Pet Toothpaste Market Report By Type of Pet (Dogs , Cats , Others), By Formulation (Enzymatic Toothpaste , Natural Toothpaste , Fluoride-Free Toothpaste , Tartar Control Toothpaste , Breath Freshening Toothpaste , Whitening Toothpaste), By Flavor (Chicken , Beef , Seafood , Peanut Butter , Mint , Vanilla , Other Flavors), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competitio

-

44579

-

April 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

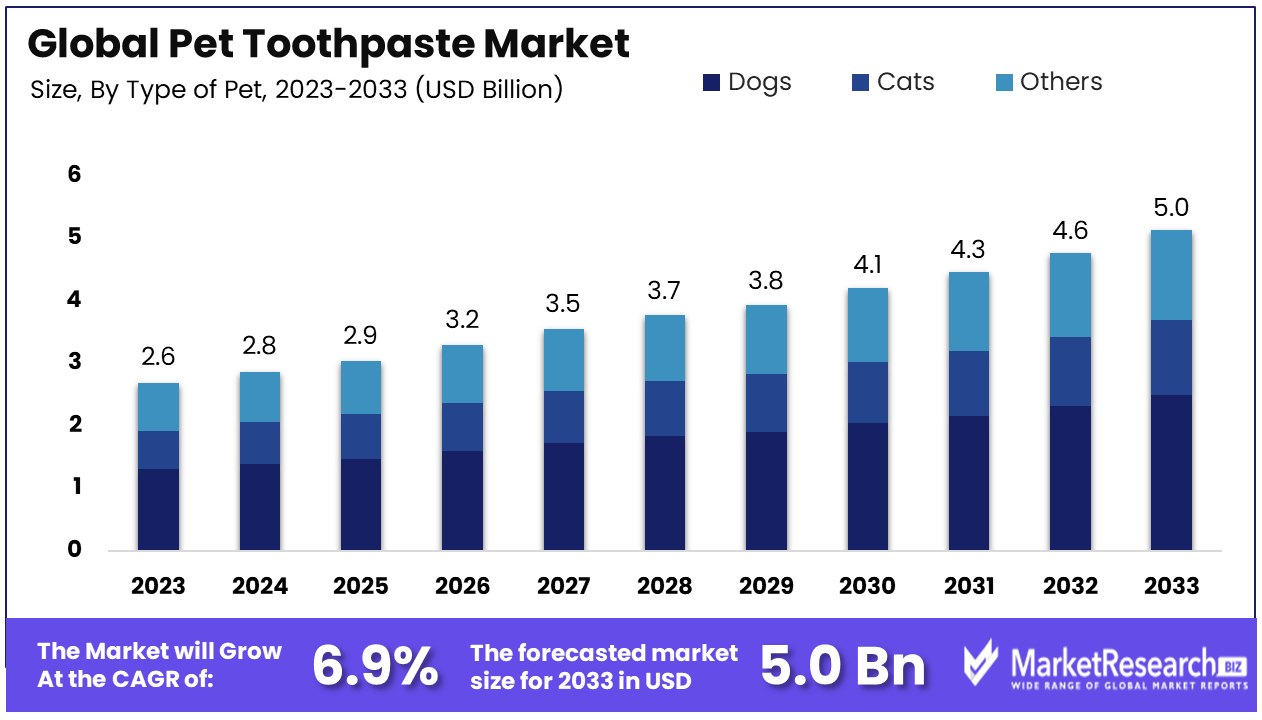

The Global Pet Toothpaste Market size is expected to be worth around USD 5.0 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 6.90% during the forecast period from 2024 to 2033.

The surge in demand for pet oral awareness and hygiene, the rise in urbanization, disposable incomes, and the surge in pet owners are some of the main driving factors for the pet toothpaste market.

Pet toothpaste is defined as a specialized dental product that is developed for maintaining the oral hygiene of domestic animals like dogs and cats. Not like human toothpaste, pet toothpaste is designed with ingredients that are safe for the animals to swallow and flavors that appeal according to their taste choices; generally, it includes poultry and beef flavors. Its main function is to eliminate plaque and avoid tartar buildup that can lead to dental issues such as gum disease and tooth decay in pets.

Pet toothpaste basically contains enzymes or other agents that help break down bacteria and food particles by promoting fresh breath and healthier teeth and gums. Daily brushing with pet toothpaste by using a pet-specific toothbrush and finger brush is suggested by veterinarians as a part of a detailed oral care routine for pets, contributing to their overall well-being and durability.

According to an article published by Oxyfresh in March 2023, Oxyfresh has launched a new pet toothpaste kit at the worldwide pet expo that features one pet dental toothpaste (4 oz.) and one with an ultra-soft finger brush. This new kit provides pet parents with great convenience.

The finger brush is BPA-free, made of 100% ultra-soft silicone to pamper tender pet gums, and is reusable and dishwasher-safe. No other pet toothpaste brand has the non-toxic power of oxygen to breakdown bad pet breath, fight plaque and tartar, and prevent gum disease, which affects 90% of dogs and 80% of cats by age two.

According to an article published by Petsplummag in January 2022, Bow Bow Labs Inc., makers of new innovative products that help to keep dogs safe, healthy, and happy, declares that they will be adding dental products to their fast-growing product line. Its new Its new 4in1 Enzymatic Toothpaste Gel and 4in1 Toothbrush will be launching just in time for National Pet Dental Health Month.

Recent developments in pet toothpaste comprise improved enzymatic formulas that effectively break down plaque, decreasing tartar buildup and gum disease risk. Moreover, specialized flavors appeal to pets by making brushing more enjoyable. These new innovations enhance oral hygiene by leading to fresher breath and healthier teeth and gums in pets. The demand for pet toothpaste will increase due to its requirement for maintaining good oral hygiene, which will help in market expansion in the coming years.

Key Takeaways

- Market Growth Projection: The Global Pet Toothpaste Market is anticipated to reach USD 5.0 Billion by 2033, showing substantial growth from USD 2.6 Billion in 2023, with a projected CAGR of 6.90% during the forecast period from 2024 to 2033.

- Segmentation Insights:

- Type of Pet Analysis: Dogs lead the market due to their high ownership rates and diverse oral health needs.

- Formulation Analysis: Enzymatic toothpaste is the leading sub-segment, valued for its effectiveness in breaking down plaque and preventing tartar buildup.

- Flavor Analysis: Chicken-flavored toothpaste leads the market, followed by beef and seafood flavors, appealing to pets with different food ingredients.

- Distribution Insights: Online retail is the primary distribution channel, offering convenience and a wide range of products.

- Regional Market Dynamics: North America dominates the market with a 42% share, driven by high pet ownership rates and increasing awareness of pet dental health. Europe holds a market share of approximately 25%.

- Analyst Viewpoint: The pet toothpaste market is witnessing significant growth, driven by increasing pet ownership, growing awareness of pet dental health, and the introduction of diverse formulations and flavors. As the market continues to expand, players can capitalize on emerging trends, invest in product innovation, and leverage diverse distribution channels to maintain market leadership and meet the evolving needs of pet owners worldwide.

Driving Factors

Increasing Pet Ownership and Humanization Trends Drive Market Growth

The pet toothpaste market is significantly influenced by the increasing trend of pet humanization and rising pet ownership worldwide. This dynamic has led to a deeper focus on the well-being and health of pets, mirroring the care provided to human family members. As pet owners become more attuned to the health needs of their pets, including oral hygiene, the demand for pet toothpaste has surged.

This trend is underscored by data showing a steady increase in global pet ownership, with the American Pet Products Association (APPA) reporting that 67% of U.S. households, or about 85 million families, own a pet. This increasing trend towards pet humanization has not only elevated the status of pets in households but also intensified the attention towards their health needs, including dental care. Brands like Virbac, capitalizing on this trend, have successfully tapped into the market with appealing flavors and formulations, making dental care a regular part of pet grooming routines.

Focus on Preventive Healthcare Amplifies Market Expansion

The shift towards preventive healthcare for pets, with a growing awareness of the link between oral health and overall well-being, has become a cornerstone for the expansion of the pet toothpaste market. The advocacy for regular dental care routines by veterinarians is supported by evidence that preventive oral hygiene can significantly reduce the risk of dental diseases in pets.

This awareness has catalyzed the incorporation of dental care into daily pet grooming practices, bolstering the sales of pet toothpaste. Brands like Petrodex are at the forefront, offering enzymatic toothpaste formulations that efficiently combat plaque and tartar. The American Veterinary Medical Association (AVMA) underscores the importance of preventive dental care, noting that regular brushing can prevent serious health issues. The convergence of veterinary advice and increased pet owner diligence in dental care practices has nurtured a fertile ground for market growth, highlighting the critical role of preventive healthcare in the industry's expansion.

Rise in Veterinary Recommendations Fuels Market Dynamics

Veterinarians play a pivotal role in shaping pet care practices, including dental hygiene. Their recommendations carry significant weight, influencing pet owners' decisions regarding oral health products. The rise in veterinary endorsements for specific dental care products, such as pet toothpaste, has notably influenced market dynamics. This professional validation boosts consumer confidence and drives awareness about the importance of maintaining oral hygiene for pets.

Brands that have received veterinary recommendations, such as C.E.T., which offers formulations containing fluoride and enzymes, have seen a positive impact on their market presence. Veterinary recommendations serve as a bridge between professional healthcare advice and consumer behavior, significantly contributing to the market's growth trajectory. The trust engendered by these recommendations amplifies the market's expansion, underscoring the relationship between veterinary practices and pet care accessories and product sales.

Expansion of Specialty and Natural Products Cultivates Market Growth

The pet toothpaste market is experiencing a renaissance with the burgeoning demand for specialty and natural products. This trend is fueled by pet owners' increasing preference for products that are not only effective but also safe and environmentally friendly. The demand for toothpaste formulations free from artificial ingredients reflects a broader shift towards natural and organic pet care solutions. Brands such as TropiClean have successfully tapped into this demand by offering natural pet toothpaste made with ingredients like green tea and coconut oil.

This pivot towards natural products is not just a fad but a reflection of a more discerning consumer base that prioritizes the health and safety of their pets. The expansion of this segment within the pet toothpaste market is indicative of a broader trend in consumer goods, where safety, efficacy, and environmental impact are paramount. The integration of natural and specialty products into the market's offerings has not only diversified the product range but also catered to a niche yet growing segment of health-conscious pet owners, further driving market growth.

Restraining Factors

Limited Awareness and Education Restrains Market Growth

A significant barrier to the growth of the pet toothpaste market is the lack of awareness and education among pet owners about the importance of pets' oral health. Despite various efforts to highlight the benefits of pet dental care, many owners remain uninformed about the critical nature of maintaining oral hygiene for their pets.

This gap in knowledge leads to a diminished demand for pet toothpaste, as owners may not recognize the need to incorporate regular dental care into their pets’ grooming routines. Especially in developing regions, where pet dental care might not be as emphasized, the market for pet toothpaste struggles to gain traction. This situation underscores the vital role that awareness and education play in market growth, suggesting that increased educational initiatives could help overcome this challenge and stimulate market expansion.

Pet Preference and Acceptance Limits Market Expansion

The pet toothpaste market also faces hurdles related to pets’ acceptance and preference for toothpaste, impacting the establishment of a consistent oral hygiene routine. Pets can show reluctance or outright refusal to accept the taste, texture, or the brushing process itself, creating a significant challenge for pet owners. This resistance can lead to compliance issues, making it harder to maintain regular dental care practices.

Further complicating the issue, pets may have sensitivities to certain ingredients in toothpaste formulations, limiting the options available to pet owners. For instance, a toothpaste’s strong flavor or odor might be off-putting for some pets, deterring its use. These factors not only affect the efficacy of dental care practices but also influence the overall demand for pet toothpaste in the market. Addressing pet preferences and developing more universally palatable formulations could alleviate some of these challenges and support market growth.

Type of Pet Analysis

Dog Toothpaste Leads Market, While Cat Segment Shows Promising Growth

In the pet toothpaste market, the segmentation by type of pet reveals that the dog segment dominates. This is largely because dogs are one of the most common pets globally, with the American Pet Products Association (APPA) reporting that dogs are owned by a majority of pet households in the United States. Their popularity as pets, coupled with their varied sizes, breeds, and dietary habits, contributes to a higher incidence of dental issues, driving the demand for dog-specific toothpaste formulations. Dog toothpaste often contains ingredients tailored to dogs' oral health needs, addressing problems like tartar build-up, gum disease, and bad breath.

Cats represent the second-largest segment. Although cats are also widely owned as pets, their grooming habits and the perception of cats being more autonomous in their care reduce the emphasis on oral hygiene by their owners. Nevertheless, awareness of feline dental issues is growing, slowly expanding the market for cat toothpaste. These products are specifically formulated to be palatable to cats and address their unique dental health challenges.

The "Others" segment, including pets like ferrets and rabbits, remains niche. These pets constitute a smaller portion of the pet population and have specific needs that are not as widely addressed by current pet toothpaste products. However, as pet ownership diversifies and awareness of the oral health needs of different types of pets increases, this segment is expected to grow, albeit at a slower pace compared to dogs and cats.

Formulation Analysis

Enzymatic Toothpaste Dominates Pet Toothpaste Market

Within the pet toothpaste market, segmentation by formulation highlights enzymatic toothpaste as the dominant sub-segment. Enzymatic toothpaste is highly sought after due to its effectiveness in breaking down plaque and preventing tartar buildup without the need for rigorous brushing, making it suitable for pets who are resistant to brushing. These formulations often contain enzymes like glucose oxidase, which reacts with the glucose and oxygen in the pet's mouth to produce hydrogen peroxide, offering a gentle antibacterial action that promotes oral health.

Natural toothpaste is another significant sub-segment, catering to pet owners seeking products with organic, non-toxic ingredients. This segment is driven by the growing trend towards natural and holistic pet care solutions, with formulations that often include ingredients like aloe, neem oil, and baking soda. These products appeal to health-conscious pet owners who prioritize safety and environmental sustainability in their purchasing decisions.

Fluoride-free toothpaste constitutes a niche yet important segment. While fluoride is common in human toothpaste for its cavity-fighting properties, it can be toxic to pets if ingested in large quantities. Fluoride-free toothpastes are formulated to provide dental benefits without the risk associated with fluoride, addressing the safety concerns of pet owners.

Tartar control toothpaste is designed to specifically target the buildup of tartar, a common problem in pets. These products contain ingredients that prevent the hardening of plaque into tartar, an essential feature for maintaining dental health and preventing gum disease.

Breath freshening toothpaste, while offering the basic cleaning and plaque control functions, also contains ingredients focused on combating halitosis in pets. These formulations often include mint or parsley to freshen breath, addressing one of the most common pet owner complaints regarding pet oral hygiene.

Whitening toothpaste, though less common, caters to pet owners looking to maintain or improve the aesthetic appearance of their pets' teeth. These products use safe abrasives or chemical agents to remove surface stains, providing a cosmetic benefit in addition to general dental care.

Flavor Analysis

Chicken Flavor Reigns Supreme in Pet Toothpaste Market, Followed by Beef and Seafood Varieties

In the diverse market of pet toothpaste, flavor plays a crucial role in acceptance and preference by pets, directly influencing consumer purchasing decisions. The Chicken flavor stands out as the dominant sub-segment within the pet toothpaste market. This popularity is attributed to chicken's widespread acceptance among pets, especially dogs and cats, making it a go-to choice for pet owners aiming to ensure a hassle-free oral hygiene routine. The familiarity of chicken as a part of pets' regular diets contributes to its leading position in the market.

However, the market is not limited to just chicken-flavored toothpaste. Beef and seafood flavors also hold significant shares, appealing to pets with different taste preferences. Beef, being another common dietary component for pets, offers a familiar taste, encouraging acceptance. Seafood-flavored toothpaste, often preferred by cats, taps into the natural predilection of felines for fish-based foods, expanding the market's reach to cat owners.

Emerging flavors like Peanut Butter, Mint, and Vanilla are gaining traction, diversifying the market further. Peanut butter-flavored toothpaste appeals to dogs with its savory taste, while mint and vanilla flavors are designed to freshen pets' breath, adding a cosmetic appeal to the functional benefits of oral hygiene. The "Other Flavors" segment, which includes innovative and niche flavors, plays a crucial role in market growth by catering to the unique preferences of a broader range of pets, thereby attracting pet owners looking for customized oral care solutions for their pets.

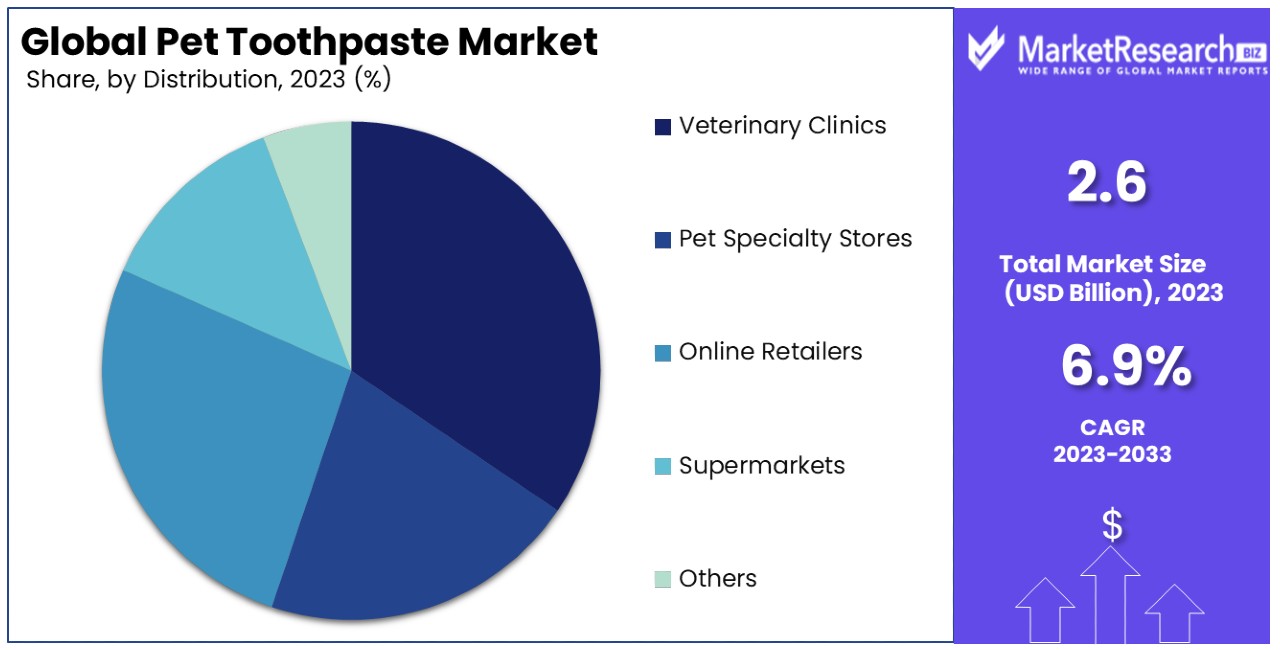

Distribution Channel Analysis

Online Retailers Take Lead in Pet Toothpaste Distribution, Followed by Veterinary Clinics and Specialty Stores

The distribution channel segment of the pet toothpaste market is vital for understanding how consumers access these products. Among the various channels, Online Retailers emerge as the dominant sub-segment. The growth of online retail can be attributed to the convenience it offers, including easy access to a wide range of products, the ability to compare prices and reviews, and the comfort of home delivery. This segment's rise is further propelled by the increasing penetration of the internet and the proliferation of e-commerce platforms dedicated to pet care products.

Veterinary Clinics form another crucial distribution channel, serving as a trusted source of pet health products, including toothpaste. Recommendations from veterinarians carry significant weight, often influencing pet owners' purchasing decisions. This channel benefits from the professional endorsement of products, ensuring trust and reliability in the eyes of consumers.

Pet Specialty Stores remain an important part of the distribution network, providing pet owners with the opportunity to physically examine products before purchase. These stores often offer a broad selection of flavors and formulations, catering to the specific needs and preferences of pets and their owners. The personalized service and expert advice available at these stores further enhance their role in the market.

Supermarkets and Hypermarkets offer the convenience of purchasing pet toothpaste alongside other household items, catering to consumers who prefer one-stop shopping. Although this channel may not offer the extensive range found in specialty stores or online, it plays a significant role in making pet toothpaste more accessible to the general public.

The "Others" segment, which includes small retailers and direct sales, adds to the market's diversity, ensuring the availability of pet toothpaste across a wide variety of retail environments. This segment is particularly important for reaching consumers in areas with limited access to large retail chains or online shopping facilities.

Key Market Segments

By Type of Pet

- Dogs

- Cats

- Others (e.g., ferrets, rabbits)

By Formulation

- Enzymatic Toothpaste

- Natural Toothpaste

- Fluoride-Free Toothpaste

- Tartar Control Toothpaste

- Breath Freshening Toothpaste

- Whitening Toothpaste

By Flavor

- Chicken

- Beef

- Seafood

- Peanut Butter

- Mint

- Vanilla

- Other Flavors

By Distribution Channel

- Veterinary Clinics

- Pet Specialty Stores

- Online Retailers

- Supermarkets/Hypermarkets

- Others

Growth Opportunities

Expansion of Premium and Specialty Products Offers Growth Opportunity

The growth trajectory of the pet toothpaste market is significantly bolstered by the expansion of premium and specialty products. As pet humanization trends gain momentum, there is a noticeable shift in consumer preferences towards high-quality dental care products. Pet owners are now more inclined to invest in pet toothpaste that boasts of natural ingredients, organic extracts, and unique flavors, all of which cater to the specific needs and preferences of their pets.

This shift opens up a vast market for brands that innovate with formulations that are not just effective but also safe and appealing to pets. Products like enzymatic or fluoride-free toothpaste, which offer additional benefits such as breath freshening or tartar control, are especially popular. For instance, companies like Petrodex are capitalizing on this demand by offering a range of specialty pet toothpaste products that promote optimal oral health. This trend towards premiumization not only enhances pet care but also drives market growth by meeting the evolving demands of pet owners.

Focus on Oral Health Education and Awareness Offers Growth Opportunity

Focusing on oral health education and awareness presents a substantial growth opportunity in the pet toothpaste market. Despite the availability of dental care products, a significant number of pet owners remain unaware of the critical importance of maintaining oral hygiene for their pets. Ignorance about the potential health issues arising from neglected dental care, including periodontal disease and tooth decay, can have dire consequences.

Brands have the opportunity to bridge this knowledge gap by launching comprehensive education and awareness campaigns. These initiatives can range from creating engaging online content and resources to collaborating with veterinarians for educational outreach. By emphasizing the benefits of regular dental care and demonstrating proper brushing techniques, brands can empower pet owners to take more proactive steps in managing their pets’ oral health. This educational approach not only fosters a healthier pet population but also stimulates market growth by boosting the demand for pet toothpaste.

Trending Factors

Rise in Functional and Specialty Toothpaste Variants Are Trending Factors

The pet toothpaste market is currently experiencing a significant trend towards the adoption of functional and specialty toothpaste variants. This trend is driven by the growing understanding among pet owners of the importance of oral health for their pets and the need for products that address specific dental issues. Brands are responding by offering a variety of formulations that cater to diverse needs such as plaque control, tartar prevention, gum health improvement, and breath freshening.

Moreover, the introduction of toothpaste with unique flavors and features, such as dual-action cleaning and long-lasting freshness, caters to pet preferences, ensuring better compliance with brushing routines. For instance, brands like Nylabone are diversifying their offerings with flavors like peanut butter and chicken, which are particularly appealing to pets. This trend not only highlights the market's responsiveness to consumer demands but also indicates a growing potential for expansion as pet owners continue to seek out specialized oral care solutions for their pets.

Emphasis on Sustainability and Eco-Friendly Packaging Are Trending Factors

Sustainability and eco-friendly packaging are emerging as significant trending factors in the pet toothpaste market. With growing awareness of environmental issues and concerns about plastic waste, pet owners are increasingly drawn to products that align with their values of minimizing environmental impact. This consumer shift is prompting brands to innovate in their packaging solutions, offering recyclable, biodegradable, or compostable packaging options.

Products manufactured with sustainable practices and packaged in environmentally friendly materials are gaining favor among a segment of consumers dedicated to eco-conscious purchasing decisions. Brands like Ark Naturals are leading the way by packaging their pet toothpaste in recyclable tubes made from post-consumer recycled materials, resonating with environmentally conscious pet owners. This emphasis on sustainability not only addresses consumer preferences but also sets a standard for the industry, suggesting a promising avenue for growth as more brands adopt eco-friendly practices to meet market demands.

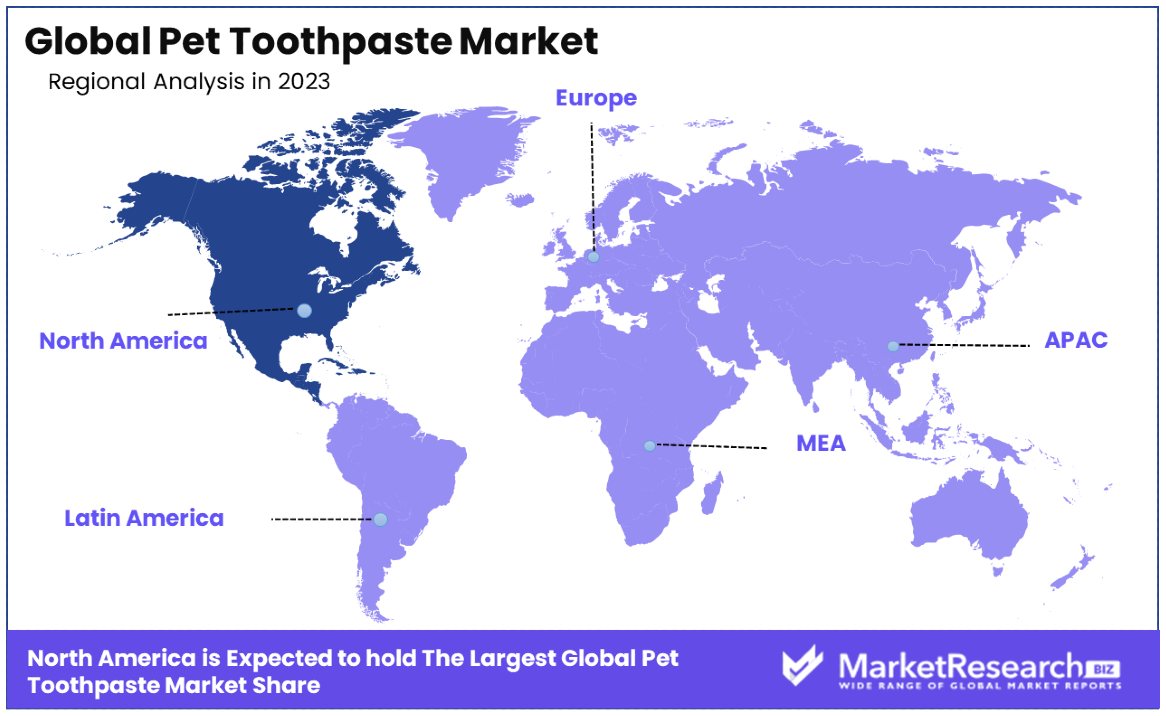

Regional Analysis

North America Dominates with 42% Market Share

North America leads the pet toothpaste market with a commanding 42% share. This dominance can be attributed to several key factors, including high pet ownership rates, growing awareness about pet health, and the availability of a wide range of pet care products.

The region's strong emphasis on pet healthcare, coupled with significant spending power, allows pet owners to invest in premium oral care products for their pets. Moreover, North America hosts a robust network of veterinarians and pet care professionals who play a critical role in educating pet owners about the importance of oral hygiene, further driving market growth.

Market dynamics in North America are influenced by the region's advanced pet care infrastructure and the presence of leading pet care brands. These companies are often at the forefront of innovation, offering specialty and functional toothpaste variants that cater to specific pet needs. The region's regulatory environment, which supports the development and marketing of pet health products, also contributes to the industry's performance.

Market Share and Growth Rate by Region:

- Europe: Holding a market share of approximately 25%, Europe follows North America in the pet toothpaste market. The region's growth is supported by increasing pet ownership and rising awareness about pet health among European pet owners. Initiatives by veterinary associations across Europe to educate pet owners about dental care contribute to market expansion.

- Asia Pacific: Asia Pacific is witnessing rapid growth with a market share of around 20%. Factors such as increasing pet adoption rates, rising disposable incomes, and growing awareness of pet health are driving the market in this region. The expanding pet care industry in countries like China, Japan, and Australia offers significant growth opportunities.

- Middle East & Africa: This region holds a smaller share of the market, approximately 8%, but is experiencing gradual growth due to increasing pet adoption and a growing interest in pet care. However, the market's expansion is somewhat limited by lower awareness of pet dental health in comparison to other regions.

- Latin America: With a market share of about 5%, Latin America's pet toothpaste market is growing slowly. Factors such as increasing urbanization, rising pet ownership, and a growing middle class contribute to the market's potential. However, awareness and availability of specialized pet care products remain challenges to faster growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The pet toothpaste market features a diverse array of companies, each contributing strategically to the industry's dynamics. Leading the sector are Dechra Pharmaceuticals Plc and Vetoquinol SA, renowned for their robust R&D capabilities and extensive distribution networks, which enhance their market penetration and customer reach. TropiClean Pet Products and its affiliate, Petsmile Professional Pet Toothpaste, distinguish themselves through a focus on natural ingredients, aligning with consumer preferences for eco-friendly and health-conscious products.

Healthymouth LLC and AllAccem Inc. specialize in innovative dental solutions, gaining traction by offering unique formulations that promise enhanced oral health benefits. These companies have carved out niche positions by leveraging proprietary technologies and specialized product offerings.

Furthermore, PetzLife Products Inc. and Paws & Pals have strategically positioned themselves in the market by emphasizing cost-effectiveness and accessibility, appealing to a broader demographic seeking reliable, yet affordable pet dental care solutions.

Lastly, Hill's Pet Nutrition Inc. integrates dental health into its broader nutritional product lines, thereby benefiting from synergy effects and reinforcing its market presence through established brand trust and product efficacy.

Collectively, these companies shape the competitive landscape of the pet toothpaste market through innovation, strategic market positioning, and responsiveness to evolving consumer preferences. Their collective efforts are instrumental in driving the market forward, influencing both market trends and consumer behaviors.

Market Key Players

- Dechra Pharmaceuticals Plc

- TropiClean Pet Products

- Healthymouth LLC

- Vetoquinol SA

- Imrex Inc.

- PetzLife Products Inc.

- Petsmile Professional Pet Toothpaste

- TropiClean

- Paws & Pals

- Hills Pet Nutrition Inc.

- AllAccem Inc.

Recent Developments

- On January 2024, Wellness Pet Company announced the launch of Wellness ® WHIMZEES® Natural Dental Treats for cats, the brand's first-ever dental treats for felines, in time for Pet Dental Health Month (February). These treats are specially designed to support the four areas vets check most: breath, plaque, tartar, and gums.

- On June 2023, AGY Holding Corp.’s plant on Wagener Road in Aiken, South Carolina, produces glass fiber used in various applications, including aircraft, automobile exhaust and ignition systems, surfboards, and electronic handheld devices.

- On Sept 2022, Bow Wow Labs, a pet care company, was awarded the Best New Emerging Brand at SuperZoo. The company's innovative products, including the LickiMat Slow Feeder, the LickiBrush, and the LickiMat Wobble, have been designed to improve pets' dental health and overall well-being.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 5.0 Billion CAGR (2024-2033) 6.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Pet (Dogs , Cats , Others (e.g., ferrets, rabbits)), By Formulation (Enzymatic Toothpaste , Natural Toothpaste , Fluoride-Free Toothpaste , Tartar Control Toothpaste , Breath Freshening Toothpaste , Whitening Toothpaste), By Flavor (Chicken , Beef , Seafood , Peanut Butter , Mint , Vanilla , Other Flavors), By Distribution Channel (Veterinary Clinics , Pet Specialty Stores , Online Retailers , Supermarkets/Hypermarkets , Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dechra Pharmaceuticals Plc, TropiClean Pet Products, Healthymouth LLC, Vetoquinol SA, PetzLife Products Inc., Petsmile Professional Pet Toothpaste, TropiClean, Paws & Pals, Hills Pet Nutrition Inc., AllAccem Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Dechra Pharmaceuticals Plc

- TropiClean Pet Products

- Healthymouth LLC

- Vetoquinol SA

- Imrex Inc.

- PetzLife Products Inc.

- Petsmile Professional Pet Toothpaste

- TropiClean

- Paws & Pals

- Hills Pet Nutrition Inc.

- AllAccem Inc.