Global Poultry Feed Market By Type Analysis (Complete feed, Concentrates, Others), By Ingredient Analysis (Corn, Soybean meal, Others), By Form Analysis (Mash, Pellets, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

14059

-

May 2023

-

158

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

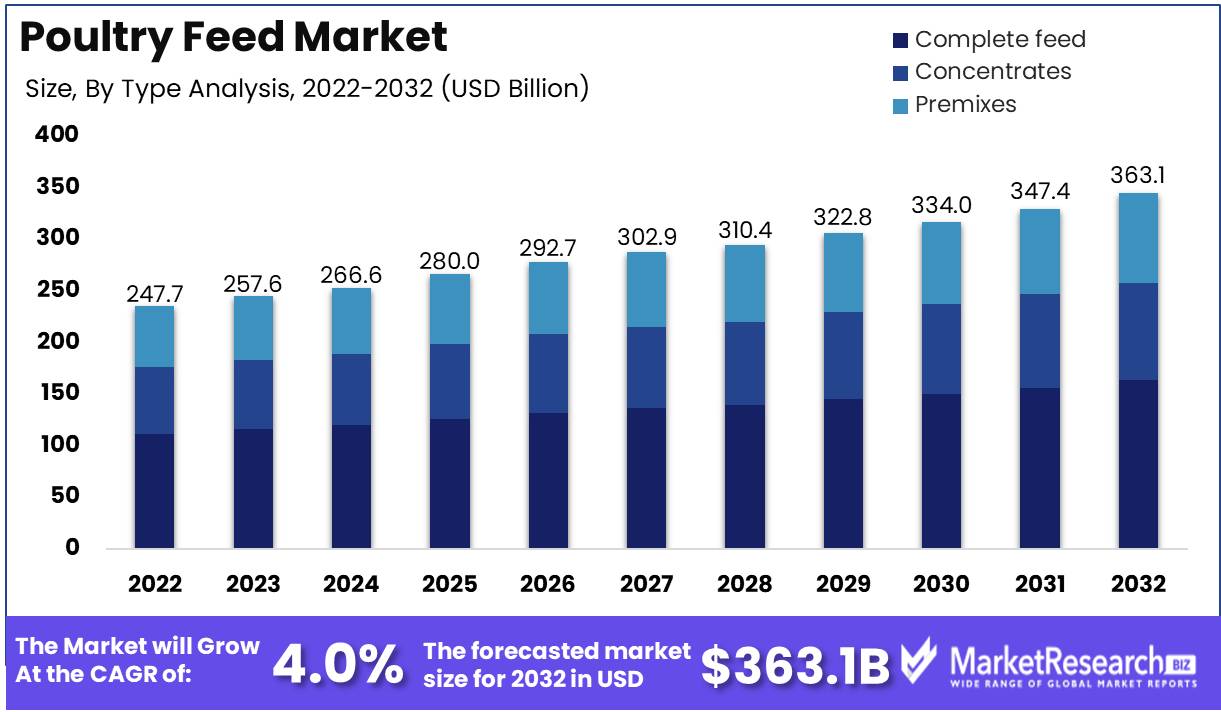

Global Poultry Feed Market size is expected to be worth around USD 363.1 Bn by 2032 from USD 247.7 Bn in 2022, growing at a CAGR of 4.0% during the forecast period from 2023 to 2032.

The poultry feed market has expanded significantly in response to the growing demand for high-quality, nutrient-dense animal feed. This increase is a result of the vital role it plays in the global food industry, assuring the health and growth of poultry by supplying them with essential nutrients. Poultry feed, a carefully formulated mixture of cereals, vitamins, minerals, and proteins, is essential to the health and productivity of poultry.

This report aims to provide a comprehensive overview of the poultry feed market, including its multifaceted definition, diverse objectives, and profound significance. In addition, it illuminates the extraordinary innovations occurring in animal nutrition, the substantial investments made in this field, and how these innovations are being seamlessly incorporated into products and services.

As a crucial pillar of the global food industry, poultry feed is unwaveringly committed to providing poultry with essential nutrients, enhancing their health, and catapulting their productivity to previously unattainable levels. This carefully crafted feed consists of a complex mixture of essential constituents, including grains, vitamins, minerals, and proteins.

The poultry feed market is of the utmost importance due to its undeniable contribution to enhancing poultry productivity by promoting good health and superior nutrition. This market assures the optimal growth and development of poultry through the provision of high-quality, nutrient-dense feed containing essential amino acids, vitamins, and minerals. In addition, it helps reduce mortality rates, achieve efficient feed conversion, and increase protein production.

Technological innovations have revolutionized the poultry feed market, catapulting it to new heights. These ground-breaking innovations have paved the way for the production of custom-tailored feed solutions, which ensure optimal animal performance, improved animal welfare, and the prudent use of resources.

Numerous prominent corporations have made enormous investments in the poultry feed market, thereby propelling the production of innovative animal nutrition solutions. These investments have primarily targeted the expansion of animal nutrition solutions, yielding customized feed solutions that ensure optimal animal performance.

The poultry feed market is intricately intertwined with other complementary industries, most notably the animal feed industry, which specializes in manufacturing feed constituents used in the production of poultry feed. In addition, the animal industry significantly relies on poultry feed to maintain productivity and quality of meat production, whereas the animal health industry focuses on the identification and management of animal diseases.

The poultry feeds market is primarily driven by the rising demand for sustainable and ethically produced feed, the widespread adoption of animal nutrition technology, and an unwavering commitment to animal welfare. Changing consumer preferences, such as the demand for antibiotics-free and naturally produced poultry and the growing popularity of plant-based diets, have also contributed to the soaring demand for innovative animal nutrition solutions.

Ethical concerns and practices play a crucial role in the poultry feed market, ensuring responsible and sustainable production methods. Diverse sectors within this market place a strong emphasis on accountability, explainability, animal welfare, the reduction of antibiotic overuse, the responsible procurement of raw materials, and the effective use of natural resources.

Driving factors

The Rapid Expansion of the Poultry Feed Market is fueled by the Rising Demand for High-Quality Products:

Due to numerous factors, the poultry feed market is undergoing accelerated growth. First, the rising demand for nutritious and high-quality poultry products among consumers has led to an increase in the population and production of poultry. This has consequently increased producers' awareness of the significance of feed quality and its impact on poultry health.

Technological Innovations and Investments Fuel Surge in Poultry Feed Market:

In addition, technological advances in the poultry feed industry, such as precision feeding and automation, have increased the efficacy and precision of feed production. The demand for poultry feed has increased as a result of this, as well as the growth of the animal husbandry industry and rising investments in poultry farming.

Changing Dietary Habits and Government Initiatives Drive the Growth of the Poultry Feed:

In addition, increasing disposable incomes and shifting dietary preferences have led to an increase in the demand for poultry products, thereby driving the growth of the poultry feed market. Government initiatives promoting the use of high-quality feed in poultry farming have also played a significant role in the expansion of the market.

Poultry Feed Industry Determined by Potential Regulatory Changes and Innovations:

However, there are potential regulatory changes that could affect the poultry feed market, particularly in light of rising concerns about food safety and the adoption of stringent animal feed regulations. Innovative feed formulations, including probiotics, prebiotics, and enzymes, have enabled the poultry feed industry to increase the nutritional value of their products.

Blockchain and AI Transform Poultry Feed in the Face of Emerging Disruptors:

Emerging technologies such as blockchain and artificial intelligence offer ways to enhance supply chain traceability, which may result in significant industry-wide changes. In addition, potential market disruptors, such as new firms or alternative protein sources, may have an impact on the competitive landscape.

Restraining Factors

Exploring Limitations in the Exploding Poultry Feed Market:

As the global population continues to rise, so does the demand for poultry products. Consequently, there is an increasing demand for poultry feed, making the market for poultry feed even more vital. However, the market is not devoid of restrictions. This article will examine the market-restraining factors impacting the poultry feed industry and their effects on the sector.

Fluctuating Prices of Raw Materials Used in the Production of Poultry Feed:

Fluctuating prices of basic materials used in the production of poultry feed are one of the primary factors inhibiting the market for poultry feed. Over the years, the prices of key poultry feed ingredients such as corn, wheat, soy, and other cereals have risen dramatically. This is due to a number of factors, including climate change, production costs, and transportation.

The Spread of Diseases and Health Problems among Poultry Led to a Decline in Production and Demand:

The industry continues to be seriously threatened by the spread of diseases and health problems in poultry. Disease outbreaks frequently result in decreased production, which has an impact on the demand for poultry products. Moreover, epidemics of diseases may result in the culling of poultry, which reduces the supply and raises prices.

Increasing Competition from Alternative Protein Sources, Including Plant-Based and Laboratory-Grown Meats:

As the global demand for alternative protein sources increases, competition from plant-based and lab-grown meats increases. These options provide a more sustainable and environmentally favorable source of protein for consumers. As a result, individuals are shifting away from animal-based products, which could have a negative impact on the poultry feed market.

Antibiotics and other Feed Additives are Subject to Stringent Regulations and Standards:

The poultry feed industry is highly regulated, which could function as a constraining factor. The market is significantly impacted by regulations and standards governing the use of antibiotics and other feed additives. In many instances, stringent regulations and standards increase production costs and decrease profitability. Moreover, the regulations could reduce the market's supply, resulting in higher prices that could impact demand.

By Type Analysis

In recent years, the poultry feed market has undergone a significant transition, with the complete segment dominating the market. This segment contains all of the necessary nutrients for the growth and development of poultry. The complete segment has experienced a surge in demand, and it is expected to record the highest growth rate over the next few years. This section provides a comprehensive analysis of the factors contributing to the complete segment's growth.

The incorporation of the complete segment of the poultry feed market has been propelled by the economic growth of emerging economies. As these economies continue to expand, so does the demand for flesh and eggs, driving the growth of the poultry feed market. In addition, modernization and industrialization in these nations have led to the establishment of large-scale poultry farms that require high-quality, nutrient-rich feed for their fowl.

Consumers are becoming increasingly health-conscious and demanding premium-quality foods. Consumers are prepared to pay a premium for poultry meat and eggs because they are regarded as a healthy source of protein.

Because of the numerous advantages it offers, the complete segment is anticipated to have the highest growth rate. First, it provides the poultry with a balanced diet, resulting in enhanced growth, enhanced immune function, and increased production. Second, it reduces the need for multiple feeds, sparing poultry farmers time and money. Thirdly, it ensures that the birds obtain all the necessary nutrients for their growth, resulting in healthier birds and higher-quality meat and eggs.

By Ingredient Analysis

Corn is the dominant ingredient in the poultry feed market. This section provides a comprehensive analysis of the reasons for the growth of the corn segment.

The expansion of economies in developing nations has increased the demand for corn in the poultry feed market. Corn is a primary ingredient in poultry feed because it is an abundant source of carbohydrates. As the demand for poultry meat and eggs rises in these economies, so does the demand for corn in the poultry feed market.

The corn segment is expected to experience the highest growth rate due to its numerous advantages. It is an abundant source of carbohydrates and provides the birds with energy, resulting in improved growth and increased production. Secondly, it is an inexpensive and readily accessible ingredient, which makes it a popular choice among poultry producers. Thirdly, it is a natural and nutritious ingredient that satisfies the demands of health-conscious consumers.

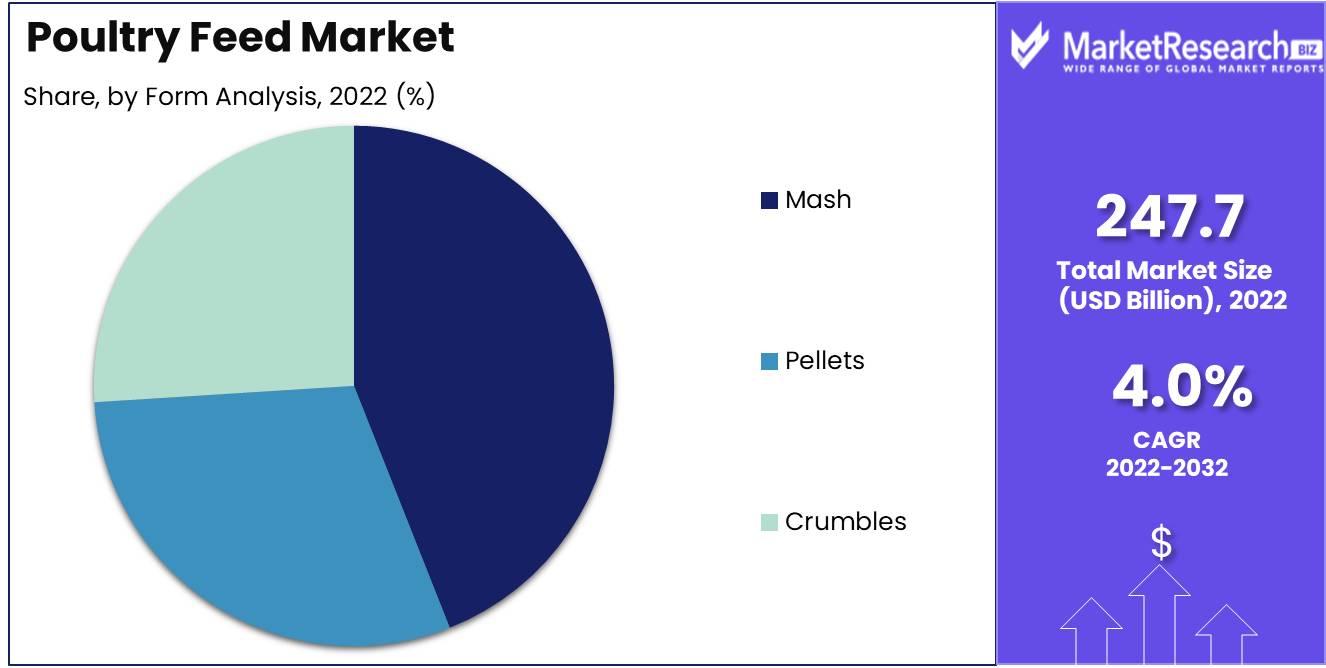

By Form Analysis

In the poultry feed market, mash is the dominant form. This section provides a comprehensive analysis of the growth drivers for the mash segment.

The adoption of the mash segment of the poultry feed market has been driven by the economic growth of emerging economies. Small-scale poultry producers favor mash because it is a common form of poultry feed and is simple to prepare. As the number of small-scale poultry producers increases in these economies, so too does the demand for mash in the poultry feed market.

Because it is simple to prepare and provides a well-balanced diet for the birds, mash is a popular form of poultry feed. In addition, it is an economical form of poultry feed, making it a popular option among poultry producers. Consumers are becoming increasingly health-conscious and demanding premium-quality foods.

Because of its numerous advantages, the mash segment is anticipated to exhibit the highest growth rate. Small-scale poultry farmers favor it because it is straightforward to prepare. Second, it is an economical form of poultry feed, which makes it a popular option among poultry producers. Thirdly, it provides the poultry with a balanced diet, resulting in enhanced growth, enhanced immune function, and increased production.

Key Market Segments

By Type Analysis

- Complete feed

- Concentrates

- Premixes

By Ingredient Analysis

- Corn

- Soybean meal

- Wheat

- Oats

By Form Analysis

- Mash

- Pellets

- Crumbles

Growth Opportunity

Exploring Potential Growth Opportunities in the Competitive Poultry Feed Market:

As the poultry industry expands rapidly, so does the demand for poultry feed. The poultry feed market is highly competitive, with numerous competitors contending for market share. In recent years, numerous opportunities have fueled the poultry feed market's growth potential.

Demand for Organic and Natural Poultry Feed is Growing:

As consumer awareness of the adverse health effects of consuming chemically treated food increases, the demand for organic and natural poultry feed rises. This trend has had an effect on the poultry industry, as consumers increasingly seek out food that is free from hazardous chemicals. To meet the demand for chemical-free poultry products, a growing number of poultry producers are now utilizing organic and natural feed.

Increased Application of Precision Farming Methods and IoT in the Poultry Industry:

The poultry industry is not unfamiliar with technological progress. As precision agricultural techniques and Internet of Things (IoT) devices proliferate, the industry is becoming more efficient and productive. The poultry industry is utilizing precision farming techniques such as GPS-guided tractors, automated feeding systems, and data analytics to maximize yields, minimize costs, and reduce waste.

Demand for Antibiotic-Free and Non-GMO Poultry Feed is Growing:

The use of antibiotics in agricultural production has caused concern among consumers worldwide. Recent research has demonstrated that the overuse of antibiotics in animal feed can contribute to the emergence of antibiotic-resistant bacterial strains. As a consequence, the demand for antibiotic-free and non-GMO poultry feed is increasing. Farmers of poultry have begun using prebiotics and probiotics to maintain the health of their livestock without the use of antibiotics.

Increasing Public Understanding of the Benefits of Fortified Feed and Feed Supplements:

Dietary supplements and fortified feed are essential for the establishment of healthy poultry. They are abundant in the vitamins, minerals, and amino acids required for the growth of healthy bones, plumage, and muscles. Many poultry producers are now using fortified feed and supplements to ensure the growth and health of their flocks, as awareness of their benefits has grown.

Latest Trends

The Poultry Feed Market is Being Shaped by Major Market Trends:

In recent years, the global poultry feed market has encountered significant transformations. Several major market trends have affected the poultry feed industry, including the increasing adoption of automation in poultry farming and feed production, the growing trend toward sustainable and eco-friendly feed production, the rising demand for customized feed formulations to meet specific nutritional requirements, the growing emphasis on feed safety and quality assurance, and the growing preference for plant-based protein sources in poultry feed formulations.

Increasing Automation Adoption in Poultry Farming and Feed Manufacturing:

The poultry farming and feed production industries have been completely transformed by automation. Modern poultry farms have automated feeding, watering, egg collection, and refuse management systems. Automation has improved the efficiency of poultry farming, resulting in increased productivity and profitability. Moreover, automation in feed production has led to consistent feed quality and decreased labor costs.

Growing Trend Toward Eco-Friendly and Sustainable Feed Production:

Sustainability and environmental tolerance are crucial concerns in contemporary agriculture. The poultry industry and feed production are not immune to this trend. In recent years, the use of sustainable and environmentally friendly feed production practices has acquired popularity. Sustainable practices in feed production prioritize minimizing environmental impact and enhancing animal welfare. The use of synthetic chemical additives, preservatives, and other hazardous substances is minimized in environmentally friendly feed production techniques.

Increasing Demand for Tailored Feed Formulations to Meet Particular Nutritional Needs:

Poultry farmers have a growing demand for specialized feed formulations that satisfy the nutritional requirements of their flocks. Breed, age, and production objectives are all taken into account when formulating customized feed. To maximize flock health and productivity, customized feed formulations are created. As they eliminate the need for additional supplements or medications, they are also cost-effective.

Feed Safety and Quality Assurance are Receiving More Attention.

The safety and quality of poultry feed are essential for maintaining the health and productivity of a flock. In recent years, there has been a growing emphasis on feed safety and quality assurance. The absence of hazardous substances, such as mycotoxins, heavy metals, and antibiotics, is referred to as feed safety. Assurance of feed quality refers to the consistency, nutritive value, and digestibility of feed.

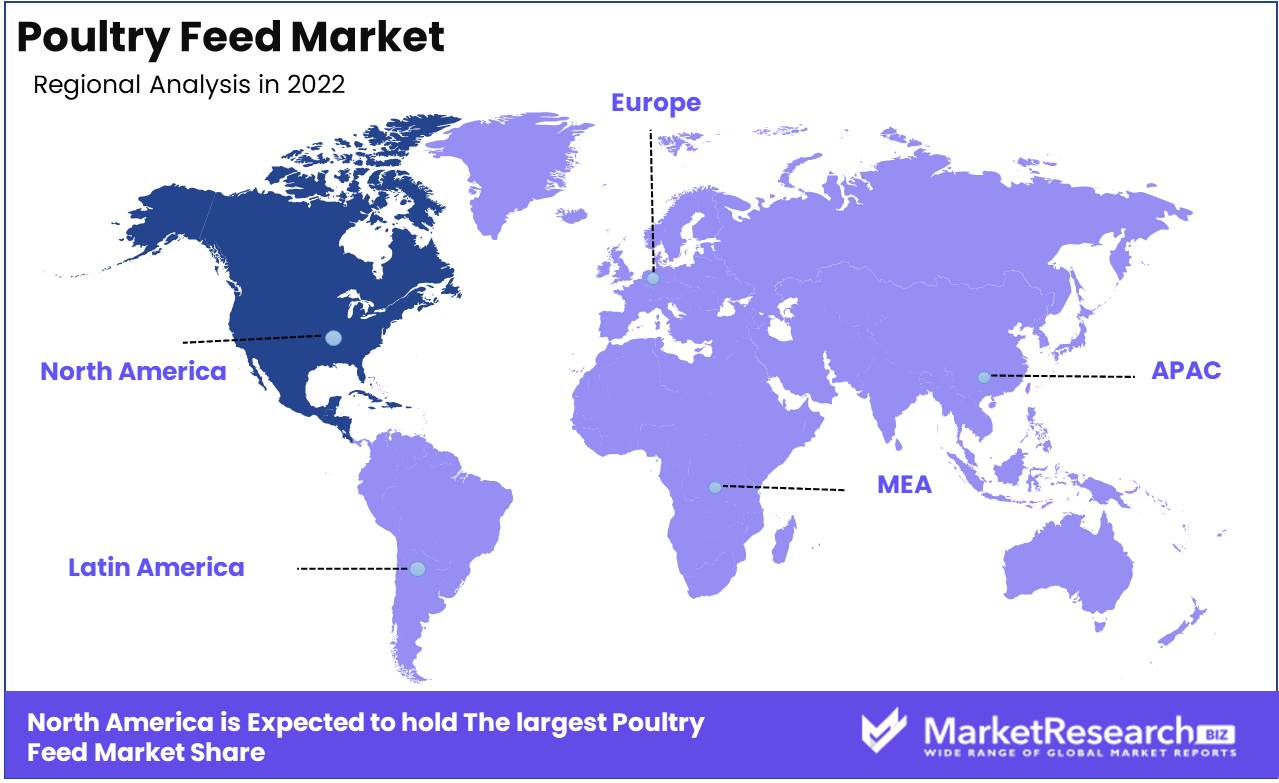

Regional Analysis

In recent years, the demand for poultry products in North America has increased, resulting in the growth of the poultry industry. Increasing health consciousness, a preference for leaner meats, and a shift towards protein-rich diets all contribute to this demand. The poultry feed market in North America has played a significant role in meeting the expanding demand for poultry products.

Over the following few years, it is anticipated that the poultry feed market in North America will experience significant growth. To maintain the health and productivity of poultry, there is a shift towards the use of high-quality, nutrient-rich feed. Moreover, organic and natural poultry feed is gaining popularity as consumers become aware of the health benefits of natural feed alternatives.

With the development of new and innovative feed formulations that have a positive effect on poultry health and productivity, innovation also contributes to the growth of the poultry feed market. The use of probiotics and prebiotics in poultry feed, for instance, has been shown to have a beneficial effect on gut health, which can contribute to enhanced animal health and productivity.

It is anticipated that the North American poultry feed market will continue to expand in the coming years, primarily due to the rising demand for poultry products. The United States is the largest market for poultry feed in North America, and its dominance is expected to persist over the forecast period.

Despite the growth prospects of the North American poultry feed market, the industry faces some challenges. These challenges include fluctuating raw material prices, environmental factors such as natural disasters, and regulatory obstacles such as restrictions on the use of specific feed additives.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

With numerous players vying for market share, the poultry feed market is a highly competitive industry. Key players in this market are focused on providing poultry farmers with high-quality, custom-tailored feed while maintaining competitive pricing to remain ahead of the competition.

Cargill Inc. has a considerable presence in the poultry feed markets of North America, Europe, and Asia, making it one of the leading players in the industry. Their portfolio includes a variety of feed products, including layer feed, broiler feed, and poultry feed. Additionally, they are committed to investing in research and development to create innovative feed solutions that improve avian performance and reduce environmental impact.

Tyson Foods Inc., another major player in this market, focuses predominantly on serving the North American poultry feed market. Their product line includes poultry feed, cattle feed, and swine feed, among others. They are committed to providing inventive nutritional solutions, such as nutritional analysis and customized formulations, to meet the specific needs of individual farmers.

Top Key Players in Poultry Feed Market

- Alltech, Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Charoen Pokphand Foods Public Company Limited

- Hansen Holdings A/S

- Evonik Industries AG

- Novus International Inc.

- Nutreco N.V.

- Balance Agri-Nutrients Ltd.

- Suguna Foods Private Limited

Recent Development

- In 2022, As these have been shown to increase feed efficiency and decrease disease risk, the use of probiotics and enzymes in poultry feed has increased.

- In 2021, The European Union prohibited the use of antibiotics in poultry feed which increased research into alternative methods of disease prevention and treatment.

- In 2020, the COVID-19 pandemic had a significant impact on the poultry industry, as it disrupted supply chains and increased demand for poultry products.

- In 2019, Population growth, rising incomes, and shifting dietary preferences have all contributed to the rise in demand for poultry products.

Report Scope:

Report Features Description Market Value (2022) USD 247.7 Bn Forecast Revenue (2032) USD 363.1 Bn CAGR (2023-2032) 4.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Analysis (Complete feed, Concentrates, Premixes), By Ingredient Analysis (Corn, Soybean meal, Wheat, Oats), By Form Analysis (Mash, Pellets, Crumbles) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alltech, Inc., Archer Daniels Midland Company, Cargill, Incorporated, Charoen Pokphand Foods Public Company Limited, Hansen Holdings A/S, Evonik Industries AG, Novus International Inc., Nutreco N.V., Balance Agri-Nutrients Ltd., Suguna Foods Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alltech, Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Charoen Pokphand Foods Public Company Limited

- Hansen Holdings A/S

- Evonik Industries AG

- Novus International Inc.

- Nutreco N.V.

- Balance Agri-Nutrients Ltd.

- Suguna Foods Private Limited