing Services held a dominant market position in the By Service Type segment of the Healthcare Contract Development and Manufacturing Organization (CDMO) Market. This category includes comprehensive services critical for biopharmaceutical production, such as cell line development, process development, analytical and quality control services, and biomanufacturing. The dominance of this segment is driven by the increasing demand for biologics and biosimilars, which require specialized expertise and infrastructure for their development and manufacturing.

Additionally, advancements in biotechnology and the rising number of biotech startups outsourcing their production needs further bolster the market position of biopharmaceutical services.

Within the broader CDMO landscape, Drug Development Services play a crucial role, encompassing early-stage activities like preclinical trials and clinical research, which are vital for new drug entities. Drug Manufacturing Services are pivotal in scaling up production and ensuring consistent, high-quality output of pharmaceuticals.

Pharmaceutical Packaging Services focuses on the final product's presentation, ensuring compliance with regulatory standards and enhancing product safety and stability. The Others category, including Clinical Trial Services and Regulatory Affairs, supports the entire drug lifecycle, ensuring adherence to global regulatory frameworks and facilitating smooth market entry. Collectively, these segments illustrate the comprehensive nature of the CDMO market, with biopharmaceutical services leading due to their specialized focus and growing market demand.

By End-User Analysis

In 2023, CROs dominated the CDMO market, primarily serving pharmaceutical, biotechnology, and medical device companies.

In 2023, Contract Research Organizations (CROs) held a dominant market position in the end-user segment of the Healthcare Contract Development and Manufacturing Organization (CDMO) Market.

The significant influence of CROs in this segment is driven by their extensive service offerings, including clinical trial management, regulatory affairs, and data management, which are critical for pharmaceutical and biotechnology companies. Pharmaceutical companies, a key end-user, increasingly rely on CROs to expedite drug development and navigate complex regulatory environments. This outsourcing allows pharmaceutical firms to streamline operations, reduce costs, and focus on core competencies, enhancing overall productivity and innovation capacity. Biotechnology companies also benefit from the specialized expertise of CROs, which aids in the rapid advancement of biotechnological research and development, ensuring quicker market entry for novel therapies and products.

Additionally, medical device companies leverage CROs to manage clinical trials and regulatory submissions, essential for compliance with stringent global standards. This partnership helps mitigate risks and accelerates time-to-market for medical devices. Other end users, such as academic institutes and government organizations, engage CROs for their robust infrastructure and expertise in managing large-scale research projects. This trend underscores the pivotal role of CROs in enhancing the efficiency and effectiveness of the healthcare development and manufacturing landscape.

By Therapeutic Area Analysis

In 2023, oncology led CDMO market growth across diverse therapeutic areas.

In 2023, Oncology held a dominant market position in the By Therapeutic Area segment of the Healthcare Contract Development and Manufacturing Organization (CDMO) Market. The increasing prevalence of cancer and the corresponding rise in demand for novel therapeutic solutions have significantly propelled the oncology segment. This dominance is further fueled by extensive R&D investments and a robust pipeline of oncology drugs, driving partnerships with CDMOs for drug development and manufacturing. Oncology’s prominence reflects the urgent need for innovative treatments and the sector’s rapid advancements in precision medicine and biologics.

Following oncology, the Cardiovascular segment also demonstrated substantial growth, driven by the rising incidence of heart diseases and the continuous demand for effective cardiovascular drugs. The Neurology segment is gaining traction due to advancements in treatments for neurological disorders like Alzheimer’s and Parkinson’s. Infectious Diseases remain critical, especially with ongoing efforts to address emerging infections and antibiotic resistance.

The Metabolic Disorders segment, focusing on diabetes and obesity, shows steady growth with increasing prevalence rates. Finally, the Others category, encompassing respiratory, immunology, and other therapeutic areas, continues to expand, driven by advancements in chronic disease management and immune-related therapies. This diversified growth highlights the comprehensive demand for CDMO services across various therapeutic areas.

Key Market Segments

By Service Type

- Drug Development Services

- Drug Manufacturing Services

- Biopharmaceutical Development and Manufacturing Services

- Pharmaceutical Packaging Services

- Others (e.g., Clinical Trial Services, Regulatory Affairs)

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device Companies

- Contract Research Organizations (CROs)

- Others (e.g., Academic Institutes, Government Organizations)

By Therapeutic Area

- Oncology

- Cardiovascular

- Neurology

- Infectious Diseases

- Metabolic Disorders

- Others (e.g., Respiratory, Immunology)

Growth Opportunity

Expanding Opportunities in Medical Device Development

The global healthcare CDMO market is poised for significant growth, driven by a marked increase in demand for medical devices. As healthcare systems worldwide continue to adapt to both aging populations and chronic disease prevalence, the need for innovative medical devices escalates. This surge places CDMOs in a critical position to support device manufacturers through specialized services from design and development to regulatory compliance and mass production. This uptrend not only promises enhanced revenue streams for CDMOs but also offers them a chance to diversify their service portfolios and cement long-term partnerships with device manufacturers.

Capitalizing on New Product Launches

Another substantial growth avenue for CDMOs stems from the launch of new pharmaceutical products. The introduction of new drugs and therapeutic treatments is accelerating, partly due to the rapid advancements in biotechnology and an increased focus on personalized medicine. This trend necessitates robust development and manufacturing support from CDMOs, which are integral in navigating the complexities of product development, ensuring scalability, and maintaining compliance with stringent global regulatory standards. The ability of CDMOs to efficiently manage the scale-up processes from clinical to commercial production will be crucial in capitalizing on these new opportunities.

Latest Trends

Escalating Demand for Outsourcing in Pharmaceutical and Biotech Industries

The global Healthcare Contract Development and Manufacturing Organization (CDMO) market is witnessing a significant surge in outsourcing activities. This trend is driven by pharmaceutical and biotech companies' strategic shift towards focusing on their core competencies such as R&D and marketing, while outsourcing manufacturing and development processes to specialized CDMOs. The cost-efficiency, coupled with the ability to accelerate product time-to-market, is compelling companies to leverage the expertise of CDMOs. As healthcare continues to become more personalized, the demand for precision and specialized manufacturing solutions intensifies, further bolstering the growth of CDMOs.

Advancements in Technology Reshaping the CDMO Landscape

Technological advancements are profoundly transforming the CDMO sector. We are observing an increased integration of technologies such as artificial intelligence (AI), machine learning (ML), and continuous manufacturing processes. These technologies are enhancing the efficiency and quality of drug development and manufacturing. For instance, AI and ML are being used to optimize manufacturing processes and predict potential challenges in drug formulation, significantly reducing costs and improving yield.

Moreover, the adoption of continuous manufacturing offers advantages in scalability and flexibility, crucial for adapting to the dynamic demands of the healthcare market. This technological evolution not only supports the rapid production of pharmaceuticals but also ensures compliance with stringent regulatory standards, providing a competitive edge to CDMOs that invest in these advanced capabilities.

Regional Analysis

North America leads the Healthcare CDMO market with a 41.5% share; Asia Pacific grows fastest.

The global market for Healthcare Contract Development and Manufacturing Organizations (CDMOs) is strategically segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each showcasing distinct growth dynamics and opportunities.

North America remains the dominant region, commanding a significant 41.5% market share, driven by advanced healthcare infrastructure, robust pharmaceutical R&D activities, and strong regulatory frameworks supporting outsourcing in countries such as the U.S. and Canada.

Europe follows closely, leveraging its sophisticated healthcare systems and increasing inclination towards outsourcing to manage rising drug development costs. The presence of leading pharmaceutical companies and a growing focus on biologics contribute to its strong market position.

Asia Pacific is the fastest-growing region, fueled by cost advantages in manufacturing and a skilled workforce. Countries like China and India are becoming pivotal in the CDMO landscape due to their substantial investments in biotechnology and favorable governmental policies.

The Middle East & Africa, though nascent, is beginning to emerge as a potential market with increasing healthcare expenditures and strategic government initiatives aimed at developing pharmaceutical manufacturing capabilities.

Latin America, while smaller in comparison, shows promise due to its evolving regulatory environment and increasing local demand for pharmaceutical products, coupled with a growing emphasis on establishing regional manufacturing hubs to ensure drug availability and affordability.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the evolving landscape of the global Healthcare Contract Development and Manufacturing Organization (CDMO) market, several key players are poised to significantly impact the sector in 2024. Companies like Thermo Fisher Scientific Inc. and Lonza Group Ltd. are at the forefront, leveraging their robust manufacturing capabilities and extensive expertise in biologics to cater to the surging demand for outsourced pharmaceutical services. Thermo Fisher, with its integrated solutions across the drug development cycle, and Lonza's focus on specialized manufacturing processes, particularly in cell and gene therapy, are well-positioned to capitalize on industry trends.

Catalent Inc. and IQVIA Holdings Inc. also remain integral to the CDMO landscape, driven by their innovative approaches to drug development and strong clinical research services. Catalent’s recent expansions in biologics and gene therapy and IQVIA’s data-driven solutions provide them with a competitive edge in meeting complex client demands.

Emerging players like Recipharm AB and Siegfried Holding AG are enhancing their service offerings, focusing on niche markets within the pharmaceutical sector, which could lead to increased market share. Meanwhile, technology-focused companies such as Jabil and Sanmina Corporation are likely to drive advancements in medical devices and diagnostics, further diversifying the CDMO market.

Market Key Players

- Flex

- Covance Inc.

- Lonza Group Ltd.

- Thermo Fisher Scientific Inc.

- Jabil

- Catalent Inc.

- Sanmina Corporation

- IQVIA Holdings Inc.

- Siegfried Holding AG

- Recipharm AB

Recent Development

- In May 2024, Bain & Company and HeathQuad reported that India's healthcare innovation market is projected to double to $60 billion by FY 2028, driven by increased consumer demand, advancements in technology, and favorable regulatory conditions.

- In May 2024, the CPHI Experts Report recommends that small to mid-sized US CDMOs must invest in key areas such as manufacturing process improvements, quality management, and AI to capitalize on the expected surge in contract funding in 2025.

- In March 2024, Bain & Company and HealthQuad reported that India's healthcare innovation market is expected to grow from $30 billion to $60 billion by FY28, with significant contributions from biotech, vaccines, and med-tech sectors.

- In November 2023, EY Parthenon and the Organisation of Pharmaceutical Producers of India (OPPI) launched the 'Reimagining pharma and healthcare for India@100' report envisioning India's pharma and healthcare innovation by 2047.

Report Scope

Report Features Description Market Value (2023) USD 211.0 Billion Forecast Revenue (2033) USD 471.7 Billion CAGR (2024-2032) 8.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Service Type ( Drug Development Services, Drug Manufacturing Services, Biopharmaceutical Development and Manufacturing Services, Pharmaceutical Packaging Services, Others), End User (, Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Contract Research Organizations (CROs), Others ), Therapeutic Area (Oncology, Cardiovascular, Neurology, Infectious Diseases, Metabolic Disorders, Others ) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Flex, Covance Inc., Lonza Group Ltd., Thermo Fisher Scientific Inc., Jabil, Catalent Inc., Sanmina Corporation, IQVIA Holdings Inc., Siegfried Holding AG, Recipharm AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Flex

- Covance Inc.

- Lonza Group Ltd.

- Thermo Fisher Scientific Inc.

- Jabil

- Catalent Inc.

- Sanmina Corporation

- IQVIA Holdings Inc.

- Siegfried Holding AG

- Recipharm AB