Global Printing Blanket Market By Blanket Types(UV Printing Blankets, Conventional Printing blankets, Combination Printing Blankets), By Substrate Type(Paper and Board Printing, Metal Printing, Textile Printing (Fabric), Other Printing),By Application Type(Packaging, Commercial, Newspaper, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49368

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

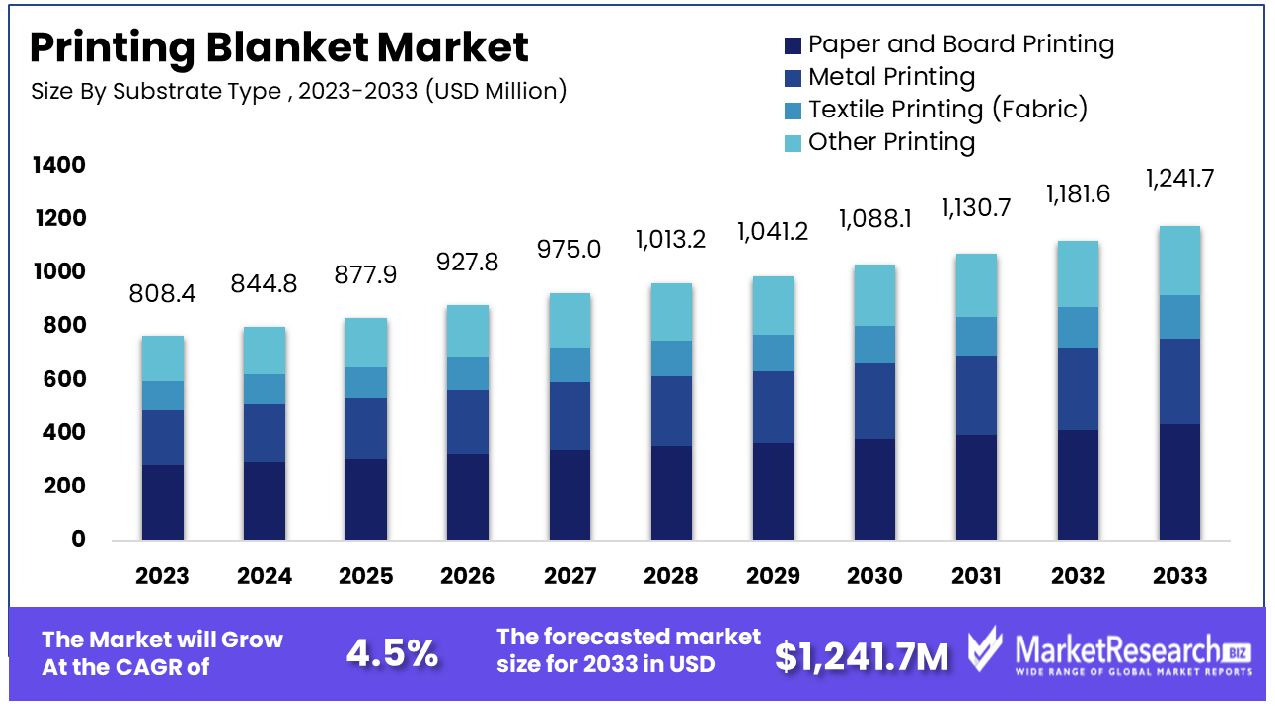

The Global Printing Blanket Market was valued at USD 808.4 million in 2023. It is expected to reach USD 1,241.7 million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Printing Blanket Market encompasses the production and distribution of printing blankets, essential components in offset printing presses. These blankets, made from rubber or other composite materials, transfer ink from the printing plate to the paper, ensuring high-quality print outputs.

As a critical element in the commercial, newspaper, and packaging printing industries, the market's dynamics are influenced by trends in media consumption and packaging needs. For executives and product managers, understanding the advancements in material technology and regional market shifts is vital for strategic planning and maintaining a competitive edge in the evolving print industry landscape.

The Printing Blanket Market is undergoing significant shifts, predominantly influenced by technological advancements and environmental considerations. As a fundamental component in the printing process, printing blankets, primarily composed of rubber or composite materials, play an essential role in ensuring the quality and efficiency of print operations.

The market is notably impacted by the sustainability trends sweeping across industries, with an estimated 900 to 1,900 printing blankets disposed of annually per print shop in excellent condition. This disposal rate not only highlights the potential for improved recycling processes and lifecycle management but also underscores a critical area for innovation in product durability and environmental impact reduction.

Additionally, the global trade dynamics of the Printing Blanket Market are well-captured by the Harmonized System (HS) code 591110, which categorizes rubber printing blankets. This classification helps in understanding import-export volumes, influencing market strategy formulation for regions actively engaged in manufacturing and distribution.

Key Takeaways

- Market Growth: The Global Printing Blanket Market was valued at USD 808.4 million in 2023. It is expected to reach USD 1,241.7 million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

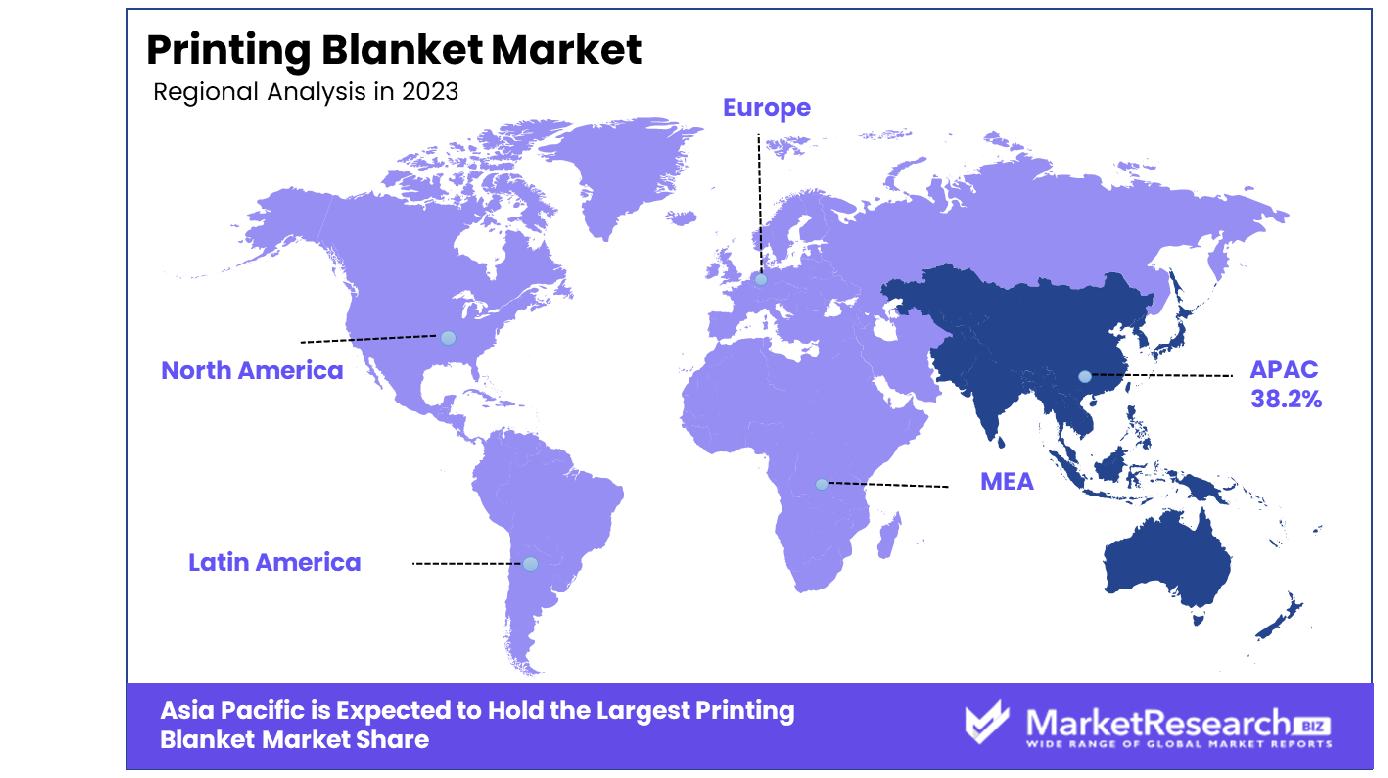

- Regional Dominance: Asia Pacific dominates the Printing Blanket Market with a 38.2% share.

- By Blanket Types: Conventional printing blankets dominate, holding a 55% market share.

- By Substrate Type: Paper and board printing leads substrate types with 60% dominance.

- By Application Type: Packaging applications command the market with a 50% share.

Driving factors

Expansion of the Packaging Industry

The growth of the packaging industry, which demands high-quality printing solutions, serves as a significant catalyst for the expansion of the Printing Blanket Market. As manufacturers and retailers increasingly focus on innovative packaging to enhance product visibility and consumer engagement, the requirement for superior printing quality escalates.

This need directly translates into a heightened demand for printing blankets, which are pivotal in delivering precise and vivid print results on various packaging materials. The rising standards in packaging aesthetics and functionality drive continual innovations and upgrades in printing blanket technologies, ensuring compatibility with evolving packaging materials and printing methods.

Innovations in Printing Technology

Technological advancements in printing technologies profoundly impact the Printing Blanket Market. Modern printing techniques, such as digital printing and 3D printing, require specialized printing blankets that can handle diverse materials and intricate print jobs with higher efficiency and lower error rates.

These innovations not only enhance the quality and speed of printing but also extend the functional lifespan of printing blankets, thereby reducing operational costs. The integration of new materials and coatings in printing blanket manufacturing further boosts market growth by offering products that meet the advanced requirements of contemporary printing presses.

Rise in Printed Advertising Materials

The increasing demand for printed materials in advertising and media is another pivotal factor driving the growth of the Printing Blanket Market. Despite the digital shift, print media remains a valuable tool for advertisers due to its broad reach and high engagement levels, particularly in regional and niche markets.

This sustained demand ensures a steady market for printing blankets, as they are essential for producing high-quality printed advertisements, including flyers, posters, and magazines. The reliability and quality of printing achieved with advanced blankets make them indispensable in the competitive advertising sector, where the clarity and attractiveness of printed materials can significantly influence consumer perceptions and actions.

Restraining Factors

Impact of Digital Media Shift on Traditional Printing

The shift towards digital media presents a nuanced challenge to the Printing Blanket Market, ostensibly reducing the demand for traditional printing methods. As businesses and consumers increasingly prefer digital formats due to their cost-effectiveness and immediacy, sectors traditionally reliant on print, such as newspapers and magazines, have seen a decline.

This transition influences the printing industry's volume requirements, potentially diminishing the market for printing blankets used in conventional presses. However, this shift also encourages print shops to innovate and adapt, integrating digital printing technologies that still require high-quality printing blankets, albeit with different specifications. Thus, while the demand dynamics are shifting, there remains a sustained need for specialized printing blankets compatible with new digital printing technologies.

Environmental Sustainability Pressures in Printing

Environmental concerns significantly shape the Printing Blanket Market, primarily through the pressures of reducing waste and enhancing sustainability in printing processes. The environmental impact of printing, including the disposal of printing blankets that can number between 900 to 1,900 units per year per print shop in excellent condition, drives the market towards more sustainable practices and products.

This trend has spurred the development of eco-friendly printing blankets that are recyclable or made from sustainable materials, aligning with global regulatory and consumer demand for greener printing solutions. These advancements not only address environmental concerns but also open up new market opportunities in sectors keen on reducing their ecological footprint, thus driving further growth in the market.

By Blanket Types Analysis

Conventional Printing Blankets dominate the market with a 55% share, reflecting their widespread use in traditional printing.

In 2023, Conventional Printing blankets held a dominant market position in the "By Blanket Types" segment of the Printing Blanket Market, capturing more than a 55% share. This segment's robust performance is attributed to the widespread adoption of these blankets in traditional printing settings, where their durability and efficacy in delivering high-quality prints are highly valued. Conventional blankets are preferred for their compatibility with a wide range of inks and printing substrates, making them indispensable in settings that require versatility and reliability.

UV Printing Blankets and Combination Printing Blankets, although holding smaller shares, represent significant innovation within the market. UV Printing Blankets, specifically engineered for UV curing processes, are increasingly popular due to their faster drying times and reduced environmental impact. These attributes align well with industry trends emphasizing sustainability and efficiency, positioning UV blankets for potential growth.

Combination Printing Blankets, which cater to specialized printing needs by accommodating both conventional and UV printing technologies, are also gaining traction. These blankets offer flexibility for printers that work with diverse printing requirements and substrates, thus broadening their application scope. Their adaptability makes them particularly appealing to print shops looking to streamline operations and reduce the need for multiple inventory types.

Collectively, these segments highlight the dynamic nature of the Printing Blanket Market, with Conventional Printing Blankets maintaining a stronghold due to their proven performance and reliability, while newer types like UV and Combination Blankets capture interest with their innovative features tailored to modern printing demands.

By Substrate Type Analysis

Paper and Board Printing holds a 60% dominance in substrate usage, emphasizing its continued importance in the industry.

In 2023, Paper and Board Printing held a dominant market position in the "By Substrate Type" segment of the Printing Blanket Market, capturing more than a 60% share. This segment's leadership underscores the enduring relevance and demand for traditional paper-based products in sectors such as publishing, advertising, and packaging. The robust performance of paper and board printing is driven by its versatility and ongoing innovations that enhance print quality and processing speeds, meeting the high standards required in commercial and industrial applications.

Meanwhile, Metal Printing, Textile Printing (Fabric), and Other Printing represent smaller but vital parts of the market. Metal Printing is increasingly used in industrial and decorative applications, benefiting from specialized printing blankets that can handle the rigors of metal substrates. This niche is expected to grow as industries such as automotive and electronics continue to explore customized and durable marking solutions.

Textile Printing (Fabric) is another significant segment, especially with the rise in demand for personalized and fashion-driven products. Advances in printing technology have made it possible to produce vibrant and detailed prints on various fabrics, driving the need for compatible printing blankets that ensure precision and color fidelity.

The Other Printing category, which includes unique substrates like plastics and composites, is also expanding as new technologies broaden the scope of printable materials. Each of these segments is fueled by specific industry requirements and technological advancements, making the broader Printing Blanket Market a complex and dynamic arena. Together, they reflect a market that, while dominated by paper and board printing, is increasingly diverse and technologically integrated.

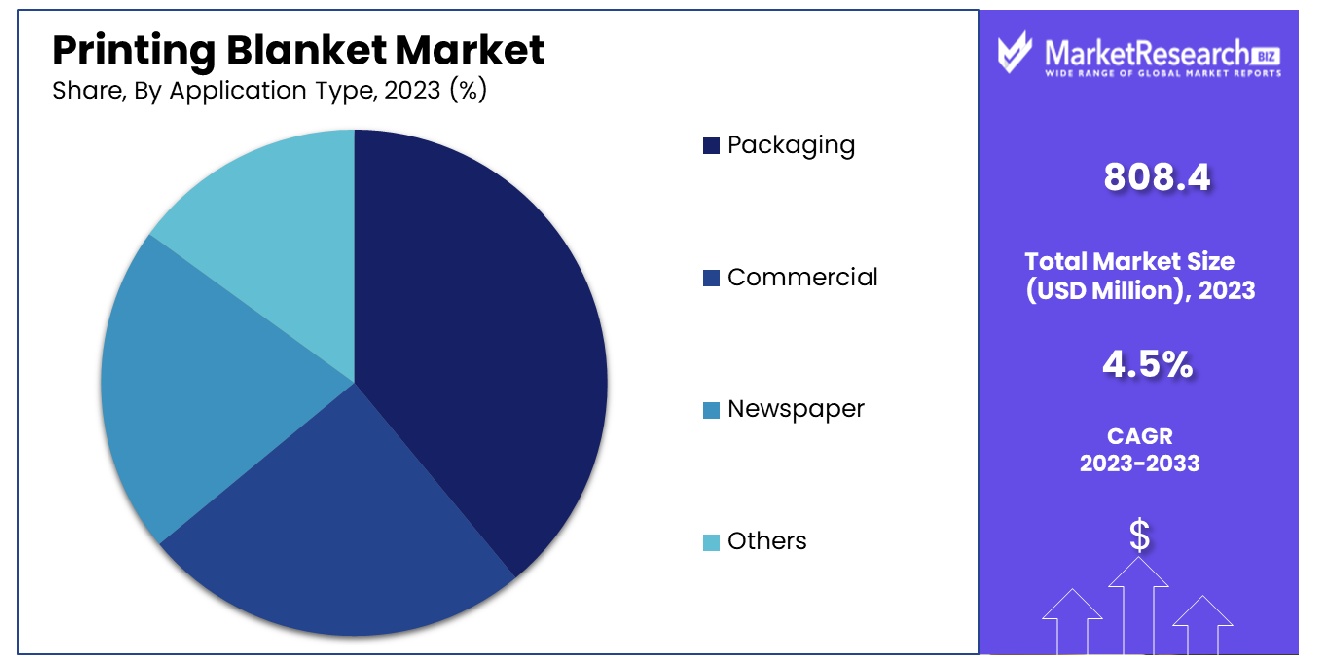

In Application Types Analysis

Packaging leads with a 50% share, underscoring its critical role in the printing sector.

In 2023, Packaging held a dominant market position in the "By Application Type" segment of the Printing Blanket Market, capturing more than a 50% share. This dominance is primarily due to the critical role packaging plays in marketing and protecting products, with an increasing emphasis on aesthetics and functional design driving demand for high-quality printing solutions. The packaging industry's ongoing innovations, such as the use of sustainable materials and advanced graphic techniques, require specialized printing blankets that can deliver precision and durability, thus fueling segment growth.

Other segments such as Commercials, Newspapers, and Others also contribute to the market dynamics but with varied degrees of influence. The Commercial printing segment, which encompasses a broad range of printing needs including advertising materials, corporate brochures, and direct mail, remains robust due to the continuous need for print marketing in business operations. Despite the digital shift, tactile marketing materials still prove effective in capturing consumer attention, necessitating reliable and high-quality printing blankets.

The Newspaper segment, although experiencing a decline due to the rise of digital media, still maintains a significant portion of the market in regions where traditional media consumption remains high. This segment's demand for printing blankets focuses on speed and efficiency, critical factors for the timely production of newspapers.

Lastly, the Others segment includes niche applications such as security printing and textile printing, each requiring specialized blankets. This diversity within the Printing Blanket Market underscores its adaptability and the broad array of applications it serves, with Packaging leading the way due to its integral role in product presentation and protection.

Key Market Segments

By Blanket Types

- UV Printing Blankets

- Conventional Printing blankets

- Combination Printing Blankets

By Substrate Type

- Paper and Board Printing

- Metal Printing

- Textile Printing (Fabric)

- Other Printing

By Application Type

- Packaging

- Commercial

- Newspaper

- Others

Growth Opportunity

Development of Eco-Friendly and Sustainable Printing Materials

The 2023 growth opportunities for the global Printing Blanket Market are substantially driven by the development of eco-friendly and sustainable printing materials. As environmental regulations tighten and consumer preferences shift towards sustainable products, the market is responding with innovative solutions. Companies are increasingly investing in R&D to produce printing blankets made from recycled and bio-based materials that offer reduced environmental impact without compromising on quality.

These advancements not only meet regulatory compliance but also cater to the growing green consumerism trend. The shift towards sustainable printing materials is expected to open new avenues for growth, particularly in industries like packaging, where sustainability is rapidly becoming a critical purchasing factor.

Expansion into Emerging Markets

Another significant growth opportunity in 2023 for the Printing Blanket Market lies in the expansion into emerging markets. These regions are experiencing rapid industrialization and urbanization, leading to increased demands for commercial and industrial printing. Countries in Asia, Africa, and Latin America present lucrative markets due to their growing middle-class populations and increasing business activities.

As these markets develop, there is a heightened need for high-quality printing solutions to support local industries, advertising, and media sectors. By entering these emerging markets, companies can tap into new customer bases and diversify their market presence, which is crucial for long-term growth in the global landscape. This strategic expansion not only enhances market reach but also mitigates risks associated with reliance on mature markets.

Latest Trends

Adoption of 3D Printing Technologies

In 2023, one of the most transformative trends within the global Printing Blanket Market is the adoption of 3D printing technologies. This integration marks a significant evolution from traditional to advanced manufacturing techniques, where printing blankets are increasingly used in specialized applications beyond conventional flat media printing.

The versatility required for 3D printing challenges the market to innovate in material science, ensuring that printing blankets can handle varied textures and materials without compromising the integrity of the printed objects. This shift not only broadens the scope of applications for printing blankets but also aligns with industrial trends towards customization and rapid prototyping, opening up new revenue streams and strengthening market positions in high-tech sectors.

Increased Use of UV-Curable Inks

Another pivotal trend in the 2023 global Printing Blanket Market is the increased use of UV-curable inks, which require specific types of printing blankets capable of handling the quick-drying characteristics of these inks. UV-curable inks are favored for their faster drying times and reduced environmental impact, as they do not emit volatile organic compounds (VOCs).

The shift towards these inks is driven by industries demanding higher efficiency and sustainability in printing operations, such as packaging and labeling. The need for compatible printing blankets that can rapidly adapt to the curing process enhances product development and quality assurance in manufacturing. As a result, manufacturers who can innovate their products to be compatible with UV-curable inks are likely to see increased demand and customer loyalty, reinforcing their competitive edge in a rapidly evolving market.

Regional Analysis

The Printing Blanket Market in Asia Pacific dominates with a substantial market share of 38.2%, driven by robust industrial growth.

In North America, the market is driven by advanced technological adoption and stringent environmental regulations, promoting the use of eco-friendly and high-efficiency printing solutions. The presence of major printing companies and a robust commercial sector underpin steady growth in this region.

Europe follows closely, with a strong emphasis on sustainability and high-quality printing. European countries are leading in implementing green printing technologies, which supports the demand for innovative printing blankets that comply with strict environmental standards.

Asia Pacific is the dominant region in the Printing Blanket Market, holding a substantial market share of 38.2%. This region's growth is fueled by rapid industrialization and the expansion of the packaging and publishing industries, particularly in China and India. The increase in manufacturing activities and rising consumer markets in Asia Pacific make it a critical area for potential market expansion and innovation.

The Middle East & Africa, and Latin America, though smaller in comparison, are emerging as significant markets due to increasing urbanization and industrial growth. These regions are experiencing a rise in demand for printing technologies as local businesses expand, driving the need for printing blankets in various applications, including advertising and media.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Printing Blanket Market is characterized by the strategic movements of key players that are shaping industry trends and driving technological advancements. Among these, Trelleborg AB and Continental AG (ContiTech) stand out for their innovation in durable and high-efficiency printing blankets, catering to both traditional and digital printing markets. Their leadership is underscored by robust R&D investments and global distribution networks which enhance their market presence and competitive edge.

Flint Group continues to influence the market through its comprehensive range of printing supplies, including printing blankets that are compatible with the latest printing technologies. This adaptability makes Flint Group a preferred partner for printing companies seeking to optimize print quality and efficiency.

Fujikura Composites and Kinyosha Co., Ltd. are noted for their commitment to technological refinement and quality. Their products are specifically designed to meet the stringent requirements of high-speed printing operations, making them pivotal in the commercial and industrial printing sectors.

Meiji Rubber and Chemical Co., Ltd., along with Habasit AG, are recognized for their contributions to the market through the development of environmentally friendly and sustainable printing solutions. Their focus on reducing the ecological footprint of printing activities aligns with global environmental trends and regulatory pressures.

Smaller players like Birkan GmbH, CNI XINYUAN Ltd. (Airdot), and Shanghai Chen Jie Printing Material Co., Ltd., though niche, are vital in driving local market dynamics and specialization. Their ability to cater to specific regional needs and customization requests positions them uniquely in the market, allowing them to capture and serve segmented market niches effectively.

Market Key Players

- Trelleborg AB

- Continental AG (ContiTech)

- Flint Group

- Fujikura Composites Inc.

- Kinyosha Co., Ltd.

- Meiji Rubber and Chemical Co., Ltd.

- Habasit AG

- Birkan GmbH

- CNI XINYUAN Ltd. (Airdot)

- Shanghai Chen Jie Printing Material Co., Ltd.

Recent Development

- In June 2024, Kinyosha Co., Ltd. expanded its production facility in Japan in June 2024 with a $15 million investment. This expansion is aimed at increasing their capacity to produce innovative printing blankets that cater to the latest digital printing technologies.

- In May 2024, Fujikura Composites Inc. invested $25 million in research and development to create advanced composite materials for printing blankets. These materials are designed to improve the durability and print quality of blankets used in high-precision printing.

- In April 2024, Trelleborg AB launched a new range of printing blankets designed for ultra-high-speed printing presses. These products aim to meet the industry's increasing demand for faster and more efficient printing solutions.

Report Scope

Report Features Description Market Value (2023) USD 808.4 Million Forecast Revenue (2033) USD 1,241.7 Million CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Blanket Types(UV Printing Blankets, Conventional Printing blankets, Combination Printing Blankets), By Substrate Type(Paper and Board Printing, Metal Printing, Textile Printing (Fabric), Other Printing),By Application Type(Packaging, Commercial, Newspaper, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Trelleborg AB, Continental AG (ContiTech), Flint Group, Fujikura Composites Inc., Kinyosha Co., Ltd., Meiji Rubber and Chemical Co., Ltd., Habasit AG, Birkan GmbH, CNI XINYUAN Ltd. (Airdot), Shanghai Chen Jie Printing Material Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Trelleborg AB

- Continental AG (ContiTech)

- Flint Group

- Fujikura Composites Inc.

- Kinyosha Co., Ltd.

- Meiji Rubber and Chemical Co., Ltd.

- Habasit AG

- Birkan GmbH

- CNI XINYUAN Ltd. (Airdot)

- Shanghai Chen Jie Printing Material Co., Ltd.