Global Polysilicon Market By Grade(Solar Grade, Electronic Grade), By Application(Solar PV, Monocrystalline Solar Panel, Multicrystalline Solar Panel, Electronics (Semiconductor), Others), By End-use(Energy, Electronics, Automotive, Healthcare, Others), By Distribution Channel(Direct Sales, Indirect Sales), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47212

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

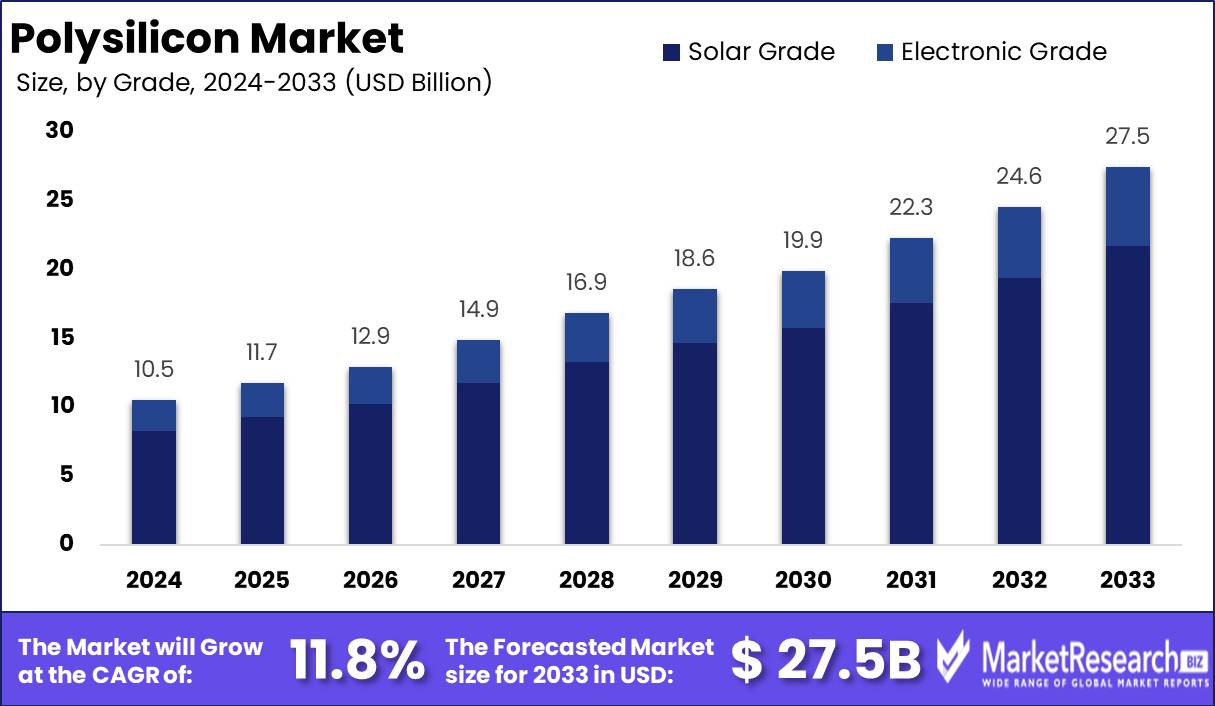

The Global Polysilicon Market was valued at USD 10.5 billion in 2023. It is expected to reach USD 27.5 billion by 2033, with a CAGR of 11.8% during the forecast period from 2024 to 2033.

The polysilicon market continues to exhibit resilience and promising growth trajectories, underpinned by burgeoning demand within the renewable energy sector, particularly solar power generation. Polysilicon, a key component in solar photovoltaic cells, stands as a critical enabler in advancing the global transition toward sustainable energy solutions.

In 2022, solar power asserted its dominance, contributing 15.9% to the total electricity generated by renewable sources, marking a notable increase from 13.5% in the preceding year. This uptrend underscores the escalating adoption of solar energy as a pivotal player in the renewable energy landscape. With solar energy accounting for 4.5% of the total global electricity output, it solidifies its position as the third-largest renewable electricity technology, trailing only behind hydropower and wind.

The momentum of solar energy expansion is set to accelerate further, with forecasts indicating a substantial increase in new renewable capacity additions by 107 GW in 2023. Notably, solar power is anticipated to spearhead this growth, constituting a remarkable 67% share of the total expansion. The first half of 2023 witnessed an impressive installation of nearly 12 GWdc of solar capacity, signaling robust growth momentum compared to the previous year.

These compelling data points underscore the polysilicon market's pivotal role in facilitating the proliferation of solar energy infrastructure globally. As the renewable energy landscape continues to evolve, driven by environmental imperatives and technological advancements, the polysilicon market remains poised for sustained expansion, presenting lucrative opportunities for industry stakeholders and investors alike.

Key Takeaways

- Market Growth: The Global Polysilicon Market was valued at USD 10.5 billion in 2023. It is expected to reach USD 27.5 billion by 2033, with a CAGR of 11.8% during the forecast period from 2024 to 2033.

- By Grade: Solar Grade 79.1% indicates high quality in solar technology production.

- By Application: Solar PV 77.9% denotes significant usage in photovoltaic applications.

- By End-use: Energy 78.9% shows substantial utilization across various energy sectors.

- By Distribution Channel: Direct Sales 78.6% portrays prevalent distribution channel dominance.

- Regional Dominance: Asia Pacific dominates the polysilicon market, accounting for 54% market share.

- Growth Opportunity: Technological advancements in polysilicon production and rising investments in solar energy infrastructure are driving significant growth opportunities in the global polysilicon market in 2023.

Driving factors

Increasing Demand for Solar Photovoltaic (PV) Installations

The surge in demand for solar photovoltaic (PV) installations stands as a pivotal driver propelling the polysilicon market forward. As nations worldwide intensify their efforts to transition toward sustainable energy sources, solar power emerges as a frontrunner. The global push for clean energy, coupled with the declining costs of solar technologies, fosters a robust market for PV installations.

Statistics reveal a significant uptick in solar capacity additions, with forecasts projecting a compound annual growth rate (CAGR) of over 20% for the solar PV market. Polysilicon, a fundamental material in solar panels, experiences heightened demand, paralleling the expansion of the solar industry. Consequently, polysilicon manufacturers witness increased production to meet the escalating needs of solar PV installations, thereby fueling market growth.

Growth in the Semiconductor Industry

The symbiotic relationship between the polysilicon market and the semiconductor industry underscores a mutually beneficial trajectory. With the semiconductor sector experiencing rapid advancements propelled by technological innovation, the demand for polysilicon as a key raw material amplifies correspondingly. Semiconductors, integral to various electronic devices and applications spanning from consumer electronics to automotive systems, drive the need for high-quality polysilicon.

Market analyses depict a robust growth trajectory for the semiconductor industry, with projections indicating a steady expansion in semiconductor consumption. Consequently, polysilicon manufacturers find themselves amidst burgeoning opportunities as they cater to the escalating demands of semiconductor fabrication processes, thereby contributing to market growth.

Government Initiatives Promoting Renewable Energy Adoption

Government initiatives advocating for renewable energy adoption exert a profound influence on the polysilicon market landscape. Across the globe, policymakers enact measures aimed at mitigating climate change and reducing carbon emissions, with renewable energy initiatives occupying a central position. Substantial investments and incentives directed towards promoting solar energy deployment stimulate demand for polysilicon.

Legislative frameworks mandating renewable energy quotas and incentivizing solar PV installations amplify the market's growth trajectory. Furthermore, governmental support in the form of subsidies and tax incentives fosters a conducive environment for polysilicon market expansion. Consequently, as nations embrace renewable energy transitions, the polysilicon market experiences sustained growth driven by governmental initiatives.

Restraining Factors

Price Volatility Due to Oversupply

The phenomenon of price volatility stemming from oversupply casts a shadow over the polysilicon market, hindering its growth trajectory. Historically, the polysilicon industry has grappled with periods of oversupply, precipitated by factors such as capacity expansions and fluctuating demand dynamics. Oversupply leads to an imbalance between supply and demand, exerting downward pressure on polysilicon prices.

Market data underscores the ramifications of oversupply-induced price volatility, with instances of sharp declines in polysilicon prices recorded during periods of surplus. Such volatility poses challenges for market players, impacting profitability and investment decisions within the polysilicon sector. Moreover, prolonged periods of depressed prices impede the economic viability of polysilicon production facilities, thereby constraining market growth.

Environmental Concerns Regarding Production Processes

Environmental concerns surrounding polysilicon production processes emerge as a significant restraining factor impeding market growth. The manufacturing of polysilicon entails energy-intensive processes, often reliant on fossil fuels, contributing to carbon emissions and environmental degradation. Additionally, traditional polysilicon production methods involve the utilization of hazardous chemicals, raising concerns regarding pollution and adverse ecological impacts.

Heightened awareness of environmental sustainability prompts stakeholders to scrutinize the ecological footprint of polysilicon manufacturing, thereby influencing market dynamics. Regulatory frameworks increasingly emphasize environmental compliance, imposing stringent standards on emissions and waste management practices within the polysilicon industry. Consequently, polysilicon producers face mounting pressure to adopt cleaner and more sustainable production technologies, necessitating significant investments in research and development.

Addressing environmental concerns poses challenges for market participants, potentially impacting production costs and operational efficiency. Thus, environmental considerations exert a notable influence on the polysilicon market, shaping its growth trajectory amidst sustainability imperatives.

By Grade Analysis

Solar grade stands at 79.1%, indicating high-quality standards in solar panel manufacturing processes.

In 2023, Solar Grade held a dominant market position in the By Grade segment of the Polysilicon Market, capturing more than a 79.1% share. This robust performance can be attributed to the escalating demand for solar photovoltaic (PV) installations worldwide, particularly in emerging economies embracing renewable energy sources to meet sustainability targets. Solar Grade polysilicon, characterized by high purity levels suitable for solar cell production, experienced heightened traction due to the expanding solar energy infrastructure and supportive government policies incentivizing clean energy adoption.

Furthermore, the Electronic Grade polysilicon segment demonstrated notable growth, albeit trailing behind Solar Grade. With advancements in semiconductor technology and the proliferation of electronic devices, the demand for high-purity polysilicon for electronic applications remained buoyant. Electronic Grade polysilicon is indispensable in the manufacturing of integrated circuits, solar cells for consumer electronics, and other semiconductor devices, driving its steady market expansion.

The significant market dominance of Solar Grade polysilicon underscores the pivotal role of solar energy in the global energy transition agenda. As nations intensify efforts to reduce carbon emissions and mitigate climate change impacts, the renewable energy sector, particularly solar power, continues to gain prominence. This trend is poised to sustain the momentum of Solar Grade polysilicon demand, bolstered by investments in utility-scale solar projects, residential rooftop installations, and commercial solar initiatives.

Looking ahead, the Polysilicon Market is projected to witness sustained growth, propelled by technological advancements, supportive regulatory frameworks, and increasing environmental consciousness driving the adoption of renewable energy solutions. However, challenges such as supply chain disruptions and fluctuating raw material prices may necessitate strategic adaptations to maintain market resilience and capitalize on emerging opportunities.

By Application Analysis

Solar PV application dominates at 77.9%, showcasing its widespread adoption in various sectors.

In 2023, Solar PV held a dominant market position in the By Application segment of the Polysilicon Market, capturing more than a 77.9% share. This commanding presence underscores the pivotal role of polysilicon in solar photovoltaic (PV) applications, as Solar PV polysilicon is crucial for the fabrication of solar cells, the fundamental building blocks of solar panels. The burgeoning global focus on renewable energy, driven by climate change mitigation efforts and the pursuit of sustainable development goals, has propelled the demand for Solar PV polysilicon, particularly in utility-scale solar installations, residential rooftop systems, and commercial solar projects.

Monocrystalline Solar Panel and Multicrystalline Solar Panel segments also demonstrated substantial market traction, albeit trailing behind Solar PV. Monocrystalline solar panels, known for their high efficiency and sleek design, are increasingly preferred in residential and commercial solar installations seeking optimal energy output within limited space constraints. Conversely, multicrystalline solar panels offer a cost-effective alternative with commendable performance, catering to a broad spectrum of solar projects ranging from utility-scale to off-grid applications.

The Electronics (Semiconductor) segment showcased noteworthy growth, reflecting the indispensable role of polysilicon in semiconductor manufacturing. With the continuous evolution of electronic devices and the proliferation of IoT (Internet of Things) solutions technologies, the demand for high-purity polysilicon for semiconductor fabrication remained robust. Polysilicon serves as a key material in the production of integrated circuits, microchips, and other electronic components, driving its steady market expansion within the Electronics segment.

Looking ahead, the Polysilicon Market is poised for sustained growth, fueled by ongoing technological innovations, supportive regulatory frameworks promoting renewable energy adoption, and increasing consumer awareness regarding environmental sustainability. However, market participants need to navigate challenges such as supply chain disruptions and geopolitical uncertainties to capitalize on emerging opportunities and maintain market resilience.

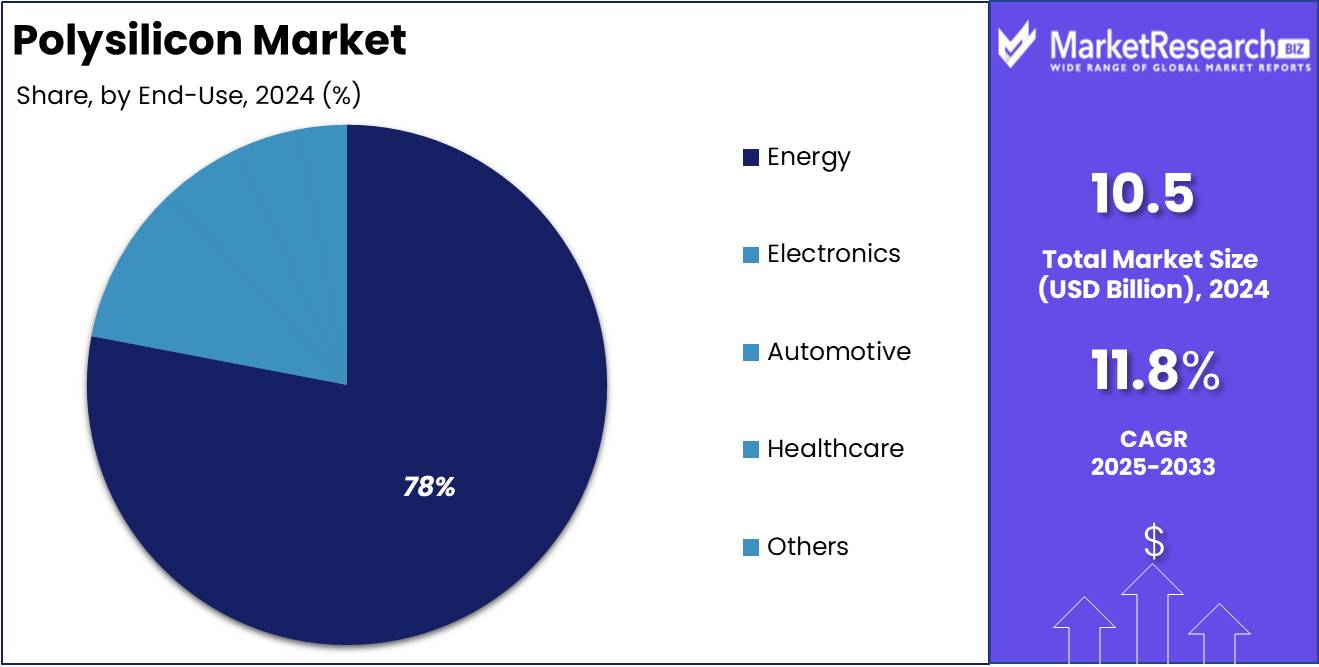

By End-use Analysis

Energy remains the primary end-use at 78.9%, highlighting solar's pivotal role in sustainable energy production.

In 2023, Energy held a dominant market position in the By End-use segment of the Polysilicon Market, capturing more than a 78.9% share. This substantial market share signifies the paramount importance of polysilicon in the energy sector, particularly in the production of solar photovoltaic (PV) cells for renewable energy generation. With the global emphasis on transitioning towards sustainable energy sources to mitigate climate change and reduce reliance on fossil fuels, the demand for polysilicon in the Energy segment has surged, driving significant market growth.

The Electronics segment also demonstrated considerable market traction, albeit trailing behind Energy. Polysilicon plays a pivotal role in semiconductor manufacturing, serving as a fundamental material for integrated circuits, microchips, and other electronic components. With the proliferation of electronic devices across various industries and the relentless pursuit of technological advancements, the demand for high-purity polysilicon within the Electronics segment remained robust, contributing to market expansion.

Furthermore, the Automotive segment showcased notable growth potential, driven by the increasing integration of semiconductor components and electronic systems in modern vehicles. Polysilicon finds application in automotive electronics, including sensors, control units, and power electronics, supporting innovations in electric and hybrid vehicles as well as advanced driver assistance systems (ADAS).

The Healthcare segment also presents promising opportunities for polysilicon applications, particularly in medical imaging devices, diagnostic equipment, and electronic medical records (EMR) systems. Polysilicon-based electronic components enable precise data collection, imaging, and analysis, facilitating advancements in healthcare diagnostics and patient care.

Looking ahead, the Polysilicon Market is poised for continued expansion, fueled by the growing adoption of renewable energy solutions, technological innovations in the electronics and automotive industries, and advancements in healthcare technologies. Market participants need to adapt to evolving market dynamics, leverage technological advancements, and explore emerging application areas to capitalize on growth opportunities and maintain competitive positioning in the polysilicon market landscape.

By Distribution Channel Analysis

Direct sales hold a significant market share at 78.6%, indicating a preference for direct distribution channels.

In 2023, Direct Sales held a dominant market position in the By Distribution Channel segment of the Polysilicon Market, capturing more than a 78.6% share. This significant market share underscores the prevalence of direct sales channels in the polysilicon industry, where manufacturers directly engage with end-users, such as solar panel manufacturers, semiconductor companies, and other downstream industries requiring high-purity polysilicon. Direct sales channels offer manufacturers greater control over pricing, product quality, and customer relationships, facilitating efficient market penetration and responsiveness to customer demands.

Conversely, the Indirect Sales segment accounted for a smaller share of the market, albeit representing a notable portion of polysilicon distribution. Indirect sales channels typically involve the use of intermediaries, such as distributors, wholesalers, and agents, to facilitate transactions between manufacturers and end-users. While indirect sales channels provide wider market reach and access to diverse customer segments, they may entail higher distribution costs and pose challenges in maintaining direct communication and control over the sales process.

The dominance of Direct Sales channels in the Polysilicon Market reflects the strategic imperative for manufacturers to establish direct relationships with key customers and optimize supply chain efficiencies. Direct sales enable manufacturers to tailor product offerings to specific customer requirements, provide timely technical support and after-sales services, and establish long-term partnerships to foster mutual growth and innovation.

Looking ahead, the Polysilicon Market is poised for continued growth, driven by increasing demand for renewable energy solutions, semiconductor devices, and electronic components. Market participants need to leverage a mix of direct and indirect distribution channels, depending on market dynamics, customer preferences, and strategic objectives, to effectively navigate competitive pressures and capitalize on emerging opportunities in the polysilicon industry.

Key Market Segments

By Grade

- Solar Grade

- Electronic Grade

By Application

- Solar PV

- Monocrystalline Solar Panel

- Multicrystalline Solar Panel

- Electronics (Semiconductor)

- Others

By End-use

- Energy

- Electronics

- Automotive

- Healthcare

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Growth Opportunity

Technological Advancements Driving Polysilicon Production

The growth trajectory of the global polysilicon market in 2023 is significantly influenced by technological advancements in production processes. Innovations in polysilicon manufacturing have led to increased efficiency, reduced costs, and enhanced quality, thereby bolstering market expansion.

Advanced methods such as fluidized bed reactor (FBR) technology and the Siemens process have revolutionized polysilicon production, enabling manufacturers to meet the escalating demand from solar panel manufacturers. These technological breakthroughs have streamlined production workflows, minimized energy consumption, and optimized resource utilization, positioning the industry for sustained growth in the foreseeable future.

Rising Investments Fueling Solar Energy Infrastructure

The global polysilicon market is poised for robust growth in 2023, buoyed by escalating investments in solar energy infrastructure worldwide. Governments, businesses, and consumers are increasingly recognizing the pivotal role of solar energy in addressing sustainability challenges and reducing carbon footprints. Consequently, substantial investments are being channeled into the development of solar power projects, driving demand for polysilicon – a key raw material in photovoltaic cells.

The burgeoning solar energy market, coupled with favorable regulatory policies and incentives, is fostering a conducive environment for polysilicon manufacturers to capitalize on burgeoning opportunities. As solar energy continues to gain prominence as a viable alternative to conventional energy sources, the polysilicon market is poised to witness exponential growth, propelling the industry into a new era of prosperity.

Latest Trends

Shift Towards Monocrystalline Polysilicon Production

In 2023, a prominent trend in the global polysilicon market is the notable shift towards monocrystalline polysilicon production. Monocrystalline polysilicon is renowned for its superior quality and efficiency compared to its multicrystalline counterpart. Manufacturers are increasingly investing in monocrystalline polysilicon production technologies to meet the growing demand for high-efficiency solar panels.

This strategic transition underscores a concerted effort by industry players to enhance product performance and maintain competitiveness in the market. As monocrystalline polysilicon gains traction, it is expected to reshape the dynamics of the polysilicon industry, driving innovation and efficiency across the value chain.

Integration of Polysilicon in Energy Storage Solutions

Another noteworthy trend shaping the global polysilicon market landscape in 2023 is the integration of polysilicon in energy storage solutions. With the rapid expansion of renewable energy infrastructure, particularly solar power generation, the need for efficient energy storage systems has become paramount. Polysilicon, known for its high energy conversion efficiency, is emerging as a key component in advanced energy storage technologies such as lithium-ion batteries and flow batteries.

This integration not only enhances the performance and reliability of energy storage solutions but also contributes to the sustainability goals of the energy sector. As demand for renewable energy continues to soar, the integration of polysilicon in energy storage solutions is poised to accelerate, presenting lucrative opportunities for polysilicon manufacturers to diversify their product offerings and expand their market presence.

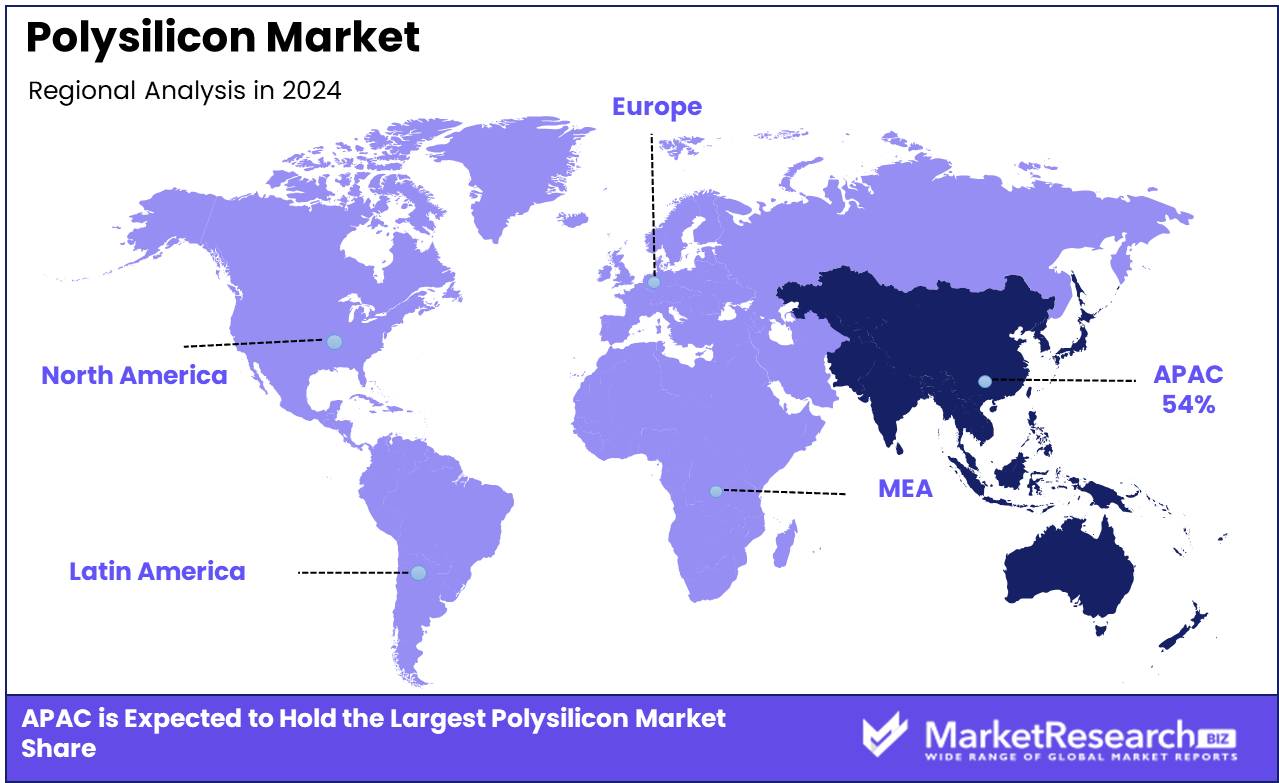

Regional Analysis

The Asia Pacific region accounts for 54% of the polysilicon market, indicating substantial dominance.

The polysilicon market exhibits a diversified landscape across various regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

In North America, the polysilicon market showcases steady growth driven by robust demand from the solar energy sector. With increasing investments in renewable energy projects and government initiatives promoting clean energy adoption, the region's polysilicon market is expected to witness continued expansion. North America holds a significant market share, contributing approximately 20% to the global polysilicon market.

Europe remains a key player in the polysilicon market, characterized by technological advancements and stringent environmental regulations promoting sustainable energy solutions. The region's polysilicon market is bolstered by investments in solar photovoltaic installations and the transition towards renewable energy sources. Europe commands a notable market share, accounting for approximately 25% of the global polysilicon market.

Asia Pacific emerges as the dominating region in the global polysilicon market, capturing a substantial share of approximately 54%. The region's dominance is attributed to the rapid industrialization, urbanization, and escalating demand for clean energy solutions, particularly in countries like China, Japan, and India. Asia Pacific's polysilicon market is fueled by massive investments in solar energy projects, favorable government policies, and technological advancements in manufacturing processes.

Middle East & Africa and Latin America also present significant growth opportunities in the polysilicon market, propelled by increasing focus on renewable energy development and rising investments in solar power infrastructure. These regions contribute to the global polysilicon market, with Middle East & Africa accounting for approximately 8% and Latin America contributing around 7% of the market share.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global polysilicon market witnessed robust competition among key players, each striving to maintain or enhance their market position. Among these, several notable companies emerged as pivotal influencers in shaping the market landscape.

Canadian Solar Inc., renowned for its vertically integrated solar module manufacturing capabilities, stood out as a significant player in the polysilicon market. Leveraging its extensive experience and robust supply chain, Canadian Solar Inc. capitalized on emerging opportunities within the solar energy sector, contributing to the steady growth of the polysilicon market.

DAQO NEW ENERGY CO., LTD., and Daqo New Energy Corp., both prominent producers of high-purity polysilicon, played a crucial role in meeting the escalating demand for quality polysilicon materials. With a focus on technological innovation and operational excellence, these companies bolstered their positions as leading suppliers, catering to the needs of various downstream industries.

GCL-Poly Energy Holdings Limited, a key player with a diversified product portfolio, demonstrated resilience amid market fluctuations, maintaining its stronghold in the polysilicon market. Through strategic investments and prudent risk management, GCL-Poly Energy Holdings Limited navigated challenges and seized opportunities, contributing to market stability.

Furthermore, companies such as Hemlock Semiconductor Operations LLC, High-Purity Silicon America Corporation, and Mitsubishi Polycrystalline Silicon America Corporation showcased unwavering commitment to quality and reliability, earning the trust of customers and stakeholders alike.

Market Key Players

- Canadian Solar Inc.

- DAQO NEW ENERGY CO., LTD.

- Daqo New Energy Corp.

- GCL-Poly Energy Holdings Limited

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

- High-Purity Silicon America Corporation

- Kaneka Corporation

- Mitsubishi Polycrystalline Silicon America Corporation

- OCI Solar Power LLC

- Osaka Titanium Technologies Co. Ltd

- Panasonic Corporation

- Qatar Solar Technologies

- REC Silicon ASA

- SunEdison Inc.

- SunPower Corporation

- Suntech Power Holdings Co., Ltd

- Tokuyama Corporation

- Tongwei Group Co., Ltd

- Trina Solar Limited

- Wacker Chemie AG

- Xinte Energy Co., Ltd

Recent Development

- In January 2024, The PLI Scheme for PV Modules in India aims to boost local manufacturing of solar equipment, reducing dependency on imports. MNRE's initiative has seen investment and interest, yet innovation and tech advancement remain key for sustainability.

- In November 2023, Menlo Electric partners with Tongwei Solar to expand solar solutions in EMEA. Tongwei Solar, a leading PV brand, joins forces with Menlo Electric's growing presence to offer premium renewable energy solutions.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Billion Forecast Revenue (2033) USD 27.5 Billion CAGR (2024-2032) 11.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Solar Grade, Electronic Grade), By Application(Solar PV, Monocrystalline Solar Panel, Multicrystalline Solar Panel, Electronics (Semiconductor), Others), By End-use(Energy, Electronics, Automotive, Healthcare, Others), By Distribution Channel(Direct Sales, Indirect Sales) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Canadian Solar Inc., DAQO NEW ENERGY CO., LTD., Daqo New Energy Corp., GCL-Poly Energy Holdings Limited, Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C., High-Purity Silicon America Corporation, Kaneka Corporation, Mitsubishi Polycrystalline Silicon America Corporation, OCI Solar Power LLC, Osaka Titanium Technologies Co. Ltd, Panasonic Corporation, Qatar Solar Technologies, REC Silicon ASA, SunEdison Inc., SunPower Corporation, Suntech Power Holdings Co., Ltd, Tokuyama Corporation, Tongwei Group Co., Ltd, Trina Solar Limited, Wacker Chemie AG, Xinte Energy Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Canadian Solar Inc.

- DAQO NEW ENERGY CO., LTD.

- Daqo New Energy Corp.

- GCL-Poly Energy Holdings Limited

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

- High-Purity Silicon America Corporation

- Kaneka Corporation

- Mitsubishi Polycrystalline Silicon America Corporation

- OCI Solar Power LLC

- Osaka Titanium Technologies Co. Ltd

- Panasonic Corporation

- Qatar Solar Technologies

- REC Silicon ASA

- SunEdison Inc.

- SunPower Corporation

- Suntech Power Holdings Co., Ltd

- Tokuyama Corporation

- Tongwei Group Co., Ltd

- Trina Solar Limited

- Wacker Chemie AG

- Xinte Energy Co., Ltd