Polylactic Acid Market By Grade (Thermoforming, Extrusion, Injection Molding, Blow Molding), By Application (Rigid Thermoform, Films & sheets, Bottles, Others), By End-Use Industry (Packaging, Consumer Goods, Agricultural, Textile, Biomedical), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

8582

-

March 2023

-

175

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

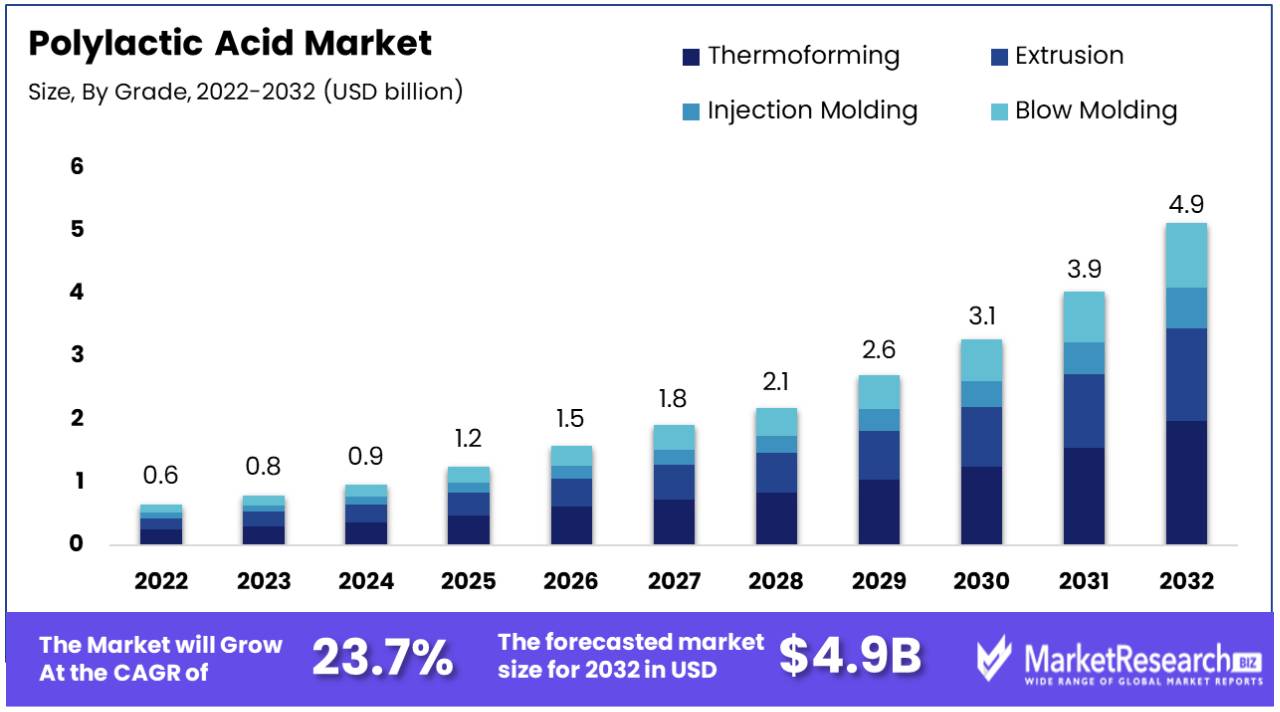

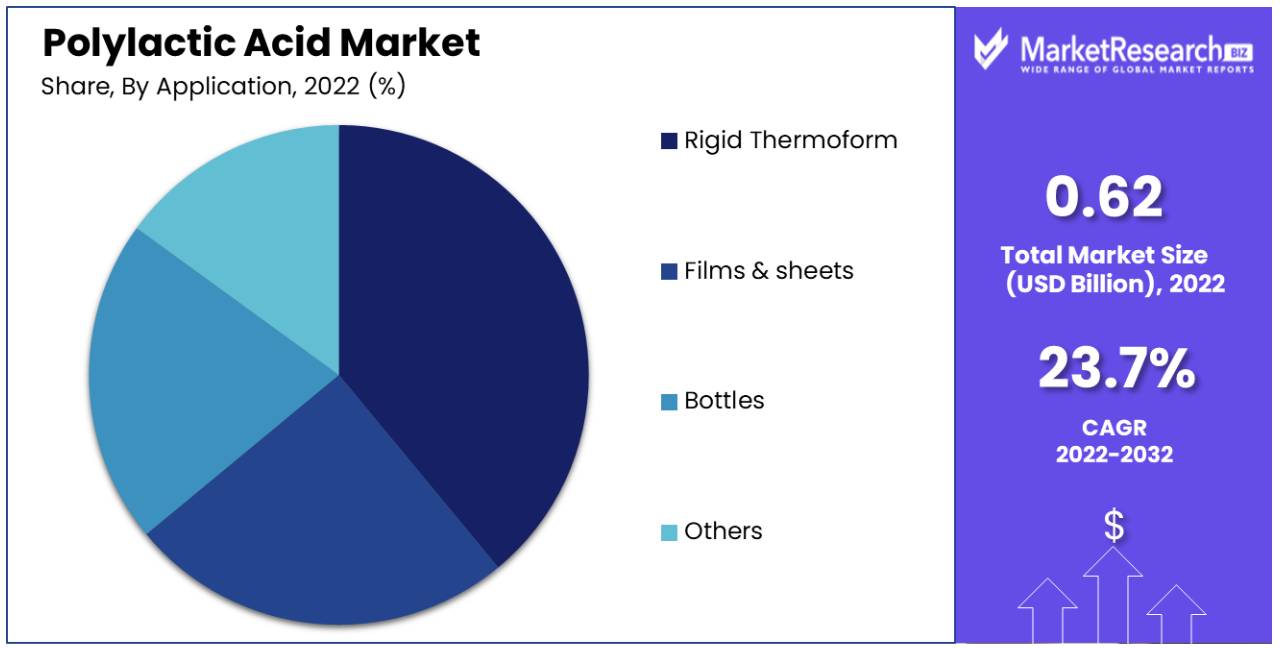

The global Polylactic Acid Market size was estimated at USD 0.62 billion in 2022 and is expected to grow at a CAGR of 23.7% from 2023 to 2032. It is expected to reach USD 4.9 billion by 2032.

Polylactic acid (PLA) is a type of biodegradable plastic that is primarily derived from materials, like corn starch and sugarcane. Its mechanical properties are superior to biodegradable polymers because it is classified as a polymer formed through the crystallization of lactic acid (C3H4O2). This polymer is both hydrophobic and crystalline making it versatile and environmentally friendly with applications across industries.

Currently PLA dominates the consumption charts for bioplastics in terms of volume, driven by government subsidies and growing environmental concerns about petroleum based plastics.

The packaging, textiles and electronics industries in developing countries are experiencing growth due to advancements knowledge transfers from developed nations and increasing consumer demands. Moreover, the rising global popularity of bioplastics has attracted investments while expanding the range of applications for PLA in industrial sectors. This flexible acid derived from sugarcane and corn starch has found use, in manufacturing plastic films, bottles, automotive components especially excelling in food packaging and medical devices.

The major players, in the Polylactic acid market are expected to benefit from the growth opportunities presented by the emerging applications of Polylactic acid. Polylactic acids have functions. Their production can be easily supported by readily available raw materials in both developed and emerging economies. For instance, The United States had a hold, on the PLA market in 2022. It is expected to continue. This dominance can be attributed to the availability of materials and the presence of key manufacturers involved in PLA production.

Despite the challenges caused by the pandemic, in the fashion apparel market there has been a rise in the demand for personal protective clothing due to the increasing number of COVID 19 cases. This surge is playing a role in driving growth within the textile industry. Leading to an increased demand, for PLA specifically in this sector.

Driving Factors

Initiatives to Increase Environmental Awareness and Sustainability

The growing global emphasis on environmental preservation has been a major driving force in the Polylactic Acid (PLA) industry. With increased concern about environmental sustainability, there is a growing need for biodegradable alternatives such as PLA. This material is particularly valuable because it is derived from renewable sources such as maize starch or sugarcane. This makes PLA a more environmentally responsible option than traditional polymers manufactured from fossil fuels. This is exactly in line with the global effort to reduce plastic waste and reduce the overall environmental impact connected with plastic manufacture and disposal.

Government Policies Supporting Bioplastics

Governments around the world are taking proactive measures to fight plastic waste by establishing legislation and policies that encourage the use of biodegradable materials. These policies include a variety of actions such as providing incentives, implementing mandates, and establishing rules to stimulate the use of PLA and other bioplastics in a variety of industries. This regulatory drive gives the PLA market a significant boost by creating a favourable climate for expansion.

Expanding Packaging Industry Applications

Because of its biodegradability and composability, the packaging industry is a major consumer of PLA. PLA is used in a variety of applications in this business, including films, bottles, and food containers. This spike in demand is being driven by two factors. On the one hand, as customers become more environmentally concerned, they are gravitating toward eco-friendly packaging solutions. In response to this shift in customer expectations, companies are actively seeking for sustainable alternatives.

Technological Advances in PLA Manufacturing

Continuous advances in science and technology in the field of PLA manufacture have played a critical role in creating the market. These advancements have resulted in major advances in the characteristics of PLA while also lowering its production costs. Innovations in polymerization processes and the emergence of hybrid PLA mixes are two key breakthroughs. These developments have significantly broadened the variety of potential uses for PLA, boosting its acceptance across a wide range of sectors.

Restraining Factors

Mechanical properties and limited heat resistance

When compared to conventional plastics such as PET or HDPE, one of the key drawbacks of Polylactic Acid (PLA) is its inferior heat resistance and mechanical strength. This makes PLA less appropriate for applications requiring materials to tolerate high temperatures or to be extremely durable. PLA's characteristics may be insufficient for industries and applications that demand materials to withstand harsh environments. PLA, for example, may not be the best solution in the automotive or aerospace industries, where materials are frequently subjected to severe temperatures and mechanical stress.

Concerns about land use and dependence on feedstock supply

PLA is typically generated from crops such as corn starch and sugarcane. Despite the fact that these are renewable resources, there are worries regarding potential rivalry with food resources and agricultural land use. Critics contend that reserving arable land for PLA feedstock development may shift resources away from food production. Furthermore, the PLA market's reliance on specific feed stocks can render it subject to swings in availability and costs. Weather, crop yields, and worldwide demand for these feed stocks can all have a direct impact on the pricing and availability of PLA, thus influencing its market dynamics.

Pricing Competition and the Availability of Alternatives

Despite its eco-friendliness, PLA can often encounter price competitiveness issues when compared to traditional plastics. This could be a crucial element impacting its use in a variety of applications. Furthermore, the availability of other biodegradable materials or recycled plastics may put PLA in competition. When these alternatives are freely available and have comparable eco-friendly properties, firms and industries may choose them over PLA, thereby reducing its market share.

Growth Opportunities

Additive Manufacturing and 3D Printing

Because of its ease of use, low level of toxicity, and biodegradability, PLA is a prominent material in the 3D printing business. The growing use of 3D printing in a variety of industries, including healthcare, automotive, and consumer goods, is expected to fuel demand for PLA filaments and powders.

Textiles and consumer goods

PLA fibres, which have characteristics similar to polyester, can be employed in textile applications. PLA-based fabrics have the potential to acquire traction in the fashion and garment industries, given the growing need for sustainable and eco-friendly materials. Furthermore, PLA-based consumer goods including as flatware and containers can be used in place of single-use plastics.

Interiors and components for automobiles

The vehicle industry is investigating biodegradable materials for interior components such as panels, trim, and upholstery. PLA, with its renewable sourcing and recyclability potential, is an appealing solution for producers looking to lessen their environmental imprint.

Solutions for Sustainable Packaging

PLA is an ideal material for eco-friendly packaging because to its biodegradability and composability. As people become more environmentally conscious, there is a greater demand for sustainable packaging solutions in a variety of businesses. PLA's renewable origin and biodegradability place it at the forefront of the environmentally friendly packaging market.

By Grade Type

The thermoforming grade of PLA has the biggest market share, due to its exceptional properties that make it perfect for thermoforming procedures. Thermoforming encompasses heating a plastic sheet until it becomes pliant and then shaping it using casts or dies.

PLAs thermoforming grade stands out because of its opposition to heat, dimensional firmness and crystal clear look which makes it an excellent choice for packaging, not reusable food containers and consumer goods. Its transparency enhances product displays while its ability to endure temperatures ensures lasting durability. Renewable characteristics align with consumer’s prospects for friendly packaging solutions. This ascendency in the market highlights the role that PLA plays in meeting both sustainable packaging requests.

By Application Type

In terms of application type, rigid thermoforms is the largest sector, accounting for the majority of PLA market share. PLAs pre-eminence lies in its lucidity making it an ideal choice, for interesting and transparent packaging solutions. Its intrinsic strength and stringency make it suitable for a variety of products that entail integrity.

Additionally, the renewable nature of PLA line up perfectly with the cumulative consumer demand for eco packaging options. The mixture of these features is driving the growth of thermoform applications, in the PLA industry.

By End-Use Type

Packaging holds the market share, among end use industries. The increase in market size can be attributed to the rising need for packaging in the food and beverage as cosmetic industries worldwide. These factors play a role in the dominance of packaging, within the acid markets application segment. Additionally, there is a growth rate expected for the transport sector throughout the forecast period.

Key Market Segments

By Grade

- Thermoforming

- Extrusion

- Injection Molding

- Blow Molding

By Application

- Rigid Thermoform

- Films & sheets

- Bottles

- Others

By End-Use

- Packaging

- Consumer Goods

- Agricultural

- Textile

- Biomedical

Latest Trends

Bio-Based Feedstock Sourcing

An important trend in the PLA market is the use of bio-based feed stocks such as maize starch or sugarcane. This tendency is consistent with the larger goal of decreasing reliance on fossil fuels and boosting material sourcing sustainability.

High-Heat PLA Development

There is a rising emphasis on producing high-heat resistant PLA variations. This overcomes one of PLA's constraints, allowing it to be employed in applications requiring higher temperatures, such as automobile components and durable packaging.

Focus on Circular Economy Practices

The biodegradable nature of PLA accords with the ideas of the circular economy. This promotes a system in which things are meant to be reused, recycled, or degrade naturally. The implementation of PLA in various industries is being driven by the push toward circular economy principles.

Customized PLA Formulations

To suit unique industry requirements, manufacturers are increasingly producing customized PLA formulations. Tailoring PLA features such as stiffness, flexibility, and biodegradability to specific applications is becoming popular.

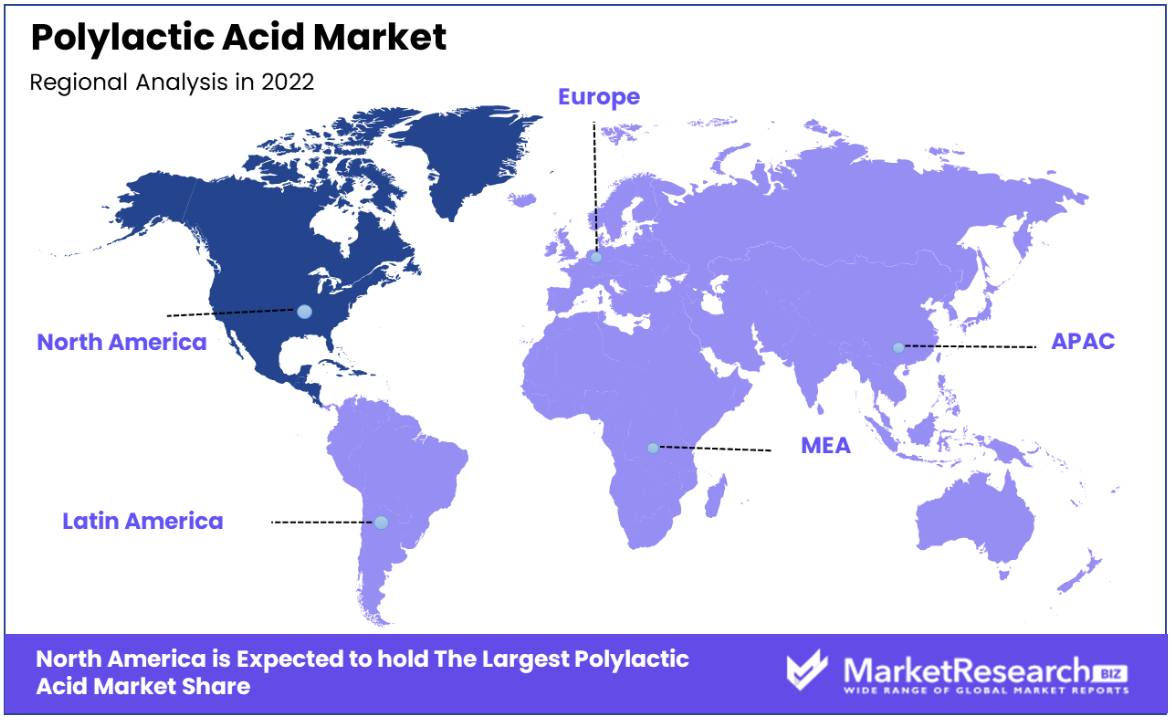

Regional Analysis

North America took the lead with a 43.0% share of revenue due, to the growing demand for bioplastics in Europe. This can be attributed to government regulations promoting its production and the abundant availability of materials in countries, within this region, particularly the United States.

In European nations industries are increasingly turning to bioplastics of traditional petroleum based plastics due to the strict regulations imposed by governments. The regions demand for Polylactic acid is anticipated to increase because of the availability of government subsidies for products and technical expertise. The global market for Polylactic acid is expected to experience growth during the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major companies, in the market for Polylactic acid production are working together to offer solutions that meet the specific demand, for Polylactic acid. Many European and American firms are taking steps to increase acid production in the growing Asia Pacific market through technology and expertise transfer.

Key Players in Polylactic Acid Market

- TotalEnergies Corbion bv

- NatureWorks LLC

- Jiangsu Supla Bioplastics Co., Ltd.

- Futerro

- COFCO

- Jiangxi Keyuan Biopharm Co.,Ltd

- Shanghai Tong-jie-liang Biomaterials Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Corbion Purac BV

- Mitsui Chemicals, Inc.

- Hitachi, Ltd.

- BASF SE

- Braskem

- Uhde Inventa-Fischer

- Toray

- Synbra Technology

- Sulzer

- Teijin

- Toyobo

- Hisun Biomaterials

Recent Developments

- In October 2023, NatureWorks is currently building a brand manufacturing facility, in the Nakhon Sawan Province of Thailand which will be fully integrated for the production of Ingeo PLA biopolymer.

- In September 2023, BASF SE announced their line of additives called biomass balance additives. These ground-breaking additives are formulated to encourage the utilization of resources of fossil fuels in line, with the company’s dedication to sustainability objectives.

- TotalEnergies Corbion teamed together with Bluepha Co. Ltd. in May 2023, with the goal of pioneering sustainable biomaterial solutions in China. Bluepha polyhydroxyalkanoates (PHA) are combined with TotalEnergies Corbion's Luminy polylactic acid technology in this venture.

Report Scope

Report Features Description Market Value (2022) USD 0.62 Bn Forecast Revenue (2032) USD 4.9 Bn CAGR (2023-2032) 23.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade (Thermoforming, Extrusion, Injection Molding, Blow Molding), By Application (Rigid Thermoform, Films & sheets, Bottles, Others), By End-Use Industry (Packaging, Consumer Goods, Agricultural, Textile, Biomedical) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape TotalEnergies Corbion bv, NatureWorks LLC, Jiangsu Supla Bioplastics Co., Ltd., Futerro, COFCO, Jiangxi Keyuan Biopharm Co.,Ltd, Shanghai Tong-jie-liang Biomaterials Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., Corbion Purac BV, Mitsui Chemicals, Inc., Hitachi, Ltd., BASF SE, Braskem, Uhde Inventa-Fischer, Toray, Synbra Technology, Sulzer, Teijin, Toyobo, Hisun Biomaterials Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TotalEnergies Corbion bv

- NatureWorks LLC

- Jiangsu Supla Bioplastics Co., Ltd.

- Futerro

- COFCO

- Jiangxi Keyuan Biopharm Co.,Ltd

- Shanghai Tong-jie-liang Biomaterials Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- Corbion Purac BV

- Mitsui Chemicals, Inc.

- Hitachi, Ltd.

- BASF SE

- Braskem

- Uhde Inventa-Fischer

- Toray

- Synbra Technology

- Sulzer

- Teijin

- Toyobo

- Hisun Biomaterials